Those who have contributed to Employee Provident Fund also contribute to Employee Pension Scheme or EPS. If you have worked in an organization for more than 10 years and you want to withdraw from EPS you will not get your money but would get an EPS Scheme certificate, which you can use at age of 60 years to EPFO to get your pension. This article explains How EPS Works, What is EPS Scheme Certificate, EPS Withdrawal Form 10C, EPS Scheme Certificate and Pension and FAQ about EPS Scheme Certificate.

Table of Contents

How EPS Works?

- An employee contributes 12 percent of his basic salary directly towards EPF.

- He does not contribute directly towards EPS. Of the employer’s share of 12 per cent, 8.33% is diverted towards the EPS, with a cap of Rs 1,250 (earlier Rs 541) a month. Even in the EPF managed by Trust, EPS is always with EPFO.

- When the employee switches jobs, the employee has the option to either withdraw the EPS amount or carry it forward to the next job. This, however, depends on the length of his service and his age.

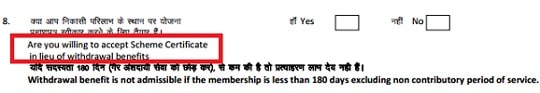

- If you have worked for less than six months, the EPS contributions cannot be withdrawn as the EPFO rules say that for those who have not yet completed 180 days in the organisation, the withdrawal benefit is not admissible. One can, however, apply for the scheme certificate.

- If an employee has NOT completed 10 years in service, he can either withdraw the EPS amount or take the scheme certificate.

- The option to withdraw or take the scheme certificate has to be submitted by filling Form 10C. Recently, the EPFO introduced UAN based Form 10C but UAN based Form 10C can only be used for withdrawal and not for taking the scheme certificate.

- The employee won’t get the entire contribution in EPS(Rs 541/Rs 1,250 a month) back after applying through Form 10C. The amount received will be subject to Table D.

- Pension begins at the age of 58 and for that, one needs to fill Form 10-D through the last Employer.

EPS Scheme Certificate

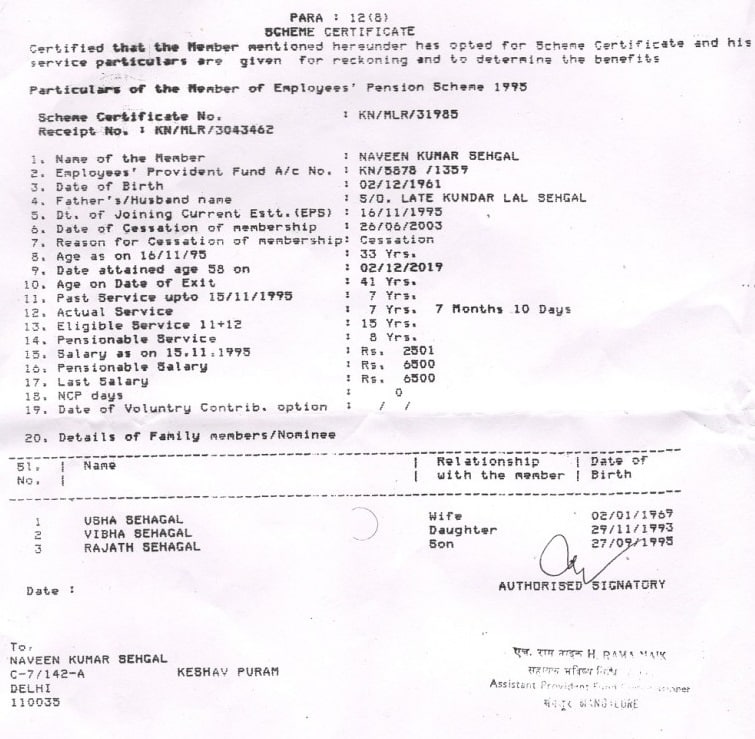

EPS Scheme certificate is a certificate issued by the Employees Provident Fund Organisation(EPFO), Ministry of Labour, Government of India. stating therein the details of service of the PF member. The EPS Scheme Certificate shows the service & family details of a member who are eligible to get provident fund pension in case of death of the member. Scheme Certificate is also an authentic record of service.

EPS Scheme Certificate is issued if the Member has not attained the age of 58 while leaving an establishment and

- He applies for this certificate if his service is less than nine years and six months 10 years or

- Withdraws from EPF after completing 10 years of contribution to EPF then he cannot withdraw money from EPS and would get Scheme Certificate.

While leaving his organization, the employee can apply for withdrawal from EPS through Form 10C.

When he joins another establishment to which EPF applies, he can surrender the scheme certificate through the new employer and by doing so his past service will be added to the new service and his pensionable service would be cumulated.

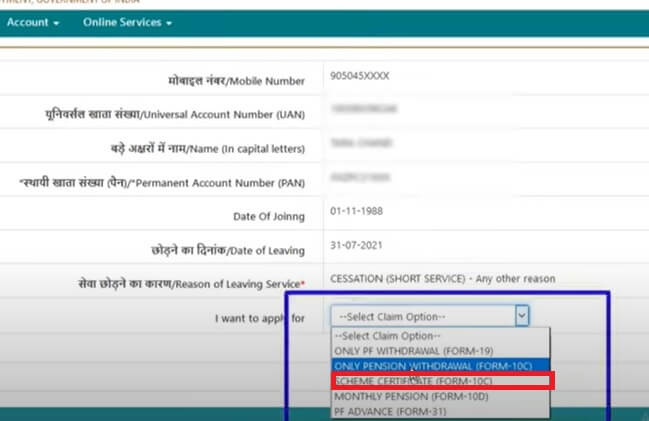

How to apply for Scheme Certificate online?

- Login to EPF Member Portal using your UAN and password

- Select “Claim (Form – 31, 19 and 10C)” from the “Online Services” menu.

- Enter last 4 digits of your bank account number and click on “Verify”

- Sign the “Certificate of Undertaking” and click on “Yes” to agree to the terms and conditions

- Select the “Scheme Certificate(Form -10C) in the “I want to apply for” section

- Enter your complete address, tick the disclaimer and click on the “Get Aadhaar OTP” button

- An OTP will be sent to your mobile number registered with Aadhaar (UIDAI). Enter this OTP and click on “Validate OTP and Submit Claim Form”

- Your pension claim form will be submitted and the fund will be disbursed in your bank account after verification by EPFO.

The video explains how to get EPS Scheme Certificate Online

How to apply for Scheme Certificate using Umang App

First of all install the Umang app and open it.

- Open EPFO Services in it.

