After having filed ITR many people receive notice from the department saying , Defective return u/s 139(9). What is the Defective return notice ? What is defective Income Tax Return? Why do people receive it? What do to in case one receives defective return under section 139/9 notice.

Table of Contents

What happens after you submit your ITR or Income Tax Return?

Once you file your income tax return, it is checked, assessed and processed by the Income tax department. It matches the information that you provide,income from different sources, tax deducted at source, self-assessment tax paid, among others,with data available to the department, and then intimates you accordingly.

- If the information provided by you in your return matches with what the tax department has, a final intimation is sent (under Section 143(1) of the Income-tax Act, 1961). It contains details of return filed by you and the information available with the tax authority.

- But if there is a mistake or some information is missing, you may get a notification, which would be under Section 139(9) of the Act. This means that the return filed is defective.

When is Income Tax Return Defective?

An income tax return will be considered defective if you provide incomplete details. For instance,

- Not providing Permanent Account Number (PAN) as per records, employer details, income details or tax paid.

- Tax deducted has been claimed as a refund, but no income details are provided in the return.

- If tax along with interest has not been paid before filing the return. Tax challan number and other details should be filled properly. A lot of the taxpayers file their tax returns without updating the information with respect to the self-assessment tax paid. The taxpayer must ensure to furnish the details of the self-assessment in the tax return before submitting the ITR. Our article Paying Income Tax Online, epayment: Challan 280 shows how to pay Self Assessment Tax and Fill Excel ITR1 Form : Income, TDS, Advance Tax how to show it.

- Not paying tax on the bank fixed deposits (FDs). Banks deduct 10 per cent mandatory tax at source(TDS) and pass it to the department. This information is then added to the individual’s Form 26AS that gives details of tax deduction at source. If a person is in 20 or 30% tax bracket, he should pay the remaining tax on it. Many don’t pay the balance tax on FDs thinking that whatever bank has deducted is the final liability

- When you are required to maintain balance sheet and profit and loss statement, but haven’t attached them with your income tax return, the tax return is declared defective.

- When total presumptive income under Section 44AD is less than 8% of gross turnover or recepits, ITR-4 has to be filed. A notice is sent when the filing is made on ITR-4S instead of ITR-4.

What to do If you receive notice that Income Tax Return is defective

If you receive communication regarding your return being defective, you need to respond or file a revised return within 15 days of receiving such intimation. Do remember to mention the date of receipt when filing the revised return apart from correcting the information as indicated in the notice.

However, if you are unable to file a rectified return within the stipulated time, you can seek an extension from the assessing officer (AO). If the mistake is not rectified within 15 days, or within the extended period, or before the assessment is made, the AO will treat the income-tax return as invalid. This is the same as not filing a return at all. In such cases, the benefits of exemption, deduction or carry forward of losses cannot be claimed as the return is deemed to have not been filed.

Response to Defective Return notice under section 139/9

Once the e-Filed returns are processed and the return is termed as defective, you have to submit the response against defective notice (u/s 139(9)) sent by CPC/AO. The detailed process to submit the Response to defective notice is as below

Login on to www.incometaxindiaefiling.gov.in with your User ID, Password and Date of Birth/ Incorporation

Revising the ITR if you agree with Defective Return Notice under section 139/9

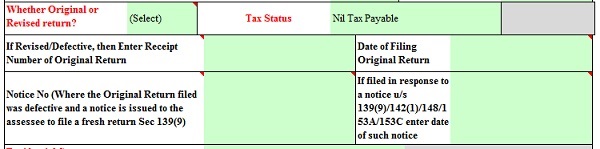

- If you think the notice is correct, you need to revise your ITR . On the income tax return, select the option “In response to a notice under Section 139(9) where the original return filed was a defective return”

Enter the communication reference number, available on the notice, and acknowledgement number and date of filing original return.

