Some companies have formed their own PF trusts to manage the contributions of employees instead of sending them to the EPFO. These companies have obtained an exemption from EPFO to enable them to do this. Hence they are called exempted establishments in EPFO. Private PF trusts function according to the same rules as the EPF and members are allotted UANs (Universal Account Numbers). But passbook of employees of exempted trust is not available on the EPF website/Umang. There are more than 1000 such companies in India large companies like TCS, Wipro, Hindustan Unilever (HUL), Reliance and public sector organisations like Bharat Heavy Electricals (BHEL). This article talks about EPF private trust, How to find if your Company runs EPF trust, Talks about features of EPF Private Trust,EPF Private Trust and UAN, Transfer from EPF Private trust to Unexempted EPFO ie Regional EPFO.

Table of Contents

EPF Trust or EPF Exempted Establishments

As we know the Employees Provident Fund actually consists of EPF, EPS(Employee Pension Scheme) and Insurance EDLIS(Employees Deposit Linked Insurance Scheme). Distribution to EPF,EPS and EDLI remains the same for exempt and unexempt as shown in the table below. Our article Basics of Employee Provident Fund: EPF, EPS, EDLIS explains it in detail.

The Government has permitted employers/companies to establish and manage their own private PF schemes, subject to certain conditions prescribed under the Employees Provident Funds and Miscellaneous Provisions Act, 1952. These trusts are regulated by the Employees’ Provident Fund Organisation (EPFO). These private EPF trusts are required to seek approval under the Income-tax Act, 1961 for employees to get tax benefits. There are over 1,500 private Provident Fund (PF) trusts, with an estimated corpus of Rs 1 lakh crores and a membership of 50 lakh employees, which are managing the accounts as well as retirement fund of their workers. Companies like Infosys,TCS, Accenture have their Private PF Trust.

Employee of Company with EPF Exempted Trust

An employee working in company with EPF Trust has to realise that

- Though the employees of companies with EPF trust are allotted UAN and Provident Fund number or Member Id. They have limited use of UAN website. They cannot do the online withdrawal from UAN website.

- The employees of companies with EPF trust cannot see their passbook on EPF website with PF and Pension amount on the epf website as the employer or Private Trust does not deposit money to EPFO. The Company provides them with this information through payslips, company own website.

- If an employee has an EPF account with exempted or unexempted organization then he can transfer this account to Trust on joining a company with EPF Trust.

- If the employee leaves the company which has EPF trust he needs to withdraw only from the company which maintains the trust.

- If the employee joins another company then he can transfer his PF from EPF trust to another EPF trust or to EPFO depending on his new employer.

Roles and Responsibility of EPF Exempted Trust

EPF Private trusts are formed by firms that manage the provident fund and PF accounts of their workers themselves.The members of these trusts enjoy income tax and other benefits at par with EPFO subscribers. The PF Trust may frame their own rules and regulations for the maintenance of PF accounts but such rules and regulations are supposed to be based on relevant PF rules.

- Such companies who seek exemptions and create EPF Private Trusts are called exempted establishment.

- About 1,500 companies have been granted exemption by EPFO to maintain their own EPF trusts such as Infosys, TCS, BOSTON CONSULTING GROUP (I) PVT LTD

- EPF Trusts opens and maintains PF accounts of the employees.

- The employees of companies with EPF trust are allotted UAN and Provident Fund number or Member Id.

- It has to give interest to the members at rate declared by the EPFO every financial year.

- However, the pension or EPS is payable only by the EPFO. So EPS still needs to be submitted to EPFO.

- EDLI may be continued with EPFO. If the employer provides equal or better benefits, the exemption may be granted in lieu of EDLI also.

- Pays administrative charge of 0.18% instead of regular 1.1 %. This 0.18% charge is to be remitted as inspection charges.

- Issues annual accounts information to the members.

- Disburse the amount of PF accumulations to the members on death, retirement, resignation etc.

- Pay the Deposit Linked Insurance benefits to the members’ nominees in the event of the death of the members.

- Submit periodical returns/report to the EPFO for the accounts maintained by it.

Why do companies go for EPF Private Trust?

- The private EPF Trust seems to be more appealing as money remains with the in-house trust formed by the employer.

- Many of these companies have a large number of employees(ex Infosys, TCS) so it becomes easier and faster for EPF trust to handle settlement of employees claims on retirement/ resignation faster.

EPF Trust and EPF, EPF Contributions

Distribution to EPF,EPS and EDLI remains the same for exempt and unexempt as shown in the table below

| Scheme Name | Employee contribution | Employer contribution |

| Employee provident fund | 12% | 3.67% |

| Employees’ Pension scheme | 0 | 8.33% |

| Employees Deposit linked insurance | 0 | 0.5% |

| EPF Administrative charges | 0 | 1.1% for Unexempt

0.18% for Exempt |

| EDLIS Administrative charges | 0 | 0.01% |

How to find if your company is an exempted trust

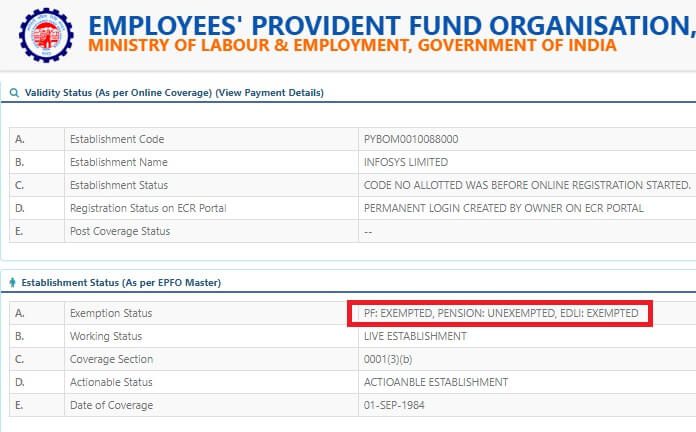

You need to find Exemption Status. if Exemption Status is unexempted then your EPF contributions are with Regional EPFO office. If the status is exempted then the EPFO is maintained by a private trust. Our article How to find your employer’s EPFO office and EPFO office Phone Numbers explains it in detail.

- Go to http://www.epfindia.gov.in/

- Click on Our Services->Employers

- Click on Establishment Search

- Find your organization by entering the Establishment code/ name of the office

- Enter Captcha

- Click on Search

- Select your company

- Click View Details on the company

- You will see Validity Status and Establishment Status

- If PF status is exempted as shown in Image below then your EPF money is with your company trust.

EPF Private Trust and UAN Number

Just like Employees who are members of unexempt EPF, Employees Registered With Company Managed Private Provident Fund Trust get UAN Number. UAN is a 12 digit single account number which is linked to your provided fund money. It is like PAN number. Please activate your UAN to verify the EPF details.

UAN number can be used while transferring. The process of transferring from/to EPF Private Trust also remains the same as from Unexempted organization. Now you don’t need to worry about different EPF accounts and then transfer them when you join a new job. Now each employer will just give you a member id, and all those member ids will be linked with the same UAN. Our article FAQ on UAN number and Change of Job talks of What is Member Id and how does it differ from UAN number in detail.

Though UAN number is provided employees of EPF Private Trust cannot see there balance/passbook online from UAN official website. Such employees have to depend on their company for providing such details.

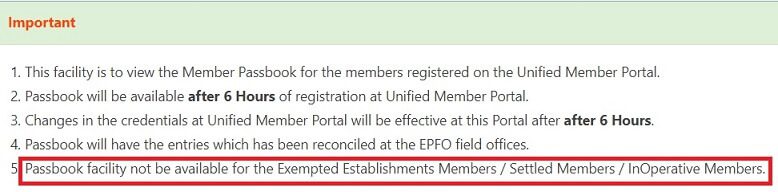

EPF Trust, Exempted Establishments, EPF Balance, Passbook

The Passbook which shows that company is depositing EPF and EPS amount is not available on EPF website for employees who work in companies with EPF Trust as shown in the image below. The company provides its own site or information about the contributions to EPF Trust.

EPF details of exempted trusts are only available with the employer.

Employees of such exempted establishments can check their EPF balance in the following ways:

- Check your PF slip or payslip: Most big establishments, provide salary slips to their employees via internal emails. Employees can check their payslips for EPF account balance. Some companies also give EPF slip in addition to the salary slip. Employees can find their monthly contributions as well as their EPF account balance in that slip.

