“Wish I was between jobs so that I could withdraw from my provident fund (PF) account to repay my home loan?“, remarked Sujoy. Yes, you can partially withdraw from you EPF while in service for repaying the housing loan, Marriage, Treatment, subject to prescribed conditions. This article talks about how one can do EPF partial withdrawal, for what purpose, how much can one withdraw and how many years of service one needs to have completed.

Table of Contents

EPF Partial Withdrawal

For what purposes can one withdraw from the EPF?

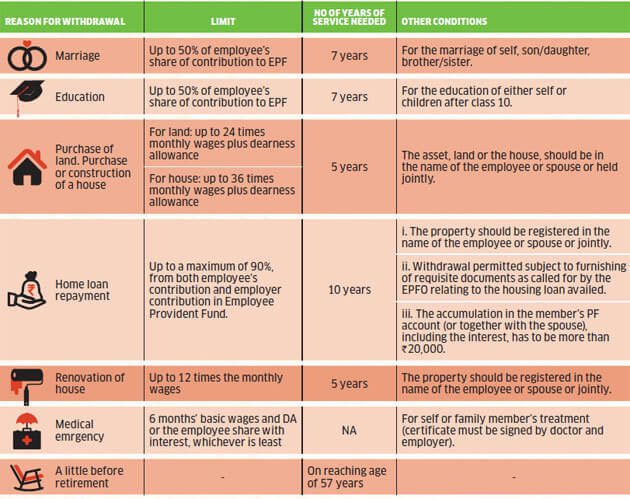

Advance or Withdrawals may be availed for the following purposes after putting in at least 5 years of service. The amount that can be withdrawn depends on the purpose, depends on the number of years of service. How many times can one withdraw for the same reason depends on purpose, for example, one can withdraw for the marriage of self, son or daughter, brother or sister 3 times after one has completed 7 years of service. For marriage purpose, one can withdraw 50% of employee share but for treatment, one can withdraw up to 6 times of Wages. Wages here mean Basic + Dearness Allowance, not your Take Home salary. Our article Salary, Net Salary, Gross Salary, Cost to Company: What is the difference takes about basic salary.

- Marriage / Education

- Treatment

- Purchase or construction of Dwelling house

- Repayment of Housing Loan

- Purchase of Plot

- Addition/Alteration of House

- Repair of House

- Lockout

- Withdrawal Prior to Retirement

Note number of years of service is the total number of years you have contributed to EPF. It can be with multiple employers with or without breaks. The amount of withdrawal is not required to be refunded under normal circumstances. If the amount is not utilized, the same should be refunded with penal interest of 2% per annum. The image below gives an overview of how much can one withdraw and when

Overview of EPF

The table below gives the rates of contribution of EPF, EPS, EDLI, Admin charges in India.

| Scheme Name | Employee contribution | Employer contribution |

| Employee provident fund | 12% | 3.67% |

| Employees’ Pension scheme | 0 | 8.33% |

| Employees Deposit linked insurance | 0 | 0.5% |

| EPF Administrative charges | 0 | 1.1% |

| EDLIS Administrative charges | 0 | 0.01% |

Should one withdraw from EPF?

EPF is meant for your retirement So, EPF Partial Withdrawals should be your last resort. In earlier Hindi movies people used to withdraw money from EPF for marriage of daughter . In movie Ferrari ki saawari (2012), where Sharman Joshi wants to apply to EPF who wants to send his son to a cricket coaching camp at Lords, London. Sharman’s boss informs him that the wheels of loans against Provident Fund grind correctly but exceedingly slowly.

What is the process of EPF Partial Withdrawal?

You can do EPF Partial Withdrawal Online and Offline.

For Online Partial Withdrawal one should have activated Universal Account Number (UAN) and linked Aadhaar.

Online EPF Withdrawal: How to do Full or Partial EPF Withdrawal Online explains how to withdraw from EPF online

Offline One has to submit Composite Withdrawl Form Form 31, called as EPF Withdrawal or EPF Advance Form, through the Employer along with documents. A fixed minimum balance in the account will be kept before arriving at the amount of advance admissible subject to the above conditions. In EPF’s Form 31, you need to provide your personal, PF account, salary and bank account details. Once the claim is processed, you will receive a direct credit to your bank account. Do note that only after your Employer verifies your partial withdrawal application the EPF office will process it. It would take a month to get the withdrawal amount.

EPF Partial Withdrawal For Marriage

- Under Para 68-k of the Scheme.

- Whose marriage: Self, son, daughter, brother, sister

- Eligibility : Should complete atleast 7 years of service.

