The New Pension Scheme or NPS is a social security scheme introduced by the government, aimed at providing a steady stream of income post retirement. While the scheme has been around since 2009 opening the account involved going to the bank. Since Sep 2015 it is possible to open this account online using the e-NPS system if you have Permanent Account Number (PAN) and a Bank account with any of the registered Point of Presence empanelled for KYC verification . This article gives an overview of NPS and explains how to open NPS account online and contribute to NPS account online.

Try firefox browser for opening the eNPS account, if you have problem in uploading images

Table of Contents

How to Open eNPS account online overview

Till Dec 2016 an NPS account could be opened online via eNPS portal but the printout of the application submitted online had to be sent to the PFRDA’s Central Recordkeeping Agency

(CRA) to open the account. The Pension Fund Regulatory and Development Authority (PFRDA) has issued a circular dated December 15th, 2016 directing that in the case of NPS accounts being opened online on the basis of Aadhar verification followed by esignature, a physical printout of the application need not be sent.

There are two ways to open an NPS account. One method has now been made totally online and the other method is partially online and partially physical. The completely online process is based on Aadhar verification which is possible provided your mobile number is linked to Aadhar card. The steps in this fully online process are:

- Click on the Registration and select ‘register with Aadhar’ Option.

- Enter the Aadhar Number and click on “Generate OTP” option

- The OTP will be sent to your registered mobile number linked to Aadhar Card.

- Enter the OTP number and fill in your personal details, Nomination details, bank details.

- On the ‘Photograph and Signature’ tab, your photograph will be shown same as on the Aadhar card. Upload your signature in the ‘jpeg’ format.

- Click on the ‘esignature’ option. Once again the OTP will be generated and sent to your mobile number.

- Enter the OTP to verify your signature and make payment.

Once the application is successfully submitted, your PRAN will be allotted instantly

Note: If you are facing error of “Document Uploaded () are not in Proper File Format”. ONLY upload images not Pdf

How does NPS work?

Investors contribute amount towards their New Pension Scheme or NPS account. This contribution is in turn invested in avenues as per investor choice and risk profile. Upon retirement, a part of the corpus could be withdrawn as lump sum, and the balance will be paid out as pension annuity. The Government of India (GOI) rolled out the NPS for all citizens of India from May 1, 2009 and Corporate sector from December, 2011. Our article Understanding National Pension Scheme – NPS explains it in detail.

The NPS is regulated by the Pension Fund Regulatory Development Authority (PFRDA). Designated Pension Fund Managers (PFMs) have been appointed who are responsible for investing the funds and generating returns from them. An investor has the liberty to choose or change their fund manager.

Note: State Bank Of India (SBI) allows one to contribute to NPS through internet banking.

What are the Tier 1 , Tier 2 accounts of NPS?

There are two NPS account options available for investors.

- Tier 1 NPS account: This is a mandatory non-withdraw able pension account. Money would be available on maturity only, i.e., at 60 years.

- Tier 2 NPS account: A voluntary withdrawable account, it lets you withdraw money at any time. However this option will not have any government contribution. Also, it is mandatory to have a Tier 1 account in order to open a Tier 2 account. Our article NPS Tier 2 or Tier II Account: Performance,How to open,Withdraw explains it in detail.

Our article Returns of NPS, shows the returns of NPS

What are tax benefits of NPS?

Tax benefit to employee: Individuals who are employed and contributing to NPS would enjoy tax benefits on their own contributions as well as their employer’s contribution as follows:

- Employee’s own contribution : Eligible for tax deduction up to 10% of Salary (Basic + DA) under Section 80 CCD(1) within the overall ceiling of Rs. 1.5 lakh under Sec 80 CCE.

- Employer’s contribution : The employee is eligible for tax deduction up to 10% of Salary (Basic + DA) contributed by employer under Sec 80 CCC(2) over and above the limit of Rs. 1.5 lakh provided under Sec 80 CCE.

- From financial year 15-16, there is an additional tax exemption of Rs 50,000 for investing in NPS. For someone in the 30 per cent tax bracket, this is a clear benefit of Rs 15,000 over and above the Rs 1.5 lakh allowed under Section 80 C.

Comparing NPS with other tax saving options

It could also give NPS the much-desired push. Since its launch in May 2009, NPS has been at a disadvantage with respect to other competing savings schemes such as the Employees’ Provident Fund (EPF) and Public Provident Fund (PPF) because of the tax treatment of the final maturity corpus. Public provident fund (PPF) is long-term retirement saving product on which there is clear tax benefit available at time of saving and at time of maturity. For equity mutual funds, while you might not get a tax benefit at the time of investing in , there is no tax on the returns if you stay invested for one year.

At present, NPS and pension plans offer tax deferment, rather than tax savings. While you get tax exemption at the time of investing, you are taxed on maturity. Our articles Should you Invest in NPS the National Pension Scheme for additional 50,000 and save tax, Saving For Retirement : Pension Plans,NPS,EPF,PPF cover in detail about tax saving options.

How to open NPS account done offline?

Before eNPs one could open NPS account manually or online through through CAMS on internet or through ICICIDirect. For manually one had to visit the nearest POP division.For a complete lists of the POP and branches, you can checkout http://pfrda.org.in/writereaddata/linkimages/POP-SP_Location0502115605373405.xls

Now eNPS has been introduced. Now you can register the NPS account online through eNPS. You can also pay online your NPS contribution , even though you have opened account manually.

Transfer to NPS online if you have opened through SBI or State Bank of India account.

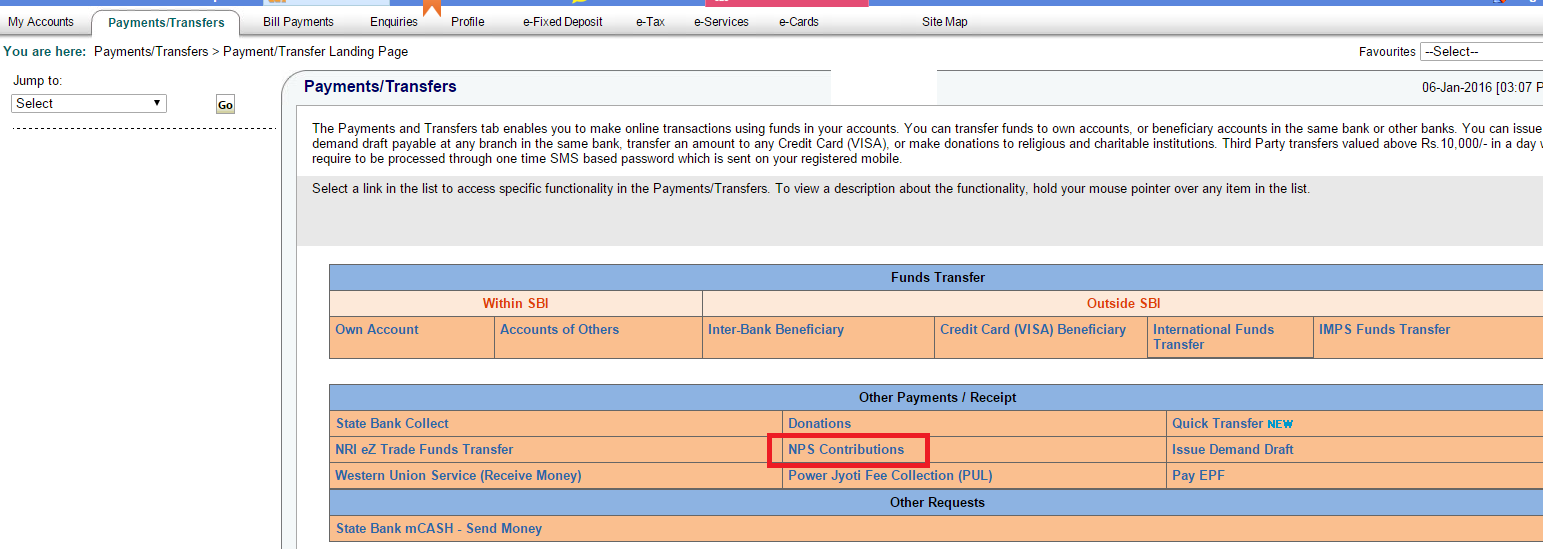

If you have account in State Bank of India and open NPS account also in SBI then you can link your NPS account to internet banking and transfer money to NPS online. You need to go to Payment/Transfer tab and select NPS Contributions. Register your account and then transfer.

How to open new NPS account online through e NPS?

What is e NPS?

e NPS is electronic National Pension Scheme at https://enps.nsdl.com/. By accessing the link you can

- Open Individual Pension Account under NPS (only Tier I / Tier I & Tier II)

- Making initial and subsequent contribution to your Tier I as well as Tier II account

If you have opened NPS account offline you can also contribute in Tier I & Tier II account using eNPS. For queries on eNPS please contact : 022 – 4090 4242 or write to: eNPS@nsdl.co.in

How to Register for new NPS account online?

