After finally choosing a particular mutual fund,based on performance or recommendation or rating etc, an investor faces question about Growth and Dividend option in Mutual Funds

- Should one go for the Growth option or the Dividend Option? Their NAVs are different and in most cases NAVs of dividend options are much lower than the growth option. So does it mean they are two different schemes? What is the difference between Growth and Dividend option?Is Fund manager different? Is performance different?

- Under the dividend option, there are two choices: Dividend Payout and Dividend Reinvestment. Getting dividends seems understandable, but what’s the purpose of having a dividend reinvestment option? BTW What is dividend reinvestment plan?

- How should one choose the option?

- What if I am unable to choose? Is there a default option? What is it?

This article tries to answer these questions.

Table of Contents

What is Dividend?

Definition of a dividend is as follows :

A dividend is a payment made by a corporation to its shareholders, usually as a distribution of profits. When a corporation earns a profit or surplus, it can either re-invest it in the business , or it can distribute it to shareholders. A corporation may retain a portion of its earnings and pay the remainder as a dividend

Typically dividend is associated with stocks. A dividend is a portion of a company’s earnings that is returned to shareholders. Dividends provide an added incentive to own stock in stable companies. For a lot of stock investors, dividend income means a lot.With stocks, regular dividends (in combination with other key factors like revenue and profit growth, cash flows) speak for the company’s solid fundamentals.

But with Mutual Funds dividends are different. A mutual fund does not declare the dividend from its own pocket it is drawn from the NAV. Dividend in a mutual fund is your own money coming back to you. The exact amount of dividend that is declared will be reduced from the Net Asset Value (NAV), so effectively your net wealth does not change.

Difference between Growth and Dividend option in Mutual Funds

Mutual fund schemes offer three options while investing: growth, dividend payout and dividend reinvestment. The following table shows Difference between Growth and Dividend option in Mutual Funds

| Description | Growth | Dividend Re-investment Option | Dividend Payout Option |

| Dividend Received | No | Yes | No |

| Dividend distribution tax(DDT) | No | Yes for schemes with equity <65% | Yes for schemes with equity <65% |

| NAV Change | No | Declines to the extent of dividend and DDT | Declines to the extent of dividend and DDT |

| Number of Units | No change | Increase in no of units | No change |

Growth and Dividend Option in Mutual Funds

How Mutual Funds Work

Investors contribute money to the fund which is invested by the fund manager into a variety of holdings. This gives the individual investors the power to own a wide variety of stocks, bonds and other investments.Net asset value (NAV) represents a fund’s per share market value. This is the price at which investors buys units from a fund company and sell them (redemption price) to a fund company. If 10 people contribute Rs 1,000 each to the same mutual fund and all is used to buy variety of stocks, bonds then the NAV is Rs 1,000, but the total value of the fund is Rs 10,000. The entirety of the mutual fund’s extensive portfolio is referred to as Assets under management(AUM). When a manager successfully grows a fund, the value of the portfolio increases along with the NAV.

NAV is calculated is by dividing the total value of all the securities the fund holds by the number of shares/units in the fund. Using the example above, if a mutual fund started with a total value of Rs 10,000 and its fund manager then increased the overall value of the fund to Rs 15,000, the original 10 shares in the fund would now be worth Rs 1,500. The fund manager is compensated for his efforts (which hopefully includes growing the value of the fund) through what’s known as the assets under management fee, or the expense ratio

Growth Option of Mutual Funds

- Under the growth option, the scheme does not pay any dividend, but continues to grow. Whatever gains are made by selling any fund holdings are ploughed back into the scheme. This gain is reflected in the NAV of the scheme, which rises over time.

- Under growth option, you will not receive any returns in the intermediate. You will not receive any payments in the form of interest, dividends, gains, bonus etc.

- You will get your returns only on selling the units. The returns will be the difference in selling price and purchase price, similar to gold investment. The NAV on the date of investment will be the cost price and the NAV of the sale date becomes the selling price. The difference is you return. For example you bought 100 units of a mutual fund scheme at an NAV of Rs 50 and you sold those units after 6 years when the NAV had reached Rs 120. So your returns will be Rs 7000. You will not get any payout in between.

Dividend option of Mutual Funds

Under dividend option, the mutual fund will pay you from the profits made by the scheme at periodic intervals . However, these dividends are not guaranteed and the mutual fund is not under any obligation to announce a dividend, dividend amount is also not fixed. The dividend gets deducted from the NAV of the fund and is paid to the investor. If your fund has an NAV of 50 and declares a 20% dividend ( 2 on a face value of 10), the NAV will fall to 48 after paying the dividend.

There are two sub-options :Dividend Payout & Dividend Reinvestment

- Dividend Payout Option: Dividend is paid out to the investor.

