To complete the e-filing process, taxpayers would no longer have to send the 1-page verification document ITR-V to the Income Tax Department in Bangalore . They can instead verify their return online after e-filing using an electronic verification code or EVC. You can everify ITR with EVC’. A taxpayer may verify his return through internet banking or through the Aadhaar-based authentication process. For the convenience of small taxpayers having total income of Rs. 5 lakhs or below without any claim of refund, facility for generating Electronic Verification Code (EVC) has also been provided on the E-filing website of the Department. This article covers What is Electronic Verification Code, ways in which one can generate Electronic Verification Code through NetBanking, ATM, Online, Prevalidating Bank Account, Demat account. How to e-verify your income tax return using EVC generated and through Aadhaar

What is Electronic Verification Code?

To facilitate taxpayers the income tax return for assessment year 2015-16 can now be verified electronically. Persons using this facility will not be required to submit a signed paper copy of ITR-Verification form (ITR-V) to CPC Bengaluru. The electronic verification code comprises a string of characters in the form of a locator number that give a unique identifier to electronic documents as explained in our article Income Tax for AY 2015-16: Tax slabs, ITR Forms. It works in same way as the One Time Password that one uses to do shopping on internet through credit-card.

In case a taxpayer is unable to electronically verify the ITR using the EVC or does not want to e-verify then, the signed copy of ITR-V has to be sent within 120 days to CPC Bengaluru by Ordinary post or Speed post.

E-Verification of Income Tax Return through Electronic Verification Code (EVC) is available from the AY2015-16 or F.Y. 2014-15. If you are filing belated return of the last previous year u/s 139(4) or filing revised returns for past years u/s 139(5) than you would have to follow the old method of ITR-V signing and sending it to CPC, Bangalore within 120 days of filing of return

Reference: Income Tax E Verification Manual

When to e-verify or How to use Electronic Verification Code while Filing Income Tax Return?

After you have uploaded your return to income tax e-filing website you can Verify the ITR electronically. Electronic Verification or E Verification of Income Tax return consists of two parts:

- Generation of Electronic Verification Code

- Electronics Verification of Income Tax Return can be done after uploading Income Tax Return .

- Electronics Verification can also be done of an already uploaded Income Tax Return in last 120 days which are not e-Verified.

Table of Contents

What are the ways in which one can generate Electronic Verification Code for Everifying ITR?

- By linking Aadhaar to PAN Number and verifying it with one time password. The Aadhaar Number and PAN card can be linked if Name, Date of Birth and Gender are same on both the records

- Using Generate EVC at the income tax return filing website, incometaxindiaefiling.gov.in . You can use this method only if Total income as per ITR is less than Rs 5 Lakh and there is no Refund claim

- Through bank ATMs of all major banks

- Online Verification of ITR by Generating EVC Using Bank Account Details

- E-verification of ITR by Generating EVC using Demat Account Details

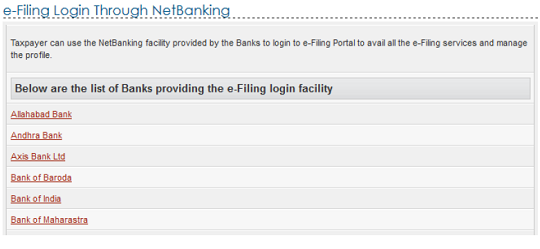

- Through Net banking of all major banks.

- Allahabad Bank, Andhra Bank, Axis Bank Ltd, Bank or Baroda, Bank of India, Bank of Maharashtra,Canara Bank, Central Bank of Inda,City Union Bank Ltd, Corporation Bank-Corporate Banking, Corporation Bank-Retail Banking, Dena Bank,HDFC Bank, ICICI Bank, IDBI Bnak, Indian Bank, Indian Overseas Rank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, State Rank of India, Syndicate Bank,UCO Bank Union Bank of India, United Bank of India, Vijaya Bank .

-

List of Banks providing e-filing Login facilty. Click on Image to Enlarge

Some important information about Electronic Verification Code or EVC

- EVC is a unique 10 digit alpha numeric code and can be used only with the PAN of the person furnishing the income tax return.

- EVC can be used to verify any ITR such as ITR 1 (Sahaj) / ITR 2A / ITR 2 / ITR 3 / ITR 4 /ITR 4S (Sugam).

- One EVC can be used to validate only one ITR whether it is original or revised return.

- EVC remains valid for 72 hours but can be generated various times through various modes.

- In case the tax returns are already filed or uploaded, the verification needs to be done within 120 days of filing of return.

How to Generate EVC through Bank ATM?

This can be used if the bank account has PAN Card linked to it and use the ATM card of the bank which is registered with the IT department. This is useful for people who do not have net banking facility

- Visit bank ATM and swipe the card and enter ATM PIN Number

- Select Generate EVC for Income Tax Return Filing option on the ATM Screen

- The EVC would be sent to your registered mobile number with Bank.

How to Generate EVC through NetBanking?

If you have linked your bank account with your PAN Card linked as part of KYC then you can Generate Electronic Verification Code through Net Banking. The process is similar to Viewing Form 26AS through Net Banking

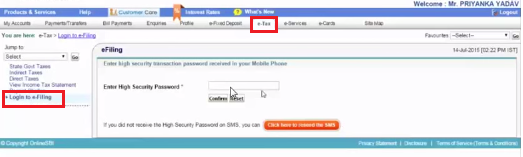

- Login to your bank account through internet banking

- Under the Tax related section for example e-Tax in SBI, Click on Login to e-Filing

- The screen will show your PAN card number and asked to confirm

- Once confirmed you would be redirected to Income Tax filing website

- Generate EVC

Generate EVC Through income tax return filing website

You can use this method only if Total income as per ITR is less than Rs 5 Lakh and there is no Refund claim.

- Login to Income tax Website: incometaxindiaefiling.gov.in

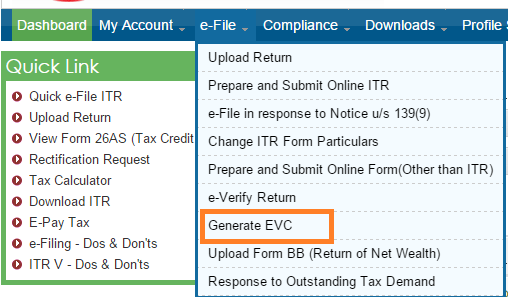

- Click on e-File ->Generate EVC as shown in image below

- The EVC code would be sent to your registered mobile number and e-mail id

How to e-verify your income tax return using EVC

E-verification process of Income Tax Return has to be done after you have uploaded your income tax return

- Login to your income tax e-filing website.

