Investors of the six debt schemes of Franklin Templeton Mutual Fund that were frozen on 23 April 2020 have received their investment in tranches from Feb 2021. On 23 April 2020, Franklin Templeton Mutual Fund announced the winding up of six of its credit-focused debt schemes. This article explains about Franklin Debt Schemes fiasco that started in April 2020, How the money is being returned to the investors, tax on the money returned, the timeline of events, the penalty imposed by SEBI.

Table of Contents

How are Franklin Templeton Debt Schemes returning the money?

In April 2020, Franklin Templeton India had abruptly shut six debt mutual fund schemes, citing redemption pressure which has left investors with Rs 25,800 crore in the lurch about getting their money back.

The six schemes were Franklin India Low Duration Fund, Franklin India Short Term Income Fund, Franklin India Ultra Short Bond Fund, Franklin India Dynamic Accrual Fund, Franklin India Credit Risk Fund, and Franklin India Income Opportunities Fund.

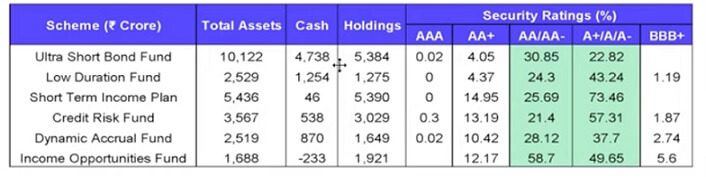

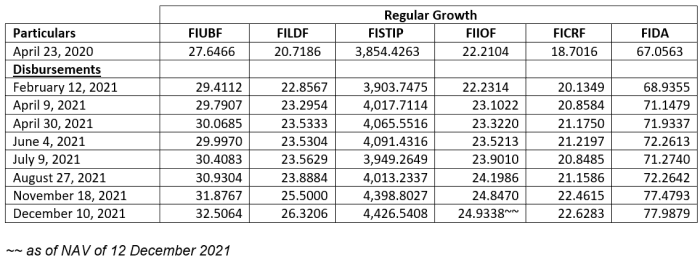

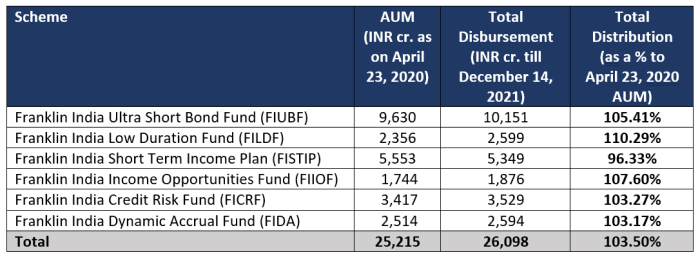

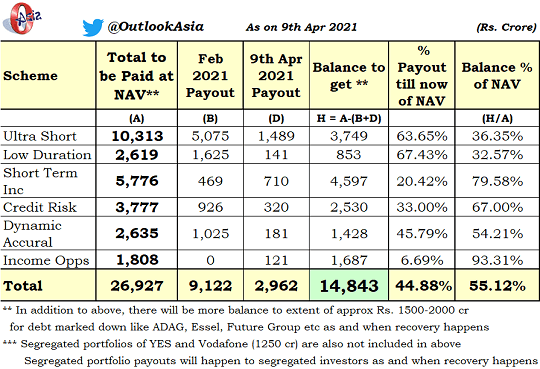

Investors of the six debt schemes of Franklin Templeton Mutual Fund have received the money in tranches. As of 12 Dec 2021, the total amount distributed is Rs 26,098 crore. The total break-up & scheme-wise breakup is given below.

Overall the money returned each of the scheme is shown in the image below

- The Fourth Tranche of Rs 3,205.25 was paid to the investors, by extinguishing proportionate units at the NAV of June 4, 2021

- In the third tranche in the week of May 3, investors were paid Rs 2,489 crores.