- Click on Raise Claim option

- Enter your bank account number and click on Next button.

- In the next page select your PF account and click on the next button.

- Enter your address in the next page and click on the next button.

- Select FORM 10C (scheme certificate) in Claim type.

- Upload your bank account passbook or check book photo.

- Click on the check box below and click on Get aadhaar OTP button.

- After submitting the OTP, your FORM 10C (scheme certificate) will be submitted.

- After this, after cross-checking by EPFO office, you will get the scheme certificate.

EPS Withdrawal Form 10C

If you have contributed for less than 9 years and 6 months in EPS, One can withdraw from EPS by filling Form 10C through the employer or UAN based Form 10C to EPFO. Form 10C asks you to choose between the scheme certificate or withdrawal benefit. It is recommended to transfer your EPF and EPS account on switching jobs. For an employee, the service for six months or more is treated as one year. Therefore, 9 years and six months will be considered 10 years. The excerpt of Form 10C where one can fill for Scheme Certificate is shown below

Once 10 years are completed, the withdrawal benefit stops and one can only take the scheme certificate from the EPFO by filling the same Form 10C.

You can withdraw EPF both the employee and employer contribution by submitting Form 19.

Regarding EPS contribution the form that one can fill are given in table below

| Your Age | EPS Contribution | Form | Instructions |

| Less than 50 years | Less than 10 Years | 10C | Withdrawal/Scheme Certificate |

| Less than 50 years | More than 10 Years | 10C | Scheme Certificate(No Withdrawal benefit allowed) |

| Between 50 years to 58 years | More than 10 Years | 10C/10D | Scheme Certificate or reduced Pension |

| Between 50 years to 58 years | Less than 10 Years | 10C | Withdrawal/Scheme Certificate |

| Above 58 years | Less than 10 Years | 10C | Withdrawal |

| Above 58 years | More than 10 Years | 10D | Pension |

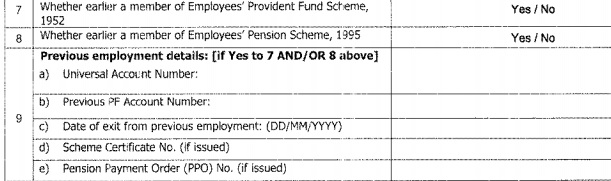

EPS Scheme Certificate and Joining a new Job

If you have taken a scheme certificate and you join a new job, you submit it to the EPFO through the new employer by filling details in Form 11. Form 11. Every employee needs to submit a declaration Form 11 when he takes up new employment in an organization which is registered under the EPF Scheme of 1952. EPF Form 11 is a self-declaration by new joinee about his status whether he is a member or nonmember of EPF / EPS in earlier employments and opt out of EPF. EPF Form 11 on Joining a New Job article explains what is EPF Form 11, contents of EPF Form 11 and instructions on how to fill it. When you leave the job, you will again have to fill Form 10C. The EPFO will add the new number of years in the scheme certificate showing the cumulative service record and give it back to you through your employer. It is not mandatory to inform the current employer about the previous employer. You will be alloted new PF account no and UAN.

When one leaves the job and withdraws and if decides to withdraw from EPF by filling in Form 10C. The EPFO will add the new number of years in the scheme certificate showing the cumulative service record and give it back to you through your employer.

One can do this till one reaches the age of 58 and then surrenders the certificate to the EPFO to start getting the pension. Or One may opt for an early pension (reduced to the extent) after 50 years provided one has completed 10 years of service.

EPS Scheme Certificate and Pension

To be eligible for the pension (for a lifetime and then family pension), one has to work minimum 10 years. Let’s see how much pension one could get after the hard times of a working life.

While working, the maximum amount that can go into the EPS of an employee is 8.33 percent of the employer’s share, but the basic pay is capped at Rs 15, 000. So the amount comes to Rs 1,250 each month, i.e., Rs 15, 000* 8.33 per cent. As the EPS funding is capped, the pension that one will get is also capped and is based on the following formula:

(Pensionable Salary * service period) / 70.

The pensionable salary is capped at Rs 15,000 and service period at 35 years. Therefore, irrespective of the actual years and the basic salary, the maximum monthly pension would be Rs 7,500.

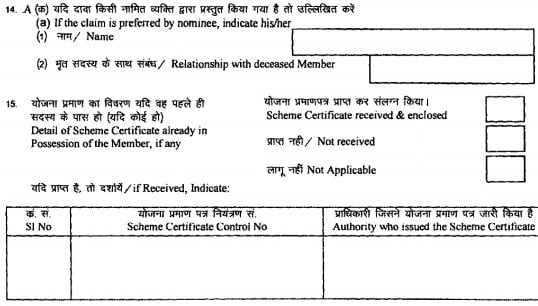

Pension begins at the age of 58 and for that, one need to fill Form 10-D through the establishment in which the member last served. The establishment should furnish the certificate and wage particulars duly attested by the authorized officer. Form 10-D has a section where one can fill details about Scheme certificates as shown in the image below. One has to fill in the details about the Scheme Certificates such as Scheme Certificate Number(ex KN/MLR/13985) , Authority who issued the Scheme Certificate ( ex: Assistant Provident Fund Commissioner) Our article How to Fill EPS Pension Form 10D to claim EPS Pension explains it in detail.

FAQ about EPS Scheme Certificate

I have resigned from a company after working there for around 8 years. I am not able to decide whether I should go for the withdrawal of the pension fund or should I opt for the Scheme Certificate?

- Transfer your EPF account if you are joining a new organization.

- If you need money or are not keen to get EPS Pension then do EPS Withdrawal.

- If you opt for Scheme Certificate you would have to submit it to new Employer

I have resigned from a company after working there for around 12 years and I am less than 50 years old. I am not able to decide whether I should go for the withdrawal of the pension fund or should I opt for the Scheme Certificate?

Since you have 12 years service you can not withdraw the Pension Fund amount. There are two alternatives: But you can get a Scheme Certificate which would benefit you in getting a continuous service when you join another establishment.

- You can transfer your entire account- both PF and Pension- to new account on joining a new establishment where EPF exists by applying in form 13.

- Withdraw the Provident Fund by applying through Form 19 and applying for scheme certificate in form 10 C.

I have completed 24 years service and I am 51 years old. I want to know that if I apply for withdrawal will I get lump sum amount immediately and scheme certificate also to get the benefit of pension after at the age of 58.

You can withdraw from EPF but You cannot withdraw from EPS as you have more than 10 years of contribution to EPS.

