Employee Provident Fund (EPF) is one of the main platforms of compulsory savings in India for nearly all people working in Government, Public or Private sector Organizations. This calculator is used to calculate the total amount accumulated in EPF based on 12% Employee contribution and 3.67% employer contribution to EPF. It is based on the following assumptions:

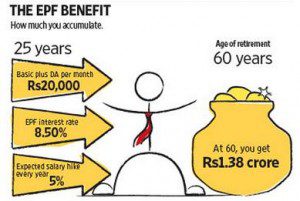

An employee starts with a basic salary of Rs. 20,000 at 25 years and works till 60 years. Every year, on average, he gets a 5% increment. He contributes 12% of his basic salary towards PF which is matched equally by one’s company, (EPF contribution is 3.67%, EPS 8.67%). Over the course of 35 years of his working life, his total contribution is Rs. 26.01 Lakhs. Of course, his company makes a contribution of Rs. 7.955 Lakhs, a total contribution of Rs 33.967 lakh. And this amount grows into – Rs. 1.38 Crores at the time of his retirement!

EPF Calculator

It uses Method I, the most common method to calculate EPF. To know more about EPF, different methods in which EPF can be calculated you may read our Basics of Employee Provident Fund: EPF, EPS, EDLIS

It uses Zoho Sheet which is like Excel. It may take a little time to load so be a little patient. You can play around with the numbers just like in excel using Options on the top-right corner of the sheet.

EPF Withdrawal amount

People usually wonder how much would they get from EPF.EPFO has been using technology to turn into a more professional and nimble organisation. It has made several other investor-friendly changes in the past. Now you can check your EPF balance through SMS, see your passbook. It has introduced online facility for transferring the balance to a new account. Going forward, all members will have a Universal Account Number(UAN) which will be portable across employers and cities. UANs have already been allotted to 4.17 crore active contributors to the EPF.

You can check your EPF balance in various ways. Our article How to get information about EPF balance : Annual Statement, SMS, E-Passbook explains the various methods of getting EPF balance in detail. We shall look in detail the SMS option

- EPF balance by SMS : From July 2011 one can check the EPF Account balance online.

- Go to www.epfindia.com/MembBal.html. Select EPFO Office

- Enter PF Account Number which is in the format : EPFO Office Code/Establishment Code(Max. 7 Digits)/Extension(Max. 3 digits)/Account Number (Max 7 digit) (PF Account Number may not have Extension code, in that case leave it blank).

- Enter your Mobile and Name, Accept Terms and condition and Submit.

- You will get SMS alert from EPFO : EE amount : Rs XXXXX and ER amount Rs:XXXXX as on <Today’s Date>(Account updated upto Date).

When you get information from EPFO the information is in terms of EE , ER and EPS.

The SMS is kind of coded so let’s try to decode it. The SMS says:

EPF Balance in A/C No. BG\BNG\0045123\000\000134 is EE Amt: Rs. 67009, ER Amt: Rs. 47000 as on 27-08-14 (Accounts updated upto 31-03-2014)-EPFO.

So what is EE and ER? Decoding the EPF balance SMS from EPFO:

- A/C No: This is your EPF account number. You EPF account number have your area code, company or establishment code and your account number.

- EE Amt: Employee Contribution i.e. your total contribution in the EPF account. The sum total of PF amount deducted monthly from your salary.

- ER Amt: Employer Contribution i.e your company contribution. The sum total of PF amount monthly contributed into your EPF account by your employer.

- As on [Date]: The date till which your monthly contribution has been updated in your EPF account. In the example above, contributions in EPF upto 27-08-14 are shown

- Accounts updated upto [Date]: This tells you till when the accounts were updated. Usually accounts are updated at the end of financial year when the interest till this date has been added into your EPF account. From the example above, it tells that interest till 31st March 2014 has been added into your EPF account. It does not show current balance of PF Account as on the day you asked for information.

You can see that EE(Employee Contribution) is more than ER(Employer Contribution). Because Employer’s contribution is split into two halves , the Pension fund(EPS) and Provident Fund(PF). SMS does not show the information about the Pension fund but the EPF passbook does.

You would get both EE which Employee’s contribution and ER which is the employer’s contribution.

If you have contributed for 5 years in EPF then there is no tax deduction but for less than 5 years TDS is deducted. Our article SMS What is EE, ER? How much on Withdrawal from EPF? explains it in detail.

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Understanding Employee Pension Scheme or EPS

- Voluntary Provident Fund, Difference between EPF and PPF

- Tax on EPF withdrawal

- Transfer EPF account online : OTCP

- UAN or Universal Account Number and Registration of UAN

Hope you find it helpful! Please let us know whether you liked it or not by leaving a comment.

127 responses to “EPF Calculator: Can one become Crorepati?”

My pf balance is showing as 60000 total as employee + employer and pension contribution. So I want to know how much amount will I get if I withdraw it now. Worked for 2 years and 8 months.