Complete the income tax return like you normally would. - Generate the XML File

Submitting the response to Defective Return Notice under section 139(9)

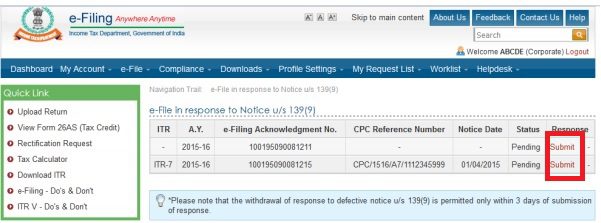

Go to e-File and then e-File in response to notice u/s 139(9)

On successful validation if there is any defective notice raised by either CPC/Assesing Officer(AO), the below screen will be displayed

Click on Submit link under Response column for the respective defective notice number in order to submit the response, shown marked in image above.

For defective notice raised by AO, the below screen will be displayed.

Select the ITR from the drop down and uploads the corrected XML file and clicks on Submit. Once the response is successfully submitted, the below success page will be displayed.

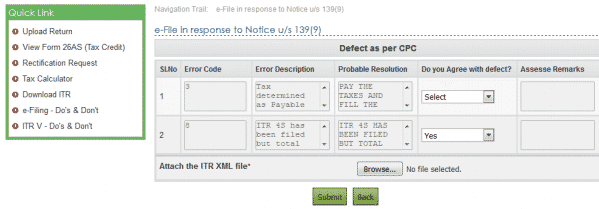

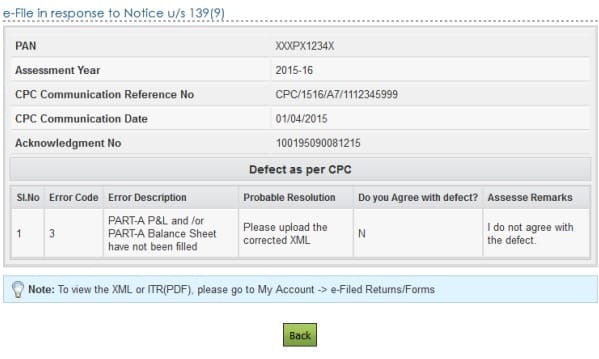

For defective notice raised by CPC, the below screen will be displayed

If you agree with the defect then select Yes under column Do you agree with defect?, and upload the respective corrected return XML. Complete the income tax return like you normally would.

– Generate the XML File and upload it to the Income Tax Department website

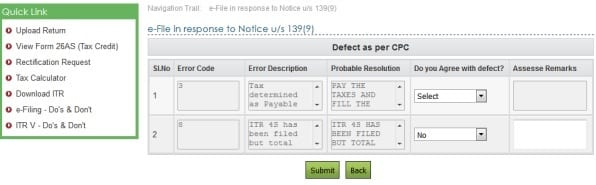

If you do not agree with the defect then you select No under column Do you agree with defect?, and provide the remarks under column Assesse Remarks as shown in the below screen.

You can click on View link under Response column to view the response submitted. The below details will be displayed.

Click on Transaction ID to know the details of response submitted.

To view the XML or ITR (PDF), please do to My Account-> e-Filed Returns/Forms

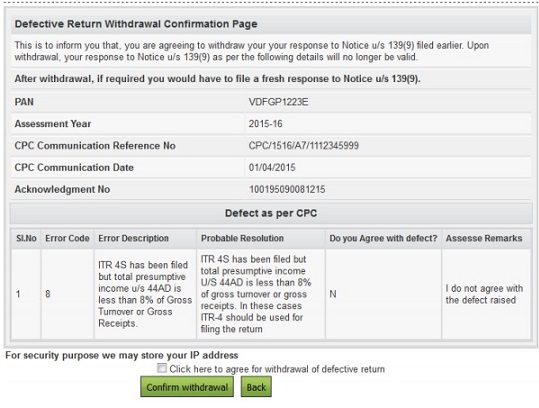

Withdrawal of Defective response submitted

You are allowed to withdraw the response submitted for any defective return within 3 days of submission. You need to click on Withdraw link under Response column.

