You plan a tower that will pierce the clouds? Lay first the foundation

Recap:Swayam was now king of the world. All the hours of studying in school, college had paid off, he had the job and he would spend money living life king size. But then he was pulled in different directions-taxes, savings, insurance, investments, stocks, mutual funds, . He realized he was educated but had no financial education and started on money awareness journey. He brushed up his school maths such as percentages, compound interest. He also learnt that It’s not what you earn that makes your financial position! Today he will learn about the four cornerstones of one’s financial position:Income, Expenses, Assets and Liabilities. Note these terms can be applied to companies and individuals but here we will focus on individual.

3. Assets : adds to one’s income now or in future strengthening one’s financial position ex: investments in gold/silver, deposits, stocks, mutual funds, art/antiques, land or house. Asset is something that generates money for you. If you have to work to generate money, then that is Income. If you do not have to work but keep getting money, then that source of Income is your Asset. Robert Kiyoski in Rich Dad, Poor Dad series defines Asset as one that puts money in your pocket. Assets are the things that we own that we could sell for money. Some common examples of assets are:

- A house or other real estate

- A car

- Household appliances

- Electronics like a TV or computer

- Our furniture

- Money in a bank account

- Clothing, shoes, etc

- Stocks, mutual funds, bonds, etc

4. Liabilities:is a form of obligation or responsibility. It represents an outstanding debt, products or services that have yet to be provided, or acknowledgment of responsibility and payment provided for damage caused through actions or negligence. Robert Kiyoski in Rich Dad, Poor Dad series defines Liability as one that takes money from your pocket. It weakens one’s financial position. Ex:

- An old vehicle that needs a lot of fuel and repairs,

- Personal loans,

- Credit cards,

- Education Loan

- Home loan or mortgage,

- Payment plans for purchased items purchases or commitments that we take and service for long period of time.

- After one year you would owe109 rupees (i.e. 100+100 x .09).

- At the end of the second year you would owe118.81 (i.e. 109+109 x .09).

- Good liabilities gives one leverage — e.g., home mortgage, student loans, business loans, etc.

- Bad liabilities put one at a disadvantage — e.g., consumer loans, credit cards debt, etc.

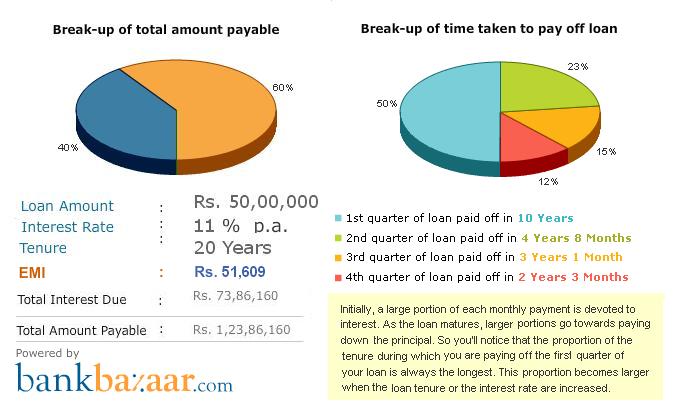

Liabilities can also be a significant source of expenses. Interest payments on loans and credit card debt can add up very quickly and really eat into our income over time. Then why do people own a liability? Because they think it will help them to build an asset such as home loan or mortgage. But good liabilities can turn bad. For example, a mortgage that is too large. As mentioned in earlier article,It’s not what you earn that makes your financial position MD is about to loose his job and he has home loan of 52 lakhs to pay along with regular expenses including children education , 1 lakh per month. He has some savings in Mutual Funds and insurance policy but..!

President of USA, Barrack Obama and his wife Michelle graduated with significant student loan debt. “We left school with a mountain of debt,” Mr. Obama said in 2008. “Michelle I know had at least $60,000. I had at least $60,000.( New York Times). Michelle Obama told women that when she and her husband left law school, the monthly payments on their school loan debt was more than their monthly mortgage payment, and that they only got out of that debt when Barack Obama wrote his two best selling books. To know more about click Obamas Financial Struggle

Net Worth: The amount by which assets exceed liabilities. This is one’s true wealth or net worth. It can be a useful tool to measure one’s financial progress from year to year.

The value in calculating Net Worth is to map out assets and liabilities to gain actionable financial insights. For example, if after mapping out one’s assets and liabilities, one realizes that one is up to Rs 20,000 in a savings account and has Rs 10,000 in credit card debt that one is paying 30% interest on, that can be an incredibly valuable insight to take action on.

To find out how much rich a person actually is one uses Net Worth. For example as per gulfnews.com

Mukesh Ambani remains the richest Indian on earth although his net worth has dropped by $4.4 billion (Dh16.16 billion) in the past year.

Savitri Jindal with net worth of $9.5 billion is ranked overall fifth in the list of 100 richest Indians and has become the richest woman of India.

richest.org website lists richest people in various categories – Sports, Hollywood. For example as per richest.org, Mark Zuckerberg’s, founder of Facebook, net worth is $17.5 billion (as on Sept 2011) and Aishwarya Rai Bachchan’s net worth is $35 million. Interested ones can read about Richest people of World and Rich people of India at bemoneyaware.com

What else makes one’s financial position? How can one have a strong financial position? Do you think house is an asset or a Liability?

8 responses to “Four Corner Stones:Income, Expense, Assets, Liabilities”

Hi,

Good article to brush up basics. I feel House is a neutral concept for a varied people in consideration. For all, it is an asset while the loan component is definitely a liability for some. Owning a house has been given more importance in India due to ancient culture and traditions associated with it. My advice for the current generation is to look for apartments to stay on rent(Any which way it is just a question of having a roof over your head). You can explore your creativity/talents elsewhere rather paying debts throughout lifetime.

[…] Four Corner Stones:Income, Expense, Assets, Liabilities […]

i, ı love your web site

Thanks. Hope we can meet your expectations

Hi – Housing is definitely an asset. The long term value of housing goes up (dont look at the US where the bubble burst!).

I saw an example of 50 Lacs loan and 74 lacs of interest being paid on that over a period of 20 years. One needs to take into consideration that though the absolute value is 74 lacs the inflation adjusted amount for a 50 lac loan will be barely 20 lacs – making the amount spent on a house a total of 70 lacs. Even when all investments go away a house is a place for shelter – one MUST invest in a house before most other goals are planned for.

Mumbai is one exception where a second house is a far far dream. In the rest of the country houses are second houses are excellent sources of passive income enough to cover 30%-40% of the EMI in many cases.

House is an asset as long one does not overleverage.

House is an asset or not is a tricky question..and in India we all believe in having our own roof over our heads.

But yes we do agree with you..House is an asset as long one does not overleverage.

[…] Four Corner Stones:Income, Expense, Assets, Liabilities […]

Many thanks for taking this chance to speak about this, Personally i think strongly regarding it and I make use of learning about this subject. When possible, as you gain data, please update this website with new information. I’ve found it extremely useful.

this is the first time i am coming across bleeders as a term to describe liabilities. quite apt. bleeding indeed & how! 🙂

seems like Aishwarya sure made a lot of money thanks to her brand endorsements whether her films worked or not

ah! that chart with the 4 corners! mine has a larger & darker shade of orange right now 🙁