You will get all this amount. But remember EPF withdrawal before 5 years is taxable as explained in our article

EPF Withdrawal before 5 years,TDS,Form 15G,Tax and ITR

Hi

Please need your help to understand to open the PF account for employees,

As I’m working in a startup company, at present our strength is 20 Including the CEO.

Can we eligible to open PF accounts for our employees

I have read, an article saying that to open a PF account company need a minimum of 20 members

Please let me know about this

Thanks and Regards

Aradh

Hi I have worked for 4.4 years and my total amount of pf is 1 lac including EE,ER and EPS. I wanted to know that I Left the organization in December 2018. Please confirm while filling the form 15 g which annual year I have to mention and what will be my annual income of that year.

Please go through our article http://bemoneyaware.com/submit-form-15g-epf-withdrawal-online/ for more details

i complete 5 year in my job and leave on feb 2019. so i want to know is there any tax deduction in my pf amount bcos when i do process for withdraw the msg show abt income tax deduct 34.60% so kindly give some information abt it.

Is your PAN associated with your UAN?

Does your service history show that you have worked for 5 years?

If PAN is not associated with your UAN then TDS is deducted at 34.6%

hi, mine employee share is 22829 and employer share is 6990. i had done my job from august 2015 to march 2017. How much amount will i get if i withdraw my pf in today’s date?

Will get both employee and employer share.

If you withdraw the pension you will get pension amount too.

But as you withdrawing before 5 years, it would be taxable

I left a company in 2005, that time my PF deducted per month was 444 and was equally matched by company. I worked for 30 months and left. I have not withdrawn or used the same PF account further. What approx could be the amnt if i withdraw today

My pf balance is showing as 44212 total as employee + employer and pension contribution. So I want to know how much amount will I get if I withdraw it now.

How many years have you worked?

Hi,

actually my pf amount is 44000 and pension amount is showing 22000 and total Rs 66000. now i want to withdraw the amount and could not update my pancard details. can u please conform if i with the amount now, will the TDS of 34% will get deducted or not. And that without updating pancard.

You can try raising EPF complaint and attach PAN details. Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

If your PAN card details are not verified then typically you have to take offline route.

Visit the Regional EPFO office and submit form 19 and Form 10C.

Our article How to find your employer’s EPFO office and EPFO office Phone Numbers explains it in detail.

You can download Composite UAN form from our site here or Google and download from epf site.

Please also submit Form 15G if no you don’t want TDS to be deducted. Sample filled Form 15G is here.

Do Keep us updated.

I submit form 19 form and receive my amount but I have submit 10c form but not accept my form. Form is under procee. I have submit 10 c form is 13 july. Today 31 july but form 10c is under procee. Request you pls my form is accept. As soon as possible my request.

You can raise it on social media platforms of epfo : Facebook (https://www.facebook.com/socialepfo) and Twitter(https://twitter.com/socialepfo)

You can file the grievance. Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

You can visit the EPFO. Our article How to find your employer’s EPFO office and EPFO office Phone Numbers gives details.

Hi,

My EE is Rs 7950 and ER is Rs 2436

Joining Date: 31/03/2014

Release Date: 19/07/2017

Please tell me my total PF amount I will get to withdraw

Hi,

I have 6 years of exp. Through miss call number i received msg for my pf balance, it is showing 66670 only, Does it include all the EE and Er contribution.

Hello Sir,

I have three questions to ask:

1. In my salary slip I see that my EPF contribution is deducted from my salary and the Employer contribution is also deducted from my salary. Is it correct that employer will cut his share from my salary only…

2. A part of ESI is also deducted from my salary. My question here is that Will I get that ESI amount also in EPF+EPS withdrawl if I never use any ESI facility..

3. And can I stop my ESI contribution from my salary.. Is it possible..

Hi, EPF, EPS etc., is all critical submit and hardly get info on this. I really appreciate your contribution by providing knowledge on this critical subject.

I would like to know how to check last 10 years EPS contribution. Passbook only shows existing employer contribution, but my 2 previous companies EPS contribution cannot be seen anywhere. I have been transferring all accounts into existing. Kindly let me know. Thanks again. Balaji

Hi,

I have left my job in August 2016 and in a process to withdraw my PF and send my PF withdrawal forms (form 15 G, 10C, 19 and 15G) to my previous employer. I was employed with my last organization a little more than 4 years. I was not much aware about the pension fund i.e. EPS. I came to know that in order to withdraw the pension fund the form 10D has to filled in and submitted to the employer, is that true? I checked my passbook in UAN website, my EE and the ER PF contribution was about Rs 123000/- and the pension was contributed was around Rs 47000/-.

Can you please confirm if I’m going to get both the amounts i.e. PF (EE+ER) and the pension contribution? If not then please help me with the procedure to withdraw my pension contribution.

Please please please reply.

