We have got many queries on fixed deposit and request on writing about fixed deposit only from perspective of income tax return. So this article is answers to questions: Is Fixed Deposit interest taxed? Is TDS deducted? Do I need to pay tax if TDS is deducted? How to show interest,TDS in Income tax return? How to claim refund if tax has been deducted?

Table of Contents

Overview of Fixed Deposit and Tax

Fixed Deposit(FD) is an investment product which allows you to invest a lump of money for a fixed time period and at a fixed rate of interest. Its features are as follows:

-

- Interest income from Fixed Deposit comes under Income from Other Source. Other types of Income are Income From Salary, Income from House Property, Income from Business and Profession, Income from Capital Gain.

- Interest that is earned on fixed deposits is taxable in the hands of the depositor as per the income slab so a person who earns income above 10 lakh pays 30% tax (And education cess and surcharge extra) while below exemption limit does not pay any tax.

- If the total interest income from fixed deposits that you are likely to earn for all your deposits held in a branch is greater than Rs 5,000 in a financial year, you become liable for TDS.

- For Senior Citizens, Under, Section 80TTB of the income tax act, interest income earned from deposits qualifies for a deduction of upto Rs 50,000 in a year. This section is available to senior citizens since April 1, 2018. The benefit of section 80TTA, which allows the deduction of the interest income (up to Rs 10,000) from the savings account, is not available to the senior citizens.

- If PAN is not submitted TDS is deducted at the rate of 20%.

- TDS is also deducted on interest earned or accrued, but not yet paid, at the end of the financial year. If you have gone for cumulative option in FD which pays interest at maturity still interest would be earned every year and TDS if applicable would be deducted though you DID NOT get the money.

- A TDS Certificate in Form 16A, for TDS, deducted during a financial year is issued in the month of April of the following financial year.

- TDS deducted is also shown in your Form 26AS which is tied to your PAN number. Details in it should match the Form 16A provided by the bank to you.

- Tax liability of FD is calculated on the first applicant’s name. The second or joint holder has no tax liability.

- Deposits held by minors, as a first account holder, is also subject to TDS. In this case, the interest income will be clubbed under the income of the person in whose hands the minor’s income is included.

- If fixed deposit held by the non-working wife as first account holder from the money of her husband, interest income will be clubbed with that of husband.

- If FD is held by a parent as first account holder from the money of her adult children then interest income will be the parent’s income. But if FD is held by an adult child then the interest income is of the adult child and not of parents.

- If you believe that your total interest income for the year will not fall within overall taxable limits, you should inform the Bank not to deduct TDS on deposits by filing Form 15G or 15H (There are chances that in-spite of filing Form 15H/15G TDS may be deducted. Govt has asked the bank to provide acknowledgement for submission of Form 15H or 15 G)

YouTube Video on Fixed Deposit (FD)

Our video (9 min long) explains it detail

When to show Interest from Fixed Deposit in Income Tax Return

Show Income from Fixed Deposit every year, on the basis of accrual i.e., interest earned but not yet received (technically called as mercantile (accrual) basis of accounting)

As now Form 26AS shows the TDS amount whether TDS is deducted or not. Income Tax Department will be using the TDS in verifying your income tax return. Our article Viewing Form 26AS on TRACES explains it in detail.

How to show Income from Fixed Deposit income tax return?

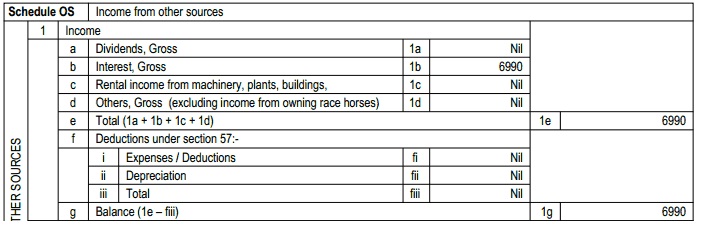

Income from Fixed Deposit needs to be shown as Interest portion of Income from other sources explained in Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR as shown in picture below. Please show the entire interest amount including TDS. For example, if you have earned income of 19,535 (without TDS deduction) with TDS deducted as Rs 1953.5 ( 10% of 19,535) then 19535 should be shown in income from other sources and 1953.5 should be claimed in TDS.

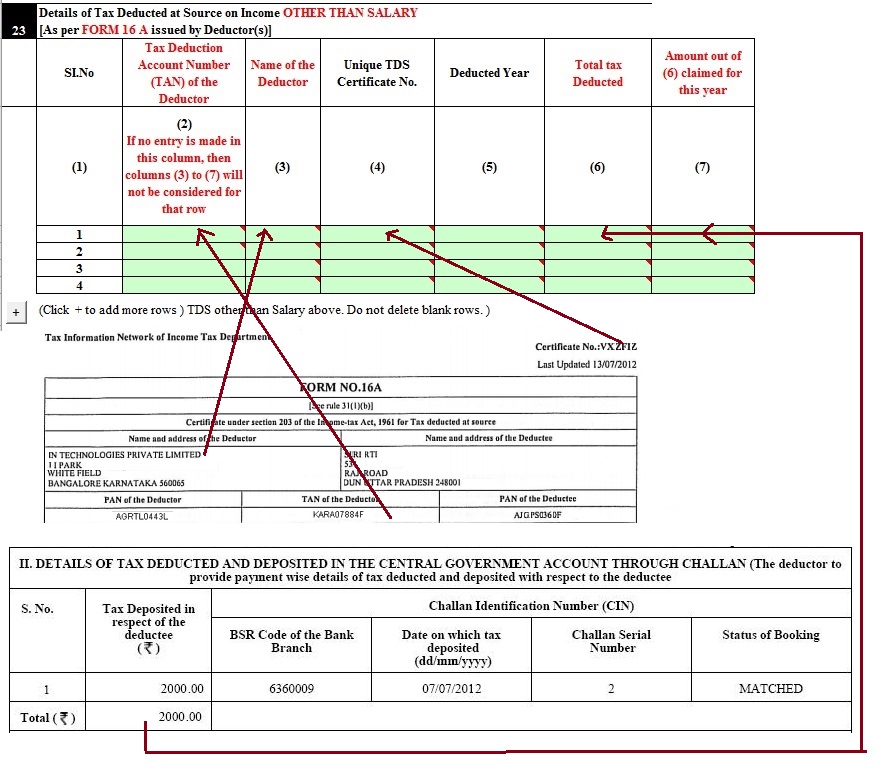

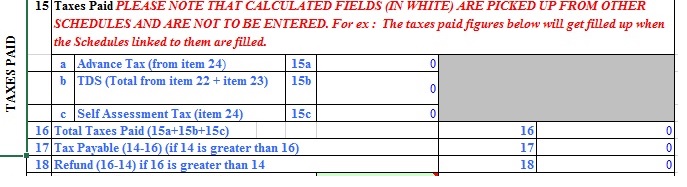

TDS (if deducted) on the interest income should be claimed by the individual in the income tax return and should be shown in TDS section. Explained in detail in Fill Excel ITR1 Form : Income, TDS, Advance Tax means filling information following information as shown in image below

- Unique TDS Certificate Number : This is a six digit number which appears on the right hand top corner of those TDS certificates which have been generated by the deductor through the Tax Information Network (TIN) Central System.

- Deducted Year -mention the financial year in this column.

- Total Tax deducted Enter details from Form 16A. Round off to nearest Rupee.

- Amount out of (6) claimed for this year. Usually this will be the same as tax deducted. This value cannot exceed tax deducted. Round off to nearest Rupee.

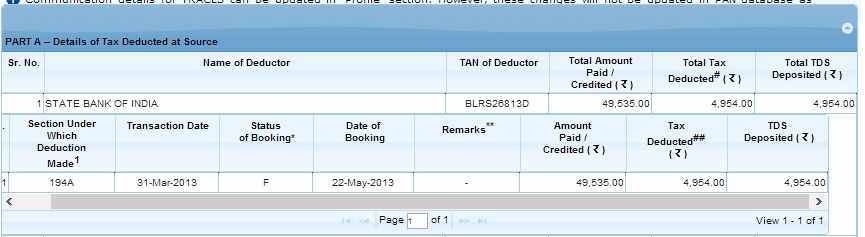

TDS deducted should be reflected in Form 26AS in PartA – Details of Tax Deducted at Source as shown in picture below (it is not for same amount as shown above)

How to calculate tax liability for interest on Income Tax Return?

As mentioned earlier, Interest that is earned on fixed deposits is taxable in the hands of the depositor as per the income slab so a person who earns above 10 lakh pays 30% tax (And education cess and surcharge extra). If TDS is deducted and you are in 30% tax slab then you need to pay a remaining tax of 20%.

Say you have earned income of 19,535 (without TDS deduction) with TDS deducted as Rs 1953.5 ( 10% of 19,535) then 19535 should be shown in income from other sources and 1953.5 should be claimed in TDS.

