Verify your Form 26AS, all income tax articles insist and rightly so. But what to verify is question that we have come across in our discussions. This article gives an for an individual an overview of Form 26AS, why is it important, how to view it and what information from Form 16, Form 16A, Advance or Self Assessment tax paid, refund should be verified.

Table of Contents

What is Form 26AS?

Form 26AS, also called as Annual Statement, is a consolidated tax statement which has all tax related information (TDS, TCS, Refund etc) associated with a PAN. It shows how much of your tax has been received by the government and is consolidated from multiple sources like your salary / pension / interest income etc. This form contains the annual tax statement under Section 203AA and Rule 31AB. This statement, includes details of tax deducted:

- Tax deducted at source (TDS)

- Tax Deducted at Source (TDS) for 15G/15H

- Tax collected at source (TCS)

- Advance tax/Self assessment tax/regular assessment tax etc., deposited in the bank by the taxpayers (PAN holders).

- Refund received during the financial year.

Why is the Form 26AS important?

This form MUST be cross-checked with the details of the TDS certificate (Form 16 / Form 16A) to ensure that the TDS deducted on the deductee’s income was actually deposited with the Income Tax department. The information available in the tax statement confirms that:

- The tax deducted / collected by the Deductor / Collector has been deposited to the account of the government.

- The Deductor / Collector has accurately filed the TDS / TCS return giving details of the tax deducted/collected on your behalf.

- Bank has properly furnished the details of the tax deposited by you.

SO Once tax credit is reflected in the statement, no need for TDS certificates.

- Enables view of all financial transactions involving TDS/TCS during the relevant Financial Year at one place.

- Helps in claim of tax credits and computation of income at the time of filing of return of income : This is the first check that is done in verifying your income tax return. If the tax entries don’t match Income tax dept. sends a notice. That’s why they say view your Form 26AS before filing returns.

- Seamless processing of Income Tax Return and speedy credit of refunds

- Verification of Refunds encashed during the Financial Year.

As the Form 26AS says Tax Credits appearing in Part A, A1 and B of the Annual Tax Statement are on the basis of details given by deductor in the TDS or TCS statement filed by them. The same should be verified before claiming tax credit and only the amount which pertains to you should be claimed

Since when is Form 26AS issued?

Form 26AS is prepared from Financial Year 05-06 onwards.

- From FY 2005-06(AY 2006-07) to 31st Oct 2012 one can view the Form through TIN-NSDL website.

- From FY 2008-2009 (AY 2009-10) one can also view the Form through TRACES website

How to view Form 26AS?

Form 26AS can be viewed in many ways as given below. Our article Viewing Form 26AS on TRACES explains how to View Form 26AS in detail

- 1. View Tax Credit from incometaxindiaefiling.gov.in

- Taxpayers who are registered at the portal incometaxindiaefiling.gov.in for e-filing of income tax returns can view 26AS by clicking on ‘View Tax Credit Statement (From 26AS)’ in “My Account”. The facility is available free of cost. Earlier it used to TIN-NSDL website, now it takes to TRACES.

- 2. View Tax Credit (Form 26AS) through banks using net banking facility

- The facility is available to a PAN holder having net banking account with any of authorized banks. View of Tax Credit Statement (Form 26AS) is available only if the PAN is mapped to that particular account. The facility is available for free of cost.

- Banks Site showing tax credit through TRACES (Earlier it was taking to TIN-NSDL site)

- 3. Through TRACES website after registration. New registrations can be done at TRACES site.

How to see the information in Traces for Form 26AS?

Choose the Assessment Year and the format(HTML,text,pdf) in which you want to see the Form 26-AS. For example for filing returns for FY 2012-13 or AY 2013-14 Assessment year should be chosen as 2013-14. Please Be careful of terms Financial Year and Assessment Year.

- If you want to see it online, the format should be HTML.

- If you would like to download a PDF for future reference, choose PDF.

- After you have made your choice, click on View/Download

Password for opening downloaded Form 26AS for an assessment Year is date of birth of PAN holder in ddmmyyyy format as mentioned in PAN Card. So if your date of birth mentioned in PAN card is 23-Jan-1983 then to open pdf file password would be 23011983

Structure of Form 26AS

The Form 26AS (Annual Tax Statement) is divided into parts described below. Our article Understanding Form 26AS discusses all parts of Form26AS in detail.

