This article lists the various forms, Form 15G & 15H to avoid TDS such as for Fixed Deposit or EPF Withdrawal before 5 years. It also lists the various forms one needs for EPF Withdrawal and EPS Pension.

Table of Contents

Form 15G & Form 15H: Avoid TDS

The Income Tax Department has announced a new procedure regarding Form 15G & Form 15H starting 1st October 2015. Key Changes are given below. Our article How to Fill Form 15G? How to Fill Form 15H? discusses the process of filling form 15G/15H in detail.

- Forms have been simplified. Gone are the various schedules like Schedule 1,2 etc

- Introduction of Electronic mode of filing Form 15G & 15H as an Alternate to Paper Form. No procedural rules has been prescribed as regard to filing of Form 15G. However, It seems Form 15G & 15H can be filed using Internet Banking facility or Similar facility for in case of Other institution which are making payment as provided in Section 197(1) or 197(1A) or 197(1C). –

- The person responsible for making a payment or the Deductor shall allot a UIN (Unique Identification Number) to each Form 15G and Form 15H received.

- The Deductor shall mention the particulars of these Form 15G & Form 15H received during any quarter of the financial year along with the unique identification number allotted by him in TDS Quarterly Statements, whether or not any TDS has been deducted by him.

- The Deductor is no longer required to submit physical copy of Form 15G & Form 15H to the Tax Department.

- However, these forms must be maintained by the Deductor for a period of 7 years from the end of the financial year in which these are received

The forms required for different categories have been listed below :

| Category of Tax Payer | Income Tax Section | New Form in pdf | Form 15G in word

Form 15H in word format |

Old Form |

| Individual:Senior Citizen | Sub-section (1C) of section 197A | New-Form-15G | New Form 15G | Form15H (pdf) |

| Individual:Non senior Citizen | Sub-sections (1) and (1A) of section 197A | New-Form-15H | New Form 15H | Form15G (pdf) |

| Trusts/SocietiesAvailable from Assessing Officer | 15AASample form(pdf) |

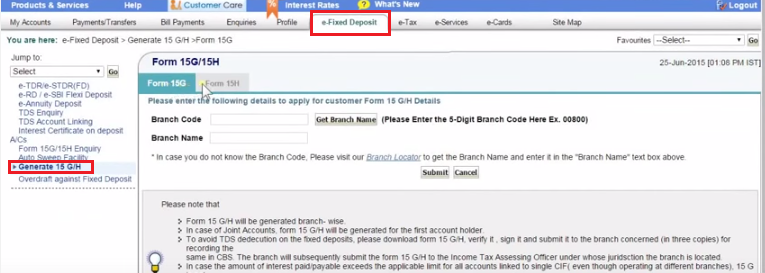

Banks which allow submission of Form 15G & Form 15H Online

Banks like State Bank of India allow for online submission of Form 15G & Form 15H. .

Please note that

• Form 15 G/H will be generated branch- wise.

• In case of Joint Accounts, form 15 G/H will be generated for the first account holder.

The YouTube Video on How to Fill Form 15G/15H online from State Bank of India Tutorials shows how to Submit Form 15H/Form 15G online. This video was published in Sep 2015 before the New Guidelines for Form 15G/15H were introduced. So it shows how to fill the old form.

EPF Withdrawal and Pension Forms

You can withdraw from EPF and EPS if you are unemployed for 2 months. You can also wait for two months to get a new job and then you can get your PF Account transferred to the new Account. However, in case of not getting the job , apply for the settlement before 36 months from leaving the last job as no interest will be paid after 36 months and the account will become inoperative.

If person passes away while in service or before claiming EPF and EPS, his family can claim EPF & EPS. Various forms required are listed here. Our article Basics of Employee Provident Fund: EPF, EPS, EDLIS, EDLI, Employee Deposit Linked Insurance Scheme, How to get information about EPF balance : Annual Statement, SMS, E-Passbook discusses the basics of EPF ,EPS and EDLI.

How to withdraw from EPF and EPS

You can withdraw EPF both the employee and employer contribution by submitting Form 19.

Withdrawal from Employee Pension Scheme, EPS, depends on if you have more than 10 years of contribution to EPF. If you have more than 10 years of contribution to EPS you will get a Scheme Certificate. You can apply for Withdrawal Benefit or Scheme Certificate through Form 10C for retaining the Pension Fund Membership. Retention of the membership will give advantage of adding any future period of membership under the Fund and attain eligible service of 10 years to get pension. The Family Pension Benefits will also be admissible in

case of death of member if before 58 years of age even with less than 10 years of eligible service.