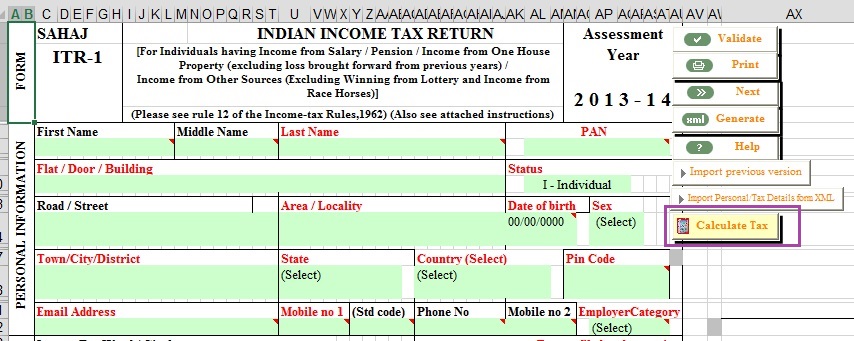

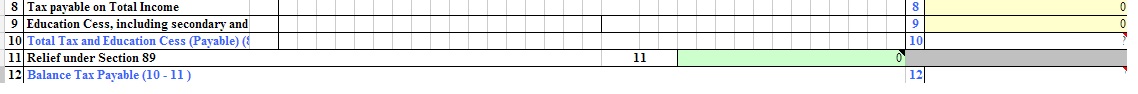

After entering ALL your other Tax details when you calculate your Tax Liability, for example in ITR1 Excel Click on tab Income Details. Click on Calculate Tax to calculate the tax that you should be paying for the income and deductions you have declared as shown in picture below

If you have paid less tax, it would show the difference in the Balance tax payable row of Income Tax Details as shown below

To recall from Fill Excel ITR form : Personal Information,Filing Status : White cells with blue labels indicate auto calculating fields which should not be filled. These are calculated automatically based on information entered in other cells.

It would also show up in the rows 15-18 of tab Taxes Paid and Verification. If you have paid more tax, it would show the amount in the tax refund row 18 of tab Taxes Paid and Verification

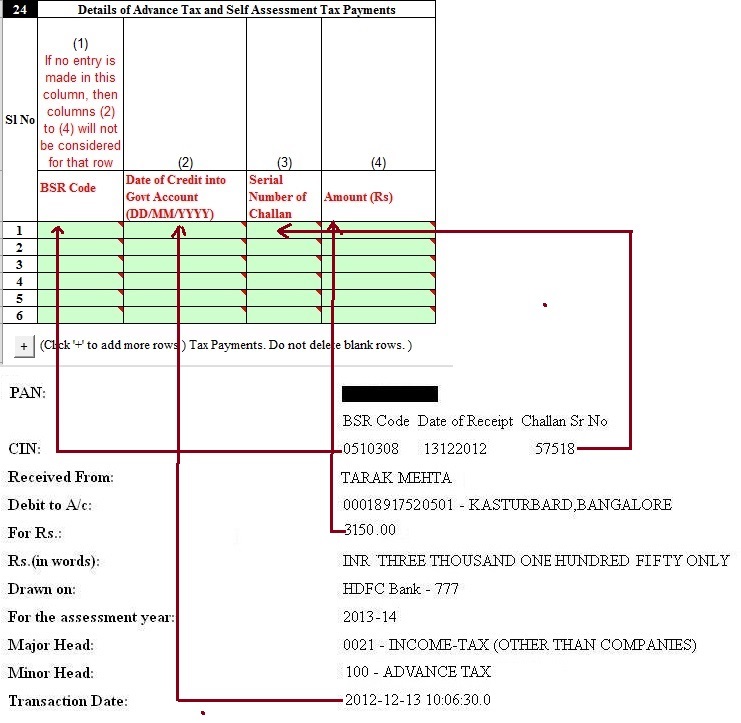

If tax is payable then Pay Self Assessment tax using Challan 280 , update it’s detail in TDS section as shown in image from our article Fill Excel ITR1 Form : Income, TDS, Advance Tax so that your tax due to Income tax department is Zero or Nil (0). Our article Paying Income Tax : Challan 280 explains how to pay the Self Assessment Tax.

If I have Tax Refund what to do?

In many cases it has been seen that TDS was deducted even though Form 15G/Form 15H was submitted Or TDS was deducted but income is below taxable limit. In such cases tax would be refunded to you. To claim refund you need to :

-

- Fill your income tax return form in the normal way

- Show Interest earned for Financial year as Interest income in Income from other sources

- Show TDS deducted in TDS section

- Then when you calculate tax due it would show up as Tax refund row 18 shown below. This is the amount you would get back or refunded.

What if there is TDS mismatch for FD?

If it happens TDS is not showing in Form 26AS, which may happen even if you have Form 16A issued from bank, you need to contact the bank and get it reflected in Form 26AS. If you claim the TDS and it is not in Form 26AS then while verifying your Income Tax Return, mismatch would be caught and you would get a notice from Income Tax Department for tax due. (Yes it has happened with me and that was one of the factors that made me take up personal finance blogging)

Our articles which can help you fill the Form ITR1

- E-Filing of Income Tax Return

- E-filing : Excel File of Income Tax Return

- Which ITR Form to Fill?

- Fill Excel ITR form : Personal Information,Filing Status

- Fill Excel ITR1 Form : Income, TDS, Advance Tax

- Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

If you found this article helpful, please share the link on Facebook/Twitter. The links are provided below.

I got interest of Rs 1,55,615 on fixed deposits and TDS was Rs 15566 (@10% of income). I paid the remainder 20% of the tax (Total: Rs 32006 along with surcharges) under self-assessment tax paid in AY 2018-19 and accordingly showed it to the return. Was it right?

If the 15G form is submitted to the bank but they do not add it in their system, what can be done if TDS is deducted? How can I get the refund? Can any action be taken against the bank?

You have to file ITR to claim TDS deducted.

You can raise the issue with the bank manager.

Raise it on the social media channels of the bank

you can approach the Banking Ombudsman IF

You have not received a reply from your bank within one month from the date of receipt of the complaint by the bank OR

The bank has rejected your complaint OR

You are not satisfied with the bank’s reply

I made two fixed deposits four years back for the total amount of Rs 2,70,000 with my savings and money that I received from my elder siblings. I did not file any tax return at that time but I am regularly submitting 15G as the interest earned on all my fixed deposits is below taxable limit and I don’t have any other source of income as I am unemployed right now. Yesterday I received income tax notice for not filing return four years back and the transactions mentioned were these fixed deposits. I was directed to give my response online and submit the acknowledgement at the income tax office. Will there be any penalty because of this? Can you please direct what I have to do in this situation? Thank you

Sir,my daughter is an unmarried & unemployed graduate.Her only income is fixed deposit interest.She has given PAN copy and form15G.The bank has credited Rs 42000/- in her account.Should file ITR separately/should I include her income into my income tax calculation.

If she is an adult and FD is in her name(first name is hers) then you cannot include her income.

Why do you need to file her ITR?

Was any TDS deducted?

No need to file ITR if her income is below 2.5 lakh

Dear Sir

Good morning

I want to ask you one question for income tax related for FD and FD interest my wife FD i want to show in balance sheet and that interest show in income tax return please advice me how i will do it

thanks

laxman Parmar

Could you explain what you want in balance sheet?

Why do you want FD interest in balance sheet?

sir

l have Rs 200000 in my FD a/c from jan.2017.I did not submitted 15g form unfortunately.In september tax deucted on my FD interest of Rs 688.what to do?

Check if it is reflected in Form 26AS.

Once TDS is deducted it cannot be reversed as money is deposited to Income Tax Department/Govt.

You can claim TDS deducted while filing ITR

You can file Form 15G/15H so that TDS is not deducted further. Our article How to Fill Form 15G/15H talks about how to fill Form 15G/15H

Before filling the Form 15G please verify if you meet the conditions. As not everyone fills Form 15G/15H . You need a valid reason to request the bank or financial institution not to deduct TDS

The basic conditions for filing 15G are :

The final tax on estimated total income computed as per the Income Tax Act should be nil

The aggregate of the interest received during the financial year should not exceed the basic exemption slab of that assessment year ex: 2.5 lakh in FY 2017-18

Bank deducted tds of rs. 45000/- on deposits. But in 26as tds is reflected correctly, but gross introduced income showed as 320000/- instead of rs450000/-. My auditor saying that filing of return is not possible as the IT site is not allowing. When I contacted the bank, they told that when tds is deducted correctly, u can file the return. Kindly help me out

Sir,I have given my pan details to the bank still they deduct tds on my fd interest at 20% due to which the amt deducted is not reflecting in my 26 AS

What should I do in order to get refund as my income is below taxable limit

Please suggest

Respected Sir,

I have a small FD in my bank whose accured interest in this financial year is less than Rs. 10,000. So no TDS was deducted by bank. Since the FD will mature in next FY, I forgot to consider the accural interest in my IT return of this year.

So should I file a revised return or I can declare the complete interest in the next FY when it will be actually credited to my account..?

Please guide

If you have not shown FD interest in any other year then you can claim it next year, explained in our article Methods of accounting: Mercantile and Cash

SIR

I HAVE AN FD OF RS 700000 AND BANK HAS DEDUCTED TDS ON INTEREST ON FDR RS 51000 WHICH IS TO BE SHOWN IN ITR U/H OTHER SOURCES. MY DOUBT IS AT WHAT AMOUNT FD IS TO BE SHOWN IN BALANCE SHEET. MY FDR STATEMENTS WERE RENEWED THIS YEAR AND IT SHOWS AMOUNT OF RS 809933.