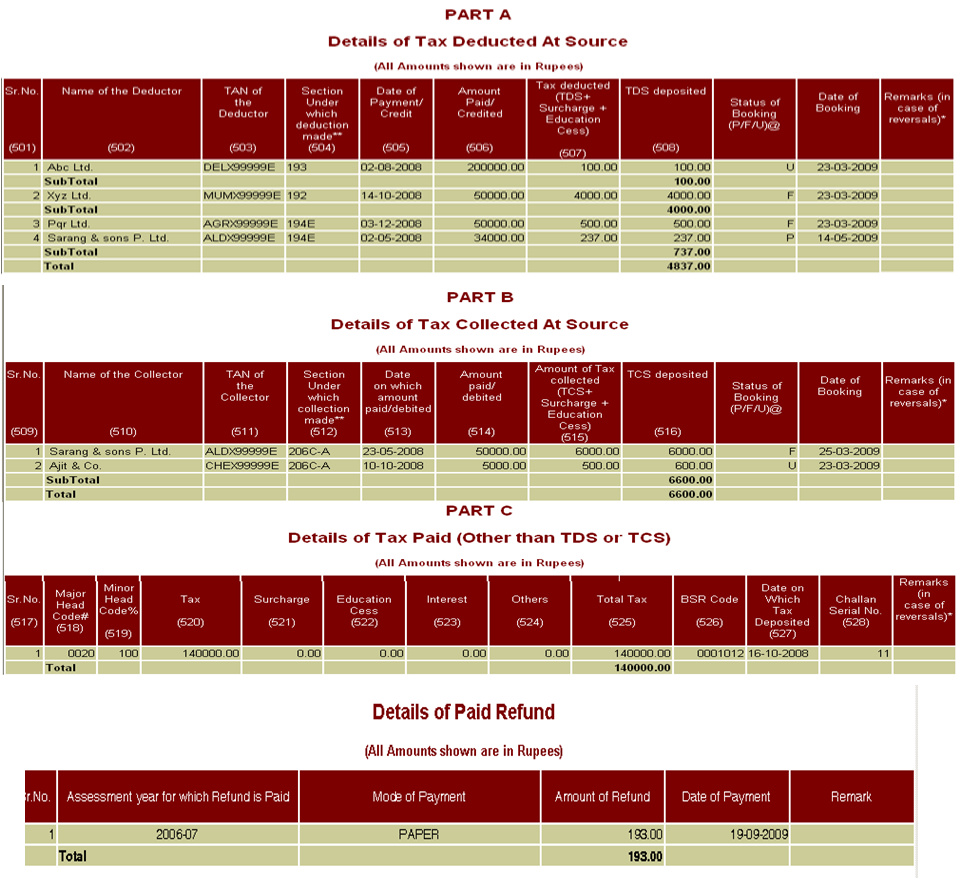

- PART A – Details of Tax Deducted at Source (All amount values are in INR)

- This section will show the TDS deducted from your salary / pension income and also TDS deducted by banks on your interest income. TDS deducted by each source is shown as a separate table

- PART A1 – Details of Tax Deducted at Source for 15G / 15H

- This section will show transaction in those financial institutions such as banks where the individual has submitted Form 15G / 15H. TDS in these cases would be zero (because you have submitted 15G/15H). This section enables you to keep a track of all the interest gain which has not been taxed.

- PART B – Details of Tax Collected at Source:

- Tax Collected at Source (TCS) is collected by the seller from the buyer at the time of sale of specified category of goods(such as Alcoholic liquor for human consumption,Scrap,Parking lot, Toll plaza). The TCS Rate vary for each category of goods and the TCS is to be deposited with the govt. SimpleTaxIndia’s India Tax collection at source and tcs provisions discusses it in detail.

- PART C – Details of Tax Paid (other than TDS or TCS)

- If you have paid Advance Tax or Self Assessment Tax, this will be listed here, Whenever you deposit your advance tax / self assessment tax directly to bank, the bank will upload this information around three days after the cheque has been cleared.

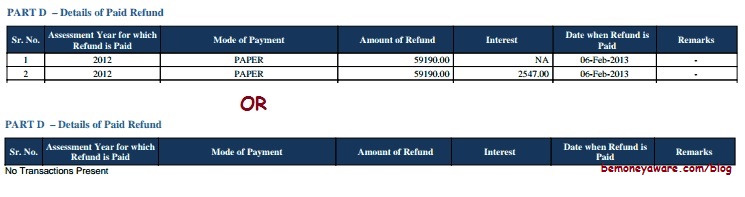

- PART D – Details of Paid Refund

- If you have got any tax refunds in that assessment Year it would be listed under this section.

- PART E – Details of AIR Transaction.

- If you make some high value transactions, such as investment in property and mutual funds, then these transactions are automatically reported to the income tax department by banks and other authorities through Annual Information Return (AIR)

Form 26AS looks different from earlier versions?

Yes it does. Earlier version of form is shown below. The change is due to agency which maintains the information. Earlier the information was maintained by TIN NSDL but now it is maintained by TRACES. Though look and feel is different Information reported is similar (Part A1 for tax saved by submitting Form 15H/15G was missing in earlier versions of Form 26AS) . Click on image to enlarge

What verification does one need to do?

You need to verify that tax has been deducted from you , proof of which is Form 16(Salary), Form 16A(Interest on Fixed Deposit), Advance Tax or Self Assessment Tax paid by you using Challan 280 proof of which should be the receipt.