Details of the submitted response will be displayed. You need to agree to withdraw by checking the checkbox and click on Confirm Withdrawal button.

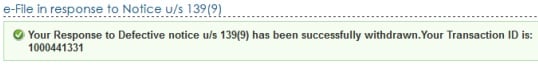

Once the response has been withdrawn successfully the below screen is displayed.

Related articles:

- Income Tax Notice :Sections,What to check,How to reply

- Understanding Income Tax Notice under section 143(1)

- Compliance Income Tax Return Filing Notice

- Exempt Income and Income Tax Return

- Notice for Adjusting Refund Against Outstanding Tax Demand, Section 245

- Fill Excel ITR1 Form : Income, TDS, Advance Tax

Thanks to CA Ehjaz S. Savaijiwala(ca.ehjaz@gmail.com) for the article.

75 responses to “Defective return notice under section 139(9)”

This is very attention-grabbing, You’re an excessively professional blogger.

I’ve joined your feed and sit up for searching for more of your great post.

Additionally, I have shared your web site in my social networks

Thanks

For discribe wonderfull blog.

Great point,Very informative…

Hi, I had to pay self assessment tax of 7200, but i submitted the ITR by mistake without paying the tax and also e-verified my return for the AY 18-19. Now after having e-verified, is there any way to pay the tax? Kindly help me with my confusion. Do I need to pay any penalty when the Income tax department sends me notice for not having paid the tax? What notice will they send?

Be careful in future.

If you don’t pay all tax due your return may be called defective.

If after calculating the income, taking care of deductions and deducting the tax already paid (TDS) one realises that one has paid less tax than due then one has to pay the balance tax. This tax is called Self Assessment Tax. One has to calculate the self assessment tax, pay the Self Assessment tax using Challan 280,update the ITR and then submit it. Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR explains it in detail and also has a video.

Please revise the return after filling the details about Self Assessment Tax.

Hai all,

I received a defective notice under section 139(9) with error code 35.it is regarding tax audit for professionals.I have not opted for presumptive income scheme and my income from profession is 38lakhs. But notice is raised saying my income as exceeded 50lakhs and it is required to prepare balance sheet and P&L.I have filed itr- 3 with full particulars in p&l and balance sheet.

Kindly tell me how to resolve this issue.

HARINI

How much time it will take to get ITR after filling defective itr ??

Hi I received the defective u/s 139(9) status as mail but when I check the website, the status is still showing as successfully e-verified. Kindly provide any help

They might update the status at their own sweet time.

You must reply to notice within 15 days.

I have filed u/s 139(9) acknowledge number 772459430110517 at date 11/5/2017 but not processed till date Plz help I need money soon…

Sorry, we can’t help you much.

You would get information from Income Tax Dept soon.

Really informative article. Keep up the good work.

Thanks.

i uploaded my itr4 for the ay 2015-16 and 2016-17 as belated return .my income is 340000/- which is not liable u/s. 44aa and 44ab , i selected both options as ‘no’.i fille d with blank balance sheet .but now i got the defective notice with ‘error code 31’ for the both the returns .both has been raised by cpc. for one notice time has been lasped i.e.15days .

i am confused and not know what to do .can you please suggest me solution .

Hi Sir,

I have responded the notice received under section 139(9) and submitted three months before. How much time did income tax department takes after our re submission.

