What is the tax on income from the purchase or sale of shares? Gains or losses from the sale of shares can be considered as income from business or Capital gains. For capital gains, If equity shares listed on a stock exchange are sold within 12 months of purchase, then one has short term capital gain/loss, else one has long term capital gain/loss. The question you need to answer when you buy/sell shares is that Are you a trader or investor or both? Are shares listed on BSE/NSE? Do you have capital gains or business income? Which ITR do you have to file? What if you have loss on selling shares?

Table of Contents

Overview of Tax on Buying, Holding and Selling Shares

For the stocks listed on the Indian stock exchanges(BSE/NSE) as STT(Securities Transaction Tax) is applicable on all shares which are sold or bought. A mutual fund is considered as equity-oriented if at least 65% of the investible funds are deployed into equity or shares of domestic companies.

- Trading F&O (Equity, currency, commodity) is considered a non-speculative business, taxed as per income slab, after deduction of expenses.

- Trading intraday equity is considered speculative business as there is no intention of taking delivery, so it is taxed as Income from Business and Profession, as per the income slab, after deduction of business expenses.

- Equity holdings for more than 1 year are considered Long term capital gain (LTCG), taxed 0% for first Rs 1 lakh and @10% exceeding Rs 1 lakh

- Equity holdings between 1 day to 1 year with a low frequency of trades is considered Short term capital gain (STCG), else in case of a high frequency of trades it should be considered as non-speculative business income.

- short term capital gains are taxed at 15%

- Business Income is taxed as per the Income Slabs after deduction of business expenses.

You can be an investor, trader, or both. You can consult a chartered accountant before filing returns.

Hiding trading activity from the Income Tax department could mean trouble. The chances of getting a call for scrutiny are higher when the IT department systems/algorithms pick up trading activity on your PAN, but the same not declared on your ITR. IT scrutiny is when the assessing income tax officer (AO) demands you to meet him and give an explanation on your IT returns.

Video on Income Tax on shares & Mutual Funds: Dividend, Trading

This video explains with examples and Questions:

Types of Income, Income Tax Slabs, Tax on dividend from Shares and Mutual Fund, Capital gain on Mutual Funds both Debt/Equity, Tax based on Types of Mutual Funds,Capital gain tax on Mutual Funds, Indexation(CII), How to use, Capital Gain Statements from Mutual Funds, Joint account, Nominee, Will, Capital gain on Stocks both as Investor and Trader,Things to consider for tax on shares,Tax Harvesting , Grandfathering, Things to be careful while filing ITR for FY2020-21

For Stocks or Equity Mutual Funds listed on Indian Stock exchange

- When you buy stocks, there are not any tax implications.

- If you get a dividend from the stock then from Apr 2020, the dividend is considered as Income from Other sources & taxed as per your income slab. Before that it was tax-free.

- If you sell shares then it can be income from business or Capital Gains based on your activity. If you are a day trader or if you trade regularly in Futures and Options the income is typically classified as Income from Business. But Income Tax Departments lets you decide which type of income you treat it as.

- Before budget 2018, the long-term capital gain on sale of equity shares was exempt from tax but now they are taxed if one makes long term capital gain of more than Rs. 1 lakh at the rate of 10%.

- If income from selling shares is considered as Capital Gains, then

- Short term capital gain (STCG): delivery based stocks or equity mutual funds,

- when the holding period is lesser than 1 year

- short term gains are taxed at 15%.

- Long term capital gain (LTCG): delivery based stocks or equity mutual funds where the holding period is more than 1 year

- LTCG For stocks/equity – 0% for first Rs 1 lakh and @10% exceeding Rs 1 lakh

- Short term capital gain (STCG): delivery based stocks or equity mutual funds,

- Tax-harvesting is using the tax-free window of Rs 1 lakh to lower overall LTCG tax. You redeem, and then re-invest, a portion of your equity investments which are over one year old, and hence are long-term in nature, to the extent that the gains do not exceed Rs 1 lakh in a given financial year. This helps in saving tax.

- Grand fathering: For stocks bought before 31 Jan 2018, all capital gains until 31 Jan 2018 will be grandfathered. You will be taxed based on the value of stocks

For Stocks not listed on Indian Stock exchange

If you get shares as RSU/ESPP , unlisted shares for which no formal market exists for trading(for example startups in India) or stocks of companies listed in US or international stock market,

- When you buy/get stocks, tax is deducted as per the income slab as it is considered Prerequisite

- If you get a dividend, it is considered as Income from Other sources & taxed as per your income slab. Tax might be deducted from the dividend too ex: Stocks of US company.