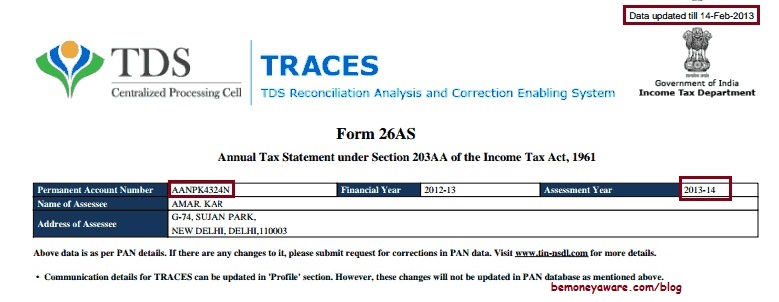

Assessment Year, PAN Details, Date of Updation

Form 26AS statement includes payments pertaining to tax information of a particular Assessment Year (AY). It is a living document so data is updated based on details given by deductor in the TDS / TCS statement filed by them. Please verify the details (highlighted by maroon colored boxes in image below):

- Date on which data was uploaded

- Assessment Year

- PAN Details

If the name and address details given in Form 26AS are incorrect then you can get the Data corrected by applying in TIN for changes or correction in PAN Data. This request can be made either online or through the existing network of TIN-FCs.

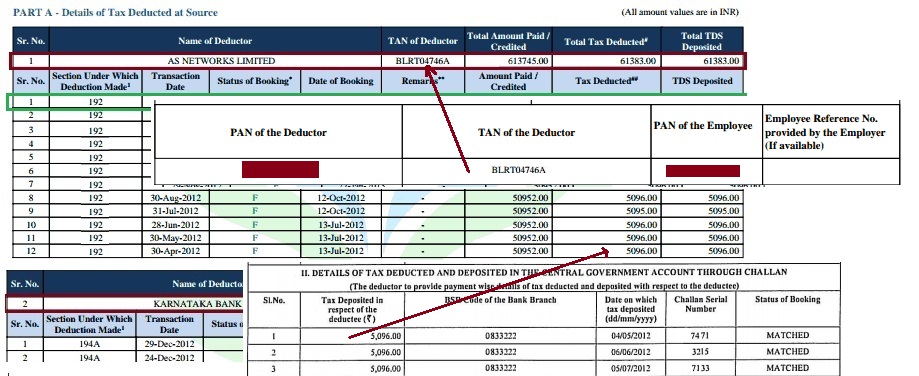

TDS in Form 16/Form 16A matches PART A of Form 26AS

TDS deducted by each source is shown as a separate table as shown in image below. Entries are in reverse chronological order that means entry with later date will appear first. So if you have entry for date 31-Jul-2012, 31-Aug-2012, 30-Sep-2012 then they will appear as 30-Sep-2012 31-Aug-2012 31-Jul-2012. Please verify that

- Details of deductor match your Form 16,Form 16A.

- All entries for a deductor match the entries in your Form 16/16A. Check each entry for Section Under Which Deduction is made (192 for Salary, 193 for interest on Fixed Deposit from bank) , Date at which Transaction is made, Status of Booking.

- Status of booking is F or FINAL which shows that payment details of TDS / TCS deposited in bank by deductors have matched with the payment details mentioned in the TDS / TCS statement filed by the deductors.

- If Tax deducted by an employer is not reflecting in Form 26AS then employer should be approached to ensure filing of TDS statement with correct PAN.

Please contact the deductor to update details if :

- Some entry(s) is missing.

- If Status of Booking is U which means Unmatched . It means Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment details in bank match with details of deposit in TDS / TCS statement.

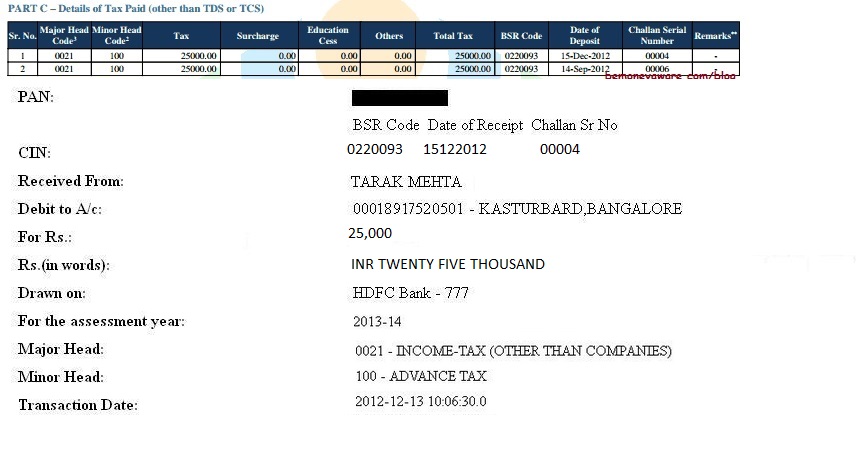

Advance Tax or Self Assessment Tax paid matches Part C of Form 26AS

Part C of Form 26AS has details of Tax Paid (other than TDS or TCS). If you have paid Advance Tax or Self Assessment Tax it will appear in this section. Our article Our article Paying Income Tax : Challan 280 explains how to pay the Self Assessment Tax. Please verify that advance tax or self assessment tax details are showing up in Form 26AS, If they don’t match with your details please contact the Bank

Part D: Details of Paid Refund

If you have got any refunds then information should match Part D or if no refunds got it should show No Transactions Present

Related Articles :

- E-Filing of Income Tax Return, E-filing : Excel File of Income Tax Return, Which ITR Form to Fill?

