To deposit Advance Tax, Self Assessment tax and Regular Assessment Tax an individual has to use challan ITNS-280. It can be paid both through internet (online or e-payment) and at designated branches of banks empanelled with the Income Tax Department (offline). Our article Challan 280: Payment of Income Tax discusses the basics of Payment of Income Tax. In this article we explain for an individual how to pay income tax through Challan 280 offline,physically through designated bank branches with pictures.

Details of Challan 280

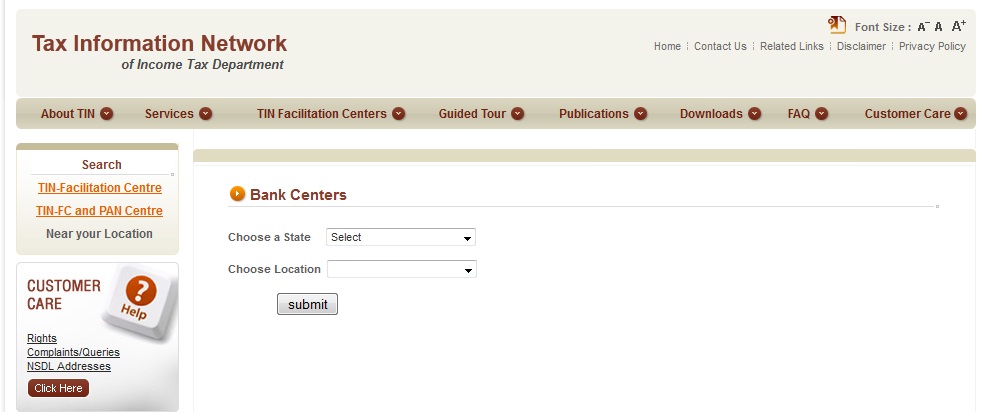

Form for physical payment of Challan 280 can be downloaded from TIN NSDL webpage (pdf format). TIN NSDL webpage of Bank centres help to finding the bank with address by entering your state and location.

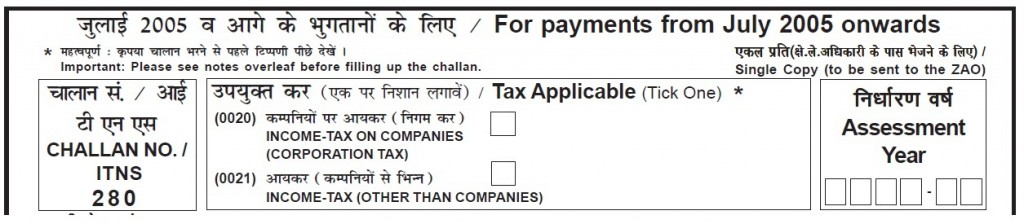

Challan 280 has following parts:

Assessment Year, Kind of Tax : 0020: Income Tax on Companies (Corporation Tax) and 0021: Income Tax (Other than companies)

Please select Assessment Year properly. For Self Assessment tax before filing ITR for Income earned between 1 Apr 2015 to 31 Mar 2016, Assessment Year(AY) is 2016-17.

For individual Select 0021 : INCOME-TAX (OTHER THAN COMPANIES)

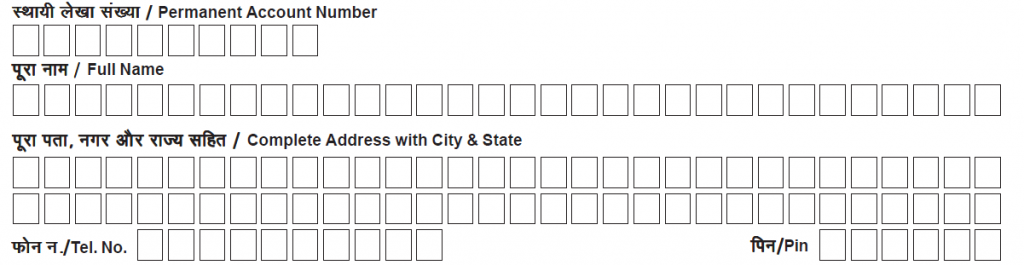

Personal Information : Permanent Account Number (PAN), Name, Address with Pin

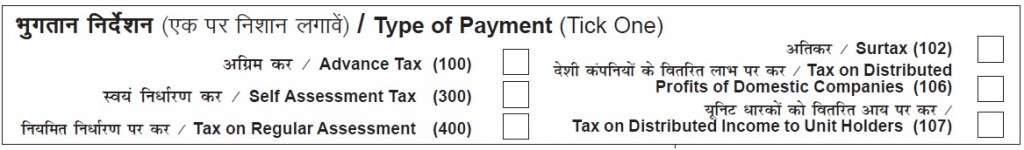

Types of Payments:

Type of payment depends on why you are paying income tax.