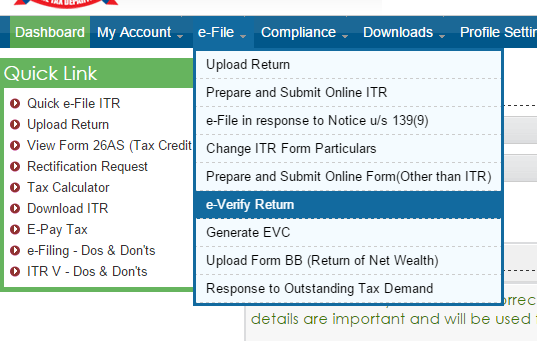

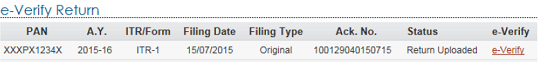

- Click on e-file button and select e-verify Return as shown in image below

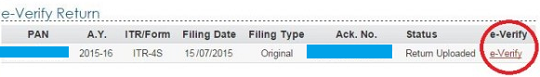

- Uploaded returns (120 Days) which are yet to be e-Verified are displayed in a table as shown in image below

- Click on e-Verify for the return you want to e verify

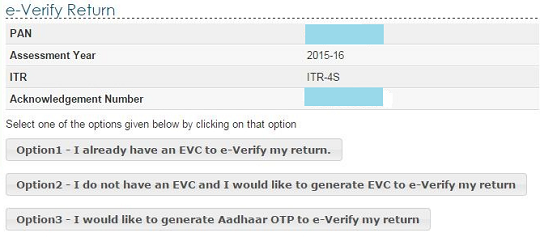

- Option 1 :I already have an EVC and I would like to Submit EVC

- Option 2 :I do not have an EVC and I would like to generate an EVC

- Option 3 :I would like to generate Aadhaar OTP to e-Verify my return

- If you don’t select E-Verify then it means either you would like to e-Verify later or would like to send ITR-V

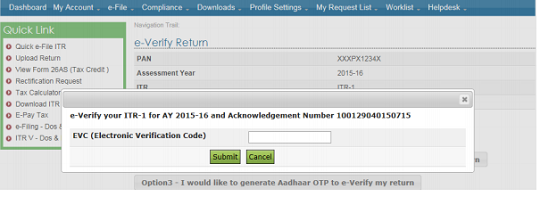

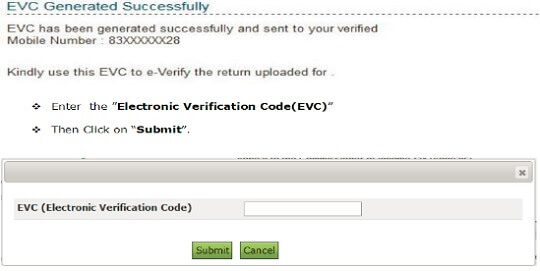

Option 1: I already have an EVC and I would like to Submit EVC

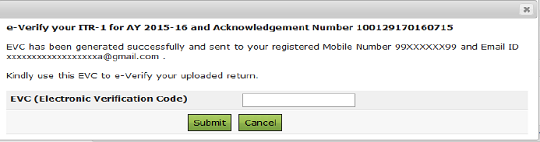

If you click on I already have an EVC to e-Verify my return the below screen is displayed. Generate the EVC by any process mentioned above . Remember that EVC that is generated is valid for 72 hours

- Provide the EVC in the text box

- Click Submit.

- Download the Acknowledgement

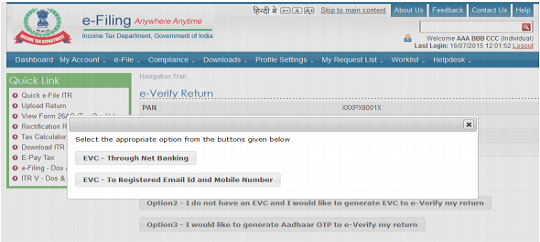

Option 2 : I do not have an EVC and I would like to generate an EVC

If you click on I do not have an EVC and I would like to generate EVC to e-Verify my return the below screen is displayed. Note Total Income is greater than 5 lakhs or if there is refund, Taxpayers are provided with only one option EVC – Through Net Banking.

EVC to e-Verify my return

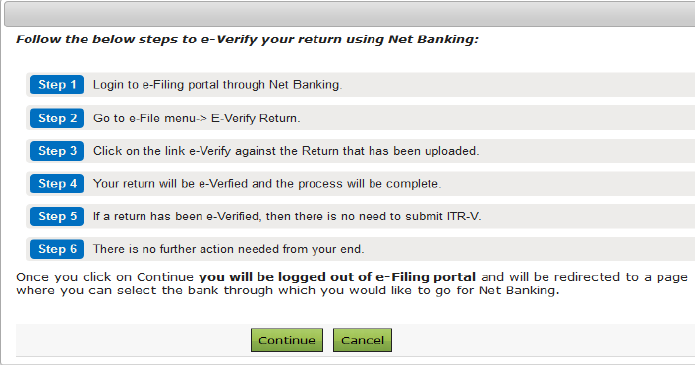

On clicking EVC Through Net Banking screen displayed is shown below

If you Click on Continue, Taxpayer is logged out of e-Filing and will be shown the list of banks available for NetBanking Login as shown in image below. For complete list click here

Login to e-Filing through NetBanking. For example for State Bank of India after logging in through Net Banking on Clicking on Login to e-Filing, you would have to fill in the Security Password which would be sent to your registered mobile. After filling in Security Password , Click Confirm.

You would be redirected to the income tax e-filing website as shown in image below

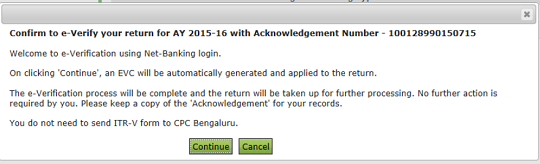

Now when you click e-Verify the screen shown below is displayed

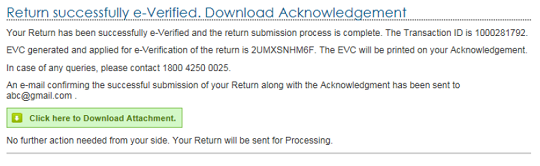

Confirm to e-Verify by clicking on Continue button. Success message will be displayed as shown in image below. No further action is required

Option 3 :I would like to generate Aadhaar OTP to e-Verify my return

Generate EVC through Aadhaar Card as described below

Generating EVC using Bank Account Details

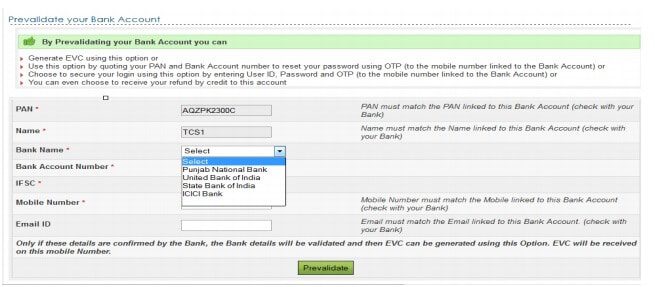

To generate EVC – Through Bank Account Number, Bank Account Number must be pre-validated

- Visit Income Tax Department e-filing website and Login If you do not have a account,then first register yourself.

- After logging in, select View Returns/Forms .

- Select Click here to view your returns pending for e-verification tab to view the returns that are pending for verification. Then click on e-verify tab.

- Select option 3 -Generate EVC through Bank Account Number.

- To generate EVC,you first need to prevalidate your bank account.If the bank account is not already prevalidated,the screen will appear as shown in the image below.

- Select the bank name,enter the bank account number,IFSC code and mobile number.Click on “Prevalidate”.

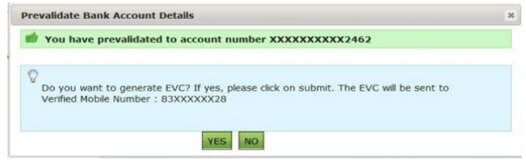

- On successful pre-validation,the following page will appear.Click “Yes” to generate EVC.EVC will be sent to the mobile number validated with the bank.

- Enter EVC number and click Submit.

Generating EVC using Demat Account Details

You can generate EVC using your demat Account Number, registered email address, registered mobile number, PAN and name as used to file returns.

