Every month, 12 per cent of your basic pay is deducted from your pay cheque and parked with the Employees’ Provident Fund Organisation with purpose of building your retirement kitty. We follow the interest rate announced by EPFO. But how does EPFO generates that return? In 2015-16, EPFO invested 5% of its incremental corpus, or a little more than Rs.6,000 crore, in stocks. Labour ministry officials estimate that in 2016-17, the amount would rise to as much as Rs.10,000 crore. This article talks about how EPFO manages money , EPFO investment in Stock market.

How EPFO Manages Money

How are EPFO returns earned?

The EPFO ‘declares’ the annual interest paid out to subscribers each year. In the last four years, the returns have been around 8.75 per cent a year. This interest is decided based on the surplus of its income over expenses. The fund earns income from the interest on government deposits, gilts, corporate bonds and the other securities it holds in its portfolio. It incurs costs on subscriber payouts and expenses.

While EPF returns depend on the fund’s annual income, the Employees Pension Scheme has been running a deficit for several years. According to a recent valuation report, by end of 2013-14, the pension scheme faced a deficit of ₹7,800 crore.

How does EPFO invest money?

Every month, 12 per cent of your basic pay is deducted from your pay cheque and parked with the Employees’ Provident Fund Organisation which is tasked with building your retirement kitty.Well, India’s largest retirement fund manager doesn’t disclose its portfolio or investment strategies regularly. In the April 2015 the government has released the notification for investment pattern for EPFO money.

- 45-50%- Government securities

- 35-45% Debt securities and term deposits of banks

- 5-15% equity market.

- Up to 5% Money market

- Up to 5% Asset backed securities

Hindu Newspaper sifted through EPFO archives and responses to Parliament questions to answer these FAQs.

- The money contributed by active EPFO subscribers goes into a common pool and is invested based on guidelines formulated by the Central Government. The Central Board of Trustees of the EPFO selects the fund managers and monitors their adherence to these rules.

- According to the recent disclosure to Parliament, the EPF’s ₹3.6 lakh crore corpus (the provident fund alone and does not include the pension fund) was invested to the extent of ₹1.74 lakh crore in Central and State Government securities and Government-guaranteed securities; ₹52,845 crore in the special deposit scheme of the government; and ₹1,31,691 crore in corporate bonds (both public sector and private sector) as on December 31 2014.

- The government’s approved investment pattern for the EPFO requires that up to 55 per cent of the corpus be parked in government securities or State/Central Government-guaranteed bonds. 5% within this limit may be invested in gilt mutual funds.

- Another 40 per cent of its corpus is to be earmarked for term deposits in banks or corporate bonds, of which 75 per cent has to be rated investment grade. The remaining 5 per cent of the corpus may be parked in money market mutual funds.

- A recent amendment requires the EPFO to park a minimum of 5 per cent and a maximum of 15 per cent in stocks or equity-linked mutual funds. All these investments are managed on a buy and hold basis, without any active trading on market movements.

Who manages EPFO debt investments?

The EPFO’s debt investments are managed by SBI and four other private sector fund managers. The trustees allocate the EPF kitty between these fund managers and monitor that the money is managed according to the investment pattern.

While SBI has been a portfolio manager for the EPFO from 1995, the four other private sector fund managers were inducted in 2007 to improve fund management. At present, ICICI Securities Primary Dealership, Reliance AMC, HSBC AMC and UTI AMC are the private sector managers.

How are the fund managers selected by EPFO?

They are selected through a bidding process, once every three years. The current managers have just been appointed for the period from 2015 to 2018. The EPFO selects the managers based on their ability to bid the lowest fee for managing the EPF kitty entrusted to them.

EPFO Investment in Stock Market

How much does EPFO invest in stock market?

In FY 2015-16, the finance ministry asked the EPFO to invest between 5% and 15% of its incremental corpus in equities, but the EPFO decided to invest only 5% of it. EPFO had 8.5 lakh crore in its kitty. The EPFO investment in the stock market is only from the incremental corpus. It means the money accumulated in the current financial year would be considered for stock investment. In a financial year, EPFO gets about 1-1.2 lakh crore. The 5% of this amount would be about 5000-6000 crore. Only this amount would be invested in the share market. The existing 8.5 lakh crore will remain in debt securities.

Why does EPFO want to invest in Stock Market?

So that EPFO can give better rate on EPF. If EPFO gives 8.75% and it invests 5% investment in stock market and earns return of 15% one may get a return of 9.06% instead of 8.75%. However, in the short term, it all depends upon market movement.