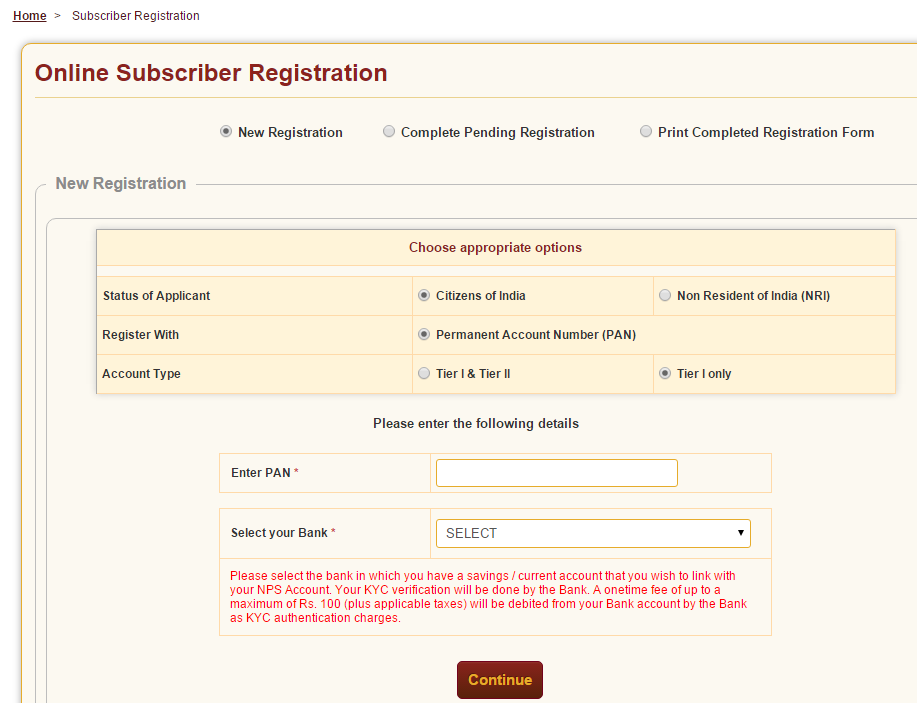

To open the National Pension Scheme account, you need to register for NPS. You can register with eNPS. If you have Permanent Account Number (PAN) and a Bank account with any of the registered Point of Presence empanelled for KYC verification Overview of registering NPS online through eNPS is:

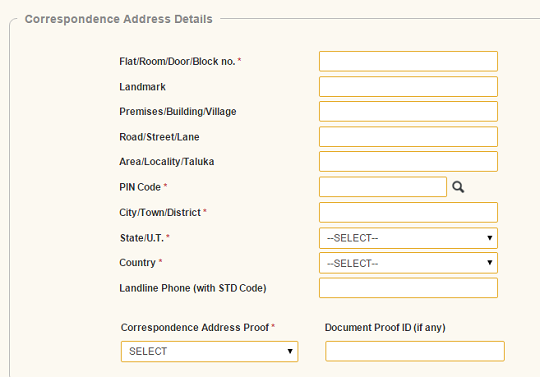

- Fill the Prescribed application form and submit the necessary Know Your Customer (KYC) documents. Documents required are Identity Proof, Address Proof, Date of Birth Proof, and Two Recent Colour Photographs. KYC Verification in NPS will be done by your Bank selected by you during the registration process.

- You need to upload your scanned photograph and signature in jpeg or jpg format having file size between 4kb – 12kb.

- On the application form, you would need to provide the preferred scheme, and asset allocation choice. The NPS caps the equity allocation at 50%.

- An initial contribution is collected at the time of opening of account from Debit / Credit card or Internet Banking.This contribution is a minimum of Rs 500 for Tier 1 and for Tier-II it is a minimum of Rs. 1000

- After successful payment of initial contribution, a Permanent Retirement Account Number (PRAN) is allotted to you. After online account opening process is completed,and a PRAN kit containing a PRAN card, IPIN/TPIN, subscribed master report, scheme information booklet along with a welcome letter is sent to the registered address.

When last checked, on 18 Mar 2017, the Banks associated with eNPS associated with SBI ePay

| Sr.No. | Bank Name | Sr.No. | Bank Name |

|---|---|---|---|

| 1 | Allahabad Bank – Retail | 23 | Karnataka Bank Ltd |

| 2 | Andhra Bank | 24 | Karur Vysya Bank |

| 3 | Andhra Bank – Corporate | 25 | Kotak Mahindra Bank |

| 4 | Bank of India | 26 | Lakshmi Vilas Bank |

| 5 | Bank of Maharashtra | 27 | Oriental Bank of Commerce |

| 6 | Canara Bank | 28 | Punjab and Maharashtra Co-operative Bank Ltd |

| 7 | Catholic Syrian Bank | 29 | Punjab and Sind Bank |

| 8 | City Union Bank | 30 | Saraswat Bank |

| 9 | Corporation Bank | 31 | South Indian Bank |

| 10 | DCB Bank Personal | 32 | State Bank of Bikaner and Jaipur |

| 11 | Dena Bank | 33 | State Bank of Hyderabad |

| 12 | Dhanlaxmi Bank-Corporate | 34 | State Bank of India |

| 13 | Dhanlaxmi Bank-Retail | 35 | State Bank of Mysore |

| 14 | Federal Bank | 36 | State Bank of Patiala |

| 15 | HDFC Retail Bank | 37 | State Bank of Travancore |

| 16 | IDBI Bank-Corporate | 38 | SVC – Retail |

| 17 | IDBI Bank-Retail | 39 | Syndicate Bank |

| 18 | Indian Bank | 40 | Tamilnad Mercantile Bank |

| 19 | IndusInd Bank | 41 | UCO Bank |

| 20 | ING Vysya Bank – now Kotak | 42 | United Bank of India |

| 21 | Jammu and Kashmir Bank | 43 | Vijaya Bank |

| 22 | Janata Sahakari Bank Ltd. Pune | 44 | YES Bank |

What to do After Registration for new account on e NPS?

If you have linked Aadhar then your eKYC is done. If you have not linked Aadhar then.

- You need to take a printout of the form, paste your photograph (please do not sign across the photograph) & affix signature. The photograph should not be stapled or clipped to the form.

- You should sign on the block provided for signature.

- The form should be sent within 90 days from the date of allotment of PRAN to CRA at the following address or else the PRAN will be ‘frozen’ temporarily:

Central Recordkeeping Agency (eNPS)

NSDL e-Governance Infrastructure Limited,

1st Floor, Times Tower,

Kamala Mills Compound, Senapati Bapat Marg,

Lower Parel, Mumbai – 400 013

Steps in Registering new NPS account Online at eNPS

When you select Registration button at eNPS, you are taken to Online Subscriber Registration Form shown in image below (Click on image to enlarge)

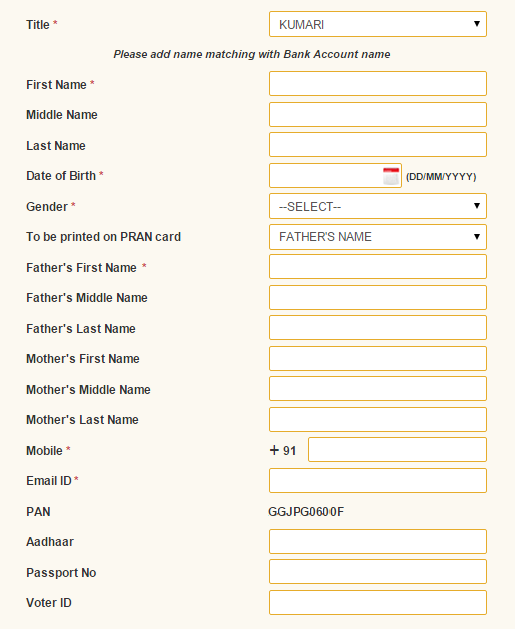

Once you enter the details like PAN number it asks you to fill Personal Details as shown in image below. Note only those fields marked with * are compulsory or mandatory.

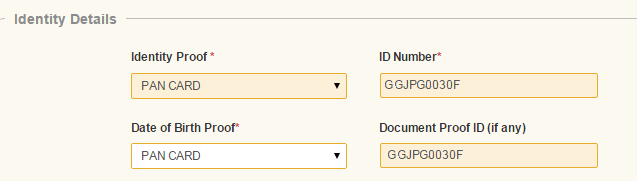

You then have to enter Identity Details as shown in image below

Once you enter the Captcha details, which here is simple Maths operation, to verify that you are human being and not robot for example as shown in image below

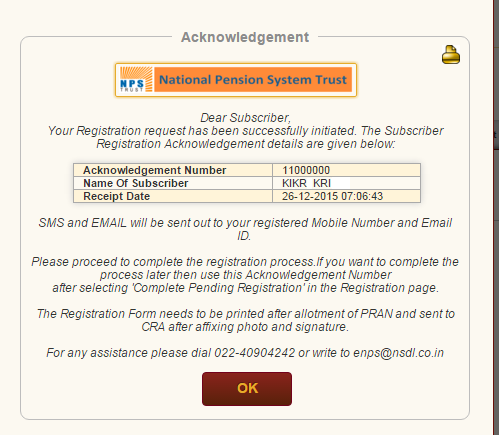

You select Generate Acknowledgement Number.