You had an FD which was over multiple financial years.

Can you give us exact details on when did you start the FD, what was interest rate and when it was renewed.

For this financial year the FD Interest is 51,000

TDS should be 10% of this amount i.e 5100 which should appear in your Form 26AS.

The interest amount has to be shown as Income from other sources and TDS deducted has to be claimed.

Our article Fixed Deposit over multiple Financial Years, Tax and ITR covers it in detail.

Sir,

I have a Fixed Deposit, which got Tax Deduction.

I have declared my tax, with the exceptions in 80c, now I am not coming under taxable.

How can I get the TAX DEDUCTION on the FD back?

You would have to file ITR to reclaim TDS deducted.

For next year you can submit Form 15G/15H

My uncle did FD (child scheme) 20 years back .Bank detected 10% tax while i clime that amount.

How can avoid that tax, Is it possible? (I am not an employee)

SIR,I DID NOT SUBMIT FIRM 15G/H AND TDS WAS DEDUCTED ON TERM DEPOSIT/FIXED DEPOSIT.

HOW TO GET IT BACK.

MY INCOME IS 1.2 LAKHS FOR THE SAID FINANCIAL YEAR ACCORDING TO FORM 16.

You would have to file ITR to get the TDS deducted.

To claim your refund you need to:

As explained in the article

Fill your income tax return form in the normal way

Show Interest earned for Financial year as Interest income in Income from other sources

Show TDS deducted in TDS section

Then when you calculate tax due it would show up as Tax refund row 18 shown below. This is the amount you would get back or refunded.

Sir we have fd 200000 in 2014 for 3 year in get inst 65864 rupee my tds tax will deducet in 20% my pan can card is not aptaded and my income is below one lack

How it will be refund tds tax…

Plz help me

Sir,

My mother (super senior citizen) had FD in SBI and when matured the interest earned was Rs.2,35,729=00. SBI deducted TDS (10%) although I have submitted for 15H. SBI told me that if interest crosses 2 lakhs, form 15H submitted is NOT applicable and TDS will deducted. If interest is less than 2 lakhs, 15H is honored and TDS will NOT be cut.

Is that true sir ?

No it is not true.

Form 15H can be only filed by individuals above 60 years of age.

This form imposes the condition that the final tax on the investor’s estimated total income should be nil. So, if you are above 60, your taxable income for the financial year can be up to Rs 3 lakh for you to be eligible for 15H. For super senior citizens above 80 years, this limit is Rs 5 lakh.

Thanks for reply sir

I understood your answer. However, my question is little different.

My mother is 82yrs and eligible to give 15H, which I am doing for last several years. FD was cumulative (interest is accrued) and I keep renewing for several years (and giving form 15H also) and there was no tax cut by bank.

However this time, on maturity of FD, the interest crossed 2 lakhs and as per bank authorities, if interest exceeds 2 lakhs on FD and despite giving 15H, the system automatically deduct tax. Is that true ?

Will you please answer my above query

Apologies. We are trying to find the info.

So far what we have found is that there is no upper limit on 15G/15H.

Shall update if we hear otherwise.

Can you ask bank manager to tell the source or show some documentation?

Thanks, I will ask bank manager

I did not submit form 15 g and the TDS has been deducted. Can I claim refund during filing my tax returns. My annual income is taxable.

Yes you should the TDS in your ITR and claim it as shown in the artilce

sir, fd interest was not added with pension income and tax was paid for pension amount only for many years.is it possible to pay taxes now.what are the documents required.still fds are in society.whether after paying taxes only,we can close fds or i need to pay tax whenever i close the fd.otherwise,we can invest in the pmgky 2016 for the entire tax due amount.is it possible.kindly advise at the earliest. thanks for your valuable service.please help us.

Dear Sir,

I have 2 FD in SBI of ₹150000 each since 2011, i haven’t submitted 15G in bank, and my overall income falls below income tax slab. few days ago i came to know that my tax is deducting at 20% from past 5 years, i want to claim refund for all these years,but my PAN was not updated in my account, i have just submitted PAN in my account,can i get refund in this case.

Hi Sir

My name is Moin, Sir If a person has not submitted PAN in Bank and his interest is exceeding 10000, Bank will deduct 20 % on his Interest income right?

So,There are hundreds of people in the bank who has not submitted the PAN like him and already TDS has deducted and TDS return filed by the bank.So,how how this TDS deducted get reflected in their form 26AS.

Good point. It is best to have PAN.

The TDS deducted with not be reflected in Form 26AS as there is no PAN.

You get Form 16A from the bank saying that TDS has been deducted at 20%/

Wen the tax is deducted by the bank, it is duly deposited with the government within the applicable due date. Hence once tax is deducted at a higher rate, due to non-availability of the PAN at the time of deduction, the bank would not be able to reverse the same if PAN is provided by the customer post deduction of tax.

But if the customer has PAN at the time of filing of his return of income, then he can claim the excess tax amount deducted. Income tax authorities will scrutinize his claim and then issue the refund accordingly.

I have started a FD amount Rs.2 Lakhs on 12 August 2016. My yearly income is Rs. 1.5 Lakhs. When (in which month) should I submit Form 16A to get exemption of TDS?

My father expired last year leaving two Fixed Deposits worth 4.3L and 5.8L as maturity amount. Both the FD has me as nominee and after maturity the bank took TDS on the proceeds and remitted the maturity amount to my bank account which is in another bank.

I provided my PAN details to the bank when i went to claim the FD maturity.

Would you be able to guide me what else i need to do from my part as far as Tax Liability is concerned?

Dear Sir / Madam,

I have income only through bank interest. TDS deducted for all my deposits are 10%. As per the income slab, i need to pay 20% tax. For the past two years, I am paying advance tax in Dec or through self assessment tax during Mar for the remaining tax amount.

Do I need pay advance tax in Jun & Sep since I have no other source of income? Can I pay the remaining tax through assessment tax?

Thanks in advance.

Dear Sir,

When my husband expired last year, his employer have provided me FD worth rs 10 lakh for my son. The FD is in the name of minor, operated by Guardian.

I am working and fall in taxable income bracket.

The FD will attain maturity on my minor son’s date of attaining maturity, i.e, 18 years. His present age is 5 years.

Should I pay tax on the interest gained by the FD amount, or tax exemption can be

claimed after maturity, as it is in minor son’s name.

Thanks to please clarify, so that I can act as per the correct rules.

Best Regards,

Amita

Dear Sir,

I have multiple FD In which two FD got matured one FD is for 50000/- i have done for one yr at rate of interest 8.2% i got a mail stating that my maturity amount is 54227.83 but i got only 52972 they said they have reduced TDS but in TDS sheet it is mentioned tax deducted is rs1010/-. 2nd FD is also for Rs50000/-tenure it is showing for 183 days for rate os interest 7.5% for this i got got mail maturity amount is rs.51901.90/- where as i got rs.51856 and in TDS tax deducted is showing zero.

can i clam this amount or not and do i get the difference amount Rs.1255 why did they charge extra.

If I have a taxable income of 5lac (after 80C deductions) I cannot submit 15G. Is that correct? Also, SBI deducted TDS of 1500 on my FD interest of 15000. I did not get any F16 from SBI, but it got reflected in my online ITR account.

While filing return, why should I put 15000 as additional income, When it has been already taxed by bank. Wont it be taxed as per slab again? So 5lac+15000-1500 = So 13500 will be taxed again at 13500*20% = 2700. So in total I have to pay 2700+1500=3200 on FD income of 15000. Is this the way it is or I am paying additional tax for no reason?

Respected sir/madam, this year when i closed my NSS account in Post office department they deducted the tds at 20% as they do not asked my pan when i asked for rectification they finally did it but as the last date was 5 august,till then i was not provided with for 16 A and the same was not reflected in 26 AS. I was advised to fill my return asking for refund as in the mean time the rectification will reflect in 26 AS.today the form 26 finally reflect the tds but it is double the amount both the tax credited and tax deucted,now should i ask them to again rectify the form 26 as or will i get the refund.

Also i have not yet sent the ITR V receipt to the deptt as i was asked to wait till the tax credit is shown in 26 as ,now in the light of recent events should i send it straight away.

Thanks

Hello, I’ve made a fixed deposit of 17L in SBI bank on April, at that time I didn’t fill any 15g form for exemption of tax. I’ve recently know about that, can I fill that now to get my 2 months tax refund or is there any another form to submit..

Sir TDS on FD is usually credited at end of year. So you can still fill Form 15G if you don’t want TDS to be deducted.

Our article How to Fill Form 15G? How to Fill Form 15H? discusses it in detail.

As you said today I’ve submitted 15G to Bank.As I mentioned you, I’ve made FD on April, Bank has credited some amount as CREDIT INTEREST and deduced some amount as TAX DEDUCTION for every two months.Totally bank has deduced CREDIT INTEREST two times since the date of CREDIT.Can I get back that previously deducted credit interest to my bank account back..Thanks for your reply

Dear sir, bank has deducted 20% as tds on fd’s interest for the fy 2014-15 and 2015-16. In the month of july 2016, we have get issued the PAN and submitted to the bank. Kindly advise how to take refund for both the years. This is for my sister who has no income.