Sir i got defective return u/s139/9 error code 38.iam a govt employee i paid all the taxes there are no due but while filing the return by mistake it has taken the option as tax payable.what is the solution for this sir

I am filed IT return for the A.Y.2016-17.I am IT4 return under head of Profit & gain of business. MY income is only commission and i am not claim any expenses & deduction also i am not prepare balance sheet & P &L A/c & file return with balance sheet & p & L A/c. now IT dept. send notice that your return is defective.So IT dept is correct or Not if IT dept is correct which return i have filed or not what response should be given to officer

I got a defective notice U/S 139(9) where some information was missing in P&L and BS

i am reply CAPITAL INVESTMENT IS NIL AND CASH BALANCE AT THE END OF THE YEAR IS NIL AND NO FURTHER INVESTMENT IN THE FIRM DURING THE YEAR

But department not process it upto till day. I am filed my return belated.

What can i do for process the return. my refund due 16000/-

b http://paydayloans24h.review payday loan online

I have received intimation from cpc u/s 139(9) as defective return, showing error code 38 on 11.01.2017 for assessment year 2106-17.

It is as I had not paid due tax. On checking details I have found that I had also not shown Rs. 466 Fd interest as my income in earlier itr filed on 28.07.2016.

Now I want to revise my income, so I want to ask should I file itr now under section 139(9) as original return or should I file return under section 135(5) as revised return.

Kindly help.

I have filed income tax return.I received notice under Section 139(9) of the income tax Act as error code 38 tax liability. Then I checked my income tax return and came to know that I have the worongly filled the column 80ccd(1)in place of 80ccd(2)and that’s why the error code 38 tax liability has been served. So, I want to know that should I pay the tax or submit the corrected return without paying the tax liability as shown in error code 38.

I also have got a defective notice U/S 139(9) where in P&L and BS are missing .

At the time of filling regulare retun i have fill only GROSS RECEIPT, GROSS PROFIT & EXPRESES. at that time there was a LOSS of Rs. 3.86 Lacs.

Please let me know how do i proceed for the same. Do i have to fill in Balance sheet and profit and loss compulsorily or what. Please guide me for further action

Hello,

I’ve received an intimation of 139(9) a day back pertaining to AY 2016-17.

Error Code: 38

Tax liability is shown as payable in the return of income .

SOLUTION: The tax payer should pay the balance tax liability and furnish complete details in the corrected xml. Kindly ensure that there is no tax payable at the time of uploading the corrected XML.

Now, I understand that I need to pay liability amount. In the solution, it is mentioned to upload CORRECTED XML. But, I do not know how to generate the Coorect XML. When I try to choose “Prepare and Submit Online ITR”, and under Filing Status, choosing “18-u/s 139(9)” for the field A22. Return filed under section[P], it is forcing to go to page “e-File in response to Notice u/s 139(9)”, where there is no provision to generate XML.

I know to pay the liability, but, Please help me how to get the correct xml.

Hi,

I am facing a similar issue as Ravindra and not sure how to pay the liability and generate the revised xml. Please suggest.

Thanks,

Partha

Hi Partha,

Ravindra here. I sorted it out. You’ve to follow below steps.

1) Go to efiling home page (without login)

2) Click Downloads > ITR-1

3) Can go either with Java utility or Excel utility [I went with Excel]

4) Fill the form ITR-1 keeping your Form-16, Form 26AS and earlier submitted ITR-1 (For your reference). Here, you just have to fill as you did earlier, keeping below details.

4.a) Return filed (Select (18 – u/s 139(9))

4.b) Whether Original or Revised (Select O – Original)

4.c) Enter Original acknowledgement number, Notice No. and date.

4.d) Enter the notice Number and Date of Notice Receipt

5) After filling all the details, click Calculate Tax button (in case of excel), just need to know how much Tax is being shown. Here, you can see how much liability (Tax Payable) has to be paid.

6) Go to home page of https://incometaxindiaefiling.gov.in/e-Filing/UserLogin/LoginHome.html > Services > E-pay Tax

7) It will re-direct to another website, where you can fill certain info [CHALLAN NO./ITNS 280 (Payment of Income tax & Corporation Tax)] > Type of Payment as “(300)SELF ASSESSMENT TAX” and pay the amount using online banking.

