Do Fixed Deposits beat returns from Sensex? If we follow the newspapers/personal financial books/blogs or financial advisers advice it is often quoted that equities returns more than 12% while Fixed Deposits give less than 10%. Hence equities should definitely be the part of one’s portfolio for long term infact the formula suggested is 100 – age. Economic Times in April 2012 in its article Don’t buy and forget if you invest in stocks for the long term(Apr 2012) compared the returns in Fixed Deposits with BSE Sensex and said :

It’s just that they need to get rid of the notion that they will get handsome returns if they hold their stock investments for a very long time.

This article was followed by lots of articles on personal finance blogs discussing whether Fixed Deposits beat returns from Sensex? This post tries to present diverse views on a single page.

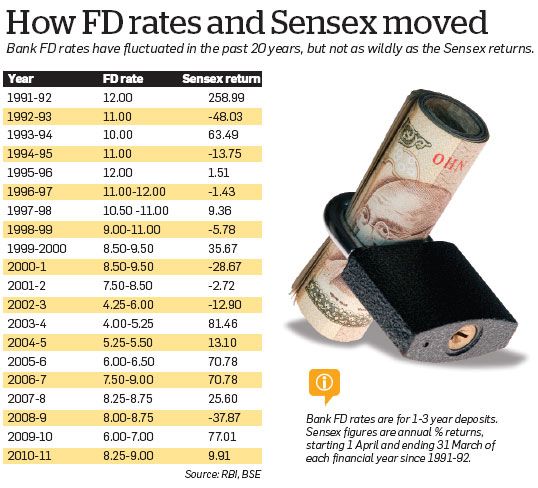

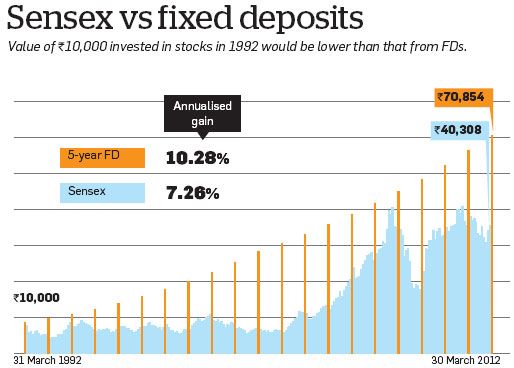

Economictimes:Don’t buy and forget if you invest in stocks for the long term(Apr 2012) compared the returns in Fixed Deposits with BSE Sensex. Quoting from article:

- The BSE Sensex was quoting at 4,285 nearly 20 years ago. It’s now at 17,404, an annualised return of a paltry 7.26%, which is well below the current high inflation rate.

- If the same money had been invested in a 1-year fixed deposit with a commercial bank and rolled over every year, it would have grown to Rs 49,722.

- If investors could have opted for five-year FDs that offered higher rates. This corpus would have been bigger at Rs 70,854.

|

|

|

As per CapitalMind:The Great Indian Stock Market Story was only 5 good years(Apr 2012) The Great Indian Stock Market Story of the last twenty years is only about four years, 2003-2007. If you’re finicky, we could add the stellar 1991-92 time when Harshad Mehta pushed the market up 3x in one year and say this: Just five years of the last twenty two have accounted for nearly all of stock market returns.From 2007 to now, the total market return is a miserable 5.9% per year. Of course individual stocks have given great returns. Chart from the article is given below.