Yes you will get both Employer , Employee contribution and Pension

Our article EPF Withdrawal:How to withdraw from EPF and EPS talks about process in detail.

Overview of Withdrawing from EPF and EPS

If withdrawing through previous employer.

Download and take print outs of form 10C and Form 19. Please mention your mobile number on the top of the Form-19 and 10c.

Fill in Form 19 and Form 10C

Submit to previous employer

Fill Form 15G to avoid TDS deduction.

Attach a cancelled cheque leaf of the account mentioned in the Forms.

Revenue Stamps Re. 1 each are required to be affixed on the forms and duly signed. (Not available in Karnataka so just sign in the location where it has been requested for revenue stamp)

EPFO normally takes around 15-60 days to process your claim.

Track EPF Withdrawal

You will get SMS updates

You’ll receive two different amounts in your account. One is for your EPF withdrawal and one is for Pension contribution.

Check out your tax liability.

mera pf account meh 21000rs hai aur meri service 15 month ki hai

ab my pf withdraw karu tho total kitna amount paata hu pls send me answer

Dear Sir.

My Passbook Amount showing is-42000 but i have recive only 11193 rupess

I assume you are talking about EPF Withdrawal. Check if amount in EPS matches 11193?

my problem is my Epf is credit to other person due carelesness of HR For last 2 years .. if i am going to HR ask about my pf .. they will give me alwys goli.. i have all documents as a proof my pf is always debit from my account but not credit in my account.. please help me what cn i do..

Better ask your HR politely. Goli kha loo..aakhir apni kamai ki baat hai.

You can say that you will go to EPFO and submit a complain. You can read our article Is your employer depositing PF money to EPFO or trust, If not then what to do for more details.

My basic salary is 53000 thousand but my employer is deducting only 1800 towards my PF.Here my concern is actually it should be 12% basic right?Or is there any other percentage changes based on basic ?In case what would be the percentage for Employee and Employer towards the PF deductions?

My name is Balaji.I had been in service in my previous organization up to Oct 2015 (8 and half years) and joined in another organization on Nov .2015 and working till now.I applied for Pf transfer from my previous account to current account on April 2016 thru my current organization. As on. Date I did not know the status and I didn’t even received SMS.let me know the status. Thank you!

You can check your Claim status at http://epfoservices.in/homepage_claim_status_new.php

You can also login to UAN portal. You would have an updated status of the claim in the View the status of Transfer Claims under CLAIM.

Hello !!I’m Gaurav. I worked in last company for 1 year 2 months n quit job in oct’15 since then m unemployed hence earned no other income.now planning to withdraw my pf which as per form 16 shows 25999 as employee’s contribution till sep’15 and 15358 as per full n final settlement statement given by company on 7th oct’15 whereas chcking online epf balance it says EE 14992 & 6972 as ER updated on 23rd jun 15. As per salary slips 2104 rs. Used to be deducted as pf amt from my salary (EE).

Need ur advise as wht shuld i fill in field 16, 17 and 19. My last yr income was taxable and tax was deducted thru compny every eligle mnth. Getting confused as i dont want my savings to be taxed for a reason like change in rule.

Need ur advise as wht shuld i fill in field 16, 17 and 19 of form 15g

Please go through our article How to Fill Form 15G? How to Fill Form 15H? and sample filled form for details.

Do you have UAN then check your Passbook for exact amount.

Missed Call:A missed call to 011 22901406 ,at no cost, will fetch the user all the required details. This facility is available only to UAN members.

After changes in PF withdrawal rules from Feb 10, 2016, I need to know is the employee still eligible for the pension amount i.e 8.33% of Basic pay along with his (employee contribution). I need clearance on this. kindly help.

The rules for Pension/Pension amount from EPS have not changed. They are still same. You can withdraw the EPS amount if your total number of service is less than 10 years.

Thank you so much…. My service tenure is less than 10 years but what are the rules if the service tenure would have been more than 10 years for EPS?

You actually make it seem really easy together with your presentation however I find this topic to be really something which I believe I might by no means understand.

It sort of feels too complex and very broad for me. I’m looking ahead

to your subsequent put up, I will attempt to get the cling of it!

Sir Myself (D.O.J 21.02.1983)with salary deduction with FPF Contribution left working on 14th Nov 1995 more than 10 yrs and now aged 55 yrs and not worked later. Am I going to be eligible for Family Pension under Family pension SCEHEME 1995.my employee code 071402082 PF NO 032 and pension a/c WB/15008/186.Hope my resignation on 14th NOV will not affect my pension and if I can start my pension on reduced rate being 55 yrs now.