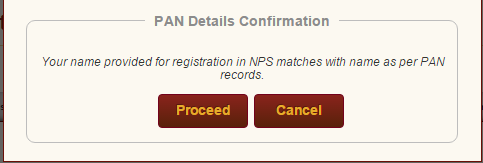

It verifies if your details matches your PAN details . If PAN records matches information for NPS registration you get PAN Details confirmation as shown in image below

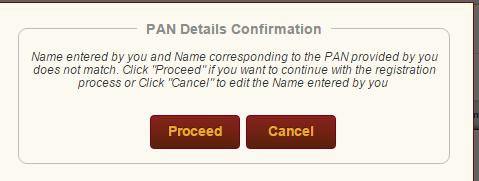

If PAN details do not match the message shown is below

Enter the Contact Details

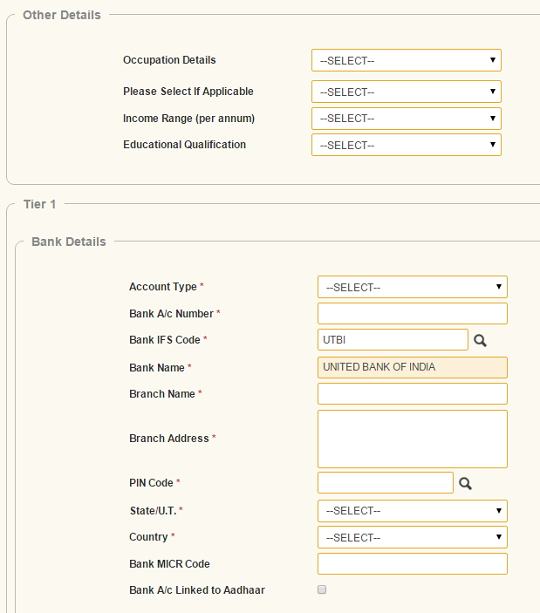

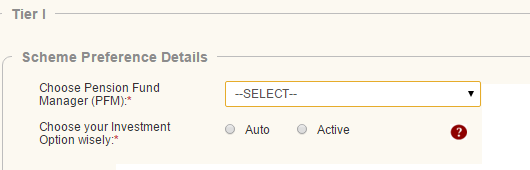

Enter Bank Details for Tier 1 and/or Tier 2 Account

Enter Scheme Details for Tier 1 and or Tier 2. Our article Returns of NPS, shows the returns of NPS

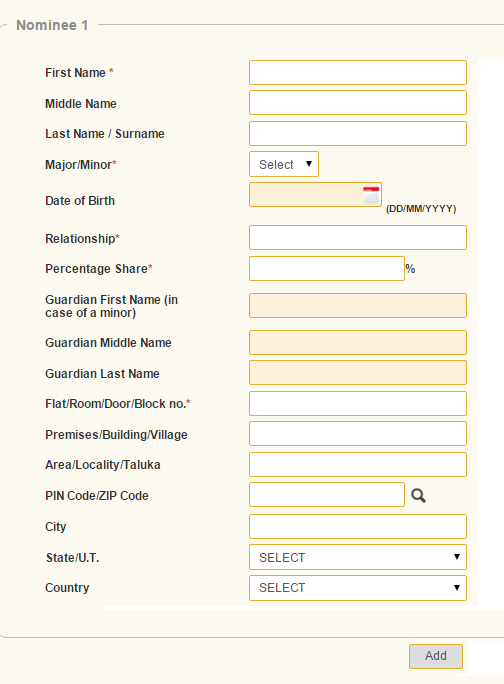

Enter Nominee Details. If you want more than one nominee click Add button at the bottom of the nomination details.

Upload your Photo and Signature. Photo and signature should be in jpg format. Size of photo should be between 4KB and 12KB.

Check Status of your NPS Registration at https://cra-nsdl.com/CRA/subRegReqSts.do

How to contribute to NPS online ?

All existing subscribers (registered through both online and offline mode) can contribute in Tier I & Tier II account using eNPS. To contribute online, you need to

- Have an active Tier I / Tier II account

- Authenticate your PRAN using the OTP sent to your registered mobile number

- Pay using your Debit / Credit card or use Internet Banking option.

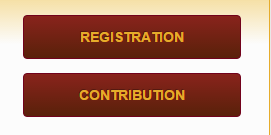

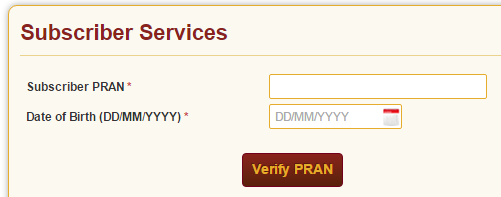

To pay online for NPS click Contribution on eNPS website as shown in image below.

Authenticate your PRAN using the OTP sent to your registered mobile number

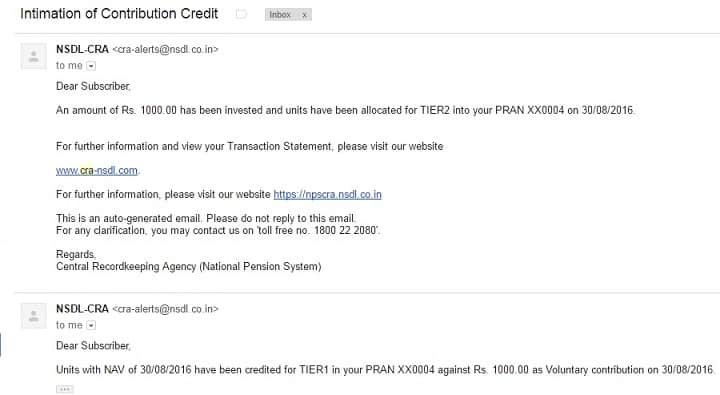

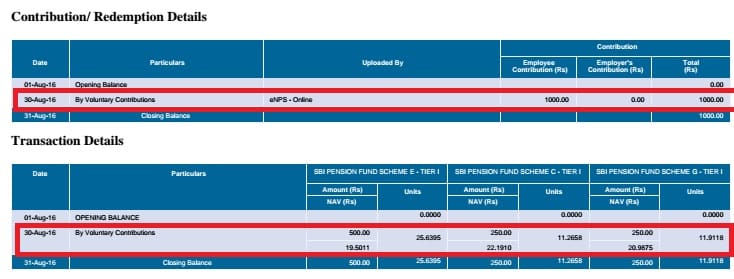

After successful contribution to eNPS you should get mail from CRA informing you about successful contribution as shown in image below

It would also be reflected in the Transaction statement sent by CRA around 10th of every month.

For queries on eNPS please contact : 022 – 4090 4242 or write to: eNPS@nsdl.co.in

Solution to Errors in uploading documents in eNPS

Following solutions have been suggested by our readers. Try them and let us know if they work for you or not? Which one worked

- Renaming all files without spaces and saving it to jpeg with .jpg extension and reuploading helped. (Thanks Pritesh)

- I re-saved all my PDF files on the previous page in a different name and re-uploaded them. (Thanks AGN)

- Although the site accepts PDFs for PAN and Cancelled cheques, the site, it seems, doesn’t support it. ONLY upload images that should help you proceed. (Thanks Gaurav)

Do you think NPS is a good investment option? Have you contributed to NPS? Would having NPS online make it popular?

237 responses to “eNPS : Open NPS account online, contribute to NPS online”

Hi,

Unable to do “OTP Authentication of Subscriber Registration Form”

as i am not receiving OTP for the email account.

BUT OTP is received for the Mobile Number.

Can you please suggest how can we verify the email account entered and how can we verify why email OTP is not been received.

Thanks!!

I am faced issue with “System Failure occured please try after some time or try to upload photo/signature between 4kB to 12 KB”

But both(Photo and signature) are between size mentioned 4kB to 12 KB only.

Still not able to upload the files.

I am facing the same issue

I am also facing same problem. did you find the solution

@Vengatesh/@Madhura/@Sundar, did you guys find the solution? Its August now and I am also facing the same issue.

Has this issue been resolved , still facing the same problem.

I am also facing the same issue. Any one got solution?

any update on this , it keeps on failing with the same error no matter how small the signature is

I trying ‘Aadhaar Offline eKYC’ Based Registration. Continuously facing error ‘Photo & Signature Uploaded are not in Proper File Format please reupload the same’. Please help!

I am facing same issue with Photo and signature upload.

My NPS registration has been stuck at Payment gateway since yesterday as I was not able to complete the payment before PRAN generation.

When I am trying to login again – I am getting the below error:

Registration against this Acknowledgement Id is pending for confirmation from payment Gateway.Please try again after sometime.

Can someone pls advise how to resolve this and proceed further towards PRAN generation.

I am stuck with this same issue since 2 days. Is your problem solved? if yes how did you do it? Plz help

I am still facing the error Document Uploaded () are not in Proper File Format please reupload the same

Kindly help as i have tried multiple times without success

I am facing the same issue. Please let me know if you manage to solve it.

I have tried in different ways, but still facing the same issue.

hai…i am also facing the issue…please let me know once you found the solution

Hello everyone,

I was facing the same error of “Document Uploaded () are not in Proper File Format”. Although the site accepts PDFs for PAN and Cancelled cheques, the coding doesn’t support it. ONLY upload images which should help you proceed.

Hope this helps

Thanks a ton. Worked perfectly.

thank you so much

Thank you so much, It worked.

I can guess that you are a software engineer 🙂

even in jpg format i m getting below error:

Document Uploaded ( PAN CARD COPY CANCELLED CHEQUE COPY ) are not in Proper File Format please reupload the same

Can anyone please help me in this

Bhai Gaurang Ji.. Aap great ho. Bahut mushkil me tha iske karan se main. Thank you. It worked

Error when uploading signature even if all requirements were satisfied: “Document Uploaded () are not in Proper File Format please reupload the same”

Tried solutions found in this blog. But did not work.

PLEASE HELP

Hello everyone,

I was facing the same error of “Document Uploaded () are not in Proper File Format”. Although the site accepts PDFs for PAN and Cancelled cheques, the coding doesn’t support it. ONLY upload images which should help you proceed.

Hope this helps

Thank you . This has been a pain point for a couple of months now for me. I was only trying different things for Photo and Signature as the error message comes in that page. But actual issue is the pdf documents submitted in the previous page . After replacing all pdf documents in .jpg format, it worked.

Thank you so much..you saved my time

Thank you , it worked

Thanks

How was your experience?

Thanks a ton! After so much struggle this worked!!

Initially faced the same error of “Document Uploaded () are not in Proper File Format”.