8) Input the BCR Code, Date and Challan number in the TDS form > 21IT section [Details of Advance Tax and Self Assessment Tax Payments]

9) Click Calculate Tax and you must see that the Tax Payable as ZERO.

10) Click Generate XML and save it.

11) Now, go to e-file and Submit by attaching the above generated XML.

Precise and informative steps were a a great help. Thanks Ravindra.

great help. Thanks Ravindra

Thanks a lot Ravindra!! It is really helpful.

Would you please help on below details as well.

4.c) Enter Original acknowledgement number, Notice No. and date.

4.d) Enter the notice Number and Date of Notice Receipt

There is no column in the excel to capture the above data.please let me know what notice data I have to fill as there is only one column to capture the same. Whether the date of notice filed or the date on which i received??

7) It will re-direct to another website, where you can fill certain info [CHALLAN NO./ITNS 280 (Payment of Income tax & Corporation Tax)] > Type of Payment as “(300)SELF ASSESSMENT TAX” and pay the amount using online banking.

Here there is one more data to be entered

Tax Applicable*

(0020)INCOME-TAX ON COMPANIES(CORPORATION TAX) (0021)INCOME-TAX (OTHER THAN COMPANIES)

Which one should I choose??

I hope for the quick reply. Thanks in advance!!!

Great Post !

Most useful Thanks Ravindra

I received a defective notice u/s 139(9) for Assessment year 2015-16 on 28.11.2016. and rectified return efile on 06.01.2017.before processing

on 08.01.2017 received order u/s 139(9) treated as invalid return.

please suggest.

Thanks & regards

bhupender

hi bhupender,

pl let me know, what value you had given for

Amount of total sundry debtors – ?

Amount of total sundry creditors – ?

Amount of total stock-in-trade – ?

Amount of the cash balance- ?

Did you enter “0” for all columns?

No account case, is this first year or 2+ years ?

Thanks,

Kumar

Mr.Kumar,

Thanks for your reply

Amount of total sundry debtors – 0

Amount of total sundry creditors – 7600

Amount of total stock-in-trade – 0

Amount of the cash balance-130,000/-

No account case, 2+ years

not reced any reminder from CPC

Dear all,

Under Balance Sheet for ITR-4, i could see below items

a Amount of total sundry debtors

b Amount of total sundry creditors

c Amount of total stock-in-trade

d Amount of the cash balance

what is the meaning/need explanation on each items.

It will be really helpful for those whose return is defective now and we need to fill-in data for above columns,

I guess applying “0” doesn’t acceptable from AY15-16.

Thanks.

Hi,

I have received a notice u/s 139(9) for defective return with error code 31 by email on Jan 05, 2017.

In the actual PDF, date of notification is mentioned as Dec 16, 2016.

When i login to incometaxefiling website, i don’t see any link under e-file for notice u/s 139(9) to resumbit the revised XML or update my findings/comments.

Appreciate your time and inputs.

Thanks,

Kumar

Same case is mine as Kumar’s after receiving the notice through e-mail.

After login to IT website, It shows ‘NO RECORDS FOUND’ under my e-File in response to Notice u/s139(9) of my login page.

Also after login : Activity/Status shows – (29/07/2016) Return uploaded; (29/07/2016 – Successfully e-Verified; (04/08/2016 – EVC Accepted.

Does it mean I need not to file any further return or to attend my defective notice for Error 31 because I have now again checked that I had opted for not liable to maintain accounts as per Section 44 AA.

Pl. guide me.

I too have exactly same case. The only difference is the pdf says Dec 15, 2016.

Let me know what you did further. I raised an online grievance stating I don’t see any pending action link. I also called up customer care, the lady was a bit rude but she said the link will enable or come into picture after 2-3 days.

Its already 5 days and I don’t see any actionable link enabled.

Please let me know what you did. Is the issue resolved?

Regards

I have received notice under 139(9) error code 999 due to “variation in salary in column BT1 and Schdeuled TDS section is more than 5 lacs”.