- Check the company’s employee portal: Most large companies maintain a company website on which employees can log in and check their EPF account balance in the EPF section. Wipro and TCS are an example of such companies that provide the online facility to check one’s EPF account balance and get PF statement.

- Check with the company’s HR/Payrool department: Employees contact the company’s HR department as it deals with the employees’ PF and is better able to provide the related details.

EPF details of Wipro Exempted Trust

Wipro: employees can view their PF contribution by logging into an internal site called My Wipro -> MyFinancial->Reports->PF

EPF details of TCS Exempted Trust

TCS: In the Ultimatix portal go to my documents column. You can check your PF balance there.

If you leave TCS then you can access TCL Alumni portal, https://www.alumniportal.tcs.com/, You can also download your PF statement from TCS alumni portal. TCS Alumni Portal -> My Documents -> Download Provident Fund Statement

Transfer from/to EPF Private trust

When you change job, your UAN number remains the same but a new Member Id is generated for the new employer. The service details should be reflected in the UAN site.

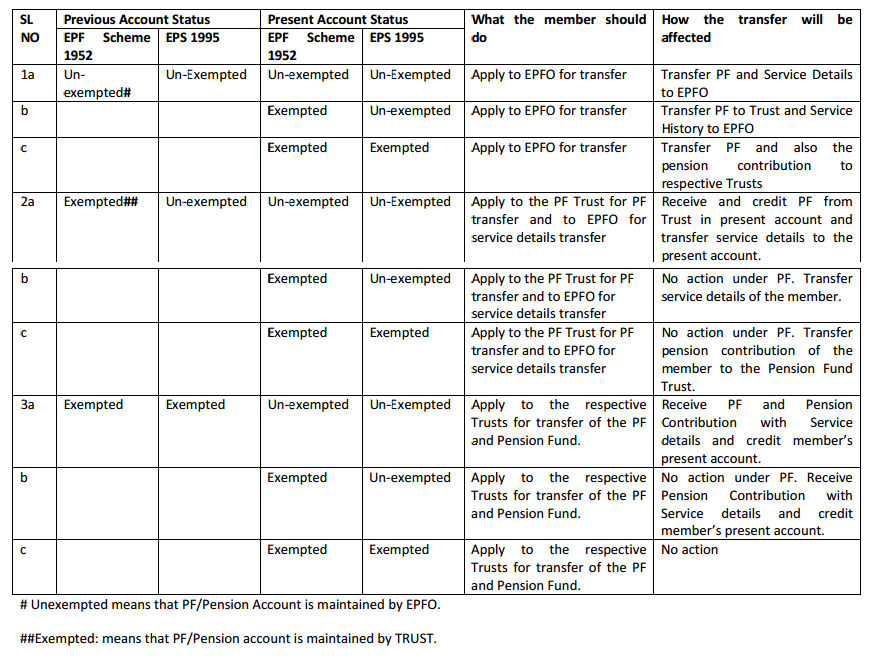

The image below gives an overview of how to transfer from EPF Private trust(Exempted) to Un-exempted EPF(2a) or From Unexempted EPF to Exempted EPF Trust(1b) or from Exempted to Exempted(3b). The online transfer for PF launched on October 2, 2013, is also available to Private Trusts from Oct 2014. Our article How to Transfer EPF Online on changing jobs explains it in detail.

From Exempted to Unexempted (2a in image below) :

- Apply Online at EPF website, submit the claim to old Employer(with trust).

- You must collect/ensure that you get Annexure-K, Cheque in name of EPFO to the new employer.

- After some days, Check EPF passbook of the new employer.

- You should see the amount transferred in, to passbook with the new employer.

- Now you can track the UAN passbook of new member id for further EPF contributions.

From Unexempted EPF to Exempted EPF Trust(1b in the image below):

- Apply Transfer Online at EPF website,

- submit the claim to new Employer(with trust).

- The new employer should complete the formalities.

- After some days, Check EPF passbook of old employer. You should see the amount transferred out, from passbook with the old employer.

- To track further EPF contributions, you need to contact your new employer with Trust. As new employer is exempted trust your details will not be available at UAN website.

From Exempted EPF to Exempted EPF Trust(3b):

- Apply Online at EPF website,

- submit the claim to old Employer(with trust)

- You must collect/ensure that you get Annexure-K, Cheque in the name of the new company to the new employer.

- Submit the Annexure-K, Cheque to the new employer

- The new employer should complete the formalities and transfer money from old employer.

- To track further EPF contributions, you need to contact your new employer with Trust. As new employer is exempted trust your details will not be available at UAN website.

Transfer of EPF on changing Job from EPF Exempted Trust to Unexempted EPF

-

- Go to the EPFO members’ portal and log in using your UAN and password.

- Verify that all your details are populated in the UAN portal. No missing or incorrect information.

- Verify that your KYC is approved.

- Click on Online Services->Transfer Request.

- The Employee has to get his claim attested by the previous employer (with Exempted Trust).

- A PIN will be generated and sent to the registered mobile number.

- Submit the claim form to the previous employer (with Exempted Trust).

- The employer should approve the request.

- Collect Statement, Annexure K, Letter and Cheque issued to Regional EPFO office

- You can check the status of transfer through your member portal account. You would also get a regular update through SMS.

EPF Private Trusts are like Cooperative Banks

To show an analogy, EPF Trusts are like Cooperative Banks while EPFO is like RBI. A cooperative bank is an institution which is owned by its members. They are the culmination of efforts of people of same professional or other community which have common and shared interests, problems and aspirations. They cater to a services like loans, banking, deposits etc. like commercial banks but widely differ in their values and governance structures. They are usually democratic set-ups where the board of members are democratically elected with each member entitled to one vote each. In India, they are supervised and controlled by the official banking authorities and thus have to abide by the banking regulations prevalent in the country, RBI in India.

Now think of EPFO in place of RBI and EPF Private Trust in place of the cooperative bank.

Video on What are EPF Trust of EPF Exempted Establishment

This 9-minute video talks about, What is PF trust? 2. Is there any difference between members of EPFO and members of PF trust? 3. How to withdraw money from PF trust of a company? 4. How to transfer PF trust money to another company, EPFO? 5. How check PF Trust balance?

Video on How to transfer EPF Trust of EPF Exempted Establishment

This 8-minute video talks about how to transfer from EPF trust, what documents you need to collect. Remember you need to contact your old employer as your EPF contributions are with the EPF trust and not EPFO.

EPFO and EPF Trust

These trusts are regulated by the Employees’ Provident Fund Organisation (EPFO).

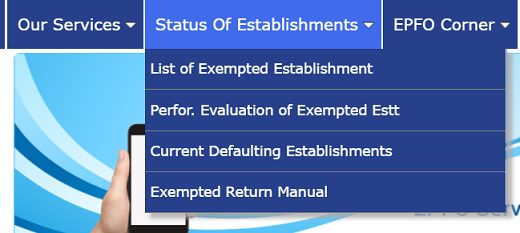

Retirement fund body EPFO has made it mandatory for private provident fund trusts to file their returns online every month from April 2014 to improve the monitoring of these employers. In the e-return, the trusts provide information about employment in their organisation, contribution towards social security schemes, investments of funds, audit, financial statement and financial health of the trust. The EPF website has information about the Exempted Establishments.

EPF Website provides information about Exempted Establishments as shown in the image below.

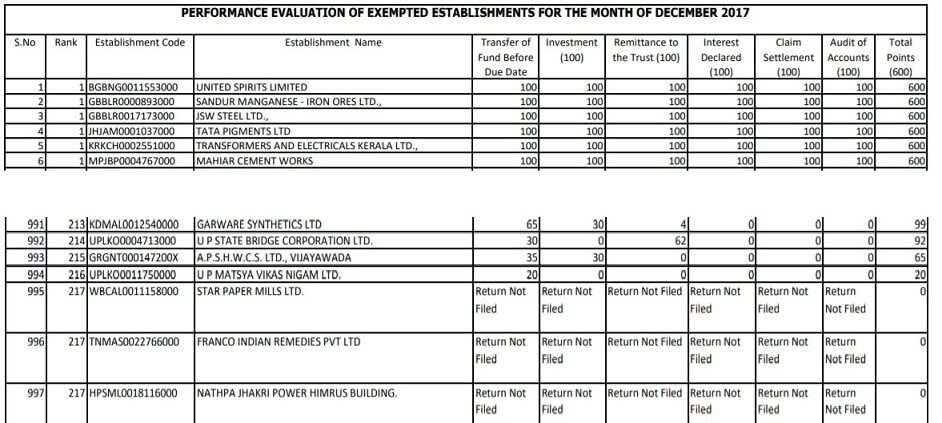

Companies with private EPF trusts are evaluated periodically on six parameters (100 points for each), such as: full and timely monthly remittances of EPF accumulations to the private trust; transfer of funds — for example on exit of employees; efficacy of making investments, the rate of return and settlement of claims and audit of the private trust’s accounts. he EPFO website has already put up the ranking of 1,552 companies for Dec 2017, with many firms getting a perfect score of 600. The image shows the excerpt from PerformaEvaluationtion of Exempted establishments

Overview of EPF and Types of EPF Funds

Employee Provident Fund (EPF) is implemented by the Employees Provident Fund Organisation (EPFO) of India. An establishment with 20 or more workers working in any one of the 180+ industries ( given here) should register with EPFO. Typically 12% of the Basic, DA, and cash value of food allowances has to be contributed to the EPF account. EPFO is a statutory body of the Indian Government under Labour and Employment Ministry. It is one of the largest social security organisations in the world in terms of members and volume of financial transactions undertaken.