- When you sell the shares, Income arising is taxed under the head Capital Gain

- Short-term capital assets – when sold within 24 months of holding them. Short-term gains are taxed at employee’s income tax slab rates

- Long-term capital assets – when sold after 24 months of holding them. Long-term gains are taxed at 20% with indexation

- This capital gain must be declared in Schedule CG of ITR2 ITR3, ITR4 for tax purposes

Our article RSU of MNC, perquisite, tax , Capital gains, ITR, eTrade explains it in detail.

On Selling Shares: Business Income or Capital Gains

When you buy & sell (long trades) or sell & buy stocks (short sell) within a single trading day then such transactions are called intraday trades. Alternatively, if you buy stocks and and it gets delivered to your DEMAT account(in T+2 days), then it is called delivery based transactions.

On 2 March 2016, the income tax department came out with a circular allowing an individual to decide either show his stock investments as capital gains or as a business income (trading) irrespective of the period of holding the listed shares and securities. Once the choice is made, the taxpayer will have to continue with the same in the subsequent years. Check this circular.

- Stocks that you hold for more than 1 year can be considered as investments as you would have most likely received some dividends and also held for a long time

- Shorter-term equity delivery buy/sells can be considered as investments as long as the frequency of such buy/sell is low.

- If you wish, you can also show your equity delivery trades as a business income

- But whatever stance you take, you should continue with it in the future years as well.

Income from shorter-term equity delivery based trades (held for between 1 day to 1 year) are also best to be considered as non-speculative business income if the frequency of such trades executed by you is high or if investing/trading in the markets is your main source of income.

Audit – You would have to maintain the book of accounts which will need to be audited if your turnover goes above Rs 5 crore (was Rs 2 crore until FY 19/20) for a year or if your profit is less than 6% of your turnover

Income from Intra Day Trading & Futures & Options

Income from intraday equity trading is considered as speculative.

Income from trading F&O (both intraday and overnight) are considered as non-speculative business income as these instruments are used for hedging and also for taking/giving delivery of the underlying contracts.

Speculative and non-speculative business income has to be added to all your other income (salary, other business income, bank interest, rental income, and others), and taxes paid according to the tax slab you fall in.

Business Income on Selling Shares

If you do lots of share trading activity (e.g. if you are a day trader or if you trade regularly in Futures and Options), then your income becomes as income from the business.

When you treat the sale of shares as business income, you are allowed to reduce expenses incurred in earning such business income.

The profits would be added to your total income for the financial year and charged at tax slab rates.

For income from the business, one has to file an ITR-3

If you treat your income as capital gains, expenses incurred on transfer are deductible.

- How would I declare my Profits and/or Losses from my market activity?

- Do I bifurcate between speculative business income and non-speculative business income?

- Are books of accounts to be maintained?

Claim expense – One can claim the benefit of all expenses incurred for the business of trading (while for capital gains only charges on your contract note other than STT can be claimed). For example, brokerage charges, STT, other statutory taxes while trading, internet, phone, newspapers, depreciation of computers and electronics, research reports, books, advisory, etc.

If one incurs any non-speculative F&O trading loss, this can be set-off against any income other than salary. For example, if one incurs Rs 1,00,000 loss in trading F&O and his other income (like rent & interest, excluding salary) is Rs 5,00,000, then he will have to pay tax only on Rs 4,00,000.

Which ITR form to use to show Capital Gains/Business Income

Every taxpayer with business income or with realized (profit booked) short term capital gains is required to pay advance tax

You can declare capital gains either in ITR 2 or ITR3

- ITR 2: When you have a salary and capital gains or just capital gains

- ITR3: When you have business income and capital gains

Short-term capital gains on Selling Shares

If equity shares listed on a stock exchange are sold within 12 months of purchase, one has short term capital gain or loss.

Calculation of Short-term capital gain = Sale price-Purchase price- Expenses on Sale

There is a special rate of tax of 15% on short term capital gains, irrespective of your tax slab.

if your total taxable income excluding short term gains is below taxable income i.e Rs 2.5 lakh, you can adjust this shortfall against your short term gains

For example, Kumar bought Infosys shares worth Rs 100,000 today and sells the same 10 days later for Rs.120,000, his profit is 20,000. He is liable to pay STCG of 15% on Rs 20,000 i.e Rs 3000 as taxes.