Then, tried uploading images for PAN and Cancelled Cheques, and Image for Signature,

then getting the error of

“Document Uploaded ( PAN CARD COPY CANCELLED CHEQUE COPY ) are not in Proper File Format please reupload the same”

SAME FOR ME, ANY SUGGESTION

All solution is time wasting.. try firefox browser. it will work

Thanks

SAM E ISSUE FOR ME!

hi,

while confirming my sign and photo i am getting an error INVAIL DOCUMENT VALIDITY EXPIRY DATE.

PLZ HELP

Can you send the snapshot of error and the images of your photo and sign to our email id bemoneyaware@gmail.com

Ensure that you have set the correct document expiry date in FATCA details page.

Go to CONTACT DETAILS -> FATCA Details and change the expiry date to future 2050 or something. It solved issue for me. I was able to submit the form successfully.

I CHANGED THE FATCA EXPIRY DATE TO A FUTURE DATE (JUST RANDOM ONE TO PROCEED ) AND I WAS ABLE TO PROCEED

Good info

Thanks for sharing.

I am facing the issue “Invalid Document Validity Expiry Date” on Upload Photo & Signature page when I am clicking on Confirm button. I am unable to proceed further.

Can any one suggest the solution. I checked all other replies. But nothing helpful.

Can you please suggest, how did you fix this error?

Can you explain the steps you took?

Are you using Mobile/Desktop?

Which one?

Which web browser?

If you’re creating the PRAN first time, you don’t need to add the Validity date FATCA compliance.

So once submitted and PRAN generated successfully, you can register for the FATCA online via govt website

While login, when click on send otp, session gets expired

Hey,

I have completed eSign and got my PRAN on Feb 15th 2019. For opening the PRAN i have made only the minimum required amount as my contribution.

Now, when i try to do the subsequent contribution, i get “User not eligible for subsequent contribution”.

Q1: Can you, please help me here ?

Q2: After eSign document, do i need to courier the document to the CRA ?

Thanks

I am also facing same problem,if you got solution pls also revert me

I too facing the same problem. Can you please update me as well

I filled passport details for my birth proof and the issue got resolved. You can try it out.

Does your problem solve? If yes, How?

Hey,

I have completed eSign and got my PRAN on Feb 15th 2019. For opening the PRAN i have made only the minimum required amount as my contribution.

Now, when i try to do the subsequent contribution, i get “User not eligible for subsequent contribution”.

Q1: Can you, please help me here ?

Q2: After eSign document, do i need to courier the document to the CRA ?

Thanks

After uploading the photo and signature in registration process i am getting error message “Invalid Document Validity Expiry Date”. Please help me how to remove this error and proceed further steps.

I am also having the same problem . Not sure what is the problem .

What is the browser that you are using?

Which documents have you uploaded?

If Aadhaar, try document other than Aadhaar.

For queries on eNPS please contact : 022 – 4090 4242 or write to: eNPS@nsdl.co.in

Anybody found any solution to this problem? Unable to proceed forward because of this issue

“Invalid Document Validity Expiry Date” error i am getting always whenever i click on confirm. Please help to solve this problem.

Hi,

I found the solution, ““Invalid Document Validity Expiry Date” error” your acknowledgement number is expired. so register again and continue with the boring form filling again, It worked for me. Good luck.

Nandeesh.

I have notified the same error of ““Invalid Document Validity Expiry Date”while uploading the Photo and signature. Can any one faced the problem and and advise how you have solved. can yyou please send the solution by Email – m.sajith77@gmail.com

Requirements of photos are

You need to upload your scanned photograph and signature in jpeg or jpg format having file size between 4kb – 12kb.

What is the size of images and what is the format?

I am also facing same problem “Invalid Document Validity Expiry Date”

Both photo and sign are in jpeg and size within limit

Pls help

Document Uploaded () are not in Proper File Format please reupload the same. I am getting this error when I am trying to upload the image and signature although the uploaded image is of jpeg format as mentioned and within the permissible size.

Unable to complete the registration

Please help

Did any one recieved this issue recently?

Was anyone able to find the fix to this issue? Please update.

Has anyone solved this issue??

Document Uploaded () are not in Proper File Format please reupload the same

I am unable to proceed further. Do not know whom to contact. Please help if you have solved this issue.

I solved this issue! I re-saved all my PDF files in the previous page in a different name and re-uploaded them. Then it worked!

Good luck.

Thanks for sharing

renaming all files without spaces and saving it to jpeg with .jpg extension and reuploading helped.

Thanks, Pritesh for sharing the solution

It would be helpful for other readers too.

Have updated our document

this still doesnt help… does anyone else have a trick here?

Facing similar issue. Have you found a solution to this?

Hi,

I am unable to upload the image and signature in the nps form. I have uploaded new image and my signature(both in jpg format and size btw 4kb-12kb). When I click on save it says uploaded successfully. However as soon as I click on Confirm , I get the below error:

Document Uploaded () are not in Proper File Format please reupload the same

I am sure about the image size and format. Please suggest

Hi, I found a fix for this. Convert all teh documents to pdf format. Open all the documents one by one in Adobe Acrobat Reader as save as with another name. Upload the newly saved pdf documents and it should work. Good luck.

Thanksm Sir

I am still facing the error Document Uploaded () are not in Proper File Format please reupload the same

Kindly help as i have tried multiple times without success

Can you send the snapshot of the error and the document you are trying to upload to our email id bemoneyaware@gmail.com?

Hi , I am also facing the same issue of Documents uploaded are not in correct format, please reupload the same.

Kindly help me for the same.

Did you find a solution to this problem?

Did you get any solution for this?

Kindly let us know if anybody found solution for this issue.Unable to complete registration from last 1 month

Same here. Cant complete the registration process.

Please upload pan, cheque and signature between 4kb to 12kb.

sir,

i had done all the step for completing my application , after reaching payment through sbi gateway system got stuck up, unable to complete the payment ,

now how can i do the payment ? while checking complete pending registration getting error that your id pending for payment confirmation , how can i go for payment /???

I have opened eNPS account on 15th Feb’17 and allotted PRAn number to me. But while login to NSDL site, I am getting error as “INVALID PRAN”.

Please guide me into this.

i’ve registered for NPS online and also paid 50000 but missed to download receipt. How can i get the receipt now?

you can revisit the complete registration and download .

Hi guys ,

i am facing problem , i did payment of 20000 for first contribution from ?HDFC net banking, my amount deducted , on return from hdfc site its navigate to http://www.sbiepay.com/secure/failure.jsp?error=Transaction%20Failed url , but its not loaded at all in my browse , link shows its a failed transaction , and from nsdl site i see my Adhar number registered and waiting for payment confirmatioin , finally sms came to PRAN is generated and asking for submit document , where i will get form ?

Any error – failed payment will take at least 5 working days to reset.

You can contact HDFC site and also try making a contribution for a small amount.

Hi,

contribution through Online deduct transaction amount like against online contribution of 30,000 through debit or credit card there is a charge of extra 300 Rs. which is too much and I don’t have account in listed banks in the site

Does anyone know the procedure to offline contribution to NPS and any charges involve

Dear bemoneyaware

While investing in eNPS I completed my payment of 50000 rs. payment is debited from my sbi account,but i didn`t receive PRAN number/registration number pls help. details are as fallows.

acknowledgement no 11174683

receipt date 13/01/2017

SBI epay transction ref no 80447326284121GAAPLWWK7.

I would like to open e-NPS account online. But, I am getting the following message “The name entered by you and the name corresponding to the PAN provided by you does not match”. I feel, when I applied for PAN a few years ago, I would have entered my name in different fields (in Middle name also).

I would like to know is it safe to proceed for e-NPS registration without filing application for name change to PAN department, Pune.

Please clarify

Please verify your pan using your Pan number at Search PAN

Use the Name in PAN for your eNPS.

Please stick to one name for all your financial investments.

Make sure PAN and Aadhaar match

Thank you bemoneyaware

dear bemoneyaware

I have completed the eNPS registration process and then when I paid 10000 through sbi epay then after successful payment website gets closed. And I didnt get my PRAN no. Now how to get my PRAN no.? When I am again trying to go in option “complete Registration” it is showing no records found. Please help.

Dear bemoneyaware,

I have Registered in eNPS and uploaded photo and signature then payment gateway opened, i have paid 10000 through SBI epay, but then it came out of the web page and I did not get PRAN no. Now how to get PRAN no.? Payment was done successful.

Hi,

I just contributed 50k to my PRAN Tier 1 account through SBI netbanking. While the payment was successful and the money got deducted from my SBI account, I didn’t get any transaction receipt. It just displayed a message- “Error receiving status. In case the payment was successful, the corresponding units will be credited to your PRAN ID within 2 working days”.

So, I’m left with 50k deducted from my account and no enps transaction receipt. Should I be worried? And to claim tax benefits I need to show the recepit- how can I get that?

Wait for a day or two.

You should get your money back.

Then try again.

Dear bemoneyaware, I just opened my eNPS account and in the last step of payment I deposited 50000. Now i have a username and password for this account after PRAN generation. But when I checked he transaction statement, the Rs. 50000/- transaction is not showing! Where is the money. I have the receipt of that payment, but in transaction statement it is showing Rs. 0.0 amount.

Wait for a day or two. When we had contributed on 30 Aug 2016 we got mail about it on 2 Sep 2016.

Now that eSign has been introduced, we need not even send the physical copy. We just need a verification via OTP.

Thanks for the information. Aadhaar has made life simple.

We shall update the document.

I had enrolled using enps but didn’t downloaded the registration form. pl tell me how to download filled enps form

Dear bemoneyaware,

I have open NPS account using PAN card and now my verification for KYC has been sent to SBI(as i mentioned SBI account), though my account is KYC compliance but SBI has not yet confirmed from there end so i keep getting message

“User is not eligible for subsequent contributio”

As time has come to submit the proofs, I am confused what to do, I can not make further contribution till SBI confirm CRA about my KYC confirmation.

