On 1 Feb 2019 Modi’s Government presented an interim budget full of populist goodies for the middle class, farmers, and small-and-medium-sized businesses. There is No change in Income Tax Slabs, though those with income up to 5 lakh get a rebate on filing their income tax. TDS on bank deposits and post office deposits have been increased to 40,000 from 10,000. PM Modi said Budget is merely a Trailer. This article talks about Budget 2019-2020, presented by Piyush Goyal, what changes it proposed for the salaried class, such as gratuity limit increased, home-related benefits, Why is it called Interim budget, what is interim budget? How has been 5 years of Modi Government for the Indian tax payer?

The Prime Minister said over 12 crore farmers and their families, over 3 crore salaried professionals and their families will gain due to the measures. “It is good to see more people being removed from the shackles of poverty. Our Neo-middle class is rising and so are their dreams… Interim budget a trailer for what will take India towards prosperity after Lok Sabha polls,” he said in a televised statement.

Regardless of whether the government implements any of its goodies with the election due by May, the announcements could still hurt opposition parties as they head out on the campaign trail with the only manifesto promises to offer voters.

Table of Contents

Overview of Income Tax in Interim Budget 2019-2020

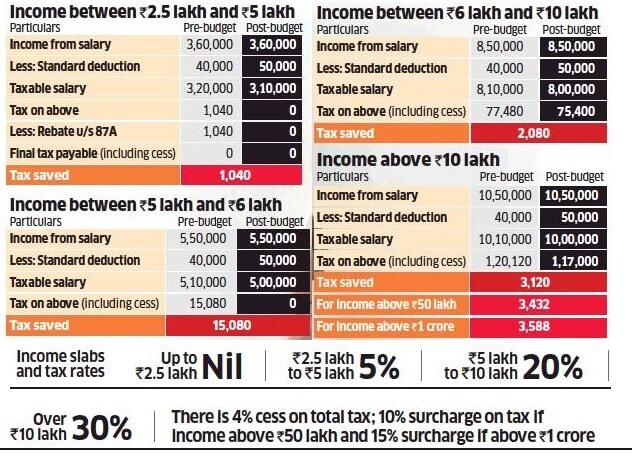

- Rebate from income tax has been allowed maximum up to Rs 12500 u/s 87A to assessee having income up to Rs 5 lakh(500000). This is not an exemption limit that has been raised. It only applies to those earning up to Rs 5 lakh a year(or income up to Rs 6.5 lakh if they also avail the full benefit of Rs 1.5 lakh Section 80C deduction.) So, an individual with a taxable income of more than Rs 5 lakh in a year will continue to pay 5 per cent on the taxable income between Rs 2.5 lakh and Rs 5 lakh. This tax proposal would cost Government Rs 18,500 crore but would provide benefit to 3 crore middle-class taxpayers, self-employed and senior citizens. The details are explained here.

- No change in Income Tax Slabs. The tax slabs remain as it is. That is, nil tax up to Rs 2.5 lakh; 5 per cent tax from Rs 2.5 lakh to Rs 5 lakh; 20 per cent tax on income between Rs 5 lakh and Rs 10 lakh; and 30 per cent tax on income above Rs 10 lakh.

- People having taxable income between Rs 2.5 lakh and Rs 5 lakh have to file ITR as they have taxable income and the rebate will be given only on the tax payable.

- People having taxable income up to Rs 5 lakh only will get the tax rebate. If the taxable income exceeds the limit by even a rupee, the taxpayer has to pay tax on the income of Rs 2.5 lakh onwards

- No changes in deductions available to individuals

- The standard deduction for salaried Employees has been proposed to be increased to Rs 50000 from Rs 40000. This is expected to result in a maximum tax saving of Rs 3,588. In the previous budget, this standard deduction was introduced instead of tax-free transport and medical allowance worth Rs 34,200. Revenue forgone for this will be about Rs 4,700 crore.

- The I-T department plans to be more taxpayer-friendly by processing income-tax returns within 24 hours and issuing refunds simultaneously.