Also my husband with Employee code no is 2938 and FPF ac no is W.B/15008/P-118. who worked for more than 20yrs and was deducting FPF took early retirement on 31st Dec 1994 is eligible for Family Pension under the scheme?Can I get advise on Mail as I am not very Computer savvy and may not be able to locate this site again am afraid.Pl help and tell me whom to approach as we are not getting any pension.Also my husband worked in differenet states of same company so who is responsible to get the funds transferred to one place to give pension.Is it employers duty to do so.

my countributin 17400 and ather coutribution 4000 so 21000 rs mere pf me dikha rahe he pass book pe to muze pf kitna milega

Jab aap withdraw karenege, pura EPF milega. EPS bhi pura agar you have worked for less than 10 years. Else EPS you get Scheme certificate.

5 saal se pehle EPF withdraw karenge to tax lagega.

HI:- I have not received Complete EPF i have worked for 5 years 4 months . Passbook shows it as 44600. But withdrawal showing it as 42265. Please let me know. How to get it verified.

Regards,

Rahul Gupta 9873550100

From 10 Feb 2016 Employer’s contribution is not being given. Please verify in the passbook if that’s the missing amount.

Else you can send the picture of passbook to bemoneyaware@gmail.com and we would try to look at it

Hi,

I feel that there is a mistake in calculation unless my understanding of calculation is wrong.

My understanding of interest calculation at the end of each year would be:

12 months interest for EPF contribution in month of april +

11 months interest for EPF cont in May +

and so on.

Is my above understanding correct?

But in your excel sheet calculation you have accumulated total contribution in that year (I am talking about first year) and applying 8.5% interest p.a. equally for all contributions.

If my understanding is correct then your calculation of interest accrual at the year end is incorrect.

Please confirm.

Regards

Praveen

Dear Sir ,

I have working for 3 years . I have resigned from Job. My basic was Rs 6600 for 1st two years and then 6790 . I have UAN account which says Employee share 31150 and employer share 9712 and pension contribution 19784 . How much amount i will get after withdraw ?

You would get Employee share + Employer Share + Interest accumulated this year from 1st Apr.(Earlier year interest is included in employee and employer share)

You would also get pension amount(which does not earn any interest) so has a ratio.

But as your contribution is less than 5 years it would be taxable, there would be reversal of 80C if you have used EPF contribution.

Thanks for the reply . What will be ratio in my case for pension amount ?

I had transfer my old epf amount to new one through UAN by online. EmployeeShare and EmpolyerShare has been credited to new account with interest amount.but Pension Contribution amount(3177) is not credited.How can I withdrawn that amount from my previous account?

Yes currently only transfer of EPF is happening. To withdraw from EPS one has to go the old way submitting Form 10C

What’s up everyone, it’s my first visit at this web page, and

post is reallpy fruitful inn favor of me, keep up posting these articles.

Hi,

I worked for a private company for 3.8 years. As per the EPF passbook, My contribution = 75500 , employer cont = 42000 and EPS = 29800.

How much amount I will get if I apply for withdrawl ?

Thanks in advance.

You would get EE (Employee contribution) ER : Employer contribution .

If you withdraw before 5 years you would have to pay tax on withdrawal.

You can withdraw from EPS full amount.

You can only withdraw if you have been unemployed for last 2 months

Sir,

I am contributing my epf from last 16 years. can i withdraw my total balance now or before 58 of age. what amount i will get on retirement. or i will get pension only.

You cannot withdraw if you are working . You can withdraw on retirement your epf and eps after 58 years but can be done after 50 years

Hi,

I served for more than 10 years and after that I withdrew my PF corpus (I went to Overseas). At the time, I was given the Scheme Certificate for Pension purpose.

Again, after coming back from Overseas, I started PF contribution and ongoing (Employee PF Contribution + Employer PF Contribution + Emp. Pension Scheme (At present 1250 is deducted)…

Now I am confused and my querry is – what to do with Perviously issued Scheme Certificate ?

Pl guide me & Oblige.

Many thanks in anticipation,

Kind regards,

Umang Shah

Hello Sir,

When you become 58 years old you become eligible for Pension,

You can approach the EPFO with scheme certificate, fill Form 10 D to start claiming your pension

Your calculations are wrong.. The number you have mentioned (3.67% and 8.33% (8.67 is again wrong)) are true only for someone whose basis salary is 15000/-. For someone who is getting a basic of 20000/-, his employer’s contribution will be, 1250 to EPS and 1150/- to EPF..

Hello,

I am planning to withdraw my PF amount now in June 2015. The account was started on Nov 2010 and I resigned the job on Nov 2014. So the contribution was made for 4 years.

EE Amt : 120896/-

ER Amt : 84212/-

as on 05-05-15

I am planning to submit form 10c as well.

My questions :

1: What will be TDS

2: How much money will I get on withdrawal after TDS.

Please advice. Based on your advice I might proceed further whether to withdraw or not.

I am planning to withdraw my PF amount now in June 2015. The account was started on Nov 2010 and I resigned the job on Nov 2014. So the contribution was made for 4 years.

EE Amt : 22579/-

ER Amt : 6901/-

as on 31-03-15

I am planning to submit form 10c as well.

