If one sells a property which has been held for more than 2 years, one long term capital gains. If one invests the capital gain(not the difference between cost and sale price) within 1 year of sale or 2 years of the transaction, under section 54, 54F/FC, the capital gain is not charged for tax. However, in many cases, the due date for filing income tax returns for the year in which the capital gains arises is before the expiry of the specified period. If a person is unable to utilize the capital gain or invest the same in another property or bond before the tax filing due date which is usually 31 Jul, then he can invest capital gain with Capital Gains Account Scheme (CAGS) to buy more time. He can easily withdraw at the time of investment in the specified instrument.

In Mar 2017, Rahul sold a residential property after 5 years of acquisition. On sale, he made a capital gain of 10 lakhs (10,00,000). As this property was held for more than 3 years(after Apr 2017 it is 2 years), its long term capital gain. So sale happened in Jan 2017 and Rahul has Long term capital gains, To claim Loing Term capital gain Rahul has following options:

- If he does not want to buy another property he can invest the capital gains in capital gain bonds under section 54 EC. The maximum amount is 50 lakhs and has to be done within 6 months from the sale of a property.

- To invest the Long Term capital gain on sale of house

- in a new residential property under sections 54/54F. To get the exemption, one needs to purchase the new residential house within a period of one year before to or two years after the ale of the original house.

- If one is unable to buy the benefit Before due date of filing of Income Tax Returns for that year one has to open a Capital Gains scheme account with any scheduled bank in order to convince the government that he intends to invest the so earned capital gain in some array but needs some more time to do so. So for property sold in Jan 2018 if he has not bought house till 31 Jul 2018 then he needs to open Capital Gains scheme account. Note: If you deposit the capital gain not utilized after last date of filing ITR (5 Aug 2018) then the capital gain amount will not be eligible for exemption under section 54 under any circumstances. You need to pay Long term capital gain (LTCG) tax of 20% on the amount.

Table of Contents

Why a Separate Capital Gains Account

If you purchase a new property from capital gain then you can claim the exemption at the time of filing ITR. There is a possibility that either whole or part of the capital gain is not used. The buyer has time till 2/3 years to invest capital gain from the date of sale of the old property. An income tax department cannot keep track of this amount. Therefore, Capital Gain Deposit Account Scheme allows one to put the capital gain from the sale of property in the separate account. You can withdraw money from this account to purchase/construct new property. Please note you can claim exemption under 54 only after depositing the capital gain not utilized in Capital Gain Deposit Account. The exemption can be reversed or withdrawn if the capital gain is not utilized within specified period.

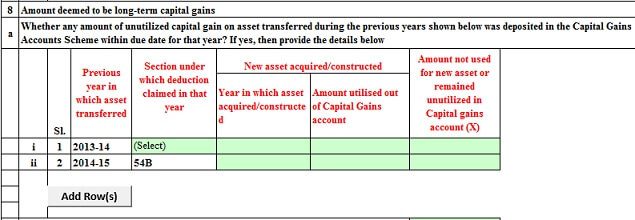

Details of deposit has to be shown while filing ITR as shown in the image below

What is Capital Gains Account

Capital Gains Account Scheme (CGAS) was introduced in 1988. It is used to put long-term capital gains until one is able to invest it as specified in Sections 54 and 54F.

- A Capital Gains Account can be opened only by individuals and Hindu United Families (HUF)

- No loan can be taken on this account.

- Saving in Long Term Capital Gain Scheme comes under section 54/section 54B/section 54D/section 54F /section 54G

- Section 54, you can invest the Long term Capital Gain(LTCG) made from the sale of an immovable property, in a residential property.

- Section 54F, you can invest the Long term Capital Gain(LTCG) from the sale of shares and bonds, in a residential property.

