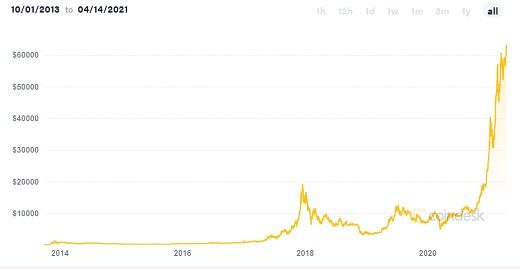

Bitcoin and other cryptocurrency prices are just rising as shown in the image below. Many Indians are suffering from FOMO. The government had stated that ‘while it supports blockchain technology, used across industries from banking to agriculture and virtual currencies, it is not in favour of digital currencies.’ Is Cryptocurrency banned in India? What are the details of the Committee report formed by the Indian Govt on Virtual Currencies? What is the Draft Bill to ban and criminalise CryptoCurrency proposed by the Committee? What are the Income Tax notices sent to the Crypto Currencies users in India?

It is true that it is not illegal to buy cryptocurrency in India.

However, there is no legal guarantee of the safety of the invested amount like regular investment avenues.

In Mar 2021, Finance Minister Nirmala Sitharaman said, “The Government does not consider crypto-currencies legal tender or coin and will take all measures to eliminate use of these crypto-assets in financing illegitimate activities or as part of the payment system.” But the Government would explore the use of blockchain technology proactively for ushering in a digital economy.

Like gold, cryptocurrencies are seen as a hedge to protect fiat portfolio, and their value as a hedge lies in their inflation-beating qualities. Traditionally, investors used gold to hedge against stock volatility. But today, crypto is slowly emerging as a mainstream investment class especially among millennials.

Table of Contents

India and CryptoCurrency Ban

A Crypto currency is a medium of exchange, such as the US dollar on Indian Rupee, but is digital and uses encryption techniques to control the creation of monetary units and to verify the transfer of funds There are around 2,116 cryptocurrencies, Bitcoin like Ripple, Ethereum and Cardano with a market capitalisation of $119.46 billion. Our article Crypto Currency: What is it? Types ex Bitcoin, Ethereum, Technology BlockChain

Through a circular in 2018, the RBI had advised all the entities regulated by it not to deal with virtual currencies or provide services for facilitating any person or entity in dealing with settling them.

The uncertainty around cryptocurrencies in India continues as the government is now planning to propose a new law that will not only ban digital money but will also fine anyone trading in the country or even holding such digital assets.

- The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 (“ODC Bill”) has been proposed with the objective of creating a facilitative framework for creation of the official digital currency to be issued by the Reserve Bank of India (“RBI”) and prohibit all private cryptocurrencies in India

