What would you choose Rs 100 a day or Rs 1 on the first day doubling the next day? Albert Einstein is credited with the statement compounding is the eighth wonder of the world, He who understands it earns it… he who doesn’t… pays it. Simple interest and compound interest are the two methods of calculating interest charged. In simple interest, the interest is calculated on the principal amount. While compound interest is interest earning interest. It is important for one to know simple and compound interest in order to make a good financial decision. This article talks about how compound interest can be your friend or your enemy.

Table of Contents

King, Chess and Compounding

Once upon a time, a king lost a game of chess to an ordinary farmer. The king asked the farmer to choose his reward. The farmer asked double the grains of wheat every square of chess. In other words

- 1 grain of wheat for the first square of the chess board,

- 2 grains for the second square,

- 4 grains for the third square,

- 8 grains for the fourth and so on and so forth for all the 64 squares.

The king was very happy for being let off rather lightly and readily granted the wish.

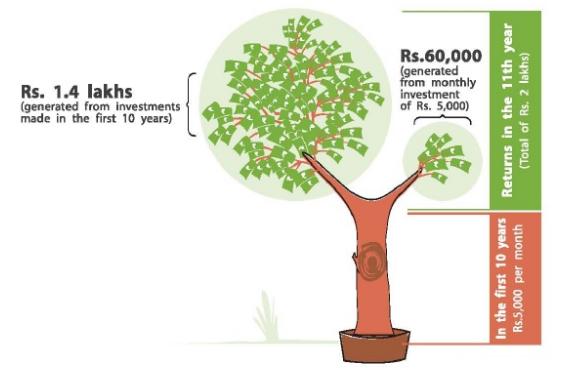

Things were fine until the first few squares. After 16th square things kind of became out of control as you can see in the image below.

Total number of grains on all the 64 squares of chess, as explained in Wikipedia article Wheat and chessboard problem

Totally King requires 18,446,744,073,709,551,615 grains of wheat to settle the claim. Isn’t that mind-boggling! There are about 25,000 grains in 1 kg of wheat. The king required about 737,870 million tonnes of wheat to fulfil his obligation. In 2004 India produced 200 million tones of all agricultural products such as wheat, rice, sugarcane, cotton, etc. The required quantity of wheat is about 3,690 times this amount.

Even all the wheat produced from all over the world, ever since cultivation started would be less than this quantity! If the king had decided to settle this in cash, say, at a rate of Rs 3.50 per kg, he would be required to pay Rs 25,82,54,417 crore.

What happened there was that the smart farmer used the power of compounding to his advantage. And such is the power of compounding that the king didn’t know what hit him.

Maths of Simple Interest and Compound Interest

Simple interest is paying/taking interest on the principal amount for the entire period. The principal amount does not change.

The simple interest formula is: Interest = P*r*T Where P = Principal , r = Rate of interest , T = Repayment tenure

Suppose, you availed a loan of Rs 1,00,000 for a time period of 2 years at 7% simple interest. So, the interest charged on it would be INR 7,000 in the first year and also in the second year. Simple!

Compound interest

Compounding is the idea that interest grows on interest. Money that earns money. Works on the principal amount as well as interest accrued.

- You deposit 100 in the bank. This is your principal.

- Let’s say the bank pays you a 10% annual interest rate

- Thus, after Year 1, you have 110.

- Your initial deposit (100) is bundled together with the interest (10) to become your new principal. In the bank’s eyes, 110 is now your balance and in the next year, you’ll earn interest on it. As far as you’re concerned, that 10 in interest is the closest thing you’ll find to money growing on trees.

- Now, after Year 2, you’ll have 121 (as opposed to 120) because the bank paid you 10% interest on the initial principal and the interest (=110). That extra dollar (120 to 121) is compounding and over time will grow exponentially

The compound interest formula is: Interest = P*(1+r)^t Where P = Principal , r = Rate of interest , t = time period

Suppose, you borrowed INR 1,00,000 at the rate of 10% (compounded annually) for 2 years. The interest accrued would be INR 10,000. And with that, your new capital for the second year would be 1,10,000. So, the interest in the second year would be 11,000. A total compound interest that you would pay on INR 1,00,000 at the end of 2 years will be INR 21,000.

Difference between Simple and Compound Interest

Simple Interest |

Compound Interest |

|

|

|

|

|

|

When Compounding works against You

Compounding can work against you whenever you take debt i.e a credit card interest, loan, a mortgage, —you pay the bank interest – often compounded interest.

Credit cards are among the most common loans that employ compound interest in a way that works against you. If you only pay the minimum amount on your credit cards (about 2 per cent of the outstanding balance or 10, whichever is higher), you’ll be paying a long time. Also, you’ll end up paying more because of accumulating interest charges.

And because you know compounding is not a force to be reckoned with, compounded debt means you end up paying a big amount of money.

