Crossed cheque means drawing two parallel lines on the left corner of the cheque with or without additional words like Account Payee Only or Not Negotiable. What does Crossing of Cheque mean? Why do you need to Cross the Cheque? What are different types of Crossings?

Table of Contents

Why do We Cross the Cheque?

A cheque is a written order that orders a bank to pay a specific amount of money from a person’s/organization’s account to the person /organization in whose name the cheque has been issued. A cheque is an important part of banking. It is the simple and safest way to carry money.

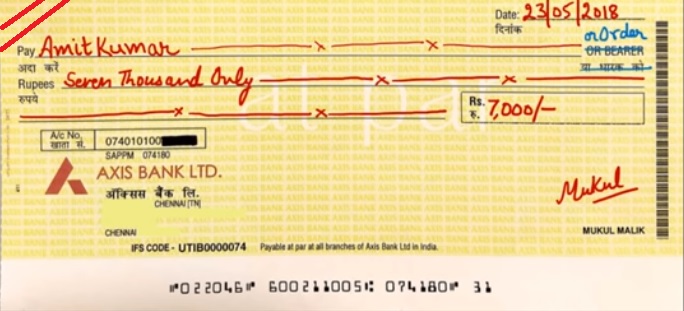

If a cheque is crossed by drawing two parallel lines across the face of the cheque, with or without the words and Co or A/c payee only, it is called a crossed cheque. A crossed cheque can only be to the payee’s account and cannot be en-cashed at the cash counter of a bank. This is a safer way of transferring money than Open cheque or Uncrossed

A bank’s failure to comply with the crossings amounts to a breach of contract with its customer. The bank may not be able to debit the drawer’s account and may be liable to the true owner for his loss.

The crossing of Cheques is dealt with in Indian Law, under the Negotiable Instruments Act, 1881 under sections 123 and 124. Section 123 deals with the general crossing while section 124 deals with the special crossing.

Our article Kinds of Cheques explains the Cheque in detail

Kinds of Crossings of Cheques

The crossing of a cheque is the instruction by the customer to bank on how to give payment.

- The purpose of crossing the cheque is that one cannot collect cash from the counter of the bank. Money can only be deposited into the payee’s account only.

- There are two parallel lines on the cheque. Many people prefer slanting parallel lines on the top left-hand corner but it can be drawn anywhere on the cheque.

- The cheque may have words & Co or Not Negotiable or A/c Payee between the two parallel lines. It is called General Crossing

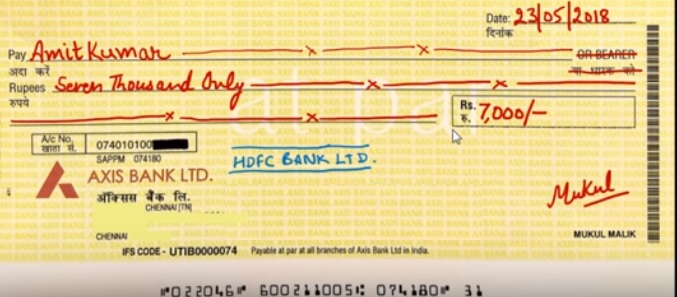

- If a name of the bank is written between the two parallel lines then it becomes Special Crossing. Special Crossing ensures that payment is made only to the banker whose name is written in the crossing. Specially crossed cheques are safer than a generally crossed cheques.

- The cheque is usually payable to payee or bearer. The person on whose name cheque is drawn can authorise another person to receive the amount from the bank. This authorisation is called an endorsement.

Advantages of crossing the cheque

It ensures safe payment as It prevents the payment of the cheque to a wrongful holder. it is a guard against any cheating or theft.

A/C Payee cheques

A/C Payee or account Payee, the cheque will be deposited in the account of a person for whom the cheque is drawn. The person can deposit the cheque in any bank where he has an account. But The A/C payee cheque cannot be further endorsed.

Note There is no definition of A/C payee crossing in the Negotiable Instrument Act. A/C Payee cheque is a result of custom, use and practice and is now accepted legally.

Special Crossing of Cheque

If a name of the bank is written between the two parallel lines then it becomes Special Crossing. Special Crossing ensures that payment is made only to the banker whose name is written in the crossing. Specially crossed cheques are safer than a generally crossed cheques.

So if the cheque is drawn for Amit Kumar and HDFC bank is written between the parallel lines then to encash the cheque Amit Kumar has to submit his cheque to his HDFC Bank. Unlike A/C Payee cheque where the person can submit in any bank in which he has an account.

Opening of A Crossing

The cancellation of a crossing on a cheque is known as the opening of the crossing. This is often done by writing the words ‘pay cash’ and cancelling the crossing accompanied by the drawer’s signature. Only the drawer of the cheque is entitled to open the crossing of a cheque. The crossed cheque after the cancellation or opening becomes an open cheque.

What is an endorsement of a cheque? What is Negotiable in Cheque?

Endorsement means signing of one’s name on the back of a cheque. The word endorsement is derived from a Latin term “in dorsum” which means on the back in English. Section 15 of the Negotiable Instruments Act 1881 defines endorsing as “signing on the face or an instrument for the purpose of negotiating a negotiable instrument (such as Cheque). “

The cheque is usually payable to payee or bearer. The person on whose name cheque is drawn can authorise another person to receive the amount from the bank. This authorisation is called an endorsement. The person who authorises is called as endorser; the person to whom the cheque has been endorsed is known as endorsee and cheque is called as an endorsed cheque. By making an endorsement the endorser promises that in case of dishonour, he provides a guarantee to compensate the holder. This person can further endorse the cheque to another person.

For example, Ayush receives a check from Sohan which has been crossed, Ayush can get this payment in his account only and not across the counter. But Ayush is free to endorse the cheque in favour of Suresh and further Suresh can endorse the cheque or instrument in favour of Mukesh and so on. When there are several endorsements on the back of the cheque, each endorsement is deemed to have been made in the order in which they appear on the instrument, unless the contrary is proved. In case the cheque gets dishonoured, Rakesh can sue Suresh and Suresh can sue Ayush and Ayush can sue Sohan.

Technically it called as Negotiability. Negotiability in cheque means that the holder can endorse the cheque in favour of another person and so he transfers the right to get the payment and value mentioned in the cheque.

There are different kinds of endorsement

- Endorsement in blank – signature of the payee or holder

- Endorsement in full – “Pay to xxxxxxxx” and signed by the payee or holder

- Restrictive endorsement – “Pay to xxxxx on his birth day” duly signed by the payee or holder

If Not negotiable are written between parallel lines, the drawer can endorse but the right of the drawer is more than the person to whom cheque was endorsed. For example, if a cheque for Seema was stolen by Mr thief who endorses it to say to Ranveer. Then Seema’s right is more than Ranveer.

For example, if a person steals a car and sells it. The buyer does not get any legal right/title of the car as the transferor himself had no title to the car. The real owner of the car can anytime obtain possession from the buyer, even if the buyer had purchased the car in good faith and even if he had no idea that the seller had no title to the car.

It is often wrongly understood that the use of the words Not Negotiable affects the transferability of the cheque.

Image ref : YouTube Videos

Related Articles:

- Cheque: Clearing Process, CTS 2010

- Payment Methods While Shopping Cash,Cards,Digital Wallets,

- What is Demand Draft? How to make, Cancel a Demand Draft

2 responses to “Crossing of Cheque , Endorsment”

Very nice post on Cheque crossing

Thanks