Generally this difference is 3-4 lacs due to HRA, Conveyance and section 80C. I have received Leave encashment of Rs 3.5 lacs from my previous employer. I have included Rs 3 lacs for tax purposes because of which difference of more than 5 lacs has come.

Can someone please let me know how to handle this notice?

Thanks

Keshav

Can “Income Under Salary” in SCH TDS1 section be different than what is reported in Form 26AS or Form 16? Or we have to copy this amount as it is from Form 16?

Hi Keshav, I’m also facing same error 999 for defective returns 139(9).

Please let me know how did you close this issue. I

Due to exemption under section 10 (allowances) there is mismatch in TDS.

I refiled ITR and modified SCH TDS1 section to whatever I have in form 16 rather than what is there in form 26as.

There seems to be inconsistency in software check, form 26as has gross income reported if u remove all deduction like investment, HRA etc it will be less than 90% of what is reported. But still notice is sent.

It all depends on the way income is reported in your Form 26AS by your employer.

Better to consult an income tax lawyer/CA.

Dear Sir,

Kindly help me, I am a no account case in ITR-4, Working as contractor in IT.

From income tax dept. i got below message for defective.

Taxpayer having income under the head “Profits and gains

of Business or Profession” but has not filled Balance

Sheet and Profit and Loss Account as required in

explanation(d) under section139(9) read with section

44AA.

The Part A of the Profit and loss account and Part A of the

Balance Sheet should be entered in the corrected return

without which the return filed earlier is liable to be treated as

invalid.

Kindly help me, what should i do?

Thanks,

Devi

I am also facing the same problem. Did you get any link to view/preview this issue in incometaxefiling website ?

ERROR CODE 31. NON SUBMITTING THE B/S & P&L.

The Error Code 31 is sent for only assessees who have filed their Income Tax Return (ITR 4) with ‘Income from Business or Profession’. Until last year, there is no such Error Code 31 for Returns filed. Error Code 31 arises when you have not submitted the Balance Sheet or If the Balance Sheet you submitted is empty with all Zero Balances.

You will find the Bank and Cash Balance Columns in Point No-51 of the Income Tax Return.

In this case all you have to done is to put in your estimated cash balance and actual bank balance used for the business or profession.

You need to rectify the notice under ‘defective return u/s 139(9) error code 31’ by submitting a revised return after rectifying the defect.

You can consult a lawyer,

You can check YouTube video on how How to fill the Profit and loss statement in ITR 4 return for professionals

The best way to prepare Balance Sheet is to start with ‘Application of Funds’ section.

Sir,

what does error code 35 describe about?

Sir,

I already filed response in August 2016 to Defective notice. I still not get my return

Now what is next step of Income tax office or by me?

I actually added your blog to my favorites and will look forward for more updates. Great job. First of all let me tell you, you have got a great blog. I am interested in looking for more of such topics and would like to have further information. Hope to see the next blog soon.

ITR FILED U/S 139(4) HAS BEEN DEFECTIVE.

CAN I REVISE THIS U/S 139(5)?

08793939479

139(4) is for belated return , u have recd notice for 139(9) than u have to file it under the same section.whatsapp me the notice in case @9662161576 i will try to help u out.

I have received a notice u/s 139(9) for defective return.. I have filled the corrected return but there is a requirement to fill the date of notice. Which date should I mention, the date of communication as written in the notice i.e 5th Aug, 2016 or the date of receiving the letter from post office i.e. 22nd Nov, 2016.

Thanks in Advance

Better write the date written in the notice as the department tracks the same through there system

I have received notice under 139(9) for not filled”B/S AND PROFIT AND GAINS OF BUSINESS OF PROFESSION” , balance sheet. What should i response in this case. Should i agree with defect or not?

U must have filed ITR 4 and not submitted b/s and p/l decide what is your income , u do business? Than attach profit loss and balance sheet otherwise select another ITR.

