Before filing the ITR one has to make sure that one owes no tax . If after calculating the income, taking care of deductions and deducting the tax already paid (TDS) one realises that one has paid less tax than due then one has to pay the balance tax. This tax is called Self Assessment Tax. One has to calculate the self assessment tax, pay the Self Assessment tax using Challan 280,update the ITR and then submit it. This article explains Self Assessment Tax in detail.

Table of Contents

Self Assessment Tax

What is Self Assessment Tax

While filing income tax returns, one does a computation of income and taxes to be filed in the returns. Sometimes, the tax paid either as advance tax or by way of TDS is less than the actual tax payable . The shortfall of tax,which we owe, is called the Self assessment tax. This needs to be paid before Income Tax Returns are filed.

How can one pay less tax than due? Give examples of where one has paid less tax than due?

Interest from FD, Interest from Saving Bank account, short term capital gains are often the cases where a salaried person ends up not paying the tax due. Note if tax due in the financial year is more than 10,000 Rs you need to pay Advance tax else pay penalty under section 234B, 234C while filing ITR.

Less tax paid on Fixed Deposit

Say you invested in Fixed Deposit . Interest from FD is taxable as per your income slab. If interest on FD in a financial year is less than 10,000 Rs no TDS is deducted. if interest on FD is more than 10,000 interest is deducted at 10%. You have to pay tax on interest , even if you get interest at end of fixed deposit tenure.

Say you have earned interest of 11,535 of FD in the financial year (without TDS deduction) , TDS , at 10% of Rs 11535 i.e 1153.5, has been deducted then 11,535 is your income from other sources and 1153.5 should be claimed in TDS. So if you are in 20% slab(for FY 2015-16 income is more than 5 lakh) or 30% tax slab (for FY 2015-16 income is more than 10 lakh) then you owe tax and you need to pay 1153.5 or 2307 as tax.

Interest on Saving Bank Account more than 10,000

Interest earned on Saving Account is considered as Income from other Sources. This needs to be declared in your income tax returns. No TDS is deducted from the interest on Saving Bank Account. Before 1st Apr 2012, it was taxed based on your income slabs.

From FY 2012-13 under the new section 80 TTA of the Income-tax Act, a deduction up to an extent of Rs 10,00 in interest from all the bank accounts is allowed to an individual or Hindu undivided family, Interest over Rs 10,000 is taxed as per tax slabs. So if you have earned say Rs 14,000 on all your Saving Bank Accounts together. 10,000 Rs is tax free but you need to pay tax on remaining 4000 . So you need to pay tax of Rs 400 at 10%, rs 800 at 20% and 1200 at 30%.

Interest on Saving Bank Account : Tax, 80TTA discusses it in detail.

How to find out that you have paid less tax or you need to pay Self Assessment Tax?

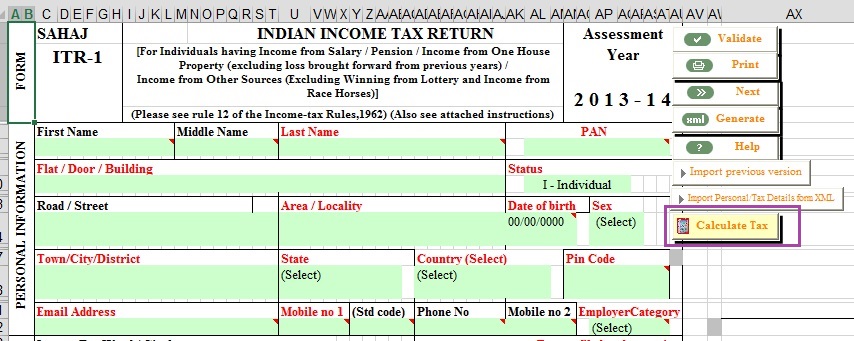

After entering ALL your other Tax details when you calculate your Tax Liability, for example in ITR1 Excel Click on tab Income Details. Click on Calculate Tax to calculate the tax that you should be paying for the income and deductions you have declared as shown in the picture below

