Equity markets are at an all-time high and many investors are feeling jittery. For them, financial advisers are recommending Equity Saving Funds or Equity Saving Schemes (ESS) so they one does not miss a rally in equity markets and at the same time be safe from the downside. A relatively low-risk product that invests in a mix of stocks, debt and arbitrage opportunities, Equity Saving Funds are similar to Debt Funds in nature but with tax benefits of equity funds, similar to Balanced funds. What are the Equity Saving Funds? How are they different from Balanced Funds? Should you replace fixed deposits with an equity savings fund?

Table of Contents

Equity Saving Funds

Equity savings funds are a comparatively new category of mutual funds. They were introduced after the Union Budget 2014 increased the holding period for debt mutual funds to qualify as a long-term capital asset from a year to three years. They are certainly not substitutes for pure equity funds, especially for long-term portfolios, and fit those with a 2-3 year time frame who want tax benefits that are not available in debt-oriented funds for such a short time period.

- Equity savings funds invest 30-35% of the corpus in equities and rest in debt and arbitrage

- Pure equity scheme typically invests 90% in equity

- Balanced fund invest above 65% in equity

- Debt funds invest the entire amount in debt instruments such as bonds, corporate debentures, government securities and money market instruments.

Let’s take the example of an investor who has held an equity savings scheme for six months after which the equity portfolio sheds 10% of its value. Assuming the fixed income portfolio generates 7% annualised returns and the arbitrage portfolio generates 5.5% annualised returns, the total loss for the investor will be minimised.

- Equity goes down by 10 %, as equity is 30% of the portfolio, impact on portfolio is 30% * 10 which is -3%

- Debt goes up by 3.5 %, as debt is 30% of the portfolio, impact on portfolio is 30% * 3.5 which is +1.05%

- Arbitrage goes up by 2.75 %, as Arbitrage is 40% of the portfolio, impact on portfolio is 40% * 2.75% which is +1.1%

- So net effect of markets going down by 10% is reduced to -0.85%(-3+1.05+1.1). Whereas the pure equity or balanced funds will post negative returns between -7% and -15%, depending on stocks in the portfolio.

What is Arbitrage?

The spot market, also known as the cash market or physical market, is a public financial market in which commodities or financial instruments are bought and sold for immediate delivery (or within a couple of days, depending on local regulations). Unlike the futures market, orders made in the spot market are settled instantly at spot prices. Spot markets can be organized markets or exchanges or over-the-counter (OTC) markets.

Exchanges are highly organized markets that bring together dealers and brokers who buy and sell commodities, securities, currencies, futures, options and other financial instruments. Exchanges are divided according to objects sold and type of trade.

- Based on objects sold, exchanges are divided according to the stock exchange, commodities exchange, and foreign market exchange.

- Based on the type of trade, exchanges are divided according to classical exchange and future exchange. Trades under classical exchanges are for spot trades, while future exchanges are for derivatives.

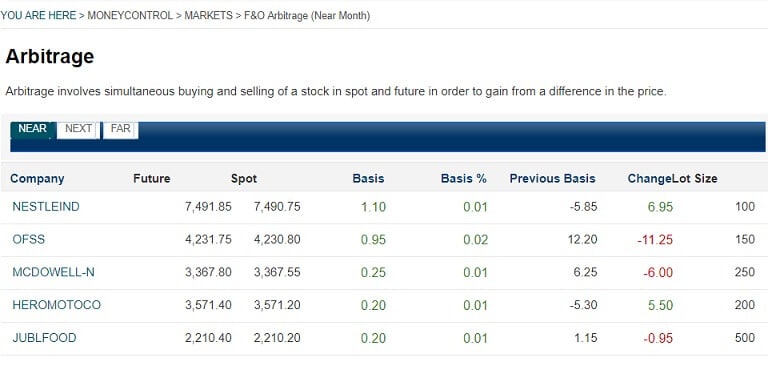

Arbitrage exploit the price difference in stocks in different segments of markets. Arbitrage involves simultaneous buying and selling of a stock in spot and future in order to gain from a difference in the price.

Let us assume that company XYZ trades on the NSE(National Stock Exchange) cash market for Rs. 100 and for Rs. 101 (same month futures price) in the futures market. Buying in the cash market and selling in the futures market will result in a gain of 1%. If we assume a 0.2% brokerage for these transactions, then the net gain is 0.8%.

If all markets were perfectly efficient, there would never be any arbitrage opportunities – but markets seldom remain perfect. It is important to note that even when markets have a discrepancy in pricing between two equal goods, there is not always an arbitrage opportunity. Transaction costs can turn a possible arbitrage situation into one that has no benefit to the potential arbitrageur. Many feel that there are significantly higher arbitrage opportunities in a bull market, but lesser during falling or flat markets. The image below shows the data for Arbitrage from Moneycontrol.com .

Tax favours Equity Saving Funds

Equity savings funds are treated as equity funds for taxation wherein up to 65% can be invested in equities. That means if they are sold before a year, short-term capital gains would be taxed at 15 percent. If they are sold after a year, they qualify for long-term capital gains tax which is nil currently.

