In every stage of life, your family is the only constant that stays beside you. Especially in a large Indian family, you can find all the emotional and financial support you need while growing up. It is your duty to return the favor when you are an adult. Here are five things you can do to make your family more financially secure.

- Educate them about finance

There was a time when saving money meant putting it in a savings account. Costly physical possessions like jewellery made of gold were stored in a cupboard and would not see the light of day for ages. Nowadays, you can use the money and the gold to grow your assets even more. There are more ways available for saving and investing money more effectively. You can help your family members with that knowledge and make sure that their wealth grows as much as possible. You can use financial websites to educate yourself first and then guide your family.

- Buy term insurance

Term insurance is a pure form of life insurance policy that is affordable and rewarding. The term plan cover is paid only if the policyholder dies before the maturity of the policy. Such a plan does not have any other benefits. So, the premium you need to pay for a term plan is very affordable. You should purchase term insurance plans for yourself and set your younger sibling or one of your parents as a nominee. This way, you will be able to ensure their financial security if something happens to you untimely.

- Avail of health insurance for family

Your employer might provide you with a group health insurance plan. However, most of these insurance plans do not come with any flexible feature. So, it is the smartest choice to find the best family floater health insurance plan in the market and make sure that it provides you with exactly what you need. A family floater plan might suit you the best as you can use it to cover the medical expenses of anyone in your family when needed.

- Invest in mutual funds with family members

Mutual funds have become a widely popular choice among investors. You can turn to invest in mutual funds into a family affair. What you need to do is to convince your family members to invest in a mutual fund together. This is a great way to invest a lump sum into a fund and get higher returns. You can then divide the profits among yourselves.

- Secure your future financially

So far, all the options have been about your family. However, do not forget that you are a part of the family too. When it comes to taking care of the family’s finance, many people forget about their own future. Invest in a retirement fund. If you start investing at an early age, you will be able to live in comfort after you retire.

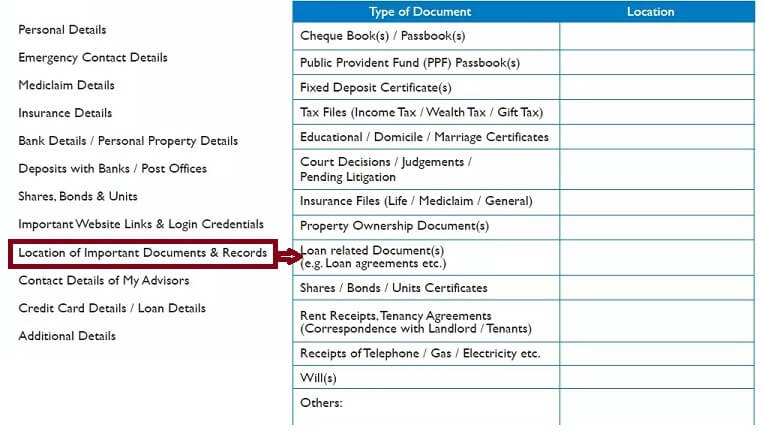

Make sure to keep your family informed about your financial information so they can continue to live a life of comfort, security and happiness, even when you are not around. Example of information to be shared with the family is shown in the image below.

Follow these aforementioned ideas to ensure the financial security and prosperity of yourself and your loved ones.