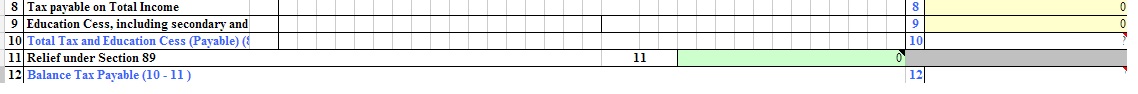

If you have paid less tax, it would show the difference in the Balance tax payable row of Income Tax Details as shown below. To recall from Fill Excel ITR form : Personal Information,Filing Status : White cells with blue labels indicate auto calculating fields which should not be filled. These are calculated automatically based on information entered in other cells.

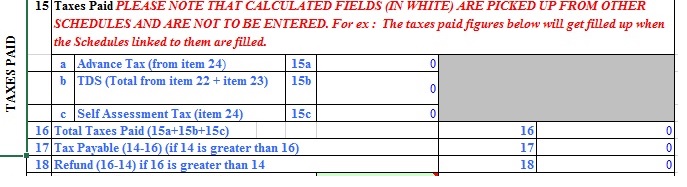

It would also show up in the rows 15-18 of tab Taxes Paid and Verification. If you have paid more tax, it would show the amount in the tax refund row 18 of tab Taxes Paid and Verification

If the tax is payable then you need to Pay Self Assessment tax using Challan 280, explained later in the article.

What if an individual fails to pay Self Assessment Tax?

Income Tax Returns can be filed only if we have paid the Tax due to the government. If you submit the ITR without paying then your Income Tax Return can be declared Defective. Our article Defective return notice under section 139(9) talks about in detail.

Further, non-payment of Tax is a criminal offence and the individual is liable to be penalized & punished under the court of law. Moreover, Interest will get added to your tax liability till the date of payment of tax.

When should the Self Assessment Tax be paid?

There are no specific dates to pay Self Assessment Tax. But it has to paid before one submits ITR. Non payment of Self Assessment Tax and non filing of the returns within the due date of filing i.e., 31st July will fetch Interest under section 234.

Paying Self Assessment Tax Using Challan 280

What is the procedure for paying Self Assessment Tax?

When one needs to pay tax , Advance Tax, Self Assessment or Regular Assessment tax,Tax Payment Challan, ITNS 280 Challan is used to pay Income Tax due, if any.

- It can be paid by going to designated branch and paying through cheque or cash, called as Offline or physical payment. Our article Paying Income Tax offline : Challan 280 explains it in detail.

- It can also be paid through online if you have net-banking. Our article Paying Income Tax : Challan 280 explains it in detail.

Online Mode of Payment of Self Assessment Tax

One could pay Self Assessment Tax Online through the NSDL website,at https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp. Online Payment is allowed only by Net Banking & not by Credit/ Debit cards. You can pay anyone’s Tax using Challan 280 through your net banking.

- Select Challan No./ITNS 280(Payment of Income Tax & Corporation Tax)