- Fill Excel ITR form : Personal Information,Filing Status

- Fill Excel ITR1 Form : Income, TDS, Advance Tax

- Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- Paying Income Tax : Challan 280

Hope it clarifies what to verify in Form 26AS. Looking forward to your questions, comments and feedback

You have explained well about 26 as. I want to suggest GSB taxation for all company registration services in delhi like limited liability company registration in india, opc registration in india, proprietorship firm registration online, fssai registration consultant/ license, msme registration, nbfc registration in india, agmark registration online, mcd trade license consultant.

Connect : http://www.gsbtaxation.com/contact.php

my form 26 as is saying no transaction present while i have transactions, what should i do?

Hi Kirti,

I have a query on the SChedule CG . I have sold a property for 25 lakhs last year but the amount receivable was only 8 lakhs to me and rest went to the mortgaged bank in my case GIC i.e 17 lakhs . My question is while filing the return what should be shown as receivable 8 lakhs and as per section 50c what amount should be considered as the stamp duty valuation authority it will be 25 lakh .PLease clarify

Hi,

My TDS for the FY 2015-2016 was Rs.17,250/- at 10%. whereas the employer has provided me with Form 16 of Rs 1,616/- and remaining amount of Rs 15,634/- have been credited in Form 26AS for next FY 2016-17. Due to which my slab rate for the FY 2016-17 will cross 20% and i will be suffering an financial loss.

Please suggest how would I go in filling me returns.

So remaining TDS will be applicable for the FY 2016-17.

Govt goes with what is in your Form 26AS.

Going from 10% to 20% is that a big a leap.

If your salary is 4,80,000 then tax with cess is 21630 (10% of 2300)

If your salary is 5,20,000 then tax with cess is 29870 (25000 (10% of 2.5 lakh) + 4000 (20% of 20,000))

Sir, we arranged efiling of a deductor’s E TDS for 26.Q They are asking for FORM 26 AS for employer/deductor.What is FORM 26AS for employer/deductor?Kindly clarify.

Does any kind of postal income is reflected in 26 AS ??If yes which kind of ?

Only TDS from Senior Citizen Scheme is reflected in Form 26AS.

while filling up the online return the systems shows that ” The amount of salary disclosed in income details/part BTI is less than 90% of salary reported in TDS1″.I don’t understand what wrong with me. please help me.

Our article The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1 discusses it in detail.

It is just a warning you can submit your ITR. This is because your employer reported your gross salary in the TDS section which is higher than what you have filled in the Income from Salaries due to the bug that’s there in the sheet. To fix this error, just modify the TDS sheet column 4 and change the amount to what is there in the Income chargeable under the head salaries in Form 16(pt 6) .

Hi Sir,

I have less than 5000 rs capital gain profit last year, I do not see it in 26AS form ( which I downloaded from TDS , traces website ). should I need to show this in last year ITR ? Is there any cutoff saying that , we need to show only if the transaction amount overall for the year is more than 1 lakh.

Thanks you for your informative article

In my form 26 AS Part A1 I foud that Total amount Paid/Credited as 970 by my bank [SBI]. Total tax deducted and Total TDS deposited is Nil. Part A1 is correct as per my employer given form 16.Do I need to add this amount 970 in income from other sources when I e file my tax ? This Bank’s TAN number also shows my E filing section

I too am in a very similar situation. In my form 26AS, under “Part A1”, “Total Amount Paid/Credited” shows Rs “8520” and “Total Tax Deducted” is “0.00”.

The same question : Should I include this amount “8250” to “Income from other sources” when filing the ITR?

Can someone please advice? Thanks.

I hav 2 fds with bank. Total interest generated was 14000 for the year 15-16. Since i didnt submit pan card details the bank deducted tds at 20% rate.but tds is not seen in my form 26as and now i hav to file return. How can i claim my tds. Thanks

I have checked 26AS. The income shown in 26AS and actual intrest recieved differs. Income shown in 26AS is more by nearly Rs.1 lakh due to which total income shown in 26AS is around Rs.5.80 lacs.Actual interest income is Ra.4.75 lacs.TDS deducted is Rs.12900/= by the Bank inspite of submitting Form 15H.For getting refund shall I submit the ITR-1 with the interest amount of term deposits credited in my SB Acct (i.e.Rs.4.75 lacs) or shall I wait till the bank rectifies total income in Form26AS. My age 81 years and I am eligible for deduction of Rs.80000 u/s 80DDB also(medical exps). Please guide immediately. Thanks.