As per the Employees’ Provident Fund & Miscellaneous Provisions Act 1952, those establishments that recruits 20 or more employees have to covered under the EPFO act and they have to deduct 12% contribution from Employees wages/salary(Basic+DA+retaining allowances if any) on monthly basis and it has to be remitted to EPF fund along with employer equal share.

What is the meaning of Statutory?

Statutory means controlled or determined by a law or rule.The difference is between statutory and legal. If something is legal, it is allowed by the law, whereas if it is statutory, it is regulated by law. It is easier to understand if one looks at the what is not legal or Statutory. If something is not legal, the law says you can’t do it. If something is not statutory, there are no laws regulating it. Example of Statutory warning is : Cigarette Smoking is Injurious to Health

What is the meaning of exempt?

Exempt means free from an obligation, duty, or liability to which others are subject.

Types of EPF Funds

For an employer, there are three ways he can contribute to Provident Fund of his Employees if the number of employees is more than 10.

- One is to save in an un-exempt fund like the EPF under the EPFO. Un-exempted firms are those firms which maintain the PF accounts of their workers with EPFO. There are over five crore active subscribers whose accounts are being managed by EPFO.

- Save in a company-run exempt fund, EPF Private Trust, recognised by the EPFO and which pays at least the same interest as the EPF. EPF Trust has to do the duties and responsibilities like EPFO. EPF Private trusts are formed by firms that manage the money and accounts of their workers themselves and have an exemption from filing PF returns. The members of these trusts enjoy income tax and other benefits at par with EPFO subscribers. Such establishments who seek exemptions and create EPF Private Trusts are called exempted establishment. However, the pension is payable only by the EPFO.

- Put money in a company-run excluded fund, which is not EPFO regulated, but is set up with approval from the resident income tax commissioner. This type of fund looks after all investments and fund management itself and is self-regulated.

How to start EPF Private Trust?

The organization has to make an application to the Government, through the jurisdictional Regional Provident Fund Commissioner, to exempt it from the operation of the statutory provident fund scheme. The permission to companies to run their own PF scheme is however subject to a number of conditions. One of the important conditions relates to guaranteeing a rate of return on PF accumulations at par with the statutory scheme. If the government is satisfied that the benefits provided to the employees under the private provident fund scheme are, on the whole, not less favourable than the benefits provided in the statutory scheme, then it may permit the entity to run its own scheme instead of the statutory scheme. The EPF exemption requirements can be read at EPF page.

A private scheme can be formulated either for all the employees of the company or for a specified class of employees (e.g. managerial staff) .The organization is required to create a board of trustees for governance of the PF scheme and to ensure an arm’s length transactions between the entity and the trust. The entity is also liable to make good any loss caused to the trust by fraud, defalcation, wrong investment etc. The entity has to pay only an inspection charge of 0.18% of wages rather than the administrative charges of 1.10% of the wages. Therefore, there is a cost saving of 0.92% of the wages. Multiple units of an entity can also participate in a common provident fund trust.

Related Articles:

All About EPF,EPS,EDLIS, Employee Provident Fund

Have you worked in company with EPF Trust? Did you transfer from EPF Trust to Unexempted organization or from Unexempted Company to EPF Trust? How was your experience?

310 responses to “EPF Trust, Exempted EPF, UAN, Transfer, Passbook”

Regarding PF Transfer Exempted to Unexempted, I got Annexure-K uploaded in EPFO Portal but PF Passbook(EPFO) still not showing details of transfer.

New Employer asking Annexure-K along with Neft Details but I don’t have NEFT details nor Old Company or EPFO giving me NEFT Details

You can file an EPF complaint as explained in the article http://bemoneyaware.com/epf-grievance-complaint-online/

Urgent help needed. I had worked in State Bank of India and now joining a Private company. I tried to find UAN number from SBI PF dept but they say UAN number not generated, only PF number is available. Can you pls confirm if organizations like SBI who maintain their own PF monies, also generate UAN numbers? I have only the PF number printed on my salary slips & PF account statements from SBI.

I have previously worked in TCS and after resigning ,i have withdrawn my EPF aount. They have given me an UAN number. Now ,I applied for a PSU and i havent mentioned my previous experience.

Can I get a New UAN number from my new employer ,.Will the new come to know my previous experience

Dear Sir

I have worked below three companies-

HCL Infosystems LTD : 01.11.2010 to 31.01.2018

Prograssive Infotech LTD : 26.04.18 to 08.05.18

Ambit Swithgear LtD : 11.05.18 to 06.06.18

after that current company not deduct any PF i have transfer all previous 10c amount in my last company. but when i applied my 10c epfo reject due to short service they count my last company period 11.05.18 to 06.06.18. sir please suggest how i can apply so i can withdraw my PF

As you have not transferred the account, each of them is independent.

So EPFO does not add the services.

You need to transfer all accounts to one account and then apply to EPF.

Process is explained in our article How to Transfer EPF Online on changing jobs

Are you still working?

Hello Sir,

I am following with my previous employer (Cisco) to transfer funds which has exempted trust to my current PF account (non exempted). They are not transferring the amount and every time, asking me to submit form 13 again. I have submitted form 13 multiple time. Is there a way I can complain against them? Is there a way to do it online?

Please file EPF grievance as explained in the article How to register EPF complaint at EPF Grievance website online

and send the details to your

Hi thanks for this article.

Am a student pursuing my post graduation and for my final year project , I have opted provident fund. And the title is ” A study on tax implications and compliances of employees provident fund”.

I was asked to take up my project in Berger paints India limited , which is actually maintaining its own provident fund trust.

Due to this corona pandemic am not able to visit the company and the manager there is now not ready to share information on how their company maintains provident fund trust. I am not able to gather any information and this topic itself is very unfamiliar to me to analyze.

Could you please help me out for framing common questionnaire for my project. I literally have no idea about this and not able to gather any information.

Please help!!

Sure, we would love to help.

What kind of questionnaire do you have in mind?

How many questions?

Can you tell us what you understand of Exempted Trust?

Thank you for the response!

As my topic is completely on tax , i wanted to know, what are the tax benefits that the company gets with respect to provident fund. especially provident fund trusts. and i need to frame my survey questions only related to tax. as tax savings is confidential information in the companies for outsiders , am finding difficulty in gathering tax related information. at least 20 questions are required for my further analysis.

so, can you please share how the company gets benefit with respect to tax.

and with regard to understanding of the trusts your blog helped me. may be not 100% but atleast now i have got an idea about the private trust.

Sir I am working in Reliance Retail and my current PF is in Trust and i did not transferred by old PF to Current company Pf. Now i want to withdraw the amount but in EPFO portal when raise request it says you have submit the request to your trust.

is there any way to withdraw old company PF amount from old PF account. or i need to transfer first old pf amount to new pf amount.

Hi Ashish sir,

I was a member of exempted pf trust L&T,for 4.5 yers( from February 14 to July 18),i initiated pf transfer process to my present company,but my pf amount has not been accumulated,and same amount was retain with that exempted trust of Larsen & Toubro since last 1.5 years,total amount is around 15 lakhs,my question is that who will give the interest on this huge amount,LnT is denying to pay interest,they reply that we do not give interest from the period you resign,

Are they really exmpted to give interest on pf accumulations just after resignation???(as far as I know members are liable to get interest upto 3 years/)

Second thing my job was on contract basis,after 4.5 years they given me notice to cease the contract,when i asked to withdraw pf they said tds will be applicable of around 365000/-.