Please suggest. (Though I have SBI net banking and i have added my PRAN number there as well, but i think from there also transaction can not be done until my account will not get active because currently its showing Freeze because KYC not confirmed)

I am also facing same problem.

Could someone tell me what to do ?

In my case, i have added a date in contact details -> Fatca coloumn,

please try keeping that empty

I have opened enps for all india citizen . Now I joined state government service. Do I have to change subscriber details through inter sectoral change form

I am constantly browsing online for posts that can facilitate me. Thanks!

Very good written story. It will be helpful to anyone who employess it, as well as yours truly :). Keep doing what you are doing – can’r wait to read more posts.

i have opened eNPS and got PRAN, but i have worngly entered DOB of minor nominee, how can correct it, please advice

I have opened by PAN (NON AADHAR) Method and landed in paying 0.05% for every transaction , is there any way to convert to AADHAR registration by submitting AADHAR copy.

no way u are caught now..UPA scam

What is the process for withdrawal from tier II. Will i be able to withdraw contributions from tier II account online. My NPS account has been opened online through e nps using aadhaar verification. Pls help with the process.

I will be opening e-NPS using AADHAR in next few days.

1> Is it mandatory to pay initial & later contributions with the bank savings account mapped to NPS?

2> How will I update the NPS details later like change in nominee, change of fund manager, change in allocation of funds, etc.? Are there any charges for updation if I open NPS using AADHAR?

3> How will I perform withdrawl of NPS accumulation amount from NPS after maturity from e-NPS or through online mode? OR, visiting bank branch as mapped in NPS opening is required during withdrawl?

4> How to choose and open Annuity at maturity if NPS account opened online using AADHAR?

5> Is it mandatory to pay service charges additionally during annuity purchase?

6> Do SBI charges NEFT charge of Rs4+ST if I perform NPS contribution from SBI e-portal?

I want to open NPS account, but I don’t have account in nationalize bank. I have account only in Axis & HDFC bank. I will not be able to make initial online payment as it doesn’t give option of these bansks.

Please advise what to do in this case to open NPS

Now you can register using Aadhar card which does not require any KYC conformation from the banks as its already KYC verified. Also the number of banks as on 08-May-2016 is increased to 22.

I eRegister with NPS, transferred money to it and generated my PRAN number but unfortunately forgot to note down the PRAN number. Pl help me to get the PRAN number.

How many days since you registered with eNPS?

You should be getting PRAN kit soon.

I have done my eNPS registration (Tier 1) on 27th April, 2016 and got my PRAN generated

Unfortunately the bank acct number which I have mentioned in my form is incorrect. As i have already made the payment, i am not able to edit my details.

Please guide me as to what needs to be done from my side to correct the error before sending the form to your office.

we don’t work for NSDL.

You need to re-submit bank details.

You can contact NSDL at

Toll Free Number : 1800222080

NSDL e-Governance Infrastructure Limited Head Office.

Mumbai Office

Address NSDL e-Governance Infrastructure Limited

1st Floor, Times Tower, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai – 400 013

Tel.(022) 4090 4242

Fax (022) 2495 2594/ 2499 4974

Subscribers to the National Pension Scheme (NPS) must submit their name, date of birth, contact information, bank account details and other personal details while opening an NPS account.

This information is noted by the CRA and a Permanent Retirement Account Number (PRAN) is allotted to the investor. The subscriber can change or carry out corrections in the details provided, including nomination. If the change necessitates the reissue of a fresh PRAN card, the same will be issued by the CRA.

A standard Form UOS-S2 needs to be filled by the NPS subscriber. This form can be downloaded from http://tinyurl.com/cse6g7e. Only those fields that need to be modified should be filled in the form.

Documents

The subscriber needs to furnish a copy of the existing PRAN card along with two self-attested photocopies of supporting documents mentioned in the form in case of change or correction in personal details. In case of a change in the bank details, the form needs to be supported with a cancelled cheque bearing the new bank account number.

Submission

The form UOS-S2 along with supporting documents should be submitted to the POP. The subscriber also needs to bring original documents, which will be returned to him after verification by the POP.

Points to note

* A new PRAN card will be sent to the subscriber only if the change pertains to the name of the subscriber, his date of birth or the father’s name.

* Subscribers should retain the acknowledgement slip signed/stamped by the POP where they submit the application.

* For issuing a new card, a processing fees of Rs 20 (plus applicable taxes) will be deducted from the subscriber’s account.

[…] eNPS : Open NPS account online, contribute to NPS … – Note: State Bank Of India (SBI) allows one to contribute to NPS through internet banking. What are the Tier 1 , Tier 2 accounts of NPS? There are two NPS account … […]

I have one query related to NPS PRAN no.I was a state govt employee for three months till march 2016 and thus opened a new nps pran account but in april i had resigned from there as i have joined another job of central govt.But i have hidden about my past job in the new job so i dont want to use that old pran no. So can i open a new nps pran account Now as i also have an old one.My desire is that the old account will be close easily and new nps account will open as i dont want to use the money deposited by me in old account.Is that possible?? Please help me with your valuable guidance.i am in big problem mentally…..thinking and thinking about it……please help as soon as possible

i hav applied throuh eNPS my PRAN no is 110007279895

may i know who is my POP and POP SP

and i got kit of PRAN card not IPIN how much time it will take to get IPIN cover

I could deposit additional amount. There is no problem. but for all forms they are asking verification of POP. In my case I don’t know who

Same question who will be my pop ?

Sir

I have invested (under Sec. 80 CCD (1B)) Rs. 45000/- for financial year 2015-16 through eNPS on 30.03.2016 13:31 and got Online payment acknowledgement receipt with Transaction status successful. My CRA account shows that date of credit of the amount is 04.04.2016 under financial year 2016-17.

1. As I have invested the amount in financial year 2015-16 then the amount for tax saving purpose in financial year 2015-16 is considerable or not?

2. Investment (under Sec. 80 CCD (1B)) Rs. 50000/- for financial year 2016-17 is allowed or not?

Thanks

hi Aditya,

I have same query, i have made payment on 30.03.2017 and i have payment receipt also.

My CRA is yet to reflect the payment details.

Will i be eligible for tax benefits for FY 2016-17?

I want to open an nps account through online. I am a bank of india employee. So i have to open a corporate account. But when applying, i have to mention head office name in the space provided at the first page registration. I want to know the head office name of bank of india.

An interesting chain of communications I had with NSDL guys when I faced the same problems with online process. Please go through the chain and find out for yourself how clueless these guys are.

Re: Acknowledgement number for registration under National Pension System

Saturday, January 30, 2016 6:20 PM

From:

[Text Suppressed to not disclose identity in public forum]

To:

[Text Suppressed to not disclose identity in public forum]

Dear Madam/Sir

Thanks for the swift response on email. The same is highly appreciated!

While I could not understand what you meant when you say the following ‘you are requested to try making payment through Payment Gateway Service Provider’, I tried going to the website of SBI e-Pay to explore. I could not find any way in which I could go by your advise and make a payment from there.

So you would probably be required to elaborate as to what your resolution substantially means.

I also tried getting in touch with [Text Suppressed to not disclose identity in public forum] yesterday on their respective landline phones but could not reach them. Hence, I chose to try my luck on the website again in generating a new acknowledgement. And Bingo, this time it worked, I could generate a new acknowledgement number and made the requisite payment as well and I have my PRAN by now.

So, since the matter seems resolved by now. I thank you all again for your cooperation.

You might however try and research for future as to why your resolution did not work and sheer luck brought about a seeming solution.

Thanks again.

[Text Suppressed to not disclose identity in public forum]

P.S.: Request you to kindly fix the initial level touch points i.e. 1800222080, (022) 4090 4242 and enps@nsdl.co.in.

I had a miserable time reaching you people initially and had to ultimately google out the contact details of [Text Suppressed to not disclose identity in public forum] and thanks to his promptness that my case could at least reach the right departments and people for resolution.

1800 number asks for account number else does not allow to proceed and you are stuck.

The 4242 number has pathetic people manning the same who are rude and arrogant as well. Firstly, only after 4-5 times of full rings going unanswered, do you get connected. In my case, when I asked to be connected to a helpdesk, twice I was kept on hold with music in the background continuously without any connection.

And what to say of the email ID? Please note that my original email was to this email ID. There is not even an auto acknowledgement yet. The matter is resolved but its funny that they are yet to respond.

________________________________________

From: [Text Suppressed to not disclose identity in public forum]

To: [Text Suppressed to not disclose identity in public forum]

Cc: [Text Suppressed to not disclose identity in public forum]

Sent: Friday, January 29, 2016 2:49 PM

Subject: RE: Acknowledgement number for registration under National Pension System

Dear Sir,

This is with reference to your email regarding your request for enrolment in NPS through eNPS portal. We understand from your email that you have made NPS contribution amounting to Rs. 6,001 on Jan 18, 2016. Kindly note, in eNPS the contribution is collected through Payment Gateway Service Provider (PGSP-SBIePay in this case). The PGSP-SBIePay has confirmed that it has not received funds for your transaction. Hence, you are requested to try making payment through Payment Gateway Service Provider.

[Text Suppressed to not disclose identity in public forum] | NSDL e-Governance Infrastructure Limited | (CIN U72900MH1995PLC095642)

[Text Suppressed to not disclose identity in public forum] | Website: http://www.egov-nsdl.co.in

1st Floor, Times Tower, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai – 400 013

From: [Text Suppressed to not disclose identity in public forum]

Sent: Thursday, January 28, 2016 5:53 PM

To: [Text Suppressed to not disclose identity in public forum]

Subject: Re: Acknowledgement number for registration under National Pension System

Dear Mr. [Text Suppressed to not disclose identity in public forum]

Thanks for the response over phone call to my appended email earlier today.