You have two alternatives:

- Get Scheme Certificate which you can use to get Pension at age of 58 years.

- You can apply for getting pension early. You would get reduced amount.

Can my family claim my pension in case of my death?

The lifelong pension is available to the member. Upon his death, members of the family are entitled to the pension. In the case of death of member having a family, the pension is payable to (1) the spouse and (2) two children below 25 years of age. When a child reaches 25 years of age, the third child below 25 yrs of age will be given pension and so on.

- If the child is disabled, he may get the pension till his death.

- In any case, only 2 children will receive the pension at a time.

- If a member does not have a family, the pension is payable to single nominated person. One can change one nomination anytime within the framework of rules for such nomination. In other words, if one has a family, the nomination should be in favour of a member(s) of the family. If he/she has no family he/she can nominate anyone he/she wishes

- If not nominated and having a dependent parent, the pension is payable first to Father and then on father’s death to Mother.

Related Posts:

- Understanding Employee Pension Scheme or EPS

- How much EPS Pension will you get with EPS Pension Calculator

- EPF Private Trust, the Exempted EPF Fund

- Transfer EPF account online : OTCP

- How much EPS Pension will you get with EPS Pension Calculator

- What are EPF,Pension and Insurance Changes from1 Sep 2014

- How EPFO Manages Money, EPFO invesment in Stock Market

116 responses to “What is EPS Scheme Certificate?”

Hi sir, I have taken scheme certificate after 16years of service in 2011and joined another company and not submitted the scheme certificate to the new employer and I am keeping the scheme certificate with me and continually working in another organization and in the coming May 2023 I will attain 60 years. Can I submit the said scheme certificate along with form 10 D at the time of pension application or now I have to submit the scheme certificate directly to the EPFO office. Please advise.

Dear Sir,

Please accept my thanks for your tireless clarifications and informative portal.

I have completed 60 years of age and still continuing my service with an organisation. I have completed 8 years in the current organization and 2 years in the previous organisation. My service history in EPFO portal is showing both the records. But I have noticed that my EPS DOJ is showing only the current employer joining date in the Claims portal form. I am not getting the option to apply for Scheme Certificate after verification of bank account number. Is it because the EPS DoJ (which needs tobe updated with previous employer DOJ) or is it because I am eligible for Pension only (not Scheme Certificate or withdrawal). If yes, how do i apply for pension online, while in service.

Please clarify.

Check with your employer

Have you transferred your PF?

Scheme Certificate is available for those below 58 years.

You are eligible for pension.

Please verify this with your employer

Hi,

I have moved out of India to Canada. I worked in with my previous Indian employer for 13 years, so I think I can not withdraw EPF and will need to go for scheme certificate. But I want to withdraw my EPF amount. Can you please advise if there is any way to withdraw the EPF amount for those who have moved to foreign countries?

Dear Sir/Madam

I have applied for monthly pension Form 10D, the EPFO, Mumabi office rejected the claim and “stating that Overwriting /cutting in scheme certificate not attested”.

The scheme certificate was issued by EPFO, Hyderabad during October 2002, the certificate was received by post, and they changes was done by the concerned official at EPFO and kept in plastic cover.

Kindly suggest how to get new scheme certificate without corrections or who will issue a letter /attest stating that the corrections were made by EPFO (after 17 years )

Form 10 C submission to PF office Pune with Employer _inputs needed

My EPS is not settled ;had submitted my FORM 10 C during exit

and when grievance was raised to the Pune office they stated employer has not submitted Form 10 C ,please submit the same.

Now the issue is my employer is not co-operating nor responding.

I have settled abroad and can’t contact PF Pune office personally;

just wanted to know can we submit the Form 10 C to PF office with out contacting the employer and get it settled.

Please advise.

Dear sir,

Earlier I was working in another company from 1989 to till2001, i am resigned for the job. At the time they given scheme certificate for pension. pl let me know how to claim the benefit. I am joined another unit, but they are not taken the scheme certificate and not included service also.

i left the one job and i withdraw my PF amount, and did withdraw my EPS amount and when i join new company i surrendered my scheme certificate in Pf OFFICE to add my service to new UAN. My question is how to check whether it is added to my new pf account or not/

Hi, Pension wont reflect in passbook but you can check PF so that you will come to know. If PF added automatically pension also would be added.

Sir, i have transfer my old EPF amt to new establishment, but my EPS amt is not transfered, i worked in 3 companies between 7 years, i have only one UAN that shows all my 3 companies detail (still working in 3rd company), but i want to withdrawl my EPS amt of last 2 companies, when i try to claim for EPS withdrawl it shows only “EPF advance” option. and not shows “form 10C” or etc for withdrawl and take scheme certificate. my question is that is there is any option to withdrawl my EPS amt or take scheme certificate online, because only advance option is shown on my UAN portal.

When you transfer you cannot withdraw EPS amount of earlier jobs.

The Pension will depend on how many years you have worked.

Please refer to our article http://bemoneyaware.com/eps-transfer-epf/ for more details.

sir,

I have done 4.5yrs job in ‘X’ and withdrawn (EMPLOYEE share) and taken Scheme Certificate for 4.5 Yrs (not received Pension Contribution) with UAN No. ‘A’ after gap of 6 Months i have joined new job at ‘Y’ (but PF office in Other State) and i got new UAN No. while i am joining i have given xerox copy Scheme Certificate ( Old Ofc) recently i resigned from ‘Y’ after 3Years, now i want to with draw PF!

can i withdraw (Employee Share) by keeping Pension Contribution

*Can i get new Scheme Certificate (‘Y’ period)

*Can i link old Scheme Certificate with new

*by this i can eligible for Pension Scheme?

is compulsory required 10 Years?

if i dont work in any ofc, by this 7.5 Years Scheme Certificate what is the use for me and if i want to cancel Scheme certificate What is the process

i am ready to keep the PenSion Contribution may i know what is the benifits.

Raise EPF grievance to find out if old scheme certificate details are attached with the current organization.

Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

EPF Pension depends on the number of years but is minimal. (between 1000 to 7500)

Are you planning to join another organization?

PENSION CERTIFICATE BANNE KE BAD NEW JOINING ME ADD KE BAD KYA FAYADA HE

It is the right thing to do.

Then your EPS contribution would include the Pension from old employer.

And when you want to withdraw/claim your pension you won’t have to just take care of only 1 employer

I have withdrawn PF contribution that I have made during my employment from 2 May 2011 to 10 Oct 2011. RPF Nagpur have settled the claim in 2012. I have not received the subscription certificate for the 5 months of employment.

Is it possible to get the certificate now?