I agree that i have not completed 5 years of continues service but i am not responsible for this as LnT has terminated the contract which is beyond my limit and i had not given resignation then

why TDS is applicable in my case???

Please advise

I mentioned the name of that trust because I have all evidence in form of mail, letters , annexure K etc.

One gets PF interest till one withdraws. You can tell them you will be complain to EPFO.

Well, the company is justified about TDS but TDS is on withdrawal and not on transfer.

If you transfer your PF to the current employer and contribute for 6 more months then you would meet 5 years limit

hi, i have worked in PSU for 4.8 years, it has own trust at the time of leaving i have opted for withdrawal of amount, tds was deducted and paid balance. Later i joined in another company , it has its own trust, where i worked for 4 years. now i am going abroad, when i applied for PF withdrawal at new company they informed me that they will deduct TDS, mentioning that i dont have service of 5 years in this company.

My question is, eventhough i didnt work in new company for 5 years, i have over all continuous experience of 8.8 Years, in that case why should employer should deduct TDS ?

When you withdraw your pension amount the number of years of work is reset.

So the company is justified in deducting TDS.

The only way to get years of the earlier job is to transfer the earlier EPF to new company

hi , i have make my pf transfer from my previous account new trust-owned account, as it shows that amount is transferred but approved amount shows rs 0,can someone suggest

hi , i was working with a company in Delhi , which have a private PF trust . I have left that organization and Its been 52 days and still i have not got my Pf withdrawal and they are not providing any information about the same as well. I would appreciate if you could guide me how to withdraw that money as the company is not supporting me in the same.

With trust sadly, the control is in the company’s hand.

You can file a complaint in EPF office as explained in the article here http://bemoneyaware.com/epf-grievance-complaint-online/

Thank you so much for all the information: Your information of transfer of PF from one kind of an account to the another is limited to individuals. But my question is what kind of a step wise procedure would a company need to imply to change their PF preference from a PF Trust to the EPFO. They don’t want to be an exempted company any longer and want to put the employee PF funds into the EPO. Will be grateful if you could please through some light on this.

It is best to consult an EPFO adviser.

You can Check out Labour Law Advisor, esipfadvisor.com

Thanku for this information, but i want to know that i had submitted pf transferring request online from previous organization trust to present organization epfo account.

After that i have received email along with Annexure k and statement from previous organization. But cheque transfer directly to my present organization and current employer are saying they already submitted cheque Epfo office.

But i have yet not received any PF amount of previous trust and I live in Delhi and my organization vendor office is mumbai.

So please assist to advise how can i transfer my pf amount. Can i submit Annexure and bank statement in Delhi local officer?

For migrating in-house EPF Trusts to the RPFC, tell us the procedure to follow.

If any research documents, PPTs, process workflow, EPFO’s guidelines, circulars issued, indicative timelines, information checklist, questionnaires etc. for the transfer of in-house EPF Trust to RPFC, request if you could share that with us.

Thanks for a very informative article, especially since I was searching for one in relation to my case. I will be thankful if you could throw light on that as well.

I was earlier working in an organisation, which maintained an Exempted PF Trust (Call it Company A). My EPF amount was transferred to this new organisation’s PF Trust, when I joined them. I left this Company A after serving for two years, and joined another organisation (Call it Company B) which had account in EPFO. So, I got a new UAN.

Company A transferred my amount to Company B, after one year of my leaving them. However, they did not pay me any interest for this period, stating that as per their PF Trust rules, no interest would be paid after the date of leaving (though the Trust kept earning interest on my amount of Rs 13.98 lakhs). The amount sent to Company B has still not been credited by the Regional EPF Office into my EPF Account stating that the Company A has not provided the details of their Establishment Code/Registration Number. The same has been asked for from Company A, but the details are still not forthcoming. Surprisingly, the name of Company A does not feature in the list of Exempted PF Trusts as shown on the EPFO website.

So, please guide me as to how to get my interest for the period of one year for which my amount was lying with the Company A, and also how to get my amount credited in the EPF Account athe Regional PF Office by Company B.

I will be extremely thankful.

Talk to company A and try to talk to them why they are doing so?

tell them that you will contact senior officials, raise a complaint with EPFO and also raise it on their social media account.

Thank you very much for your reply.

I have been writing to Company A.

For the non payment of interest part, they are quoting their PF Trust rules, which I feel are not correct and not in sync with the EPFO guidelines. What are your views on this aspect. I have even kept their higher responsible organisation (which happens to be RBI in this case) in picture, but even they have not responded in a manner to rectify this aberration.

I would like to thus raise a complaint to EPFO. Would seek your guidance as to whom to approach in this regard. Had tried to approach the office 0f the Regional PFC, but they also wanted to know the Establishment Code/Registration Number of the Company, which I do not have. How do I work around this information gap?

Please guide. I will be extremely thankful.

Please use the following search engine, to know the establsihment PF number:-

https://unifiedportal-epfo.epfindia.gov.in/publicPortal/no-auth/misReport/home/loadEstSearchHome

To register a compliant the following EPFO link is helpful:-

https://epfigms.gov.in/Grievance/GrievanceMaster

Sir presently I am working in a company which has private trust for pf if i resign the job and with draw all the pf amount will my service details will removed from epfo site or will it be there if i withdraw pf

I want to hide previous employment history in epfo any suggestions

I have UAN as well which is linked to aadhar.

If it is linked to UAN then you cannot hide your service details.

We would recommend you not to hide your earlier company details as sooner or later it will come out.

Most employers do check on the employee

Hi, I had PF account with Trust, however they are making me to wait since 3 months for withdrawal, earlier they said it would be transferred to current PF, as previous one was not adhar linked they told me to raise offline transfer request, i have done and send them documents, they dont reply properly , please suggest what can be done as i feel that if i escalate or raise grievance against the firm they might further delay it intentionally .

Sad to hear about it.

But in this case better to be calm and wait.

You can indirectly tell them that you will file complaint with EPFO if there are delays.

Is your current PF an exempted trust?

Hello,

Good Article. I have my pf account in PF trust with my Ex-company(HCL). How to link or transfer to my EPF account? I have my UAN account with credentials. Unfortunately i do not have any contact mail id/phone number to reach them, as I am out of India currently. Any input would be greatly helpful.

Is it HCL Technologies in Noida?

mail them pfhelpdesk@hcl.com.

they will provide a link fill application online.

Hi ,

i am amit malgani i want withdrawal my pf amount this is trust amount my reliance telecom has shutdown company kindlly please guide how i withdrwal process threw manually and online process iam facing issue threw withdrawal online since 2 yrs .kindlly team plz support

Thank you for article.

I moved to organization which has PF Trust, So it is beneficial to transfer old EPF amount from previous employer to this Trust. If No, Is it fine if I withdraw amount after 1 year.

Thanks.

Sir,

I have retired from the Bank on 31.03.2018 and till date I have not received my PF. The bank is maintaining the Provident Fund Trust Account with them. I have requested the Trustees of the Bank, Managing Director, Chairman but nobody is ready to give me the positive reply that when they are giving me the Provident Fund Amount. Sir, were I have to complaint regarding this matter.

Hi

I am leaving my company to move outside India. My current company is India has a private EPF trust. I dont want to withdraw money, however company says you cannot continue account with us after employment.

Can I transfer account to EPFO in this case.

You can withdraw the amount or leave it for interest.

When you came back to India, you can transfer it to newly joined company or else withdraw the amount. Pls. ensure that Date of exit should be entered by your employer as early as possible after you left the company. In case the company shuts down in the future, you have to submit the claims offline with attestation.

Hi,

I have applied online for PF transfer from my previous organization HCL (PF A/C No. held by Trust) to current organization CTS (PF A/C No. held by : RO CHENNAI) and now i am able to see the status as ‘accepted by the field officer’ and ‘Claim Form-13 (Transfer Out)(Transfer (Unexempted to Unexempted in other region or to Exempted Establishments)) Claim id-GNG******** Member id-GNGG******** your claim has been settled.

I am not sure what is the meaning of this status. If amount had been settled to my current PF account then where can i see the Old PF amount in my current PF account. Because i am unable to see old pf amount in my new pf account. Kindly help

Please raise complaint as explained in the articleHow to register EPF complaint at EPF Grievance website online

Hi,

My previous PF was maintained by EPFO but my current employer have its own trust. I haven’t transfered my previous pf balance to current pf trust. Is my epfo blance earning intrest or not?