As advised therein, I tried the same transactions using IE browser. I am facing the same problems. Screenshots attached.

Request you to kindly resolve the issue at your end pleaase.

I want to apply for Tier-I only and want to invest Rs. 50,000/- ASAP and provide proof of investment to my employer for tax purposes.

An urgent reply on this would be hugely appreciated.

Thanks

[Text Suppressed to not disclose identity in public forum]

________________________________________

From: [Text Suppressed to not disclose identity in public forum]

To: [Text Suppressed to not disclose identity in public forum]

Sent: Thursday, January 28, 2016 4:01 PM

Subject: Fw: Acknowledgement number for registration under National Pension System

Dear Mr. [Text Suppressed to not disclose identity in public forum]

Further to our telecall a few minutes back, forwarding to you the appended email sent yesterday to your helpdesk.

Would be obliged if you could please resolve my query.

Thanks

[Text Suppressed to not disclose identity in public forum]

—– Forwarded Message —–

From: [Text Suppressed to not disclose identity in public forum]

To: “eNPS-alerts@nsdl.co.in” ; “enps@nsdl.co.in”

Sent: Wednesday, January 27, 2016 7:36 PM

Subject: Re: Acknowledgement number for registration under National Pension System

Dear Madam/Sir

My Acknowledgement Number is [Text Suppressed to not disclose identity in public forum] dated 18 Jan 2016.

Please delete this acknowledgement number from your system so that I am allowed to create a fresh online application.

I want to create a fresh online application for Tier-I only.

At present, I am not able to do anything in the system i.e. No Activities are being allowed. I have attached the screenshots for your reference please.

Kindly do the same urgently as I have to invest Rs. 50,000/- and provide proof to my employer ASAP.

Please call me on [Text Suppressed to not disclose identity in public forum] for any clarifications on this.

Please solve the issue immediately and oblige.

Thanks

[Text Suppressed to not disclose identity in public forum]

________________________________________

From: “eNPS-alerts@nsdl.co.in”

To: [Text Suppressed to not disclose identity in public forum]

Sent: Monday, January 18, 2016 5:11 PM

Subject: Acknowledgement number for registration under National Pension System

Dear Subscriber,

You have successfully initiated your request for registration under National Pension System (NPS). The Acknowledgement Number is [Text Suppressed to not disclose identity in public forum] and the Acknowledgement Date is 18/01/2016.

In case you want to complete the registration process at a later date, please select the option “Complete pending registration” and enter the Acknowledgement Number, Acknowledgement Date and your date of birth. However, these details will be valid for next 15 calendar days.

Once the online registration process is completed by entering all the relevant details and making an initial payment (minimum contribution amount is Rs. 500), a twelve digit unique and portable Permanent Retirement Account Number (PRAN) will be allotted to you. Please take a printout of the registration form generated online with the details entered by you. Ensure that you affix your photograph and put your signature on the Form before sending it to the address given below:

Central Recordkeeping Agency (eNPS)

NSDL e-Governance Infrastructure Limited

1st Floor, Times Tower, Kamala Mills Compound,

Senapati Bapat Marg, Lower Parel,

Mumbai – 400 013

If you have opted for Tier II, you have to submit a cancelled Cheque and a copy of the PAN Card along with the form.

If the form and the documents does not reach the above mentioned address within 180 days after registration, the allotted PRAN will be “Frozen” temporarily and will be reactivated on receipt of the form.

Please do not reply to this email as this is an system-generated email. For any clarification, you may write to enps@nsdl.co.in

Regards,

eNPS Team

*************************************************************************************************************************** This message is for the named addressees’ use only. It may contain NSDL confidential, proprietary or legally privileged information. If you receive this message in error, please immediately delete it. You must not, directly or indirectly,

use, disclose, distribute, print, or copy any part of this message if you are not the intended recipient. Unless

otherwise stated, any commercial information given in this message does not constitute an offer to deal on any terms quoted. Any reference to the terms of executed transactions should be treated as preliminary only and subject to our

formal written confirmation.

***************************************************************************************************************************

*************************************************************************************************************************** This message is for the named addressees’ use only. It may contain NSDL confidential, proprietary or legally privileged information. If you receive this message in error, please immediately delete it. You must not, directly or indirectly, use, disclose, distribute, print, or copy any part of this message if you are not the intended recipient. Unless otherwise stated, any commercial information given in this message does not constitute an offer to deal on any terms quoted. Any reference to the terms of executed transactions should be treated as preliminary only and subject to our formal written confirmation. ***************************************************************************************************************************

Just had the below queries

1. Since it is online do we need to get a POS stamp on the Online form generated before sending to CRA address?? As i am yet to send the form e ven though i have recieved the PRAN card

2.For any further transactions like withdrwal etc in future, whom should we contact, dirctly the CRA, PFRDA or anyother bank- POS?? Since i have subscribed online , banks wont entertain my requests.How can i get my withdrwals done???

I registered online for NPS on 23rd march , Got my PRAN Kit with PRAN card on 28th march. Today on the last day of the year, i-pin & telepin will be mailed seperately at my address. Today on the last day of the year, i deposited in the voluntary account i.e the TIER 1 account and the amount got debited from my account. I did this using debit card ( may be others can try instead of net banking). However i have not recieved any intimation on the deposit of the money. Also i am unable to view my accunt since i think i will be able to only after i recieve the IPIN.I would suggest others to just try, since otday being the last day many users are trying and the server is overloaded .

Hi I made a voluntary contribution thru eNPS portal today. The transaction was successful. But I got the SMS from CRA that units will be credited within two days.

I want to know whether I can show this contribution today to avail tax deductions for FY 2015-2016 which ends today.

@Amit- Did you recieve the sms immediately on debit of the amount ????

yes

Thanks @ amit. I have not recieved the acknowledgement yet. Hope it should be mailed later.

Any clarity if contribution made on 31st march for which credit of units will happen 2-3 days later, will be eligible for tax benefit in FY 15-16.

hi, i m unable to make contribution. although I’m filling correct PRAN and DOB, yet it is giving promt as wrong details .

Wait for a day. Problem will resolve itself

But today is last day for making contribution to avail tax rebate.

Yes we can understand that. Still some hours are left.

Did you try now? Or try 24 hours after your registration/last contribution?

the payment details link is still not coming up in the morning. Is this expected? it’s greyed out for me since yesterday night ~14 hours now. All the other forms are filled.

Hi.. I have registered on 22nd March, 2016 and got my acknowledgement # for Tier-1 account but couldn’t upload only signature on that day. Today I am unable to go ‘Payment’ page after uploading my signature. Please suggest me on how to contribute online? I have tried both options on the signature page – Save & Confirm but it is not redirecting to Payment page.

yes, same problem with me as well.

I have generated PRAN through adhar based registration and paid initial amount of rs 4000 and want to make further contribution of 46000 Rs but when I click on contribute page, it is asking for PRAN and my DOB, I am providing them correctly but it gives message’ Details entered not correct’…application does not allow to collect 2nd contribution to tier 1 and2.ples guide.

Many have reported this error. Did you register using Aadhar or PAN? Wait for a day. Then try again.

Keep us updated

Unable to make subsequent transaction after 500 (which was initial amount for account opening) in Tier 1. Showing i am not eligible for making subsequent transactions. What could be the reason for this ? Will it be possible to make the 50k investment by this month end for financial year 2015-16?

FAQ says as below

Can a subscriber make contributions in his / her NPS account before receipt of the PRAN Card?

Under NPS, Subscriber accounts are identified by unique PRAN allotted to them by CRA. If subscriber has opted for both Tier I and Tier II in the registration form , then he can start subsequent contributions in both Tier I and Tier II once PRAN is known and need not wait for receiving the PRAN Kit. However, if he has opted for only Tier I in the registration form , then he needs to submit a copy of the PRAN Card along with the duly filled UOS-S10 form to activate Tier II account.

But the above seems not true.

May be till physical signed paper reached eNPS they may not allow further contributions.

I opened today NPS Account via eNPS. I used adhaar KYC. I contributed 50K in my first payment itself so that I can get Tax benefit. I tried to contribute again but did not allow. Got error message that PRAN details are incorrect.

Thanks for Information Suresh. It would be helpful to many readers.

I tried today again, now it is allowing to contribute. I did not contribute but it gave a page to do contribution.

so, may have to wait for a day or so to contribute.

Hope you might have sent the physical application form to CRA, and further hope that your KYC is done before 31-03-2016 so that you are eligible to put the remaining Rs. 49,500 /- in this fiscal. You wud soon get your PRAN card and welcome letter by physical post from CRA. I don’t know that once the PRAN is generated, whether one can go and invest physically with the nearest POP service provider / Fund manager quoting the PRAN? Authorities shud clarify on this. I am also stuck up in a similar situation, lets hope for the best. Surely, latecomming has a cost!

Unable to make subsequent transaction after 1000 (which was initial amount for account opening) in Tier 1. Showing i am not eligible for making subsequent transactions. What could be the reason for this ? I received the PRAN Card within four days.

I have received PRAN card and welcome letter by physical post from CRA. But not able to made further contribution.