I have now retired (March 2017 and I am not employed after that and I am now 59 years old) and only if I could add this period of employment, I can get family Pension.

The company I worked in Nagpur is closed and also I live in Delhi. How can I get the subscription certificate?

should I then send the certificate directly to to RPF Bandra, Mumbai from where, my Family Pension will be settled.,or through my last employer?

My service without the including this 5 months adds up to 9 years 5 months and 8 days only. So, if I cant get this certificate, should I submit form 10 C and claim my dues?

An early reply would be appreciated.

Thanks in advance

As you worked for less than 6 months you are not eligible to get EPS.

You do have your UAN right?

You can file a grievance on the EPF website and ask for Annexure K which shows proof of your EPF contribution as explained in the article How to register EPF complaint at EPF Grievance website online

You can try submitting details of old PF.

The pension amount is not big it is between 1000 Rs to 7500 Rs per month.

You can check if it would be better to claim the pension amount and use that money elsewhere.

Now there is no separate form 10C and 19 unless you are applying online.

For Offline there are composite forms with or without Aadhaar.

after applying thru grievances portal, we are getting result;

“CURRENT STATUS: NO ACTION REQUIRED

Final Decision: ”

without proper reason they are closing our registered request.

1. I have worked in a private organisation from May 1991 to Dec 2007. Withdrawn EPF. I did not have UAN that time and did never applied for EPS transfer.

2. Then I have worked in two other companies for 2 years and 3 years. Withdrawn EPF there.

3. I worked in the 4th private company from Sep 2012 to October 2018. Got UAN there. After leaving I have withdrawn EPF.

How to get pension from EPS from 1st company where I have worked for 17 years.

Please advise.

Raise EPF grievance to get Annexure K for the first organization.

As you need UAN to try using the one you have currently.

Did you not get Scheme certificate while withdrawing from 1 organization.

You will get a pension from EPFO and not from the company.

Will it be possible to go to EPFO of the previous organization?

You actually are entitled to get the pension for all the companies you worked for.

It is not big amount but..still

Dear Sir,

I have completed 10 yr & 6 month , now i am jobless i want to withdraw my EPS amount. As it is required to maintain my family. please let me know whether i can withdraw entire amount or any partial withdrawal avaliable.

My mom(age: 45) completed 10 years of service in private school and she took Voluntary retirement. we don’t want scheme certificate but wants to take early pension. How to proceed for early pension?

Early pension can only start at 50 years of age.

You should give the option to draw a reduced pension in form 10D.

You can opt for the reduced pension at any age between 50 -57. It is not necessary to claim immediately on leaving service.

The Pension is reduced by 4% for every year. The reducing balance is used to get the deducted amount.

Hi,

I worked for Indian firm for more than 10 years. After I quit, I took a job outside India and took permanent residency outside India.

My previous employer is reaching out to me asking me to provide me a copy of Aadhar card/passport pr PAN and age proof of my kids. I am eligible for Scheme Certificate.

So I have a residence in India but I don’t stay there anymore and my passport also has my international residence address. My kids are also not indian citizen.

Will all this create any complications for getting the scheme certificate?

After 10 years of service, One can withdraw pension amount at the age of 50 years with some penalty.

Else one can get a pension after reaching 58 years.

Pension is between 1000 Rs to 7000 Rs.

Do you have Aadhaar?

as per the Aadhaar Act, NRIs are fully exempted to produce Aadhaar for any verification. NRIs, although they are citizens of India, are not eligible for Aadhaar card if they have not stayed for 182 days or more in the last 12 months, preceding the date of application

I worked with organization “A” for 2 years and 2 months. I was given a scheme certificate on leaving the organization “A” by them.

After that, I did 2 years full-time post-graduation course in management. During this time, the scheme certificate was with me.

After 2 years, I joined organization “B” and gave the scheme certificate details to them. However, I had not opted for PF in organization “B”. The scheme certificate was still with me.

After 5 years, I have now left organization “B” and joined new organization “C”. I have opted for PF in organization “C”. As per organization “C” rules, I created my UAN. Now, please guide me how can I link my scheme certificate with this UAN for carry forwarding/transferring the PF amount in this UAN.

Yes, you can and should.

Typically Every employee needs to submit a declaration, Form 11 when he takes up new employment in an organization which is registered under the EPF Scheme of 1952.

In Form 11 employee has to declare his Scheme certificate.

Talk to your new employer in organization C and Please submit the scheme certificate.

They will send it to Regional EPFO office and your service history will be added to current employer.

If new employers says No then you

-raise an online complaint at EPF grievance website to know the details as explained in the article here

-you can contact/visit the regional epfo office. Details of how to find contact are explained in this article.

Thank you for the reply

If some one get a epf scheme certificate and later he get a state government GPF Pension job whether is he is eligible to draw both pensions on superannuation.

Hi,

I have worked for 5 months in a company. Got the EPF amount by submitting from19 online. When i am trying to submit form 10C, it is throwing an error i.e. “DATE OF EXIT IS LESS THAN 2 MONTHS FROM TODAY OR TOTAL SERVICE IS LESS THAN 6 MONTHS”

I have my own business now and will not join the job again.

Please help, how can i get this money.

Thanks,

Balvinder

As the message says that you have worked less than 6 months so you cannot withdraw your Pension or EPS.

Sir,

I have 2_scheme certificates.

One is with 12 years and another one is 2 years.(two different organizations).

Now working in another organization since 5 years.

Shall we keep both scheme certificates? Or should club as a single with 14 years service, if to club pl to conform the process how?

You can submit both these scheme certificates to your current employer who will pass it on to the EPFO.

In fact he should have done it when you joined the organization by asking details in EPF Form 11 on Joining a New Job: Auto transfer of EPF account

The Service History will be updated.

Please keep a scanned copy of the documents before submitting.

My 10c rijectd

And did they tell the reason why?

Hi Sir,

I had completed 10 years 10 months service in the 3 companies and transferred PF\EPF amount to 3rd company. How can i get the scheme certificate and add my kids in the dependent.

i am planing to withdrawal to PF amount and continue EPF amount until retirement.if withdraw EPF amount also shall i get the pension after 58 years.

what is the benefit of Scheme Certificate and how to apply this.

Can you please provide your suggestions on above my quires?

Sir/ Madam,

I worked 1 place for 3 years 7 months. Then I quit without notice.

My next workplace, I had a new uan number. I got my pf transferred to my new uan number. But my eps isn’t transferred. I had one month break in epf & EPs contribution between both the jobs. Since I had quit my previous job in December & joined new job at the end of January.