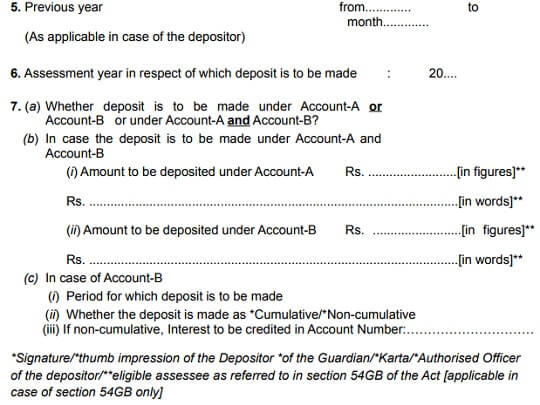

- There are two types of Capital Gain accounts i.e. Account A and Account B. Deposit Account A is like your savings account and Deposit Account B is similar to Fixed Deposit/Term Deposit. The interest rate is as per Bank’s Term Deposit Rates. The nature of the account can be changed . How to select the type of deposit account? It depends on when you will need money to purchase/construct the new property.

- Interest is not exempted under Income Tax Act, 1961. The interest earned under CAGS scheme will be chargeable as per Income tax slab rates.TDS will be deducted at applicable rates on Term Deposits.

- No cheque book is issued. You have to use forms to withdraw money.

- A passbook is issued.

Types of Capital Gains Account

Type A Capital Gain Account

Type A is a capital gain account that functions similar to a savings account. The interest that is paid on this account is the same as paid by the bank for any regular savings account. Type A Capital Gain account mandates the bank to issue a passbook to the investor wherein his deposits, withdrawals and interest are to be entered. The amount deposited in this account is highly liquid and can be withdrawn anytime.

Best suited for: People who have to pay money at regular intervals as installment during construction.

Type B Capital Gain Account

Type B is a capital gain account that is similar to a fixed deposit account of a bank. The rate of interest and other related terms like attracting pertinent penalty charges on premature withdrawal are also similar to fixed deposit of the particular bank. On the opening of account type B with a bank, the investor will be entitled to receive a deposit receipt specifying the principal deposited, date of maturity, date of deposit and pre-decided interest rate. There is a penalty for the premature withdrawal of Deposit Account B.

Best suited for: People who want to buy the property after a specific period.

Type B of CAGS is further sub divided into

- Cumulative: where the interest earned is added to the term deposit and is re-invested thus a total amount is paid at the end of the tenure of withdrawal,

- Noncumulative: Interest can be claimed by an investor on quarterly, half-yearly or yearly basis.

Type B account can be of maximum 3 years if you are constructing a house and maximum 2 years if you are buying a new house that is ready in possession.

How to open a Capital Gains Account Scheme

A capital gains account can be opened by filling in and submitting Form A along with proof of address, PAN card copy, and photograph. The amount can be deposited in the account through cheque, cash or demand draft. You can even deposit the amount in installments. If you have made a deposit in the form of a cheque or demand draft, the date of deposit shall be counted from the date on which the cheque or DD is encashed. Excerpt of Form A is given below. List of Banks where one can open Capital Gain account scheme is given here.

You can appoint a nominee for this account using form E and change the nominee using form F.

Withdrawal from Capital Gains Account Scheme

To withdraw the parked money from CAGS account, you need to submit a duly filled Form C to the bank. Once the amount is withdrawn, you need to utilize it within 60 days.

If in case you have not withdrawn the entire sum during first withdrawal, the second withdrawal can be done only using Form- D.

Transfer and Conversion of Capital Gains Account

- One can transfer his capital gains account, from one deposit office to another deposit office of the same bank.

- One can also transfer part of or all the funds from Type A Account to Type B Account and vice-versa using Form B

- Transfer of amount from Type B to Type A and vice versa before the expiry of the specified period for which the deposit was made, such request shall be treated as premature withdrawl of amount.

Closing of Capital Gains Account scheme

- You will have to take approval of the Income Tax Officer of your jurisdiction.

- To close the Capital Gains Account, an application in Form G is required to be made.

- In case of the death of the depositor, such application would be required to be made by the nominee/legal heirs in Form H.

Banks providing Capital Gain account

The government has notified 28 banks that are allowed to render capital gain account scheme to its customers. Below listed banks can open CAGS. The amount that can be deposited under CAGS differs from bank to bank. Banks differ in amount(lower limit) for depositing.