You can claim unclaimed TDS of past years by filing ITR ans asking for refund.

Check if form 26AS if reflects the TDS. Once it does then you can file ITR for last year before 31 Mar 2017 and ask for refund.

Please note that last date to file for ITR for FY 2015-16 or AY 2016-17 was 5 Aug 2016. So you would be filing a Belated Return under section 139(4). process of filing return remains same as original return. Belated return is explained in our article Belated Return under section 139(4)

Dear sir, thanks for the reply, as of now tds is not reflecting in 26AS and bank is not helping. Kindly advise how to get 20% tds updated in 26AS .

dear sir last night i file the itr but by mistake i fill 300 more for refund what i do can i filled form no 280 in bank next day. please reply

thanks

i having an fd as for last 2 financial years i having a tax deduction made unfortunately even after submitting 15 g form .i need my tds refund for 2013-14 and 2014-15. can i get it back without any penalty. or it is applicable for penalty

I am also suffering From the same situation, bank staff did not update my 15g.

Hope some can give me the answer soon

If TDS is deducted in earlier financial years you can claim it in other years too.

Certain provisions of TDS (including TCS) require deduction of tax at source at the time of payment or at the time of credit, whichever occurs earlier. Resulting advance payments are also subjected to TDS. Old ITR form did not have any mechanism to carry forward the excess TDS, thus, taxpayers were required to show the entire TDS as a deduction and claim refund of excess TDS. To fix the issues, the Schedule TDS/TCS introduces two new columns:

Unclaimed TDS/TCS brought forward

Financial Year in which deducted/collected

Amount brought forward

TDS/TCS being claimed this year from amount brought forward or from TDS/TCSÂ of current financial year

My Wife is a house wife and she has an Bank FD on which every quarter Tax are getting deducted on Interest.

Bank has deducted around Rs 5000 total taxes on the interest amount for 2015-16 FY

FD was opened with her own sources around 1.5 years back.

She also has an Post office MIS from her own sources (opened in Jan 2016) for which she is getting Rs 3150 every month (i.e for FY 2015-16 total MIS interest received 3150 X 2 = Rs 6300)

As she has no other income, can she use ITR1 to file her return and get refund for the taxes deducted.

If not let us know which ITR form she has to use for filing return and get the refund.

As a note: We tried efiling on ITR1 and provided all details pertaining to Income Details as 0

(i.e. for rows like Income from Salary or Pension, Income from Own House Property, Income from other sources etc. as 0)

The total Tax and Interest under D12 is so 0.

Under the Tax details tab she has provided the TAN of the Bank (from Form 26AS) and amount deducted for year 2015

When she submitted she is getting the error which says

“No Income/Loss details or Tax computation has been provided in ITR but details regarding Taxes Paid have been provided.”

My question is whether she is filling the right form (ITR1)? If yes then what is the reason for the error which website is showing?

Would be good if could provide suggestions on this situation.

I have doubt on row “Income from other sources” . Do she need to add “actual interest earned from Bank FD + interest paid by PO MIS” and enter the total amount against this row(Income from other sources)?

Sir ITR1 is fine.

Yes you have to show interest from FD and POMIS as income from other sources, fill TDS details in TDS2.

Thanks for the response.

Will show interest from FD and PO MIS as income from other sources.

But we have a query regarding FD interest.

In case of FD, bank is crediting only after tax interest (as we have not declared 15G/H for tax exemption on FD interest).

For example if FD interest quarterly is coming as 9000 bank is deducting tax as 900 and credits remaining 8100 as interest to savings account.

In this situation do we need to again show 8100 as income from other sources or we can skip this?

Hello Sir,

I have taken a 3 year non-cumulative FD which matures in 2016. But I get interest paid on my savings bank account every quarter. Also the interest is less than 10,000 and bank didn’t do TDS.

1)Do I have to pay tax for each year after the interest is credited under section Head of Salaries ?

2) Also I have not reported this interest income last year. Can I collectively do this reporting and tax after 3 years maturity ? Is this possible with non-cumulative FD ? where the interest is paid every quarter

The article is informative and well written. I have a query regarding TDS on FD . My question is that I have FD with several Banks, they are deducting TDS @ 10% since 2, 3 years, but I have not showed it in my tax return . This year I want to show all my interest income on FD though they have not matured ,but since they are all reflecting in 26AS ,I want to show them.

While showing all my FD Interest Income in my return ,can i claim the TDS in this year which were deducted in preceding years ?

I along with my wife ( both govt employee) booked a flat in apr 2012 with a builder for which we paid approx 1440000/- after taking loan of Rs 650000/-from my department. But when builder did not commence construction even after due date of possession passed we asked him to return our money.

I have suffered huge loss in booking of this flat, as I had taken loan to deposit payments for this booked flat for which I had paid interest @ 9.5% whereas when Builder returned this money to me they gave interest of Rs 378017 @ 8% and deducted TDS of Rs 37802/-.

Builder gave this money in Feb 2016 by a/c payee cheque in favour of my wife but quoted my PAN instead of my wife’s PAN, while depositing TDS. Hence now it is showing in My form 26AS.

As my taxable pay is already above 10 lakh,So now I have to pay 20% more tax.

Had this been shown against my wife’s PAN & form 26 AS then we need not pay any more Tax as her taxable income including this interest paid is approx 520000/-

I requested the office of the builder to do correction of PAN in this TDS & show it on my wife’s PAN, but they are not forthcoming in doing this and just making lame excuses.

Plz tell me is it possible to correct this now and what option I have to get it done if builder doesn’t cooperate?

TDS correction can be done by builder only.

What was the ratio in which you took loan – 50:50? 60:40?

Best to speak to CA.

But A suggestion could be to split the interest as income between your wife and yourself and claim the income for the TDS yourself, which is 10%.

Hi, My spouse doing work from home from a local vendor and got her payment after deducting TDS from him. How will i need to proceed to get the refund and how will i need to file the IT

Could you please suggest me if I need to include “Tax on FD interest” in the Gross income while filing e-return even after submitting Form 15H/15G?

Bank has not deducted any tax after submitting Form 15H/15G as expected however advance tax on FD interest was considered in overall tax computation and has already been submitted to government. Please suggest me If I claim this amount back.

I would be obliged if you could assist me with the same.

I along with my wife ( both govt employee) booked a flat in apr 2012 with a builder for which we paid approx 1440000/- after taking loan of Rs 650000/-from my department. But when builder did not commence construction even after due date of possession passed we asked him to return our money.

I have suffered huge loss in booking of this flat, as I had taken loan to deposit payments for this booked flat for which I had paid interest @ 9.5% whereas when Builder returned this money to me they gave interest of Rs 378017 @ 8% and deducted TDS of Rs 37802/- @ 10%.

Builder gave this money in Feb 2016 by a/c payee cheque in favour of my wife but quoted my PAN instead of my wife’s PAN, while depositing TDS. Hence now it is showing in My form 26AS.

As my taxable pay is already above 10 lakh,So now I have to pay 20% more tax.

Had this been shown against my wife’s PAN & form 26 AS then we need not pay any more Tax as her taxable income including this interest paid is approx 520000/-

I requested the office of the builder to do correction of PAN in this TDS & show it on my wife’s PAN, but they are not forthcoming in doing this and just making lame excuses.

Plz tell me is it possible to correct this now and what option I have to get it done if builder doesn’t cooperate?

What procedure I should adopt.

Thanks and Regard

Hi BeMoneyAware Team,

Congratulations on the good job you are doing.

I have a query on TDS on bank fd interest income.

My form 26as is reflecting interest income earned on fd from two different banks which is roughly just above 10000 each.

Out of these two for one FD TDS @ 10% was deducted and for other its not.

So when filing the ITR1, in income from other sources field do we need to show the consolidate interest income earned from both the banks or only that income for which the TDS was deducted?

If latter is true, then do i need to delete the the other bank details(which did not deduct TDS) from Sch TDS2?

Since i fall in 20% bracket i will end up paying more tax, so paying self assessment tax and the same should be entered in Sch IT section Tax details tab so that the tax payable will be NIL, is my understanding correct?

Please advice.

Thanks.

First of all i thank you for such a helpful blog.

I wanted to know if we have filled 15G/15H form and still its showing tax deducted in the column of ITR form.Does that mean that we need to claim return for it .please help me with this.

Dear Sir,

I am working for a company and my wife was working for another company for couple of months. And now she is housewife. Her salaried income was less than 2 lakh in those few months. She forgot to mention savings in 80C so nothing was deducted. She also have FD’s with her own money. She earned interest on it. Including that her total income gone to 5.5 lakh.

We need help, guidance on how to file ITR for her. In this case we are expecting refund. Can you please guide?

Small correction : nothing was declared under 80C. Tax is dedicated on salary in assumption of slab of 30%.

Dear Sir,

I am working in a company and my wife was working but right now she is Housewife.

Now we have a FD of 4.5 lacs in her name.Please provide the Income tax process

Questions you need to ask is:

Whose money was used to make the FD?

Has TDS been deducted on Interest of FD? Against whose PAN does it show?

If its your wife money then if interest is less than 2.5 lakh it is tax free for her. She can show interest as Income from other sources.