Follow the steps given below to e-verify ITR using this method:

- Visit Income Tax Department e-filing website and Login

- Select the option on the main blue menu bar titled “Profile Setting”

- Go to the option “Update Demat Account Details”

- Click on “Generate EVC using Demat Account details” while verifying returns

- Check your registered email address or registered mobile number and find the 10-digit alpha-numeric E-verification code sent to you.

- Enter the EVC and E-verify returns within 72 hours of generation.

How to e-verify your income tax return using Aadhaar number

This option can be used only if Your mobile number is registered with Aadhaar. As mentioned in our article,JAM Trinity: Jan Dhan Yojana, Aadhaar and Mobile number, Considering the increasing acceptance of Aadhaar it is must for everyone to get it issued. It is believed that the Aadhaar will further be given more importance as more and more government schemes are being launched requiring it as a mandatory document.

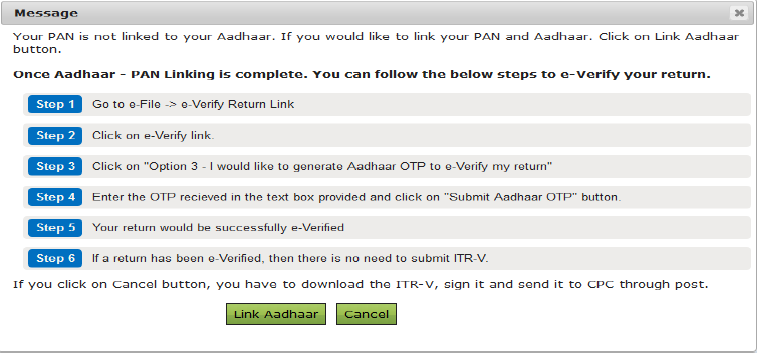

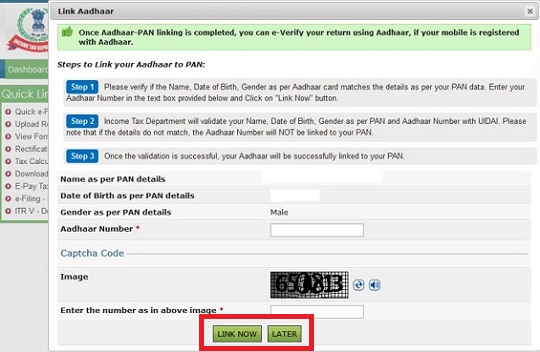

Link your PAN and Aadhaar if Name, Date of Birth and Gender are same on both the records. First step is to Link the Aadhaar number with PAN and then e-Verify using Aadhaar

- Log on to the Department e-filing website.

- As soon as you login, a popup would appear asking you to link your Aadhaar number with you e-filing account. You can choose to Link Now or Later as shown in image below. (Highlighted by red)

If you choose to Link Now, fill in the details like Name , Date of Birth , Gender as per PAN details, Aadhaar number and numbers as shown in image of Captcha Code

- Make sure your PAN details are correct and enter the Aadhaar number..

- Your Aadhaar number will be linked to your PAN after validation.

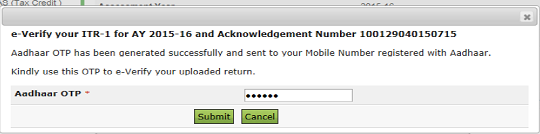

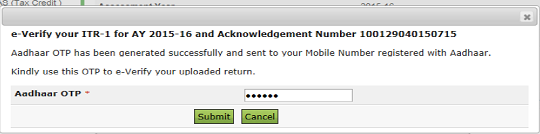

- After your Aadhaar number has been validated, enter the Aadhaar One Time Password(OTP) sent to your mobile number registered with Aadhaar. Note that the Aadhar OTP as EVC is valid only for 10 minutes.

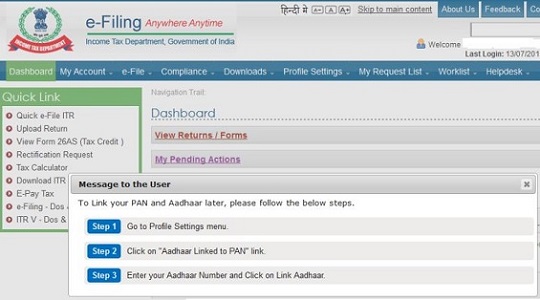

If you choose to Link Later than message screen is displayed below. You need to link later through Profile Settings->Aadhaar Linked to PAN

So when you click on Option I would like to generate Aadhaar OTP to e-Verify my return and your Aadhaar is not linked then you get the screen as shown in message below

Verifying IT return

If your Aadhaar is linked to PAN then after you have filed your ITR, Online or through Uploading XML file generated after filing returns through Excel or Java Utility

- Submit to e-Verify return.

- Select the Option 3: I would like to generate Aadhaar OTP to e-Verify my return

- If your Aadhaar number is linked to your PAN then One Time password will be sent to your registered Mobile number as shown earlier

- Enter Aadhaar OTP in the text box provided and click on Submit, as shown in image below

- Success page is displayed. No further action is required.

- Download the Acknowledgement

I would like to send ITR-V

If You don’t want to use the new method of Electronic Verification and would like to go with the old method of ITR-V signing and sending it to CPC Bangalore then don’t e-verify.

- Click on Download ITR-V

- Submit ITR-V to CPC, Bangalore as earlier.

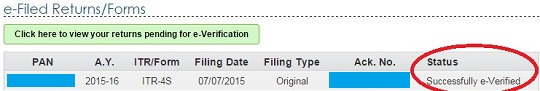

After E-Verification of ITR

The Return would appear as successfully e-verified as shown in the image below

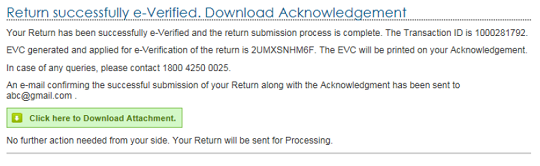

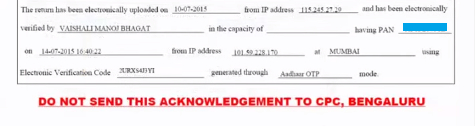

Acknowledgement Form

Once you do E-Verification of your ITR screen showing success message is displayed as shown below. If you download the acknowledgement form ,Click here to Download Attachment, mentioned in the Success message

You would see it’s similar to ITR-V except now it has message printed in the bottom as shown in image below, Do not send this Acknowledgement to CPC, Bengalaru,

Password for opening ITR-V –is your PAN number in lowercase alongwith your date of birth and no spaces in between. For example – Example: PAN: AAAPA1111F Date of birth: 01/01/1975 password: aaapa1111f01011975

For e verification using HDFC Bank, Chrome Browser is not redirecting to the ITR website. Please use Mozilla, Internet Explorer. Thanks to Sunil and Mangesh for finding solution and sharing

Related Articles:

- What is PAN Card ?

- Jokes,Quotes,Cartoons about Tax Taxing Times: In a lighter vein

- Income Tax for AY 2015-16: Tax slabs, ITR Forms

- How To Fill Salary Details in ITR2, ITR1

- Interest on Saving Bank Account : Tax, 80TTA

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

Readers are requested to use Electronic Verification facility in view of the convenience and flexibility offered. What do you think of e Verification?

198 responses to “E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking”

this blog is very helpful.

Yes, We also provide free online income tax filing. we have 10 years experience in tax consultation.

For more information visit my website https://www.trutax.in/

Your article and your answers towards above raisen queries are simply awesome

Many queries on E-verification may be solved in this article

after e verification accepted how many days require to refund my tds?

