The Supreme Court ruled that special allowance must be included in basic pay for calculation of provident fund (PF) deduction from employees and the company on 28 Feb 2019. What was the case of EPF vs Companies on basic pay and Special Allowances? What is the basic pay? How does this judgement affect an employee who contributes to EPF?

Table of Contents

Judgement of the Supreme Court on Basic Pay and Special Allowance

A bench of Justices Arun Mishra and Naveen Sinha dismissed appeals filed by many companies, such as SURYA ROSHNI LTD, Saint Gobin, from 2011-2013, questioning the Provident Fund Commissioner’s decision to club basic pay with special allowances for deduction of PF and matching contribution by employers. The list of cases is here and judgement here.

The case of artificially lowering basic wages, which is the basis for computation of EPF contributions, was pleaded by the EPFO in the apex court.

The question placed before the bench for adjudication was whether special allowances paid by a company to its employees will fall within the expression ‘basic wages’ under Section 2(b)(ii) read with Section 6 of the PF Act for computation of deduction towards PF.

What is Basic Pay?

An employee contributes 12% of his basic salary to EPF along with a matching contribution from his employer.

As per Section 2(b) of PF act, basic wage refers to all emoluments given to an employee excluding the following:

- 1) Dearness allowance, house rent allowance, overtime, bonus, commission on business sourcing or any other allowance

- 2) Cash value of food coupon

- 3) Any present made by the establishment

Section 6 of the EPF Act talks about contribution and matters which may be provided for in the scheme. It also states that contribution shall be paid by the employer to the fund at 10% (or 12%) of basic wages, DA and retaining allowances, (if any). The original scheme provided for contribution on the basic wages alone. However, by Amendment Act 46 of 1960, DA and retaining allowance were included for the purpose of Payment of Contribution

What are the components of Salary, How is take home salary calculated? What are different kinds of allowances, what is Dearness allowance, What is the salary of a Government employee, what is 7th pay commission? This article, Salary, Allowances, tries to answer these questions

One can personally increase his own contribution(employee part) by opting for the Voluntary Provident Fund or VPF. Our article Voluntary Provident Fund, Difference between VPF, EPF and PPF

Is Special Allowance part of Basic Pay?

The court ruled that the “allowances in question were essentially a part of the basic wage camouflaged as part of an allowance so as to avoid deduction and contribution accordingly to the provident fund account of the employees” and dismissed the appeals.

“Conversely, for the same reason the appeal preferred by the Regional Provident Fund Commissioner deserves to be allowed,” it added.

The apex court noted that basic wages included Dearness Allowance for the purposes of PF calculation.

Appealing establishments did not submit any proof to demonstrate that the special allowances being given to their employees “were either variable or linked to any incentive for production” with visible results. “In order that the amount goes beyond the basic wages, it has to be shown that the workman concerned had become eligible to get this extra amount beyond the normal work he was otherwise required to put in,” read the order.

The court ruling could also result in a higher outgo in case of foreigners working in India.

Following the judgement, the EPFO will take stringent action against firms which would not factor in the special allowance for computation of EPF contributions. The body is studying the judgement and would soon come out with a detailed plan to implement the judgement.

Note that New EPF members enrolled on or after September 1, 2014, and having a salary of more than INR 15,000 month at the time of joining, will not become members of the EPS. Accordingly, the entire contribution of 24% (from the employee and employer) will go to the provident fund account of the employee. Our article Basic Salary More than 15000,EPS Contribution,Rejection of Transfer or EPF Claim explains it in detail

What this means for those contributing to EPF

Following the Supreme court judgement, if special allowance is considered as a part of basic pay, the take-home salary of the employee will be reduced by 24% of special allowance (12% as employee’s contribution and 12% as employer’s contribution).

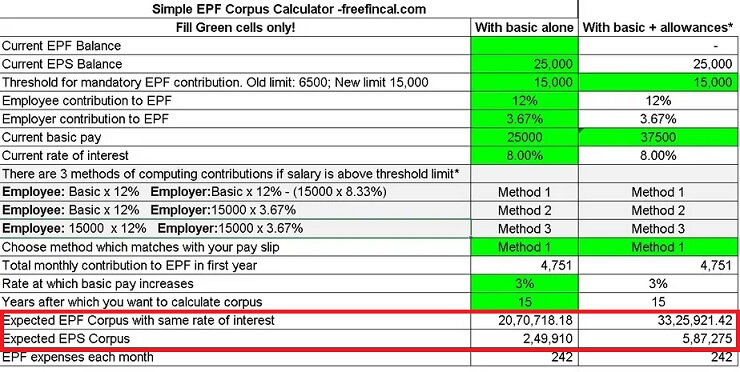

This will help you help built a big retirement corpus, but it would mean a lower take-home salary which might affect your current lifestyle. FreeFinCal has come up with an Excel sheet where you can do this comparison, you can download from here.