Debt funds sold before three years, attract short-term capital gains tax. Short-term gains are added to the income and taxes at the income tax slab applicable to the investor. If they are sold after three years, they qualify for long-term capital gains tax of 20 percent with indexation.

Equity Savings funds are managed like equity-oriented balanced funds wherein up to 65% can be invested in equities. Equity savings funds have allocation to debt, equity and arbitrage, i.e., equity cash-futures hedged exposure. Equity Saving Funds have an overall 65% allocation to equity to maintain the equity taxation; 30-40% is open or unhedged exposure to equity, and 30-35% is hedged with matching sale position in the stocks in the futures segment. The equity and the derivative exposure is considered as ‘equity’ allocation and hence, these categories of funds are treated as equity funds. In the cash-futures hedged component, the returns come from the price differential in the scrip between the cash segment and futures segment of the exchange, and not from stock prices going up. The purpose of hedging is to reduce risk. The active equity exposure or the un-hedged equity exposure indicates the true risk profile of the fund. Therefore, as there is a substantial equity investment in equity savings fund, these are not suitable for short-term investment option.

Who should invest in Equity Saving Funds?

I am thinking of making investment in Equity Savings Fund of different AMCs so that reasonable return of 9-10% can be obtained and also no capital gains tax after one year withdrawal

Equity savings funds offer is stability and tax efficiency(compared with debt). These funds are suitable for those with limited risk appetite and looking for less uncertainty in returns or for those looking for some equity exposure but do not have a very long time frame. Many of these funds seek to provide regular dividend income although they are not mandated to do so. Equity Saving Funds are suitable for conservative investors who do not want to deal with volatility of the equity market or first-time investors who want to move from traditional savings options to capital market-linked investments.

They are not substitutes for pure equity funds, especially for long-term portfolios, and fit those with a 2-3 year time frame who want tax benefits that are not available in debt-oriented funds for such a short time period.

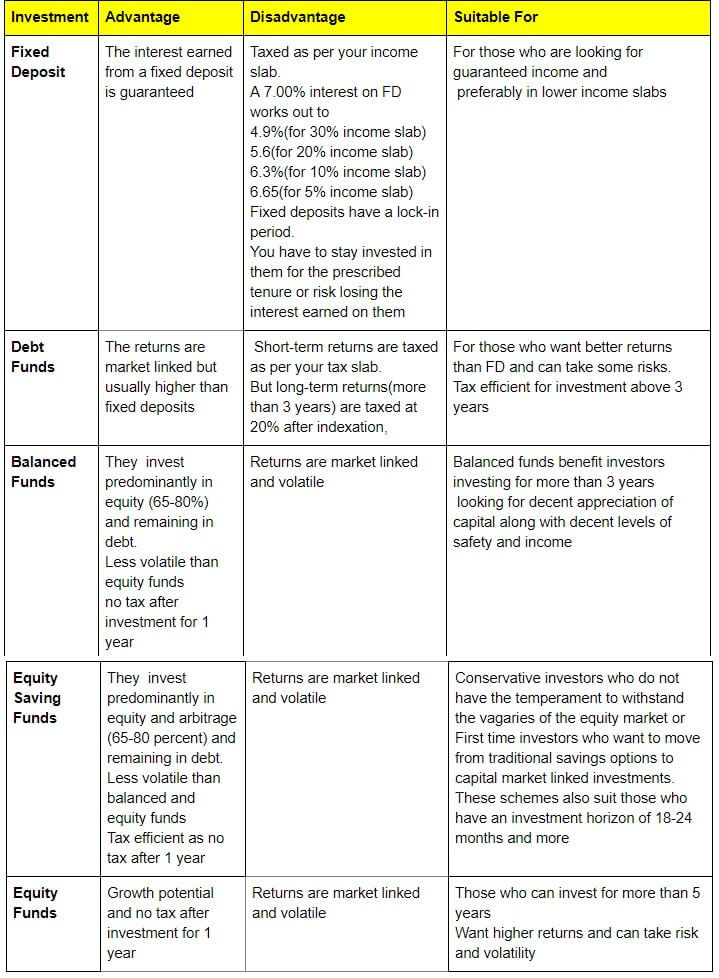

The strategy behind equity savings funds having 30-40% ‘actual’ exposure to equity, is conceptually step-up over monthly income plan (MIP) funds, which have 15-20% exposure to equities. But participation in equity is limited to 30-40% in equity savings funds against 65-70% in balanced funds. So, from this perspective, balanced funds offer better participation, as long as you have an adequate investment horizon. The image below compare various investmens options like Fixed Deposits, Balanced Funds, Equity Saving Funds.

The image below shows various equity saving funds

One response to “Understanding Equity Saving Funds, Arbitrage, Taxation”

I plan to invest RS. 5000 for my future and children education. Long term upto 20 years.

Please suggest.. my calculations are right or wrong.. if any correction please made sir.

1. ₹1000 in SBI blue chip fund through sip.

2. ₹1000 in Reliance small cap fund through sip.

3. ₹1000 in Brila sun Life frontline equity fund.

4. ₹1000 in PPF

5. ₹1000 in Sukanya Samruddhi account.