I’ve been working at this new place for 2 years now. I want to know

1) Can I still apply for scheme certificate & give it to my new workplace?

2) Since I had 1 month break in contribution between both jobs, would my service be counted as continuous service if I apply for scheme certificate ? (To evade TDS at withdrawal)

I have worked for total of 11 years in two organizations. I have now moved to Australia permanently and I am now Australian permanent resident. Can I now withdraw my EPS as after some time, I will no longer be Indian citizen?

I AM HOLDING SCHEME CERTIFICATE . NOW I WANT TO APPLY FOR PENSION BUT IN FORM 10D THERE IS A CLAUSE MENTIONING EMPLOYERS SIGNATURE. BUT IN MY CASE THE COMPANY IS NO MORE(CLOSED) VIEW THIS HOW I CAN FILL THE FORM 10 D.

Do you have UAN? If you do not have UAN then

You can download the form from https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form_CCF_nonaadhar.pdf

Get it attested by

Manager of a bank.

Any gazetted officer.

Member of the Central Board of Trustees./ committee/ Regional Committee (Employees’ Provident Fund Organization).

Magistrate/ Post/ Sub Post Master/ President of Village Panchayat/ Notary Public

But in practice attestation by the bank manager is preferable. Also, Manager should be from the branch, where you maintain an account.

Note that you have to take signature and stamp in every page of the application.

you should attach copies of payslip, ID card, form16 or appointment letter from employer to substantiate your claim.

Also, attach a copy of your identity proof and address proof.

Dear Sir,

I have transferred my two previous companies EPF through UAN online to present company, I can see all the three companies name listed in service history, but EPS amount is 0 and EPF amount is visble. Now my question are below.

1) Does it mean my service at previous two companies are not considered ?

2) I did not applied for scheme certificate(Since i dont know about that) Is it mandatorily need to apply now?

3) If mandatory, how to apply. If not applied then what happens ?

Sorry for my serial questions. Hope the above questions must get the answers of manyone. Please reply.

sir i have worked in a private company for 9 year and four month.already i have left the company and with draw my epf amount.how i will get scheme certificate.

For less than 9 years 6 months you can withdraw your pension EPS too.

Why do you feel that you have not withdrawn EPS?

How did you withdraw online or offline?

Which form did you submit?

Hi Sir,

I have transferred my epf money from one company to other.

In the current employer member passbook the old employer EPS amount is not shown only the employee and employer contribution is shown.

Please suggest me

After the successful claim, the money will be UAN passbook of the old and new employer will reflect the transfer as shown in the image in the article

How to Transfer EPF Online on changing jobs

Dear Sir,

Thanks for publishing a detailed article on EPS. While everyone is aware of PF, majority of the people are not aware of EPS. Today while checking my EPF balance, I saw EPS details and then I got a doubt.

I have worked for totally 18 years till now and have changed 5 companies. I have got my PF transferred from all the companies to next company.

I didn’t know that I can take scheme certificate for EPS and have to produce it to next employer.

In each of my previous companies, I have worked for 3 years or more.

So, can I apply for scheme certificate for all the previous companies now?

Should I submit separate application for each employer or can I submit one application?

Do you provide this service? If so, can you help me in getting Scheme Certificate for all the previous companies?

Best Regards,

Narendra

We don’t provide EPF service.

We are just an employee like you trying to understand EPF/EPS and sharing our knowledge.

How did you transfer?

Did you transfer only EPF or EPS also?

Can you login to UAN website with your UAN credentials and check View->Service History.

Does your UAN passbook show transfer of EPF?

You can mail the details if OK to our login bemoneyaware@gmail.com.

We can then check the facts

Hello Sir, I have just received my PPO under EPS 95 scheme. I have sought reduced pension wef 01 Jan 2018 which is 1 yr 11 months before the age of 58. As per the PPO my eligible service is 12 yrs , pensionable salary is 11600 and I am 1 yr 11 months away from 58. They have calculated my pension as 1199 which does not reconcile with the formulation of pensionable salary*12/70 reduced @4% per year . I have written an email to Regional PF Commissioner here in Kolkata but not sure how active they are on email .

2. What should have been my pension amount ? What is the correct channel t take up such issues ? Regards

1. Difference between PF, EPF and VPF?

2. We can increase our contribution through VPF. How it can be done? Are there any prescribed procedures? Can our declaration be changed often. For example initially by 50 percentage, then by 75 percentage then reduce by 12 percentage etc.,

3. Since the PF money deducted will have income tax benefits, the increased money what we are contributing towards VPF will have income tax benefits? Apart from the PF will we have any benefits on our pension. Since our pension will be calculated on our average salary, will our VPF contribution affect our pension income?

4. Is it mandatory to get scheme certificate whenever we change our organisation? If we did not get what will be the consequences on that on EPS amount? If it is necessary presently how to get the certificate, either from my previous organisation or current organisation? Now PF amount is transferred. Only EPF amount has to be transferred.

5. Is it true that if I withdraw the EPS amount, will my services be reduced?

6. Pension amount will be calculated only on consecutive salaries. Then what will happen to the accumulated amount in EPS? Are there any option to withdraw the money and also to continue our service years. That is eventhough when we withdraw our EPS amount, our number of service years will not be reduced.

Hi,

I had transferred my previous two EPF accounts to my current employer. This process was done through offline transfer in 2007.

The tenure in first orgainsation was for 6 years and the second for 1.5 years. My question is related to the EPS part of it. I am not able to verify if the tenure in the previous organisations has been added to my service history in EPS.

In the UAN portal the DOJ for EPS shows my current organisation’s DOJ, it does not show my previous service history, pls advise on how to get the exact details on my total tenure of service in EPS.

Thanks

Hi,

Greetings of the day !

I have transferred mine PF from Old PF A/c to New PF A/c.

Pls guide how EPS can be transferred.

Also, guide what is scheme certificate!!!!!!!

How did you transfer?

If its online your EPS would be transferred automatically!

In case of medical emergency whether scheme certificate can be cancelled to withdraw the amount, if yes – what is the procedure to be followed, if Not – what is the alternate solution to surrender the scheme certificate.

As you have scheme certificate you would have worked for more than 10 years.

But you cannot cancel the scheme certificate. You can only use it to get Pension.

One is not eligible for with-drawal benefit of EPS if you have more than 10 years of pensionable service.

One is eligible for Pension under following Circumstances:

1) On superannuation (Age 58 years or More and atleast ten years of service) – The member can continue in service while receiving this pension. On attaining 58 Years of age, a EPF member cease to be a member of EPS automatically.