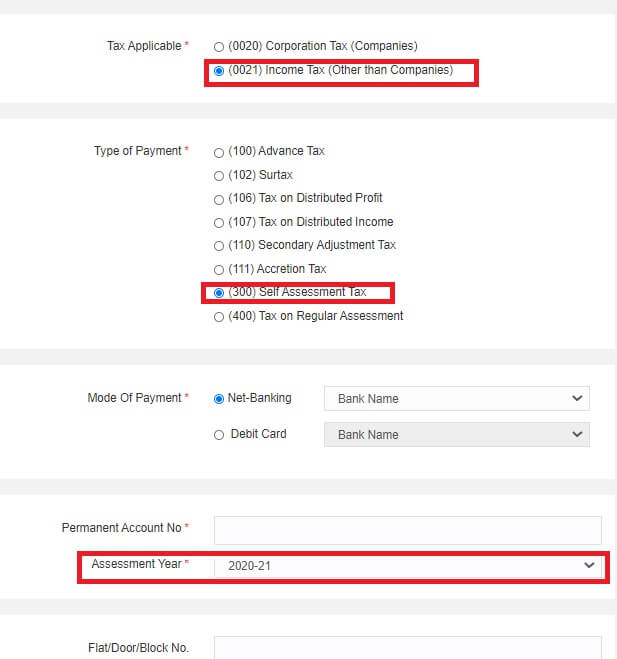

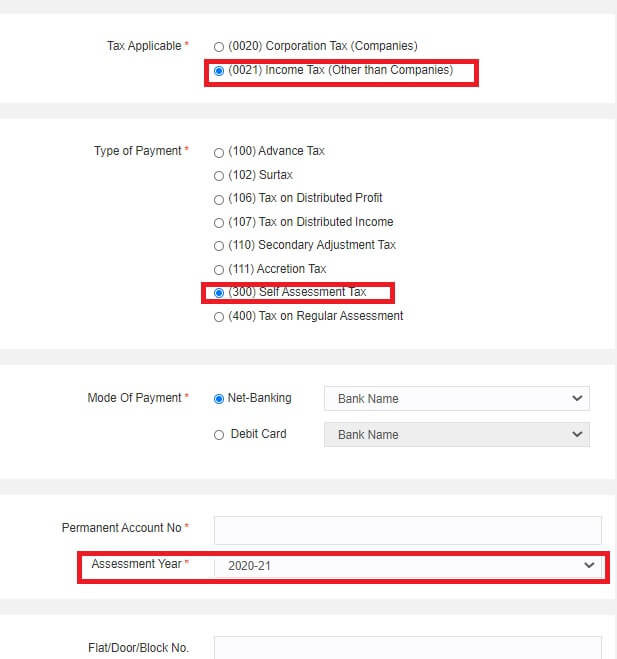

- Select Tax Applicable as (0021 – Income Tax – Other than Companies)

- Select Assessment Year . Please be very careful in selecting Assessment Year. For filing ITR before 31 Dec 2020 for income earned between 1 Apr 2019 to 31 Mar 2020 FY is 2019-20 and AY is 2020-21 . Selection of wrong Assessment Year while paying tax will result in demand for the amount of tax to be paid for that respective year. It can be corrected through Challan Rectification Process but It is a lon…g process.

- Then select the type of payment as (300) Self Assessment Tax, and fill rest details. (You don’ t have to fill Name. It will be filled based on PAN and address entered.)

- Select the correct assessment year

- Fill in the form and click “Proceed”

- Fill in the Tax Details

- Enter the Tax payable amount

- Confirm & Proceed

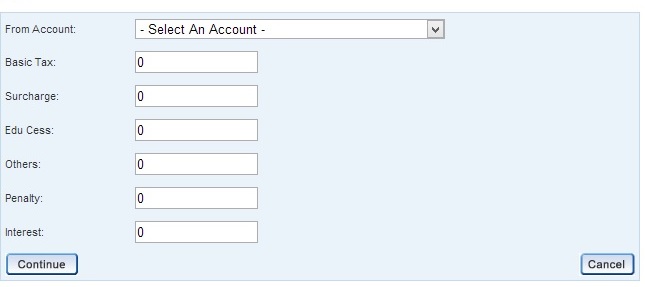

You need to break up the tax payable into its components, i.e. “Income Tax” and “Education Cess” etc as shown in the picture below. The terminology used for paying Self assessment tax is given below.

If you are confused about the breakup just pay total amount as Basic Tax. Income Tax Department checks that total amount has been paid or not.

- Basic tax is tax payable without any cess, interest etc.

- Surcharge :

- Surcharge: 10% of income tax, where total income exceeds Rs.50 lakh up to Rs.1 crore.

- Surcharge: 15% of income tax, where the total income exceeds Rs.1 crore.

