If you wish to trade in the Indian stock market, you will need to open a demat account. A demat account holds all your financial instruments like shares, securities, bonds, mutual funds and other trade-related documents at one place. It facilitates simple and seamless trading and investing.

Opening a demat account has become very simple. Moreover, the procedure and list of mandatory documents required to register the account are the same across different firms and institutions. This article gives you a list of mandatory documents required to open a demat account.

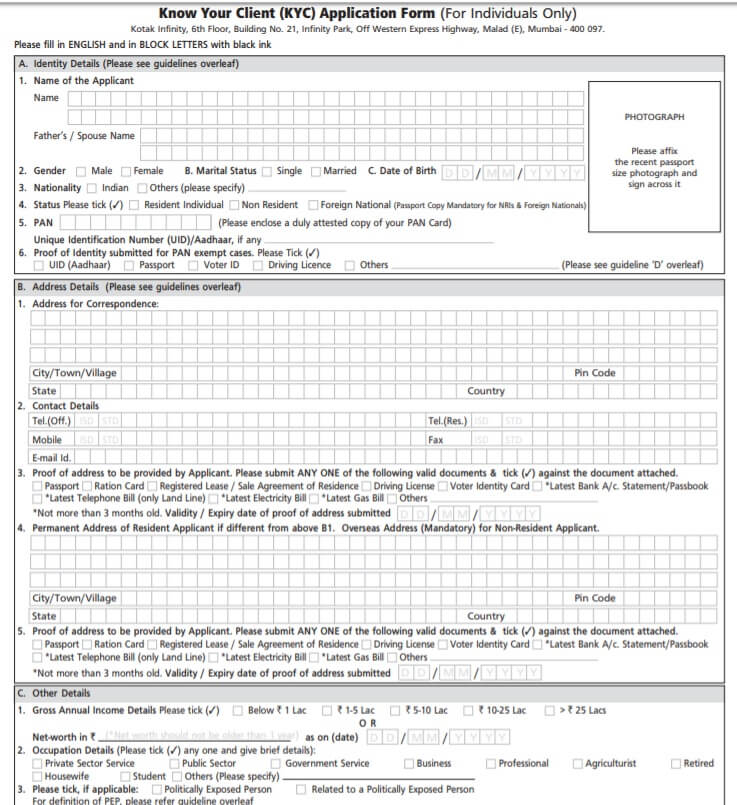

Documents Required To Open A Demat Account

- Proof of Identity

Any government-registered document that has your photograph acts as a proof of identity. It includes your passport, driving license, Aadhaar card, PAN card, voter’s identity card, ration card (provided it has your photograph), etc.

- Proof of Address

Any government-issued card that bears the address of your place of residence acts as a proof of address. It includes your passport, driving license, Aadhaar card, PAN card, voter’s identity card, ration card, recent utility bills (such as electricity bill, gas bill, telephone bill, etc.), recent bank statement or passbook, insurance copy, leave and license agreement or agreement for sale.

- Proof of Income

List of documents admissible as proof of income includes your recent salary slips, form 16, copy of income tax returns acknowledgement slip(ITR-V), certified net worth certificate, copy of certified annual accounts, current bank account statement reflecting the income history of the past 6 months, etc.

- Proof of Bank Account

You will need to submit a cancelled bank cheque as a proof of bank account.

- PAN Card

PAN card is a mandatory document for opening a demat account.

- Passport Size Photographs

You will need to submit a maximum of 3 passport size photographs.

The above mentioned are the basic documents required to open a demat account of an individual, shown in the image below

In order to open a joint demat account, the above-mentioned documents are to be submitted for all the joint account holders. All the joint demat account holders have to also sign the account opening form.

In case of a corporate demat account, along with the basic documents, you will need to submit the copies of the balance sheet of the company for the last 2 financial years, board resolution for investment in the securities market, FATCA declaration, memorandum of association, articles of association and certificate of incorporation, etc.

In case of an NRI demat Account, you will need to submit the original power of attorney, PIS letter, NRO/NRE bank proof, FEMA declaration form, copy of visa/residence permit/work permit, copy of the passport page with India visit stamp from immigration, etc.

Once the above-mentioned documents are submitted and verified, your demat account will be opened. We hope this article has helped you solve your problem of how to open a demat account.

One response to “Documents Required For Demat Account”

thanks for the information and posts 🙂