- Second Tranched was paid In Apr 2021 when Rs 2,962 crores were distributed to investors of the six debt schemes

- The first tranche was paid In February 2021 when Rs 9,122 crores were distributed to investors of five of the six schemes.

Tax on money received from Franklin

Money received by Franklin Templeton Investors will be treated as redemption.

The number of units sold will be the number of units extinguished.

Redemption is as per the first in first out (FIFO) method wherein units first bought are assumed to be redeemed first.

As it is the sale of Mutual Funds, the capital gain will come into play. If you sell at a higher price than the cost price you have a profit which is called Capital Gains. The tax paid on this amount of capital gains is called Capital Gains Tax. Conversely, if you make a loss on the sale of assets, you incur a Capital Loss. Basics of Capital Gain

These are debt schemes and the tax depends on the period of holding as given below.

- Short Term Capital Gains: You sell them within 3 years, capital gains on debt funds will be treated as short term. It will be added to your income and taxed as per your applicable tax slab. Our article Short Term Capital Gains of Debt Mutual Funds, Tax, ITR talks about it in detail

- Long-term capital gains: if you sell funds after 3 years, they are taxed at 20 percent with an indexation benefit on your cost.

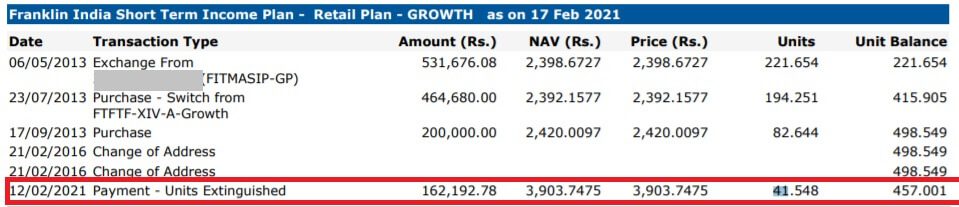

The statement sent by Franklin shows the purchase and sale details.

Capital Gain Statement of Franklin opportunities fund is shown below

4719.79 units were bought on 19/Jul/2010, with a NAV of 10.59.

As money was returned, units were considered to be redeemed and Long term capital gain with indexation came into play as shown in the table below

Its indexed cost in 2021-22 is 10.59 X (371/167) . CII of FY 2021-22 is 371, CII of FY 2010-11 is 167

(You can use our calculator Capital Gain Calculator with CII from 2001-2002 to find the indexed cost and capital gains)

For the first tranche received on 9 Apr 2021 , the 314.75 *(23.10 – 20.11) = 942.11

| Scheme Name | Desc | Date | Units | Amount | Sale Price | Desc_1 | Date_1 | PurhUnit | Red Units | Unit Cost | Indexed Cost | Short Term | Long Term With Index |

| Franklin India Income Opportunities Fund – Growth, ISIN : INF090I01445 | Purchase | 7/19/2010 | 4719.79 | 7271.43 | 23.10 | Payment – Units Extinguished | 4/9/2021 | 314.75 | 314.75 | 10.59 | 20.11 | 0.00 | 942.11 |

| Franklin India Income Opportunities Fund – Growth, ISIN : INF090I01445 | Purchase | 7/19/2010 | 4719.79 | 20266.86 | 23.32 | Payment – Units Extinguished | 4/30/2021 | 869.00 | 869.00 | 10.59 | 20.11 | 0.00 | 2792.10 |

| Franklin India Income Opportunities Fund – Growth, ISIN : INF090I01445 | Purchase | 7/19/2010 | 4719.79 | 16420.77 | 23.52 | Payment – Units Extinguished | 6/4/2021 | 698.12 | 698.12 | 10.59 | 20.11 | 0.00 | 2382.21 |

| Franklin India Income Opportunities Fund – Growth, ISIN : INF090I01445 | Purchase | 7/19/2010 | 4719.79 | 21018.00 | 23.90 | Payment – Units Extinguished | 7/9/2021 | 879.38 | 879.38 | 10.59 | 20.11 | 0.00 | 3334.60 |