I had filed my ITR and successfully e Verified it through Aadhar option on 02/08/2017 and it is a revised one. There is still no status as EVC accepted what does it mean?

In the ITR 3 form available in the Income tax website in the TDS section the year dropdown box is there only 2015 am i the getting it like that or all have the same problem

I got a defective notice U/S 139(9) where some information was missing in P&L and BS. Already 15 days over after receiving the notice. I responded to the notice with corrected return.Later found the information is not fully correct then I withdrew this and files a revised return by changing the formITR4 to ITR 4S where I found ITR 4s is more suitable for me as I am working as a Freelancer. Please let me know if any issue on this or any suggestion for it.

From our CA Akshay Mehta

See following People cant file ITR-4S as prescribed in coondition

Professionals – who are carrying on profession of legal, medical, engineering, architectural, accountancy, technical consultancy, interior decoration, an authorized representative, film artist, company secretary and information technology.

Here Authorized representative means – any person, who represents someone, for a fee or remuneration, before any Tribunal or authority under law. Film Artist includes a producer, actor, cameraman, director, music director, art director, dance director, editor, singer, lyricist, story writer, screenplay writer, dialogue writer, dress designer – basically any person who is involved in his professional capacity in the production of a film.

I don’t know , for which purpose you are doing freelance work , so if you are covered in above details then you aren’t eligible to file ITR-4S

.

Secondly, Switching over return may lead to unnecessarily giving chance to departments to look into you matter closely without any particular/big reason. So What I suggest that, First get you things ready in such way that mistakes does not arises. And if some mistakes already happened then try to comply in such a way that department get convinced.

So whatever done by you is correct only, but please be careful for things mentioned above.

I had submitted and e verified the ITR 4 in the month of July as I am working as a Consultant. I have filled the necessary information in the Profit and Loss account sheet and did not enter in the Balance Sheet part. Now I got a Defective note from Income tax department under section 139(9) . 1)”Tax Payer having income under the head “Profits and gains of Business or Profession” but not filled Balance Sheet and Profit and Loss Account”

2) “The complete details of Profit and loss account and Balance Sheet should be entered in the return.”

Kindly advice what to do in this regard . As I dont have more information in the Balance sheet section and in profit and loss section . I have only the income from Sales of Service.

Recently I field returns… My itr v is showing successfully verified…. But its been one month… The status is same… Its not giving any intimation like “evc accepted”… What I have to do????

Please wait. It takes from 1 week to 6 months for IT returns to be processed.

Hi,

I have filed for a return. I have got a receipt saying ‘Do NOT send this to Benglore’. Just wondering where do I have to submit the proofs of my investment and spending?

You don’t have to send any proofs of my investment and spending to Income Tax Department.

Most of things are verified from Form 26AS and Form 16.

If you don’t e-Verify the ITR then you have to send it to CPC

As you have e-verified the ITR then you don’t have to send the ITR-V

Hi,

Firstly thank you for the information you share regarding filing Income tax returns. Its so useful for people like me who are far away and cant get help or guidance easily.

Please help me as I am stuck, I filed my returns with wrong email id and also did not add a bank account. I have not e-verified yet.

So please confirm if I have to follow the following steps,

1. Fill the ITR (ITR-1) form with correct details.

2. In the form under FILLING STATUS

•For Whether original or revised return i selected ‘Revised’.

•For Return filed under section i selected ‘Revised 139(5)’.

•Entered the E-filing acknowledgement receipt number from the ITR-V which I got after filing the original return.

•Then I e-verify both original and revised return ITR-V forms.

Please let me knnow whether my course of actions mentioned above are correct and if I need to do anything more.

Thanks in advance.

“Income from other sources”

How should i calculate the interests i get across all banks ? what should i enter ? what should i enter in section 80tta field ?

Say if i got 5000 as interest for my savings account. I got say 15k as interest for my various FDs across various banks. Please tell what amount shud be entered in “Income from other sources” field and section 80TTA field ????

Which ITR are you filing ITR1 or ITR2. You can go through our article Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR for more details.

it is ITR1

hi,

on calculation, tax payable came to Rs 100/- but before paying the tax, i submitted my itr1 returns. I havent e-verified it yet. I have now paid the tax and have the bsr and challan no. What should I do now ?

Typically if tax payable is Rs 100 you don’t need to pay tax.

Since you have paid, you can revise the return and fill in BSR code and challan. Our article Self Assessment Tax explains it in detail.

I mean should i e-verify my wrong return and then create a new revised return ?? or should i leave the wrong return as it is ?

Income Tax return is not considered filed unless it’s verified. So you can revise the return and then E-verify the latest one.

Your income tax (I-T) return submission is not complete unless you’ve ticked off these these steps —

Step 1: You have e-filed your tax return

Step 2: You have verified the return

Step 3: Final return processing by the tax department i.e. refund is processed or intimation under Section 143(1) is received.

Taxpayers who do not verify end up with incomplete filings. A refund, if any, is not processed in such cases.

Returns can be verified either electronically or by sending the physical ITR-V to CPC, Bengaluru. ITR-V is a one-page document, emailed by the I-T department to you; it can also be downloaded from the department’s website. ITR-V must be signed in blue ink and sent via ordinary or speed post to CPC, Bengaluru. You cannot courier the ITR-V. Sending the physical ITR-V involved a lot of problems. With the introduction of electronic verification, your return can now be verified easily and quickly.

Hi ALL,

My EVC has been accepted . When i can except money in my account . I did through net banking . Is there any process is there to get money fast .20 july 2016 its accepted . when i can except money ?Please help me out . Thanks in advance..

Usually CPC is very fast as less ITRs are filed. You can expect refund within a month.

I e-verified and also find an acknowledgement to the effect it is ‘successfully e-filed’ under My Accounts > e-Filed Returns/Forms in the e-filing website.

On 28th Feb 2015 I received a 245 notification indicating a refund is dues and an old demand is pending and may need to be adjusted. It so happened that I had paid the old demand on 26th Feb 2016 and as per the website there is no demand pending.

On 11th March 2016 I got an sms suggesting I have not filed the return for 2015-16 and should file immediately. How come an automated system sends a notice that is not in line with the contents of their own database?

Hi,

My income is less than Rs.2 lakhs with no TDS. I had done e-verified and it shows ‘successfully e-verified’. Approximately in how many days, will it get processed?

A week to 3-6 months.

I have submitted ITR-4S form for refund my TDS return on 20th July 2015 and did E-verify completed on 2nd August 2015 by net banking…Can anyone please tell me when I get that refunded on my bank account(what the time its does take)???

Thanks

Regards

It takes about 3 to 6 months of time for processing the refunds. So please wait.

Hello,

It takes about 3 to 6 months for refund??? After filling or after e-verification???

Takes 3-6 months After filing.Basically refund happens when your ITR is processed. When income tax department checks whether what you have said while filing ITR matches the details with it.

Every taxpayer has to furnish the details of his income to the Income-tax Department by filing up his return of income. Once the return of income is filed up by the taxpayer, the next step is the processing of the return of income by the Income Tax Department for its correctness. The process of examining the return of income by the Income Tax department is called as Assessment. It takes around a year to process the return. But now CPC is doing it fast. Some people got their returns processed in 1 week this year

Sir,

I have income above 5 lakhs and e verified through aadhar.can i get refund?

Ofcourse you can get refund if you have paid more tax than you were required to pay. How much you earn does not matter in case of refund.