- How often can one withdraw for same purpose : 3 times in the entire service

- Maximum Admissible Amount : 50% of Employee share at the time of tendering the application

Proof/ documents required : Marriage invitation card along with the application

EPF Partial Withdrawal For Education

- Under Para 68-k of the Scheme.

- Whose Education: self, son, daughter

- Eligibility: Should complete at least 7 years of service.

- How often can one withdraw for the same purpose: 3 times in the entire service

- Maximum Admissible Amount: 50% of Employee share at the time of tendering the application

Proof/ documents required: Bonafide Certificate duly indicating the fees payable from the educational institution

EPF Partial Withdrawal For Medical Treatment

- Under Para 68-j of the Scheme

- Whose Treatment:

- Self :

- Hospitalisation for 1 month or more

- major surgical operation in a hospital

- suffering from TB, leprosy, paralysis, cancer, mental derangement or heart ailment and having been granted leave by his employer for the treatment of said illness

- Family: spouse, son, daughter, dependent father, mother

- major surgical operation in a hospital and 1 month or more hospitalisation for the operation

- suffering from TB, leprosy, paralysis, cancer, mental derangement or heart ailment

- Self :

- Eligibility: No minimum service required.

- How often can one withdraw for same purpose : Whenever required for treatment

- Maximum Admissible Amount : 6 times of Wages OR Full of Employee share (whichever is less)

Proof/ documents required : Certificate from the doctor stating the hospitalization need. In case of any of the disease mentioned above certificate from specialist doctor.

EPF Partial Withdrawal For construction/ purchase of house/ flat

From Apr 2017, EPFO subscribers can withdraw up to 90 percent of their accumulations in their provident fund accounts for purchase/construction of houses or purchase of land.

To purchase a house under this new scheme, the subscriber has to be a member of a cooperative society or a society registered for housing purpose and such society should have at least ten members. The subscriber can also purchase the flat/house or land from the government or any agency under housing scheme or any promoter or builder.

The retirement fund body will make the payment for purchase of the property to the housing agency – not to the provident fund subscribers.

The new rules also provide that that monthly instalment towards home purchase can also be paid from provident fund deposits. The monthly instalments will be directly paid to to the government, housing agency, primary lending agency or the bank concerned.

If the member fails to get allotted a flat or in the event of the cancellation of an allotment, the amount so withdrawn has to be refunded in one lump sum within a period not exceeding fifteen days from the date of such cancellation or non-allotment.

- Under Para 68-B of the Scheme

- Whose House: self . Property should be in the name of self or spouse or jointly. It should not be a joint property owned by other than the spouse

- Eligibility: Should complete 3 (

5) Years of service. The rule applies to all those who together with their subscriber spouse have at least Rs. 20,000 in their accounts. - How often can one withdraw for same purpose : Only Once for either the construction or purchase of house or repayment of housing loan

Maximum Admissible Amount : 36 times of WagesProof/ documents required : Declaration in the Proforma obtained along with application signed by Member

EPF Partial Withdrawal Repayment of housing loan

- Under Para 68-BB of the Scheme

- Whose House: self . The property should be in the name of self or spouse or jointly. It should not be a joint property owned by other than the spouse

- Eligibility: Should complete 10 Years of service.

- How often can one withdraw for the same purpose : Only Once for either the construction or purchase of house or repayment of housing loan

- Maximum Admissible Amount: 36 times of Wages

Proof/ documents required: Declaration in the Proforma obtained along with application signed by Member

EPF Partial Withdrawal For the purchase of site/ plot

- Under Para 68-B of the Scheme

- Whose House: self. Property should be in the name of self or spouse or jointly. It should not be a joint property owned by other than the spouse

Eligibility: Should complete 5 Years ofservice .- How often can one withdraw for same purpose : Only Once for either the construction or purchase of house or plot or repayment of housing loan

Maximum Admissible Amount : 24 times of WagesProof/ documents required : Declaration in the Proforma obtained along with application signed by Member. Copy of the Purchase Agreement

EPF Partial Withdrawal For Addition/Alteration of the house

- Under Para 68-B(7) of the Scheme

- Whose House: Property should be in the name of self or spouse or jointly. It should not be a joint property owned by other than the spouse. Should have completed 5 Years after construction.

- Eligibility : Should complete 5 Years of service .

- How often can one withdraw for same purpose : Only Once for either the alteration or repair of the house

- Maximum Admissible Amount : 12 times of Wages

Proof/ documents required : Annexure III (construction / completion certificate/ utilisation certificate) should be submitted

EPF Partial Withdrawal For Repair of the house

- Under Para 68-B(7) of the Scheme

- Whose House: Property should be in the name of self or spouse or jointly. It should not be a joint property owned by other than the spouse. Should have completed 10 Years after construction

- Eligibility : Should complete 5 Years of service .

