Unit-linked insurance plans, more commonly known as ULIPs, provide the dual benefits of life cover and investment. These are market-related products that allow you to invest a portion of the premium in different financial instruments such as equity, debt, and money market products.

When ULIPs were first launched, the different charges levied were very high, which reduced your effective returns. However, in 2010 the Insurance Regulatory and Development Authority (IRDA) capped the charges to 2.25% in the first 10 years of the policy term. Therefore, newly launched ULIPs are significantly cheaper when compared to mutual funds.

Table of Contents

ULIP Calculators

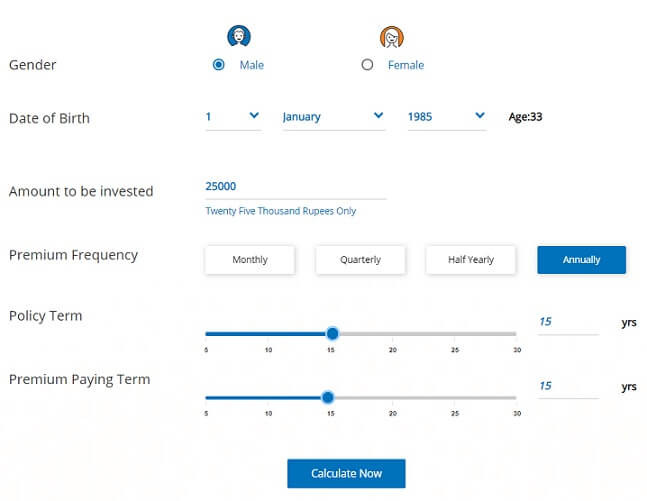

Several online portals provide a ULIP calculator that is beneficial in making the appropriate investment decisions. These calculators allow you to determine the potential value of your investment in the future. You need to input certain parameters such as the capital amount, premium payment frequency, investment horizon, and the annual post-tax returns to understand the potential returns before you make an investment decision.

You may calculate the potential returns based on the premium amount and the investment tenure. Such types of insurance plans have a minimum lock-in period of five years. However, most experts recommend that you stay invested for a longer duration to maximize the returns on your ULIP policy. In case the ULIP does not perform as per your expectations or underperforms when compared to the market, you may switch your investment from one underlying asset to another.

Calculating ULIP returns

Insurance companies levy certain charges, which must be duly considered while calculating the returns on your ULIP investment. Some of these include premium allocation, surrender charges, fund management fees, mortality charges, and administrative charges. Such charges affect your returns. Here are two ways in which you may calculate the ULIP returns.

Absolute returns

Absolute returns are also known as ‘point to point returns.’ You only need to know the initial Net Asset Value (NAV) and the current NAV to determine the absolute returns. In the first step, you deduct the initial NAV from the present NAV. Then, divide this value by the initial NAV. Finally, multiply this value with 100 to calculate the percentage returns.

Absolute returns = {(Current NAV – Initial NAV)/Initial NAV}*100

This is an efficient way to determine the performance of the ULIP in the shorter duration. For example, assume that the initial NAV at the time of investment was INR 100. At the end of one year, the NAV increases to INR 150. Therefore, the absolute return on your investment is 50%.

One of the disadvantages of this method is that although you may use it at any point during the tenure, it is beneficial to calculate returns only in the initial years. This formula helps you to only calculate simple returns based on your initial capital investment. However, the investment is compounded when you stay invested for a longer period and this is not captured when you calculate the absolute returns.

Compounded Annual Growth Rate (CAGR)

CAGR helps you to calculate the annual growth of your investment over a period of time. The formula to determine the CAGR is simple. It uses the end value of the plan, its initial value, and the total number of years during which you hold the ULIPs.

CAGR = {[(Present NAV/Initial NAV) ^ (1/Number of years)]-1}*100

Here is an example to help you understand the calculation of CAGR. Assume that you invested in the policy when the ULIP NAV was INR 100. At the end of five years, the NAV increases to INR 150. The CAGR is calculated as below

CAGR = {[(150/100) ^ (1/5)]-1}*100 = 8.45%

A disadvantage of using CAGR to calculate returns is that it is the mean annual rate during the investment period. It does not consider the market volatility that affects the returns over a period of time. CAGR is a historical value. Therefore, even if a ULIP has delivered consistent CAGR in the past, it does not guarantee similar returns in the future. Market conditions and other factors may affect its performance and therefore, have an effect on the returns.

ULIPs are complex financial products and are available as multiple options. Every plan is unique and comes with specific advantages and features. Making the right investment decision may seem like a daunting task. However, by following a few simple steps as outlined below, you will be able to make the right investment decision.

- Do your research to clearly understand more about ULIPs and know exactly how these financial products work

- Ensure you are aware of the entry and exit charges

- Do not be lured by some marketing features and base your investment decision on your personal needs considering your risk appetite and financial situation

- Compare the performance of the various ULIPs over the last two or three years against benchmarks such as the Sensex or the Nifty

- Evaluate different options provided by various insurance companies and compare things like performance, premiums, cost structure, and additional features

It is a huge misconception that ULIPs provide lower returns. When you judiciously invest in ULIPs and assume appropriate exposure to debt and equity, you are able to earn good returns. Choosing the right funds, exercising the switching option at the right time, and redirecting the premium are some ways to maximize your returns. Moreover, you must stay invested for the long-term (often until maturity that is between ten and 15 years) to accumulate a higher corpus.

2 responses to “Calculate Your ULIP Returns Before Investing”

Mera bhee nekalna hai

Hi Kirti,

One needs to understand the impact of mortality charges too. For old investors, the hit due to mortality charges can be quite high. Even maturity proceeds may not be exempt from tax.

Moreover, looking at ULIP returns in form of NAV may not be the best approach. A few charges such as mortality charges are recovered through cancellation of units. Therefore, such may not affect NAV. However, these charges will affect returns. Therefore, CAGR growth in NAV will be a misleading indicator.