Is it mandatory to transfer pf account from previous employer to current employer as I have same UAN? Please help.

Thanks

Check your passbook.

Both should have a transfer in/out amount.

Else raise the complaint with EPFO at How to register EPF complaint at EPF Grievance website online

The claim for transfer is settled but not pf amount i.e. only the service details relating to EPS is transferred to the current employment

It seems that your claim has been settled. Check passbook for clarity.One of the PF accounts becomes zero.

hi, is your issue resolved? i am also facing the same issue, transfer claim is settled but the approved amount is showing as ZERO and the passbook is not reflected. How long we need to wait to have the passbook is updated with the transfered amount. please share your experience.

old Passbook should transfer out and

new passbook should show transfer in as shown in the images in the article here http://bemoneyaware.com/transfer-epf-online-changing-jobs/#UAN_passbook_after_the_transfer

Are you transferring from/to an exempted trust?

Download the Annexure-K in that case.

Hi Sir,

I worked in HP from 2005. The ES services got merged with CSC and while leaving the organization it was under new Logo DXC.

I resigned from DXC during May with experience of 13 years. I would like to withdraw my PF amount rather transferring to new company. Will I be deducted any amount for withdrawal? Please advice

No, as you have worked for more than 5 years no TAX would be deducted.

Hi

I was working for DXC .I resigned in the month of March 2019 and filled the PF withdrawal form on May 2019. On 19th July i got the PF amount which is way less than (Rs 70000 less )what my PF balance shows . Why there is such a huge discrepancy? Is there any fraudulent activity going on ? Are these trusts running scam?

What should i do to get my hard earned money?

You can raise the grievance in EPF site http://bemoneyaware.com/epf-grievance-complaint-online/

Questions we have for you are:

-How many years did you contribute to EPF more than 5 years

-If it is less than 5 years was PAN linked to UAN?(then TDS gets deducted @30%)

-Did you work in many companies and if yes did you transfer your old account to new.?

You can send your UAN passbook details to our email id bemoneyaware@gmail.com if you want us to look into it

Thank you for the reply.

I was there for 3 years.

Yes PAN was linked to UAN.

I did work in many companies however, after leaving the previous employer i had withdrawn my PF and i got the full amount . Nothing was deducted. My money was with EPF and i could see it in the UAN password. I had no issues after i left the organization.

Hi JHUMUR,

My name is Pravina ,I have worked in DXC from 2015 may till oct 25th 2018.I want to withdraw my PF amount.Please let me know what all we need to withdraw it.

Hi

My previous employer was with Private trust and my current employer is with EPFO. I initated the transfer from Trust to EPFO by submitting Form13 in Dec 2018. When I contacted my previous employer, they said they have released from their end. But, I still do not see it as updated in UAN portal. Also, I tried the SMS service and missed call service to see the balance, it is showing only the current employer balance. For the previous employer, they are saying it is pertained to trust, so service not available.

Its been 5 months, how do I know if the amount is transferred?

Thanks

Judz

I exactly have the same problem. I have the annexure K from my old employer(who had a trust). The transfer was done in May 2018. Till date, the amount is not reflected in my current PF account, which is with EPFO. I am following it up with my current employer on a regular basis.

thanks,

Reema

Check the current pf account no. In the annexure k. Get the cheque details from the pf trust and approach the epfo

Check the current pf account no. In the annexure k. Get the cheque details from the pf trust and approach the epfo

My previous employer was EPFO trust and my current employer having Private Trust. I have transferred my fund from epfo to private pf trust(my present employer).

My present employer (private trust) asking for annexure k, i have raised grievance but epfo is not providing annexure k copy. How to get annexure k copy.?

Ask your previous employer.

You can also raise EPF grievance at the EPF grievance website as explained in our article How to register EPF complaint at EPF Grievance website online

Did you do it by submitting form 13?

Hi

My total experience is close to 3 yrs Now. Recently I joined a new company B. My first company A was managing PF via EPFO. Now my new company has a pf trust. Now I wanted to take loan from my Pf money. I’m yet to transfer my pf amount from company A to B.

Is there any chance I’m eligible to withdraw or take loan from my Pf amount?

Pls do reply ASAP

Hi,

I worked for 4 years in a company which had it’s own trust for pf. Now i have joined another company which doesn’t have that.

I have transferred my epf to the epfo account. It is getting reflected in my passbook but eps contribution still shows 0.

1. How do i know if my previous employer has transferred the eps amount as well?

2. If they have then What if I withdraw epf online now, the eps will also get withdraw?

EPS will show 0 only as at the time of retirement the pension gets calculated on the basis of salary.

can you tell how much time does it took to transfer money from epf trust to epfo.

I was leave reliance communications in 2012 , still my PF not recieved,now how can I withdraw my PF from Reliance Communications, there is no UAN no updated in that organication, kindly help me to get my PF withdrawl and provide me the procedure.

Dear Ashish,

First thing first no organisation can ever deny PF money to an employee either working or resigned. And second thing it took you 7 years for withdrawal very surprising so definitely there must be few hidden bites in the story. Any ways lets resolve your query .

As per your query you left organisation in 2012 back then UAN was not in serious existence people had PF number instead. Check your old companies Payslip, your PF no. must be mentioned. Visit your nearest PFO office and meet the designated In charge discuss the case with him with proofs of identity and communications made with old organisation against PF withdrawal. Please make 2-3 sets of all emails,letters, salary slips, and documents related to your employment in previous organisation. this will surely help your cause and if this doesn’t then get in touch with Labour commissioner of your district and file a case in Labour Court.

I recently saw that my current employer is contributing 1250 towards EPS. Why is that? I never opted for this. I started my job in 2015 (i.e. after September 2014 ) and then changed job to current employer in 2016 hence it is not mandatory for me to have a EPS account.

I really do not want any deduction towards EPS. I want all the money in EPF account.

-What are the options that I have now?

-Why my current employer started EPS deduction? ( I have seen other employees in my team who do not have this EPS deduction)

-From what I have read, I feel there is no option to stop EPS deductions now, but only option is to get Certificate from Previous Employer. What are the steps to get that?

Hi,

I was working with a company for 4.5 years from Dec 2013 to 2018 April and the PF was exempted. Then i moved to a company where the PF is handled as a trust. I did not transfer my earlier PF to this trust as i wasnt sure about it. Now i am moving to another company which is unexempted. So can i transfer my PF from the Trust to the current unexempted one and what about the earlier PF? Should i transfer that as well?

As your establishment is exempted in PF, please submit your withdrawal case to concerned Trust.

How do I withdraw my PF balance??

Please help me

I was working with a company for the period 2011 to 2017 and the PF Money was deposited in the Private trust of the company. The money was not transferred to my EPFO office after I moved to another company, even after submitting all forms.

I am working with another company from 2017 to date, and I dont want the money to be transferred to EPF office, but wants to withdraw from the trust now.

Is this allowed as per Law, or tax involved. Please clarify.

Theoretically one should not withdraw EPF money as it is ballparked for retirement.

You should transfer it so that compounding can do magic.

But if you want to withdraw you can.

As you have contributed for more than 5 years EPF withdrawal is tax-free.

Hello,

I need advise on somebody who has knowledge on this, i am in deep trouble as i am not able to withdraw money from my pf account.

i left my 1st company A aand joined B comapny on 4th may 2018 and filled my form 13 on the DOJ, later i was not comfortable with my team so i decided to leave the company and joined another company C on 18 of june without any notice to B.

Now since i had filled form 13, my pf from A was transferred to B.

the problem is B has put my DOE as 4 july 2018. Now my pf amount from A, which is a lot of money as i used to add VPF monthly.

now iam not able to do anything with my pf, i am in urgent need of my own money but stuck in this loop.

B DOJ – 4th may 2018

B DOE – 4th july 2018

current C DOJ – 18 june 2018.

Please help me, any kind of help will be appreciated.

awaiting your response.

Thanks,

Neeti

Has there been any EPF contribution in June and July from Company B?

Yes they have contributed in the month of june.

thnkd

Hi,

I was going through your concern couldn’t actually understand what actually it was. But let me just pin point a few that i think are there:

1) You were employed in 2 organisation at one point of time as per PF data.

2) You did not resign from Organisation B but were absconding.

3) If you were absconding how DOE got mentioned in your account. Did you later requested your organisation to do so?

Please Get in touch (ashish.aries.17.4@gmail.com) i think we can solve this.