2) Before superannuation (Age between 50 and 58 years and atleast ten years of service) – The member should not be in service.

Dear sir

i have doubt regards if the member having scheme certificate and he dies before 50 years of age, then when the family have to apply form 10-D.(TO GET PENSION)

regards

madesh

If the employee dies and is working then to claim Provident Fund, Pension benefits and Insurance benefits the family has to submit the composite form.

That also details for the pension and the scheme certificate details.

The sample form is shown below.

My total service is 6 years and I worked in Organisation “A” for 3.5 years and Organisation “B” for 2.5 years.I transfered my PF from A to B and I could see it in the passbook but the EPS Transfer is not visible anywhere?

I have joiner a new organisation now and would be transferring the PF but like to withdraw the pension accumulated in A?

I understand form 10 has to be submitted.Please clarify if i can withdraw the pension amount and how?Organisation B did not have the EPS scheme and all the money was credited only to my PF and Pension.

Hi, this is suresh, i worked in an organisation and resigned on 30.11.2015. My total service is 14 years, 2 months and 1 day. I have with drawn my EPF amount and also got EPS certificate. I have joined in an another organisation and i have included in EPF in the new employer. Now can i submit my scheme certificate to the new employer?

One more question, what does it mean pensionable salary, in my scheme certificate the pensionable salary is mentioned as Rs.7907/- , is that indicates my pension after my age crosses 58 years.

Hi Sir,

I have 9.4 years of experience when I left the organisation. I have opted for PF withdrawal from my organisation’s trust but I prefer not to withdraw the EPS and rather achieve Pension Scheme certificate.

The new form 10C that I got from my organisation only talks about withdrawal and does not have an option for Pension Scheme certificate.

Is there a way I can apply for Pension Scheme certificate instead of withdrawing my EPS.

Thanks

Shreechi

Can you send the form to bemoneyaware@gmail.com ?

Sir

I worked in Pvt company for 6 years & resigned in 2012.i got my Epf amount but not aware of EPS withdrawal, can I claim now

Hello Sir,

One of my employee turns to 58 years on this January’18, but till now he has only worked for 9 months (started in april’17) and he want’s to continue his job.

So kindly inform what to do now

Hello Sir,

One of my employee turns to 58 years of age in this January’18 but he has only worked for 9 months in our organization (started in April’17) and now he want’s to continue job in our organization..

So please inform me what to do now.

My years of service is 8 years and 3 nonths. I applied for pension withdrawal after 1.5 years. Pf department has issued a scheme certificate saying my years of service is more than 9 years and6 months… Are they mistaken or have they added1.5 years to 8 years and 3 months?

Hi Sir,

I have worked on 3.6 years in my previous organization. Just three months back I changed my job and joined new company.

Also, I have transferred my PF amount from old PF account to new PF account successfully. But that time EPS amount is not transferred.

Coming to EPS:

Currently I am 30 years old (Age) and I was contributed EPS amount every month till 3.6 years job experience in previous company.

Can I eligible to apply Pension scheme certificate??? (OR) Can I withdraw EPS amount as well???

Which is best option, Please provide your suggestion.

Thanks,

Madhav

If your EPF has got transferred then your EPS also has got transferred.

EPS is used for Pension calculation, is a defined amount usually(max 1250 from Oct 2014).

To calculate Pension one needs just number of years of service.

When you transfer your account, UAN records the number of year of services across multiple companies.

If you Log in to UAN Portal and click on View->Service History then you would see something as follow.

For one who has worked in multiple companies, the Service history shows multiple member Ids as explained in our article How to check Member Ids or PF accounts linked to UAN

You would see following information

Your Member Id or PF account Number

Your name as it appears in the records of EPF for that organization

Name of the company for which you worked.

DOJ EPF: Date of joining Employee Provident Fund. The day from when your EPF contribution started. Should be your date of joining.

DOE EPF: Date of Exit of Employee Provident Fund. The day when your employer stopped contributing to your EPF account. Should be the date of your resignation.

DOJ EPS: Date of joining of Employee Pension Scheme. It would be same as DOJ EPF.

DOE EPF: Date of Exit of Employee Pension Scheme. It would be same as DOE EPF.

DOJ FPS: FPS stands for FAMILY PENSION SCHEME, 1971 and is no more in operation. FPS has been replaced by EPS (Employee Pension Scheme) in 1995 and FPS is now known as Ceased Pension Scheme. It would always be Not Available for those who joined after 1995.

DOE FPS: Date of Exit of Family Pension Scheme. It would always be Not Avaible for those who joined after 1995.

Dear Sir

I have emplyees pension certificate scheme which is dated 24/07/2014 but have not submiited to the organization i joined and currently have changed two jobs . Can i submit now with the current employer my age is 49 years . Kindly assist and guide.

Yes you can submit it to the current employer

ihave recd schme certificate on dtd 10/6/2005 in that my service mentioned 5 years &my pentionable salary₹4790/-

since 2011 again iam working in another company ,ihave not sumitted this certificate so for , if can i ubmit now.if so how much dura5ion counted.

iam eligible for pention?

now my basic pay around 17000/-

how mch pention would i entitle after 60 years?

Sir, I have used online transfer option for PF (form 13) as my aadhaar was linked to UAN. Do I need to apply form 10C also for EPS scheme certificate?

Sir Form 10C is needed for EPS withdrawal.

As you have transferred the EPF, your EPS will also get transferred.

Have you transferred by clicking on as explained in our article How to Transfer EPF Online on changing jobs , given below

Go to the EPFO members’ portal and log in using your UAN and password.

Verify that all your details are populated in the UAN portal. No missing or incorrect information.

Verify that your KYC is approved.

Click on Online Services->Transfer Request.

The Employee has to get his claim attested by the current or the previous employer.

A PIN will be generated and sent to the registered mobile number.

Submit the claim form to the selected employer.

The employer should approve the request.

Hi Sir, I have completed 11 yrs 4 months and applied for EPF transfer in 2016 by filling form 13C via current employer. The current EPF pass book reflecting previous EPF amount but EPS shows ‘0’. Does it mean I have to apply for Scheme Certificate from previous employer to transfer EPS? Do I need to submit Scheme Certificate to accumulate my service with service with current employer? I have 2 UANs for the 2 EPF accounts.

Hi Venkateshwarlu,

Have you got the answer to your question. Even i have the same doubt. My EPS of current passbook is 0. Please reply

Most of us are having the same question, but nobody has an answer…

You don’t need to apply for Scheme certificate in such a case

In any transfer case of EPF, service less than 10 years or more than 10 years, EPS amount is shown as 0

EPS amount is fixed (1250 or before Sep 2014 541)

It does not earn interest.