My questions :

1: What will be TDS

2: How much money will I get on withdrawal after TDS.

Please advice. Based on your advice I might proceed further whether to withdraw or not.

Dear Sir / Madam,

I was working in a pvt. engineering college at Chennai from August 16th 2012 to 30 April 2015. My CTC was Rs. 14000/- per month and at the time of resigning my CTC was 15,500/-. I like to know how much PF amount they will be deducting and from when.How much now I will get back. Yet I have to submit my PF Forms. What all forms I have to submit to my accounts department.What are the documents to be submitted for withdrawing my PF amount. Any photos or stamp to be given with forms. Please do revert me back.

hello sir,

i was working in bank before for 1.5 yrs. There i was getting the epf. Now i have joined other bank where we are having NPS scheme. Now i want to get my money transferred from earlier epf account to current NPS account. Dont know whether such process exit or not. Do shed some light on this. Thanks

I want to know the basic threshold limit for PF.

how to calculate pf ?

what is the employer contribution ?

Kindly give the details of above question.

Regards,

Nagesh

Please read our article Basics of Employee Provident Fund: EPF, EPS, EDLIS

Hi,

I have completed 4.3 years of service in first company and i’m going to join new company soon. Please let me know whether its possible to withdraw my EPS amount Rs: 31300/- or will transfer to my new company and I have UAN number.

Thanks

Boopathy M

Your EPS and EPF amount will be transferred.

In your new company you will get a new Member id. You will fill Form 11 and submit it to new employer. The employer will submit the form to EPFO which will be linked to your UAN number. Then you can transfer your EPF & EPS of your old emplpyee.

Are you talking about EPS in particular? or both EPF and EPS

I have worked in a private company for 4 years 5 days.I left the job on 15.09.2014 and applied for my pf.some of my friends who have worked for 2 years 11 months got 52000 and me 55000.I am not satisfied with the amount I received as i expected more than that.

Please help me as early as possible.

How will I calculate my pf amount?

per month 1800 epf dedication . 20 years after who much received?

Try our EPF calculator .

EE Amount – 127602

ER Amount – 69746

as on 26/12/2014 (Accounts updated 31/03/2014)

Left the company on 12/02/2015 after completing 7 years and 9 months.

What will be the amount of EPF and Pension that I will get in total??

You would get EE + ER + Pension amount.

I would suggest you get your EPF account passbook to get more clarity. You can read our article Withdrawal or Transfer of Employee Provident Fund for details

If you are planning to get another job I would suggest Please don’t withdraw.

my pf was getting deducted 780/- per month since past 50 months and last 10 months its 1800 irrespective to my basic salary. please help me how much money will i get now since i have left the company. completed five years.

waiting for ur reply thank you

Hello Rosh,

It is easy to find out using SMS or having a UAN number.

Please go through our article How to get information about EPF balance : Annual Statement, SMS, E-Passbook to get more details

ee amnt:29464

er amnt:9003

so how can I got my total pf balane..

I want to know that how much money I will got..

plz help

Hi, Thanks for ur feedback to everyone…

EE– 6870

ER– 2104

started from 2012 nov to till date …

but Really cant understand how to calculate

Monthly contribution to EPS

my basic slary is : 11,257

my pf contribution is : 1,351

then please confirm what should be employer share and pension contribution amt. ?

Hello Manish,

1351/11257 * 100 is 12%. So your share to EPF is 12%.

If you have been working before 1 Sep 2014 Employer would also be contributing same amount i.e 1351 but out of it 8.33% i.e Rs 937.71 will be going towards EPS and remaining Rs 413 will go towards EPF.

For a person has taken his first job after 1 September 2014, both the employer’s and employee’s share, 12% of salary each will be allocated fully to the PF. NO EPS

Hope it helped

hi, my company(AAI) manages our PF account on its own. we have an option to opt for Pension(under EPS 1995)

a). on actual salary(Basic+DA) by diverting 8.33% of employer contribution and 1.16% of Salary in excess of Rs 15,000 from Employee contribution or

b) on Rs 15000 by diverting 8.33% of Rs15000 from employer contribution of 12% on Basic+DA(in which case the remaining amt om Employer contribution goes to EPF)

Now the dilemma is -What to Opt for a) Pension on full salary or b) Pension on Rs.15000.00

My Basic at present is Rs.35700 with VDA @ 98%. Annual increment is 3 % of basic.

Pl advise

Difficult question. It depends on many factors such as how long do you intend to stay with your company?

How long company has been around?

Discuss it with the finance department and your colleagues to get the facts

ee amnt:31829

er amnt:9732

so how can I got my total pf balane..

I want to know that how much money I will got..

plz help

EE Amt: Employee Contribution i.e. your total contribution in the EPF account. The sum total of PF amount deducted monthly from your salary.