Shymala bought 300 equity shares of company X in Apr 2020 at the rate of Rs. 100 per share and paid a total sum of Rs. 30,000 on them. He sold the shares at the rate of Rs. 150 per share in Oct 2020, after 5 months. The Brokerage charges (0.5%) levied at the time of transfer of the shares was Rs. 225.

The short term capital gain on shares is illustrated in the table below –

| Particulars | Amount (in Rupees) |

| Sale value(A) | 45,000 |

| Purchase Value(B) | 30,000 |

| Expenses(Brokerage) | 225 |

| Short term capital gains | 45,000- 30,000 – 225 =14,775 |

Thus, the short term capital gain acquired by Mr Dutta on the sale of equity shares is Rs. 14,775.

Long-term capital gains on Selling Shares less than 1 lakh

Long term capital gain on equity shares listed on a stock exchange are not taxable up to the limit of Rs 1 lakh.

From 1 April 2018. the long term capital gain of more than Rs 1 lakh on the sale of equity shares or equity-oriented units of the mutual fund attracts a capital gains tax of 10% and one cannot use any indexation benefit.

For example, I bought 10 shares of company XYZ for Rs 10,000 on 17 Apr, 2019 and sold all of them on 14th Sept, 2020 for Rs 12,500. As I am selling after 12 months of holding period, this is classified as LTCG. My capital gains tax in this case is Rs 250 (Rs 2,500 x 10%).

As this is less than 1 lakh, it is exempt from tax.

Long-term capital gains on Selling Shares more than 1 lakh

From 1 April 2018. the long term capital gain of more than Rs 1 lakh on the sale of equity shares or equity-oriented units of the mutual fund attracts a capital gains tax of 10% and one cannot use any indexation benefit.

For example, I bought 10 shares of company XYZ for Rs 2,10,000 on 17 Apr, 2019 and sold all of them on 14th Sept, 2020 for Rs 3,12,500.

As I am selling after 12 months of holding period, this is classified as LTCG.

Profit or LTCG is 1,02,500

Exemption of Rs 1 lakh so LTCG is 2500(102500 – 100000)

My capital gains tax in this case is Rs 250 (Rs 2,500 x 10%).

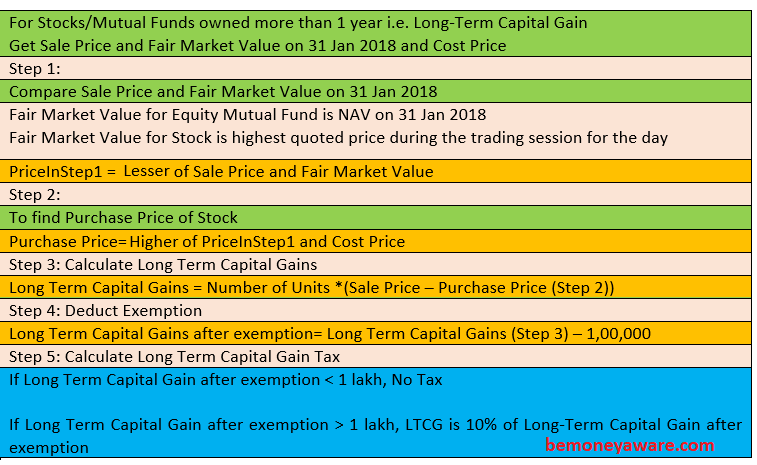

GrandFathering for stocks bought before 31 Jan 2018

All capital gains until 31 Jan 2018 will be grandfathered

In Budget 2018, The Finance minister announced 10% tax, without indexation, for capital gains exceeding one lakh from all direct equity and equity mutual funds. However, all capital gains until 31 Jan 2018 will be grandfathered, that is still subject to old rules. Short-term capital gains tax remains at 15%. So for a person selling after 31.3.2018, only the actual gains after 31.1.2018 would be taxed

So If you sell stocks and equity mutual funds that you bought before 31 Mar 2018 the LTCG will be taxed as follows:

The cost of acquisition of the share or unit bought before Feb 1, 2018, will be the higher of :

a) the actual cost of acquisition of the asset

b) The lower of :

(i) The fair market value of this asset(the highest price of the share on the stock exchange on 31.1.2018 or when the share was last traded. NAV of unit in case of a mutual fund unit) and

(ii) The sale value received/accrued when the share/unit is sold.