Note: On December 10, 2018, the finance ministry announced a proposal to increase the tax exemption limit for lump-sum withdrawal from the National Pension System to 60% of the total amount. With this, the entire lump sum withdrawal from NPS, which is limited to 60% of the accumulated corpus, would have been exempt from tax.

TDS Limit raised

- TDS limit on interest earned on bank/post office deposits is raised from Rs. 10,000 to Rs. 40,000. This means on a deposit of nearly Rs 6 lakh at an assumed interest rate of about 7 per cent per annum, the annual interest earned will not be subject to TDS.

- Importantly, for interest earned from company fixed deposits, the threshold stands at Rs 5,000 per annum.

- Non-incidence of TDS till Rs 40,000 of interest in one year, does not make the interest tax-free. One needs to add the interest amount earned under ‘Income from other sources’ and based on the income slab, this interest is fully taxable.

Benefits For the Salaried Class or Employees

- The government also decided to hike the gratuity limit to Rs 30 lakh from the next financial year. The Gratuity Act is applicable to employees who have completed at least five years of continuous service in an establishment of 10 or more. The government had in Budget 2018-19 increased the gratuity limit by Rs 10 lakh to Rs Rs 20 lakh. After working in a company for 4 years,10 months and 11 days an employee is eligible for gratuity which he gets on leaving the company. Our article What is Gratuity? covers it in detail.

- Employees who are members of EPFO and receive grievous injuries while being an employee will now get Rs 6 lakh (earlier Rs 2.5 lakh) under EDLI. All employees who join the Employees’ Provident Fund are covered by the EDLI or Employee’s Deposit Linked Insurance Scheme, 1976. EDLI provides a lump sum payment to the insured’s nominated beneficiary in the event of death due to natural causes, illness or accident, explained in detail here.

Benefits for Home Owners

- TDS limit on rental income raised from 1.8 lakh to 2.4 lakhs

- No tax on notional rent on Second Self-occupied house has been proposed. Currently, income tax on notional rent is payable if one has more than one self-occupied house. So, you can now hold 2 Self-occupied properties and don’t have to show the rental income from the second house as notional rent.

- Now one can invest in two houses to save on capital gains tax under section 54 of the Income Tax Act for a taxpayer having capital gains up to Rs 2 crore. This benefit can be availed once in a lifetime.

- the benefit is available only if the new residential properties are situated in India

Other Big announcements

- For farmers, a New scheme is proposed. PM Kisan Samman Nidhi Yojna(PM Farmer respect money scheme), small and marginal farmers who have less than two acres will get Rs 6,000 per year directly in their bank accounts in three instalments of Rs 2,000. This will help 12,000 crore farmers and will cost the government Rs 75,000 crore,

- An amount of Rs 19,000 crore has been allocated for Pradhan Mantri Gram Sadak Yojana and Rs 60,000 crore for MGNREGA this year.

- All households will be provided with electricity connection by March 2019.

Tax Rebate

The salient features of the Income Tax Rebate under Section 87A are given below. Our article Income Tax Rebate under Section 87A covers it in detail

- The amount of tax rebate under section 87A is restricted to a maximum amount which for FY 2018-19 is Rs 2500. If the computed tax payable is less than Rs 2,500, say Rs.1,500 the tax rebate shall be limited to that lower amount ie Rs 1,500. The Income Tax Rebate has been increased from Rs. 2500 to Rs. 12,500 in Budget 2019-20 and would be applicable from Financial Year 2019-20 onwards

- Rebate under Section 87A is only available to Individuals. All categories of Individuals whether Male or Female or Senior Citizens are eligible to claim Income Tax Rebate under Section 87A. Other types of assesses like HUF, Companies, Partnership Firms, LLP etc are not eligible to claim Income Tax Rebate under Section 87A.

- Income Tax Rebate under Section 87A is only available to Resident Individuals and not to Non-Resident Individuals.

