Are LIC and other insurance companies are withdrawing their insurance plans?

Yes and No. The Insurance Regulatory and Development Authority (IRDA) had notified changes to the guidelines on design of insurance products life ,health insurance in February 2013. These guidelines were to make insurance policies friendlier. All existing group products were to withdrawn from 1 July 2013 and all individual products from 1 October 2013. The insurers were required to re-file their products as the IrDA’s new guidelines prescribe a higher insurance cover plus other benefits such as a higher minimum surrender value and death benefit. The deadline was moved from Oct 2013 to Jan 2014. So the plans would not be available in their current form.Existing plans of insurance companies will be revamped to suit the new regulations. So LIC’s Jeevan Anand or Jeevan Tarang may come out with new features.

Why was the deadline shifted from Oct 2013 to Jan 2014?

If the guidelines came into force from October 1, at least five companies would have been left with no product to sell. Further, customers would also have had lesser products to choose from, because larger insurers had only limited products in place. Even the Life Insurance Corporation of India (LIC) did not have approvals for all the re-filed products and, hence, it had sought an extension. But insurers had to discontinue highest net asset value guaranteed products and index-linked insurance plans from 1 October 2013.

What type of changes are for insurance plans?

Insurance policies, life as well as health, are all set to undergo a makeover. Let’s go through these changes in detail. Please note These changes are applicable to policies bought after Jan 1 2014 not those bought earlier.

What are the changes in health insurance plans?

- An insurer will not be able to reject an insurance cover till the age of 65 but you may need to undergo some medical check-ups

- All health policies will have to offer insurance through your lifetime and will have lifetime renewability.

- Health policies at par with life insurance plans will have a free-look period of 15 days.

- Surprises regarding health insurance premiums will now be minimized. According to the regulations, now insurers can’t increase premiums if you have made frequent claims on your policy. Any increase in the premiums will have to be done on the basis of the insurer’s experience with all its health policies.

- Insurer will not be able to change the premiums for the first three years. However, from the fourth year the premiums can be changed every year and there will a standard list of exclusions.

- Insurers will have to adopt standardized terminology,46 health insurance terms, to explain health insurance coverage. This makes job of understanding a health insurance policy a lot easier. For instance, Earlier maternity benefit for one insurer could mean paying only for a caesarean section, while for the other it could mean covering any complication. Now the definition has been standardized. Now a maternity benefit would mean medical treatment expenses during hospitalization traceable to childbirth including complicated deliveries and caesarean sections and expenses towards lawful medical termination of pregnancy during the policy period. Obviously the insurer may choose to offer maternity benefits and also charge you extra.

- Standardization of claims forms. To smoothen the process the claim forms have been standardized. Further these forms will be in an optical character recognition format that will enable data entry from handwritten paper to computer systems. Additionally, Irda has prescribed set formats in which hospitals will need to furnish information such as the discharge summary report.

But should you expect a huge premium hike to accommodate the new regulations? Not really. Newer firms have a younger pool so new regulations will not affect pricing drastically. Also, many products that have been launched recently are more or less compliant with the regulations. Insurers with the older pool may need to review their premiums, but even there premium hikes will not be drastic or immediate. For details Livemint Buy healthier insurance plans now

What are changes in life insurance policies?

The new guidelines have drawn three broad categories: traditional insurance plans, variable insurance plans (VIPs) and unit-linked insurance plans (Ulips).

- Traditional plans: These are opaque products and can be divided into pure insurance and insurance-cum-investment products. The current regulations haven’t tinkered with their design.

- Variable plans: According to the guidelines, Variable Insurance Plans (VIPs) will guarantee a certain minimum rate of return, also called the floor rate, at the beginning. Additional benefits could either be pegged to an index, declared upfront, or come in the form of periodic bonuses which will be guaranteed once declared. Like Ulips, VIPs will have to conform to cost caps. That means the reduction in yield will not be more than 4 percentage points in the fifth year, coming down to a difference of 2.25% 15th year onwards.

- Ulips: New rules don’t change Ulips much as most of the changes took place in 2010. Ulips will have to conform to cost caps by observing the maximum reduction in yield. If the limit is breached, the insurer will have to plough back the extra cost.

Changes in life insurance policies

- Minimum cover : At any point the death benefit will have to be at least 105% of all premiums paid till date.

- Irda has mandated that the minimum sum assured or death benefit on a life insurance shall not be less than 10 times the annual premium for individuals below 45 years of age.

- But for policies with tenors of less than 10 years, the sum assured limit has been reduced to five times the annual premium.

- Note: purpose of tax benefits; you need to have a sum assured that is at least ten times the annual premium.