- Penalty: Not applicable for Self Assessment or Advance Tax. It is applicable only if assessment order is passed and you receive a notice from Income Tax Dept.

- Education cess. : is 3% of the Basic tax.

- Interest: If one has to fill interest for late payment of advance tax and self assessment tax 234B,234C or any other interest . Then it has to be mentioned here.

- Others: Which does not fit into any of the above categories. Fill in as 0

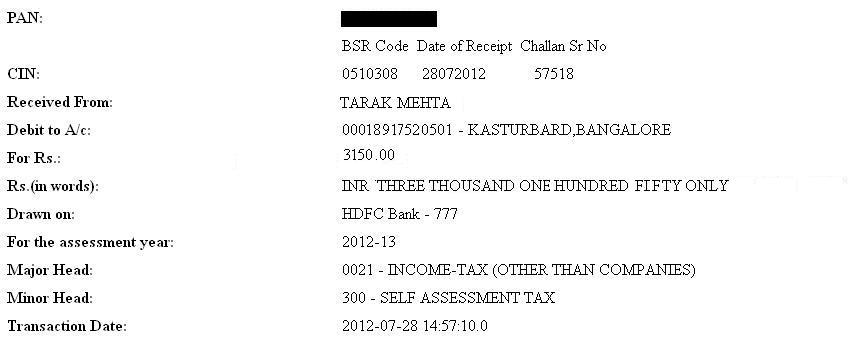

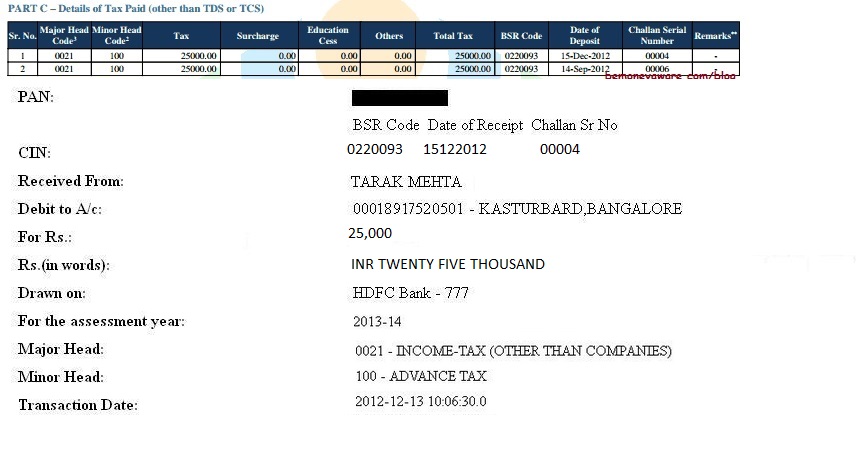

After the taxes are paid through Challan 280, you will get a receipt or counterfoil as the acknowledgement for the taxes paid. The receipt has details of the person paying the tax, amount, type of payment etc and Challan Identification Number (CIN) as shown in the receipt of e-payment of Income Tax below. The challan identification number has to be cited in the return of income as of tax payment. CIN can also be cited in any further queries about the tax payment. CIN comprises of the following :

- Seven digit BSR code of the bank branch where tax is deposited

- Date of Deposit (DD/MM/Year) of tax

- Serial Number of Challan

- Example of CIN: 0000762 020208 32

Show Self Assessment Tax in ITR

After paying income tax through Challan 280 what next? Is your responsibility over. No. You need to show the tax paid in your ITR, If you have paid Self Assessment tax through Challan 280 fill in the details in Tax paid and make sure that your tax liability is 0 before submitting the return as explained for ITR1 in our article Fill Excel ITR1 Form : Income, TDS, Advance Tax and shown in image below. (Note below image is for Advance Tax. But details to fill Self Assessment Tax are same)