What replies / comments recd. reg. Rad hike query

What advise recd. reg.Radhika query

Thank you for the information. Recently I withdrew my PF and there was a 10% TDS on the sum. This is for FY 2016-17 AY 2017-18. My question is will this TDS by EPFO be recorded in my Form 26AS? The reason is I want to claim the TDS during my IT returns for AY 2017-18.

Form 26AS purpose is that only, to track TDS deducted.

Within week of TDS deduction it should come up in Form 26AS.

A request can you send us snapshot of the Form 26AS with EPF Withdrawal. Just the part where EPF withdrawal comes up. Many other would be benefited from it.

Thanks for the reply. I checked my 26AS for the applicable Assessment Year. But there is no TDS entry and I have raised a grievance to the EPFO.

I find that the interest (paid + accrued) on FD shown in the interest certificate I downloaded from the SBI online banking site is different from the interest paid shown in the SBI part of 26 AS. Why should these be different? Which one should I use for tax calculation?

Sir if its ok with you, you can send us the documents at our email id bemoneyaware@gmail.com. We shall not pass the information to anyone.

It is nice of you to offer to help. After I posted my query, I discovered that the SBI interest certificate, though it says “Deposit Interest Certificate”, includes as one entry the savings account, where they show interest paid as well as accrued. If I deduct that, then the amount almost agrees with the amount shown in 26 AS, apart from a minor discrepancy of Rs. 137. This seems to be an error in 26AS, because it shows amount paid as 891871, and tax deducted as 89206. The tax deducted is more than 10%. If I add 137 (the discrepancy mentioned above) to 891871, the amount paid would be 892008. Then 10% of this agrees (closely) with the tax deducted 89206. If you have the time and patience, please let me know if you agree with the logic. If not, I will find time and send you more details. Thanks again for your helpful site.

Dear Sir,

I am working with company A upto Feb-2016. then work with company B. I have recieved form 16 of Both company. Now i have file ITR-1 as per previous company form-16. where i have pay income tax Rs. 4075. which is e verified after ITR-1 submission. then i have form 26AS where entry of both the company given with tax deduction in company A section. no tax deduction in company B section (As my company B form 16 shows no tax deduction).

Here i want to konw it is sufficient to submit ITR-1 with company A form 16 A for me or any other requirement is there. pleaase let us know if any.

Your early reply appreciated.

You have income from both the companies , so please don’t ignore income from Company B, though it is only for a month and no tax was deducted.

ITR1 has just one row for filling in the details as shown in image of filling Salary Details in ITR1 above and no employer details. So you to do calculation yourself of consolidated income, tax deduction etc. So your consolidated salary would be sum of Income chargeable under the head Salaries (point 6 in your Form 16) from all your Form 16

Thanks for your valuable reply.

Here i want to know if i consolidate the income from both the company then incometax amount was greater than what it was deducted from company A. so please guide me on that. whether i want to pay balance tax or not.

Regards

Yes you are bang on. You total salary will include salary from A and B. As B has not deducted tax, you need to find how much tax you have to pay. This is called Self Assessment Tax.

Please go through our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR for more details.

Dear Sir,

I have worked for MNC (say A) from april 2015 to july 2015 and then switched to MNC (say B) from august 2015 till march 2016.

Now I have received Form 16 from both MNCs A & B. But when I am comparing the values of Form 16 with Form 26AS, I found that there are no entry for MNC A in 26AS. Please note that no tax has been deducted during employment in MNC A but tax deducted by MNC B.

Kindly let me know what should I do in this case as form 26AS not showing income of MNC A ?

Regrds,

somendra

somende2010@gmail.com

Why was tax not deducted from salary in MNC A? If A did not deduct TDS then it would not show up in Form 26AS. But you still have to show income from MNC A.

Dear Sir, in my case i got form 16 part b only from MNC A.

how should i approach in this case not getting part a of form 16

That is OK. As Part A of Form 16 shows information on TDS. As your earlier employer has not deducted TDS, he has not provided Form 16. You need to add Income in Form 16B to income from new employer while filing ITR. Please go through our article How to Fill ITR when you have multiple Form 16 for more details.

All income tax online utility and excel utitility are available on Income tax website. Problem is 26AS is not updated. It is showing TDS till December 2015. What is the use of utilities?we can’t fill the return till 26AS is updated. Anybody knowing the solution

Sir, I had correctly filed ITR2A for AY 15-16, shown income from Bank Interest also, as well as TDS thereof, in 17C. However, CPC sends me 143(1) intimation mentioning lesser TDS amount in row 33. The difference is exactly the amount I had shown in 17C, in col 7 & 8. Even my form 26AS shows the amount. Your comment / advice plz. Can it be bank did not actually pay the TDS to IT Deptt?

Hi,

Can any on Suggest, ” Is their is any taxation or auditing requirements for maintaining records of Form 16A (TDS certificate ) corresponding to 26AS ” .