ER Amt: Employer Contribution i.e your company contribution. The sum total of PF amount monthly contributed into your EPF account by your employer.

You would get both EE which Employee’s contribution and ER which is employer’s contribution. If you have contributed for 5 years in EPF then there is no tax deduction but for less than 5 years TDS is deducted. Our article SMS What is EE, ER? How much on Withdrawal from EPF? explains it in detail.

Regarding EPS

If total service of employee is less than 9.5 years, one is not entitled for pension so one can apply for Withdrawal benefit i,e Pension Fund Money back. Once, the service period crosses 10 years, the money withdrawal option ceases one can only get Scheme Certificate which (s)he can use to get pension from the age of 50 years.

Hi,

As per the SMS I received it is showing the following amt as on 17-10-2014:

EE AMT = 28040

ER AMT = 9559

i joined on 10th august 2011 & I left job on 1st may 2014. Kindly suggest how much will be my withdrawal amount.

Regards,

Sat

Hello Satish

You would get both EE which Employee’s contribution and ER which is employer’s contribution.

But as you have contributed for less than 3 years you would have to pay tax on it. Our article SMS What is EE, ER? How much on Withdrawal from EPF? explains it in detail.

ee amnt:7739

er amnt:2339

so how can I got my total pf balane..

I want to know that how much money I will got..

plz help

You would get both EE which Employee’s contribution and ER which is employer’s contribution.

Our article SMS What is EE, ER? How much on Withdrawal from EPF? explains it in detail.

Hope it helps.

hi I am working G4S at 9 years.now I resigned the job. I check my PF balance showing EE Amt Rs:46967 & ER Amt Rs:14361 pls clarify totally how many rupees I receive my PF.

Hello

Sorry for delay in replying as I was busy with office work and kids exams.

You can only withdraw from EPF if you don’t have a job. It would be wise to transfer your EPF.

In any case you would get both EE which Employee’s contribution and ER which is employer’s contribution.

Our article EPF SMS What is EE, ER? How much on Withdrawal from EPF? explains it in detail.

Hope it helps.

hi I am working g4s 9 years now I resigned the job.i check my epf balance EE:46967 AND ER:14361 SHOWING PLS CLARIFY TOTALLY HOW MANY RUPPES I receive PF amount.

hi dear sir

some days ago I leave my job.

so I wat to know how much money I received from pf…

plz help me to calculate this….

I give some information below…

first,

Employee Share :8235

Employer Share :2521

Pension Fund :5412

I has been served in a LTD comapany for 2.5 years..

NOW I LEAVE….

so plz help me for how much money I received…..

joining date 01 / 06 / 2012

Ashish if your total service is less than 5 years than EPF returns will become taxable. We would suggest you to transfer the EPF account to new job that you are joining.

Pension Fund one does not receive till one is 58 years old.

Are the shares that you have mentioned are per month or annually?

In the sms that i recieved it says that EE amt is 15079 and ER amt is 5187. I have worked for 20 months in total where for the 1st 9 months rs 708 was being deducted from my salary and rs 721 was being deducted for the next 11 months from my salary. So wht will be the total amt i will recieve in hand. Thanks…..

RP sorry for delay in replying.

We are working out the calculations and would update you soon.

of course like your web-site however you have to check the spelling on quite

a few of your posts. Many of them are rife with spelling problems and I to find it very

bothersome to tell the truth nevertheless I’ll certainly come back again.

How to calculate PF amount if EE is 58567 & ER is 23073

How much i will get at hand?

Hello Dip

Very interesting question. I never thought about it. Let me investigate a little.

I would request you to see the EPF passsbook.

Based on the information that we have covered in out article How to get information about EPF balance : Annual Statement, SMS, E-Passbook

EE = Employee Contribution and ER = Employer Contribution on date(shown in Account updated date) mentioned in your SMS. It does not show current balance of PF Account as on the day you asked for information.

Ex : EPF Balance in A/C No. BG/BNG/0045123�00�00134 is EE Amt: Rs. 67009, ER Amt:Rs. 47000 as on 30-01-14 (Accounts updated upto 31-03-2013)-EPFO.

A/C No: This is your EPF account number. You EPF account number have your area code, company or establishment code and your account number.

EE Amt: Employee Contribution i.e. your total contribution in the EPF account. The sum total of PF amount deducted monthly from your salary.

ER Amt: Employer Contribution i.e your company contribution. The sum total of PF amount monthly contributed into your EPF account by your employer.

As on [Date]: This date tell you that your monthly contribution till this date has been updated in your EPF account. From the example above, it tells that your monthly contribution till 30th Jan 2014 has been added into your EPF account

Accounts updated upto [Date]: This tells you that the interest till this date has been added into your EPF account. From the example above, it tells that interest till 31st March 2013 has been added into your EPF account.