Hello,

I have sent my ITR-V and post tracker said it is received, but income tax helpdesk say it is not received.

so, for e-verify, Do I have to use the same account which used when filing ITR?

Hi,

I have an income of less than Rs. 5.00 lakhs. I have filed my return and e verified also using aadhar otp on 13/07/2015 which was accepted on 21/07/2015 and there is a refund of Rs.1890/- . But I haven’t got the refund yet. what should I do next to get the refund as I just read that ITR’s with no refund status should only be verified using evc.

Please wait for some more time. You have done your part correctly. ITRs with refund take slightly longer time for processing.

Hi, I had sent both original and revised ITR-V forms to Bangalore CPC. However, due to my forgetting to sign them, they were rejected and the same was intimated to me. Then I E-verified them online. Now, it is showing as ITRV REJECTED but at the same time it’s showing as EVC Accepted! My friends who also submitted their ITR-1 well after I did have already got them processed. What should I do?

Don’t worry Vishal. You can wait for sometime or you can call CPC

The helpline numbers for CPC are: Toll free – 1800-425-2229, and Phone Number – 080-22546500

Taxpayers can contact CPC from 8:00am to 8:00pm from Monday to Friday.

I have filed my ITR 4 return on 1st Aug and EVC Accepted on 3rd Aug. It is almost two months now . No update on the refund . When can I expect the refund . Most of my friends who filed ITR 1 got the refund in 10 days. Does ITR 4 take more days ?

ITR1 is easy so it is handled quickly. ITR4 being complicated would take more days.

Hi , have uploaded the return but not able to generate the EVC code because I do not have net banking , and not able to generate through ATM .

kindly let me know any other options to e-verify my return , since I have refund of Rs.3130 .

Regards

Yeshaswini

You can try using Aadhaar.

E verifying the return is not compulsory. You can also send the ITR-V to CPC Bangalore like earlier years.

Dear BeMoneyAware,

I e-filled my ITR-1 and submitted online. However I haven’t e-verified or sent ITR-V yet. I had to revise my form so I submitted revised ITR and e-verified that. I need to get refund in revised ITR.

Now, I have revised ITR which is e-verified but original ITR which is not e-verified.

My question is, Do I need to e-verify both the ITR (Original and Revised) to get the refund ?

Sir,yes please do verify the original return.

Revised Return can only be filed only once the original return is filed.

So you will first file your original return by verifying the original return and then file the Revised Return and then verify the revised return.

Thanks BeMoneyAware for your prompt response.

I verified my original return also. One small question, I had filed ITR-1 as original but for revise, I had to file ITR-2 due to different declaration.

Is this allowed ? Because in ITR-1 (original) I have no refund but in ITR-2 (revised) I have to get refund.

Thanks for your regular support.

Sir entire purpose of revision is to correct the mistakes.

Note: Revision is only allowed for the ITRs filed before the due date i.e 7 sep.

You can also file revised tax return using different ITR form.

If your return has not been processed verify your return and if all things are correct you will get refund.

my income is less than 5 lakhs and tax is refundable.can i use e verified it through aadhaar OTP.

Yes you can e -verify through Aadhaar. You will get refund if its genuine.

my income is less than 5 lakhs and tax is refundable.

but i had e verified it through aadhaar OTP.

Will I be able to get refund?

Yes you can e -verify through Aadhar. You will get refund if its genuine.

Hi

I have file return on 29th Aug 2015. EVC was accepted on 01 September.

Now it is 11 Sept and there is no update. Status still showing EVC accepted.

Don’t worry. As per rules CPC can take 1 year to process.

Hopefully soon you will get the mail from CPC that returns are processed.

I have file my Returns and E-Verified. I have a Refund. While filing the Returns I have given my Central Bank Of India Account Number for receiving my Refund. But i have done the E-Verification through Axis Bank. Will it be a problem to receive the Refund, to which account will i get my refund. Or should i do anything from my side.

That’s a tricky question and we do not know the answer.

During e-verification through bank they said this account would be used for refund. And in ITR they ask to fill the bank account where ypu want refund.

You can revise the return to change the bank account or just wait and see where the amount is credited.

We will appreciate if you could tell us and our readers which account you get the refund.

Hi there, You’ve done an excellent job. I’ll definitely digg it and personally recommend to my friends. I am confident they will be benefited from this website.

Hi there, You’ve done an excellent job. I’ll definitely digg it and personally recommend to my friends. I am confident they will be benefited from this website.

Hi,

I took help from HNR for my tax e-filing which was successfully completed and an uploaded and one hard copy was sent to CPC. I got an intimation for this.

Later moment , I referred my personnal CA and according to him there is more refund for me for current year so I asked him to e-file the revised ITR-1 which I successfully e-verified after receiving the intimation of original ITR-1.

Will my revised e-verified ITR-1 request will be rejected as I have much more Refund due as per new calculations.

Please suggest the best option.

Hi,

I took help from HNR for my tax e-filing which was successfully completed and an uploaded and one hard copy was sent to CPC. I got an intimation for this.

Later moment , I referred my personnal CA and according to him there is more refund for me for current year so I asked him to e-file the revised ITR-1 which I successfully e-verified after receiving the intimation of original ITR-1.

Will my revised e-verified ITR-1 request will be rejected as I have much more Refund due as per new calculations.

Please suggest the best option.

No Sir provision of revision of return is for this purpose only. There should not be any problem.

If Income tax department rejects your return,whether original or revised, it will tell you the calculations it has made and how different they are from yours. It will send Intimation under section 143(1)

respected sir thanks for your blog http://blog.cleartax.in/how-to-e-verify-your-income-tax-return-using-your-netbanking-account/

I have two question

1) i want to know that as shown in your chart for e verification if any body want to take return is it necessary to e verify through net banking only as shown in your graph.or through Aadhar verification we also get return. please check your chart

2) is it necessary to everify through net banking to the same account in which i want refund. or we can verify through any account

3) is it necessary the account which i mention for refund is pancard linked if i mention account in which pan card is not updated or account which i have given for refund in which i am joint holder second then i will get refund or not

1. you can e-verify either through net banking or Aadhar

2. Yes it seems so. The Account No selected by you will be passed will be used for the refund of excess tax paid by the IT Department, says ICICI Bank Terms and Conditions.

3. Yes it seems so Specified banks which have been registered with the I-T department for the purpose of e-filing may provide direct access to the e-filing website. The banks will be providing this service to their accountholders whose bank accounts have a validated PAN as part of KYC (know your client). The facility will be available using the existing internet banking website and the taxpayer can use this facility through their existing internet banking user ID, login password and transaction password.

respected sir thanks for your blog http://blog.cleartax.in/how-to-e-verify-your-income-tax-return-using-your-netbanking-account/

I have two question

1) i want to know that as shown in your chart for e verification if any body want to take return is it necessary to e verify through net banking only as shown in your graph.or through Aadhar verification we also get return. please check your chart

2) is it necessary to everify through net banking to the same account in which i want refund. or we can verify through any account

3) is it necessary the account which i mention for refund is pancard linked if i mention account in which pan card is not updated or account which i have given for refund in which i am joint holder second then i will get refund or not

1. you can e-verify either through net banking or Aadhar

2. Yes it seems so. The Account No selected by you will be passed will be used for the refund of excess tax paid by the IT Department, says ICICI Bank Terms and Conditions.

3. Yes it seems so Specified banks which have been registered with the I-T department for the purpose of e-filing may provide direct access to the e-filing website. The banks will be providing this service to their accountholders whose bank accounts have a validated PAN as part of KYC (know your client). The facility will be available using the existing internet banking website and the taxpayer can use this facility through their existing internet banking user ID, login password and transaction password.