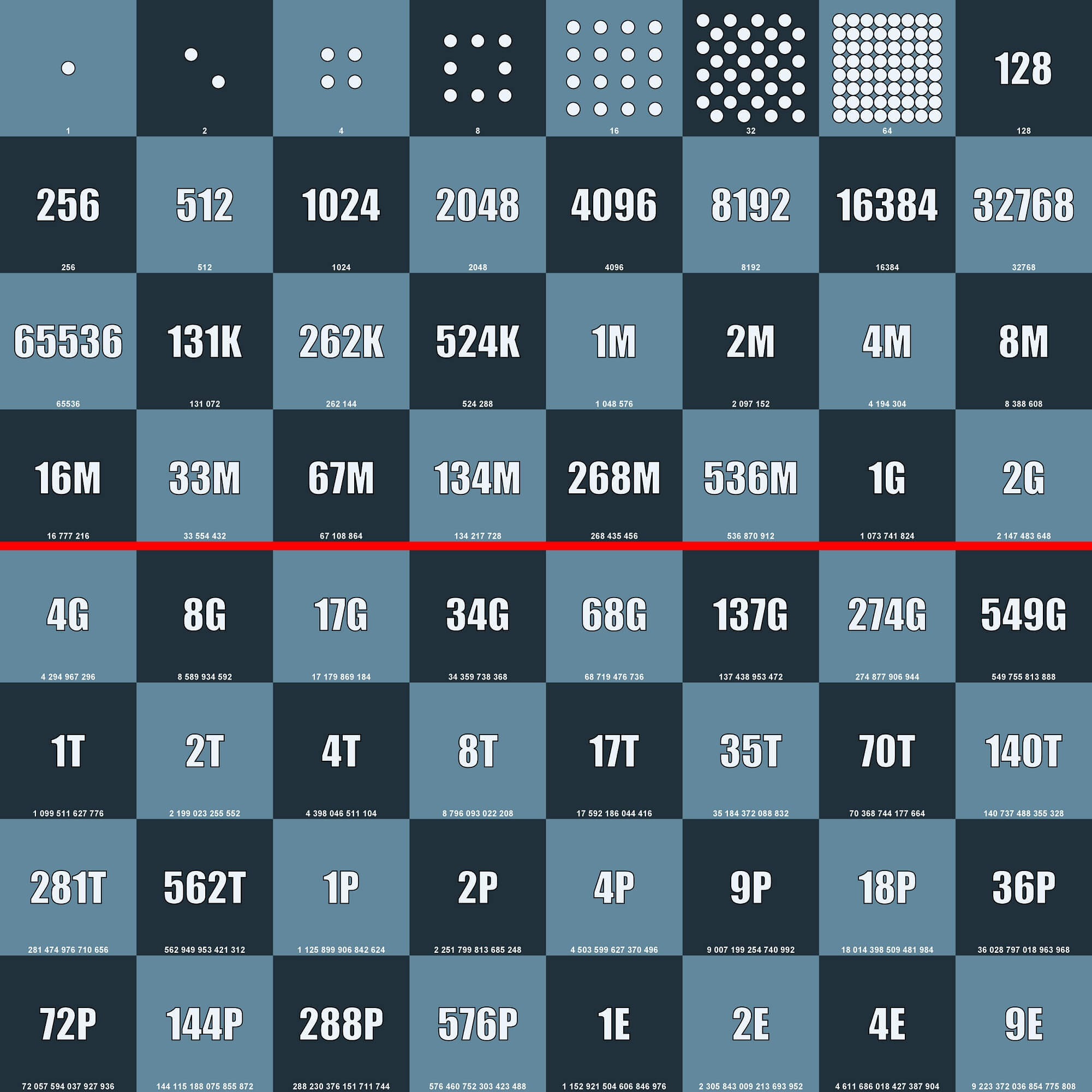

When Compounding works for You

How much difference does a head start make?

- Investor A starts saving when he’s 25 and makes a 1,000 initial deposit followed by 1,200 deposited annually with an average 5% annual return.

- Investor B starts saving when he’s 35 and makes a 1,000 initial deposit followed by 1,200 deposited annually with an average 5% annual return.

- At age 60, Investor A will have contributed 42,000 and earned 70,900 in interest on those deposits.

- At age 60, Investor B will have contributed 30,000 and earned 29,659 in interest on those deposits.

- Investor A contributed 12,000 more than Investor B but earned 41,241 more in total interest!

The takeaway: Time is money when it comes to compound interest. The longer you wait around, the less interest you’ll earn.

Every great force begins small. A small piece of snow becomes an avalanche by first becoming a snowball. At first, the amount of force and energy to create a snowball must be great. Snow needs to be continually added, with an almost intense effort.

But once the snowball is built? Then you can roll it down a hill, and it will naturally do the work for you until one day it is an unstoppable force.

Your wealth works the exact same way. The work you need to do in the beginning is often very painful and tiring. But once your wealth snowball is built, then your wealth naturally attracts more wealth. Then the power of compounding interest can work in your favour.

Just as a snowball compounds and grows, so can your wealth.

The reason rich people get richer and others fall short are that the rich make compounding interest work for them, not against them. And now that you know how to calculate compound interest and simple interest, you can also use it to your advantage. So what are your thoughts on compound interest?

2 responses to “Compound interest: How it can be your friend or your enemy”

Great article! The example with chess is the best thing, which can illustrate the power of maths. Also it’s an excelent example, why chess is good for development the math skills. The development of the brain’s left hemisphere which is responsible for logical thinking takes place through counting combinations, whereas the development of the right hemisphere, which is responsible for creative thinking, occurs by arranging new plans and finding new non-standard moves in different positions. A child with quick analytical thinking will do better at school. It is also worth mentioning the aspect of psychological development – a child who realizes that one does not always win but also loses, learns humility and respect for other people. In addition to aiding analytical and developmental skills of the mind, playing chess is also a great excuse for socializing with other chess amateurs. Chess gives children the opportunity to make many new friends by participating in chess schools or local amateur tournaments. There are many advantages of playing chess from a young age. One thing your child will appreciate most is that playing chess is also great fun. With proper approach and proper tools, you can interest your kid in this marvelous game. One of the tool is to creat some interesting background stories, other tool is to practice specific movements and strategies, using special diagrams. In this case, I can recommend this book – net-bossorg/chess-puzzles-for-kids-by-maksim-aksanov

[…] Compound interest: How it can be your friend or your enemy […]