| Franklin India Income Opportunities Fund – Growth, ISIN : INF090I01445 | Purchase | 7/19/2010 | 4719.79 | 34088.59 | 24.20 | Payment – Units Extinguished | 8/27/2021 | 1408.70 | 1408.70 | 10.59 | 20.11 | 0.00 | 5761.02 |

| Franklin India Income Opportunities Fund – Growth, ISIN : INF090I01445 | Purchase | 7/19/2010 | 4719.79 | 3870.07 | 24.85 | Payment – Units Extinguished | 11/18/2021 | 155.76 | 155.76 | 10.59 | 20.11 | 0.00 | 737.97 |

| Franklin India Income Opportunities Fund- Segregated Portfolio 2 (10.90% Vodafone Idea Ltd 02Sep2023), ISIN : INF090I01TF4 | Creation of units – Segregated Portfolio | 7/19/2010 | 4719.79 | 607.97 | 1.60 | Payment – Units Extinguished | 9/3/2021 | 381.10 | 381.10 | 0.00 | 0.00 | 0.00 | 607.97 |

Example of Long Term Capital Gain on Franklin Debt Schemes Partial Payout

In the example above the person(that’s me) bought Franklin’s Short term fund in May 2013 and got money on 12 Feb 2021. So I have Long Term capital Gain and can use indexation to calculate the tax.

You can use our calculator Capital Gain Calculator with CII from 2001-2002 to find the indexed cost and capital gains

For example, in the example above

Sale information: Number of Units: 41.58 NAV: 3903.7475 Date of Sale: 12/Feb/2021

Purchase information: NAV 2398.6727 Purchase Date: 06/May/2013

| The time between:7 years 124 days |

| Gain Type: Long Term Capital Gain |

| Difference between the sale and purchase price: 62581.0 |

| CII of the Purchase Year: 2013 month: Apr : 220 |

| CII of the Sale Year: 2020 month: Aug : 301 |

| Purchase Indexed Cost:136458.09 |

| Difference between sale and indexed purchase price: 25859.73 |

| Long Term Capital Gain Tax with indexation (at 20%):5171.95 |

Example of Short Term Capital Gain on Franklin Debt Schemes Partial Payout

If someone bought the Franklin Templeton scheme in Jan 2019 then it would be short-term capital gains and would be taxed as per tax slabs.

| Gain Type: Short Term Capital Gain |

| Difference between the sale and purchase price: 62581.09 |

| Short Term Tax is as per income slabs: |

| (at 10%)/12516.20 |

| (at 20%)/18774.30 |

Franklin Templeton Debt schemes timeline

On 23 April 2020, Franklin Templeton India abruptly shut six debt mutual fund schemes, citing redemption pressure which has left investors with Rs 25,800 crore in the lurch about getting their money back.

The six schemes were Franklin India Low Duration Fund, Franklin India Short Term Income Fund, Franklin India Ultra Short Bond Fund, Franklin India Dynamic Accrual Fund, Franklin India Credit Risk Fund, and Franklin India Income Opportunities Fund.

After Franklin closed its schemes, Fresh subscriptions and redemptions were stopped. The funds continued to publish their net asset values daily, and investors are not charged any investment management fee on these funds.

The timeline of events is given below. Details in the ValueResearchOnline article Franklin Debt Schemes

Various investors filed writ petitions in Chennai, Delhi, Ahmedabad High Courts, and in the Supreme Court against FT’s winding-up decision.

On 19 Jun 2020, The Supreme Court considered the special leave petition filed by FT and directed transfer of all pending cases to the Karnataka High Court, and gave a three-month deadline.

On 3 December 2020, the Supreme court issued an interim order allowing the Trustee of Franklin Templeton to seek the consent of the unitholders for the winding up of the six schemes u/r 18(15)(c) of SEBI (Mutual Fund) Regulation 1996.

