Credit cards or debit cards are called Plastic cards. Plastic cards are one of the most popular forms of payment. In fact, Plastic cards are an inevitable part of our life. They allow cardholders to pay for goods and services easily and conveniently and provide an alternative to cash and cheques. As Credit Card, Debit card, ATM card etc are, used as the alternative to money such as cash or cheque, and are made of plastic, they are also called Plastic money. This article is about: What are plastic cards? Debit cards and Credit cards, Kinds of Cards(Add-on card, charge card), Details of plastic cards, EMV card, Analysis of card number

Plastic cards are issued to users by a variety of organisations(called as card issuers) such as banks, retailers such as Big Bazaar, Shopper Stop. There are various plastic card schemes such as MasterCard, Visa, Rupay Cards, American Express, Diners Club, Maestro etc. These operators work behind the scene to make sure that card works The types of cards issued and their levels of functionality vary from card issuer to card issuer and between the different card schemes under which the cards are issued.

Table of Contents

What are Plastic Cards: Debit Cards and Credit Cards?

Cards that are made of plastic are called plastic cards. The identification card, Membership card, Smart Card, Credit Card, debit cards, ATM cards are all plastic cards. Some example of Plastic cards are shown below :

Types of Plastic Cards

There are basically two kinds of Plastic cards which are commonly used to buy goods and services : Debit Card and Credit Card

Debit Card

Debit card is linked to the account of the cardholder i.e one who owns the cards. They are usually issued by Banks and financial institutions. When ones use a debit card the money is immediately deducted directly from one’s account associated with the card. One can buy things as long as there is money in account. A debit card is a way to “pay now” Say you have Rs 10,000 in your account. The amount you can spend, or withdraw, through your card cannot exceed this limit.

Credit Card

Credit Card is a small plastic card that is issued by financial institutions such as banks. As the name Credit when one buys using credit card, one is buying by taking loan. One needs to pay back later(there are no free lunches in life!). There is a limit to which one can buy on a credit card. So, even if you have only Rs 10,000 in your account but your credit limit is Rs 50,000, you are free to spend up to Rs 50,000. You could also have Rs 1,00,000 in your account, but your credit limit is only Rs 50,000. You need to repay the amount bought on credit by a due date.

Comparing Credit Card and Debit Card

Credit Card and Debit Cards are similar in appearance except on the front side “Debit card” is printed in small letters while for credit cards ‘Credit Card’ is printed. Credit is like buying money, goods, services now but paying for it in future. As in buying the two people or business involved are buyer and seller. In credit the person who agrees to provide money, goods, services etc is called as creditor or lender and one who takes money, goods or services for the promise of future payment is called as debtor or borrower.

Other Kinds of Cards

There are different types of plastic money available in the market today. Such as Credit cards, Debit cards, add-on cards, charge cards, co-branded cards, affinity cards or Diners Club cards. More and more Indians are using them as a convenient mode of payment. Let’s check out these cards.

- Charge card carries all the features of credit cards. However, after using a charge card you will have to pay off the entire amount billed, by the due date. If you fail to do so, you are likely to be considered a defaulter and will usually have to pay up a steep late payment charge. In case of credit card, one can pay late payment fee if one misses the due date. Popular charge cards are American Express cards also called as Amex cards

- Photo card If card holder photograph is imprinted on a card, then card is known as a photo card. This helps identify the user of the credit card and is therefore considered safer.

- Global cards allow one the flexibility and convenience of using a credit card rather than cash or travellers checks while travelling abroad for either business or personal reasons.

- Co-branded cards are credit cards issued by card companies that have tied up with a popular brand for the purpose of offering certain exclusive benefits to the consumer.For example, the Citi-Times card gives you all the benefits of a Citibank credit card along with a special discount on Times Music cassettes, free entry to Times Music events, etc.

- Affinity Card An affinity credit card program allows an organization to offer its members and supporters–those who have an “affinity” for that organization–a credit card that promotes the organization’s brand and imagery each time a cardholder uses the card. When the card is used, a certain percentage is contributed to the organisation /institution by the card issuer.

- An add-on card allows you to apply for an additional credit card within the overall credit limit. You can apply for this card in the name of family members like your father/ mother/ spouse/ brother/ sister/ children above 18 years of age. You are liable to make good all the payments for the purchases made using the add-on card(s). Your billing statement would reflect the details of purchases made using the add-on card. Normally an issuing bank permits two add-on cards per credit card.

Details of Debit Cards and Credit Cards

A plastic card (Debit Cards and Credit Cards) size is 85.60 X 53.98 mm (3.37 in)and, a thickness of 0.76 mm. Corners are rounded with a radius of 3.18 mm. Specifications for credit card numbering have been drawn up by the International Standards Organization (ISO/IEC 7812-1:1993)

Details on the front of a typical plastic debit/credit card:

- 1. Issuing bank logo,

- 2. Card number,

- 3. Card brand logo such as VISA or MasterCard,

- 4. Expiry date,

- 5. Cardholder’s name

Details on the reverse of a typical plastic card such as debit or credit card are

Back side of debit or credit card

Magnetic stripe : The stripe on the back of a credit card is a magnetic stripe, often called a magstripe. Information such as name of card holder, expiry date of card, card number etc. is written in the magnetic strip. The magnetic stripe is read by swiping past a reading head and the information stored is sent to the acquirer’s bank.