As such no specified records are mandated, however, do keep a record of – the invoice and details of payment made, name address and PAN information of the receiver, date of deduction and amount paid after deduction.

In case you are an employer and deduct TDS for payments made to employees, you are required to maintain documentation of all deductions claimed & exemptions allowed. Where an employee claims HRA, rent receipts, rent agreement must be kept in record. Similarly, documentation for Section 80 deductions claimed. Medical expenses reimbursed and also details of LTA claimed must be kept. If certain perquisites are allowed, the tax computation and documentation for these must be maintained. In case an employee submits details of income from previous employer, it must also be filed.

Hi,

There is a difference in my Form 16 given by Employer and Form 26AS (Downloaded from TRACES. TDS deducted & deposited is same but the amount credited differs.

Amount paid in Form 16 by employer is more than that of Form 26AS

For the A.Y. -2014-15, I filed my return of Income on the basis of Form 26AS resulting in refund of Rs. 8900/- to me.

A few days back I have received a ShowCause notice from the Jurisdictional AO stating that there is difference in Income as per Form given by Employer and Return of Income filed by You.

Can You please help me regarding this.

Is there any Case law reference, I can quote while replying the SCN.

Please Help.

Hello ,

How can i get 26as form before AY 2009-10. I am looking for 26as form for AY 2008-09. I tried TIN-NSDL website, but it gives error.

Thanks.

Hi Kirti,

The total credit amount im my form 26AS differs from Form 16.However the total TDS deposited matches in both.

Total credit in form 16 is Rs.583080(Gross)

Total credit in form 26AS Rs.452078

Total TDS deposited in form 26AS-Rs.18186

Total Tax paid in form 16- Rs.18186.

Which figure should I take for filing returns Form 16 or form 26AS?

When I use the figure of form 16 I get tax demand whereas when I use the figure of form 26AS I get a refund of about 13000 Rs.

I am salaried govt employee with no other source of income except salary.

Please guide.

Regards.

You have to find why there is difference and get it corrected.

As you rightly said figures in Form 26AS will be used by Income tax department for processing your returns

Hi Madam

My annual salary not come under tax slap. but i need form 16 for loan purpose. can u help on same .

THANKS

kindly reply as soon as poosible kirti

Form 16 is issued by the employer to employee showing income earned and tax deducted. If working please ask your employer.

For loan you will need a documented proof of your income. In case of salaried person, apart from the ITR and Form 16, it can be in the form of salary certificate backed by monthly credit entry in a bank account, etc.

If the salary has been credited into a your bank account regularly then even if you do not have Form no.16 or have not filed income tax returns, the proof of salary credited in the bank statement for last three years can be sufficient for establishing your regular source of Income. This is especially true if statutory deduction such as EPF or professional tax have been made. The important thing is the regulatory of such salary deposits and the length of time for which such deposits have been made (will be needed for at least 3 years).

From FY 2005-06(AY 2006-07) to 31st Oct 2012 one can view the Form through TIN-NSDL website.

What is the link to the site.

Is https://onlineservices.tin.egov-nsdl.com/TIN/LoginSubmit.do?

When I opened the above It says it is discontinued and informed to use http://www.tdscpc.gov.in

Hi,

My ex-employer has not issued form-16 as well as they have not paid income tax deducted from our salary to IT department. The company was a pvt ltd company, part of conglomerate and has already ceased the business (the parent company is still in business and parent company was funding our company). Suggest me:

1) legal procedure to file a complaint against the ex-employer

2) how can i file income tax return without form16 and no entry in 26AS

Regards,

Kunal

Hi Kirti,

Any inputs on the my query? I would be great if you can acknowledge the receipt of the message.

Regards,

Kunak

Sorry Kunal for delay. Team has been busy with work and kids vacation.

The employee has a right to obtain the TDS certificate in form 16 from his employer. The certificate details should be filled in return of income, since no credit for TDS can be given without it. In case your employer fails to issue the TDS certificate, he shall be liable to a penalty of Rs. 100/- for each day of default u/s 272A(2)g).

The Only remedy in case your employer refuse to issue you tds certificate or he is not issuing TDS certificate is that you can complain to the concerned Assessing Officer in writing, who will take appropriate action or initiate penalty proceedings against the employer.

The employee however has no other legal remedy against his employer in case he refuses to issue the certificate except that the employee may intimate about such default to concerned Assessing Officer, who may take appropriate action or initiate penalty proceedings against the employer.

Hi Kirti,

Thanks a lot for the revert.

My employer is registered in Chennai and I used to work in Mumbai branch. I usually file my IT return from my hometown (Baroda). So do i need to file my complaint to accessing officer in Baroda?

Also, any idea on the time frame to get the issue resolved? In between if i want to file my IT return for that particular year how can i do that?

Thanks and Regards,

Kunal

Hi Kirti,

Need your inputs on how should i file my income tax without Form 16 and without 26AS entry. My ex-employer is not willing to issue form 16 as well as they have not paid income tax to IT department; thus it is not reflecting in 26AS. It would be great if you can help me out with the process of filing income tax return.