- Dividend Reinvestment Option:

- Under this option, the dividend is not paid to the investor but is used to buy more units of the scheme on his behalf.In dividend reinvestment option too, profits are stripped. But instead of giving them as cash, they are allotted to you as units at the prevailing NAV. Hence, indirectly, by adding more units, you simply stay invested in the fund. Conceptually, the dividend reinvestment option is the same as growth option for all equity funds.

- As with dividend payout, the NAV of the scheme falls after the dividend is paid.

- Though the dividend reinvestment option does not effectively make any difference in the value of the investment, Please note that reinvested dividend is treated as a new investment. This means in the case of tax-planning funds, ELSS a fresh lock-in period comes into effect .

- The behaviour, objective, fund manager, performance are all the same but only the way your returns are delivered is different.

- A mutual fund scheme can declare dividends only from the realised profits in its portfolio. Realised profits are the gains made by the fund manager from instruments by selling them and booking profits or when he receives dividend or interest (in case of debt funds) from the instruments the scheme holds.

- Dividends are not certain and the amount is also not fixed

- From 1 Apr 2018, Equity mutual funds (>65% in equity ) will pay Dividend Distribution Tax or DDT at the rate of 10 percent. (if you include the surcharge and cess, the rate of dividend tax is 11.648% and if you add the effect of “grossing up”, the full tax rate is 12.942%)

- For Debt funds the fund house pays a dividend distribution tax of 28.84% which includes surcharge and cess.

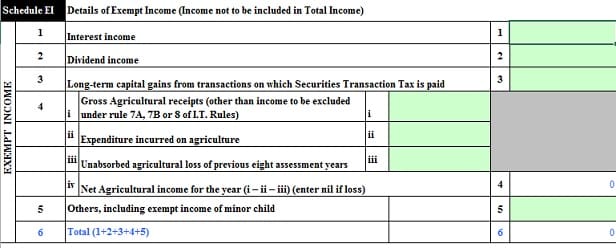

- Dividends received from all mutual funds are tax-free in the hands of the investors. Though Dividends are not taxable in hands of investors they need to be shown in the Income Tax Return Form as Exempt Income as shown in Image below. Our article Exempt Income and Income Tax Return explains it in detail.

Why is NAV of Growth and Dividend option different?

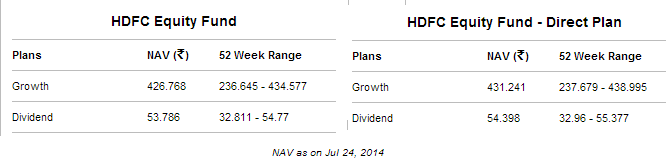

Dividend payout means that a part of such profits is taken from your NAV and given to you. Hence, your NAV falls to the extent of dividends. This is why the NAV of growth and dividend option are not the same. NAV of direct plan is higher than that of a regular plan as shown in the picture below.

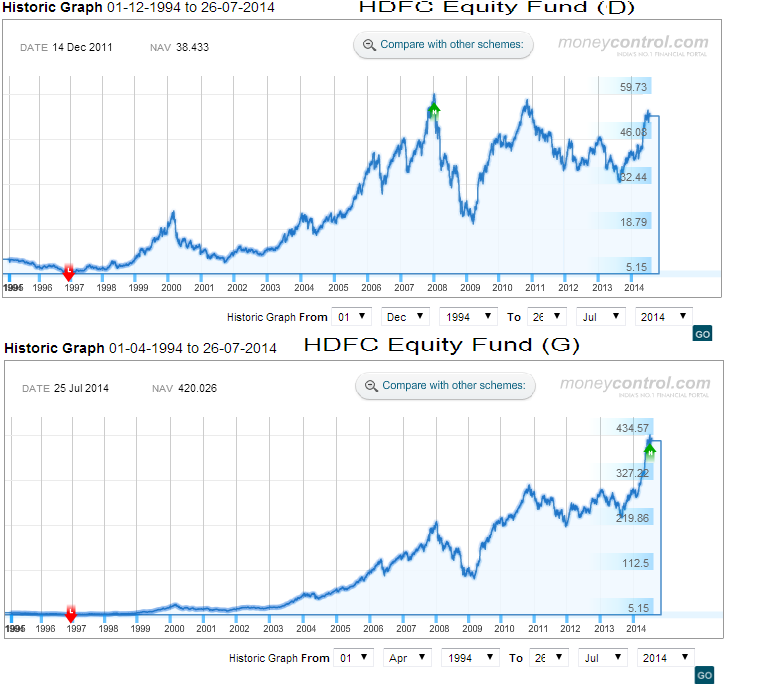

Performance of HDFC Equity Fund Growth and Dividend option is given below (Graphs from moneycontrol.com)