If you are between 50 to 58 years and have done more than 10 years of EPS Contribution then you can also opt for Pension. But this will be reduced Pension. the Pension will be paid at a reduced rate from the date of leaving service or opted date or 50 years age, whichever is later. The pension will be calculated as admissible on completion of 58 years and will be reduced by 4% for each year backward.

You can withdraw EPF both the employee and employer contribution by submitting Form 19. Regarding EPS contribution the form that one can fill are given in table below

| Your Age | EPS Contribution | Form | Instructions |

| Less than 50 years | Less than 10 Years | 10C | Withdrawal/Scheme Certificate |

| Less than 50 years | More than 10 Years | 10C | Scheme Certificate(No Withdrawal benefit allowed) |

| Between 50 years to 58 years | More than 10 Years | 10C/10D | Scheme Certificate or reduced Pension |

| Between 50 years to 58 years | Less than 10 Years | 10C | Withdrawal/Scheme Certificate |

| Above 58 years | Less than 10 Years | 10C | Withdrawal |

| Above 58 years | More than 10 Years | 10D | Pension |

EPF Forms when the member dies

When the Member dies then Nominee/Beneficiary/Legal heir (as applicable) has to Apply for

- For Final Settlement of PF through FORM 20

- For EDLI Insurance amount through FORM 5IF , if Member was in service.

- For Monthly Pension through FORM 10D if member had completed 10 years of service and Withdrawal through Form 10C if member has contributed less than 10 years of service. Form 10D for claiming the Pension benefits, in case:

- (i) The claimant is a family member (Spouse/child below 25 years age as on date of death of member)

- (ii) Nominee for Pension, in case the member had no family and had nominated such nominee for Pension

- (iii) Dependent Parents, in case the member had no family at the time of his/her death and had not nominated any one for Pension.

Form 10C for withdrawal Benefit, in case the member had died after 58 years of age and had not completed 10 years of service as on date of crossing 58 years age

Documents Required

- Death certificate,

- Guardianship certificate issued by a competent court of law, if the application is preferred by a guardian other than the natural guardian of minor member/nominee/family member/legal heir.

- Copy of blank/cancelled cheque so that the payment may be sent through electronic mode in the claimant’s account.

You can withdraw EPF both the employee and employer contribution by submitting Form 20. Regarding EPS contribution the form that one can fill are given in table below

| Members Age | EPS Contribution | EPF Form | Instructions |

| Less than 58 years and working | – | 10D

51F |

For Monthly Pension through Form 10D

EDLI Insurance through 51F |

| Less than 58 years and not working | – | 10D | For Monthly Pension through Form 10D |

| More than 58 years and working | More than 10 Years | 10D

51F |

For Monthly Pension through Form 10D

EDLI Insurance through 51F |

| More than 58 years and working | Less than 10 Years | 10C

51F |

For Withdrawal Form 10C

EDLI Insurance through 51F |

| More than 58 years and not working | More than 10 Years | 10D | Pension |

| More than 58 years and not working | Less than 10 Years | 10C | Withdrawal |

Download EPF forms

Download EPF related Forms from EPFO website at Which Claim Form to Submit or from our website

Write your Mobile Number on top of form to get SMS alerts

- Final Settlement from EPF :Form19 (pdf) To see the filled sample form Sample Filled Form19_English

- Withdrawal Benefit/ Scheme Certificate from Pension Fund through Form-EPS-10C Instructions on how to Fill Form-EPS-10C-Instructions-Eng

- Apply for Pension Form Form-EPS-Pension-10D. Instructions on how to fill Form-EPF-10D-Instructions-Eng

New EPF UAN based forms

- EPF withdrawals : UAN-Based_Form 19 . Please do submit Form 15G to avoid TDS deduction if your service is less than 5 years.

- EPS withdrawals :UAN-Based_Form 10C(note that EPS withdrawal is only allowed if you have not completed 10 years of service.)

- Claiming Advance or Loan from EPF : UAN-Based_Form31

When the member dies:

- epf-Form-20 for EPF Withdrawal, epf-Form20-Instructions_Eng

- epf-insurance-Form5IF For Insurance, EDLI

If you have filled these forms and would like to share a filled sample then please do email us at bemoneyaware@gmail.com or leave message in comment. It would help other readers.

27 responses to “Forms to avoid TDS,15G, 15H, and EPF Withdrawal Forms Form 19, Form 20,Form 10C,Form 10D,Form 51F”

Sir,

I had retired from employer on completion of 60 years. I had UAN and AADHAR are linked in UAN KYC. My name in UAN is Rajappan V R but My PAN card name is Full[i.e. Rajappan Vadakkel Raghavan].Due to this PAN is not linked online.