- 100 for Advance Tax

- 300 for SELF ASSESSMENT TAX,

- 400 for Tax on Regular Assessment for making any payment only when demand has been raised by Income Tax Department.

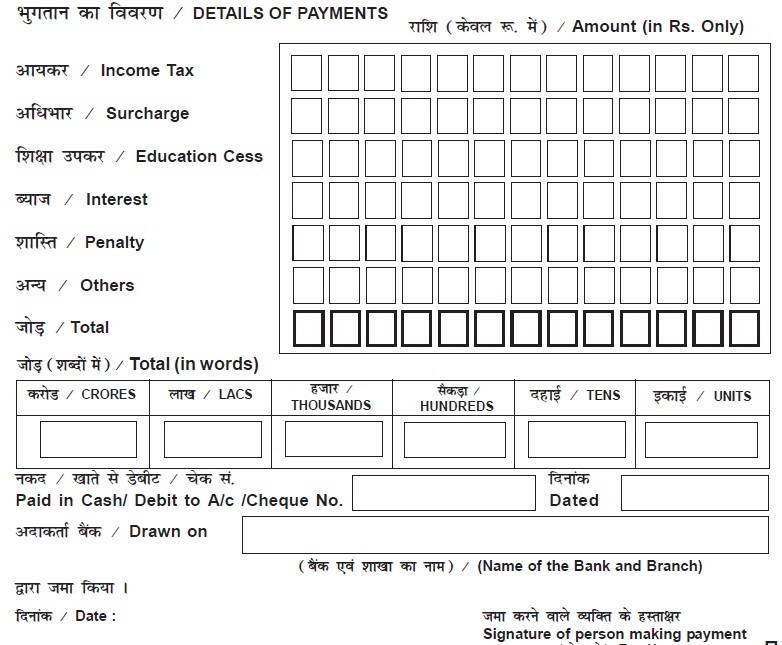

Details of Payments : Income Tax, Education Cess, Interest, Penalty

You need to break up the tax payable into its components, i.e. “Income Tax” and “Education Cess” etc. There is no Surcharge for FY 2012-13 and education cess is 3%.

-

- For Advance Tax: Filling only amount is fine but it would be best if you fill in the education cess too. So if you are paying Rs 10,000 as tax , pay 300 (3% of 10,000) as education cess too.

- For Self Assessment Tax: One needs to pay education cess and also penalties calculated under Sections 234A/B/C and entered separately in “Interest” field. For example: So if total tax payable Rs. 10,000, the Income Tax component is (10,000 / 1.03) i.e. Rs. 9,709, and Education Cess is Rs. 291 (3% of Rs. 9709).

Write down the name of the bank and income tax on cheque for example if you want to deposit it into Punjab National Bank then cheque will be in favour of PNB A/C INCOME TAX (Ref: CaClubIndia Whose name i should draw cheque for paying income tax)

