Groww offers Stocks Investing along with Mutual Funds and Gold. It is easy to open a demat/trading account in Groww using e-sign with Aadhaar. How does Grow platform look? How easy is it to buy and sell stocks on Groww? What are the charges of opening the demat account on Groww? How does it compare to other brokers like Zerodha? Should one open an account on Groww?

In March and April 2020, around 1.2 million new investors opened demat accounts with the Central Depository Services (CDSL) despite lockdown,

Table of Contents

Investing in Stocks through Groww

Groww gives free equity delivery like Zerodha. The brokerage of intraday trading is 0.01% of your turnover. If you invest a very large amount, your brokerage will never go above Rs 20.

Launched in 2017, Groww has over two million monthly active users. Groww is backed by marquee investors such as Sequoia, Ribbit, YCombinator and Mukesh Bansal.

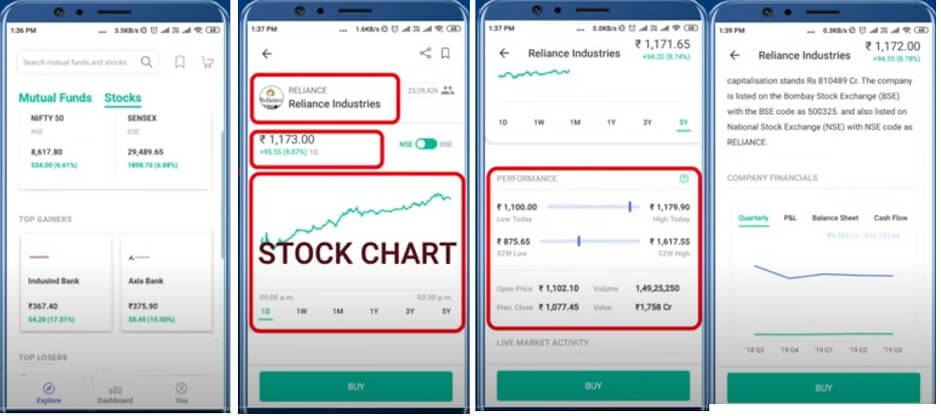

The investment options under mutual funds and stocks are presented clearly, both on the app and the website.

For stocks, an investor would be able to view all information about the company’s statistics such as financial performance, shareholding patterns, peer comparisons etc at one place. Groww does not advise/recommend stocks. However, you can browse using smart filters (such as top gainers) and do an analysis of stock to make an informed decision before investing in a stock.

The information on mutual funds includes performance graphs for various periods, the fund details and overview, historical returns, a returns calculator, and comparison with peers. A holding analysis, sector allocation graph and list of pros and cons are also available. The investing process is simple, with the user offered various options for the duration of investment in, say, an SIP, and flexibility in the amount invested.

Groww gives you many options to invest your money. You can invest through UPI, NEFT and through net banking as well

Video on Investing through Groww

The following video shows on how one can invest through Groww.

Types of Orders Available on Groww?

Groww supports the following types of orders:

- Market order: An order to buy/sell a stock immediately, but the execution price will be at or near the ask price (for buy orders) and current bid (for sell orders).

- Limit order: An order to buy/sell a stock at a specific price or lower (for buy orders) and higher (for sell orders).

What are The Market Timings/trading hours?

- Pre-market session: 9 AM – 9:15 AM

- Normal trading hours: 9:15 AM – 3:30 PM

- Post-market session: 3:40 PM – 4:00 PM

Charges for opening demat account on Groww

There is one-time account opening charge of Rs.200 (was free before May 2020)

There is an account maintenance charge(AMC) of Rs.25/month + GST, charged quarterly.

Post completion of the onboarding process, please allow a maximum of 24 hours to verify and activate your account for stocks on Groww.

What are the Charges for Investing in Stocks via Groww?

Please refer to the table below:

| Type of charges | Description | Charges applied |

| Equity delivery | Charged by broker on buy orders when equity is delivered in demat account | Free on Groww |

| Equity intraday | Charged by broker if you buy/sell on the same day | Rs.20 per executed order or 0.01% of order value (whichever is lower) |

| AMC (Account maintenance charges) | For managing your trading and demat account | Rs.25/month + GST, charged quarterly |

| DP charges – Buy order | Charged by DP for crediting stocks to demat account | Free on Groww |

| DP charges – Sell order | Charged by DP for debiting stocks from demat account | Rs.8 + Rs.5.50 (CDSL charges) per ISIN (company/ETF) per day on Groww regardless of quantity sold |

| Transaction Charges | Charged by exchange for trading | – 0.00325% of order amount on NSE– 0.003% of order amount on BSE

(applicable on both buy and sell) |

| Clearing Charges | Charged by clearing member of NSSCL (clearing corporation of NSE) and ICCL (clearing corporation of BSE) | Free on Groww |

| Payment gateway charges | Charges for depositing money in Groww Balance | Free on Groww |

| Stamp Duty | Charged by state government as stamp duty for contract note | Maximum of 0.018% (but different for each state) |

| SEBI turnover charges | Charged by SEBI (Securities and Exchange Board of India) for regulating the markets | 0.0001% |

| Securities Transaction Tax (STT) | Charged by the government when you transact on exchanges | – 0.1% of order amount in case of equity delivery– 0.025% of order amount in case of equity intraday |

| GST | Goods and services tax | 18% applied on charges wherever applicable |

One response to “Groww for Investing in Stocks: Features, How to use?”

[…] Visit Direct Link […]