I had opened my nps account through enps today, i.e. 21-03-2016. Through online banking I did the initial contribution of Rs. 20,000/ – My PRAN no. was generated, and thereafter I was able to download the application form / payment receipt. The whole process took not more than 30 minutes. I wud suggest people to try for online regn now since we don’t have time left this F/Y for the offline registration mode. Unmindfuly, I opted for the PAN-Bank KYC option. This option takes a little more time to complete, as the CRA wud ask my Bank to verify my KYC. I had Aadhaar Card also, that wud have been faster. Readers shud opt for the same.

I want to put another 30,000/- this F/Y. Shall I do the same online, before the KYC completion and PRAN kit receipt i.e. before 31-03-2016, or shud wait for the kit / KYC confirmation etc. to come and then invest? But that wud surely mean next fiscal!………any suggestions?

Do you think there will be a problem if you invest another 30K before this year. To pay online you just need PRAN.

You can wait till Tue and may be then take a call.

What are you planning to do?Do update us

Hi.. i tried making the payment but the request timed out and now when i am trying to go back to continue registration it is not showing the payment contribution page, neither pran has been generated.. ne suggestions??

Hi!

My account is frozen. I have contributed Rs.50,000/- for the current financial year.

Please suggest me how to unfreeze the account or reopen the account.

Note: Yet I have not received the kit for I-pin. I tried it thru OTP.

Thanks & Regards

I registered in NPS on 11.03.2016 and got the PRAN number after paying 500 rupees, how much amount is to deposit in NPS account for FY 2015-16 if i subscribe in March 2016.

Please give me the reply of my question is it mandatory to maintain 6000 rupees if I open NPS account in Mar 2016.

The subscriber should make a minimum contribution of Rs 6,000 every year. There is no maximum limit and the subscriber is free to decide the frequency of contributions every year.

A subscriber should invest a minimum of Rs 1,000 at the time of opening a Tier II account, and she should make at least one contribution every year and maintain a minimum balance of Rs 2,000 at the end of the financial year.

If the subscriber fails to contribute the minimum amount in a year, the account will become dormant. The subscriber will have to submit the form UOS-S10 to the POPSP, along with a penalty of R100 and a minimum contribution of R500, to reactivate the account. The dormant account will be closed if the account value falls to zero.

hi

is there any fix for this or will i have just wait and hope it gets resolved automatically in next couple of days ?

Registration against this Acknowledgement Id is pending for confirmation from payment Gateway.Please try again after sometime.

For many readers it has got resolved in a week

Thanks for the response.

To my suprise, it was resolved in a single day itself automatically.

i have opened eNPS account with Rs500 on 5 march 2016

then through sbionline i have made contribution of Rs 10000 on 7 march 2016

on 19 march i got PRAN kit.Now when i check my account status, only Rs 500 is shown. my sbi saving account shows deductions of Rs 1000 but not shown in my enps

Hi, I got the registration and PRAN. I did transaction of INR10000/-from yes bank on 17th Mar 2016. Transaction in eNPS was failure but money got deducted from Account.please guide me for further process.

your payment will be processed in this case and units will be alloted against Rs 10000/- . it takes 5-6 days for completion of this process.

thank you very much for guidance

Since we are approaching towards year end and in case if you want to show the contribution amount in this FY then I would suggest to pay entire contribution amount(FY-16) during the registrations it self.

Since there have KYC verification and bank detail confirmation and NSDL site have also technical problem due to the user load, advice to make a lump sum payment during registration only.

This is valid only for the case of non aadhaar base registration.

Hope in case of aadhaar base registration, KYC and bank detail confirmation is not required for subsequent contribution.(Not sure)

Please tell me how long does the bank take for KYC verification. I have applied through PAN on 8th fem and now unable to do further contribution as KYC is not approved by bank.

write mail to your bank to refund the amount

Sir i have applied for enps succesfully but payment gateway is not opening for payment for PRAN

11041116 DT 16 th march 2016 pl guide

Sir i have applied for enps succesfully but payment gateway is not opening for payment for Acknowledgement number is

11041116 DT 16 th march 2016 pl guide

Wait for a week. Others have reported that it opens then

when i enter the PRAN no. and DOB for the payment(contribution) i got the message that the information is incorrect. how can i make payment. also how can i attach my bank account to swavalamban yojna? If i will not complete my payment for this year is my swavalamban account close?

please rply me sir

sir

please guide me in this, my account started in 2014,annually i am paying premium manually now it is online , can i register newly or pay premium directly online.

please guide me as soon as possible

You don’t need to register again. You can pay Online. Please do let us know if it worked for you. Would help other readers.

from our article

All existing subscribers (registered through both online and offline mode) can contribute in Tier I & Tier II account using eNPS. To contribute online, you need to

Have an active Tier I / Tier II account

Authenticate your PRAN using the OTP sent to your registered mobile number

Pay using your Debit / Credit card or use Internet Banking option.

To pay online for NPS click Contribution on eNPS website

Authenticate your PRAN using the OTP sent to your registered mobile number.

the conntact no. given in mail 022/40904242 is not responding since a week

Sir i have applied for enps succesfully but payment gateway is not opening for payment for PRAN

11019286 DT 20 th Feb2016 pl guide

Typically it gets cleared in a week.

Did you get your PRAN kit? PRAN card?

I have registered on eNps and got the PRAN alloted. I also posted the application form to CRA. Today I got the PRAN kit.

But I am not able to perform contributions. It says user not permitted for contributions.

Since end of financial year is approaching, I am scared.

The initial contribution was only 500/-

PRAN is an acronym for Permanent Retirement Account Number, which is the unique and portable number provided to each subscriber under NPS and remains with him throughout. On successful registration, a PRAN (Permanent Retirement Account Number) will be allotted to the subscriber. A PRAN Kit containing PRAN card, Subscriber details (referred as Subscriber Master List), and an information booklet is sent along with the T-Pin and I-Pin to the associated nodal office. The PRAN Card is a document with PRAN, Subscribers name, father’s name, photograph and signature/thumb impression. This card proves the completeness of information in the CRA system. A copy of the card is required for Tier II activation and also for subsequent contribution in Tier II account. The Subscriber Master List shows all the information as provided by the subscriber in his / her application and accordingly captured in CRA system. A Subscriber may verify the correctness of the information submitted for registration by looking at the Subscriber Master List.

Sir,

I opened NPS account through online using pan on 14.03.16.

Today got message that CRA sent my documents to bank for KYC verification.

Maximum no of days required for verification? Also if verification done before 31.03.16 wether I’ve to deposit 5500.00 before 31st or not?

If PAN is verified it is sent to Bank within 2 days. There is no timeline within which bank has to approve. Please update us how many days it took for you. It would help other readers who are in same situation.

Wait for 2-3 days. Once the KYC is successfully verified by Bank, an alert will be send to the Subscriber and PRAN will be activated in CRA system. In case of any rejection, an alert will be send to theSubscriber for further course of action.

In about 25% of the cases where PAN and bank account have been used for KYC, the process has not been smooth due to delay in verification by banks and or mismatches in what’s available with banks and the address given by the subscriber on her eNPS form,

In case the KYC verification is rejected by the Bank, the subscriber needs to approach the Bank and shall get the details (Bank details, Personal details, KYC details) certified from the respective Bank and then submit the application form directly to CRA.

To claim deduction for this Financial year you would have to deposit it before 31 Mar 2016. Min is 6000 Rs and max deduction you can claim is 50,000 over and above 1.5 lakh in 80C

Sir,

Please everyone just go to site npstrust. Just go through about the different acts about NPS.

My account actived with 2 days and got my PRAN card within 6 days.

Thanks for your response.

But you haven’t touched upon my problem.

Registered using PAN and bank account (aadhar number also provided)

I have the PRAN number and card.

KYC verfied from CRA

Now it doesn’t allow me to contribute due to something pending.

Probably KYC from bank side may be pending.

Can I change to Aadhar based registration (instead of bank account)?

Or how do I speeden up the KYC from bank process?

Yes its waiting for KYC from Bank. The process is explained Process for KYC Verification by Bank (pdf)

Wait for a day or two.

You may try Aadhar based registration , we are not sure if you can do that. If you are successful do let us know, for it would help other readers.

Have you got your T Pin and I Pin?

Did you try contributing through eNPS online?

You can also make their subsequent contributions through eNPS.

In case of any queries or support, you may please write to enps@nsdl.co.in.

Go to the ENPS in a new window page

Enter your PRAN number and DOB.

After authentication by OTP via both mobile and email, you can make contributions to Tier I or Tier II accounts.

You can pay through debit card, credit card or internet banking options.

Hi madhav,

Did you able to do further contribution or still getting the error.

I too scared since the year end approaching and also getting same error “user is not allowed for subsequent contribution” since a week.

Please let me know once it resolved for you. Thinking to contribute through SBI portal if error continue.

i opened an account last year in february. i did not attach an bank account at the time of opening nps. I got the pran card. But i do not know how to make payment for this year. so I kindly request you to please help me.

If you have an existing account with valid PRAN no (permanent retirement account number), you can contribute online

Go to the ENPSOpens in a new window page

Enter your PRAN number and DOB.

After authentication by OTP via both mobile and email, you can make contributions to Tier I or Tier II accounts.

You can pay through debit card, credit card or internet banking options.

500 is the minimum amount,

You can also contribute to NPS from any of the POP/ POP-SP despite not being registered with them and from anywhere in India. List of POP-SPs are available at CRA website http://www.npscra.nsdl.co.in. Subscriber can select nearest POP-SP.

For queries please contact : 022 – 4090 4242 or write to: eNPS@nsdl.co.in

What is POP/POP-SP?

Facilities (like opening Permanent Retirement Account, contributing to NPS etc) will be required to be provided to all the citizens (known as ‘Subscribers’ in the NPS architecture) at various locations across India. These processes shall be carried out through the entities known as Points of Presence (POPs) appointed by the PFRDA. POPs shall provide the services under NPS through their network of branches called POP Service Providers (POP-SP).

