The government of India has deactivated around 11.44 lakh PAN cards by 27 July, 2017. If you are able to login to Income Tax website then your PAN is active. But if you still want to verify that you PAN is active or your PAN deactivated you can follow the steps mentioned in the article. You go to income tax website and Enter details in Know your PAN.

Table of Contents

Why was the PAN deactivated?

According to the law, it is not legal to have more than one Permanent Account Number (PAN) card. A penalty of Rs10,000 is liable to be imposed under section 272B of the Income-tax Act, 1961 for having more than one PAN.

The government also detected 1,566 fake PAN cards which were allotted to non-existing individuals or to people who have submitted falsified information about themselves.

How to check if your PAN is deactivated?

If you are able to login to Income Tax website then your PAN is active. To check whether your PAN deactivated, you need to visit Income Tax e-filing website.

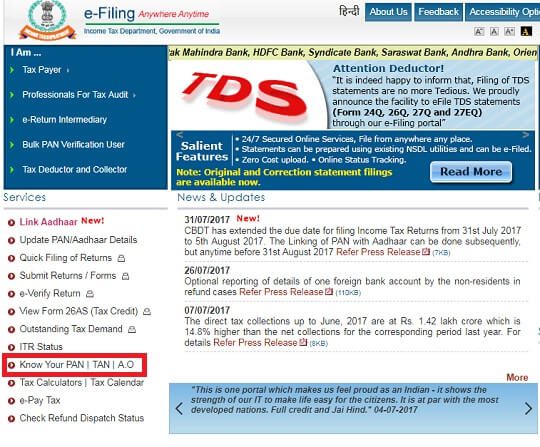

Visit http://www.incometaxindiaefiling.gov.in and click on Know Your PAN option available on the home page of the website in the left-hand column called Services.

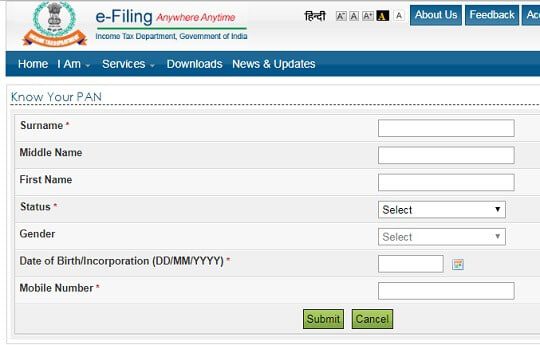

The website will take you to a new page where you will be asked to enter all your basic personal details (name, status, religion, etc.). You can enter any mobile number on this page for which you will get OTP. After filling the details, click on Submit option. You will receive an OTP password on your registered mobile.

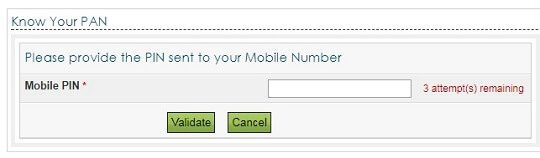

Enter the OTP you received on the mobile number given on the next page and click on Validate button.

In case, you have multiple PAN numbers registered with your details, a notice will pop up saying, “There are multiple records for this query. Please provide additional information.” It will further ask you some more details such as your father’s name.

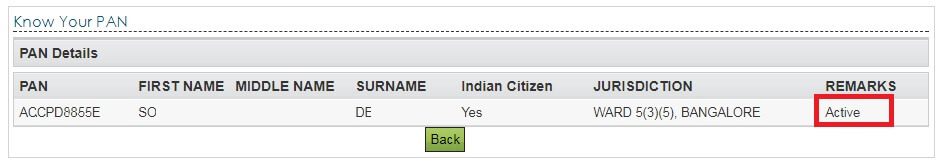

After entering the required details, you will be taken to a page where you will see the validity of your PAN Card and the number of the active PAN Card and its jurisdiction. In the end, you will see the results page showing the status of your PAN card under ‘remarks’ column: active or not active as shown in the image below.

What to do if your PAN is deactviated?

Once, the PAN is de-activated by the income tax department, the income tax e-filing login of the assessee also gets blocked and the PAN holder is not able to do anything on the Income Tax e-filing portal such as filing of Income Tax Returns, view intimations and respond electronically to various communications by the ITD. If your Permanent Account Number (PAN) is de-activated then you need to do the following. Our article How to cancel PAN If you have more than one PAN , Deactivation of PAN discusses it in detail.

- You need to write a letter to your jurisdictional AO in the Income Tax Department for activation of your PAN. Our article How to find Jurisdictional Assessing Officer : Income Tax explains how to find the Jurisdictional Assessing Officer in detail.

- Following documents need to be attached to the letter for activation of PAN:

- Indemnity Bond in favour of the Income Tax Department.

- The copy of PAN on which the PAN holder is regularly filing the Income Tax Return.

- The copy of last three years Income Tax Returns filed on the PAN de-activated.

Format of Indemnity Bond for reactivation of PAN

An indemnity bond or a surety bond protects the person or company holding the bond from financial loss.

Indemnity Bond – PAN

I, _____________________, R/o____________________, do hereby solemnly affirm and declare as under:

- My PAN is:

- I am regularly assessed in your ward/jurisdiction with PAN: ___________________.

- I have only one PAN i.e ________________ which is used for last many years for filing my income tax returns.

- I do not have any other PAN with me, if any allotted in your records, kindly deactivate the same.

- I undertake to indemnify the income Tax Department for any loss that may be caused in the future.

- Kindly activate my PAN: ___________________.

That the above statements are true to the best of my knowledge and belief.

VERIFICATION

Verified at <place> on this ________________ day of <month>, 2017, that the contents of the above affidavit are true and correct to the best of my knowledge and belief. No part of it is false and nothing material has been concealed therefrom.

(Deponent)

Related Articles:

- What is PAN Card?

- How to cancel PAN If you have more than one PAN , Deactivation of PAN

- When you loose your wallet, Credit Card, PAN Card, Driving License

- How to find Jurisdictional Assessing Officer : Income Tax

- Income Tax: How to Link Aadhaar with PAN for filing ITR

- Name in PAN Card, Passport, Aadhaar, Indian naming system

Very useful and interesting Article.

Very useful and interesting Article.