Hi,

My dad is a senior citizen, I filed his income tax return for AY 2015-16. But I did not received any option for e-verification, rather the message came that kindly send the ITR V within 120 days to Income tax Deppt. For your information my Dad’s income is less than Rs.5lakhs and no refund. Pls suggest what is to be done in this case and why there is no “e-verify” option available?

Thanks

Neha

Neha don’t worry.

Login to your income tax e-filing website.

Click on e-file button and select e-verify Return as shown in image and then select the appropriate action

We are pleased to know that you are handling your father’s return. Keep up the good job

Hi,

My dad is a senior citizen, I filed his income tax return for AY 2015-16. But I did not received any option for e-verification, rather the message came that kindly send the ITR V within 120 days to Income tax Deppt. For your information my Dad’s income is less than Rs.5lakhs and no refund. Pls suggest what is to be done in this case and why there is no “e-verify” option available?

Thanks

Neha

Neha don’t worry.

Login to your income tax e-filing website.

Click on e-file button and select e-verify Return as shown in image and then select the appropriate action

We are pleased to know that you are handling your father’s return. Keep up the good job

Hi,

My dad is a senior citizen, I filed his income tax return for AY 2015-16. But I did not received any option for e-verification, rather the message came that kindly send the ITR V within 120 days to Income tax Deppt. For your information my Dad’s income is less than Rs.5lakhs and no refund. Pls suggest what is to be done in this case and why there is no “e-verify” option availabe?

Thanks

Neha

Hi,

My dad is a senior citizen, I filed his income tax return for AY 2015-16. But I did not received any option for e-verification, rather the message came that kindly send the ITR V within 120 days to Income tax Deppt. For your information my Dad’s income is less than Rs.5lakhs and no refund. Pls suggest what is to be done in this case and why there is no “e-verify” option availabe?

Thanks

Neha

I am not redirected to the income tax page. after i log in through net banking and select details for the e tax verification it says i will be redirected to the page but then nothing happens. can u tell me what should i do in this case. i am not able to e verify.

Its HDFC Bank

Servers might be busy.

You can try after some time.

Or try another bank

Was your problem resolved I am facing the same problem cant eVerify my return using HDFC bank.

Readers have said that the problem is with Chrome browser.

I tried with Mozilla & voila I was redirected to the ITR website after confirming & it was done. So everyone who is facing an issue with HDFC bank, please use Mozilla or other browsers for verification.

I am not redirected to the income tax page. after i log in through net banking and select details for the e tax verification it says i will be redirected to the page but then nothing happens. can u tell me what should i do in this case. i am not able to e verify.

Its HDFC Bank

Servers might be busy.

You can try after some time.

Or try another bank

Was your problem resolved I am facing the same problem cant eVerify my return using HDFC bank.

Readers have said that the problem is with Chrome browser.

I tried with Mozilla & voila I was redirected to the ITR website after confirming & it was done. So everyone who is facing an issue with HDFC bank, please use Mozilla or other browsers for verification.

hi sir,

i have e filled my return and verified it through adhar card no. i have also download the ITR V form. my income is below 5 lakh. there is a refund of rs. 2120.

but i have not verify my return through net banking. is there any problem of getting refund.

how much time it takes to refund the money

You have to e verify through one way only either Aadhar or Netbanking.

You should get refund soon. Many people who had filed their ITRs in July have already their refund

hi sir,

i have e filled my return and verified it through adhar card no. i have also download the ITR V form. my income is below 5 lakh. there is a refund of rs. 2120.

but i have not verify my return through net banking. is there any problem of getting refund.

how much time it takes to refund the money

You have to e verify through one way only either Aadhar or Netbanking.

You should get refund soon. Many people who had filed their ITRs in July have already their refund

I successfully e verified my returns using net login. However, on the final screen, it says Click here to download attachment, but I can’t open the attachment after download. It keeps asking me for a password. Usually it is date of birth or PAN number. But both are not working. Any idea how to open the attachment?

Ah.. got the answer. It is the pan number (all small letters) along with date of birth in ddmmyyyy format. No spaces.

Thanks for updating us!

Password for opening ITR-V – Your password is your PAN number in lowercase alongwith your date of birth and no spaces in between. For example – Example: PAN: AAAPA1111F Date of birth: 01/01/1975 password: aaapa1111f01011975

I successfully e verified my returns using net login. However, on the final screen, it says Click here to download attachment, but I can’t open the attachment after download. It keeps asking me for a password. Usually it is date of birth or PAN number. But both are not working. Any idea how to open the attachment?

Ah.. got the answer. It is the pan number (all small letters) along with date of birth in ddmmyyyy format. No spaces.

Thanks for updating us!

Password for opening ITR-V – Your password is your PAN number in lowercase alongwith your date of birth and no spaces in between. For example – Example: PAN: AAAPA1111F Date of birth: 01/01/1975 password: aaapa1111f01011975

After EVC accepted status, how much time does it take for a refund to process?

It is pretty fast. Many who filed in Jul have already got their refund. But there is no sure time limit

After EVC accepted status, how much time does it take for a refund to process?

It is pretty fast. Many who filed in Jul have already got their refund. But there is no sure time limit

Hi. I used the AADHAAR OTP method for e-verifying my ITR-1. I goto “e-filed Returns/Forms” it shows ITR-1 is “Successfully e-verified”.But my income is more than 5 lakh,tax return is not required. in ITR-V shown need not to send.

Do i need to send ITR-V to CPC by post?

Sir you have e-verified and CPC has said that e-verification is successful.

You do not need send ITR-V to CPC by post as you have successfully e verified.

Anyone even those with income of above Rs 5 lakh can e-Verify. Those with income less than 5 lakh can also eVerify through income tax efiling website. This option is not available to those with income more than 5 lakh

Rejoice and pat yourself on back.

Hi. I used the AADHAAR OTP method for e-verifying my ITR-1. I goto “e-filed Returns/Forms” it shows ITR-1 is “Successfully e-verified”.But my income is more than 5 lakh,tax return is not required. in ITR-V shown need not to send.

Do i need to send ITR-V to CPC by post?

Sir you have e-verified and CPC has said that e-verification is successful.

You do not need send ITR-V to CPC by post as you have successfully e verified.

Anyone even those with income of above Rs 5 lakh can e-Verify. Those with income less than 5 lakh can also eVerify through income tax efiling website. This option is not available to those with income more than 5 lakh

Rejoice and pat yourself on back.

Thanks Keerthi for the needful article. I could EVerify my tax using Bank Account by following your article. You helped me in a timely way. thanks.

Thanks Keerthi for the needful article. I could EVerify my tax using Bank Account by following your article. You helped me in a timely way. thanks.

SIR I COMPLETED ALL THE PROCESS OF E VERIFICATION THROUGH ADHAR CARD.BUT WHEN I TRIED TO DOWNLOAD THE ATTACHMENT THEY ARE ASKING FOR PASSWORD.PLEASE TELL ME WHAT WILL BE THE PASSWORD TO DOWNLOAD THIS ATTACHMENT

You session would have expired. Please login again to efiling website and download the attachment.

password to open e-verified acknowledgement is your PAN(in small letters) followed by your dob.. if your dob is 10-Nov-1984, and your pan is aaaaa1111a, then your pwd would be aaaaa1111a10111984.

Hope this helps.