Franklin Templeton investors in these 6 debt schemes had to vote online between 26 Dec to 28 Dec 2020. It was suggested to Vote Yes in the best interest of investors. And most investors voted Yes.

On 2 Feb 2021, the Supreme Court directed that the cash available under the six shutdown schemes should be distributed amongst the unitholders in proportion to their holdings. Additionally, the apex court assigned SBI Mutual Fund to carry out this exercise as agreed by both Franklin Templeton and SEBI. First Tranche was received in Feb 2021.

On 12 Feb 2021, the Supreme Court upheld the validity of the e-voting process. It also appointed SBI Mutual Fund as the authorized person to take the next steps on monetisation. The apex court directed SBI Mutual Fund to follow the best effort principle to ensure timely payment to the unitholders and assure the best possible liquidation value of the securities.

On 18th Mar 2021, Supreme Court accepted the Standard Operating Procedure (SOP) submitted by SBI Mutual fund to monetize assets of the shuttered Franklin schemes and distribute the proceeds. Supreme Court said that SBI MF will undertake the sale of remaining bonds in the secondary market or they will try to ensure pre-payment.

SEBI Investigation and Penalty

Market regulator SEBI launched an investigation into the six funds. Sebi’s probe found that Fraklin India was seriously wanting in so far as its conduct is concerned

SEBI ordered a forensic audit to find out if there had been any regulatory violation by the fund management team. The investigation was to find out whether the fund took decisions in the best interest of the investors, whether the investments were in the spirit of rules, the rationale behind the classification of funds, failure of risk management measures, any possible collusion between the found house and bond-issuing corporate among other

Sebi demanded answers from the fund house on 13 counts.

The forensic audit by Choksi & Choksi found that

- While Franklin sold these funds to investors under different names, actually all of them were being run as credit risk funds (a high-risk investment avenue).

- There was non-disclosure of critical facts. And the company had breached India’s mutual fund regulations.

- few key management personnel of FT withdrew their own investments before the fund house wound up the six schemes.

- FT did not exercise the ‘put’ option in some of the papers belonging to Reliance ADAG group companies, Essel group companies, despite the rating downgrade.

Franklin made Rs 451.6 crore as a fee on the six debt schemes — which it will now have to refund with a 12% interest. Sebi ruled that Income derived out of wrongful conduct, which ultimately resulted in loss and caused hardship to the investors…is liable to be disgorged,

Vivek Kudva, a director at Franklin India and chief of its parent’s Asia-Pacific business, his wife Roopa Kudva, a former Crisil chief who now heads Omidyar Network and Vivek’s mother Vasanthi Kudva took money out of some of the troubled funds well ahead of the freezing announcement of debt funds by Franklin India

In his capacity as a director, Vivek had access to critical info regarding the six doomed schemes, Sebi found. Most of this information was not available to others including the investors.

Vivek Kudva is barred from the market for a year. He has to pay Rs 4 crore in fine.

Roopa Kudva also has to pay a fine of Rs 3 crore.

Jun 14 Update: Sebi has also decided to fine the CEO, CIO, debt fund managers, and other top officials in the case of shutting down six debt mutual fund schemes in 2020.

- Sebi has decided to put a monetary fine of Rs 3 crore on CEO Sanjay Sapre and CIO- Santosh Kamath. Other debt fund managers of Franklin Templeton- Kunal Agarwal, Sumit Gupta, Pallab Roy, Sachin Padwal Desai, and Umesh Sharma will be liable to pay a fine of Rs 1.50 crore each.SEBI also fined the trustee company a sum of Rs 3 crore

- Saurabh Gangrade, Chief Compliance Officer, Franklin Templeton, a sum of Rs 50 lakh.

Franklin Update on 12 Apr 2021

Franklin Templeton Mutual Fund will pay out another ₹2,962 crores to investors who had put their money in the six debt schemes that were frozen on 23 April 2020 from the cash accrued so far. The payments will be cleared in the week starting 12 April 2021.