Regards,

Ashish.

I was working with TCS and intiated the transfer request from my current organisaton but did see any update.after two years i am getting an email from TCS that your PF account is unsettled could you please transfer or withdraw the amount.

So i have submited the withdrawal request using alummin portal.

I randomly checked the claim status using EPFO website it says that your TCS member id is settled.

With the below remark . How can i confirm if the account was transfered at the tym when i raised the transfer request. if it was settled then why am i reciveing the email to settle the account.

Remark:

Claim Form-13 (Transfer Out)(Transfer (Unexempted to Unexempted in other region or to Exempted Establishments)) Claim id-MHBAN180500045710 Member id-MHBAN00484750000387231 your claim has been settled.

Can someone please explain me i am so confused as i have already left that particular orgaonisation.

You can Raise EPF grievance as explained in the article How to register EPF complaint at EPF Grievance website online

Check your EPF passbook. Does it shown in the transfer amount?

hi team

i recently made a switch from my un- extempted to extempted pf account. is it possible to withdraw my pf in my previous organization? i have raised a claim request within 54 days .will my claim get approved? pls confirm.

Hi,

I have opted for PF transfer and submitted form 13 by filling all necessary details. Now while checking for claim status, it says as rejected due

“Claim-Form-13 (Transfer Out)(Transfer (Unexempted to Unexempted in other region or to Exempted Establishments)) Claim id-XXXXXXXXXXX Member id-XXXXXXXXXX has been rejected due to :- DATE OF JOINING IS GIVEN AS 19.12.2011, CONTRIBUTIONS RECEIVED FROM 01/2012(PAID IN 02/2012) CLARIFY/OK”. But my joining date with my previous firm was on 19 Dec 2011 only. I really which date I need to mention while submitting the form. Please advise.

It seems that they are not paid the amount of 10-11 days PF amount pertaining to Dec month.

As admin said, you may contact your employer for the change of date of joining the PF employer portal or else they will pay the differential amount to PF trust or they may consider it as probation (with proper explanation)

Passbook not available to this Member-id as this pertain to exempted establishment (i.e. Trust).Requested to contact your employer.

My UAN account showing like this please suggest me what to do next

Details of your EPF contribution are with the company where you are working/worked and which is exempted establishment.

Please contact your employer. Every company has its own way to provide EPF informatiom

Contact your payroll department.

Big companies like TCS, Infosys, Wipro have internal websites where one can find this info.

I worked for Company with PF trust moved to Non-trust company. I initiated the transfer process on 29 Oct 18. Today (31 Jan 19) I received the transfer acknowledge letter from PF office through my present employer. The letter says, the transfer is approved by trust on 9 Nov 18. and copy of cheque dated 9 Nov 18, from trust to PF office is attached.

But the money is not transfered to my present account. I checked with My HR and they say it will take up to 90 days from Cheque date for the PF office to credit the amount in my account. Fingers crossed.

The process was smooth but, I needed to follow up several times with previous employer (trust). One bad thing is, you cannot track the progress. It is not considered as completed till the present passbook is updated with transfer.

I will update this post once my transfer is complete.

Thanks for sharing your experience.

Any work of Govt department is still slow and painful even in this age of digital India

Hi Nedungilli,

Can u please update the status of your claim. have u got money in your present account after 90 days?My case is also same as yours.

Yes, I received the amount after 300 days

I am working with an NGO which maintain its PF with exempted Trust. (Provident Fund Trust A/c) . It deduct 10% from the employee and put 10% as employer contribution. Not providing the Pension scheme. I have more than 20 years service with the organization. If I want to join the pension scheme what is the formalities.

I have initiated PF transfer. It is showing as amount approved but the status is showing as not applicable.

PARA DETAILS Transfer (Unexempted to Unexempted in other region or to Exempted Establishments)

TOTAL AMOUNT APPROVED xxxxx

DISPATCH DATE N/A

CLAIM STATUS Status Not Available

Did you check your EPF passbook? Does it show amount transferred?

Also check bank details are correct?

As explained in the article After EPF Withdrawal : Claim Status, How Many Days To Get PF Amount

Hello Sir,

My current organization is a PF trust and previous organization is unexempted.For PF transfer i have submitted hard copy of form-13 to my current organization and they have forwarded same to Regional PF office. Do i need to contact my previous organization as well in that case, as they are telling that their involvement is not required it will be handled at EPFO office.

No Vaibhav you don’t need to contact the previous organization as it was unexempted.

If and when you leave current organization which has PF trust then to transfer you need to contact this organization only.

Dear Sir

I am an ex-employee. My company head office is at Mumbai. I left the organization 4 yrs back. I have shifted my PF account to the next organization where I am working. Right now few month back I have changed my job. But I am not able to withdraw or close my pf account activated with my 1st organization. I can see my online pass book and my UAN also. But when i click on withdraw option i am getting message “As your establishment is exempted in PF, please submit your withdrawal case to concerned Trust.”

Can any one guide me the process for withdrawing my old PF.

How are sure that first organization PF has been transferred.

As in exempted trust money is not with the EPFO you need to approach your old employer which has exempted trust to withdraw.

Hi

My previous organisation has exempted PF Trust and my accumulated PF contribution was lying with its PF Trust. Since there is no contribution now my PF account becomes inoperative and they have stopped giving the interest in my PF account after three years on the pretext that their PF trust rules don’t have provisions to give interest after three years.

2. It is understood that the private PF Trust may frame their own rules and regulations for the maintenance of PF accounts, but such rules and regulations are supposed to be based on EPFO rules. As per recent Government notification, now PF account will fetch the regular interest up to the age of 58 years, whether member contribute to it or keep it idle. Since the new rules allow credit of interest into an inoperative PF account, such rules should mutatis mutandis apply to all other exempted PF trusts as it these private Trusts are regulated by the Employees’ Provident Fund Organisation (EPFO).

3. May please through some light on my above views

Yes, you are right.

You can raise a complaint against the employer to Regional EPFO office as explained in the article here.

Dear Sir,

I was working with a company named DENSO which had an exempted PF trust and subsequently joined an new organization that had PF with EPFO Gurgaon.

Could you please guide how I can transfer my total PF amount from Trust to EPFO?

Regards,

Mohan Gupta

You must contact your previous employer for transfer as your company has exempted trust.

The process of online transfer is explained in our article How to Transfer EPF Online on changing jobs and is also given here

Go to the EPFO members’ portal and log in using your UAN and password.

Verify that all your details are populated in the UAN portal. No missing or incorrect information.

Verify that your KYC is approved.

Please check that your Bank Account Number, IFSC code is correct.

Click on Online Services->One Member One EPF (Transfer Request).

The Employee has to get his claim attested by the current or the previous employer.

Hello,

I work for the company managing their own trust for EPF. I get an annual slip for EPF per year which looks like this – https://snag.gy/ot3HCe.jpg

The slip does not bear any EPS number but does bear EPF no given by trust. So my EPS is 1250. But there is not dedicated column for EPS or EPS number mentioned on a slip. How do I verify if my EPS is really getting credited to my account?

My previous employer has provident fund under epfo. My present employer has private trust.

I have raised request online epf transfer from previous employer to present employer by online.

Claim Status is displayed as settled and sent by Neft 13-4-2018 .

But in my present employer pf statement, the amount is not credited.

Can you help me on this

Hi, I worked in a MNC for 10+ years and left the company and took a break in my career for around 3 years. While coming out i withdrew my PF amt. As i have completed 10 years my EPS amt could not be withdrawn and i have not collected my scheme certificate. Now after 3 years i have joined another company and a new PF acct has been opened. Now how do i get to know the old EPS amount and how to link both EPS. Please guide. I am unable to see the old EPF/EPS details in the Govt of India PF website.

Hi,

for PF balance you need to know your UAN. Ask your old company for UAN and get in touch with your current organization for transfer your PF to your current company.

Regards

Debraj

Hi,

I have withdrawn my PF amt while leaving the company. But i did not collect my EPS amount/scheme certificate. While logging into PF website using UAN i am able to see only the current company details. I can see the previous company PF no but i am unable to retrieve the statement. I would need my scheme certificate from the previous PF details. How can i get it?

Dear Sir,

I left my previous company after completed three years and joined a new company, on UAN portal my old company also updated my last working date, however present company is a trust and now i see both the companies on the UAN Portal.

Last company has update the last working day on the UAN portal.

Both the companies I can see on same on UAN number.

