From 1 Jul 2017 GST will be levied instead of Service Tax as under. Hence tax on banking, insurance, and investments such as real estate, mutual funds will see a hike of 3 percent. Till 30 Jun 2017, we pay 15% service tax for such services. Starting from July 1, 2017 the GST will replace all indirect taxes like service tax and VAT. How does GST Impact Insurance, Mutual Funds, Hotel stay,Restaurants,Travel.

Table of Contents

Overview of GST Impact on Insurance, Mutual Funds,Eating Out,Hotel

- The expense ratio of the Mutual Funds will also go up by 3%.

- Transaction fees for financial services such as banking transactions and credit cards will increase as these services were so far taxed at 15% and now will be taxed at 18%. So individuals will have to pay Rs 3 more for every Rs 100 paid as charges/fees for banking transactions.

- Premium of the Insurance Policy will increase.

- Different GST Rates on Hotel stay. The highest tax rate of 28 per cent is assigned to tariffs of Rs. 7,500 and above. The GST rate of 18 per cent will apply on hotel rooms with tariff ranging between Rs. 2,500 and Rs. 7,500. Those charging from Rs. 1,000 to Rs. 2,500 will be taxed at 12 per cent.

- Eating out could get cheaper in some cases and expensive in some cases. Air-conditioned restaurants will attract GST at 18 per cent on food bill. Non-AC restaurants will attract a 12 per cent GST.

- However, restaurants which have both AC and non-AC seating options will be charging service tax as per AC restaurants at 18 per cent.

- Ola and Uber rides could get cheaper. Transport services will be taxed at 5 per cent.

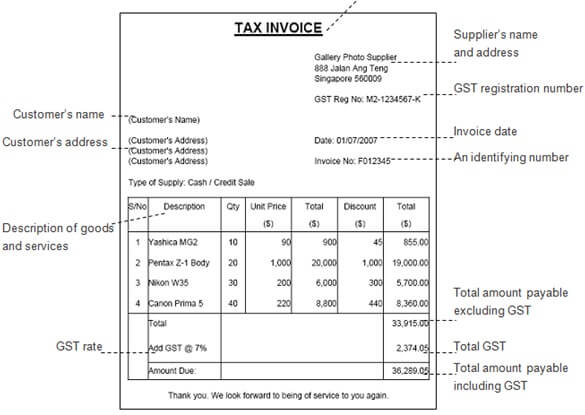

Sample GST Invoice would be something like below. Ref:ReachAccountant

GST and Insurance

Primarily, there are three major kinds of life insurance products : Term insurance plans, Ulips and Endowments (including money back). The applicability of service tax on their premium is not similar in all three of them. As per the GST rules, the value of services (on which GST is to be imposed) in relation to life insurance business shall be as follows. GST impact will be same across insurers.

- Service Tax/GST is on the risk cover part of the premium In the case of single premium annuity policies, ten per cent of single premium charged from the policy holder. In all other cases, 25 per cent of the premium in the first year and 12.5 cent of the premium in subsequent years. So, if the premium of an endowment plan is Rs 100, the GST of 18 percent will be applicable on the 25 percent of the premium i.e. on Rs 25, so, Rs 4.5 will be the GST amount.

- If the entire premium paid by the policy holder is only towards the risk cover in life insurance such as in term insurance plans, the GST of 18 percent will be on the entire premium. If the current premium of a term plan is Rs 10,000, (excluding the service tax of 15 percent) the GST impact will up the premium including tax by Rs 300 i.e from Rs 11,500 to Rs 11,800.

- In case of ULIP Plans premium payable doesn’t change. GST on charges will be deducted from the premium. Hence the fund value will change accordingly when GST comes into effect.

GST and banking and credit cards

Servicing your credit card dues and banking transactions where service tax is levied will also get costlier. The existing service tax rate of 15 per cent will be replaced by 18 per cent under GST. It means that individuals will have to pay Rs 3 more for every Rs 100 paid as charges/fees for banking transactions.

GST and Mutual funds

The impact of GST on the returns of mutual funds will be largely marginal. The levy of GST will be on the total expense ratio (TER) of the mutual fund. The TER, commonly known as expense ratio of mutual fund houses, will also go up by 3% Expense ratio is the measure of the cost incurred by an investment company to operate its mutual fund.

As per the SEBI guidelines, AMC’s can levy charge within the limits prescribed under the regulations. So, if the limit is say, 2.25 percent of total assets under management, the service tax of 15 percent has to be within it. If a scheme’s TER is 2.50 (regular scheme) excluding the service tax, it means, from 2.875 percent, the TER will increase to 2.95 percent at a higher GST rate of 18 percent.

GST and Hotel Stays

Stays at five-star hotels could also get costlier. Currently, domestic hospitality industry pays tax in the range of 18-25 per cent, which includes luxury tax and service tax.

- The highest tax rate of 28 per cent is assigned to tariffs of Rs. 7,500 and above.

- The GST rate of 18 per cent will apply on hotel rooms with tariff ranging between Rs. 2,500 and Rs. 7,500.

- Those charging from Rs. 1,000 to Rs. 2,500 will be taxed at 12 per cent.

- Hotels and lodges that charge Rs. 1,000 a day or less are exempted from the GST

GST and Resturants

Eating out could get cheaper in some cases. Currently while dining at restaurants there are basically two rates of tax that are charged over and above the food value:

- value added tax (12.5 per cent to 14.5 per cent in different states,

- service Tax (5.6 per cent) on AC restaurants, Krishi Kalyan cess (0.2 per cent) and Swachh Bharat cess (0.2 per cent).

Under GST, service tax and value-added tax (VAT) charged at restaurants will be subsumed.

- Air-conditioned restaurants will attract GST at 18 per cent on food bill.

- Non-AC restaurants will attract a 12 per cent GST.

- However, restaurants which have both AC and non-AC seating options will be charging service tax as per AC restaurants at 18 per cent.

GST and Travel

Ola and Uber rides could get cheaper. Transport services will be taxed at 5 per cent. This rate will apply to cab aggregators like Ola and Uber as well as those that currently pay a 6 per cent tax.

Train passengers may have to pay a bit more for AC and first class travel. Though non-AC train travel will be exempt from GST, on AC and first class tickets, the tax rate will get hiked from 4.5 per cent to 5 per cent.

Related Articles:

- GST Bill : Good and Services Tax

- How GST will impact inflation and stock markets

- GST India : How Will It Affect Common Man Finances?

Are you happy about GST? Do you think it will impact your budget?

One response to “GST impact: Insurance, Mutual Funds,Banks, Hotel,Restaurants,Travel”

[…] Impact of GST on different sectors […]