Signature strip : The card holder signs on the Signature strip. The merchant needs to verify that the signature on the card matches the signature on the receipt.

Card Security Code or Credit card Validation (CCV) number : CCV is an authentication scheme. It consists of requiring a card holder to enter while doing credit card transaction.

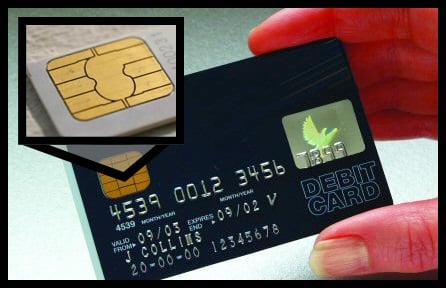

Chip card or EMV

EMV stands for Europay, MasterCard and Visa — is a global standard for cards equipped with computer chips and the technology used to authenticate chip-card transactions. It is small, metallic square you’ll see on cards. That’s a computer chip, and it’s what sets apart the new generation of cards. However, it still relies on a physical card. These cards are also called as Smart card, Chip card, Smart-chip card, Chip-enabled smart card, Chip-and-choice card (PIN or signature), EMV smart card, EMV card.

Just like magnetic-stripe cards, EMV cards are processed for payment in two steps: card reading and transaction verification. However, with EMV cards you no longer have to master a quick, fluid card swipe in the right direction. Instead of going to a register and swiping your card, you are going to do what is called ‘card dipping‘ instead, which means inserting your card into a terminal slot and waiting for it to process. You still have to sign or enter a PIN for you card transaction

The magnetic stripes on traditional credit and debit cards store contain unchanging data. Whoever accesses that data gains the sensitive card and cardholder information necessary to make purchases. That makes traditional cards prime targets for counterfeiters, who convert stolen card data to cash

Unlike magnetic-stripe cards, every time an EMV card is used for payment, the card chip creates a unique transaction code that cannot be used again. If a hacker stole the chip information from one specific point of sale, typical card duplication would never work because the stolen transaction number created in that instance wouldn’t be usable again and the card would just get denied,

EMV technology will not prevent data breaches from occurring, but it will make it much harder for criminals to successfully profit from what they steal.

While the plastic card has been the standard for a half century, recent developments show alternative forms of payment rising to prominence, including online services such as mobile wallets, cellphone apps, PayPal,

Analysing Credit Card Number

Credit card number has a lot of information. The number of digits in credit card varies from 13 to 19 depending on the issuer. Note: In the section first digit mean the leftmost digit and we read numbers left to right

First six digits of the credit card represent the card issuer. The first digit is called as the system number. It is the Major Industry Identifier (MII), which represents the type of institution that issued the card. For example, American Express, Diner’s Club are in the travel and entertainment category, VISA, MasterCard are in the banking and financial category. Different MII are shown below

Major Industry Identifier of Credit Cards

Digits 7 to last but one digit of credit card number is for account number

The last digit is the check digit. Credit cards numbers use check digits to guard against mistakes and to check for validity. A check digit in a credit card number is used as: It can determine if a person keys in a number incorrectly. If a credit card is scanned it can determine of the scanner made a mistake. The check digit is calculated based on some pattern and it is verified with the check digit on the card. If the check digit calculated matches the check digit on the card, the card is valid.

As mentioned, the maximum length of a credit card number is 19 digits. Since the 7 digits are reserved, account number field is 19 – 7, or 12 digits. Each issuer therefore has a trillion (1,000,000,000,000) possible account numbers.

How do Credit Card Work?

Mr.Kumar wants to buy a Sony T.V with ICICI credit card with a MasterCard logo. The shopkeeper at Sony Showroom swipes the ICICI credit card on a machine provided by SBI banks. Various parties involved when one uses Plastic cards as explained below. Our article What happens when credit card is swiped? explains it in detail

- The cardholder is an individual to whom a plastic card is issued. Typically, this individual is also responsible for payment of all charges made to that card.

- Card Issuer is an institution that issues cards to cardholders. This institution is also responsible for billing the cardholder for charges.

- Credit Card association – An association of card-issuing banks such as Visa, MasterCard, etc. that set transaction terms for merchants, card-issuing banks, and acquiring banks.

- Merchant – The individual or business accepting card payments for products or services sold to the cardholder also called as Card Accepter.

- Acquirer – an organization that collects (acquires) credit authorization requests from Card accepters and provides guarantees of payment. The merchant swipes the card on the acquirer’s swipe machine. He submits all the signed slips to the acquirer and collects payments from the acquirer.

Mr.Kumar wants to buy a Sony T.V with ICICI credit card with a MasterCard logo. The shopkeeper at Sony Showroom swipes the ICICI credit card on a machine provided by bank say SBI bank. In the example Mr. Kumar is the cardholder, ICICI bank is the card issuer, the merchant is the shop or Sony Showroom and SBI Bank is the acquirer and MasterCard is the card association.

Related articles:

One response to “Debit Cards and Credit Cards: Plastic money”

Well, we use different types of cards all day. But rarely do we care about the various factors that include these credits, debit or rupee cards. For any type of transaction, these cards are really necessary.