- The Supreme Court set aside the RBI circular on March 4, 2020

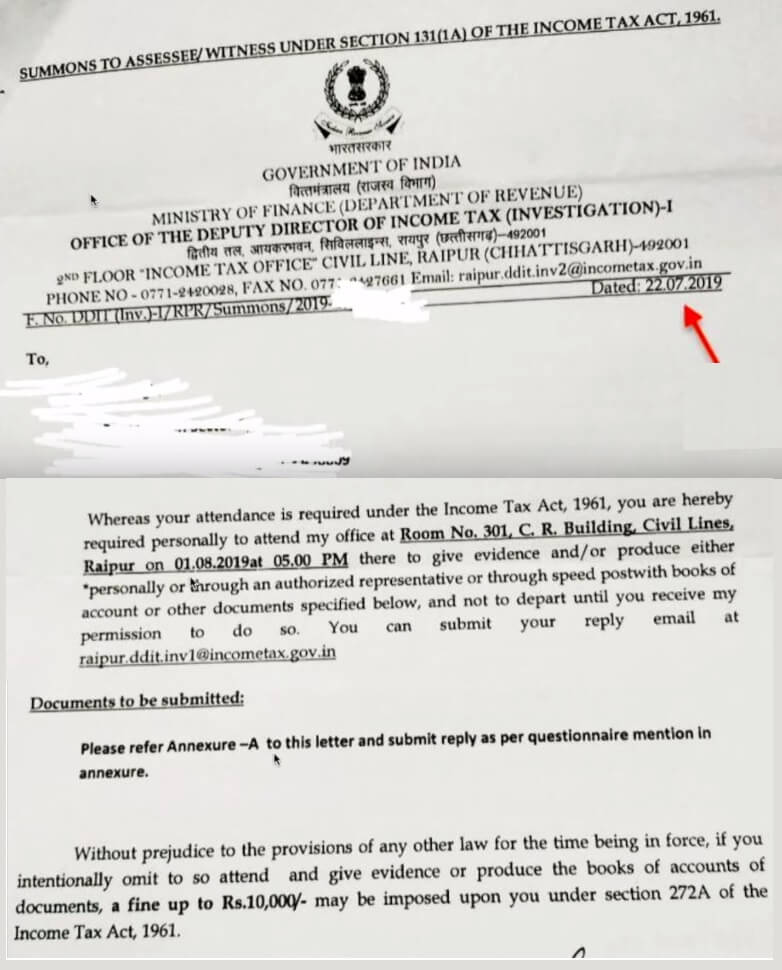

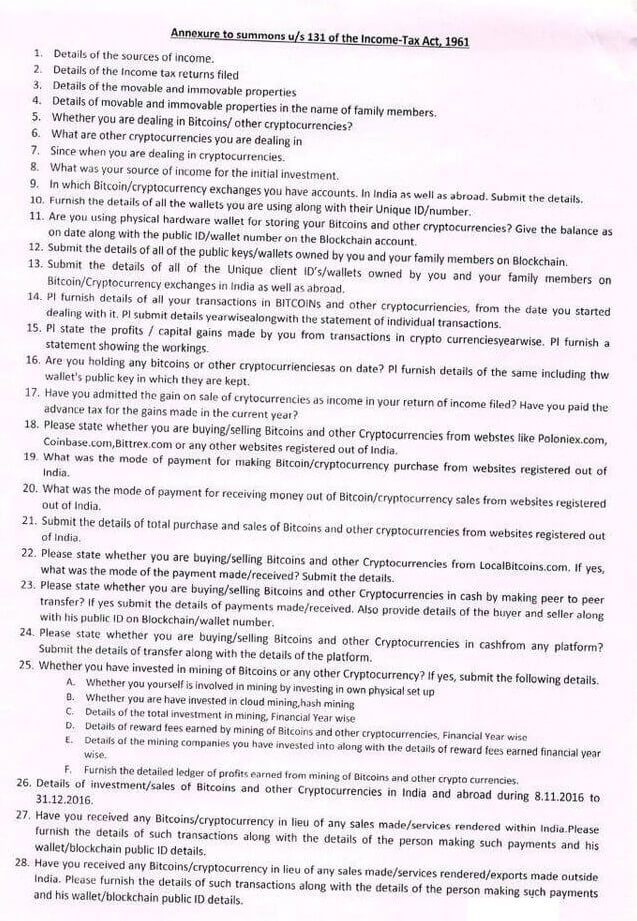

- In Jul 2019, Many people received an Income Tax notice asking for details about Investment in CryptoCurrency. They have been asked to meet the officials within one week of time along with the list of documents. The income tax department has specifically sought details of bitcoin investments during the demonetisation period, that is between 1 November 2016 and 31 December 2016. In Dec 2017, the Income Tax Department had issued notices to 4-5 lakh high net worth individuals (HNIs) under the annexure to a summons under Section 131 of the Income Tax Act.