SIR I COMPLETED ALL THE PROCESS OF E VERIFICATION THROUGH ADHAR CARD.BUT WHEN I TRIED TO DOWNLOAD THE ATTACHMENT THEY ARE ASKING FOR PASSWORD.PLEASE TELL ME WHAT WILL BE THE PASSWORD TO DOWNLOAD THIS ATTACHMENT

You session would have expired. Please login again to efiling website and download the attachment.

password to open e-verified acknowledgement is your PAN(in small letters) followed by your dob.. if your dob is 10-Nov-1984, and your pan is aaaaa1111a, then your pwd would be aaaaa1111a10111984.

Hope this helps.

Hi,

I filed my return and choose the option of Send ITR V.

Can i now, e-verify and not send the ITR V.

Regards,

Aashish

Yes you can do so. Please let us know if you face any problem.

Please do let us know if you were able to e-verify.

Hi Kriti,

Yes i was able to e-Verify, using Netbanking.

Thanks

That’s great. Thanks for getting back

Hi,

I filed my return and choose the option of Send ITR V.

Can i now, e-verify and not send the ITR V.

Regards,

Aashish

Yes you can do so. Please let us know if you face any problem.

Please do let us know if you were able to e-verify.

Hi Kriti,

Yes i was able to e-Verify, using Netbanking.

Thanks

That’s great. Thanks for getting back

i had filed my return with an amount of refund. I had linked my adhaar also with PAN No. But i can not e verify my return. Options are not working. I do not have online banking. so i am e-verifying through adhaar. how is it possible?

i had filed my return with an amount of refund. I had linked my adhaar also with PAN No. But i can not e verify my return. Options are not working. I do not have online banking. so i am e-verifying through adhaar. how is it possible?

I tried HDFC bank listed but could not go to the IT page although it mentioned “redirecting you to IT website”. Tried aadhar card but it said “name/DOB or something didnot match” The name in aadhar card is initials and also in PAN card (but the IT website takes only expanded form and I guess that was the problem). So tried State bank of Travancore and could e verify. Husband used State Bank of India and that also was easy. Not sure what is the problem with HDFC bank.

Thanks for sharing. Will try to find if other people have faced same problem

Had same issue with HDFC, closed all windows(chrome), opened in IE & it did work.

Thanks Sunil for sharing and helping others facing same problem. Have added it in the document.

Thanks, will try this year.

The problem is with Chrome browser. I tried with Mozilla & voila I was redirected to the ITR website after confirming & it was done. So everyone who is facing an issue with HDFC bank, please use Mozilla or other browsers for verification.

Thanks Mangesh for the input.

Thanks Mangesh for sharing and helping others facing same problem

Thank you

I tried HDFC bank listed but could not go to the IT page although it mentioned “redirecting you to IT website”. Tried aadhar card but it said “name/DOB or something didnot match” The name in aadhar card is initials and also in PAN card (but the IT website takes only expanded form and I guess that was the problem). So tried State bank of Travancore and could e verify. Husband used State Bank of India and that also was easy. Not sure what is the problem with HDFC bank.

Thanks for sharing. Will try to find if other people have faced same problem

Had same issue with HDFC, closed all windows(chrome), opened in IE & it did work.

Thanks Sunil for sharing and helping others facing same problem. Have added it in the document.

The problem is with Chrome browser. I tried with Mozilla & voila I was redirected to the ITR website after confirming & it was done. So everyone who is facing an issue with HDFC bank, please use Mozilla or other browsers for verification.

Thanks Mangesh for the input.

Thanks Mangesh for sharing and helping others facing same problem

Is generating evc possible through State Bank of Bikaner and Jaipur (SBBJ). Because in the list only State Bank of India is written.

No idea Sir. You can log in and see.

Is generating evc possible through State Bank of Bikaner and Jaipur (SBBJ). Because in the list only State Bank of India is written.

No idea Sir. You can log in and see.

how to EVC in canara bank…i am not finding e-filling in canara bank

Information is in Canara eTax

Login to Canara Bank netbanking first. Then go to Funds transfer -> Tax payments -> Income Tax e-filing, select bank and then click Initiate.

how to EVC in canara bank…i am not finding e-filling in canara bank

Information is in Canara eTax

Hi, for generating EVC through net banking should the bank match the one provided in the ITR form for Refund?

The bank provided for refund is Karnataka Bank and the one that I would use for generating the EVC is ICICI bank. ICICI bank T&C says

•The Account No selected by you will be passed will be used for the refund of excess tax paid by the IT Department.

Would that be a problem?

Sir no one knows what CPC or IT department will do?

As per what we found out it would be refunded in the bank account mentioned in latest ITR,

Hi, for generating EVC through net banking should the bank match the one provided in the ITR form for Refund?

The bank provided for refund is Karnataka Bank and the one that I would use for generating the EVC is ICICI bank. ICICI bank T&C says

•The Account No selected by you will be passed will be used for the refund of excess tax paid by the IT Department.

Would that be a problem?

Sir no one knows what CPC or IT department will do?

As per what we found out it would be refunded in the bank account mentioned in latest ITR,

sir i read your article about efiling with the help of EVC code generated,I already upload my ITR-1 return and at the time of efiling my return i dnt knw about all these procedure and there is Refund in my Return and now the problem is My Phone No. is not connected with Aadhar No. and i have my Account with Dena Bank am apply for Net Banking which i got but at the time of evrify the same the page of Dena Bank shows under construction.

so Know i dnt knw wt to do.

Please help me out of this situation

You can try through bank ATMs of all major banks.

This can be used if the bank account has PAN Card linked to it and use the ATM card of the bank which is registered with the IT department. This is useful for people who do not have net banking facility

Dena bank is on list of banks which are providing this facility.

Visit bank ATM and swipe the card and enter ATM PIN Number

Select Generate EVC for Income Tax Return Filing option on the ATM Screen

The EVC would be sent to your registered mobile number with Bank.

Let us know if it works for you

for ATM EVC i need to update my PAN and Aadhar linked with my Bank Account and for doing all ths i hve to rush to and ask them to check my account wther it is connected or not ? Sir this all means a big problem and harrasment too. coz u knw how these banks worked and i hv to wait till these are not connected .

Then just the plain old way. Send the ITR-V to CPC.

Using e verification is optional not compulsory.

ohh Thanx alot i thnk EVC is mandatory fr me coz i hv refund

You are welcome.

We would still recommend linking your PAN to your bank account (Not Aadhar) and using ATM

sir i read your article about efiling with the help of EVC code generated,I already upload my ITR-1 return and at the time of efiling my return i dnt knw about all these procedure and there is Refund in my Return and now the problem is My Phone No. is not connected with Aadhar No. and i have my Account with Dena Bank am apply for Net Banking which i got but at the time of evrify the same the page of Dena Bank shows under construction.

so Know i dnt knw wt to do.

Please help me out of this situation

You can try through bank ATMs of all major banks.

This can be used if the bank account has PAN Card linked to it and use the ATM card of the bank which is registered with the IT department. This is useful for people who do not have net banking facility

Dena bank is on list of banks which are providing this facility.

Visit bank ATM and swipe the card and enter ATM PIN Number

Select Generate EVC for Income Tax Return Filing option on the ATM Screen

The EVC would be sent to your registered mobile number with Bank.

Let us know if it works for you

for ATM EVC i need to update my PAN and Aadhar linked with my Bank Account and for doing all ths i hve to rush to and ask them to check my account wther it is connected or not ? Sir this all means a big problem and harrasment too. coz u knw how these banks worked and i hv to wait till these are not connected .

Then just the plain old way. Send the ITR-V to CPC.