If FD is from your money, then Clubbing of Income will come into play. You can read our article Clubbing of Income for more details and how to avoid,

Income tax process is same whether you file or your wife.

Income of interest from FD is Income from other sources.

You can choose ITR based on your/your wife other income to file ITR.

Wife Saving

She always submitted the form 15 g in the bank

Pan NO. pertaining to Wife

Tds was deducted on FDR till 31.03.2016 on accrual basis

But on 02.04.2016, the FD was withdrawn before maturity. Hence, there was a loss of interest.

So now for assessment year 2016-17 whether to consider whole interest or the actual received on withdrawl?

Whether to consider the loss of interest in the next assessment year?

I had the Nation saving scheme account in post office back then pan number was not associated with the account now when i closed the account the department did not ask for the pan number and deduct the tax @ 20% when i gave them my pan number they asked me to wait for rectification and now are saying it can not get rectified is there a way to get my refund

Process is to :Contact the Post office and update your PAN Card No. in their records. Also request them to allocate the TDS Deducted @ 20% to your PAN Card.

Once this is done, you can claim the refund of the excess TDS Deducted.

Why are they saying that it cannot be rectified?

You can lodge the complaint online at http://ccc.cept.gov.in/ComplaintRegistration.aspx

Also check Guidelines for Registration of Complaints

Hello,

Very nice & useful blogs. I’m filing ITR1 online & got stuck-up.

As per form 26AS, I have got interest of INR 36880 from 2 different banks & they have deducted TDS INR 4468.

Now in online ITR1, I see the entries of TDS2 [4468] already there. if I fill in B3. income from other source as 36880 & claim 10000 in 80TTA. still it shows tax D18. payable as 3840. I guess it’s because of 30% slab.

Question:

If I delete those entries of TDS & if I don’t fill anything in B3. income from other sources, it shows D18. tax payable as 0.

Is it ok, or will I get notice from IT dept in future ?

Thanks in advance.

I have a question on Tax benifit from housing. I have bought a home last year end. To buy the home, I have spend few lakhs as my initial payment and took the loan for 80% (interest repayment has not started yet). My question here is, can I claim tax rebate on the amount that I have paid as my initial payment.?

Sorry down payment for buying house does not save any tax.

for depositing tax on interest of saving which challan no is to be used

You mean paying Self Assessment tax which must be paid before filing ITR. Challan 280 is used.

Please read our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR for more details

THANKS

I CAN NOT SUBMIT ITR1 WITHOUT FILLING TAN NO. IN TDS2 . I HAVE INTEREST ON SB ACCOUNT RS 3225/- WHICH I FILLED IN OTHER INCOME AND RS 3225/- IN 80 TTA COLUMN .ON PRESSING SUBMIT BUTTON SYSTEM OPEN PAGE OF TDS2 WITH RED BOX JUST UP ON TAN NO. BOX AND ASK FOR FILL THE TN NO. FOR SB INTEREST THERE IS NO TDS HENCE NO TAN NO.IS. BUT I CAN NOT SUBMIT ITR 1. ONLY POSSIBILITY IS THAT I REMOVE RS 3225/- FROM OTHER INCOME COLUMN. PL GUIDE.

WHAT TO FILL IN ITR 1 TDS 2 FOR SB INTEREST WHEN TDS IS NIL SYSTEM ASK FOR TAN NO. OF THE DEDUCTOR BANK CAN NOT ISSUE TDS CERTIFICATE

TDS 2 IS MANDATORY

No TDS is deducted on Interest on Saving Bank account. Interest of all the Saving Bank account has to be added together and shown as Income from other sources and then claimed under section 80TTA.

If your total interest income from ALL your saving bank accounts

is less than or equal to Rs 10,000 For example if your interest from ALL saving bank accounts is Rs 8,000 you need to show 8000 in income from other sources and then show Rs 8000 for section 80TTA .

is more than Rs 10,000 say 12,000 then add 12,000 to Income from other sources and then show Rs 12,000 in Section 80TTA. ITR should automatically give you deduction for 10000 and calculate tax on rest as shown in image below

Our article Interest on Saving Bank Account : Tax, 80TTA,ITR discusses it in detail.

But should we show it in sch tds2. if yes how?

I had two FDs in ICICI both opened in FY15-16. One was to mature on 15th April 2016 and another on 1st July 2016. The interest 27046/- and 3864/- respectively.

I was going to show them as income next year in FY16-17’s ITR; but ICICI has declared these two as income on 28th March 2016 in my Form 26 AS.

For the first FD, they showed 25050/- and for second 1813/- as the interest and 2505/- and 181/- as TDS respectively.

My question is, I want to carry forward these two TDSs and FD income to include them in ITR next year. This year I do not wish to include them in Other Source Income. Is it okay if I carry forward the TDS of these two in TDS Schedule?

Yes if u haven’t claimed in the particular year, then TDS can be claimed in next year. As your 26AS will mismatch with your ITR you might get notice from Income Tax Dept.

i didn’t get. Can I claim it next year along with interest as income?

I have filled 20TDS2 table in ITR form1 but the total is not showing in the page of taxes paid and verification 23.b.(total tds claimed(total from item 19+ item20)

Plz suggest

Does form 26as also shows interest earned on saving accounts (not FD)?

No Form 26AS does not show interest on Saving Bank account as no TDS is deducted on interest of Saving Bank account.

You need to show interest earned on saving bank account as Income from Other sources, claim deduction under 80TTA as explained in our article Interest on Saving Bank Account : Tax, 80TTA

A house wife and filing return since last 2 years against rental income of Rs. 120000/- from property and FD interest. This financial year her rental income is same but FD interest increased from 175000/- to 750000/- and TDS has been deducted by the bank. Accordingly she is willing to file her return m willing to pay the tax as per computation. Is there any scrutiny will come from income tax against increase of FD interest.

I dont have a taxable income, and withdrawn some fixed deposits from bank,

and my TDS has been deducted around 8000 rs, banker asked me to file ITR to get it back, i made profile for so but i am very confused about how to do it properly.

You can file ITR1.

In Income from other sources you can show interest from FD.

In TDS section you can show the TDS deducted as explained in the article

When you do calculation of Tax, it should show refund.

Do you have income from salary etc?

You can check our list of articles for filing ITR

Thank you so much and sorry for bothering you… but i am unable to find it online after my login into the website.

What are you not able to find?

I have a fd for which i get interest of rs. 9000 from 1 april 2016 to 31 march 2017 and on rd deposit i get rs. 2000 in above financial year. So i want to know ia tds should be deducted on my deposit or not

Are they in the same branch?

TDS is deducted if Interest is more than 10,000 Rs.

You can verify using Form 26AS or asking for Form 16A from your bank. Our article What to Verify in Form 26AS? explains it in detail.

Yes in same branch

my form 26AS shows that my bank has credited rs 228 in my account for which TDS is Rs.0. while filing my returns it is showing TDS amount zero, but it is asking for unique TDS certificate number.from where shall i get that TDS certificate number? somebody please help. can i leave that in Schedule 2 of TDS while filing returns? or shall i need to fill the certificate number mandadtorily?

Res.Sir

I want some information about my fixed deposit. I done 2 FDs on my aunty name,on that time I dont have PAN card that’s I can’t attached to that Bank Account. Recently it’s Renuwaled on that I observed that tax amount was deducted in my FD totally it was minimum 13500Rps, after that im attached PAN card. Presently I want to know how to get back my deducted money. Please tell me how to proceed to get my money.

Dear Sir / Madam,

Senario:-

I have got 3 FD`S with Bank of Maharashtra. Each paying quarterly interest and TDS is deducted every quarter @ 10%. My Bank Passbook shows every quarterly Interest Less (-) TDS Deducted = Net Interest Earned.

However, TDS Certificate received from BANK shows interest earned on 31st March 2016, but those entries are not showing in my passbook. TDS Certificate transactions are also showing in form 26AS.

As per Bank Passbook, Total Interest Earned on all 3 FD`S after deducting TDS = Rs 87,000/=

As per Form 26AS and TDS Certificates Total Interest Earned on 3 FD`S is Rs 96,500/=.

Could you please help me with your expertise on below Questions:-

1. How do I record Interest earned as per TDS certificates in my books ?

2. If I do record as per TDS certificates then my actual Bank balance at the end of the year 31st March 2016, will be out of balance ?

3. Bank employee said you need to show accrual of interest and TDS receivable….

Sir, your total interest earned from all 3 FDs is 96,500.

Bank deducts TDS @10% if Interest on FD in a year is more than 10,000 Rs. But interest on FD is taxable as per your income slab. if your applicable income tax slab rate is either 20% or 30%, you would be required to pay the balance taxes (net of TDS) by way of an advance tax or self-assessment tax.

TDS entries will never show up in passbook. Pass book shows interest earned – TDS.

Please verify that TDS deducted is in your Form 26AS.

Our article What to Verify in Form 26AS? discusses how to verify that TDS in Form 16/Form 16A matches PART A of Form 26AS

Our article Fill Excel ITR1 Form : Income, TDS, Advance Tax,Self Assessment Tax shows how to show RD interest in ITR1

Dear Sir / Madam,

I have income only through bank interest. TDS deducted for all my deposits are 10%. As per the income slab, i need to pay 20% tax. For the past two years, I am paying advance tax in Dec or through self assessment tax during Mar for the remaining tax amount.