Let’s take an example. Consider a simple case where the basic is Rs. 10,000 and basics + allowance is 25% higher than the basic or Rs. 12,500. Assuming a constant interest rate of 8%, all other rules being the same, we get the following EPF corpus after 15 years:

EPF corpus with only basic = 12% of basic (employee contribution) + 3.67% of basic (employer contribution) = Rs. 6.56 lakh

EPF corpus with basic + allowance = 12% of basic + allowance (employee contribution) + 3.67% of basic + allowance (employer contribution) = Rs. 8.41 lakh. That is 28% higher.

In another example, if we compare the basic of Rs. 25,000 (above the threshold of Rs. 15000, meaning no EPS contribution for those joining after 2014) and a basic + allowance of Rs. 37,500 (50% higher). The PF contribution will be 60% higher but it would reduce the take-home pay.

EPF corpus with only basic used for contribution = Rs. 20.71 lakh.

EPF corpus basic + allowances used for contribution = Rs. 33.26 lakh (or 60.6% higher!).

What does EPFO say?

The case of artificially lowering basic wages which become the basis for computation of EPF contributions was pleaded by the EPFO in the apex court.

This is a long pending issue. In fact, the EPFO’s apex decision making body Central Board of Trustees had constituted a committee to give a detailed report and suggestions to deal with the splitting of wages by employers for reducing EPF liability.

The EPFO conducted a study and found out that a large number of firms were splitting their employees pay packages into numerous allowance to reduce their EPF liability convincing their workers that this would result in higher taken home pay.

The committee had given its recommendation to deal with the issue. But in the meantime, the matter went to court and recommendations given by the panel to include various allowance into basic wage could not be implemented.

Cases for EPF and Special Allowance by Supreme Court

| Year | CIVIL APPEAL NO(s) | APPELLANT(S) | RESPONDENT(S) |

| 2011 | 6221 | THE REGIONAL PROVIDENT FUND COMMISSIONER (II) WEST BENGAL | VIVEKANANDA VIDYAMANDIR AND OTHERS |

| 2013 | 39653966 | SURYA ROSHNI LTD | EMPLOYEES PROVIDENT FUND AND OTHERS |

| 2013 | 39693970 | UFLEX LTD | EMPLOYEES PROVIDENT FUND AND ANOTHER |

| 2013 | 39673968 | MONTAGE ENTERPRSES PVT. LTD. | EMPLOYEES PROVIDENT FUND AND ANOTHER |

| 2019(2013) | TRANSFER CASE (C) NO(s).19

(arising out of T.P.(C)No. 1273 OF 2013 |

THE MANAGEMENT OF SAINTGOBAIN GLASS INDIA LTD(PETITIONER) |

THE REGIONAL PROVIDENT FUND COMMISSIONER, EMPLOYEES’ PROVIDENT FUND ORGANISATION |

Related Articles:

- After EPF Withdrawal : Claim Status, How Many Days To Get PF Amount

- Basic Salary More than 15000,EPS Contribution,Rejection of Transfer or EPF Claim

- Voluntary Provident Fund, Difference between VPF, EPF and PPF

- How to Transfer EPF Online on changing jobs

- How to register EPF complaint at EPF Grievance website online

What will happen next is to be watched. Many companies are still deducting EPS for those who joined after 2014 Sep and have basic above 15,000. Will companies change their policies? If yes, how long before our EPF contribution increases? Do you think it would be good if our EPF contribution is increased?

7 responses to “EPF Basic Pay, Special Allowance, Supreme court”

any notification passed by PF department regarding the same?

No, not till now

Sir,

What is Gross wages for EPF, does it includes all emolument paid to employee during the ECR month ( ie ) our salary structure comprises Baisc+da,HRA and Special allowance, Meal voucher and Overtime wages and shift allowance for night shift employees

It is very good for all employees. When this order was implemented for employees. Is it start from April, 2019 or it may take time for implementation. Please inform

Informative post.

If the salary package is CTC then it is a setback to the employee. The increased contribution amount will be paid from employee’s packet and he will get less take home money. yes if it is not CTC then employee will get benefited.

Unfair for low waged salaries where deducted take home will affect purchasing power for necessities