- How often can one withdraw for same purpose : Only Once for either the alteration or repair of the house

- Maximum Admissible Amount : 12 times of Wages

Proof/ documents required : Annexure XIII (construction completion certificate) should be submitted.

EPF Partial Withdrawal due to Lockout or closure of the establishment

If you are not getting wage for last two months and your company is locked out or closed for at least 15 days, you can take a loan from EPF.,if there is balance in employee contribution. If closure has been for more than 6 months, you can also use the employer’s contribution.

- Under Para 68-H of the Scheme

- Eligibility :

- No minimum service required.

- Should be closed for more than 15 days

- Wages for atleast 2 months is not paid

- How often can one withdraw for same purpose : Whenever need arises

- Maximum Admissible Amount : 12 times of Wages

Proof/ documents required : Declaration

EPF Partial Withdrawal prior to retirement

- Under Para 68-NN of the Scheme

- Eligibility :

- No minimum service required.

- Atleast 54 years of age

- 1 year before retirement

- How often can one withdraw for same purpose : Only once

- Maximum Admissible Amount : 90% of total of both employee and employer share

- Proof/ documents required : Certificate from the employer showing the date of retirement

EPF ADVANCE IN ABNORMAL CONDITIONS and Natural calamities

- Under Para 68 L of the Scheme

- Eligibility : Grant of advance in abnormal conditions, Natural calamities etc

- How often can one withdraw for same purpose : Whenever need arises

- Maximum Admissible Amount : Rs. 5000 or 50% of member’s own share of contribution (To apply within 4 months)

Proof/ documents required : Certificate of damage fromappropriateauthority. State Govt. declaration.

EPF ADVANCE TO MEMBERS WHO ARE PHYSICALLY HANDICAPPED

To Physically Handicapped member for purchase of an equipment required to minimize the hardship on account of handicap.

- Under Para 68 N of the Scheme

- Eligibility : Grant of advance in abnormal conditions, Natural calamities etc

- Maximum Admissible Amount : Basic wages+ Dearness allowance. For six months or own share of contribution with interest or cost of equipment which ever is least.

- Proof/ documents required : Production of medical certificate from a competent medical practitioner to the effect that he is physically handicapped

Online EPF Partial Withdrawal

You should have activated your Universal Account Number (UAN). You need to link the following with your UAN

i) Your mobile number, which is in working condition (should be the same as registered with your Aadhaar card)

ii) Bank Account details and the IFSC Code of the branch

Step 1 is to log on to the UAN portal and enter your details.

Step 2 is to check whether the KYC details seeded are correct and verified or not.

Step 3 is to select the claim PF Part withdrawal (loan / advance)

Forms for Partial Withdrawal from EPF

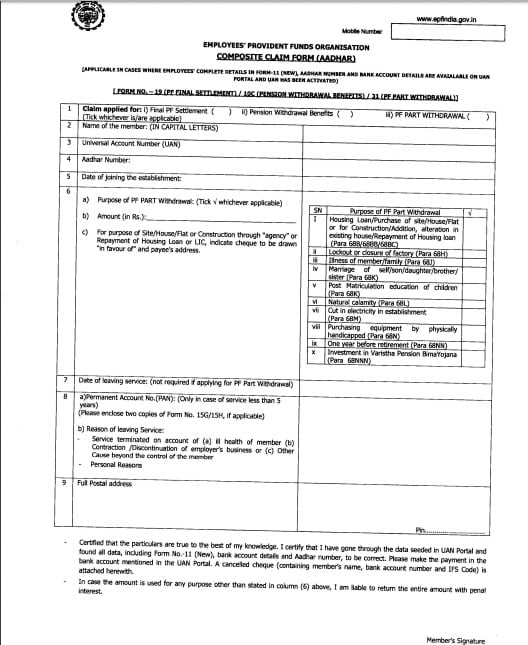

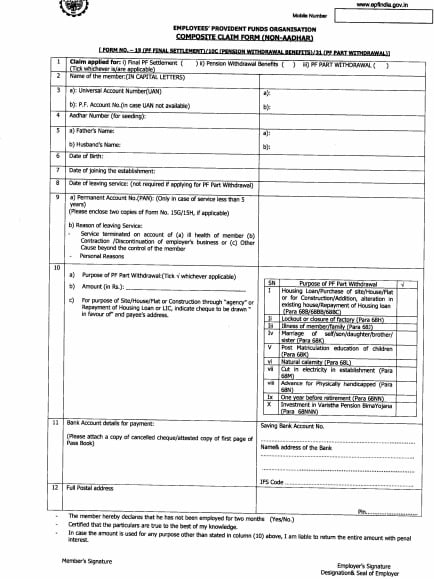

On 20 Feb 2017 EPFO(Employees’ Provident Fund Organisation) introduced Composite PF Claim Forms (Aadhar based and Non-Aadhar based) which replaces existing Forms No. 19, 10C, 31, 19 (UAN), 10C (UAN) and 31 (UAN). This is to simply the form for claiming the partial and full withdrawal from the EPF.