Do I need pay advance tax in Jun & Sep since I have no other source of income? Can I pay the remaining tax through assessment tax?

Thanks in advance.

If you are a Senior Citizen then you need to pay any advance tax.

If you are less than 60 years of age then if you don’t pay due tax then you would have to pay penalty under section 234B. Which you can pay while paying self assessment tax.

Our article Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time discusses it in detail.

hi. my 26as shows sbi hs credited sum amts n deducted tds against d same on 31st mar bt i hvnt rcvd any such amts. booking dt showing june. pls help.

hello,

i want to know whether the deposited amount in bank through fellowship for pursuing research is liable for taxes or not??? since the funding of this amount is not done regularly in every month..it is done in bulk of six months or twelve months at a time and the total fellowship is more than 2.5 lacs per year.

I have a query regarding tds on FD interest. I have 4 fd’s across 4 different banks i.e. STATE BANK OF INDIA, UNITED BANK OF INDIA, PUNJAB NATIONAL BANK & CORPORATION BANK. Interest earns of rs. 5000( five thousand only) on each fd per annum. Now am i eligible to pay tds?

In each bank if Interest is less than 10,000 then no TDS will be deducted.

But interest on FD is fully taxable and is as per your income slab.

for more details you can check our video on Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund

I m a housewife.but i earned income on interest is more than 10000.plz tell me my tds will deduct or not.can i fill the form 15 g ?

Yes if interest from 1 Apr 2015 to 31 Mar 2016 is more than 10,000 TDS will be deducted.

You can talk to your bank and submit form 15G. Typically it is submitted in beginning of financial year.

For more information on Form 15G please go through our article How to Fill Form 15G? How to Fill Form 15H?

If you don’t submit the form then TDS will be deducted at 10% if you have PAN and 20% if you don’t have PAN. If TDS is deducted against your PAN the way to get it back is filing ITR and asking for Refund.

Banks deduct TDS on FD in end of Mar so better rush

Hi

I have an queation

I hv already done the TDS 10 %

I hv no pan card

Now i hv to deposit 20% ..means ten % TDS of same month

Can i geg these both TDS durimg refund?

TDS is deducted at rate of 20% if PAN is not provided.

So please furnish your PAN.

You can claim the TDS deducted against your PAN is your annual income is below 2.5 lakh

Hi,,My daughter is eight years old and is a minor.Bank has deducted TDS on her interest income and in the TDS certificate her PAN no is shown.

I am NRI and don’t have any taxable income,how can I claim the TDS already deducted from my daughter’s account in my return?

Interest earned on the Non Resident Ordinary Account (NRO) is taxable and will be subject to a TDS of 30%. This holds true for Post office also. There is no basic exemption limit. For example, interest earned by resident Indians from bank deposits is subject to TDS only over and above a limit of Rs 10,000. No such limit applies for NRIs.

As she is minor her income would be clubbed with yours.

When Income of minor child is Rs 1500 or more – the parent can claim an exemption of Rs 1500 for each minor child whose income is clubbed.

When Income of minor child is less than Rs 1500 – the entire amount is allowed as a deduction.

I have received Interest certificate of a FD account from SBI as on 31st march, 2015. It stated as follows..

A/C No Description Status Int Paid Int Accural

3****5 STD……INR Open 759 378

Deposit date of this account: 02-12-14

Matured date of this account: 03-12-15

Deposit amount: 13079

Rate of Interest: 8.75

Now after 03-12-15, I received interest of Rs 1183

My question is (i) what is Int paid and int accural?

(ii) I already paid Tax for the amount 759 only, was it

correct ?

(iii) Please tell me how to match 1183 with int paid & int

accural.

Hello

Your total interest earned is 1183 and it spreads over 2 financial years. FY 2014-15 and FY 2015-16

2014-2015 378.09

2015-2016 804.91

1. Interest accrued is when interest that is either payable or receivable has been recognized, but not yet paid or received. It is usually paid at end of Financial Year. So on 31-Mar-215 Interest accrued was Rs 378. Interest Paid is what interest has been actually paid to you, But Why SBI is saying interest paid is Rs 759 we cannot understand.

2. You had to pay tax on accrued interest.

3. As you have paid more interest last year you can show balance interest this year as taxable income

as I have paid tax for the interest 759, so I have to pay tax for the amount 1183-759 = 424 only, is that????

my brokerage commission of rs. 2,00,000/- but PAN not provided so TDS @ 20% rs. 40000/- deducted. how income tax return submission & tax calculate

Do you have a PAN? you cannot claim refund by simply quoting your PAN while filing IT return (ITR).

You can provide PAN to those who have deducted TDS?

You can request them to submit ETDS correction statement and mention your PAN against the amount deducted. After ETDS correction you will get the credit in 26AS. This credit can be claimed for refund by filing ITR with your PAN.

Hie,

I am Ph.D Scholar and earn >2.5L per year. As per the income tax act u/s 10(16), it is not taxable. Can anybody give me clarity whether the interest earned on the savings as FD is taxable or not? If taxable, please provide me the details of rules of taxation. If not taxable, please let me know the procedures to claim the TDS deducted by the bank.

Thank You.

Interest earned on FD is classified as Income from other sources and is taxable.

If your total income in the year excluding the scholarship is less than 2.5 lakh , exemption limit then either you can submit form 15G so that TDS is not deducted.

If it is deducted then you can claim it by filing ITR

Hi all,

I calculated the extra tax to be paid on my FDs to be 2840 and I paid rs 3068 as my self assessment tax through challan 280 though keeping the self assesment tax to be 2840. Now i have got demand notice with outstanding demand amount to be 2840. The amount 2840 is being reflected in form 26AS with corresponding BSR number but still there is outstanding demand for Rs 2840. What can be done in this regard ? Thanks for any help

I am the karta of huf, where i have accumulated some corpus from various sources in the form of loans. That all money in the huf is deposited in a single bank branch in the form of various fds. I am also submitting form 15g to avoid tds by bank. My yearly huf income from fd interest would come to around 2,00000 rs, Now i want to know that 1. what interest is calculated to decide the highest limit covered under 15g perview. Accrued or that realized on maturity. 2. or we have option to specify for that ? 3. In case of accumulative Fd, how (when & from where) bank deducts the amount on accrued interest otherwise ? Thanks in advance..

I have some fixed deposits in one bank which is under administrator appointed by RBI. Last two and half years we are not allowed to withdraw money from the bank till the bank is taken over by some other bank. Still, in this case I have to declare the accrued interest on the FDs as “income from other sources”?

I have some fixed deposits and Recurring deposits in 4 banks in joint accounts with my wife as first holder and me as second holder. My wife is a housewife and doesn’t have any source of income. Every year she fills the 15H forms in each bank. The interest earned on all FDs and RDs will be clubbed in my income under income from other sources?

Thanks and regards.

I am a NRI, I have no income source in india, but i have kept the FD in two banks & both the banks have deducted TDS. While efiling online, the amount of 3986 deducted from the bank is currently showing in the refund column as there is no source income. Where to fill these details of FD to make refund zero.

Or is there any necessary to file ITR, only for FD interest deduction.

Sir i have a problem relating to claiming of TDS deducted on interest on FD in post office for the past years in which it is not claimed and also no income tax return is also filed in those years and the FD is matured in this year but the assessee is under exemption limit.what can be done now, please reply me as soon as possible it’s urgent

Thanks for the blog. I have one question regarding Fixed deposit. I have interest income of Rs. 367247 from fixed deposit this year.

The bank had already deduced 10% TDS and since I fall in 30% slab I paid additional payment of reminaing 20% (Rs 73450).

But apart from this, after declaring my interest income “Income From Other source”, I see an additional tax liability of Rs 9970. Of this 9907, Rs. 3305 is due to addtional education surcharge.

But the remaining 6672 is on account of section 23, Interest payable u/s 234 B and Interest payable u/s 234 C. I am not sure why these charges are being applied. Can you please advise.

Gaurav, Sure

Section 234A,234B,234C are Interest Penalty for not paying Expected IncomeTax on Time

Under section 234B, penalty arises when the total amount of advance tax paid along with the amount of TDS is less than 90% of the total tax liability. In such case interest is calculated at 1% per month of the amount of shortfall for time period from April to the month in which the return is filed.

Under Section 234C, there are three components. For the first installment, the shortfall penalty is calculated for 3 months @1% p.m. Similarly, in the second installment, the shortfall penalty is also calculated for 3 months @1% p.m and the final installment is calculated at a flat rate if 1% for 1 month only.

As you had interest income more than 10,000 Rs you were supposed to pay Advance tax on it. 30% by Sep, 30% by Dec and rest by Mar.

As you didn’t pay, govt has penalised you.

Our article Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time explains it in detail with examples.

i have fd in fvg of my minor son joint with my name.in my son custome id i have given my pan no , for tds exemption i have to furnish 15g form in bank in both customer id of my minor son & myself or not

Hi,,My daughter is eight years old and is a minor.Bank has deducted TDS on her interest income and in the TDS certificate her PAN no is shown.

I am NRI and don’t have any taxable income,how can I claim the TDS already deducted from my daughter’s account in my return?

Thanks so much for clarifying most of our queries.