Regards,

Kunal

Sorry Kunal for delay. Team has been busy with work and kids vacation.

The employee has a right to obtain the TDS certificate in form 16 from his employer. The certificate details should be filled in return of income, since no credit for TDS can be given without it. In case your employer fails to issue the TDS certificate, he shall be liable to a penalty of Rs. 100/- for each day of default u/s 272A(2)g).

The Only remedy in case your employer refuse to issue you tds certificate or he is not issuing TDS certificate is that you can complain to the concerned Assessing Officer in writing, who will take appropriate action or initiate penalty proceedings against the employer.

The employee however has no other legal remedy against his employer in case he refuses to issue the certificate except that the employee may intimate about such default to concerned Assessing Officer, who may take appropriate action or initiate penalty proceedings against the employer.

Subject : Regarding non-entry of Income Tax Deducted from Salary from 01-04-2008 to 31-03-2009 (AY 2009-10) PAN AAUPV3199F

Sir,

On the above cited subject, I am to inform you that in the Form 16 for the above mentioned period, an amount of ` 12,200/- has been deduced from my salary (the actual Income Tax being ` 12,187/-) i.e. to say with a refundable amount of ` 13/- only. However, the same has not been entered in the Form 26AS, Annual Tax Statement u/s 203AA of Income Tax Rules, 1962 which shows “No Transaction Present”.

Consequently, the Income Tax Department has issued Outstanding Demand amount of `15,460/- which is due to the fault of the your Divisional Office.

Accordingly, you are requested to kindly take up the matter and rectify the lapse so that the outstanding amount is written off.

Please meet your Assessing Officer. Submit xerox of the Form 16 And Form 26AS. Get the acknowledgement from the income tax department.

In the meanwhile follow up with your Employer to get the TDS deposited.

Sir,

Form 26AS for FY08 and my form 16/16A does not match. While I checked with my employer, he confirmed payment to tax authorities and also furnished a letter in this regard which is also submitted to the IT department. LIC commission for FY08 is partially missing and when I contacted LIC office, they inform that they do not have any records. I have been running from pillar to post to get the refund. All my subsequent refunds are held because of mismatch between form 16 and 26AS. I request, people who has sorted out such issues to help me to get the refund. I have filed the IT in Chennai.

Regards

Madhusudan .S

Sad to hear about your case Madhusudan. Many are in the same boat (including me) The steps you need to follow are :

Your employer must revise relevant TDS so write a letter to deductor to revise relevant TDS return so that correct credit may be reflected.You should provide relevant details in your letter must Pin-point the entries of differences

Income Tax department has issued Instruction to release refund without Matching of TDS with Form 26AS. For persons who are waiting for ther income tax refunds for the assessment year 2009-10.Income tax department has issued a instruction to all assessing officer to speed up the processing of the return processing for the assessment year 2009-10.Rules regarding TDs matching with form 26 AS (online Pan Ledger ) has been relaxed.

If person has demanded refund up to 25000/- and total tds claimed is up to 4 Lakh and out of total transaction few tds entries are matching then Assessing should process return without enquiring about the other unmatched entries.

Do you meet these conditions? Please go through Demand Notice Mis-matching of TDS why ? what to do ?

Sir,

Form 26AS for FY08 and my form 16/16A does not match. While I checked with my employer, he confirmed payment to tax authorities and also furnished a letter in this regard which is also submitted to the IT department. LIC commission for FY08 is partially missing and when I contacted LIC office, they inform that they do not have any records. I have been running from pillar to post to get the refund. All my subsequent refunds are held because of mismatch between form 16 and 26AS. I request, people who has sorted out such issues to help me to get the refund. I have filed the IT in Chennai.

Regards

Madhusudan .S

Sad to hear about your case Madhusudan. Many are in the same boat (including me) The steps you need to follow are :

Your employer must revise relevant TDS so write a letter to deductor to revise relevant TDS return so that correct credit may be reflected.You should provide relevant details in your letter must Pin-point the entries of differences

Income Tax department has issued Instruction to release refund without Matching of TDS with Form 26AS. For persons who are waiting for ther income tax refunds for the assessment year 2009-10.Income tax department has issued a instruction to all assessing officer to speed up the processing of the return processing for the assessment year 2009-10.Rules regarding TDs matching with form 26 AS (online Pan Ledger ) has been relaxed.

If person has demanded refund up to 25000/- and total tds claimed is up to 4 Lakh and out of total transaction few tds entries are matching then Assessing should process return without enquiring about the other unmatched entries.

Do you meet these conditions? Please go through Demand Notice Mis-matching of TDS why ? what to do ?

Hi,

while checking details of 26AS form i found some additional entry of payment reflected in my account which actually i have not received and due to this total taxable amount is also increase and tax also. additional entry shows only payment and no TDS submitted to in each month. while tracing the organisation who did this i found that they have intentionally did this as even after i left the job, they have continued to reflect my salary with out TDS deduction. how i can revert all these entries as i am not aware about where to approach.