So one cannot use old Form 31 and Form 31 Declaration.

There are two versions of the composite form Aadhar based form and Non-Aadhar based Forms. You can either download them from EPF site or from below.

New Aadhaar based Composite EPF Withdrawal form ,

New Non Aadhaar based Composite EPF Withdrawal form ,

Sample Aadhar based form for EPF Withdrawal is shown below

Sample Non-Aadhar based form for EPF Withdrawal is shown below

if you are taking advance for the following purpose, you no longer need to attach a declaration form with the application. Infact you don’t need at attach any document.

- Flat or plot purchase

- House construction

- Alteration or addition

- Repair of the house

In case the advance is for purchase of site/house/flat or construction through Agency or repayment of Housing Loan then indicate the name in whose favour the payment has to be made.

No Revenue stamp (Re. 1) is required to be affixed by the member

The employer will process your application after the verification. The employer should send the application the regional PF office. You should get the advance within a month.

Reference: EPFO Chennai’s webpage on advance and withdrawal , EPF rule book, read Section 68

All About EPF,EPS,EDLIS, Employee Provident Fund

Related Articles:

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Withdrawal or Transfer of Employee Provident Fund

- EPF Private Trust, the Exempted EPF Fund

- Tax on EPF withdrawal

- Transfer EPF account online : OTCP

- How much EPS Pension will you get with EPS Pension Calculator

- How EPFO Manages Money, EPFO invesment in Stock Market

Have you withdrawn from EPF? How was the process? Did you claim your EPF between jobs? Do you consider EPF should be untouched for retirement?

100 responses to “EPF Partial Withdrawal or Advance: Process, Form, How much”

Hi i have applied for pf advance form under illness code on 2nd march, it has been 24 days passed but still status is under process. What to do, im in urgency?

I have applied for advance PF for illness it shows payment will transfer via cheque. just want to know cheque will receive at my residential address or to my employer address.

I have been applied for partial amount claim by form 31 on 7 february 2019 and today its 20 of february but my amount my online claim status still shows claim under process. I need to know exact how much time it requires to amount get credited in my account

Hi,

I work with Genpact and I recently applied online for PF advance. Since 1 year i have applied for the same reason 3 times 15k each as my mother (widow & dependent on me) has been hospitalized the same number of times. This time when I applied online it said maximum number of online claims exceeded. I applied offline by composite form (aadhar) to krpuram office, bangalore on 31st Jan’2019. How much does it takes for money to be credited in my account. All KYC details are verified on UAN portal/EPFO. Also, can I check the status online or will I get any sms/email from the pf office regarding the status.

requested for 17k this time and employee contribution per month is 2836/-.

Thanks in advance

I have been applied for partial amount claim by form 31 on 20th January 2019 and today its 31st of January but my amount my online claim status still shows claim under process. I need to know exact how much time it requires to amount get credited in my account.

Within 2 days to 20 days depending on Regional EPFO, holidays etc.

Sir gi mera pf form under process hai 17 days ho gaiye mere ko form ko bhare hiye

Tell me solution please

I have applied online for PF advance form 31 but i haven’t received amount after 9 days,although the claim status is showing as “Claim settled”.

Hi when i m trying to submit the online withdrawal form it showing as your maximum no of online withdrawals has been exceeded plz submit physically what does tht how many times can I withdraw through online in a month or year ??

How many times have you applied before and for what purpose?

hi sir on my profile my pan details are shown as (—) what does it means. & i have applied for kyc of pan but my employer doesn’t seen my request of approval ,what does it means ?

My query is regarding partial repayment of home loan :

I am applying online for advance PF withdrawal for repayment of home loan. In the drop down potion “purpose for which advance is required ” no option is coming for repayment of home loan. Is it advisable to withdraw PF for repayment of home loan under option “Construction of house “. If not then how it can be done online . I have completed 10 years of service and is eligible for this facility .

Hi I have applied for Advance for illness. I had submitted the Claim Form on September 5, 2018 and the portal shows that it was sent to the field office the same day. My claim request also matched the pre-requisite of 6 Months’ wages (as per the current basic Salary) or Employee contribution, whichever is less.