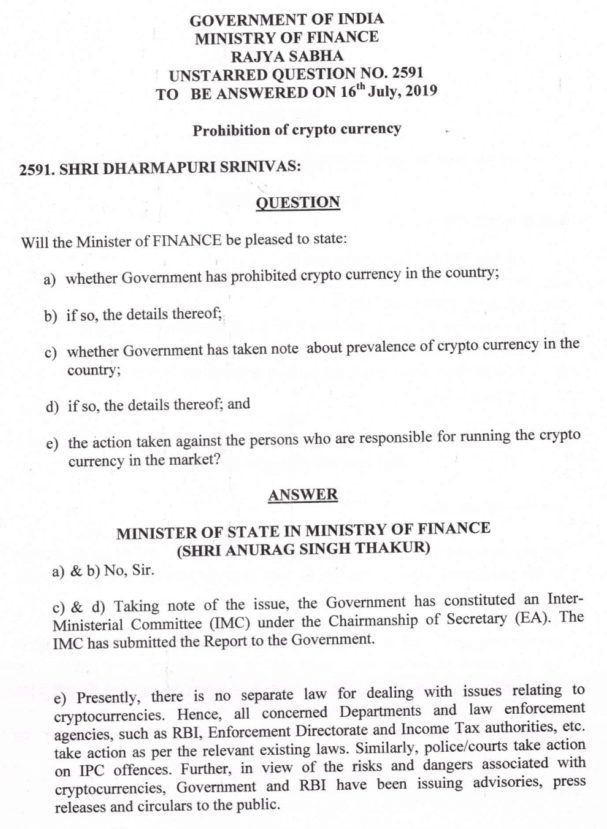

- On 20 July 2019 responding to questions in the Rajya Sabha on whether the government has prohibited cryptocurrency in the country, Minister of State for Finance and Corporate Affairs, Anurag Thakur said the answer was NO. Presently, there is no separate law for dealing with issues relating to cryptocurrencies. Hence, all concerned departments and law enforcement agencies, such as RBI, Enforcement Directorate and Income Tax authorities, etc. take action as per the relevant existing laws

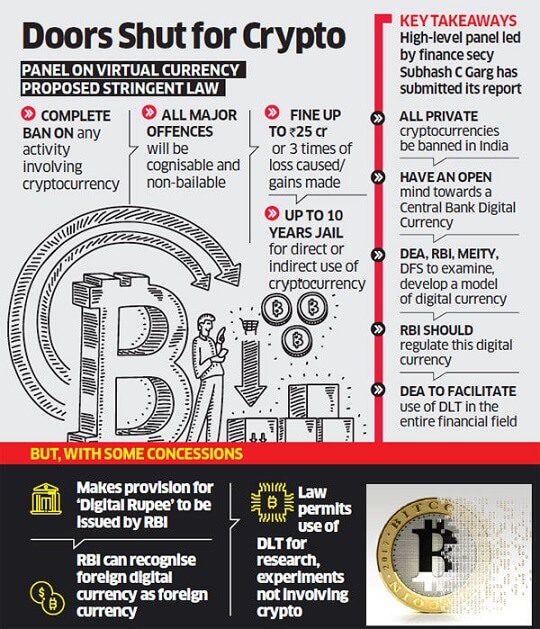

- The Government had constituted an Inter-Ministerial Committee (IMC) on 2.11.2017, to study the issues related to virtual currencies and propose specific action to be taken in this matter. This IMC, led by Subhas Chandra Garg, in Jul 2019 has proposed a draft bill “Banning of Cryptocurrency & Regulation of Official Digital Currency Bill, 2019′. This bill has been placed in the public domain. It has recommended a ban on all forms of cryptocurrencies. You can read the draft here: Banning of Cryptocurrency & Regulation of Official Digital Currency Bill, 2019And report here Report of the Committee to propose specific actions to be taken in relation to Virtual Currencies

- In Feb 2018, Former finance minister Arun Jaitley, in his budget speech, had said: “The government does not consider cryptocurrencies legal tender or coin and will take all measures to eliminate use of these crypto assets in financing illegitimate activities or as part of the payment system. The government will explore use of blockchain technology proactively for ushering in digital economy.”

- In July 2018, RBI had forbidden all financial organizations and banks from having a business relationship with firms dealing in virtual currencies. The ban went into effect on 6 July 2018. This has led to the closing of some crypto exchanges such as Zebpay. Official Responses from Indian Crypto Exchanges After RBI Ban covers responses from the Exchanges in India.

- Some of the exchanges and traders have filed a case as there was no official ban and blocking essential banking services where there is no illegal dealing was unacceptable. The case is still in the Supreme court.

- The entire industry including exchanges, lawyers, traders, influencers is coming together so that this proposal is not accepted by the government.

Income Tax Notice to those holding Cryptocurrency

In Jul 2019, Many Individuals who have invested in Cryptos have started getting notices from the Income Tax department. Indian crypto users who have received the notice have been asked to meet the officials within one week of time along with the list of documents.

In Dec 2017, the Income Tax Department had issued notices to 4-5 lakh high net worth individuals (HNIs) under the annexure to a summons under Section 131 of the Income Tax Act. For details, you can check Livemint article, Bitcoin: Income tax dept sends notices to HNIs, wants to know source of investment

Clear Tax article Income tax on Bitcoin & its legality in India discusses taxation on CryptoCurrencies in detail.