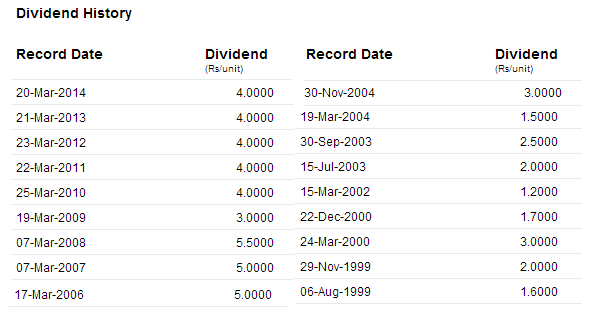

Dividend History of HDFC Equity Fund Dividend option

Are Returns same from Dividend and Growth Option of Mutual Funds

Let’s take the example of HDFC Equity Fund Dividend Option and Growth Option. Value of Growth option is 427.768 but after adding all dividend, Total value of Dividend + NAV is 109.186 (53.786 + 55.4) much less than Growth option.

| On Jul 24 2014 | |

| NAV of HDFC Equity Fund Growth Option | 427.768 |

| NAV of HDFC Equity Fund Dividend Option | 53.786 |

| Total Dividend Paid out declared by HDFC Equity Dividend option | 55.4 |

| Total Dividend +NAV Paid out declared by HDFC Equity Dividend option | 109.86 |

Let’s see the returns of the two options over period of time

| Investment of Rs 1,00,000 at NAV of 100. Number of Units 1000 | Growth | Dividend |

| Year 1 40% returns Dividend of Rs 10 per unit | NAV:140Net worth: 1,40,000 | NAV:130(140-10)Payout : 10,000Net worth:1,40,000(10,000 + 1,30,000) |

| Year 2 20% returns Dividend of Rs 5 per unit | NAV : 168 (20% of 140)Net worth: 1,68,000 | Before payout NAV : 156(130+20% 130)NAV after payout : 156-5=151Net worth: 1,66,000(1,51,000+10000+5000) |

| Year 3 10% negative return Dividend of Rs 5 per unit | NAV : 151.2 (-10% of 168)Net worth: 1,51,200 | Before payout NAV : 140.4(156-10% 156)NAV after payout : 140.4-5=135.4Net worth: 1,65,400(1,35,400+15000+5000 |

| Year 4 10% return Dividend of Rs 5 per unit | NAV : 151.2 (10% of 154)Net worth: 1,66,600 | Before payout NAV : 154.44(140.4+10%)NAV after payout : 154.44-5=139.56Net worth: 1,64,560(1,39,560+20,000+5000 |

In the dividend payout you lose because of compounding unless there is a negative return. Unlike the dividend option, the growth option reinvests the gains and the returns are compounded, resulting in higher proceed, at the time of maturity. As the dividend you receive is not re-invested by the scheme (and mostly not by the investor also) investor may loose out.

How to choose Growth and Dividend Option in Mutual Funds

Financial planners recommend dividend option for conservative investors in equity for those who are risk averse and those who need some cash flows. For those looking to build wealth over the long term through equity mutual fund systematic investment plan (SIP) it is advisable to opt for the growth option.This is because the compounding benefit is lost when the dividend is paid unless the amount is invested immediately in a higher than equity yielding asset.

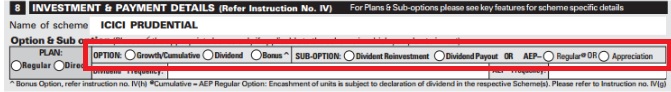

You can choose Growth and Dividend options in Mutual Funds while investing as shown in image below.