The payment to investors will be made by extinguishing the proportionate units in the scheme on the prevailing net asset value (NAV) as of 9 April.

Franklin Templeton Mutual Fund had already distributed ₹9,122 crores in February. The assets under the six debt schemes were worth around ₹26,000 crores on the day they were frozen. Their NAVs now exceed their levels on 23 April 2020.

The payouts will vary for the six schemes. As a percentage of assets, unitholders will receive

- 1,489 crore in Franklin Ultra Short Bond Fund

- 141 crores in Franklin India Low Duration Fund,

- Rs 710 crores in Franklin Short Term Income Fund,

- Rs 121 crores in Franklin India Income Opportunities Fund,

- Rs 181 crores in Franklin India Credit Risk Fund and

- Rs 320 crores in Franklin India Dynamic Accrual Fund.

Franklin Update on 6 Mar 2021

Franklin Templeton and some senior officials of the fund are being pulled up on two counts: one for money laundering and the second for favouring certain companies it had invested in and not exercising their put option when the companies went below investable grade

A forensic audit conducted by Choksi & Choksi found that there were 23 instances of top executives and entities withdrawing Rs 53 crore between March and April 2020, just before the winding up of the six debt schemes. If proved, it will be a clear case of insider trading, where officials of the fund knew the state of the fund and the action that the asset management company was going to take.

SEBI(Securities and Exchange Board of India) is conducting its own investigation on allegations of wrongdoing against Franklin Templeton MF and its officials.

SC is expected to pass an order in the next 7-10 days on the matter of how the winding-up regulations should be interpreted — whether trustees’ approval is enough or unitholders’ approval is a must before winding-up of mutual fund schemes.

SBI Mutual Fund will be filing its standard operating procedure (SOP) in SC next week, outlining how it intends to sell the debt securities held in Franklin Templeton’s schemes.

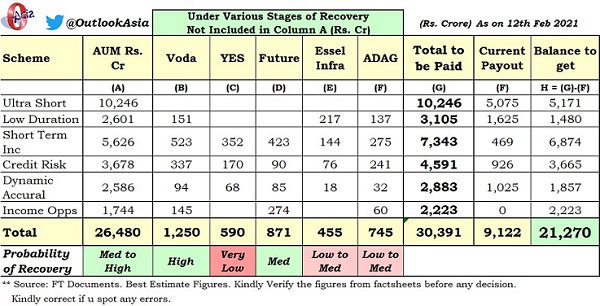

Franklin Update on 12 Feb 2021

Distribution of cash which 5 Franklin Templeton Debt schemes have already received up to Jan 15 (Rs 9122 cr) happened on 15/16 Feb 2021

For the investors who were KYC-compliant this money was automatically credited. For others, pls get in touch with the AMCs. Details of contact numbers are mentioned on Franklin website

For bonds that haven’t yet matured, Supreme Court says that SBI MF will undertake the sale of these bonds in the secondary market or they will try to ensure pre-payment – Either way, there will be no distress sale, it will be done at best effort basis. So instead of Kotak/Deloitte, SBI MF will work with Franklin to wrap up the schemes.

In SC Order balance is said to be 17,000 cr. But as per the calculation done by ManojNagpal of Moneycontrol, it is found balance is Rs. 21,270 cr i.e. 4270 cr more than 17k cr

FRANKLIN UPDATE IN Supreme Court on 18 Jan 2021

Result As Per SEBI Observer

Ultra Short Bond Fund – 96.78% votes in favor

Loan Duration – 97.23% in favour

Dynamic Accrual – 92.6% in favour

Credit Risk Fund – 97.97% in favour

Income Opp – 96.89% in favour

Short Term Income Plan – 97.61% in favour

Next hearing: Jan 25 – SC to decide on the disbursement of 9100 cr of funds after deciding on objections to Observer’s report SC Observed – “Prima facie, we feel that we should not stop the disbursement of funds at this stage”

Official information: Franklin Templeton Website on winding down

Voting in Franklin Templeton schemes

A video conference, with the trustees for each of the schemes, was held on 29 Dec 2020, which has a limit of 2000 attendees. In the meeting, for the first time unitholders of six schemes will get a chance to question trustees on their decision to wind-up the schemes. Unitholders can also vote during this meeting if they get to attend the meeting.