I am member of EPF since October 1989. My date of Birth is 04.01.1956. My Family pension is deducted on 6500/- more than 7 years. I have applied for Pnsion on 04.01.2014. To day I got letter that I will get pension Rs. 1579/- per month. I doubt, Is it correct.

Please let me know.

Regards,

Bhupinder singh

I am member of EPF since October 1989. My date of Birth is 04.01.1956. My Femily pension is deducted on 6500/- more than 7 years. I have applied for Pnsion on 04.01.2014. To day I got letter that I will get pension Rs. 1579/- per month. I doubt, Is it correct.

Please let me know.

Regards,

Bhupinder singh

It’s awesome for me to have a web site, which is good

in favor of my experience. thanks admin

Hi,

As per the SMS I received from PF office is showing the following amt as on 21-10-2013:

EE AMT = 76253

ER AMT = 30610

I left job in 2009 Dec after working for 5 years 8 months. Kindly suggest does this PF amt is clubbed with interest amt earned during last 5 years and 8 months.

Regards,

S Dey

EE stands for Employee and ER stands for Employer. Yes it includes the interest earned contribution with interest credited towards accumulated PF as on given date in SMS. contribution with interest credited towards accumulated PF as on given date in SMS.

EE is

ER is

Extremely helpful articles and tables – thanks very much. Especially the EPF interest rate data over the years was something which I could not find anywhere, including the EPF official website!

Now here’s one question which I would greatly appreciate your help in answering: When they say the interest rate for “FINANCIAL YEAR” 2012-13 is 8.5%, how is the financial year defined??? Is it March to February, or April to March?

Financial Year is From 1 Apr to Mar 31 next year. So Financial Year FY 2013-14 is from Apr 1 2013 to Mar 31 2014.

Thanks Kirti, but I was confused because all the interest calculations I have seen so far, and all the statements I receive from EPFO, they show the interest calculations from March to February.

Is this correct? Is the annual compunding of the interest done at the end of February every year?

Thanks once again in advance for your clarifications.

You are right. I checked with my Payroll friends and found that

The accounting period of PF is from March to February every year. The government credits the interest compounded on PF balance in April every year.

Thanks a lot for checking up the records!

Thanks again for your kind help and clarifications.

Thanks Kirti, but I am confused because as per the statements I receive from EPFO (the annual printed slip), all the INTEREST CALCULATIONS seem to be done from March to February.

Is this correct? Is the annual compounding of interest done at the end of February every year?

Thanks once again in advance for your clarifications.

Dear Admin,

In your EPF excel computation, have you considered the remaining amount of EPS contribution? It states 8.33% of basic salary or Max Rs 541. If Rs 541 is the max amount tat is contributed to EPS, then where does Rs 2126 (22222/12=2667, 2667-541) go? Shouldn’t that difference of Rs 2126 be contributed to EPF?

Thanks.

Jc Monthly contribution to EPS is restricted to 8.33% of 6500 or Rs 541 p.m. For person with basic salary of 20,000 Rs or with 10,000 or with 1,00,000 EPS contribution will be maximum Rs 541. Mostly contribution of EPF is 12% of basic salary which for

10,000 would be 1200 every month

20,000 would be 2400 every month

1,00,000 would be 12000 every month.

Our article Understanding Employee Pension Scheme or EPS discusses EPS in detail.

In your EPF excel computation, have you considered the remaining amount of EPS contribution? It states 8.33% of basic salary or Max Rs 541. If Rs 541 is the max amount tat is contributed to EPS, then where does Rs 2126 (22222/12=2667, 2667-541) go? Shouldn’t that difference of Rs 2126 be contributed to EPF?

Hello Kirti,

Your articles on PF made me very clear. I’ve a query in calculating the PF.

How the interest is calculated by EPFO?

Let us consider this scenario.

Opening balance is 10000.

1st month – EE – 1768; ER – 1227; EPS – 541.

After 1st month total Provident Fund is – 10000+1768+1227=12995.

And how they will give the interest will they give monthly interest and add to the total?

What about EPS? will they add it together?

Please let me know.

Hello Kishore,

Calculation of Interest on EPF is as follows:

At the beginning of each year there would be opening balance, the amount accumulated till then. Contribution to EPF is made monthly but interest is calculated yearly. One gets interest on opening balance and monthly contribution. So for next year the new opening balance would be: old opening balance + contribution throughout the year + interest on the (old opening balance + contribution)

So Opening balance in a year is is 10,000.

Monthly contribution of EE + ER is 1768 + 1227 = 2995

For 12 months it will be : 2995 * 12 = 35940

At end of financial year total amount = 10,000 + 35,940 = 45,940.

Interest is calculated on it = 45,940 * 8.4% = 3,858.96

Next year opening balance = 3858.96 + 45,940 = 49798.96

On EPS no interest is given . Our article Understanding Employee Pension Scheme or EPS explains it in detail

Hope it helped

I want to know what is the maximum time period a person can withdraw his pf amount.My wife pf amount is 16 years old and she has not withdrawn nor she is in the job right now.