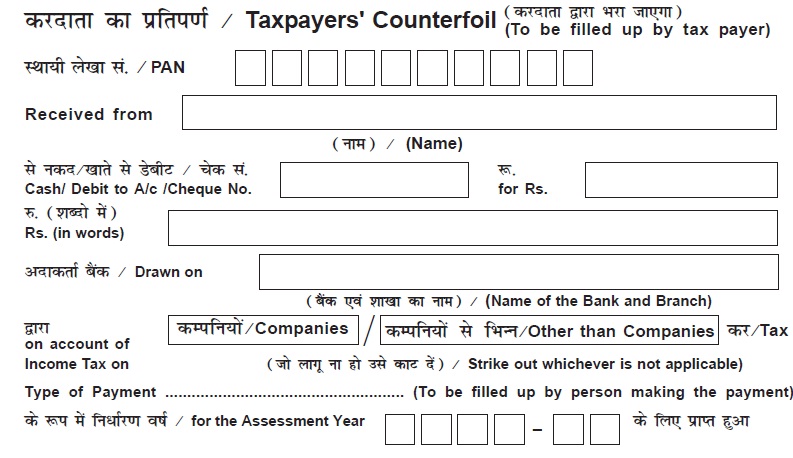

Taxpayer’s counterfoil

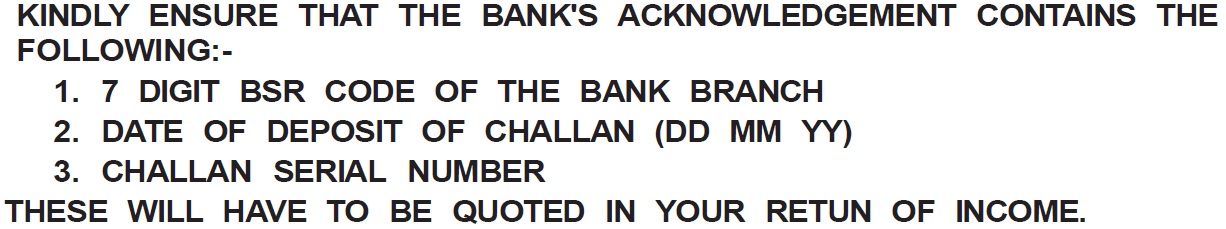

Bank acknowledgement

The collecting bank will capture the entire data of the Challan and transmit it electronically to the Income-tax Department. The bank will send the paper copy of the challans alongwith printed scrolls to the Zonal Accounts Officers. The information received from banks will be used by the Department to give credit for the tax paid based on CIN.

Uploading of Data to Government : On receipt of the amount, receiving bank will upload the details in the Challan to Government via NSDL through its OLTAS (Online Tax Accounting System) return within 3 working days.You can verify challan using CIN in bank acknowledgement Form online through your Form 26AS or through Challan Status Enquiry on TIN webpage. Our article , Challan 280: Payment of Income Tax, discusses verification, correction process in detail.

Banks upload challan details to TIN in 3 working days basis after the realization of the tax payment. On the day after the bank uploads the details of self assessment/advance tax to TIN, it will be automatically posted into your Form 26AS.

If you have not downloaded the Challan Receipt you can regenerate it using the internet Banking facility . Our article Reprint Challan 280 or Regenerate Challan 280 discusses how to regenerate Challan 280 using SBI, HDFC Bank and ICICI Bank.

Related Articles:

- Advance Tax:Details-What, How, Why

- Viewing Form 26AS on TRACES

- Income Tax Overview

- Challan 280: Payment of Income Tax

- Paying Income Tax Online: Challan 280

- Reprint Challan 280 or Regenerate Challan 280

Have you paid income tax using Challan 280 offline? When do you pay it? How has the experience been? Did you get challan 280 corrected anytime? How was the process?

36 responses to “Challan 280 : Paying Income Tax offline”

My father (pensioner) downloaded 26AS, where it shows 1.80 Lacs income and 10K TDS deducted at source. In form 16 income shown as 2.3 lakhs with zero TDS. Also bank has given statement as interest on income paid 2.65 Lakhs + Interest accrued as 2.3 Lakhs. He has investment 80k NSC and 18K Mediclaim. Now what is the income to be shown as other income and what amount to be shown in TDS2 to claim TDS.It will help if you also mention tax payable for AY17-18.

Please check that you are seeing the details of the same year. For AY 2017-18 FY is 2016-17.

The income from Salary would be Total income in Form 16 which should match total income in Form 26AS i.e 2.3/1.8

Income from Interest on bank deposits is 2.3 lakh ..is TDS deducted for it? It has to be shown as Income from Other sources as explained in our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund

Claim 80K investment done between 1 Apr 2016 to 31 Mar 2017 as 80C deduction

Claim 18K under section 80D for medical insurance.

Your ITR will be processed based on information in Form 26AS. So please verify that.

If you can send us the forms at bemoneyaware@gmail.com we can look into it.

TIN webpage link is not working.

Link has been modified. Have updated the link

on the deadline of filing the ITR for A.Y. 2015-16 on 30.3.2017, I made payment towards self assessment tax through challan No. 280 at Allahabad Bank. but I did not get the BSR code to be quoted in ITR 4. Can I file the ITR without quoting the detail of Challan No. 280. Please Suggest.

You cannot file ITR without the BSR Code. Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR shows how to show the self-assessment tax.

As per Allahabad bank webpage on ePayment

E-Payment for Direct Tax can be made 24 hours a day using Internet Banking services of the Bank. However payments made after 8 pm will be included in next working day’s scroll by the Focal point Branch.

At the end of your transaction the user gets a Cyber receipt for the Tax payment and at the same time you can check your online bank statement to verify the tax payment.

On successful payment, the Internet Banking user gets a Cyber Receipt for the Tax payment, which the customer can save or print for his record. The receipt shall be available for printing in future through “Duplicate Receipt” option.

Incase you encounter any problem you can contact us on a toll free no. 1800-22-6061 or email us at customercare@allahabadbank.co.in.

Soon after payment advance tax when I shall get “CIN”. Give details.