However it is still showing ‘ Under Process ‘ a/o 19 September. A few people around me have told me that it gets processed within a week. Can you please guide, as to how much more time could it take?

Did you received the money?

when i apply for pf advance then show maximum number is exceed please apply for physical mode . how to apply physical mode , which form i use? and where i apply ? Indian post office is right place to submit document ?

Sir. N the month of June I applied for epf advance for construction of house and amount was credited accordingly. Now l would like to apply for a new claim under natural calamities for to repair my house which was damaged in flood in kerala. So please confirm my claim will be approved or not.

Sad to hear about Kerela floods. Our best wishes to you.

Typically for the house, one can take advance Only Once for either the construction or purchase of house or repayment of housing loan.

But no harm in raising the request.

You do understand that you are taking from your retirement.

To rebuild houses there would be some Govt funds, lookout for those.

state Chief Minister Pinarayi Vijayan had requested a $1.4bn loan from Prime Minister Narendra Modi’s government to finance reconstruction efforts.

Officials at National Disaster Management Authority (NDMA) overlooking rescue operations in Kerala say that the state – on its road to recovery – will now move forth with 3R approach: Rescue, Recoup and Rehabilitation.

The NDMA will launch recoup mode by helping people reclaim their houses, disposing waste, carcasses, cleaning houses, using bleaching powder and ensuring chlorination of water in another week as a primary measure.

Kerala will be in recoup mode for roughly a month, after which the rehabilitation will be carried out in full swing

Hi when i m trying to submit the online withdrawal form it showing as your maximum no of online withdrawals has been exceeded plz submit physically what does tht how many times can I withdraw through online in a month or year ??

I have raised a PF-Advance claim request online from epfo account. Amount is greater than 50,000. But I want to cancel it as it is not needed anymore. I cant find any way to cancel it.I want to avoid TDS and tax on this PF withdraw

Also if it is not at all possible to cancel the request then anybody know how to return back the amount received to EPF account after processing the request and claim the TDS refund.

Or if there is any other possible suggestion on this. Please help.

There is no TDS on Advance of EPF withdrawal.

Advance is for special purposes as mentioned in the article.

For which purpose did you raise EPF advance?

You can raise EPF grievance and cancel your request for advance.

Our article How to register EPF complaint at EPF Grievance website online explains in detail.

I have raised the claim on 24th July…And My claim has been deducted in my total amount who have showing in my epfo passbook….But I have check my claim status which is showing status not available, then Please suggest what is the matter…….When My payment has been deposited in my account..

Hi ,

I have completed 7 years in an organisation and on 23 of July 2018 i have applied for PF Partial withdrawal with reason code illness. i have employee share of 330000 in my account so please guide me how much i might get ? and if i get lesser amount than my expectation , can i reapply for it with same reason ? please help me.

Hope you get well soon.

For medical Maximum Amount you can withdraw is 6 times of Wages OR Full of Employee share (whichever is less)

Hi I have raised claim for Advance pf for dtd on 10th July today is 23rd July normally I have seen claimed settle in 12 to 13 days but till the time it shown under process

Pls suggest how much time it will take

Well, it is usually fast.

Wait for 2-3 more days.

Typically one can get claim from 4 – 20 days if submitted online.

If you don’t get the payment you can raise the complaint against EPF.

Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

hi i applied for partial pf withdrawl under natural calamity option for 25k advance amount…..in my pf account employee share is 39 k and employer share is 12 k ..is this elgible for processing if it is eligible in how many days amount will credit into my account

Partial withdrawal is always from employee share.

As you have already applied please wait for the response.

If you have applied online it takes 5-20 days

If you have applied offline it takes longer.

Hi

I applied for Partial withdraw of PF on 27/06/2018 and got a message stating that the PF is under process on 03/07/2018 and can you let me know how long will it take to get the money credited to my account .

Note: I tried to update the AADHAR and Pancard online using the UAN login but it does not allow me to do so. I often get an error Msg “Gender does not match and name does not match”.

Please advise. Thank you !!!!!

Typically you get the money 2-3 days after the message.

Please verify if the account number is correct in UAN.

Else you would have to go for reauthorization.

Regarding Gender mismatch. Please submit request to EPFO through your employer.

Hi

I have applied of partial withdraw in EPFO portal but now the claim was rejected because of Non Availability of ESI facility to be declared.,next what can I do for withdraw the partial amount

The reason is strange.

You can file a complaint against EPFO to understand the reason. Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

You can also visit your Regional EPFO office and submit the form for partial withdrawal.