Your pension after retirement depends on the length of service detail and that is all EPS needs to decide the Pension.

The Service history information is captured in View->Service Details section of the UAN.

Our article What happens to EPS when you transfer your old EPF to new employer discusses it in detail.

Hi I am 38 yr,have taken retirement from organisation post 10 years of job..i am aware that I can’t withdraw the pension amount but opt for scheme certificate,hence please highlight few points-

1)do I start getting pension post 50 years or 58 years(what are the criteria in both cases)

2)let’s say if one has around 50 thousand rupees amount on the date of retirement in the pension fund,so will the person get only that amount post 50 or 58 years every month in small breakup until that amount exhaust or will get amount every month till the person expires.

Hi,

I’m about to join my 3rd company..I had transferred my pf account balance from 1st company to previous(2nd)..I can see from PF passbook that EPF was transferred But I can’t see the EPS money transferred.

As I’m about to join the 3rd company what will happen to EPS from 1st company .

My Total service – 5 yrs

1st company – 1 yr. Also didn’t had UAN number for 1st company as I worked there before UAN identification was implemented.

Many have the same query, but this guy is not responding to this. Don’t know why!!

Hi,

I have no spouse or dependants. I have withdrawn the PF amount using form 19, but my form 10-c was rejected and sent back from the PF Office citing that the employer has not provided any nominee details.

Now, while submitting a new form 10-C, is it ok to mention my nephew’s name in the nominee section, and say -NA- in the family (spouse/dependants) section?

Thanks in advance for your advice.

I have completed my 6years in the organization. Please help out whether I can withdraw the amount PF+EPF+EPS amount all together at the time.

You can only withdraw from your EPF+EPS if you are not working for 2 months.

You can take advance or loan from EPF + EPS while working.

PF stands for Provident Fund and EPF for Employee Provident Fund.

What do you mean by PF+EPF+EPS? It is EPF + EPS that you can withdraw

I worked 17 yrs and withdraw EPF for 14 yrs (2000-2015)but EPS rejected by EPFO and asked to submit required documents for scheme certificate.Shall I need to submit through old employer or through EPF ? Plz guide.

Also for 2015-2017 new company pf i want to withdraw so can i again apply for Scheme Certificate through new employer or EPFO ?

I hv 2 UAN 2000-2015 -UAN NO 100060902427- PF NO 302453/1763 ( EPF rejected asked for scheme crtificate) EPF credite

for period of 2015 -2017 -UAN NO 100088558111- PF no 304804/1218 and PF NO 304804 /444

EPF and EPS balance on both PF NO … and Asked to submit form to Akurdi office.

Shall I get EPF and EPS or shall i once again apply for Scheme Certifiate

Technically speaking you should not withdraw EPF & EPS if you are working.

As you have worked for 17 years you cannot withdraw EPS and would only get Scheme Certificate.

Did you get your EPF amount?

Did you get EPF amount?

You have 2 separate UAN accounts.

How did you apply for withdrawal – online or by submitting the physical application?

If you submitted the application then To whom – old employer or EPF office?

My 10 c got rejected reason showing break statement from doj to doe not available…what it means

DOJ – Date Of Joining

DOE – Date of Exit

Hi,

I have worked in my previous organization for 6 years. I left and joined another organization 4 months back. I have applied EPF transfer through my new employer and i can updated passbook with cumulative employer and employee balance but not EPS.

My doubt is if I want to accumulate EPS balance as well, why it is not showing in updated passbook where as other contributions are updated because of transfer procedure.

My UAN login shows both previous and current employer PF account entries but current employer pf account is updated with pf and epf contribution.

Do i need to take any additional step for EPS continuity ?? If so please let me know which form I need to fill and submit and if it is possible via UAN account.

I see EPS balance as 43k. If i withdraw, is that the same amount i will get?. to withdraw please let me know what steps I need to take.

thank you.

This guy will not answer this and most of us are having the same question.

Apologies Sir for the delay.

I have been working for more than 10 Years and my age is 40 Years now. I have worked in different Companies and I have transfered my PF Amount from previous Companies. UAN got registered when i was working with previous employeer (2014-2016)

I have applied 10C Form to transfer my Pension amount from that company. But i have not transfered my EPS Pension of previous employer so for. Before 2014, I have Pension numbers which is provided by each company. Each company may registed EPFO in different states(Gurgon, Bangalore ). I am bit confused how to track those information

Hi

I have worked for a company from Mar 2015 to Oct 2016. A period of 1 year and 7 months. I would like to withdraw the EPF as well as the EPS. My employer share for the EPS was 1154 per month. My salary was Rs 24,000 per month.

I would like to know

1. The period of 1 year and 7 months, would it come under the calculation of 1.99 under Table D for EPS

2. What would be the total amount that i would be getting for EPS

You are right.

1. Yes, you 1.99 from Table D would be used.

2. You would get 1154*12*1.99=27557.52

I have successfully transferred EPF balance from previous to present employer through UAN Portal.

But I am not able to transfer EPS balance. I have worked for 3.5 years in my previous organization.

When I am trying to file form 10C through UAN based portal, its showing error that multiple employer ID linked with same UAN.

Form 10C is for EPS Withdrawal.

When EPF is transferred EPS also gets transferred.

As EPS amount is fixed and on EPS amount you do not get the interest your pension is dependent on the number of years you worked.

This PF can find from your Service History.

As you have multiple PF accounts linked to same UAN you can relax.

I have in company for 10 years and 6 months. I have withdrawn my of money at present I am jobless and want to withdraw my pension money is it possible I am 35 years old

No it is not possible to withdraw the pension amount as you have worked for more than 10 years and you are 35 years old

Sir,

I have worked in a company for 18 years and 8 months, which is considered as 19 years for calculation.

Now I have resigned and don’t have plans of joining any company. Somewhere I have read that I can start getting the pension after attaining 50 years (Now I am 48). I have the scheme certificate already from my earlier employer. Is my understanding right?

How to cancel EPFO Scheme certificate and withdraw my EPS withdrawal by 10c.

my service is 9 years and I have resigned job before 3 years, also withdrwawn EPF balance.

After resigning from Job, I have 9 years of EPFO service and have withdrawn Provident Fund contribution earlier. (actually I have applied for withdrawal of both EPF & EPS contributions. But due to clerical mistake, in the forms I got only my EPF balance & Scheme Certificate.)

