When an employee has UAN before joining the present employer, he must declare the UAN/EPF account number details to the employer through the declaration form. The new employer then creates links this UAN to the company. This article explains how does the new employer links the UAN of the new employee to the company. It also explains UAN Linking Logic for New Employee with UAN, what if the employer declares an employee as a fresh new employment.

How does an Employer links new Employee with UAN from earlier job

New employer must log in to UAN website for employers. He can register using the following options, as shown in the image below.

- Employee individually by clicking on Member->REGISTER – INDIVIDUAL

- Or Do registration of many employees at once called as Bulk registration. For bulk registration of member for UAN generation or linking, click on Member->REGISTER – BULK

Our article New UAN Unified Portal for Employers explains the UAN website for Employer in detail.

On clicking REGISTER – INDIVIDUAL, the Member Registration form will look as shown in the image below. By default, Previous Employment option would be No, which is valid for all first time employment cases. For members with previous employment, the option has to be changed to Yes

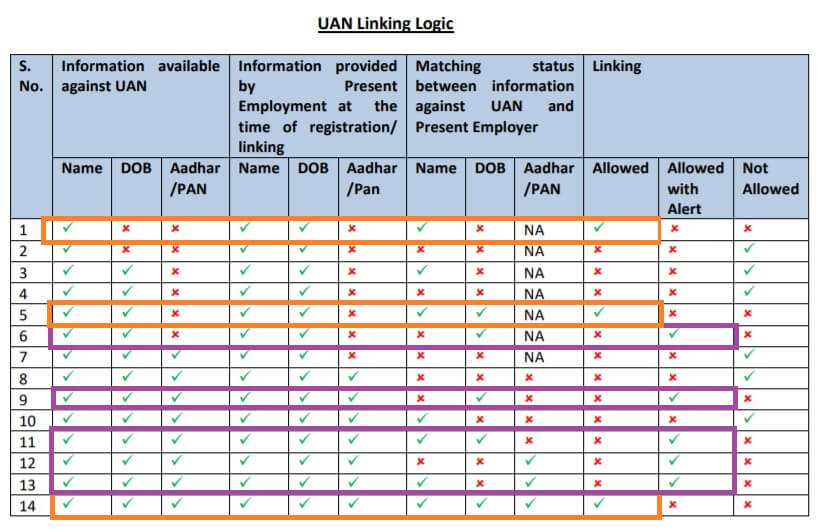

The new employer will then enter the UAN, name of the employee and date of birth. If the employee has provided the Aadhaar and PAN then they will be also used for matching details. The new employer then clicks on Verify. The EPFO database verifies that details of the member exists and shows a window with the details. The employer then clicks on OK. But if the information provided does not match the new employer cannot link the UAN of the new employee. The image here shows the various combination of the details of the new employee available in UAN and which are provided by the new employer when the match is successful and linking is allowed with an alert. Before you leave your old job make sure that your name, date of birth, Aadhaar and PAN are correct.

If the detail matches and new employer clicks ok, then the window shows details of the employee which are available. The new employer then has to add the Date of Joining. At this stage, the new employer can add missing details, change the details and KYC information.

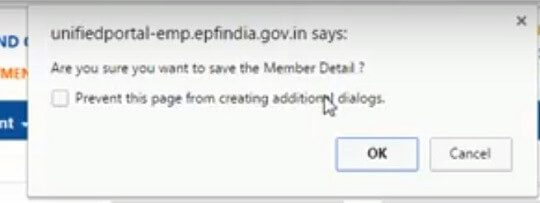

Once done the employer clicks on Save. The message comes up asking for confirmation if employers want to Save the member Detail.

The details then show in section Member details pending for approval, as shown in the image below.

At this stage, the employer can click on View to see the details, where other window pops up showing the details as shown in the image below. He can also click on Edit to make changes. The image below shows the window when View is clicked.

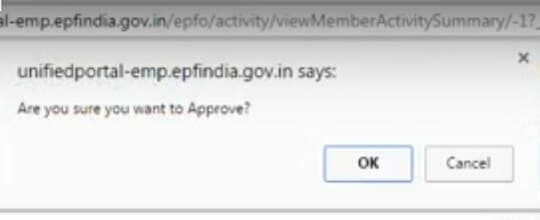

Once he is satisfied that new member details are fine, he can Approve the details. A window pops up asking if he wants to Approve. Once he clicks ok employee details are linked to the new employer. One can pay the EPF for the employee.

UAN Linking Logic for New Employee with UAN

Whether an employer is able to link a new employee with UAN is based on following things. Information means Name, Date of Birth(DOB), Aadhaar, PAN.

- information about the employee available in EPFO database

- information provided by the employee

- Matching status of the information of the employee available in EPFO database and information provided by the employee

Note: If the employer declares an employee as a fresh new employment and provides Aadhaar/PAN at the time of registration, if the same Aadhaar/PAN is already seeded with some UAN, the employer will be prompted that this KYC is already seeded with some UAN and employer has either to provide UAN or register without KYC. However, after registration, the employer can seed the same KYC with new UAN.

Related Articles:

New UAN Unified Portal for Employers

2 responses to “How does an Employer link new Employee with UAN individually”

I have a query like in my UAN portal, my bank details are of SBI. But when I submitted form 11 to my new employer, there I have mentioned ICICI bank details, Will they be able to link my UAN?

A very useful information for many new employees who works in an organization thanks for this blog.