Government Answer to Is CryptoCurrency Banned in India in Rajya Sabha

Minister of State for Finance and Corporate Affairs, Anurag Thakur said the answer was NO while replying to is CryptoCurrency Banned in India in RajyaSabha in July 2019

- Presently, there is no separate law for dealing with issues relating to cryptocurrencies. Hence, all concerned departments and law enforcement agencies, such as RBI, Enforcement Directorate and Income Tax authorities, etc. take action as per the relevant existing laws,

- Similarly, police/courts take action on IPC (Indian Penal Code) offences. Further, in view of the risks and dangers associated with cryptocurrencies, (the) government and RBI have been issuing advisories, press releases and circulars to the public,” he added.

Inter-ministerial Committee, IMC report on CryptoCurrency

A high-level Inter-Ministerial Committee was constituted in November 2017 to study the issues related to virtual currencies and propose actions to be taken. The Committee submitted its report on 28 February 2019, and the report was released in public domain on July 22, 2019.

The committee is headed by Finance Secretary Subhash Garg. The other members are Ajay Prakash Sawhney, Secretary, Ministry of Electronics and Information Technology; Ajay Tyagi, chairman, Securities and Exchange Board of India (Sebi); and B P Kanungo, deputy governor, Reserve Bank of India (RBI).

It has also proposed a draft “Banning of Cryptocurrency and Regulation of Official Digital Currency Bill 2019“. The Draft bill proposes ban on cryptocurrencies, criminalise activities associated with cryptocurrencies in India, and provides for the regulation of official digital currency

The IMC has chosen to specifically define the word cryptocurrency in the draft bill. Through this definition, the committee has separated crypto-currency from digital rupee and digital foreign currencies.

Cryptocurrency has been defined as “any information or code or number or token not being part of any official digital currency, generated through cryptographic means or otherwise, providing a digital representation of value which is exchange with or without consideration, with the promise or representation of having inherent value in any business activity which may involve risk of loss or an expectation of profits or income, or functions as a store of value or a unit of account and includes its use in any financial transaction or investment, but not limited to, investment schemes.”

You can read the draft here: Banning of Cryptocurrency & Regulation of Official Digital Currency Bill, 2019

And report here Report of the Committee to propose specific actions to be taken in relation to Virtual Currencies

Major points of the IMC Report

The Committee observed that cryptocurrencies cannot replace traditional currencies due to several issues associated with them.

- Cryptocurrencies are subjected to market fluctuations. For instance, the value of Bitcoin cryptocurrency reduced from around USD 20,000 (December’17) to USD 3,800 (November’18) in less than a year

- Cryptocurrencies are decentralised, which makes them difficult to regulate;

- Cryptocurrency design has several vulnerabilities which leave consumers open to the risk of phishing cyber-attacks and Ponzi schemes.

- Cryptocurrencies transactions are irreversible, meaning there is no way to redress wrong transactions;

- Cryptocurrencies require a large amount of storage and processing power, which can have unfavourable consequences on the country’s energy resources; and

- Cryptocurrencies provide greater anonymity making them more vulnerable to money-laundering and terrorist funding activities.

Distributed Ledger Technology or DLT

In the Report, the Group has highlighted the positive aspect of distributed ledger technology (DLT) and suggested various applications, especially in financial services, for use of DLT in India. The DLT-based systems can be used by banks and other financial firms for processes such as loan-issuance tracking, collateral management, fraud detection and claims management in insurance, and reconciliation systems in the securities market.

- The Group has also proposed that the Government keeps an open mind on official digital currency.

- As virtual currencies and its underlying technology are still evolving, the Group has proposed that the Government may establish a Standing Committee to revisit the issues addressed in the report as and when required.

- Our article Blockchain What is it? How it differs from Cryptocurrency? What is the future? explains the difference between BlockChain and CryptoCurrency.

Regulatory framework around the world

The Committee observed that different regulatory frameworks are followed in different countries with respect to cryptocurrencies. Countries such as Japan, Switzerland and Thailand allow the use of cryptocurrencies as a mode of payment. In Russia, they can be used as a mode of exchange (barter exchange), but not for payments. On the other hand, China has a complete ban on virtual currencies. The Committee observed that no country has allowed the use of any virtual currency as legal tender.