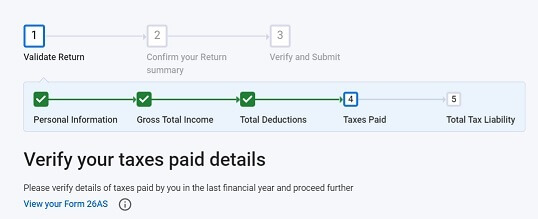

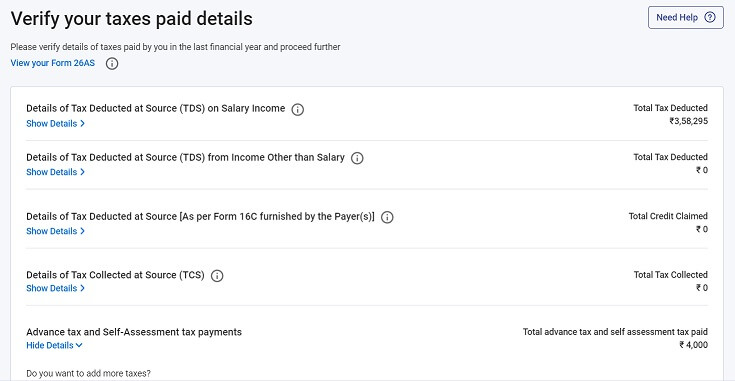

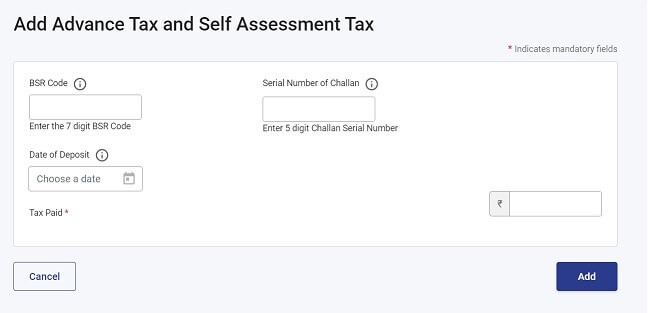

In the new ITR Utility, go to the section called Verify your Tax details, Taxes Paid as shown in the image below

Click on the Advance Tax and Self Assessment Tax as shown in the image below

Below Do you want to add more Taxes, Click on Add Another and fill in the Tax Details and Click Add

Verify Self Assessment Tax in Form 26AS

Part C of Form 26AS has details of Tax Paid (other than TDS or TCS). If you have paid Advance Tax or Self Assessment Tax it will appear in this section. Please verify that advance tax or self assessment tax details are showing up in Form 26AS, If they don’t match with your details please contact the Bank.

Normally It takes 3/4 days from the day you pay tax. If Sunday then around 5 days .

YouTube Video on Self Assessment Tax

This 5 minute video gives details about Self Assessment Tax

Related Articles:

List of all articles related to Income tax have been collected at Understand Income Tax, Fill ITR,Income Tax Notice

- Fill Excel ITR form : Personal Information,Filing Status

- Income Tax for Beginner, Income Tax For Beginner – Part II

- E-Filing of Income Tax Return

- Understanding Form 16: Tax on income,

Hope the article helped you understand Self Assessment Tax. Why one has to pay Self Assessment Tax,how to calculate the self assessment tax, pay the Self Assessment tax,update the ITR and then submit it. Please leave your comments and questions below.

We have paid self assessment tax successfully by net banking payment and fill all details in ITR and nil tax liability show after 15 day IT dept. Send SMS your CRN is expired and no. payment can be initiated against expired CRN.

Completing the tax payment , generate a new CRN through e-pay tax on http://www.incometax.gov.in

What we can doing with CRN

Got answer from this page. Thanks

Thanks for leaving the comment.

It made our day.

I paid self assessment on 25/9/2021 for assessment year 2021-2022 and trying to add it in validate tax return page but selecting the date gives error Date of deposit cannot be prior to 01-04-2020. Why it could be?

That is strange?