Aadhar based enps a/c opened.Photo upluploaded automatically from Aadhar data.Now the downloaded printed form to be send to CRA.Can I paste another photo of mine as I have no photo as my aadhar..?

I am got employee regular weft 22.1.1992.Can I opened NpS account

Yes you can. Why not?

I ave got my PRAN number created instantly after paying 500 rs, Do I need to wait before making further contribution if I would like to?

If you have Tier 1 account then you can start contributing once PRAN is know.

Under NPS, Subscriber accounts are identified by unique PRAN allotted to them by CRA. If subscriber has opted for both Tier I and Tier II in the registration form , then he can start subsequent contributions in both Tier I and Tier II once PRAN is known and need not wait for receiving the PRAN Kit. However, if he has opted for only Tier I in the registration form , then he needs to submit a copy of the PRAN Card along with the duly filled UOS-S10 form to activate Tier II account.

Hi, Thanks for the reply. Anyhow I have one problem in eNPS. I have PRAN but when I click on contribute page, it is asking for PRAN and my DOB, I am providing them correctly but it gives message’ Details entered not correct’…

Can you please suggest to whom we can approach to rectify issue.. I tried to call phone number provided but no one answers and emails are bouncing back 🙁

For Tier 1 account Subscriber is required to make contributions subject to the following conditions

Minimum amount at the time of Account opening – Rs 500 (Optional for Corporate subscriber)

Minimum amount per contribution – Rs 500

Minimum contribution per year – Rs 6,000

Minimum number of contributions in a year – one

Over and above the mandated limit of a minimum of one contribution, a subscriber may decide on the frequency of the contributions across the year as per his / her convenience. No maximum limit has been mandated.

For Tier II, minimum contribution requirements

1.Minimum contribution at the time of account opening – Rs.1000

2.Minimum amount per contribution – Rs.250

3.Minimum number of contributions in a year – one

4.Maintain minimum balance of Rs.2000 at the end of each financial year.

I had contributed-500 in my nps account through enps online subscription, on 8th March. Till today my nps account not updated. Kindly advice how many days required to update.

It takes 3 days

I am in a fix as my registration process did not get completed due to a hanged fund transfer process from SBI internet banking. The eNPS system is not even allowing me to register afresh.

For the last 3 days it is showing an error report. There is no response from NSDL

“Registration against this Acknowledgement Id is pending for confirmation from payment Gateway.Please try again after sometime”. It is making my life hell.

Can anybody provide me a solution?

Try the offline route.

Many are in same boat as you. Ex https://m.facebook.com/NPS.India/posts/444632272387425

The problem gets solved automatically in exactly one week’s time. For me, the transaction failed on 2/3/16. It got cleared on 9/3/16.

Thanks for information. It would help others.

Did you get an SMS/Mail. How did you know that transaction got cleared.

If you have some correspondence , please do share, we can put it in our blog (without your information) . which would help others

it will take 7 days

After around 7 days..if we try again..it works automatically again

I, opened eNPS a/c online and got ack.no.11031112 on 09/03/2016 opted for tier1 and tier 2 accounts. But by mistake I paid Rs.500/- for tier1 a/c and

Rs.500/- for tier2 a/c which should be Rs.1000/-. How to pay remaining Rs.500/- into tier2 a/c. My NPS account is pending. Amount got deducted from my SBI sb a/c.Kindly advice

I have registered online for NPS through my AADHAAR card details which is already linked to my SBI account, there was no problem, instantly after paying the initial amount PRAN has been generated.

But I could not put my right corresponding address as it was automatically uploaded from aadhaar records.

How can I change this address, I am trying to contact both by e mail and over phone, but no response received.

Secondly, is there any minimum numbers of transactions needed to claim the tax benefit?

You have to submit the “Subscriber Details Change Request Form – Form S2” to the concerned DDO who in turn has to submit the same after verification to the concerned PAO. PAO can make the electronic request for the change requested through NPSCAN.

Form is available at eNSDL website Request For Change/Correction in Subscriber Master details And/Or Reissue of I-Pin/T-Pin/PRAN Card

Minimum Contributions (For Tier-I)

Minimum Contributions (For Tier-II)

Minimum contribution at the time of account opening – Rs 1000

I requested for eNPS today using PAN and Bank account number.

Can you please tell me whether I need to send the printed form now or I need to wait for KYC to be completed.

Also please tell me will I get any alert for KYC confirmation.

If you could update us whether you get SMS messages etc it would be of great help to other readers and we will appreciate it.

You don’t have to do KYC. You have to wait for PRAN number and PRAN kit.

After successful payment of initial contribution, a Permanent Retirement Account Number (PRAN) is allotted to you. After online account opening process is completed,and a PRAN kit containing a PRAN card, IPIN/TPIN, subscribed master report, scheme information booklet along with a welcome letter is sent to the registered address.

You need to take a printout of the form, paste your photograph (please do not sign across the photograph) & affix signature. The photograph should not be stapled or clipped to the form.

You should sign on the block provided for signature.

The form should be sent within 90 days from the date of allotment of PRAN to CRA at the following address or else the PRAN will be ‘frozen’ temporarily:

Central Recordkeeping Agency (eNPS)

NSDL e-Governance Infrastructure Limited,

1st Floor, Times Tower,

Kamala Mills Compound, Senapati Bapat Marg,

Lower Parel, Mumbai – 400 013

From what we know about SMS, please verify if its true:

The subscriber is provided with a PRAN instantaneously on successful completion of the registration and initial contribution. An SMS and E-mail alert is sent to the subscriber on successful generation of the PRAN. For security reason, only the last four digits are mentioned in the alert.

On successful registration, a PRAN (Permanent Retirement Account Number) will be allotted to the subscriber. A PRAN Kit containing PRAN card,

Subscriber details and an information booklet is sent to the address obtained from Aadhaar.

The T-PIN and I-PIN are sent separately to the same address. The PIN mailers contain the login credentials required by the subscriber for accessing his/her

account over the internet and telephone. The despatch details of the PRAN kit and PIN mailers are provided to the subscriber through SMS alert to the

subscriber.

The contribution shall be credited in the subscriber’s account within two working days of successful remittance. On every successful credit of units to the subscriber account an email and SMS alert is sent to the subscribers registered email ID and mobile no.

I am in a fix as my registration process did not get completed due to a hanged fund transfer process from SBI internet banking. The enps system is not even allowing me to register afresh.

For the last four -five days it is showing an error report “Registration against this Acknowledgement Id is pending for confirmation from payment Gateway.Please try again after sometime”

Can anybody provide me a solution?

I also faced the same problem but not found any solution. I guess this takes 7-8 days to resolved automatically.

I was registering myself for enps. While making the initial contribution of Rs 500 through internet banking, the transaction was not completed. For the last 4 dys the payment status shows same & I am not being allowed to complete the registration.

Can anybody tell me how I can cancel the hanged transaction & start afresh for the registration process.

How long does it take to show the online contribution in your account? Its already been two working days and the contribution I made is not showing in the holding / transaction statements.

Hello

I have enrolled myself in atal pension yojana ,Am i eligible to open an eNPS in parallel

Yes Sir you are eligible to enroll for NPS.

Why all bank are not included for eNPS account drop down menu

I have online registered via eNPS and PRAN number generated today. So when can I deposit the further contribution? Means how much more days to wait?

online enps registration with sbi netbanking facility not available

I have subscribed online but no PRAN generated. Amount has been debited from my saving account..Pleae dont go for online payments

The subscriber is provided with a PRAN instantaneously on successful completion of the registration and initial contribution. An SMS and E-mail

alert is sent to the subscriber on successful generation of the PRAN. For security reason, only the last four digits are mentioned in the alert.

In case of any queries or support, you may please write to enps@nsdl.co.in.

But, there is another big thing that you left off.

Bank of Maharashtra is also offering this facility online through ITS OWN INTERFACE which no one else is offering at this time.

Link to the same:

http://www.bankofmaharashtra.in/nps/main.asp

Thanks for sharing. We had no information about Bank of Maharashtra

Awesome article with almost all details possible.

These days it is very hard to find such detailed researched articles with in depth analysis and information.

Particularly that with SBI, you can not register online but can contribute online is what I liked a lot.

Thanks for all the info.

I am a central govt employee under New Pension scheme, holding PRAN where my monthly contribution from salary is deposited. My question is “can I deposit extra 50000/- for getting an additional tax saving of Rs 50000/-? That means I want to get the maximum saving of Rs 200000/- in AY 2016-17.

Yes you can. Deductions u/s 80CCD are allowed to all individuals. 80CCD(1B) provides for additional deduction of Rs 50,000 after exhausting limit u/s 80CCD(1).

I registered through eNPS. I didn’t mention any bank details during registration.

1. Is it mandatory to provide bank details? Can I update it now? If so, how?

2. How to contribute via eNPS?

Sorry.. I gave the SBI during registration. Now that is not there in NPS bank list. How can I contribute now?

Pay manually, soon it would come in eNPS.

Did you get PRAN kit?

SBI allows one to invest in NPS through its online internet banking

I just checked, all state banks and more than 25 banks listed..still not icici/hdfc.

may be need to wait for few more months

Yes you are right. Hopefully more banks will come online.

Manually or Offline one can invest in NPS through ICICI Bank

Submit the Subscriber Registration Form with KYC documents

Identity proof

Address Proof

2 photographs (passport size)

Submit the NPS Contribution Instruction Slip (NCIS)

Submit minimum contribution amount to any of our authorized branch.

Currently that’s what it seems!

No option to change bank account!. Only 5 banks listed in eNPS