How to cancel my scheme certificate and get my Pension fund withdrawal by 10c. From past 3 years there are no contributions into my a/c.

How old are you?

Typically once Scheme certificate has been issued you cannot cancel it and get money in lieu of it.

You have wait till 58 to withdraw your pension

Hi,

My age is 50 +years. I worked 9 yrs. 8 months and 11 days , which is considered as total pensionable service. I resigned from the office and received the PF amount and one scheme certificate for pension. I am not going to join any office for a new job anymore. Now how to apply and get the pension and at which age can I apply for that?? At the time of applying whether the application should go through the previous employer or I can directly submit the same with the scheme certificate and Form 10 D? Pls. help

Regards,

Our article How to Fill EPS Pension Form 10D to claim EPS Pension discusses it in detail.

For pension, EPS Pension Form 10D should be filled.

The application should be forwarded through the establishment in which the member last served/died. The establishment should furnish the certificate and wage particulars duly attested by the authorized officer.

if the establishment is closed, the application should be forwarded through Magistrate/Gazetted Officer/Bank Manager/any other authorized officer as may be approved by the Commissioner.

With Form 10D, you will be required to attach the bank account proof [copy of passbook/canceled cheque] . For this, you must have an account in the bank, which is designated by EPFO for pension facility. For the details of such bank, you can visit your nearby EPFO.

Photographs of your family including you, your spouse and children below age of 25 yrs. Previously EPFO asks for 3 photographs, but now they are taking 4 photographs.

Age proof of the member and family, as in the photograph.

Any scheme certificate, issued earlier by any EPFO.

All the above documents and form should be attested by your employer, or any gazetted officer.

The form should be submitted in duplicate for home state and triplicate for out of state.

Sir, I completed nine years & six months of company also resigned,can i withdraw employee contributions, employer contributions & pension contributions? Please says and which form required fill up.

I worked for 10 yrs 2months and resigned on 2015.

I already withdrawn my PF amount. Can I withdraw my EPS?

I already applied for EPS to withdraw. but, I did not get any response.

please suggest me.

There used to be a separate form for EPS earlier.

In 2017 EPFO came out with composite form.

If an employee has NOT completed 10 years in service, he can either withdraw the EPS amount or take the scheme certificate.

The option to take the scheme certificate has to be submitted by filling Form 10C.

Hi

I was worked in Pvt concern for 9 years and 6 months and I got the EPF amount and then I was applied for Scheme certificate (Not yet received), however now I am working in Government sector, then I am eligible for to get pension for after 58 years?

How I will receive that scheme certificate, my previous establishment has been registered as Mumbai and I was worked in Chennai and currently resident in Chennai, is it possible to pension account is transfer to Chennai pf office?

Sir,

I worked in a Ltd company for 9yrs i resigned in 2011 . i got my PF amount but was not aware of EPS withdrawal . can i claim now

I am working in a pvt firm now

Kindly clarify , if i am eligible what should i do

Yes EPS is your money. So you can claim it anytime.

You would have to fill the form 10C through the employer or directly through the EPFO.

Hi,

As you mentioned, that under one UAN several member IDs can be linked. Since I switched jobs, I transferred my PF account under this new company’s UAN number. then it showed that I have to 2 PF accounts linked under one UAN. But when I recently withdrew my PF, I received money only from 1 PF account – the last organization where I worked. The place where I worked prior to that, I haven’t got that PF account money. Please help me understand if at the time of withdrawal, does the money of all PF accounts get clubbed and come at the same time to our bank account. or does the money for each pf account get credited seperately.

No that defeats the entire purpose of linking with UAN.

Please raise the grievance with EPF.

The EPFO’s Grievance Redressal Website is “http://epfigms.gov.in/”

The Steps to submit your request are as follows:

Click on the “Register Grievance” link

Fill up your EPF Account related details in the first section titled “Enter EPF Details”

Then fill up your personal details in the second section titled “Enter Personal Details”

Once done, scroll down to the third section on the page which is titled “Enter Grievance Details”

Select your Grievance Category correctly and clearly explain your Grievance and submit your request.

Once your request is submitted, the EPF Organizations Grievance Redressal Team will look into your request and will respond to you within 30 days.

After filing grievance wait for a week. Then raise the question on EPF social channels like facebook and twitter.

I already withdraw my epf amount and got scheme certificate for pension.But when i join another job they started another account.Could I take my pension fund back now

No you cannot withdraw from old EPS.

Yes ma’am, they would have to start another account.An employee will have one UAN or Universal Account number, which as the name implies will remain the same. It will maintain all your Member Ids. It’s like you can have multiple Saving Bank account but all these are tied to your one Permanent Account Number or PAN. So when you change your job and the new employer, if contributing to EPF, gives you a new Member ID. This new Member ID has to be linked to your UAN number.

If you have taken a scheme certificate and you join a new job, you can submit it to the EPFO through the new employer by filling details in Form 11.

PF Form 11 is a self-declaration by new joinee about his status whether he is a member or nonmember of EPF / EPS in earlier employments and opt out of EPF. EPF Form 11 on Joining a New Job article explains what is EPF Form 11, contents of EPF Form 11 and instructions on how to fill it. When you leave the job, you will again have to fill Form 10C. The EPFO will add the new number of years in the scheme certificate showing the cumulative service record and give it back to you through your employer.

If you don’t submit EPS Scheme Certificate, then while applying for pension you need to submit all scheme certificates.

How to get scheme certificate.after leaving the job in 1999 I was not received any certificate or any communication from PF department. Please advise.H

How many years did you work in the company?

Did you withdraw EPF money?

One gets Scheme certificate if one has worked in organization for 10 years.

Then you cannot withdraw from EPS but would get Scheme certificate

How to get scheme certificate.after leaving the job in 2017 I was not received any scheme certificate or any communication from PF department. I worked in State govt company, eventually does not exists company closed, worked there for 11 years…presently worked in indian multi national comany for 10 years, now i have crossed 50 years….no job….can I get my PF……Please advise.H

Saravanan

Scheme certificate you get when you do EPF withdrawal and if you have worked for more than 10 years.

You can raise EPF grievance to get Annexure K from EPFO using your details of State Govt.

Then you can initiate the epf withdrawal.

For Multinational job did you get UAN? If yes you can check UAN website.

Do you need EPF money now? If you want to withdraw our article Online EPF Withdrawal: How to do Full or Partial EPF explains the process in detail.

TO GET FREE STOCK FUTURE TIPS VISIT BEST STOCK FUTURE TIPS