Dheeraj was searching for a life insurance plan in order to safeguard the future of his family. A 30-year-old software developer, he also wanted to invest a part of his income on a monthly basis create wealth in the long run for his endeavours. When he met his colleague Sahil, at his Mumbai office, both had a thorough discussion on the same. Fortunately, Sahil’s brother-in-law, Mukesh, was an insurance agent and he had a sound knowledge about insurance policies and investment plans. Sahil suggested Dheeraj to go for a Unit Linked Insurance Plan, a mix of insurance along with investment.

What does that mean and why should I invest in ULIPs? Sahil asked. “ULIP, available on Finserv MARKETS, is an answer for your search of two products at the same time. It combines the benefits of both life insurance and investments in money markets in a single plan. Under it, you pay a premium for life insurance protection and also invest in funds according to your choice,” Dheeraj responded. So, it won’t only guarantee you protection but also but additionally help in planning finances for the future, he added. Dheeraj was relieved as he found a perfect solution in ULIP investment.

What is ULIP?

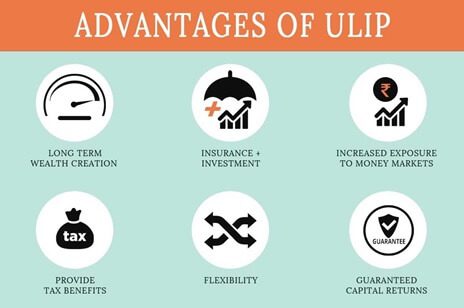

Same as Dheeraj said, ULIPs are insurance policies which offer you the potential of wealth creation for the future while providing the security of a life cover at the same time. It lets your money can grow and also protects your loved one’s future from life’s unexpected turns. Under ULIP, a part of your premium goes towards your insurance plan and the rest is assigned to investment in money market instruments like equity, debt, or a combination of both. Here, you are entitled to choose the funds on the basis of your risk appetite. If you are an aggressive investor, you can opt for equity funds; and if you are a moderate investor, you go for debt or balanced funds. Bajaj Allianz ULIPs, available on Finserv MARKETS, also offer you the flexibility to switch from one fund to another based upon the market situations or change in your investment plans.

comparepolicy.com

3 Features that Make ULIP Investment a Distinct Investment Product

Meeting Financial Goals: ULIPs, these days, have been gaining huge popularity with investors, as they offer great returns over the long term. As ULIP returns are linked to the equity market, when you invest for the long-term, it is possible to beat market fluctuations and risks and earn higher returns. You can use the accumulated amount to meet specific goals like down payment for a home loan, funding education of your children or your retirement planning. Some ULIP plans, available on Finserv MARKETS, also reward you for staying invested. They have additional features like loyalty additions and fund boosters if you remain invested for a longer period. This will enhance your corpus on maturity.

Easy on Your Pocket: Bajaj Allianz ULIPs, available on Finserv MARKETS, offers monthly, quarterly, half-yearly and annual investment options to suit your requirements and financial abilities. It may be easy for you to invest Rs. 8,000 every month, than putting Rs. 24,000 (quarterly), Rs. 48,000 (half-yearly) or Rs. 96,000 annually at once. Besides being easy on your pocket, monthly investment in ULIP makes it easier for you to deal with the market volatility and earn a high return on the investment. Higher frequency of investment reduces volatility risk.

Flexibility to Invest in Funds: ULIP investment offers you the option of switching between funds depending on your market outlook. You can switch between debt, equity and balanced funds according to your risk taking appetite. The performance of funds and your financial goals can also be considered while switching. This flexibility of switching funds is not available in other investment plans. Suppose, if the market is fluctuating dramatically and you fear that your gains may be eroded, then you can switch from equity to debt fund option to optimize the returns. With Bajaj Allianz ULIPs, available on Finserv MARKETS, you can avail switching option to modify the asset allocation according to your financial requirements. You can also leverage the top-up opportunity to increase your ULIP premium amount.

There are numerous benefits that make ULIP plans an ideal investment tool for your long-term financial goals. If you are looking for market-linked growth and benefit of life risk-cover, ULIP is your best bet.