- Income Tax Rebate is allowed before the levy of Education Cess and Secondary and Higher Education Cess(SHEC). In other words, Education Cess and SHEC would be levied on the tax payable after allowing for Income Tax Rebate.

- Total income before cess should not be more than a defined limit, which is 3.5 lakhs for FY 2018-19 but 5 lakh for FY 2019-20.

- There is no benefit of this Rebate to Super-Senior Citizens i.e. Individuals above 80 years of age as their Income up to Rs 5 Lakh is already exempted from the levy of Income

- Rebate is different from tax exemption.

- A tax exemption is when the income you earn does not attract tax ex: Agricultural income earned by the taxpayer in India is exempt from tax.

- A tax rebate is the amount of tax that an assessee is not liable to pay.

- The finance minister has announced a rebate and not an exemption. This means that people whose taxable income, after all the deductions, is higher than ₹5 lakh, the old tax rates will apply. For example, a person with taxable income of ₹10 lakh will pay a 5% tax on his taxable income between ₹2.5 lakh to ₹5 lakh

Example of How Tax Rebate works

| Description | Amount |

| Salary Income | 4,00,000 |

| Income from House Property | -50,000 |

| Income from Other Sources | 15,000 |

| Total Income | 3,65,000 |

| Deductions under 80C | 50,000 |

| Total Taxable Income | 3,15,000 |

| Tax on Income(@5%) | 3250(5% of 3,15,000-2,50,000) |

| Less Rebate(Max 12500) | 3250 |

| Total Tax Payable | 0 |

| Education Cess | 0 |

| Total Tax | 0 |

Following table shows the maximum rebate and maximum income(after deductions) for a resident individual across various years. For filing the ITR for FY 2018-19 or AY 2019-20 the rebate is Rs 2500 as shown highlighted in yellow.

| Financial Year | Assessment Year | Max Income | Rebate under section 87A |

| FY 2019-20 | AY 2020-21 | 5 lakhs | 12,500 |

| FY 2018-19 | AY 2019-20 | 3.5 lakhs | 2,500 |

| FY 2017-18 | AY 2018-19 | 3,5 lakhs | 2,500 |

| FY 2016-17 | AY 2017-18 | 5 lakhs | 5000 |

| FY 2015-16 | AY 2016-17 | 5 lakhs | 2000 |

| FY 2014-15 | AY 2015-16 | 5 lakhs | 2000 |

| FY 2013-14 | AY 2014-15 | 5 lakhs | 2000 |

About Interim Budget

When is an interim budget presented? The government presents an interim budget because Lok Sabha elections may be near or if it does not have the time to present a full Budget. When there are Lok Sabha elections the task of framing the full Budget is left to the incoming government.

Why is an interim budget needed?

The budget is for the financial year and hence the government has spending rights only till the March 31 (2019 currently). The government will need parliamentary authority for incurring expenditure in the new financial year(1 Apr 2019) until a full Budget is presented. Hence Government presents Interim budget and Parliament passes a vote-on-account that allows the government to meet the expenses of the administration until the new Government is formed and presents the Budget for the whole year. In an election year, the vote-on-account is usually for a four-month period.

How does the interim budget differ from a regular budget?

In an interim Budget, the vote-on-account seeks parliament’s nod for expenditure for part of a financial year, usually four-month. However, like the regular Budget, the estimates are presented for the entire year. So when the final Budget is presented the new government has full freedom to change the estimates completely. The government can make tax changes in the interim budget but in the 12 interim budgets since Independence have respected the fact that the government is a custodian for a few months and have refrained from announcing big-ticket changes or new schemes