The unitholders had to vote online, from 9 am on 26 Dec 2020 till 6 pm on December 28, 2020.

E-Voting: https://evoting.kfintech.com

KFin Technologies Pvt Ltd has set-up an electronic infrastructure, an alternative to the paper-based ballot process to facilitate shareholders to cast votes in electronic form through the internet.

- Each unitholder will get one vote for the scheme he/she is exposed to irrespective of the amount invested.

- Each Unitholder is entitled to vote only once per scheme that they have invested in, irrespective of the number of units

- Regardless of the number of folios a Unitholder holds under the same PAN / PAN combination, they will be entitled to vote only once.

- If the Unitholder has more than one folio under the same PAN but has a different email ids registered in the folios, they will receive the email at the address registered in the

last transacted folio - If the investments are jointly-held, the first unitholder will get the voting right.

5757 – FRANKLIN INDIA CREDIT RISK FUND (E.G.M)

- Starts at :

- Dec 26 2020 9:00AM

- Ends at :

- Dec 28 2020 6:00PM

5758 – FRANKLIN INDIA DYNAMIC ACCRUAL FUND (E.G.M)

- Starts at :

- Dec 26 2020 9:00AM

- Ends at :

- Dec 28 2020 6:00PM

5759 – FRANKLIN INDIA INCOME OPPORTUNITIES FUND (E.G.M)

- Starts at :

- Dec 26 2020 9:00AM

- Ends at :

- Dec 28 2020 6:00PM

5760 – FRANKLIN INDIA LOW DURATION FUND (E.G.M)

- Starts at :

- Dec 26 2020 9:00AM

- Ends at :

- Dec 28 2020 6:00PM

5761 – FRANKLIN INDIA SHORT TERM INCOME PLAN (E.G.M)

- Starts at :

- Dec 26 2020 9:00AM

- Ends at :

- Dec 28 2020 6:00PM

5762 – FRANKLIN INDIA ULTRA SHORT BOND FUND (E.G.M)

- Starts at :

- Dec 26 2020 9:00AM

- Ends at :

- Dec 28 2020 6:00PM

After the 1st Voting of Franklin Templeton Debt Schemes

Results of the Voting will not be known this year. Whatever the results of the voting, it will have to be given in a sealed cover to the Supreme court, which may come into effect once SC gives direction, The next round of hearings at SC will resume in the third week of January 2021.

If investors vote No

The fund which is closed will open i.e one can redeem(and invest).

There will “Bank Run” means on DAY#1 of RE-OPENING all Cash Positives in all funds will go to those who put in redemption requests first. It will be first come first serve. (Many say FT Trustees, Top Management, Employees, the Big Corporate Investors etc). All cash received until now will be drained-out on Day#1 itself

Investors will be left with the remainder of unsold bonds- which after DISTRESS SALES will fetch only around 10% of their actual purchased values.

So, finally, due to NO vote wins- investors will get losses (may expect it to be anywhere from 80% to 95% LOSSES on their original invested amounts!)

Second Voting in Franklin Debt Templeton Schemes

If most of the investors voted Yes, there will be another round of Voting.

Franklin will then ask unitholders to decide on whether they want to authorize the trustees with the winding-up process or allow independent consultant Deloitte. The fund house had reached out to unitholders to vote on this in May 2020, before the matter went to the court.

If investors authorize Deloitte to wind up the schemes, then Deloitte will make the decisions as to when and at what price it would sell the underlying securities of all the six schemes.

Else the trustees will decide how to wind up the schemes

The fund house had already appointed Kotak Mahindra Bank to assist it in liquidating the schemes

When will Investors of Franklin Debt Templeton Schemes get the money?