I have received notice u/s 139(9) on 8/9/16 but didn’t received the email. Now after two months I checked it in the pending action where it is mentioned that the return was defective. When I click on ‘in response to notice u/s 139(9)’ it doesn’t show the type of error made and when I click on submit option it is showing ‘no records found’. What should I do now? Please suggest.

It may be due to some server issue therein department have u tried back again?

Sir i have returb file by mistaky itr 1 insted of itr v then returns was defectove u/s139/9 errorcodr33 then i have not agree & submit button & then file itr1 is it correct give sujjestion by mail as early as possible

It is upon you which income u need to show itr -1 is for salary purposes and itr -5 is for firm so i think itr-1 u filed is correct in your case if u have salary and interest income. Secondly itr-v is receipt acknowledgement which u receive from department when u file itr. Dnt get confused between itr-5 and itr-v

I have received notice under 139(9) for not feeding p&l , balance sheet. I had filed rerurn by feeding point no. 53 mentioning my gross receipt & profit only. What should i response in this case. Should i agree with defect or not? & WHAT REPLY GIVEN ?

i hav filed client return in ITR 4 for ASSES YEAR 2015-16 & 2016-17 FILLED DETAILS IN NON ACCOUNTS COLOUMN GROSS RCIPTS,GROSS PROFIT,EXPS.NET PROFIT,I HAVE RECD NOTICE U/S 139(9) REGARDING TO FILE P/L A/C & BALANCE SHEET.I HAV FILED RETURN UNDER CODE 0202 & 0714 WHAT SHOULD I DO,PLS GUIDE ME

Very grateful for this clearly written information! Thanks.

Great and very informative content and i like the best thing about this article is detailing of topics.

Thank you..

Superb post. Never knew this, appreciate it for letting me know.

Awesome and much useful information. Nice and detailed resource about Income tax

Thanks for sharing this excellent info and tweeted 🙂

I Have received notice under 139(9) for not feeding p&l , balance sheet. I had filed rerurn by feeding point no. 53 mentioning my gross receipt & profit only. What should i response in this case. Should i agree with defect or not?

Mr. Sahil Narang,

Did you get any solution to the above query? I was also facing with the same problem.

Hi sreekar

No problem not yet resolved.

Although i have made p&l, balance sheet now but still cant file it because i have nof received any intimation through mail. I came to know regarding defective return when i logged in to incometax site

For filing return under 139(9), notice no. Is required which will be available only in attachment sent through mail by cpc. Still waiting for notice.

Call CPC Bangaluru at 1800-425-2229. You will need your PAN number and DOB for enquiring over the phone.

Hai Sahil Narang,

Same is the problem with me. I too haven’t received the notice or any intimation till date.

But for filing return u/s.139(9), notice no.(CPC Reference No.) is available in the efiling in response to 139(9) page, from where i get to know that the return was defective.

I have received notice under 139(9) for not feeding p&l , balance sheet. I had filed rerurn by feeding point no. 53 mentioning my gross receipt & profit only. What should i response in this case. Should i agree with defect or not?

I got a defective notice U/S 139(9) where some information was missing in P&L and BS. Already 15 days over after receiving the notice. I responded to the notice with corrected return.Later found the information is not fully correct then I withdrew this and files a revised return by changing the formITR4 to ITR 4S where I found ITR 4s is more suitable for me as I am working as a Freelancer. Please let me know if any issue on this or any suggestion for it.

Dear mr.Ajeesh, i am also thinking to file ITR-4S instead of ITR-4 like you. Please let me know whether ur action was successful.

Thanx a lot for precious information.

Thanks

Nice on this topic. Now-a-days I am finding this information for my important work of bank. Nobody tells me this information You share this article on this topic. Thank you.

Thanks for sharing this great information about income tax notification.

Thanks & Regards

Gaurav

HR Finance at SLA Consultants India

http://goo.gl/DsAioh