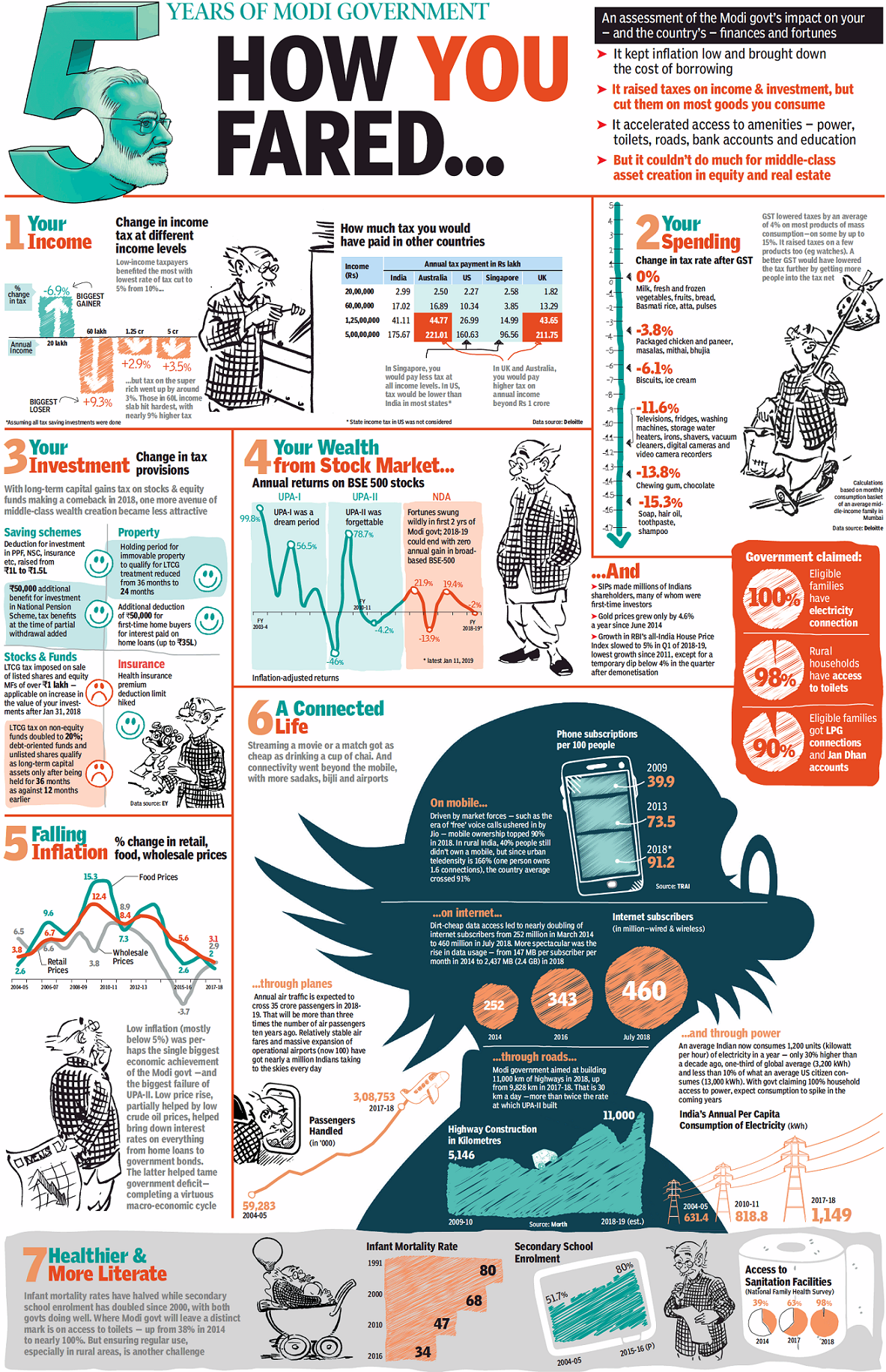

How has India fared in the last 5 years

- Income Tax for FY 2018-19 or AY 2019-20

- FY 2018-19 : Income Tax Changes that will help you Save Taxes

- Income Tax Refund: How to claim Refund,Check Status

- Income Tax Notice for Inconsistency in Salary Income and Form 26AS

2 responses to “Budget 2019-2020 : Interim Budget, Benefits for Employes, TDS benefits”

I was not able to read the whole budget news. Thanks for making it short and useful for reader

You are welcome