Using e verification is optional not compulsory.

ohh Thanx alot i thnk EVC is mandatory fr me coz i hv refund

You are welcome.

We would still recommend linking your PAN to your bank account (Not Aadhar) and using ATM

Hello,

I have completed my ITR e-filling by filling ITR-1.I requested for tax refund.

also successfully completed e-verify by generating EVC through net-banking.

Do i need to send ITR-V to CPC by post?

Please reply

No you don’t need to send anything to CPC

In your e-filed Returns/Forms it should show as Successfully e-verified

Thank u so much for quick reply 🙂

Hello,

I have completed my ITR e-filling by filling ITR-1.I requested for tax refund.

also successfully completed e-verify by generating EVC through net-banking.

Do i need to send ITR-V to CPC by post?

Please reply

No you don’t need to send anything to CPC

In your e-filed Returns/Forms it should show as Successfully e-verified

Thank u so much for quick reply 🙂

Hi,

I used Net banking method for e-verifying my ITR-1. But under My Pending Actions there is a message “ITR-V not received / rejected”. When I checked my ITR-1 status, it is Successfully e-verified.

Do I need to send anything to CPC bangalore?

Pls reply.

No you don’t need to send anything to CPC

Thanks for the reply

But I am still confused about my pending actions, its showing “ITR-V not received / rejected”.

Is there any action I have to take for that like contacting CPC regarding my pending actions.

We can understand your confusion.

We are also trying to find out why it’s coming as Pending action.

Will update it in this article as we get more information

Hi,

I used Net banking method for e-verifying my ITR-1. But under My Pending Actions there is a message “ITR-V not received / rejected”. When I checked my ITR-1 status, it is Successfully e-verified.

Do I need to send anything to CPC bangalore?

Pls reply.

No you don’t need to send anything to CPC

Thanks for the reply

But I am still confused about my pending actions, its showing “ITR-V not received / rejected”.

Is there any action I have to take for that like contacting CPC regarding my pending actions.

We can understand your confusion.

We are also trying to find out why it’s coming as Pending action.

Will update it in this article as we get more information

how do i Login to e-Filing through NetBanking OF Allahabad bank??

how do i Login to e-Filing through NetBanking OF Allahabad bank??

Sir, Did u get a solution…

What problem are you facing?

there is no link to e filing in allahabad bank net banking

Hi. I used the AADHAAR OTP method for e-verifying my ITR-1. Today, I noticed that under “My Pending Actions” there is a message “ITR-V not received / rejected”. However, if I goto “e-filed Returns/Forms” it shows ITR-1 is “Successfully e-verified”.

Could this be because I had originally downloaded ITR-V but then went on to do e-verification? Does this mean I am required to send ITR-V through post inspire of doing e-verification? Or could it be that my return has been rejected due to some discrepancy?

If you have successfully verified then you do not need to send the ITR-V.

We shall try to dig up and update if we find more information on it.

Hi, I have an update on this.

The “ITR-V not received/rejected” thing has disappeared without any action from my side. I guess it was a technical glitch sort of. Under my filed returns, it is now showing the status as “EVC accepted” and “ITR Processed no demand no refund”.

While I am relived about the ITR-V message being taken off, I am a little confused to see the “ITR Processed no demand no refund” since as per my ITR-I, I am actually eligible for a small (~70 INR) refund. I guess I’ll have to wait and see!

Thanks for update. Appreciate it. Processed so fast.

Minimum amount for refund is Rs 100. If amount is below this, no refund would be issued. Same is applicable to demand as well

Hi. I used the AADHAAR OTP method for e-verifying my ITR-1. Today, I noticed that under “My Pending Actions” there is a message “ITR-V not received / rejected”. However, if I goto “e-filed Returns/Forms” it shows ITR-1 is “Successfully e-verified”.

Could this be because I had originally downloaded ITR-V but then went on to do e-verification? Does this mean I am required to send ITR-V through post inspire of doing e-verification? Or could it be that my return has been rejected due to some discrepancy?

If you have successfully verified then you do not need to send the ITR-V.

We shall try to dig up and update if we find more information on it.

Hi, I have an update on this.

The “ITR-V not received/rejected” thing has disappeared without any action from my side. I guess it was a technical glitch sort of. Under my filed returns, it is now showing the status as “EVC accepted” and “ITR Processed no demand no refund”.

While I am relived about the ITR-V message being taken off, I am a little confused to see the “ITR Processed no demand no refund” since as per my ITR-I, I am actually eligible for a small (~70 INR) refund. I guess I’ll have to wait and see!

Thanks for update. Appreciate it. Processed so fast.

Minimum amount for refund is Rs 100. If amount is below this, no refund would be issued. Same is applicable to demand as well

Thanks for the detailed steps. I just finished e-verify.

Thanks for the detailed steps. I just finished e-verify.

i have filed online return for refund for assmnt year 15-16 and e verify it. after that it is now 15 days and i am not able to locate the next process. whether my ITR processed or not. in efile status it is showing not determined. what i do now. kindly email me the possibilites.

Have you asked for refund?

This means that the Income Tax Department has still not processed your Income Tax Return or determined the refund yet.

How many days will take for refund amount back?., after successfully verified e returns?..

i have filed online return for refund for assmnt year 15-16 and e verify it. after that it is now 15 days and i am not able to locate the next process. whether my ITR processed or not. in efile status it is showing not determined. what i do now. kindly email me the possibilites.

Have you asked for refund?

This means that the Income Tax Department has still not processed your Income Tax Return or determined the refund yet.

How many days will take for refund amount back?., after successfully verified e returns?..

I read your article and it had a gripping impact!.Thank you for sharing your information.Sikka Kimaantra Greens Sector 79 Noida is a new launch residential Project by Sikka builders. CLICKHERE

I read your article and it had a gripping impact!.Thank you for sharing your information.Sikka Kimaantra Greens Sector 79 Noida is a new launch residential Project by Sikka builders. CLICKHERE

Thank you Sir for your kind and encouraging words. Please spread the message around .

Just sharing what we know .

Thank you Sir for your kind and encouraging words. Please spread the message around .

Just sharing what we know .

Nice explanation. i filed return by following your steps. Its amazing no need to send paper now!!!!! Thanks keerthi… doing good job.

Nice explanation. i filed return by following your steps. Its amazing no need to send paper now!!!!! Thanks keerthi… doing good job.

I filed two belated returns in March 2016 for the financial years of 2013-2014 and 2014-2015 which would be assessment years of 2014-2015 and 2015-2016 . I have verified my return through EVC ( through netbanking ) and it is showing successfully verified . Do I need to send to send anything CPC , Bengaluru now that is verified . Your page suggests in RED that I am required to send it to CPC , Bengaluru since mine is a case of belated return .

Thanks for pointing out.

We checked but could not find out whether EVC is valid till 31st Mar 2016. The latest notification

Vide Notification no. F.No. 2251141/2015/ITA.II dated 20th July, 2015 CBDT has allowed validation of previous years tax return through EVC. Here previous year refers to the belated tax returns pertaining to Assessment Year 2013-14 and 2014-15 filed without digital signature. The time limit of submission of ITR-V for both the above mentioned assessment years has already been extended to 31st October, 2015 and the same time limit applies to validation through Electronic Verification Code (EVC).

While you look ,You can call Customer Care number for queries related to e-filing of Income Tax Return & e-filing website login issues, contact number is 080-2650 0025 and Toll-free-number is 1800-4250-0025. (Working Hours of call centre are from 9 AM to 8 PM – Monday to Saturday.)

Please do update us.