I had PAN and return filed upto FY 18-19. Without linking PAN no. if i draw PF, the TDS deduction is applicable or not.

Not to deduct TDS from my EPF withdrawal , what is to be done.

Kindly reply

Sir,

I had retired from employer on completion of 60 years. I had UAN and AADHAR are linked in UAN KYC. My name in UAN is Rajappan V R but My PAN card name is Full[i.e. Rajappan Vadakkel Raghavan].Due to this PAN is not linked online.

I had PAN and return filed upto FY 18-19. Without linking PAN no. if i draw PF, the TDS deduction is applicable or not.

Not to deduct TDS from my EPF withdrawal , what is to be done.

Kindly reply

I have worked for a co-operative firm for more than 25 years and now the firm is closed in 2010, and I have not yet resigned. I want to withdraw my pf and also I dont have the UAN number as the firm has closed before. What are the necessary documents and forms needs to be submitted?

Dear Sir /Madam,

I have taken VRS from multinational company in March 2016. I have completed 24.5 yrs service continuously in same company. Right now my current age is 48 yrs. Can I avail to start pension under EPS-95 scheme. If yes then please tell me the process & if no, when & how will be started pension for me.

Pension from EPS starts at the age of 58.

You can take the pension earlier from the age of 50 years. You can opt for pension after 50 but will have to forgo 4% for every year before you turn 58. This is called as Before superannuation and one should not be in service.

As explained in the article How to apply for the EPS pension?

For pension, EPS Pension Form 10D should be filled.

The application should be forwarded through the establishment in which the member last served/died. The establishment should furnish the certificate and wage particulars duly attested by the authorized officer.

if the establishment is closed, the application should be forwarded through Magistrate/Gazetted Officer/Bank Manager/any other authorized officer as may be approved by the Commissioner.

With Form 10D, you will be required to attach the bank account proof [copy of passbook/canceled cheque] . For this, you must have an account in the bank, which is designated by EPFO for pension facility. For the details of such bank, you can visit your nearby EPFO.

Photographs of your family including you, your spouse and children below age of 25 yrs. Previously EPFO asks for 3 photographs, but now they are taking 4 photographs.

Age proof of the member and family, as in the photograph.

Any scheme certificate, issued earlier by any EPFO.

All the above documents and form should be attested by your employer, or any gazetted officer.

The form should be submitted in duplicate for home state and triplicate for out of state.

Download Sample Filled PF Form 19 http://www.hrcabin.com/sample-filled-pf-form-19/

I worked from 2011 October to May 2015.Now I wish to withdraw my pf amount.my kyc are already verified by UAN.i am submitting form 19 and 10c uan.what is the procedure to submit form 15G.

Along with Form 19 and Form 10C you can submit form 15G. Purpose of submission of Form 15G is that EPF does not deduct TDS.

But as you are withdrawing before 5 years, you have to look at tax part.

I have PF account which is 5 Yeas 7 Months and Now I moved from one company to another one in different state. I quit the job in Company A on August 2016 and joined in company B and I like to withdraw my Old PF account through the UAN based forms. What is the procedure to claim the EPF and EPS amount.

respected sir,

i left my job in previous company.up to know i didnt take my pf it was nearly 7 years so how can i will withdraw my pf.please guide me

srinivas p

The process of withdrawing from EPF is the same whether it is after 2 months. Your ex employer exists?

Get the PF withdrawal application processed through your previous employer: Most companies will ask for a duly filled withdrawal(Form 19) form along with a blank cheque and will get your PF request processed via the EPF office. Getting in touch with your previous company’s HR manager is the best way to go about this.

For withdrawing EPS you need to submit Form 13. and Form 15G (to avoid TDS).

You can all submit PF withdrawal form directly to the regional Provident Fund Office. This procedure requires identity attestation since the PF office would want to be sure whether the right person is applying for withdrawal. Hence, your withdrawal form needs to be attested by one of the following listed authorities –

Any Bank Manager

A Gazetted Officer

Magistrate/ Post/ Sub Post Master/ President of Village Panchayat/ Notary Public

Attestation by Bank Manager is best when the bank is where you maintain your account. Since this direct method of application has chances of fraud so EPF office generally asks for a letter stating the reason for direct application. Non-cooperation from employer is a valid reason but only if you have a proof for that. Also, attaching a proof of employment letter is a plus.

You can check the article for more details and form.

I am Seshathri, working in a private firm and have a UAN.I am planning to withdraw the PF amount since I was associated with the organization for 3.9months and I will join in the next organization by sep’16.