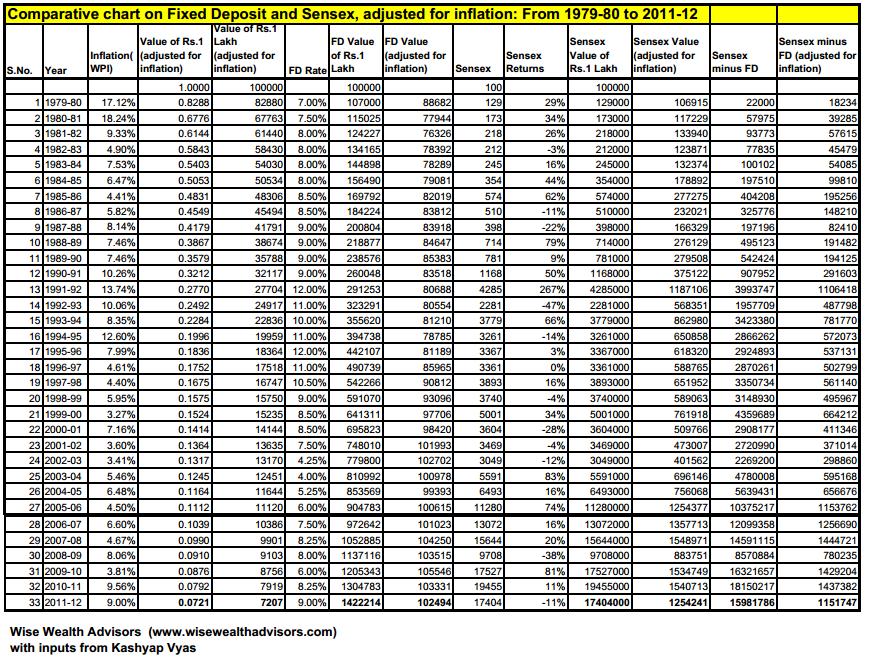

While WiseWealthAdvisors:Must Read: I’m saying this for first time (Apr 2012) which has 30+ years (since 1979-1980) comparative chart on Fixed Deposit and Sensex, Gold and Sensex, Silver and Sensex adjusted for Inflation said

- Rs.1 Lakh invested in Sensex 33 years ago is Rs.1.74 crores today. After adjusting for inflation it is worth Rs.12.54 lakhs today

- Rs.1 Lakh invested in FD 33 years ago is Rs.14.22 lakhs today. After adjusting for inflation it is worth Rs.1.02 lakhs today

- Rs.1 Lakh kept as cash 33 years ago is worth only Rs.7 thousand today in terms of purchasing power.

Given below is the image from wisewealthadvisors:comparative chart on Fixed Deposit and Sensex(pdf)

We were confused as to what to believe – do Fixed Deposits really beat Sensex or not?

Then we read article SuchetaDalal:Fixed Deposits Beats Stocks? Financial writers need financial literacy first (Apr 2012) . It found flaws in the argument of Sensex worse than Fixed Deposits. Quoting from the article.

- Arbitrary Dates: Any point-to-point comparison is completely arbitrary. This study coincidentally chose 1992 as the starting date. If one had entered the market a year earlier or a year later, the returns would have trumped fixed deposits. For instance, if you had entered the Indian market in 1993 instead of 1992, when Sensex was 2,280, you would have got 11.29% returns. Even a year earlier, in 1991, would have yielded a much higher returns of 13.73%.

- Tax: The biggest flaw is that there is no mention of tax. These returns are pre-tax. When the government takes away 30% of your interest income above a certain level as tax and allows you to earn long-term capital gains tax-free, it is foolish to consider pre-tax returns for comparison.Instead of the 8.35% (one-year FD) returns mentioned earlier in the article, the return was found to be 5.86%, over the 20-year period. Similarly, the five-year FD scheme returned slightly higher at 6.21%. This is well below the 7.26%

- Dividends: Like taxes, the ET/TOI article ignores another element—dividends. Over the long period of time, small dividends can make a huge difference. In our case, we found out that by just reinvesting dividends, every year, the annualised returns turned out to be 8.29%, a good 1.53 percentage points higher.

- Lumpsum Vs SIP: The study assumes that all the investment was made on one particular day in 1992. Our study showed that if one had invested just Rs500 (or any amount for that matter), every month, for the period 1992-2012, this strategy would have netted you a cool 11.60% return, again higher than FD returns.