Dear ma’am /sir,

I gaurav sherwal ,I have applied for partial withdrawn of provident fund on 17/06/2018,yet i did not receive money in my bank account ,it’s showing still under process,I’ve been trying to your contact number since last day but it always gets busy and never being connected ,I’d like to request you please tell me how much time will take to credit money in my bank account.

Can form 31 be used for part withdrawal of PF from exempted trust.

My PF with my current employer is under and exempted trust.

can i withdraw PF using form 31.

For exempted trust, you have to contact your employer only.

I had applied for EPF Advance 31 on May 25, it’s been 30 days, still it shows “Under process.”

What to do?

Raise EPF complaint and if no response after 7 days follow it up on social media channels of EPFO.

Our article How to register EPF complaint at EPF Grievance website online talks about how to raise complaint.

Hi,

I wan to go for advance PF withdrawal with form-31 for illness. My employee share is 15809 Rs & employer share is 4831 Rs. How much amount I can apply for withdrawal. Can I able to withdraw employer share too via form 31. Please guide. Thanks in advance.

Sad to know about sickness.

For sickness you can withdraw 6 times of Wages OR Full of Employee share (whichever is less)

No you cannot withdraw Employer share.

You can submit application online or offline.

hi,

i had applied for the PF advance on 11/06/2018 in UAN portal it shows claim settled state but i didn’t received any amount. kindly tell me what is the issue

Wait for a day or 2 and you will get

Explained in detail in our article After EPF Withdrawal : Claim Status, How Many Days To Get PF Amount

Hi i have applied 90000 PF advance for Medicals and online submitted and i would like to know how long it will take to receive fund and how will i know if the form is accepted

It would take around 2-10 days.

You can track your EPF Claim submitted online by clicking on Online Services -> Track Claim Status.

I recently changed my company and I can see new PF got added under my service history. I am yet to transfer funds to new company .

I already exhausted my employee share via multiple claims for different reasons. Now I want to withdraw Employer share + Pension contribution. Can it be done via filling by filling form 15G and submitting all the required documents physically ?

Hi,

I have applied PF advance 2 weeks back for illness, and i got the amount with in 6 working days. Now the thing is in my PF account still 64,000/- INR is available that is from employee side 20,000 and Employer side 40,000 INR. now can i apply one more time PF advance. Because for it is emergency. Can you please suggest me.

Sad to hear about the illness.

Best wishes for speedy recovery.

One can withdraw Whenever required for treatment

Maximum Admissible Amount : 6 times of Wages OR Full of Employee share (whichever is less)

So please do apply.

How 6 times of Wages can be calculated?

Hi,

I applied for a partial EPFO withdrawal for illness. My claim has been rejected stating “YOU ARE ESI MEMBER OR NOT IF YOU ARE ESI MEMBER THEN YOU ARE NOT ELIGIBLE FOR ADVANCE U/P-68J./OK”. What do I need to do now to avoid repeated rejection before I submit a new claim?

If you are of a member of EPF then you cannot be a member of ESI

Please raise a grievance. Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

Hi applied to pf last month to 24th online but i did not receive the amount. how many days to take

It takes from 2 days to 30 days to get the amount.

Please check the status. Did you do partial withdrawal?

Hi, I have applied online for PF advance on 3rd May, 2018 for Construction of House (Actually, I bought a flat and have to settle some dues.) My PF balance is 6 lakhs when I applied for advance. Will my claim get processed and how much percent can I expect.

I have transferred 3 lakhs from my previous organization where I worked for 3.5 years (DOJ is May 2012 )to current organisation where Im working for 2.5 years. so, its more than 5 years. Is form 31 ok or should I apply offline for speedy process. One of my friend working in PF organisation is telling that online process takes time and also I may not get complete amount as advance as my reason is “construction of house” and asking to submit CCF form offline so that he can try to expedite and also get full amount.

Does it really make any difference? As I have already applied online and status is “In process” , bit confused now.

I have submitted claim for withdrawal for education but received very less amount and that too only as per current pf amount whereas i have already transfered my earlier pf amount to current account and i have completed total 8 years of service.

Need more details such as UAN passbook which shows the transfer.

You can mail them to bemoneyaware@gmail.com

Hi I would like to know that i am trying to apply for partial withdrawal of PF online through Uan portal but its not letting me .its showing that maximun number of online claim submission has exceeded .is there any limit and for construction of house many times can i apply?

HI,

If i do partial withdrawal from my EPF account for construction of the house/ purchase of plot so 90 % of the money will be credited to the builder/ operative societies account or in my bank account?

Please advise

Thanks

I am applied claim form31 advance withdrawal for house construction on 22.03.2018. Im Woking in my company since 6.5 years, how many to take time for amount credited to bank account.