Indexation of the cost of acquisition will not be allowed. Indexation refers to adjusting the gains against inflation, which brings down the real quantum of gains.

Our article Long Term Capital Gain on Stocks & Equity Mutual Funds with Calculator, explains it in detail.

NAV of Equity Mutual Funds on 31 Jan 2018 lists the fair market value i.e NAV of equity mutual funds on 31 Jan 2018 which is required to calculate the cost of acquisition and Long Term Capital Gains.

BSE Stock Price on 31 Jan 2018 for LTCG on Shares lists the fair market value i.e highest Price of shares on BSE on 31 Jan 2018

Video on Grandfathering

What Is Grandfathering Concept In Long Term Capital Gains Tax Explained By CA Rachana

Short and Long term Capital Loss on Selling Shares

What if there is loss on selling shares? Thankfully Income Tax Department gives some benefit.

If one has Short term capital loss, ex If one sells stocks within 1 year and has a loss then it can be set off against short term or long term capital gain from any capital asset(real estate, gold, debt mutual funds).

If the loss is not set off entirely, then it can be carried forward for a period of 8 years and adjusted against any short term or long term capital gains made during these 8 years. But only if he has filed his income tax return within the due date.

From 1 Apr 2018, The long term capital loss can be set-off against any other long term capital gain and unabsorbed long term capital loss can be carried forward to subsequent eight years for set-off against long term gains.

We pay 15% tax on short term capital gains and 0% on long term capital gains, What if one does not have gains but net losses for the year.

If ITR is filed within the due date with losses, then Losses can be carried forward for 8 consecutive years and set off against any gains made in those years (this is true on capital loss on selling any other asset)

Therefore, even if the total income earned in a year is less than the minimum taxable income, filing an Income Tax Return is a must for carrying forward these losses.

Short term Capital Loss on Selling Shares

Short term capital losses if filed within time can be carried forward for 8 consecutive years and set off against any gains made in those years.

For example, if the net short term capital loss for this year is 1 lakh (100,000). If filed in ITR, this can be carried forward to next year.

if net short term capital gain next year is Rs.50,000 then 15% of this gain need not be paid as taxes because this gain can be set off against the loss which was carried forward.

We will still be left with Rs Rs.50,000 (Rs.100,000 – Rs.50,000) loss which can be carried forward for another 7 years.

Long term Capital Loss on Selling Shares

Long term capital losses can now (post introduction of LTCG tax@10%) also be set off against long term gains.

Long term capital loss can be setoff only against long term capital gain. Short term capital loss can be setoff against both long term gains and short term gains.

Ex: Mr. Raj is a salaried employee. In the month of April 2018, he purchased equity shares of SBI Ltd. (listed in BSE) and sold the same in December 2019 i.e., after holding them for a period of more than 12 months. Hence, shares will be treated as long-term capital assets.

Trading Loss, Carry Over

Carry forward of the F&O loss

If there is net loss any year (non-speculative F&O + any income other than salary), and if income tax returns are filed before the due date, the loss can be carried forward for the next 8 years. During the next 8 years, this loss can be set-off against any other business gain (non-speculative business income). For example, if you had net loss of Rs 5,00,000 this year trading F&O which was declared on time, you can carry forward this loss next year and assuming you made a profit of Rs 20,00,000 next year, you can set off the previous year’s Rs 5,00,000 loss and pay taxes only on Rs 15,00,000.

Carry forward of intraday equity loss

Any speculative or intraday equity trading loss can be set-off only against any other speculative gain (note: you cannot set-off intraday equity trading loss which is considered speculative with F&O trading which is considered non-speculative). Speculative losses can be carried forward for 4 years if the returns are filed on time. So assume an equity intraday trader makes a loss of Rs.100,000 this year, he cannot offset this against any other business income. However, he can carry it forward to the next year (up to 4 years). Assume the next year he makes a profit of Rs.50,000 by trading equity intraday, then, in that case, he can use the previous year’s Rs.100,000 loss to offset the complete gains of this year (Rs.50,000). The balance loss of Rs.50,000 can still be carried forward to the next 3 years. So do note, the partial offset of losses is possible

The following table summarizes the above points –

| Head of income under which Loss is incurred | Whether loss can be set- off within the same year | Whether Losses can be carried forward and set-off in subsequent years | Time limit for carry forward and set-off of losses | ||

|---|---|---|---|---|---|

| Under the same head | Under any other Head | Under the same head | Under any other Head | ||

| Losses of F&O as a Trader | Yes | Yes | Yes | No | 8 years |

| Speculation Business | Yes | No | Yes | No | 4 years |

| Capital Gain (Short-Term) | Yes | No | Yes | No | 8 years |

Adjustment of LTCG against the basic exemption limit

Can an individual adjust the basic exemption limit against long-term capital gain?