Which ITR are you filling? Online or offline

Am facing the same issue with the date of deposit throwing up an error saying it cannot be prior to 01-04-2020. This is seen with Online ITR filing. Did you resolve this problem?

Which browser are you using?

If using Safari browser change to Chrome

In the NEW Income tax efilling portal, I am filling my eReturns for the previous financial year. I have entered all details and the system calculated the balance tax to be paid. I have paid my Self Assessment tax via netbanking and generated the Challan as well for AY 2021-2022. In the NEW e-filing portal, I am unbale to figure out where should I enter the BSR and Challan Nos, so that my tax liability becomes Zero and I can submit my eReturn. The e.g. you mentioned above is of the Old Income Tax portal where details have to filled in manually and then XML file was uploaded.

There is a section called Verify your Tax details, Tax Paid.

We have updated the article with the new Images. Hope it helps

Amazing speed of response. It helped. Thanks a Lot.

Can the Self Assessment Tax can be paid more than once after 31/03 and before 31/07?

You can pay Self Assessment tax any time, as many times before filing ITR

Thank You for your prompt response.

Hi Sir,

My ITR of FY 2019-20 is defective as I changed the job in May 2019 and I am not aware I need to submit my earnings of April 2019 to my new employer. I filed returns with form-16 from my current employer alone.

I filled revised ITR on 5th of March 2021 but didn’t paid the tax. I got the new number by pre-filled excel and paid the remaining tax on 19th April. I am unable to file revised ITR as the date is over. How can I let the IT know that I paid my tax?.

Hi Sir,

I received high valued return intimation on 29th Mar 2021 for assessment year 2020-2021 (F.Y 2019-2020) due to mismatch of interests from banks i.e forgot to show interests from FD, RD and savings. So i filed a revised 139(5) return with the interest details matching the amount and verifying with tax credit statement from bank on 30th Mar 2021. However I forgot to pay tax on the e-pay section, so i referred to process for paying tax under challan 280 self assesment, and paid self assesment tax on 31st march for the amount shown on the filed ITR. On 1st April i recieved demand notice 143(1) for tax total including penalty charges and interest. What shall i do as i cant file revised return to show challan details and the form 26as is not reflecting my due tax paid as there are bank holidays till 2nd April and may not have been processed. Do i still need to pay the total tax including penalty, what will happen to the amount already paid using self assessment? My last date to respond to demand is 10th April, any help before that will be really appreciated.

Wait till Monday.

Form 26AS would be updated.

You can reply to the demand by giving the tax challan details then

Thank you Sir. Your site has helped me understand the process much better. I can now see the credit on the Form 26as for my taxes paid. Do i need to respond to demand using rectification?, can u help me with that?

Rectification would be best.

But if that doesn’t work

You can reply to the outstanding demand saying that you have paid.

And provide proof of the challan.

Dear Sir

I paid advance tax of Rs 16,000/0 on March 31, 2019. However after ITR processed I got a demand notice for paying 17,638/-. The advance Tax was paid under major head 0021 and minor head 107. How to file rectification request, plz help.

I found your article very informative and I totally love how the concepts are explained in this blog post. Thanks for sharing your insights. It helps a lot.

Got answer from this page. Thanks!!

Thanks a lot for leaving a comment.

We appreciate it.

Can you provide us with feedback on our site?

What did you like?

What you didn’t?

Could you give us a social media share twitter/facebook?

I have paid self assessment tax in April. Now I have found a mistake in the calculation of self assessment tax, before filing my return, and have to pay some more tax. Can I pay another instalment of self assessment tax now? Will I be charged interest for this month only for this additional tax due?

Don’t worry .Generally it will reflect at 26 As at income tax site later.

Sir,

I paid the self assessment tax. This tax is reflected in the AS26, But not reflected in the ITR reply intimation notice for depositing the remaining tax) Pre paid taxes (as computed ).

Therefore tax demand is raised by Income tax Dept.

Kindly suggest how to rectify the problem.

file a rectification under 139(9) in response to defect ITR return. upload the same XML . and provide comments . Explore more on other websites.