The only place iam stuck, is when i pull out the pre filled ITR form(coz facing issues with xml etc):

the prefilled doc shows, my TDS on interest is xxx, hwever iam not able to show that the same xxx amount is also taxable, hence they nullify and I do not request any refund.

The amount of tds is 3344, and i dont have any other earnings/tax payments.

The prefilled doc auto shows this is a TAX REFUNDABLE, option.

PLs help

I had FD for 3+ years and I closed my FD before yearly maturity in March 2015. The interest shown by bank in Form 26AS is Rs. 4061 and TDS as Rs. 1187. Since interest is less than 10000 do I still need to show this amount in “Income from Other Sources” section?

Mam,My father is retired employee of a Bank as he is retired now the so the bank does not issue form 16 also the bank through which pension is received refused to give form 16 saying as the they have not deducted any Tds they can not issue it,my question is whose Tan number should i enter in (income under salary).

Does Bank provide Pension certificate?

Are Details of Income mentioned in Form 26AS?

There is confusion on what should be employer details Bank which provides Pension or original employer, read Chartered Club Employer Details in ITR 1 for Pension Income

If one gets Form 16 from the Bank for pension. Then fill the Name and address of the Employer as per Form 16.

Typically The organisation from where the employee has retired should be treated as the employer and the details of the organisation should be mentioned in the ITR.

Mam no details of income by pension is mentioned in form 26AS,as the pension sum is quite small and no Tds is deducted bank says there is no need of providing form 16 now i am confused what to enter in Tan number under sch TDS1.

Also mam in form 26AS there is no tds deducted on interest on fd as form 15H is submitted,the interest mentioned in 26 AS do not match actual interest so what amount should i enter??and if tds deducted is zero on income from other sources do we have to fill sch tds2

You don’t need to fill sch tds1 as no TDS is deducted on Salary.

You don’t need to fill sch tds2 as no TDS on FD was deducted

One question why do you say interest in 26AS mentioned is different from actual interest?

Mam actually i was also calculating interest on a fd which have two holders so i was not sure under whose income the interest on that particular FD will come,no the doubt is clear the interest is matched.

thanks

Dear Sir,

My FD interest from FY 2014-2015 is Rs 8988/-. However the bank has only shown Rs 723/- in my Form 26AS and no tax has been deducted from their end. I have asked for the interest certificate which should be arriving soon. Please advise whether I need to show full Rs 8988/- in my ITR1. I do not have any Form 16A from them so I do not know what to fill. Please advise the correct course of action.

If interest on all FDs from one single bank (even if more than one FDs are in more than one branch of that bank) is less than Rs. 10,000, no TDS is deductible. If Rs. 8,988 is all your FD interest for FY 14-15, then 100% definitely no TDS is deductible and should not be deducted. As you mentioned, no TDS has been deducted.

So don’t worry about TDS part. Look at if you need to show interest income in current return or not. For your case, I recommend that if cumulative FD expired/ matured/ was renewed in FY 2014-15, then the entire income over life of FD should be shown (unless you have shown interest pertinent to a FY in that FY itself, in which case, only 14-15 interest to be calculated and shown). If it was non-cumulative, interest received in 14-15 should be shown. Hope that helps.

We are confused..you say no TDS has been deducted then what is 723 is Form 26AS.

What Joel says is correct.

Did your FD was for more than 1 year covering FY 2013-14 and FY 2014-15?

Have you accounted fro FD before in FY?

Thanks for the prompt reply.

The bank has shown earning of Rs 723/- through FD interest. However the earning is Rs 8988 in actual.

As far as I knew the entire Rs 8988 should be taxable at current slab which I need to show in my returns. Even if the bank has not deducted TDS because interest is less than Rs10000/-, I am supposed to pay Self Assessment Tax and show it in my returns.

My confusion is that in Form 26AS total earning from interest is shown as Rs 723 however it should have been Rs8988/-. So should I show earning as Rs 723 or Rs 8988 while filing my returns or should I ask the bank to rectify it. What should be the legal course of action?

Sir there are some fill in the blanks- why one 723 was deducted.

TDS deducted is 10% of interest and if the interest on FD is more than 10,000 Rs.

How do you know that interest is 8988?

Entire interest earned on FD is taxable as per your income slab. SO you have to show entire interest as Income from other Sources.

You then have to claim the TDS deducted in TDS sheet so you pay only remaining tax

I know the income is Rs 8988 from interest bacause it is the amount of interest I earned from closing Fixed Deposits last financial year which I have not calculated previously. Even the bank has agreed that it is Rs 8988/- as per my conversation with their call center and they will be sending the interest certificate shortly to me. However my question still remains unanswered. Do I need to show Rs 723 as earning because it is mentioned in Form 26AS or do I need to show Rs 8988 as earning as mentioned in the interest certificate of last financial year.

Sir my father have fixed deposits in multiple banks as he have submitted form 15H so the bank did not deduct tax,do i have to fill sch tds2 and does the income from interest on fd comes under income from other sources

Yes Sir Income from interest on FD comes under income from Other sources and is taxable as per his income slab.

No as no TDS is deducted you don’t have to fill schedule TDS2.

30455 TDS being debited from my bank account against FD interest. I have not updated my PAN no in records. My income not come under taxable. I have e-file account . Pl guide me to get refund. Now i updated my ac with PAN no.

Please submit the PAN No. to your banker.

The bank will then update the PAN No. and then allocate the TDS to your PAN No. and then you can claim refund of TDS.

The whole procedure will take a few days to be completed.

Till the time the PAN No. is not updated in the bank records – the TDS will not reflect in Form 26AS as a result of which TDS Refund wont be issued to you

Hi,

I have a query on interest income earned from FD and the corresponding tax liability.

Say per form 26AS, interest income shown is 20000 and the tax deducted at source is 2000.

My question is, interest income upto 10000 is exempted in income tax.

So, should I show 20000 as interest income or 10000 (after deducting 10000)?

I don’t think bank has accounted for the 10000 exemption. Banks have deducted 10% from all interest income.

Hemal,

Interest from saving bank account is deductible under the section 80TTA upto 10,000 Rs.

Interest from FD is taxable as per your income slab. if interest from bank is more than 10,000 Rs in a financial year(Apr-mar of next year) then bank deducts TDS at the rate of 10%.

Any Tax deducted or paid by you, mapped to your PAN, shows up in Form 26AS.

Article above discusses how to show FD in ITR , you can also see the video.

On how to show interest earned on saving bank account you can go through our article Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR

Many thanks for your prompt response..

Your response provides the exact clarity required.

Hi, I am a salaried employee falling under 20% slab. Recently, I have received some amount as part of my share from my father for sale of his property. My father is a senior citizen and he is non-salaried employee. I read in few articles, it says anything received from blood relative (in this case my father) is non-taxable. However, i would like to take some expert advise on the same. How I am liable for my share? Do I show this as my other income while filing? Please provide your suggestion.

Sir, you are right gift from father to son is non taxable.

Income earned from the gift money will be added to your income.

Now there is confusion on whether money received as gift is to be shown in ITR or not.

There are two school of thoughts:

1 says it’s not income so no need to show

2 says as its exempt and to avoid question later by assessing officer show it as exempt Income in ITR as Others.

You can read Quora’s article Are gifts from parents added to the gross income in India?

Thanks a lot.. Your comments are really helpful.

I have one last question,

1) Do i have to file ITR-1?

2) If so, do i show them as “Income from other source”, and how to exempt this income as received from relative?.

Please advise on the same.

Again, Thanks a lot for your response.

Assuming Your father would be showing sale of house property as capital gain in his Income tax return and would be paying appropriate tax on it.

So the income is white. Now he is gifting the money, if its big amount and you use it for investment you may get asked where did you get the money from.

Hence nowdays it is being recommended that you show it in ITR as Exempt income, not Income from other sources. You can have a gift deed from your father mentioning the gift of money.

My father is non-salaried employee and retired. He never filled ITR. Even if files, he falls below the tax slab limit. So, he may not be chargeable to tax.

In this case, do i still show gifted income in my ITR and claim for fully exempted? If so, can you help me in which ITR form i can show the above.

Hi,

My parents created FD of 3 lacs for 3 years.

Now, they are taking out interest from FD after every 3 months instead of accumulating.

Are they gaining anything by this way or to compound interest take effect should they take interest after every 3 months instead of accumulating it ?

How to get TDS exemption on interest on investment of PF contributions by Registered Society having no taxable income

Hi,

I’m a salaried person working in a private co. My wife has joint bank accounts and demat accounts with her parents (E&S), and these accounts are existing before our marriage. She does not make any share transaction but her father may or may not. She has a single account and joint accounts with me as well. However, her total annual income from savings bank acc interest, divident payout etc. is well below the minimum income exemption limit and this is even less than 1% of my salary. Now I’m having follwing two doubts:

1.Whether she should file ITR return (she is having a PAN)?

2.Should my wife’s income from these accounts can affect my tax liability

She should file ITR if she is below exemption limit bur

A proof of return filing may You want to claim an income tax refund.

She wants to carry forward a loss under a head of income.

Return filing is mandatory if she us a Resident individual and have an asset or financial interest in an entity located outside of India. (Not applicable to NRIs or RNORs).