Can you please let me know a way to withdraw the old PF amount ?

It’s very urgent.

Is your old EPF account transferred to new trust?

If not, which I guess should be the case,

try doing the online withdrawal as explained in the article Online EPF Withdrawal: How to do Full or Partial EPF

Dear Sir,

Old PF balance have not yet transferred to new trust PF account.

So, can i withdraw the old 100% pf balance?

Regards,

Jit Mondal

Hi,

If you are not working any organization or presently if you are not PF member then you can apply for PF withdrawal.

Regards

Debraj

Hi, I need some guidance with regards transfer of my PF from one employer to another. My past employer maintained a private trust and current employer too maintains a trust for PF. Hence my transfer cannot be done online. But in this case, can you guide me what steps i should follow to get the money transferred.

Also, I would like to know how to go about for EPS and the employee linked Insurance.

Thanks in advance.

Dear Sir,

I left my previous company and joined a new company, on UAN portal my old company also updated my last working date, however present company is a trust and now i see both the companies on the UAN Portal, Because of this now I am not able to withdraw the PF amount, can you please let me know a way to withdraw the PF amount.Last company has update the last working day on the UAN portal 1 day ago.

Both the companies I can see on same on UAN number.

This is the error message i see

As your establishment is exempted in PF, please submit your withdrawal case to concerned Trust.”

Option 1:you can submit your withdrawal case to your old company and get PF encashment

Option2:Transfer Old company’s PF to your current company’s PF Account through Member portal Login.

Dear Sir,

I left my previous company and joined a new company,old company PF goes to PF office. On UAN portal my old company also updated my last working date, however present company is a trust and now i see both the companies on the UAN Portal, Because of this now I am not able to withdraw the PF amount, can you please let me know a way to withdraw the PF amount.Last company has update the last working day on the UAN portal 1 week ago.

Both the companies I can see on same on UAN number.

This is the error message i see

As your establishment is exempted in PF, please submit your withdrawal case to concerned Trust.”

My organization declared me as absconded. I worked there for 3 months but left it due to family emergency and could not serve the notice period. How can I withdraw my PF from that organization? Please guide.

Thanks.

Hope your family emergency is resolved.

You will not get the EPS contribution as by EPFO you are required to contribute atleast 6 months to EPS.

If you were absconding, employer can only terminate your services following a procedure of inquiry. Nothing more.

Your PF cannot be touched. You write to the employer to release your PF. You can approach the RPF authorities if it is not done.

Do you have UAN? is your KYC approved? Then you can withdraw from EPF without any employer intervention.

If your EPF was private trust then you can only approach your employer.

Hi

I worked with one MNC for 20 years. Company was having its own trust and the all my of accumulation was getting transferred to that organisation. I left this organisation in Jan 2015 and joined another company which was having of account with EPFO. I recently got my of transferred to EPFO (govt) how er the previous employer deducted 30 percentage of the interest amount from 2015 till 2018 as TDS. However as per my knowledge there should not be any TDS on pf transfer. Please advise how can I claim the tax deducted due to this transfer

Hi,

Thanks for update,

I have worked in United breweries from 2011 to 2013, there is EPF trust is available, then i moved to other company, now it was almost 4 years over, How can withdraw PF.

Please give the information.

“As your establishment is exempted in PF, please submit your withdrawal case to concerned Trust”

I am getting this above error while calming the previous organization PF withdrawal. below is the career path,

LOBO STAFFING SOLUTIONS PVT.LTD. –> TATA COMMUNICATIONS TRANSFORMATION SERVICES LTD–> TATA COMMUNICATION LTD–> current employee of INFOSYS LIMITED.

I want withdraw the PF amount of LOBO STAFFING SOLUTIONS PVT.LTD but not able to do, pls. share any suggestion how u can withdraw the PF amount.

Hi i am not sure are you able to withdrawal amount ?am also same error, please let me know if able to withdrawal amount,it helpful for us

For trust money is with Organization so you have to contact your old employer.

Hi,

I was working with a exempted organisation for 9 yrs and joined a new org last year. Raised PF transfer form with prev org and got confirmation as well stating transfer completed. However, I can not see that amount anywhere under my UAN. Even after a year it is showing my PF from new org only. Tried contacting prev org and got reply stating we have made the transfer now be in touch with new employer. Reached out to new employer and got reply stating we can not help it is with prev org only.

Plz advise where can i raise a grievane for same. I tried raising it with EPFO and case was closed stating it is related to exempted org so closing the case.

Plz guide.

Thank you

Sad to hear about it Dipika. EPFO is Govt organization so …

Did you check the status of your EPF transfer claim by clicking on Online Services->Track Claim Status? What does it say

Did you check your UAN passbook?After the successful claim, UAN passbook of the old and new employer will reflect the transfer as shown here.

You can ask your old employer for Annexure K. They need to send this to EPF for transfer of EPF account.

Then You can raise EPF grievance to get Annexure K from Govt.

Hi,

Thank you for reply.

Yes I did check the status of claim under online services and it says claim settled and transfer completed.

I also checked passbook after transfer and claim settlement. For old account – no passbook generated since it is managed as trust and in new account passbook has balance of new employer only.

Please advise can’t I raise it with any higher authority as the amount of old PF is high.

Thank you

The passbook of new employer should have the transferred amount as shown in the image here

Your View->service history should have details of old and new transfer.

It transfer happened in last few days wait for 2 more days.

Please raise the EPF complaint and show snapshot of passbook of new employer and details of the transfer

Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

Thank you for guidance.

Have raised a grievance as transfer happened in Jan’18 and I am not able to see the transfer amount or details anywhere in current passbook.

Hi,

I have same problem like dipika. I have raised a grievance every time they are telling reconciliation is pending from HO Delhi.

What to do next.

Hello. Very informative article, thanks.

I worked for an exempted establishment and left to become an entrepreneur. On leaving, I withdrew my PF from the trust as I was not working any more. After two years, the business failed, and I took employment with another company. In this company I want opt out of PF as my salary falls above the cut-off limit. Please tell me what is the procedure for me to do opt out? Thank you.

You will have to ask your employer. And why do you want to opt out of EPF? It is a good saving for your retirement.

The interest of 8.5% is better than any other debt instrument out in in the market

Typically, Once a person is enrolled under PF Scheme, irrespective of his salary increments in consecutive jobs, he does not have an option of exemption from the scheme, unless the company is not registered under the EPF act.Such companies are usually startup or company which has less than 20 employees

But if a fresher joins his first organization with Basic + DA above Rs. 15,000, he can opt out of the PF scheme. However, he has an option to join the PF Scheme in his future organisations.

Process to opt out:

Every employee needs to submit a declaration, Form 11 when he takes up new employment in an organization which is registered under the EPF Scheme of 1952. This form, EPF Form 11, contains basic information regarding the employee and it is mandatory for an employee to fill it upon joining an organization. EPF Form 11 is a self-declaration by the new joinee about his status whether he is a member or non member of EPF / EPS in earlier employments and opt out of EPF

Check the image for more details.

It is in our article EPF Form 11 on Joining a New Job: Auto transfer of EPF account

HI There,

Please guide me. I worked for 1.5 years for epf un-exempted organisation and got UAN generated here. then I joined an epf exempted organisation and left it in one month( without servicing notice, received salary of one month only) linked previous UAN here.

Then again I joined new organisation which was epf un-exempted ( here they created new UAN even though I have given my previous UAN ) I left this also but so far not withdraw any pf amount.

Now I joined organisation which is exempted and i want to transfer all three PF account in this organisation pf trust. But in one UAN two pf account created and another one pf account is created.

I have initiated transfer of pf account through current employer for last organisation only having new UAN and one pf account. Also I Want to know if previous UAN where i have two pf account can also be transfer to new UAN and current organisation which is pf trust.

You can transfer PF account from trust.

But you to approach the trusts to initiate the transfer process.

Hi,

I was working with an organization having private PF Trust and now I’m working with some other organization and the same have a private trust.

I just need to transfer my PF amount from previous organization. is there any online procedure?Could you pls suggest the procedure online/offline.

You cannot move money from one exempted trust to another exempted trust through EPF website.

You would have contact your new employer and ask for what is required.

You would have to submit EPF transfer request to your old employer.

They would either give cheque or transfer through NEFT into your new employer account.

Is there any time period within which the cheque has to be submitted in PF office ?