Required amount-Rs.150000

Basic salary Rs.17500

Has the claim been approved?

It takes 7 days to 31 days to get the money in the account.

I have nothing left in my employee share but I am still working and wants to do pf advance withdrawal for illness will I get anything from employer share

No.

The maximum amount you can withdraw from EPF for illness is LESSER of-6 times of your salary (Basic+DA) OR full employee share.

You can ask your employer for a loan

i have applied for advance PF for illness it shows payment will transfer via cheque. just want to know cheque will receive at my residential address or to my employer address.

Did you apply online/offline?

Typically now EPFO does NEFT transfer

Since the amount is greater than 10 lacs, I am trying to apply online for PF withdrawal, but in the drop-down it only shows the option “Advance in PF”. My question:

a. Why is the option “PF withdrawal” not shown?

b. How long does it take to get the amount?

I was applying for pf form 31advance online after leaving my job. And my claim was done. But now i apply for PF 19 final settlement but its was not process. Why?

Sorry didn’t understand the question properly

Just check if the Date of Leaving in your old job is available.

You can only apply for PF settlement 2 months after the date of leaving (DOE) in EPF is available in View->Service History

Can you send the snapshot to our email id bemoneyaware@gmail.com

Hi,

I have claimed through EPFO online under Form-31 foe illness. How long will EPFO take to credit the amount.

my basic pay is 10200 for illness it is said that I can claim 6months/total contribution which ever is least I now work in IT’s for 2.5 years I claimed for 48000rs is it expected amount?

Kindly advise me

Should be credited with 7 days to 30 days

Best wishes for the speedy recovery.

An employee can withdraw up to 6 months of his basic and DA or employee share along with the interest, whichever is least for treatment of his/her own illness or treatment of family members. No specific membership period is required for this purpose.

Check your passbook as to the amount you contributed in the last 6 months.

If you could inform us how much you got it would help other readers

I have already claimed for form 31 for my medical reason, after that can I apply for the final settlement means for form 19…???

Yes if you leave the company you can withdraw your EPF.

EPF is for retirement. If you are going to join another company we will recommend you transferring your EPF.

Hi

I have joined new company ,I applied for of advance but got only new company employer fund.how much time one can apply for of advance and how frequently.do I need to transfer old company pf to new account in order to get total employer fund contribution.

Depends on the purpose of Advance.

3 times in the entire service for Marriage, Education of self & family members.

But for medical it can be for any purpose.

You should transfer your old PF account to new account

How many time we can withdraw PF for medical reason.

Actually I withdraw pf 2 week before that time my previous employer pf was not transfer on current account, but after transfer I again apply online for medical withdraw but it is “Rejected”.

One can claim partial withdrawal multiple times (no limit) for Medical purposes

I have submitted my Pf claim on 23 nov2017 still it is not processing

Did you submit online or through a Form?

Hi, I have claimed for advance of withdrawal online. Is this there anything else I need to do? Do I also need to go of office with any additional documents? As I have not receive any info not even a message. Please advise. I submitted the application on 3rd Dec. I think I should receive a message as well as my phone number is updated in pf site.

No you don’t need to do anything. You should get money within 3 weeks.

Check your status after logging in to UAN site.

Hi, Actually i worked in a company for 18-20 months and resigned in August 2016. Now I want to get my whole pf amount through online claim(without going to my previous office). One thing is that all my KYC details are updated in online UAN portal except my pancard,but i came to know that if our amount is less than 30,000/-, then there is no need of pancard, is it right? (My pf is less than 30,000/-).One more thing is when I try to claim my amount it is showing only ‘pf advance’ option not the ‘pf withdrawal’. Is there any difference between these two? What should I do to get my whole pf amount?.

Thanks in advance.

hi same heppen to me i have submitted claim form on 13th nov2017 status is showing money transfer via NEFT but not received in my account.i have check kyc all detail correct.

also my bank acount and ifsc code given and correct.

i have submit claim thru UMANG APP with form 31

Wait for a 2 more days. Typically message comes faster than the amount.

Let us know when you get the money.

Hi ,

I have claim for PF advance option and its showing claim settled in UAN portal but still not received money in my account.

could please let me know how much time it will take to process as per system and my Epassbook money and claim has been deducted from my account .

Date of submission -24 /October /2017

Thanks

Check the bank account mentioned in your UAN portal. Money will only come to that bank account.

Money gets deposited within 2 weeks of filing claim.

Generally, message comes earlier than the money. Wait for a day or 2 and then if you haven’t got the money you can raise a grievance.

hi same heppen to me i have submitted claim form on 13th nov2017 status is showing money transfer but not received in my account.i have check kyc all detail correct.