Do you face higher risk to your EPF money, now that EPFO has begun to invest in equities?

No. The EPFO is taking real baby steps with its stock market investments. The equity ceiling of 15 per cent exists only in theory. For the financial year 2015-16, the sum invested in equities was capped at Rs 5,000 crore. This is 5 per cent of the incremental inflows of ₹1 lakh crore that the EPFO expects to receive from subscribers this year. At last count, the EPFO managed a total portfolio of ₹6.5 lakh crore (under the PF and pension schemes). The equity investments, even if they hit the limit of ₹5,000 crore, will amount to just 0.7 per cent of this portfolio.

So, for every ₹100 of subscriber money that is already in the EPF, only 70 paise is being deployed in equities. Even if this becomes zero (which is highly unlikely) ₹99.3 of every ₹100 you invested will still remain safe in gilt and bond investments. But on the flip side, if the money doubles, don’t expect it to generate a big kicker to your returns this year. As explained earlier return of 15% would add around .25%.

How did labour unions react to investment of EPFO in stock market?

The labour unions and labour ministry were reluctant for equity investment. But finance ministry was insisting.

How does EPFO invest in Stock market?

In August 2015, the retirement fund manager entered the equities market for the first time, through two exchange-traded funds (ETF). An ETF comprises of stocks that reflect the composition of an index, such as the Nifty or Sensex, and are traded on stock exchanges like company stocks. The two ETFs chosen by the EPFO and investment in the two ETFs are as following

- SBI-ETF Nifty : 75%

- SBI Sensex ETF :25%

The EPFO chose SBI to manage its corpus because SBI is charging 5 paise for investment of Rs 100. It means EPFO is spending Rs 2.5 Crore as the charges of fund management.

How has been EPFO investment in Stock Market?

The EPFO incurred a loss of around Rs.300 crore on its investment in stocks in the year ended 31 March 2016. Between 1 April 2015 and 31 March 2016, the Nifty index of the National Stock Exchange lost 9.87% and the BSE’s Sensex dropped 10.3%. Labour unions have been less than happy with the EPFO’s move to invest a part of its incremental corpus in stocks. “When you are earning negative return, then you need to be cautious. We have not yet understood why it supports more money going to stock market“. But EPFO feels “One-year return is not an indicator of equity returns. It will give us a better rate over a long period of time. We are convinced about the long-term benefit”

What are advantages of EPFO investing in Stock Market for the stock market

The investment of EPFO in the stock market helps the equity market. It gives

- greater stability to the share market.

- liquidity to the share market.

- It also reduces dependency on FIIs. The FIIs act according to the global markets. If FIIs are selling and EPFO (along with LIC) invests in stock market, it would help to stabilise the share market.

Considering the size of EPFO corpus the investment in share market is minuscule. The 5000 crore of EPFO would be far less than 60000-7000 crore of LIC. LIC, also the government entity invests a considerable amount in the stock market. It is a major shareholder of many blue-chip companies. In FY 13-14, LIC invested Rs 2.25 lakh crore, of which 15 per cent was in the equity segment. This was increased to about Rs 3 lakh crore in FY14-15. The company has been a long-term investor in the stock market, investing for at least eight years. LIC plans to raise its total corpus of investments, both equity and debt, to Rs 32 lakh crore by 2020.

Do other countries social security schemes invest in Stock Market?

Yes and No. Other countries pension funds invest in a wide range of investments, from equities, commodities and foreign bonds, even purchasing entire companies.

- The United States Social Security Trust only purchases special issue* (1) bonds, and only from the United States Department of the Treasury .

- The Canada Pension Plan had the following investment mix and CPP returned 16.4% in fiscal year 2014 and 9.9% in 2013: Real assets 17.7%: Equities 48.7%: Fixed income 33.6%

- China’s pension funds, which account for 90% of the country’s social security funds, were only allowed to invest in safer assets like bank deposits and treasuries. The new regulations brought in FY 2015-16 allowed early $100 billion of China’s state pension funds, about a third of the total available for investment, into the country’s volatile stock markets. they can also invest in bonds, asset-backed securities, index futures, bond futures, and the country’s major infrastructure projects.