After the results of the second vote are out, unitholders of cash-positive schemes will get the proceeds in their accounts.

So, even after a ‘yes’ vote in the first round, investors will have to wait, to start getting their money back.

They will get the money back in installments

First, the cash that Franklin Templeton has in each of these schemes will be given to the investors. Investors won’t have to do anything. It will be directly credited into their accounts. Four of the six schemes are cash-positive, and held Rs 7,226 crore of cash, as of November 27, 2020. Investors of Franklin India Income Opportunities Fund (FIIOF) and Franklin India Short Term Income Plan (FISTIP) may have to wait for a little longer to get even their first installment back, even if they vote ‘yes.’

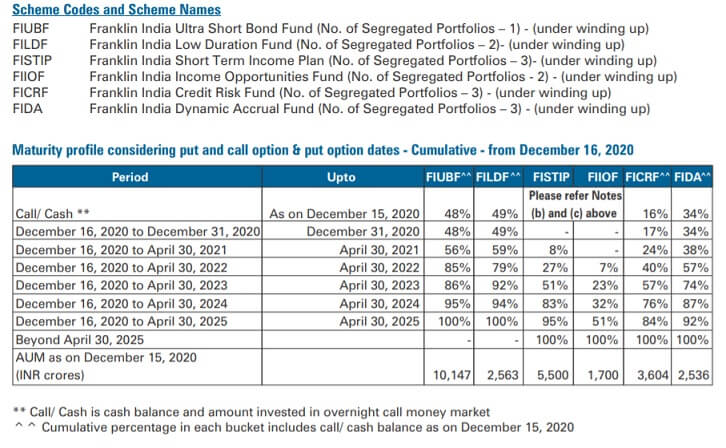

Cash and Holdings of Franklin Debt Schemes

Unitholders will also gradually receive cash from maturities, coupon payments, part-payments, or pre-payments. The maturity profile is shown in the image below

Later, depending on how the vote goes, the fund could also sell its investments, generate cash, and then distribute it.

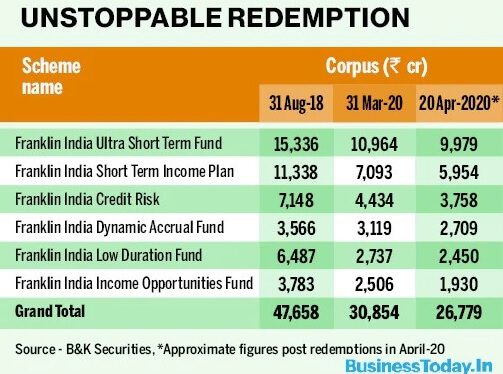

Borrowings of Franklin Templeton

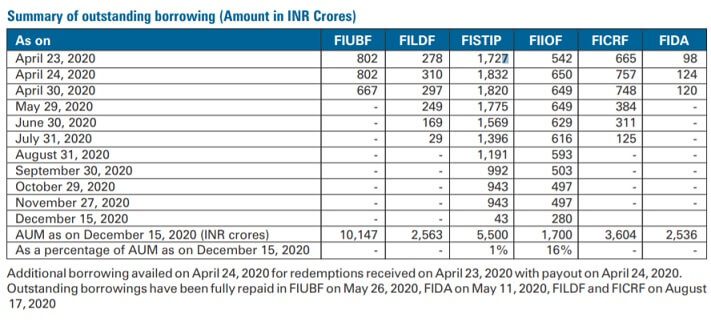

Franklin Templeton had a lot of redemptions in 2020 as shown in the table below. To meet the huge outflow, it borrowed money.

The table below shows the Summary of outstanding borrowing. Franklin India Income Opportunities Fund (FIIOF) and Franklin India Short Term Income Plan (FISTIP) haven’t yet generated cash as they are yet to fully repay the borrowing in the schemes as shown in the table below.