Draft Bill on cryptocurrency

The Inter-Ministerial Committee has proposed a draft Bill which bans cryptocurrencies, criminalises activities associated with cryptocurrencies in India, and provides for the regulation of official digital currency. Key features of the Bill are given below.

Note: This is just a draft. This bill has to be presented in parliament for debate and voted. If it’s approved by the majority, it will be sent to the President for his approval as per Article 111. Only after his assent, can a bill become an Act of Parliament.

The Bill defines cryptocurrency as any information, code, number or token which has a digital representation of value and has utility in business activity, or acts as a store of value or a unit of account. The Bill defines mining as an activity aimed at creating a cryptocurrency and/or validating a cryptocurrency transaction between a buyer and a seller.

The Bill provides that cryptocurrency should not be used as legal tender or currency in India. It prohibits mining, buying, holding, selling, dealing in, issuance, disposal or use of cryptocurrency in the country.

The Bill allows for use of technology or processes underlying cryptocurrency for the purpose of the experiment, research or teaching.

In particular, the Bill prohibits the use of cryptocurrency for:

- use as a medium of exchange, store of value or unit of account,

- use as a payment system,

- providing services such as registering, trading, selling or clearing of cryptocurrency to individuals,

- trading it with other currencies,

- issuing financial products related to it,

- using it as a basis of credit,

- issuing it as a means of raising funds and (viii) issuing it as a means for investment.

Offences and Penalties for CryptoCurrency users

The Bill provides for the following offences and penalties:

| Offence | Punishment |

| Mining, holding, selling, issuing or using cryptocurrency | Fine or imprisonment up to 10 years, or both |

| Issuing any advertisement, soliciting, assisting or inducing participation in use | Fine or imprisonment up to seven years, or both |

| Acquiring, storing or disposing of cryptocurrency with intent to use | Fine |

- The Bill provides that any subsequent conviction for any offence under the Bill would be punishable with a fine and imprisonment of 5-10 years. Further, attempting to commit an offence will be punishable with 50% of the maximum term of imprisonment for the offence or the applicable fine, or both. All offences punishable with fine may be compounded. Offences related to use of cryptocurrency for issuing related financial products or issuing it as a means of raising fund or investment would be cognisable and non-bailable. All other offences would be non-cognisable and bailable.

- The Bill provides that the maximum amount of fine levied will be the higher of: (a) three times the loss caused and (b) three times the gain made by the person. If the loss caused or the gain made by the person cannot be determined, the maximum amount of fine for acquiring, storing or disposing of cryptocurrency will be up to one lakh rupees. For all other offences, the maximum fine will be up to Rs 25 lakh. The Bill amends the Prevention of Money Laundering Act, 2002 to give effect to the offences.

The image from EconomicTimes report on CryptoCurrency Ban in India gives an overview of the Draft Bill

Can the Draft Bill be stopped from becoming law?

The entire industry including exchanges, lawyers, traders, influencers is coming together so that this proposal is not accepted by the government.

As per Wazirx article, Crypto is NOT BANNED in India. IMC report recommending a ban is fundamentally flawed, If you believe in crypto, hold crypto, or work in the industry — the time to act is now! Here’s how we can make our voice heard:

- Tweet to the government about positive aspects of crypto using #IndiaWantsCrypto and tag our ministers.

- Write on publications, your own blog, upload youtube videos pointing out the flaws in the IMC report.

To find What’s wrong with the IMC report, Please read the article by Wazirx.

Related Articles:

Banning of Cryptocurrency & Regulation of Official Digital Currency Bill, 2019

Report of the Committee to propose specific actions to be taken in relation to Virtual Currencies

- Crypto Currency: What is it? Types ex Bitcoin, Ethereum, Technology BlockChain

- Blockchain What is it? How it differs from Cryptocurrency? What is the future?

Only time will tell what the future holds. What do you feel about Cryptocurrency? Do you think that CryptoCurrency should be banned?

One response to “Is Cryptocurrency banned in India?”

[…] bill has asked for ban on Cryptocurrency but found the Blockchain technology useful. Our article Is Crypto currency banned in India? talks about it detail. Let’s find that […]