The answer will depend on the residential status of the individual (i.e., resident or non-resident). The rules in are as follows :

Only a resident individual/HUF can adjust the exemption limit against LTCG.

A non-resident individual and non-resident HUF cannot adjust the exemption limit against LTCG.

A resident individual can adjust the LTCG but such adjustment is possible only after making adjustment of other income. In other words, the first income other than LTCG is to

Tax Harvesting

Tax-harvesting is using the tax-free window of Rs 1 lakh to lower your overall LTCG tax. You redeem, and then re-invest, a portion of your equity investments which are over one year old, and hence are long-term in nature, to the extent that the gains do not exceed Rs 1 lakh in a given financial year. This results in increasing your acquisition cost (of intermittent units), thus reducing the LTCG rupee amount in the redemption year, but without any impact on the final asset value.

The basic idea of LTCG tax harvesting is to sell the units that are eligible for LTCG and buying them back at the current market price.

With a lump sum amount of Rs 300,000 growing at a rate of 10 per cent over a 5 year period, there is no tax outlay if you harvest your returns each year. This is against the Rs 8,000 plus LTCG tax you would have to pay in case of non-harvesting.

One bought 3000 shares at Rs 100. If one sells after 5 years at the cost of Rs 161.051 then total sale value is Rs 483,153.

Capital Gain = 4,83,153-3,00,000 = 1,83,153

Capital gain more than 1,00,000 i.e 83,153 is taxed at 10% i.e 8,315

But by using tax harvesting, selling and buying shares every year, one could have saved this 8,315 tax. Let’s see it in detail.

In First year, Sale price is Rs 110 so the Capital gain is Rs 3,30,000 – 3,00,000 = 30,000 which becomes tax free.

These 3000 units are bought back at 110, the total purchase price becomes 3,33,000

In the second year, the Sale price is Rs 121, so the capital gain is 3,63,000 – 3,30,000 = 33,000 which again becomes tax-free.

These 3000 units are bought back at 121, the total purchase price becomes 3,63,000

In the third year, the Sale price is Rs 131, so the capital gain is 4,39,230 – 3,99,300 = 39,230 which again becomes tax-free.

These 3000 units are bought back at 146, the total purchase price becomes 4,39,230

In the fourth year, the Sale price is Rs 161, so the capital gain is 4,83,153 – 4,39,230 = 43,923 which again becomes tax-free.

So by using tax harvesting, selling and buying shares every year, one could have saved tax of Rs 8,315.

Video on Tax Harvesting

This 7 minute video by ET Money Tax harvesting talks about A way to save taxes on your capital gains!

Test your knowledge on Capital Gains

Q1 Vikas is a salaried employee. In the month of September 2017, he got shares of ABC ltd a MNC listed on NASDAQ and sold the same in May 2019. What kind of Capital Gain does Vikas have?

Q2 Janak is a salaried employee. In January 2015 he purchased 100 shares of X Ltd. @ Rs. 1,400 per share from Bombay Stock Exchange. These shares were sold

through BSE in April 2019 @ Rs. 2,600 per share. The highest price of X Ltd. shares quoted on the stock exchange on January 31, 2018, was Rs. 1,800 per share. What will be

the nature of capital gain in this case?

Answers to the question

Q1 Vikas is a salaried employee. In the month of September 2017, he got shares of ABC ltd a MNC listed on NASDAQ and sold the same in May 2019. What kind of Capital Gain does Vikas have?

A1 Shares are listed on Nasdaq, so not on BSE & NSE. As the period of holding is less than 24 month, it is considered as Short Term capital Gains and taxed as per the tax slab.

Q2 Janak is a salaried employee. In January 2015 he purchased 100 shares of X Ltd. @ Rs. 1,400 per share from Bombay Stock Exchange. These shares were sold

through BSE in April 2019 @ Rs. 2,600 per share. The highest price of X Ltd. shares quoted on the stock exchange on January 31, 2018, was Rs. 1,800 per share. What will be

the nature of capital gain in this case?