- State bank of India & other state banks

- Syndicate Bank

- Andhra Bank

- UCO Bank

- Oriental Bank of Commerce

- Allahabad Bank

- Union Bank of India

- United Bank of India

- Bank of Baroda

- Bank of India

- Punjab & Sind Bank

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Corporation Bank

- Dena Bank

- Indian Bank

- Indian Overseas Bank

- Punjab National Bank

- Vijaya Bank

- IDBI Bank

Forms for The Capital Gain Account Scheme are available at Income Tax web page here.

9 responses to “Capital Gains Account Scheme and Sale of property”

what is sub-paragraph (3) of paragraph 9, in relation to utilisation of the capital gain amount for purchase of property?

with in due date of filing of return 0f 2018-19 previous year

i,e 31st july 2019

I sold a house proprty on 25/09/2018. By which date i have to deposit the LTCG deposit with a bank.

My wife purchased Vacant Land from a Housing Society on 28/2/2001 for sale consideration of 1,64,125

Sold Vacant Land to two buyers.

Southern Part to Buyer1 on 2/5/2019 for sale consideration of f39,00,000

Northern part to Buyer2 on 2/5/2019 for sale consideration of f24,10,000

Total sale consideration is 64,10,000

Me and my wife jointly purchased a one residential unit (out of 4 unit building) on 2/11/2019 fir sale consideration of 1,48,00,000 (one crore forty eight lakhs) . Both have invested 74,00,000 each. My wife invested complete sale deed consideration of her land sale Rs 64,10,000 . I have invested the my retirement benefits.

I want to file ITR-2 for my wife before June2020. Do I need to file ITR-2 with CA help or can be do ourself. Please guide me. Even though my wife income is NIL after considering interest from FDs , she is fileing returns every year.

You can do it yourself if you are confident and know about indexation.

Even if you get it done by CA you would have to verify.

Just way risks of going through CA.

One should not be penny wise and pound foolish.

Our article How to show Long Term Capital Gains on sale of House in ITR might help you.

my mom has agri land pruchased in 1992 located in rural area(comes under gram panchayat)

purchased price is 60000

now market value is 8crore

my doubt is…..does LTCG tax is levied on agriculture land??/

if yes, then what is tax rate need to pay on agri land??

my dad had purchased a agriculture land and registered on my mothers name in 1992

purchased price in 1992 was 60000

now in 2018, as per market value is 8crore.

but as per govt value , it is 34lac .

last week one party has offered this huge amount on our agri land.

now what is taxable amount do we need to pay on agriculture land?

how to convert this huge amount into properties?

as you said…LTCG can be exempted by investing on other property, so ..

can i purchase a villa from half of the amount of LTCG amount?? and remaining half amount can i deposit in LTCG account scheme?

My father had a house property. He sold it out in August 2018 and wish to invest to save capital gain tax. But in between, in September 2018 he was died. Now, how can i save the capital gain tax. Please suggest some way.

Sad to hear about your father. Our condolences are with the family.

The income tax returns for a deceased person has to be filed, if he/she has taxable income.

His legal heir/representative needs to file the return on his behalf for the income earned till the date of death.

Legal heir has to register himself at the income tax website for filing the return on behalf of deceased.

Inheritance is followed by thousands of problems, specially conflicts because no one wants to lose even a single penny. When it comes to money brothers turn against each other, so its always better to get things aligned before they viral out of control. First, the successor must obtain a copy of the will through which he receives his inheritance. This must be done by filing the death certificate of the dead person along with an application with the district registrar. The registrar will then open the sealed envelope containing the will in front of you and hand over a copy to you. The property will then be distributed as per the contents of the will. File all the records and documents properly and keep them safe as they are proof of your ownership. They will save you in times of crisis when conflicts arise.

Secondly after inheriting a property one must get the title of that property transferred to his name and that too at the earliest. For this you would need to pay some stamp duty to the Government.

Our article On Inheriting,Tax of Property,Mutual Funds,Shares,FD etc explains it in detail.

Our article Income Tax Return of Deceased explains how to file ITR for deceased