Why did Franklin shut down 6 debt schemes

Franklin Templeton MF had closed six debt mutual fund schemes on 23 April 2020, citing redemption pressures and lack of liquidity in the bond market. The schemes, with a total corpus of about Rs 26,000 crore, directly affected 300,000 investors, damaged the credibility of the mutual fund (MF) industry

Six debt funds were :

- Franklin India Low Duration Fund (FILDF),

- Franklin India Dynamic Accrual Fund,

- Franklin India Credit Risk Fund,

- Franklin India Short Term Income Plan,

- Franklin India Ultra Short Bond Fund, and

- Franklin India Income Opportunities Fund (FIIOF).

Franklin Debt schemes generated higher return as they took higher risks buying not so good bond papers. FTMF had high exposure to lower-rated securities in the six schemes that were wound up.FT was the sole lender to 26 out of the 88 entities in its debt schemes’ portfolio, some of which were lesser-known companies. Cash and Holdings of Franklin Debt Schemes show the ratings of holdings in the various schemes.

The high-risk high-return strategy that had benefitted the fund finally collapsed under the weight of COVID-19. Heightened redemptions amid virus outbreak brought in liquidity challenges for schemes with higher exposure to low rated instruments, thus crippling them.

The good news is that FTMF has received repayments/prepayments from some of the companies.

What happened in debt schemes since closing down?

On 19 June 2020, the Supreme court clubbed four petitions before the High Courts of Gujarat, Madras, and Delhi and transferred to Karnataka High Court.

Are Debt Mutual Funds safe?

The situation these funds are facing is unique to them, and debt funds of all other categories and across the majority of Mutual Funds remain a good option to invest.

Franklin Templeton funds had this crisis because they invested in low-rated bonds across debt funds with an aim to generate high returns and they did deliver for many years. Low-rated bonds give a higher interest rate because they carry a higher risk of default, i.e., the borrower not paying back the interest or principal amount. So to compensate for this risk that the Fund Manager takes by investing in these bonds, they tend to give a higher interest rate. This risk of default is called credit risk.

Debt funds of Franklin Templeton suffered due to investment in Vodofone, Yes Bank which led to side pocketing, voluntary markdowns that saw steep fall in returns, etc. These funds also resorted to borrowing money, and they were able to manage redemption demand by selling bonds at the right price.

And due to Covid in Mar 2020, the bond market became illiquid as there were no buyers for low-rated bonds. Then there was more than normal redemption pressure.

One must remember that Debt Mutual Funds are for protecting the capital and not earning extra returns.

So before investing in a debt fund, understand the type of fund and the portfolio.

Videos on Franklin Templeton Debt Schemes and money

P V SUBRAMANYAM of blog subramoney explains why one should say yes to unwinding.

Sucheta Dalal, one who exposed the Harshad Mehta scam, takes a look at the Franklin Templeton Mutual Funds mess and says how investors are being coerced into voting without adequate information.

What does Bemoneyaware feel?

The frying pan or the fire? What a choice, you will get burnt!

We are not just blogging about it for blogging’s sake but have a personal stake in these schemes of Franklin Mutual Funds(Short term and Income opportunities).

We do agree with Sucheta Dalal, there is not much information on how much loss will be to our capital.

All we know is that there is a chance of getting more money over a period of time than the distress sale. We are willing to wait to get the money. And hence will vote Yes in voting.

Related articles

All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- Segregated Portfolio, Side Pocketing in Debt Mutual Funds

- Mutual Funds and Segregated portfolios, Interest Payment: Franklin, Nippon, UTI

The summary is that investors of Franklin Templeton of the 6 closed debt schemes have to make a choice between getting less money soon or getting more money in installments over a period of time. The frying pan or the fire? What a choice, you still gone burn

Keep in mind that debt funds are not risk-free. Investment in debt funds carries various risks relating to liquidity, credit quality, and interest rate. Therefore, before investing in debt funds understand the various risks involved and invest in schemes where the portfolio risk aligns with your own risk appetite and financial objective.

Trackbacks/Pingbacks