While people speak different languages across the World, the language of money is same, the problems and solutions are similar. This guest post from Michael Vincent from Malaysia talks about three important pillars of good financial life which are common throughout the world.

Not everyone understands their own finances well enough to make the best financial decisions. Many could say that they understand the concept of compound interest, but ask them to solve a problem with the concept and there’s a good chance that you’ll receive a wrong answer. And that’s just what a 2005 study by the OECD found in Australia! The same study also found that Canadians find it more stressful to choose the right investments than going to the dentist. Ouch!

In Malaysia, the Federation of Malaysian Consumers Associations’ Consumer Research and Resource Centre did a survey and found that many young Malaysians lived beyond their means and many carried high personal debts and had too little savings. Household debt is also at 83% of the nation’s gross domestic product. To address the need for greater financial literacy among Malaysians, the government will include financial literacy in the curriculum starting next year.

Finance is a very useful topic, even though not everyone has to balance their check books or make a decision on whether to use a credit card to book a flight to somewhere exotic like Malaysia every day. The reasons for being knowledgeable financially are plenty so let’s look at some of these reasons and some of the online resources that could help you make the right financial decisions.

Compute for Compound Interest

Going back to the “problem” of solving for compound interest that many could find hard to understand: compound interest is the interest computed on both the principal and the accrued interest. Albert Einstein said “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” Smart guy – and he’s right. Compound interest allows a principal amount to grow faster than if simple interest was used. Those who save money in an account that earns compound interest earn money faster and they earn more the longer they keep the money in the account. The Calculator Site offers a handy compound interest calculator to help you compute for compound interest.

Choose the Right Credit Card

There are a lot of credit cards out there. Credit cards offer different terms and rates as well as different rewards and benefits to its users. Many fall into credit card debt maybe because they didn’t take their time to pick the right one that fits their capacity to pay their obligations to the credit card company.

There are sites that let you compare credit cards and help you pick the one that is right for you. Some of the considerations to make when choosing a credit card are the applicant’s monthly income and the amount of debt they already owe. Picking the best credit card lets you avoid financial problems down the road and you don’t want that card to be suddenly declined if you’re on that trip to Malaysia.

Track Your Spending

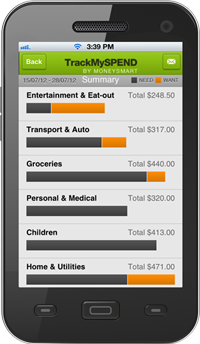

Unchecked spending is one of the more common reasons why people fall into financial problems. It’s hard to manage something like your finances if you don’t keep track of where your money is going and what you’re spending the most money on. In this age where smartphones are everywhere, the best response is “there’s an app for that!” You could go on to app stores like Google Play for Android phones or Apple’s iTunes Store for iPhones and look for expense tracking apps. There’s the TrackMySpend app that is backed by the Australian Securities and Investments Commission and there are others like the Expense Tracker from Aabasoft, which is free for Android phones.

The key to using these apps is to be diligent about adding the information about your spending. Put in all of your expenses there regardless of how little it is. If you find it tedious to do it, just do it for two to three months, you should have enough data on there to see so you could see if your monthly spending exceeds your monthly income as well as which areas you spend the most on so you could adjust your spending habits accordingly.

About the Article:

This article was written by Michael Vincent on behalf of Compare Hero for BeMoneyAware.com. Compare Hero is Malaysia’s leading financial comparison website, where users can compare a broad range of financial products, from credit cards to Internet plans.