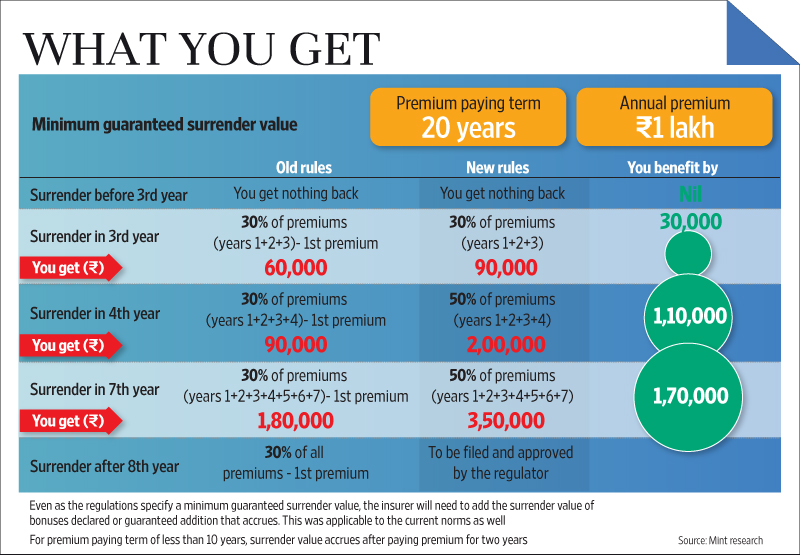

- Higher surrender value : Surrender value will depend on the premium-paying term.

- Right now there aren’t fixed rules, but usually you don’t get any money back if you surrender your policy before paying premiums for three years. After three years, the policy gives a residual or surrender amount that is usually 30% of all the premiums paid minus the first-year premium.

- In case of Ulips and VIPs, the maximum surrender charge will be Rs.6,000 in the first year tapering off toRs.2,000 in the fourth year and becoming nil fifth year onwards.

- For traditional plans, the surrender charge is still on the higher side.

- As per the new rules, you will become eligible for a surrender value after paying premiums for two years in case the premium-paying term is less than 10 years.

- You become eligible to a surrender value after three years if the premium-paying term is more than 10 years.

- The minimum guaranteed surrender value will be 30% of all premiums paid going up to 90% of the premiums paid in the last two policy years. Fourth year onwards, minimum guarantee surrender value will increase to 50% of all premiums paid until the seventh year.

Picture shows the change in surrender value between earlier and now from Livemint’s Life insurance agents make one last push before Oct

-

- Agents commissions :

- Agents’ incentives have now been linked to the premium paying term (the tenor for which the policyholder pays premium regularly) of a policy.

- For a premium paying term of five years, agents will get up to 15% of the premium as commissions in the first year.

- This first year commission will increase to a maximum of 35% in case the insurer is more than 10 years old and 40% for insurers that are less than 10 years old, if the premium paying term is 12 years or more.

- Agents commissions :

- For detailed list of changes one can read BasuNivesh IRDA Life Insurance Regulations 2013-Do you know these changes?

Changes for LIC Polices

- Service tax will be collected over and above the contractual premium. Till now LIC was not charging the service tax of 3% from the customers and paying it to govt from the pool of money collected itself, but now the service tax will have to be charged separately from policy holders.

- There is a possibility that the premiums on LIC policies will come down by some margin, because the mortality rates will now be revised by LIC in calculating the premiums.Mortality rates are the rates at which the insurance company deducts the fees for insuring you based on your age. LIC which is using the 1994-96 Ultimate Mortality Rates will move to IRDA’s Indian Assured Lives Mortality (2006-08).

- Basunivesh is maintaining List of LIC’s closed plans-2013

Related articles :

- Basics of Insurance

- Discontinue Life Insurance Policy: Surrender,Paid Up,Loan

- Insurance : Surrender or Make policy paid up or Continue

- Bonus of Life Insurance Policies

- Checklist for buying Life Insurance Policy

It is better to wait and watch how new plans will be beneficial. Traditional plans will now have a better surrender proposition and a higher sum assured, but that shouldn’t convince you to buy a policy. In order to provision for a higher sum assured and surrender value, insurers may need to increase the premiums or lower investments benefits.For you, this means you still need to look at what you buy in the name of insurance. Don’t buy a policy just because the rules have become friendlier; what it offers is still critical to making a decision.

6 responses to “Change in health and life insurance plans by Jan 2014”

we re useful information give i not see this articular my life

i am advisor …..more information

Can I buy term policy after withdraw of existing LIC insurance policy.

Will the rule apply to policies bought during 2002-03 as well please?

A good question V. Answer is No. It will be applicable for policies bought after Jan 1 2014. Have updated the article.

Will the rule apply to policies bought during 2002-03 as well please?

A good question V. Answer is No. It will be applicable for policies bought after Jan 1 2014. Have updated the article.