When choosing an insurance plan there are many things one needs to consider other than the coverage time, coverage amount and premium. In Life Insurance opt for a policy that really takes care of the financial requirements of your dependents especially in case of the Term plan. You need an insurer who honours its obligations when a claim is filed and for that one is recommended to look at Claim Settlement Ratio of Life Insurer. Claim Settlement Ratio: means the number of Claims paid by the Insurer against the claims received. But there is more to it. Like in Bollywood, the movie with any of the three Khans, Salman, Shahrukh and Aamir has a high chance of being in 100 crore club. But we have seen in recent past that movies with Ayushman Khurana, Rajkumar Rao or Vicky Kaushal are doing good. Let’s look at Claim Settlement ratio in detail.

Claim Settlement Ratio

Claim Settlement Ratio means the number of Claims paid by the Insurer against the claims received. So if a company says its claim settlement ratio is 90% it means that if a company has received 100 claims, it has paid 90 claims. It gives us an idea about the claim paying ability of the insurance company. It is recommended that for buying life insurance look at companies with a claim acceptance ratio of more than 90%.

The Insurance regulatory, IRDA, has made it mandatory for all insurance providers to publish claims related data in the public domain. It is declared in IRDA annual report every year. IRDA published its annual report with data for the year 2017-18 on 9th January 2019

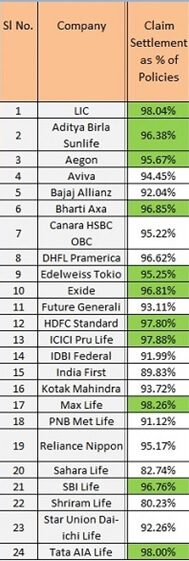

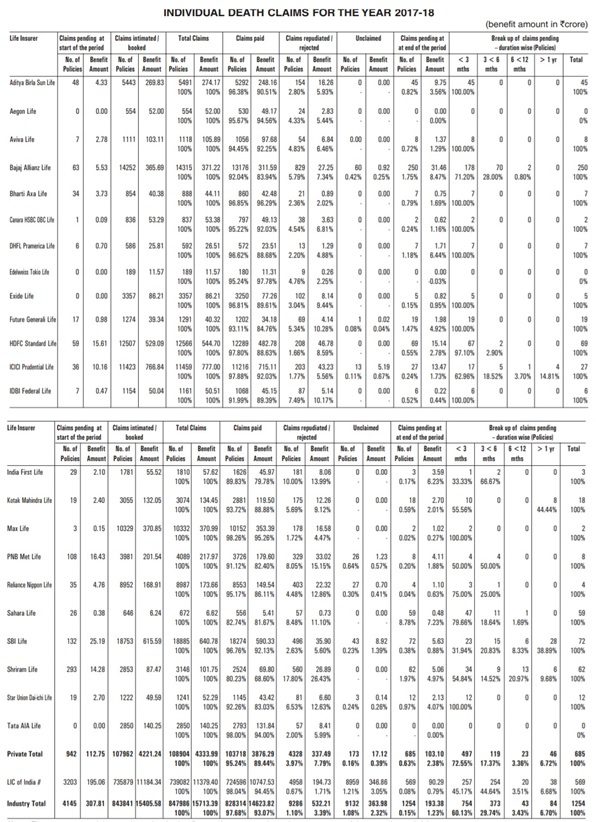

There were 68 insurance companies operating in India at the end of Mar-2017, out of which 24 are in the life insurance business, 27 general insurance, 6 are standalone health insurance and 11 are reinsurance companies including foreign reinsurers including Lloyds India. The image below gives an overview of individual death claim settled in 2017-18

Claim settlement ratio is just raw data. So if a company says its claim settlement ratio is 90% it means that if a company has received 100 claims, it has paid 90 claims. But there is more than what meets the eye. A claim settlement ratio, tells how many claims a company has settled in a particular year,

- it does not tell what type of policies have been settled. Whether life insurance policies were an endowment, ULIPs or Term plans.

- How much was the claim amount settled?

- Why the claims were rejected by the insurer or lying pending with them.

- The data does not tell how many claims were early claims, means claims were made within 2 years of buying the policy, which claims are pending for which investigations are going on.

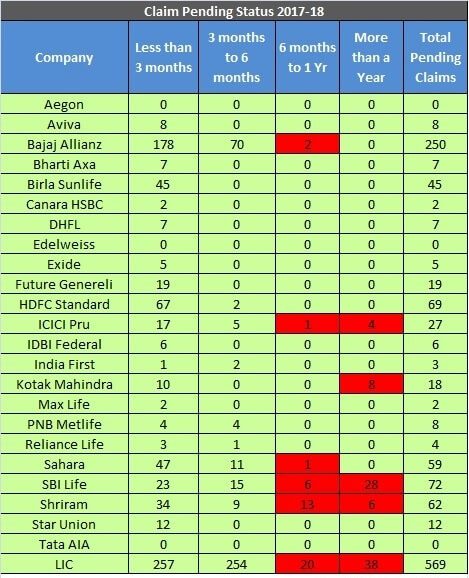

Out of the remaining 10%, some claims may have been rejected by the company, called Claim Repudiation or Rejection ratio, and the remaining claims are in a pending status called a Claims pending ratio. For example, if 2 claims have been rejected, and 8 claims are in pending status. Then the claim repudiation ratio would be 2% and Claim pending ratio is 8%.

The data from the Annual report is shown below.

If you calculate Average Settlement Amount for LIC the majority of such claims are less than Sum Assured of Rs.2,00,000(10747.53/724596)

And claim settlement time is as follows

Claim Settlement Ratio Trend

Check out the historical claim settlement ratios, are they consistent? The information below shows the trend in Aegon Life Insurance Claims Settlement Ratio for the last few years. The trend shows the consistency in terms of settling claims.

| 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| 89.78% | 95.31% | 97.11% | 95.67% | 96.45% |

Do not hide any facts while filling the proposal form. This will ensure that your claim (in any unfortunate event happens) is settled.

As per the recent amendment to Section 45 of the Insurance Act, If your policy is 3 yrs old, no matter what happens, the life insurance company will not be able to deny the claims.

You can definitely take a cue from the claim numbers, but it should not be the only parameter you should look when buying an insurance policy.