If due any reason your EPF account becomes inactive and stays like that for three continuous years then the money invested in EPF account will not get any interest. Which means EPF will pay interest for first 3 years to an inactive EPF account, but not later on.

So if your wife has left job and it has been 3 years since leaving the job her EPF account is dormant and it is best if she withdraws it.

If it has been less than 3 years since your wife left the job then she can continue her account for time till 3 years after leaving job and then withdraw.

Hi,

I have got a sms that my EE is Rs. 7565 and ER is 4135. So how much is my Total PF Balance as of today.??

Sorry for delay in reply (I missed the query somehow)(Account updated upto ).

You would have get SMS alert from EPFO saying

EE amount : Rs XXXXX and ER amount Rs:YYYYY as on

EE = Employee Contribution and ER = Employer Contribution on date(shown in Account updated date) mentioned in your SMS. It does not show current balance of PF Account as on Today.

Many people think EE and ER should be same because employer is contributing the same amount as employee. Let’s see the break up of the contribution:

1) 12 % of basic salary of Employee goes into Employee Provident fund as Employee contribution(EE).

2) 12% of basis salary goes into from employer and this amount is divided in two portion.

Employees Pension Scheme ( EPS ) contribution of Rs. 541 /- ( @8.33% of Basic salary upto a maximum of Basic salary Rs.6,500/- PM) is deducted from Employers’ Contribution.

Remaining amount goes to Employee Provident fund as employer contribution(ER).

For example Employee contribution to EPF is 1000 Rs (12% of his basic)

Employer contribution will be : 541 for Pension + 459 (1000-541) for EPF.

Interest will be added on the opening balance for Employee contribution and Employer contribution to EPF.

So your total amount in EPF as on the date at which the data was updated is 7565 + 4135 = 11700

How long have you been working?

Please provide my pf calculation

Your name is not sufficient for us to provide PF calculation.

hELLO,

I have a school and its going to touch 20 staff this year, i have designed the pay structure this way for example

Basic DA HRA CCA M.Al Gross Ded/PF Net Salary

1500 1500 450 300 250 4000 180 3820

can this structure be followed? is there any criteria for min basic prescribed by EPF? Pls help !

Raj

8790133884

Sorry Raj we have no idea on how to design a pay structure. If you are running a school do you want to get into hassles of having EPF account for your staff.

It is not mandatory to have EPF.

The definition of salary for the purpose of PF calculation has been a subject of great debate mired in litigation over the years. While organizations argue that basic wages are nothing more than the head of pay called Basic, the PF department argues that basic wages is not just the Basic head of pay and should include other heads of pay such as Conveyance, Special Allowance etc. In addition, the PF department contends that the salary for the purpose of PF calculation cannot be lesser than the minimum wages as mandated by the Minimum Wages Act.

While we try to find more details for your questions you can read Salary for the purpose of PF calculation

Dear sir,

i am working in an organization for next 6 years. they are Contributing

12% of my salary amount in two heads one is called PF (10.14%) and rest

part of amount is in EPF (Total 12% of my salary PF+EPF). and also they

are deducting my 12% salary under PF head. KIndly tell me the difference

between these two heads PF and EPF. and after my 6 years completion

which amount i will get.

Gajanand typically 12% is cut from employee pay and Employee’s contribution is matched by Employer’s contribution(till 12%) . Check your payslip, ask your Payroll or Finance dept.

You can read about our article on Basics of Employee Provident Fund: EPF, EPS, EDLIS .

It is very usefull..Thanks

Thanks for the post it is very usefull..

Thanks a lot Gangadhar for your encouraging words

Dear Sir,

Need your help on this

I had been in service in my previous organisation for 15 year till 2007 and withdrawn total PF and apked in purchase of property. I had been told that EPS which is rs. 541 pm totalling rs 97 K could not be withdrawn as it will be accumulated for pension scheme. in my current service i have not given any link to that eps account.

pl let me know when i will get this amt as I do not want any pension out of this amt and when.

Early pension can be claimed after 50 years but before the age of 58 years. But it is subject to discounting factor @ 4% (w.e.f. 26.09.2008) for every year falling short of 58 years. In case of death / disablement, the above restrictions doesn’t apply. For more details you can check our article Understanding Employee Pension Scheme or EPS

Hi, i have shift 7 jobs in last 7 years where beginning in year 2005 i have opted for EPF for 1.5 years, withdraw it, then again for 7 months and withdraw it and then again for 1 year and withdraw it till 2008. From Mar 2010, i have been again have EPF contribution, if I complete service in current organization till 2015, am I being eligible for pension scheme or not. Thanks

Did you withdraw EPS also or just EPF.

Anyways if you are making EPF contribution you also are making EPS contribution. So you are eligible for Pension scheme. For more details you can check our article Understanding Employee Pension Scheme or EPS