Shares were purchased in January 2015 and were sold in April, 2019, i.e., sold after holding them for a period of more than 12 months and, hence, the gain will be long-term

capital gain (LTCG).

In the given case, shares are sold after holding them for a period of more than 12 months, shares are sold through the recognised stock exchange and the transaction is liable to STT.

Therefore, section 112A is applicable in this case.

The cost of acquisition of X Ltd. shares shall be higher of:

a) Cost of acquisition i.e., 1,40,000 (1,400 × 100);

b) Lower of:

a. Highest price quoted as on 31-1-2018 i.e., 1,80,000 (1,800 × 100);

b. Sales consideration i.e., 2,60,000 (2,600 × 100)

Thus, the cost of acquisition of shares shall be Rs. 1,80,000.

Accordingly, Long-term capital gains in hands of Janak would be Rs. 80,000 (i.e., 2,60,000 – 1,80,000).

Since long-term capital gains don’t exceed Rs. 1,00,000, Janak doesn’t have to pay any tax.

Video on Tax on Selling Shares

This is video on TAX on stock market & mutual funds , STCG, LTCG and DIVIDENDS by YouTubers CA Rachana Phadke Ranade & Labour Law Advirsor.

Our Book on Capital Gains

If one sells an asset such as shares, mutual fund units, property, etc, one must pay tax on the profit earned from it. This profit is called Capital Gains and tax paid is called Capital Gains Tax.

This book of 172 pages explains the various Capital gain in detail with examples and pictures. You can buy it from here

Related Articles:

Understand Income Tax: What is Income Tax,TDS, Form 16, Challan 280

How to file ITR Income Tax Return, Process, Income Tax Notices

- Long Term Capital Gain on Stocks & Equity Mutual Funds with Calculator

- RSU of MNC, perquisite, tax , Capital gains, ITR, eTrade

- BSE Stock Price on 31 Jan 2018 for LTCG on Shares

- NAV of Equity Mutual Funds on 31 Jan 2018

When the shares are sold or purchased in addition to brokerage charges there are certain other charges like transaction charges,clearig charges, GST, stamp duty,STT are charged and net amount was debited or credited in the account.I want to clarify that since all costs are involved in trading of shares. Whether these costs should be included while calculating the short term/ long term capital gains. Pls also advise in which format the details are made.

Question1 – Lets say Mr X transfers shares to Mr Y for a limited time period. And Mr Y transfers it back to Mr X. Would there be any tax liability, specially capital gain. Mr Y wants to use those shares to get a loan or limit for shares.

Question2 – Is there a way by which Mr X can get a limit for shares and transfer that limit to Mr Y for trading.

You can take a loan against your Demat shares

Transfer of shares is complicated and is best to consult a tax lawyer

Gift of movable property such as shares, ETFs, mutual funds, jewellery, drawings etc without consideration and exceeding Fair Market Value of more than INR 50,000 is taxable in the hands of the recipient under Section 56(2) of the Income Tax Act. Such income should be reported under the head ‘Income from Other Sources’ in the Income Tax Return and tax should be paid at slab rates.

Taxes on the gifting of shares are exempt in the following situations:

Individual receiving gift from a relative (including siblings, spouse and lineal ascendants or descendants)

Individual receiving gift on the occasion of marriage

Gift received by way of inheritance

I am a trader I never withdraw money from trading account even if am doing profit. Should I still file for ITR. Example I invest 10 lakhs in f and o. I do buy and sell in short and long term. But I don’t transfer the profit to my bank account. In this case am I still taxable and should I pay tax or file for ITR

Yes, you have to pay tax.

Because the sale and buying is recorded with your PAN number.

You have to file ITR is your total income is more than 2.5 lakhs

If LTCG is more than 1 lakh, then entire amount is taxed at 10% and not just the gain over and above 1 lakh.

The gains in excess of Rs 1 lakh are taxed at flat 10%

Everyone gets an LTCG exemption of Rs 1 lakh

But in the ITR2 for AY20-21, whatever i declare as LTCG in 112A (in my case there was no grandfathering needed as all units of MF were purchased after jan-2018) was getting calculated as Taxable. Is this a flaw in the ITR2 excel sheet?

Equity holdings for more than 1 year are considered Long term capital gain (LTCG), taxed 0% for first Rs 1 lakh and @10% exceeding Rs 1 lakh