I was working for TCS for 2 years and left the organization in January 2018. After 6 months that I.e..June 2018 I received a mail stating that that you are

advised to transfer your Provident fund to your current employer or settle

the account which ever is applicable.It is also important for you to know that as per recent updates, the

Government of India has directed employers to transfer inoperative

Provident Fund corpus to the Senior Citizen’s Welfare Fund.

As I was unemployed for 6 months and have recently joined new organization. I can transfer my PF from previous company only when I receive my first salary. Same is informed to the concerned authority of the previous organization.

Somehow I didn’t understand if there is any rule that states if account is not active for more than 6 months then we need to withdraw it ?

Can you please send help me on this.

The notice is given below. So it is not true.

You can send the copy of the Gazette to TCS from here

Explained it for your reference below.

We would like to bring your attention to Gazette Notification No. GSR 1065 (E) dated 11TH November 2016 amending sub paragraph (6) of Para 72 of The Employee Provident Fund Scheme 1952. Para 72 deals with the Payment of Provident fund and sub paragraph (6) deals with INOPERATIVE ACCOUNTS

Amended para 72(6) would be read as follows

AMENDED PARA 72 (6)

Any amount becoming due to a member as a result of:

(i) supplementary contribution from the employer in respect of leave wages/arrears of pay, instalment of arrear contribution received in respect of a member whose claim has been settled on account but which could not be remitted for want of latest address, or

(ii) accumulation in respect of any member who has either ceased to be employed retired from service after attaining age of fifty-five years or migrated abroad permanently or died, but no application for withdrawal under paragraph 69 and 70 or transfer, as the case may be has been preferred within a period of thirty six months from the date it becomes payable, or if any amount remitted to a person, is received back undelivered, and it is not claimed again within a period of three years from the date it becomes payable, shall be transferred to an account to be called the [Inoperative Account]:

Provided that in the case of a claim for the payment of the said balance, the amount shall be paid by debiting the [Inoperative Account].

“Provided further that if any amount becoming due to a member, as a result of supplementary contributions on account of litigation or default by the establishment or a claim which has been settled but is received back undelivered not attributable to the member, shall not be transferred to the

inoperative account.”.

Conclusion

Now Provident Fund account ONLY for employees who have retired from services after attaining age of 55 years or migrated abroad permanently or dies will be transferred to Inoperative account after the expiry of 36 months. This implies that for all other set of employees’ amount standing to their credit will not be transferred to Inoperative account.

This further implies that all such employees will keep on earning the interest till the time the time they retire or shifted abroad

Hi Team,

I was working with a company which was not exempted in PF. It provided me a UAN. Now I joined another company where I continued my existing UAN but the company is exempted in PF.

I want to withdraw the PF of my previous company but when I am doing it online it says to connect with the trust.

What should I do to get my PF amount for previous employer.

Have you transferred your old PF account? Just giving UAN number is not sufficient.

Note that once you transfer the account you will not be able to withdraw your EPF money.

You can apply offline for EPF withdrawal.

Hi,

I was working in a IT company from 2012-2015 , which has an exempted EPF trust. On leaving the organization i got a UAN. Then i joined Cognizant in 2015 and received another UAN. Now i want to merge both the accounts but I am not sure about the account with my previous employer because I cant even see its passbook online.

So what can I do? Please suggest.

You can transfer your old UAN to new UAN but you have to get the transfer request submitted to your earlier IT company.

They will transfer the account to new UAN.

Hi All,

I worked for HCL Technologies 4 Year 2 months and I am planning to withdraw money. please let me is my PF & Pension amount will be returned whatever I paid? Is there any way I can transfer only Pension amount and can withdraw PF amount? please suggest. your opinion is much appreciated! thanks…

When you withdraw your PF you also get your Pension amount.

Transfer of Pension is not possible.

Please note that EPF withdrawal before 5 years is taxable as explained in our article EPF Withdrawal before 5 years,TDS,Form 15G,Tax and ITR

We would recommend you to transfer your EPF to new employer.

HI Team,

I have worked previous in HCL technologies and then Joined a new organisation 2 years back. I got Annexsure-K from HCL, but Than amount is not transferred to my current EPF account. I could not see any details regarding HCL’s EPF in EPFO site. What i need to do with annesure so that amount should credited to my current EPF account?

Please help.

Did you raise a transfer request?

Please contact your current employer and submit your Annexure K.

Please do scan Annexure K

I spoke with my current employer they asked me to raise a grievance in PF portal with Annexure K. Is it right process?

I was working for TCS for 2 years and left the organization in January 2018. After 6 months that I.e..June 2018 I received a mail stating that that you are

advised to transfer your Provident fund to your current employer or settle

the account which ever is applicable.It is also important for you to know that as per recent updates, the

Government of India has directed employers to transfer inoperative

Provident Fund corpus to the Senior Citizen’s Welfare Fund.

As I was unemployed for 6 months and have recently joined new organization. I can transfer my PF from previous company only when I receive my first salary. Same is informed to the concerned authority of the previous organization.

Somehow I didn’t understand if there is any rule that states if account is not active for more than 6 months then we need to withdraw it ? Please guide

I am also having the same issue.

Can someone please help me on this?

Don’t worry.

You can send following notification to TCS which does not say that.

here

Hi Team,

Previously I was working for Mphasis which has a private trust for EPF and I have managed to get the PF amount transferred.

But what happened to EPS contribution in Mphasis how can I track/transfer/withdraw that??

Thanks in advance!!

Does the UAN show your service details in Mphasis?

If so then you need not worry.

Hello Sir!!

If a company is not depositing PF amount in its private trust since one year and also getting zero points in its performance evaluation on exempted establishments, then what next??

EPFO can already see that they are getting zero points still how can an individual put pressure on the EPFO to make the company deposit and disburse the retired/resigned employees dues?

Kindly suggest where should one complain so that it is acted upon and one gets his dues.

Thanks.

Hi sir,

I have worked in exempted of pf trust company from 2004 to 2007, I have left the job without notice period. later joined one company having UAN number and pF number , could see Epfo online and resigned 2 months back. How to link my old EPF account to new account.. Can’t link using one uan epfo portal.

Hi,

I’m unmarried and don’t have surviving parents. As per EPFO, only parents, spouse or child can be a nominee. In my case I don’t have eligible nominee. Can I declare my brother or sister as my nominee? Or, at least can I declare their children as a nominee. If you have any suggestions to get my nephew or niece added as nominee would be highly greatfull.

Thanks

as you are unmarried, you can nominate brother/sister/nephew/neice etc. But in case there is no valid nomination, then the successor as per Hindu Succession Act1956 would be eligibile to apply. Your brother/sister/etc would be Class II successors and in the absence of Class I dependent all Class II relatives have equal claim.

Hi, I worked for Infosys for more than 2 years and have been relieved in the month of nov 2017, I Joined DXC technology which is EIT services pvt ltd and due to personal issues I had to leave the job without noticing. Now, I’m unable to withdraw my pf amount. It’s coming up as exempted and some trust, I really don’t know anything about this. If you can help me how can I withdraw my pf, much appreciated

Was unable to manage one Employee-One EPF account services,

geting error (details of previous account are different then present account, hence claim request cannot be processed)?

KYC has already updated

please help me out

Please check details (Name, Date of Birth, Father name) etc in both the accounts.

Without seeing more details that’s all we can recommend.

Hi Sir,

I have worked previously in non EPF trust company and now I joined wipro. I am receiving below message when I am trying to withdraw my previous company PF.

As your establishment is exempted in PF, please submit your withdrawal case to concerned Trust.

Can you please let me know the process to withdraw the PF from my previous company.

You cannot withdraw exempted establishment EPF online.

You need to contact your old organization and do EPF transfer.

Hi,

let me narrate this.

I worked for IBM for 1.7yrs which is not an exempted org and has my PF in EPFO. I then joined Wipro which is an exempt org.

I tried to transfer my PF from IBM to Wipro twice but failed with unkown reasons. Once I tried through paper submission and next time I tried online.

I have again raised the transfer of my PF in Wipro about a month back.

Now I am separating from Wipro and will be working outside country.

My queries are:

1. Shall I wait for transfer of IBM to Wipro and keep PF in wipro trust and withdraw whenever I need it later( i believe I’ll be getting the interest of 8.6 till i withdraw, please correct me if I have an incorrect understanding)

2. Shall I withdraw PF from IBM and wipro both and be happy 🙂

3. Keep IBM separately if transfer fails again and wipro separately and with draw later

Please suggest what can I do ?

Thanks

Congratulations on your new job outside the country.