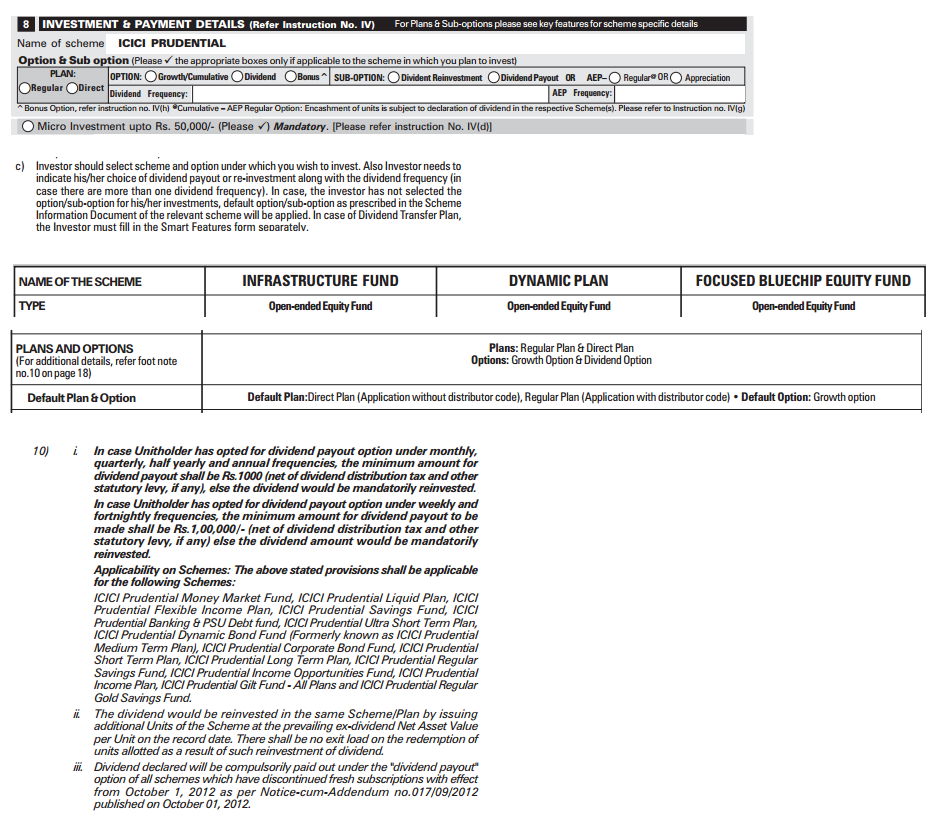

If an investor does not select the option in the application form, a default option is allotted. Depending on the scheme default may be either Growth or Dividend Payout or Dividend Reinvestment. Following picture show s the default option(Click on image to enlarge)

Switching from Dividend To Growth Option of Mutual Funds

Any change from Dividend Payout to Reinvest (or vice-versa) can be done by giving a simple written request or filling transaction slip . It has no implications on the number of units and future dividends would be reinvested(or paid out).

As the Dividend and Growth options are treated as two different schemes, with different NAVs, a change would be a Switch i.e. redemption from one scheme ex Dividend Payout and a purchase into the other ex Growth. For this change one needs to submit a switch request form.

Our article Switching of Mutual Funds discusses about Moving either the whole or part of the investment from one mutual fund scheme to another mutual fund scheme within the fund family, called as Switching of Mutual Funds.

Related Articles :

- How to Choose Mutual Fund : Ratings, Fund House,Size

- Direct Investing in Mutual Funds

- Not All Mutual Funds Do Well -the Laggards

- Mutual Fund Manager’s Limitations

- Rantings of a Mutual Fund Investor

- Articles about Mutual Funds collected at bemoneyaware.com’s Investing for 20s-30s

Which option do you choose for Growth or Dividend option? In Dividend Option as Dividend Payout/Dividend Payout? Why did you choose the particular option?

5 responses to “Growth and Dividend Option in Mutual Funds”

The series of difficult question you need to answer while dealing in mutual funds is exhaustive. The apprehension doesn’t end once you finalize on a particular mutual fund, in fact, it is just a start. The next big question is to decide on whether to select the option with mutual fund growth or mutual fund dividend. However, to understand the concept of both these available option, you need to get familiar with basic concepts such as dividend and growth. Investors must have a proper understanding of what a dividend is and the technicalities involved. Mutual fund dividend is basically a payment made to the shareholders by a corporation by the way of distributing its profits. Usually associated stocks, dividends are primarily computed using the face value of schemes. In simple terms, mutual fund dividends are investors own money coming back to them.

Thanks Lakshmipathy for the link. It is a great one, I almost fell off my chair on seeing HDFC Equity then I concluded it is the biggest equity fund hence choosing it is logical. I had not found it in my research.

Is there something specific you wanted us to look or include in our article?

Will also suggest to look at this link also for a quick walk through

http://getahead.rediff.com/slide-show/2010/aug/06/slide-show-1-money-mutual-fund-investment-concepts-simplified.htm

It was a good article about dividends of mutual funds.

Generally,there is no as much difference in dividend reinvestment and growth option but things can be different for ELSS schemes.

Since last decade we are investing in ELSS schemes to utilize 80C benefit and at couple of investments we have caught in dividend reinvestment option.Dividend reinvested in ELSS is not eligible for 80C benefit and subject to 03 yrs lock in from date of reinvestment.

After follow up with different AMCs we find that there is no uniformity across companies in this regard.One AMC told us its not possible to convert option of reinvestment into payout before lock in period and another one allow us.

for other equity schemes….we can expect earnings to grow and Net market direction will up in long term .so I think one can chose to invest in growth option and can redeem units if required(after one year for benefit of LTCG) rather than opting for dividend mode.

As well Exit load not applicable for units received through dividends reinvested so dividend reinvestment option is also not as harmful for general equity schemes.

Thanks Paresh for the ground reality.

What do people generally prefer and why?