Plz tell is your amount credit?

hii,

please let me know how many days will be taken to process partial PF withdrawal and credit to account?

Is the form 31 is still applicable whereas a composite form has been introduced by EPFO for withdrawing the amount?

Suman you are right. As the composite form has been introduced. Form 31 is no longer useful.

We will update the article soon.

[…] partially. If you’ve worked for over ten years then you are liable for pension. Our article EPF Partial Withdrawal or Advance discusses it in […]

Dear Sir,

I have applied for partial withdrawal of my PF, I am with this company for last 6 years. will the withdrawn amount will be taxable under income tax? Pls guide

i have withdrawn partial amount from my provient fund on jan 2016 will it effect my pension scheme

I have a query about PF advance for FLAT purchase.

I understood that I have to apply for the same through my employer. We have done the registration of the flat however the sales deed is to be done yet.What happens if the amount crediting into my bank account happens after I have completely paid the full amount to the builder? Since the builder will not wait and the PF advance might get delayed, I might be forced to take a loan from relatives and friends and pay off my builder. In this case, can I use my PF advance which has come after I pay off the builder to repay the loan taken from friends/relatives ?

After receiving the advance, are we supposed to show any proof that I have used the money to pay off my builder only ?

Also could you tel is the advance given of employee share only or given on the total amount available in my account. Is it full amount or some percent of the contribution.

Kindly advice.

how account numbers are alloted for new employee joining organisation for

epf and eps ? what is the procedure of deposit of epf contribution and eps

contribution

Please check my maturity amount with intrest my pf no. Is 11570/749 in delhi

I am planning to make a partial withdrawal from EPF for purchase of flat. I have completed 10 years of service. How much can I withdraw? 36 times “salary” is mentioned in instructions here – http://www.epfopune.gov.in/advances.html. However, want to clarify if there has been a change in withdrawal rules pertaining to employer, employee contribution and interest.

No there have been no changes

Thanks! I was worried about EPFO retaining employer’s contribution for true pension. There were some articles published which suggested that this change was being implemented from 01-Aug-2016. Seems like that has not been implemented or deferred – works for me which ever way. Thanks again.

Your blog is very useful. Please keep posting more.

I have a query about PF advance for FLAT purchase.

I understood that I have to apply for the same through my employer before the registration of the flat. What happens if the amount crediting into my bank account happens after I have completely paid the full amount to the seller/builder ? Because the builder wont wait and the PF advance might get delayed, I might be forced to take a loan from relatives/friends etc. and pay off my builder. In this scenario, can I use my PF advance which has come after I pay off the builder to repay the loan taken from friends/relatives ? or use it for House interiors ?

After receiving the advance, are we supposed to show any proof that I have used the money to pay off my builder only ?

Can you throw some light on this, please ?

Dear bemoneyaware,

I have following questions related to advance withdrawal for purchasing home

1. Basic means monthly or yearl?

2. It’s average basic or latest basic?

3. What means of Dearness allowance?

4. From where to initiate the withdrawal procedure, my office finance dept or EPF office?

1. Form 31 the form for withdrawal asks for Monthly wages.

2. As no definition is given latest Basic would be used.

3. Dearness Allowanceis allowance is paid to the employee against the price rise in country economy i.e to mitigate the impact of inflation.In India the Dearness Allowance (DA) is a cost of living adjustment allowance paid to Government employees, Public sector employees (PSU) and pensioners . Our article Salary,Allowances,Dearness Allowance,Government Salary, Pay Commission discusses it in detail

4. Initiate request through your office Finance Dept.

One has to submit Form 31,called as EPF Withdrawal or EPF Advance Form , through the Employer along with documents. A fixed minimum balance in the account will be kept before arriving at the amount of advance admissible subject to the above conditions. In EPF’s Form 31, you need to provide your personal, PF account, salary and bank account details. Once the claim is processed, you will receive direct credit to your bank account. Do note that only after your Employer verifies your partial withdrawal application the EPF office will process it.

Hello,

I found your blog while looking for finance-related bloggers and found it extremely relevant. I wanted to know if you’re willing to accept free content in the form of guest Blog Posting. I am associated to Paisabazaar.com and the content I have is the work of financial experts from Paisabazaar.com team. They are more than happy to offer you extremely high quality content of your niche for free with 1 or 2 links back to their website.

Let us know your opinion!

Hi,

When you mention wages are you referring to Basic salary (which is considered for PF calculation every month) or the take home salary or gross monthly salary?

Thanks,

Praveen

Wages here mean Basic + Dearness Allowance not your Take Home salary