Interested readers can also read ApnaPlan:Stocks Vs Fixed Deposit – Which is better?(Apr 2012), fingyan:Confused Whether To Invest In Stocks Or Bank FD For Long Term? – Compare Historical Returns To Choose The Best(Apr 2012)

As my professor used to quote Torture numbers, and they’ll confess to anything. While we all preferred quote by Aaron Levenstein Statistics are like bikinis. What they reveal is suggestive, but what they conceal is vital. We all know there is more to a topic than statistics and numbers Say you were standing with one foot in the oven and other in ice bucket. As per % you should be perfectly comfortable. But we all know that’s not the case

It’s like discussing about too much of protein or no carbohydrate in the diet. Or saying Whenever Sachin hits a century India loses. As we said in the article Fact or opinion:Do Due Diligence (which discusses Sachin century and India losses! also)When it comes to money, You cannot blindly accept financial advice.The point is you must know how to sift through the facts and opinions, and then make your decision. Just like balanced diet we need personal balanced financial plan with some allocation to Fixed Deposits and some to equities as per one age, risk profile and other factors called asset allocation.

Related articles:

- Overview of Fixed Deposits

- Fixed Deposit and Interest Rates

- What is Investing?

- Why Is Investing Confusing?An infographic

- Investing:Think about Liquidity,Safety,Returns,Risk,Tax

- Stock Market Index: The Basics

- Stock exchange : What is it, Who owns, controls it

What do you say: Do Fixed Deposit beat Sensex returns? Should you invest in equities? If yes does the formula 100-age should be followed or not?

9 responses to “Comparison of Fixed Deposits and Sensex Returns”

[…] Download Image More @ http://www.bemoneyaware.com […]

Great article.

As far I understand,theme of ET article is to signify the importance of entry level in the equity market…whether its by chance or by intelligence,,proper entry level is necessary for success in equity market….

For different period one can prove that different assets have performed and here ET article proves that FDs have performed better and there seems to be nothing wrong in it…

Investors actually have invested on 31st March 1992 can’t say that picture would have different if I would have invested few days back or few days latter..

Number of investors invested at the peak are waiting for getting their principle back while there are number of investors who have invested at march ends of 2009 and get more than doubled within 3 yrs..and proves importance of entry point though it was by chance.

Paresh you mean to say timing the market is as important as time in the market?

As my professor said Torture numbers and they’ll confess to anything. It is as important to see the numbers but also understand the story behind them. An idea for a post..:-)

As far my belief,timing is more relevant and time in is irrelevant for equity markets.

As already stated above,investors invested in ELSS at March ends of 2009 just to save tax exited with money doubled while investors invested earlier are struggling for the principle to get back.

In short,its not necessary that passenger entered earlier in the bus will get comfortable seat than that one have entered later.

Timing is important but Catch is how to time the market? Is it the right time to invest how does one decide that?

What happens if bus breaks down so all passengers are affected!

Its not a catch but it is a risk.

Today market is at 16800 level… It can go to 25000 or 13000 but if anyone decide to invest should ready for the risk of wrong timing..and in such case fixed deposit can also outperform the equity..thats what is a theme of the ET article…

Though we sell mutual funds we always want that people should understand the market risk and then only enter in the equity.

Its not the negative approach but investing in equity is like doing the business and should be done with that approach only.

Agree with you Paresh. One should know what one is investing in. I have seen people thinking of making quick money in stock market and some of them burn their hands!

But for the ping back today, I wouldn’t have known about this excellent blog.

I went through few past articles for the last one hour and they are extremely good.

Keep up the great work you’re doing.

May your tribe increase.

All the very best.

Thanks Muthu for your kind words. Your blog is very good and the article on Comparison of Sensex with Fixed Deposits, Gold, Silver was so researched.

We have an advantage that we have been following some great blogs like yours!

Thanks for your wishes!