Kindly intimate when I shall get Bank acknowledgement soon after deposit advance tax by cheque alongwith chhalan 280 for showing CIN. Cheque of same Bank. My question whether I shall get Bank acknowledgement on same day or not.

– – PRALAY.

Yes Sir. You would get the Taxpayer’s counterfoil immediately when you pay the Challan in bank

what name on cheque if paid income tax through cheque by union bank of india

Can somebody pay my advance tax for FY 2016-17 on my behalf in cash in old currency by Dec 15, 2016 as I am out of country until Feb 2017.

Can Income tax be paid in cash from any bank other than SBI?

Challan 280 is the form which is required to be filled when you want to pay your income taxes. This can be done offline at bank designated to collected income tax, or you can also pay it online. We will see both of them

I AM TRYING TO PAY ETAX THROUGH SBI DEBIT CARD. BUT IT IS NOT GIVING ME THE OPTION OF ENTERING AMOUNT. IT IS DISPLAYING RS. 1. PLEASE HELP.

can i enter manually my self assessment tax details in itr-1 form or otherwise i have to wait until it show automatically.

In ITR you would have to enter the Self assessment tax details yourself.

It will not show up automatically.

It takes 3-7 days for self assessment tax to show up in Form 26AS.

Income tax dept will verify with Form 26AS.

Sir,

I paid Rs. 35,000 in SBI thru Challan 280 for which I got the receipt dated 26th July, 2016.

How much time does it take to reflect this amount in 26AS as till now it does not show it?

Banks upload challan details to TIN in 3 working days basis after the realization of the tax payment. On the day after the bank uploads the details of self assessment/advance tax to TIN, it will be automatically posted into your Form 26AS.You can verify the status of the challan in the “Challan Status Inquiry” at NSDL-TIN website after 5 to 7 days of making e-payment. In case of non availability of the challan status kindly contact your bank.

If you need to Regenerate the Challan 280 for filling ITR you can read our article Reprint Challan 280 or Regenerate Challan 280 for details.

Can we make challan 280 payment in cash

Yes you can pay for Challan 280 in cash. But you would have to go to bank.

Hi, need some clarification

My Father wants to pay 20000 through Challan 280 offline (as he don’t use online banking), Is it possible for me to pay the tax online on behalf of my father ? could you please advise.

Yes you can pay. Just give his details while filing Challan 280

Thank you

Dear Sir,

Is there any limit for payment /deposit of income tax challan by cheque?

What to do if we have paid tax by cheque for amount exceeding the limit?

Kindly help and guide at the earliest.

thanks!

Rajkumar

We are not aware of any limit on payment of income tax challan. We know that till 1 lakh there is no problem.

You are really very helpful to people like us.

Would you please advise me in the following? I am a salaried person in the 30% IT bracket with full TDS. I had some fixed deposits in a cooperative bank. On 22 Sept 2015 I closed some of the FD and got interest amount of Rs. 142009; and on 28 Oct 2015, i again closed some of the FD and got interest amount of Rs. 203952; finally, on 28 Jan 2016, I got again from some FD interest amount of Rs. 191275. The bank did not deduct any income tax and I also missed to pay. I want to clear all these dues by Challan 280 through some bank. How much income tax with interest and penalty (if any) I have to pay? Is there any final date? Would you please help me with a reply? Thanks so much.

First can you verify in Form 26AS that TDS was not deducted.

As TDS is for FY 2015-16 and your interest income is more than 10,000 you would have been required to pay Advance Tax. 30% by 15 Sep, 60% by 15 dec & 100% by Mar. Now you would have to pay penalty for not filling Advance tax under section 234 B & C.

You would have to pay tax using Challan 280. You need to calculate the interest. As ITR is available now you can fill in details to find the interest you need to pay. Our article Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time for more details.

Can we make payment in cash? What is the limit upto which tax can be paid in cash?

what name on cheque if paid income tax through cheque by Punjab national bank

You can make the payment in any of the designated Banks.The cheque has to be made payable to “The Bank(Eg.Punjab National Bank)-A/c Income-tax” and should be submitted along with Challan 280.If you do not have an A/c with the Bank where you submit the payment,then the stamped challan counterfoil would be returned to you after the clearance of the cheque.

Can this challan can be paid any bank ? My father asked me to pay in state bank of Hyderabad but I payed in Andhra bank will there be any problem ? Wating for ur replay

Bank does not matter. Check Form 26AS of the your father after 2-3 days to verify.

Thank you, just the other day I was searching for this challan

Thanks Vijay. Glad to know you found it helpful.

Thank you, just the other day I was searching for this challan

Thanks Vijay. Glad to know you found it helpful.