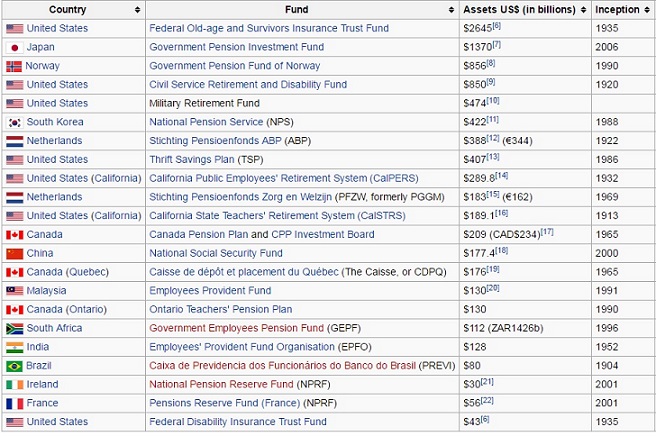

The major pension funds of countries world are shown in image below , from Wikipedia Pension fund

Who invests in Stock Market: FIIs, Domestic Mutual Funds etc.

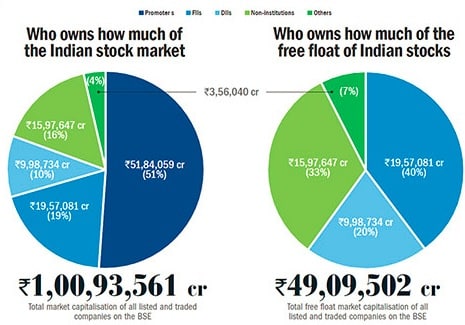

What is ownership pattern in stock market or who invests how much in Stock market?

As of March 31, 2015, the combined market value of the stakeholders (also called market capitalisation) of all the listed companies on the BSE crossed R100 trillion. From Value Research Major Shareholders of Indian Stock Market are

- The biggest chunk of the value is still held by the promoter group, which is 51% of the total market value.

- This means that only 49 per cent of the equity is marketable and it amounts to Rs 49 trillion. If we look at the marketable portion of the equity, which is also known as free float,

- then the biggest holders are the foreign institutional investors (FIIs). FIIs dominate the market by holding 40 per cent of the free float, thus impacting the market movement with their flows of funds.

- Retail investors own one-third of the free float, which is far less than retail holding in developed economies and many developing economies as well.

- Domestic institutional investors (DIIs), which mainly comprise insurance companies, banks and mutual funds, own about 20 per cent of the free float. The category labelled as ‘Others’ includes depositories receipts like ADRs and GDRs, and shares held by custodians.

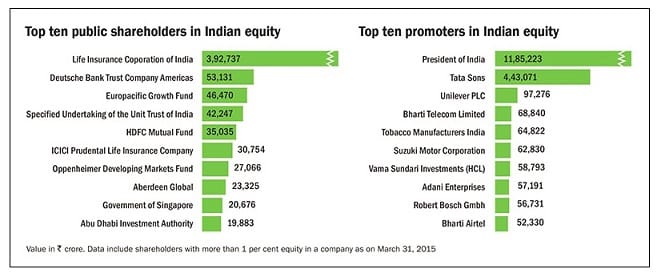

Following are the major shareholders of the Indian stock market. Among the top ten public shareholders, six are FIIs. LIC of India accounts for almost 4 per cent of the total market value of the listed equity. The president of India represents the Government of India holdings in public-sector companies. The following table is an indicative list and actual figures may differ due to indirect equity positions.

Related Articles

- Articles for Learning Investing , Basics,Investing in PPF,Stocks,Mutual Funds,Post Office,FD

- Articles for an Employee:Earning,EPF, UAN,Study…

- Stock Market Index: The Basics

- UAN HelpDesk: UAN Problems, Password,Mobile Number,Incorrect Details and Help Desk

[poll id=”87″]

Hope this helped you in understanding how your EPF money is invested. Do you think EPFO should invest in stock market? Please vote for your result in poll or leave comment. Are you worried about how EPFO invests? If you want such type of articles please leave comment.

5 responses to “How EPFO Manages Money, EPFO investment in Stock Market”

EPFO Claim Settlement Time: Death Claim in 7 days and Retirement Claim on Retiring Day.

More info@ https://www.moneydial.com/blogs/epfo-claim-settlement-time-death-claim-7-days-retirement-claim-retiring-day/

it is a very good move from the govt. I feel it would be better to allow employee to choose whether the amount to be invested in equities (like Yes or no for invest in equities on compensation sheet for their respective PF amount). I feel Govt will definitely get more investment than what they are doing it right now (5% of the total corpus).

Well i can say, this is a very interesting post indeed. I really excited to read a little more about this. Great & awesome post.

till date just knew some amount was deducted from my salary…happy to understand the logic behind it and how the investment is handled…

Such a great information on Kumbh Mela in India. Also helpful to search and full details on Yoga News. Thanks for it…