The HR in our organization says that I cannot with draw since iam joining the new organization and states that I can only transfer the amount. Is it true, Any one please clarrify

Hello Sir,

Theoretically yes you cannot withdraw if you are going to work in an organisation as EPF is for retirement.

We also would recommend you not to to withdraw.

But if you want to withdraw you can submit the withdrawal forms, either through employer or without employer as you have UAN.

You would be asked to fill Form 15G so that TDS is not deducted.

Please note that as you are withdrawing before 5 years of service the EPF amount would be taxable.

Sir i left my job on 10 jun 2016 now i like to withdraw my epf through UAN.what arw requirements for withdraw through UAN.I worked for 2 yr 8 months.

I am Rajesh, I have served in a multinational company for 12 years. I quit the job on 2009 and started some own business. now I am thinking to withdraw the EPS amount. My current age is 45. Can I withdraw my EPS?

Hi I left my job in Bangalore and moved back to home town due to family emergencies. Its been 3 months since I am unemployed and I want to withdraw my PF. I have served 2.5 years with my previous employer and also my UAN has been activated and as I checked on EPFO portal. My Bank account and PAN have been also verified by employer. Please tell me which forms to fill?Also since I have left Bangalore, please guide me how to send my forms to Bommasandra. Do PF office accept forms by post?

Hi,

I recently left my job in Bangalore and moved back home due to family emergencies. Its been three months since I am unemployed and I want to withdraw my PF. Can you please guide me which forms I need to fill?

I have served in previous company for around 2.5 years and also UAN activation has been done. Also since I m in my hometown i.e. Amritsar, how do I send the forms to regional PF office? Do they accept it by post?

Hi bemoneyaware,

I have 8 years of experience. 4 years from employer A, 1 years from employer B and 3 years from employer C. I have resigned my job 90 days before and trying to withdraw my PF.

I have transferred PF amount from previous employer to employer c(latest). What should be the date of joining the establishment in form 19? joining date of first employer pf account or joining date of last of employer pf account? where should i mention i have 8 years of experience? how EPS will verify my total year of experience?

Thanks,

Vetrivel

If you have transferred your old PF accounts to latest employer (C), then date of joining of employer C should be mentioned.

Do you have UAN?

PF department keeps record of transfer and would know about transfer and would know your total year of contribution to EPS.

What all document do we need while submitting uan form 10c and form 19.

Cancelled cheque of your bank account

Form 15G so that TDS is not deducted

Form 19 is for EPF withdrawal, both employee and employer,

To withdraw from EPS form 10C. If your years of service are less than 10 years then you would get Scheme Certificate, else you will get money.

My PF account is more than 10 years old. However I have been switch jobs every three to 4 years. I am planning to withdraw my PF since I have left my current job due to medical reason. I have completed 3 year in the present job ( latest )

DO I need to submit the Form G ( for TDS waiver). I am confused it the 5 year service clause is for company or PF account ?

I was earlier told that i need to submit 15 G along with the Forms 19 and 10 C. However upon my enquiry from the PF dept I was confirmed that this is not necessary for those who have completed 5 year of contributory service ( NOT necessarily in same company) but as a whole.

Yes Sir, you heard it right.

After 5 years of service no TDS is deducted hence no need to submit Form 15G.

But most companies are playing safe.

Have you transferred your old account to new one so that EPF office can verify number of years you contributed to EPF.

Yes bemoneyaware,

Yes I have moved three jobs and i have moved my PF from all previous employer to the current one. Now I have resigned and have completed more than 6 months, out of Job. I am primarily withdrawing becasue I heard that the GOVT is planning, to withhold the employer contribution until 58 years of age. Also I am aware that after 3 years of inactivity the account will not get any interest. SO I am not sure what will happen to my PF account after 3 years ( especially the employer contribution part)

i have thus decided to withdraw my PF. But my employer was insisting on providing form 15, scaring me that if I don’t I will be taxed at 30% of my PF. There is not clear cut policy anywhere to read thus I keep looking .

Thank you for your support.

My name is Manish Kumar s/o shri Ashok kumar, PF A/C No. UP/50438-59 office name (MGRS Automotives Pvt.Ltd.), i give up job 2 month but not help PF withdraw money. Pls suggest and help.

Thanks with regards.

Manish Kumar

8966905718

9457004904

You can withdraw your PF by filling Form 19 and EPS by filling form 10C. Submit these to old employer.

If you have UAN and don’t want to approach old employer you can submit : UAN-Based_Form 19 and : UAN-Based_Form 10C .You can download them from the site.