Sad to hear about it.

While I try to find the answer from my CA is it possible for you to ask your earlier company not to do so.

If they have done have they given you Form 16 or some document which shows the tax paid etc?

Hi,

while checking details of 26AS form i found some additional entry of payment reflected in my account which actually i have not received and due to this total taxable amount is also increase and tax also. additional entry shows only payment and no TDS submitted to in each month. while tracing the organisation who did this i found that they have intentionally did this as even after i left the job, they have continued to reflect my salary with out TDS deduction. how i can revert all these entries as i am not aware about where to approach.

Sad to hear about it.

While I try to find the answer from my CA is it possible for you to ask your earlier company not to do so.

If they have done have they given you Form 16 or some document which shows the tax paid etc?

I have a case similar to Yogesh. There are incorrect entries in form 26AS from my former employer for the financial year 2014-15, even after 3 years of leaving that organization. Effectively this increases my tax liability.

checking with them it turns out they have a current employee who has a name similar to me and it’s those entries that are being shown on my form 26AS.

and it’s those entries that are being shown on my form 26AS.

but that hasn’t still been taken care of. And the accounts guy who informed me the above reason too has left that organization.

How would you suggest should I proceed? Appreciate your help.

Thanks

Sad to hear that. Is Form 16 given to you correct?

After confirmation of differences of tax deducted and deposited in Form 16/16A by deductor and form 26AA ,next step is to write a letter to deductor to revise relevant TDS return so that correct credit may be reflected.You should provide relevant details in your letter must Pin-point the entries of differences. Keep a copy of the letter

2 If Form 16 is correct Write letter to IT/CPC. You can check the format at Demand Notice Mis-matching of TDS why ? what to do ? reply ! Preventive measures

Hi,

I have paid Self Assessment tax using Challan 280 via net banking. I have got the challan receipt after payment.

But when I check my Form 26AS it hasnt got reflected there. Does it take time to show up in Form 26 AS. If yes, how much.

Income tax website says following

Whenever you as a tax payer deposit your advance tax/self assessment tax directly to bank the bank will upload this information to the TIN central system three days after the cheque has been cleared. This information will be posted in Part C of your Form 26AS

But typically if you have paid through net banking it gets reflected in a day or two.

When did you pay? Let us know when it gets reflected?

Hi Kirti,

Just to give you an update, the Challan 280 entry for Self Assessment tax got reflected in From 26 AS today evening 29th July…I had paid the tax on 26th July.

Gagan

Thanks for the update Gagan. We appreciate it. So it does take 3 days (or was it because of Saturday/Sunday?)

Hi,

I have paid Self Assessment tax using Challan 280 via net banking. I have got the challan receipt after payment.

But when I check my Form 26AS it hasnt got reflected there. Does it take time to show up in Form 26 AS. If yes, how much.

Income tax website says following

Whenever you as a tax payer deposit your advance tax/self assessment tax directly to bank the bank will upload this information to the TIN central system three days after the cheque has been cleared. This information will be posted in Part C of your Form 26AS

But typically if you have paid through net banking it gets reflected in a day or two.

When did you pay? Let us know when it gets reflected?

Hi Kirti,

Just to give you an update, the Challan 280 entry for Self Assessment tax got reflected in From 26 AS today evening 29th July…I had paid the tax on 26th July.

Gagan

Thanks for the update Gagan. We appreciate it. So it does take 3 days (or was it because of Saturday/Sunday?)

Very informative. Thanks for sharing

Very informative. Thanks for sharing

Hi Kirti,

1) I had to pay Self Assessment Tax due to Interest from FD.

2) Hence while submitting ITR, I paid the Tax and included in ITR;

3) I can see TDS from my Employer(Part A), TDS from Bank where I held the FD(Part A1) and Self Assessment Tax paid by me(Part C) are shown correctly in Form 26AS;

4) Now Income Tax assessment raised the Demand Notification from me for the Amount which I paid as Self Assessment Tax.

Pls can you help me how this can be resolved?

If I meet my Juridiction ASO, will this be resolved? Do I need to take any CA help here as I see this is simple issue to fix;

I am from Bangalore and my AO is HMT building

When they sent the intimation they would have shown the discrepancy.

As mentioned in our article Notice for Adjusting Refund Against Outstanding Tax Demand, Section 245

please go through demand notice carefully.

Approach their jurisdictional Assessing Officer and provide the details as to why such adjustment shall not be made. Even though you may get intimation from CPC through emails, you don’t have to reply to CPC.the Intimation clearly says that the Assessee has to approach the Jurisdictional Assessing Officer.

The reply filed by the Assessee will be considered and examined by the Assessing officer before any direction for adjustment is made.

The Assessing Officer will examine the reply and communicate his findings to the CPC, Bangaluru, who will then process the refund and adjust the demand, if any.