Or if she is a Resident and a signing authority in a foreign account. (Not applicable to NRIs or RNORs).be required at the time of applying for a loan or a visa.

In filing your ITR just mention the joint accounts that you have.

Only when you are gifting her some money and she is earning from that gift money due to clubbing provision your tax liability will be affected

My form 16A from bank is showing 11,411 as net income from FD (which is on my daughter’s name-Minor).Bank already deducted 1141 (10%) tax which is also shown my 26AS.

While filing the return, when I am entering 11411 as other income, calculated tax is showing way to high compare to 1141 which is deducted by bank. Do I need to pay extra tax while filing return?

Sir,

Interest from FD is taxable as per your income slab. if interest from bank is more than 10,000 Rs in a financial year(Apr-mar of next year) then bank deducts TDS at the rate of 10%.

Any Tax deducted or paid by you, mapped to your PAN, shows up in Form 26AS.

As it is minor income it will be clubbed with your income but you will get exemption upto Rs 1500

Article above discusses how to show FD in ITR , you can also see the video.

According to my understanding, if the total interest earned in particular bank exceeds Rs. 10000/- for the financial year, then the bank will deduct TDS. Suppose if I have multiple deposits in more than 1 bank say 3 bank, do I have consider overall interest from all banks. For instance if I earn Rs 9500/- from Bank 1, earn Rs. 10500/- from Bank 2, Rs. 20000/- from Bank 3, Then Bank 1 will not deduct TDS while Bank 2 and 3 deduct TDS,right?

You are right Sir.

You have to add interest from all the FDs without TDS (if TDS is deducted) and show it as Income from other sources.

Also show TDS deducted by banks in TDS section , one entry for each bank

So your total income is: 9500+10500+20000=40000

Regarding TDS

If total interest earned in particular bank exceeds 10,000 then TDS will be deducted.

But tax is payable on the total interest as per your income slab.

TDS will be deducted by bank 2 and bank 3.

Our video above explains it.

Thanks for the reply. So you are confirming that bank 1 does not know the interest earned provided by bank 2. I am more interested to know how to avoid TDS being deducted from my interests

Hi. I have Rs.18470 as income from FD. The bank has already deducted Rs.1847 as TDS. I fall under 20% bracket. I was filling up the ITR-I and when I enter Rs.18470 as “Income from other sources”, the total tax payable is showing up a total of Rs.1960 instead of Rs.1847. (A difference of Rs. 113 which is 3% of 1847(TDS)+1847(Tax Payable).

Do I have to pay education cess of 3% for the income from interest? If so, why didn’t the bank deduct that 3% for the 10% TDS deducted? If not, how to make the total tax payable as Rs.1847 and avoid the education cess?

Sir if you are in 20% slab your total tax payable would be 20% of 18470( 3694) + education cess at the rate of 3% (111). Which is as per the calculation you have shown.

Yes you would have to pay education cess for the income from interest. Bank does not deduct 3% of 10% deduction. You cannot avoid it. Just bear it.

Sir My father passed away. My mother is an family pensioner. She deposited 3 lakhs to FD. It is taxable or not?. She also had PAN Card.

Sir Please accept our sincere condolences on the passing of your dear father. We are so sorry about your loss.

Coming to your question

Yes Sir all the income that one earns is taxable if it is more than basic exemption limit.

Various kinds of income are:

Income from pension/salary

Income from House property ex rent/homeloan

Income from capital gains ex: when one sells house or gold or mutual funds

Income from business or profession

Income from other sources : ex income from Fixed Deposits, Saving Bank Deposit etc.

Our video article YouTube Video:Income Tax,Income and Income Slabs explains it in detail.

You have to sit down and see the total income that your mother will get. For example How much interest from FD in an year. please note bank will deduct TDS if interest in the FD is more than 10,000 Rs in a Financial year. Only interest is the income not the principal amount.

If the total income is less than 2.5 lakh if mother is less than 60 years and 3 lakh if above 60 years.

If her total income is less than limit mentioned above she has to submit form

15G/15H to bank so that they do not deduct tax.

If you have more questions or need clarification please do ask

I’ m not liable to maintain accounts. Filled up Schedule “OS” in ITR 4, specifying the interest accrued from Bank/ Post office instruments viz. FD’s, Sr Citizen a/c etc. On validating showing an error viz. “Pl enter the description of others”.

Unable to comprehend.

Sir in OS schedule total interest should be shown in Interest Gross. 1a

Against item 1d, indicate any other income under the head other sources such as winning from lottery, crossword puzzles etc., income of the nature referred to in section 68, 69, 69A, 69B, 69C or

69D. The nature of such income is also required to be mentioned.

OS schedule is to be filled as follows

Schedule-OS,-

(i) Against item 1a and 1b, enter the details of gross income by way of dividend and interest which is

not exempt.

(ii) Against item 1c, indicate the gross income from machinery, plant or furniture let on hire and also

such income from building where its letting is inseparable from the letting of the said machinery,

plant or furniture, if it is not chargeable to income-tax under the head “Profits and gains of business

or profession”.

(iii) Against item 1d, indicate any other income under the head other sources such as winning from

lottery, crossword puzzles etc., income of the nature referred to in section 68, 69, 69A, 69B, 69C or

69D. The nature of such income is also required to be mentioned.

(iv) Against item 1f, indicate all such income which is included in 1e and chargeable to tax at special rate under chapter XII or XII-A. Such income cannot be adjusted against the losses under this head or under any other head.

(v) Income from owning and maintaining race horses is to be computed separately as loss from owning and maintaining race horses cannot be adjusted against income from any other source, and can only be carried forward for set off against similar income in subsequent years.

(vi) Item 4 of this Schedule computes the total income chargeable under the head “Income from other sources”. If balance in item 3c which shows income from owning and maintaining race horses is a loss, please enter 0 and enter the total of item 2

my fd money got deducted due to the tax…from my bank…they told me that they dont know that i was student what to do now how to get that tax deducted money back from my fd’s….pls help…me…

if you are adult you can file ITR1 and ask for refund.

You do have a PAN right? Else TDS would have been deducted at 20%.

I am Salaried person, and falling 10% tax slab. My Total Tax Payable is 1236 and I already Paid Tax(TDS) Rs 3000. therefore My refund is 1764.

I have get FD Interest of Rs 9230 which is less 10000 and bank didn’t deduct TDS. I have read previous Q&A in this blog and you said that this is self assesment tax which can be deposit through ITNS280 before efile.

–> If I do deposit 10% of 9230 ie 923 through ITNS280, then it appears in 26AS and therefore Tax paid becomes 3000+923=3923 & Refund = 1736

Plz tell me, can I do the following instead of deposit ITNS280….

–> Since I have refund 1764 & suppose I did not deposit 923 by ITNS280, then after e-filling it will be seen that Refund = 813

Hello Sourav,

Calculation of tax for ITR1 happens as follow

1. Income from Salary (pt 6 in form G)

2. Income from other sources (Interest from FD, Income from interest on saving bank account)

3. Income from house property

A Total income = 1+2+3

4. TDS deducted

5. Deductions in 80C,80TTA(for saving bank interest)

B= A-4-5

taxable income : A-4-5

tax on that income, which if you are in 10% slab would be 10% of B

C=As you have income below 5 lakh you get rebate under section 87(A) of max of 2000

Total tax payable or refund is B-C

If this is positive then you pay self assessment tax

if it is negative you get refund.

In your case it would be refund so need to pay self assessment tax.

Hope it helped.

Else you can see the video How to file ITR1

My question is that, since I have paid Tax 3000 and 10% of FD Interest is 823, still should I deposit 823 in form280???

Sir entire interest earned on FD is taxable as per your income slab.

TDS is deducted at rate of 10% if interest is more than 10,000.

You have to add interest from FD to your other income, add TDS details and calculate total tax.

If you have to pay tax then pay using Challan 280.

If your total income is less than 2.5 lakh you will have refund.

Please see our video in article to get more information.

Or provide more information about income earned

Sir

I am providing my income details

i) Income from Salary= 342074

ii) Income from other source = 23545 [FD Int.+Regular Int.]

—————————

Total = 365619

80C = 72478

80TTA = 3931

So, Tax Payable on total Income = 3921

After rebate 2000 it becomes 1921 & Edu cess=58

———————————————

Total Tax = 1979

TDS1 = 1200

TDS2 = 1966 (bank issued me form16A)

————–

Total tax paid = 3166

So Refund = 1187

————————————————–

Now I have a another FD Interest of 9230(I know it is taxable)

My question is here that If I do not deposit Rs923(10% of 9230) through ITNS 280, then can I show this amount9230 in Income in other source??? {In that case refund will be 237}

or again I have to deposit 923 before efilling????

If I add this in Income in other source, then refund becomes 237

Thanks for providing info.

To calculate Income from other sources you need to add interest from all the FDs.

So you calculation would be

Total Income:

1 Income from Salaries 340274

2 Income from Other sources : FD Interest of all the FDs whether TDS was deducted or not + Saving bank interest

3 Deduction under section 80C

4. Deduction under 80TTA

5 Total income = 1 +2 -3-4

6 TDS = TDS1 + TDS2

Tax payable = Tax on Income – TDS

Rebate under section 87 if applicable.

If Tax payable is -ve you would get refund, if not you would have to pay tax

Hope it clarifies