I had filed itr1 and received refund of rs 6210. Now i am filing revised return and now i would like to know where i can show this information that i have got refund from income tax department.

sir I want to pay penalty what section and what chahall can I use to pay due to late filling

Due to late filing you still have to pay Self Assessment Tax.

If you bank has a field for Penalty then enter those details, else just enter the total amount.

Hello sir,

I have e-filled my ITR and during that there was a column showing Amount payable (D11 –D12)(if D11 > D12). I verify and submit the income tax but forgot to e-pay the tax. Kindly suggest how i can pay this amount or e-pay tax.

Don’t worry.

Please download the ITR form,

Find the amount you have to pay

Pay using Challan 280

Enter details in ITR

Enter details about Revised return

You have to file the revised return under section Revised 139(5). So say No to Question Are you filing u/s 119(2)(b)/92CD

In the Filing Status , PART-A General, as shown in the image below (Fill Excel ITR form : Personal Information,Filing Status)

For Return filed under section select Revised 139(5).

For Whether original or revised return select R-Revised.

Enter the E-filing acknowledgement receipt number from the ITR-V. Which you would have got after filing the original return.

Explained in our article How to file Revised Income Tax Return ITR

Dear Sir,

Many thanks for your response . I have made the advance payment online and got the receipt of it .

Can you please tell i have to fill the ITR again as i normally done and fill the payment details in that

OR

i have to wait for things to get update in section 139(s). Their is nothing showing under revised return section Revised 139(5).

Kindly suggest what to do after making the payment online.

Regards

ankur walia

I assume you are talking about Filing ITR for FY 2017-18 or AY 2018-19.

-Why did you pay advance tax? For which year did you pay Advance Tax? You needed to pay Self Assessment tax

You have to revise your return with payment details.

Why are you saying that there is nothing showing under revised return section?

Can you send a picture of it with steps you have done to our email id bemoneyaware@gmail.com

Also send a picture of Form 26AS.

I HAVE PAID SELF ASSESSMENT TAX SUCCESSFULLY BUT I FORGOT TO DOWNLOAD THE DETAIL OF CHALLAN AND EXIT. NOW I HAVE NO BCR CODE OR CIN NO. WHAT CAN I DO? PLEASE SOLVE MY ISSUE AND REPLY ME ON MY MAIL PLEASE.

Which bank did you use?

Our article Reprint Challan 280 or Regenerate Challan 280 explains how to reprint the challan.

Hope it helps.

After adding all my income, it shows Rs. 11870/- as tax amount payable. There is an option e-pay tax, I tried paying the amount using internet bank, last saturday. The amount got detected from my bank account. But still that is not reflected in the ITR form. Again it is showing tax amount payable. Any idea when it will show up in the ITR?

read the topic carefully, in case of payment made via epay mode, it normally take 3 to 4 working days to get trigerred in Form 26AS & IT returns

Quote

Verify Self Assessment Tax in Form 26AS

Part C of Form 26AS has details of Tax Paid (other than TDS or TCS). If you have paid Advance Tax or Self Assessment Tax it will appear in this section. Please verify that advance tax or self assessment tax details are showing up in Form 26AS, If they don’t match with your details please contact the Bank.

Normally It takes 3/4 days from the day you pay tax. If Sunday then around 5 days . Unquote

Thanks Suresh

Sir you have to fill in the details in ITR your self.

How to do it is explained in Updating ITR in the article.

You have to enter this in Advance and Self Assessment portion

Seven digit BSR code of the bank branch where tax is deposited

Date of Deposit (DD/MM/Year) of tax

Serial Number of Challan

Amount

Hi,

I got 143(1) communication notice for difference in tax I payed and 26AS. I was asked to pay 1780 Rs extra which related to other income source.

I filed revised ITR and payed the extra tax through Challan 280 (Online) but I forgot to mention the CIN number in ITR, so I got one more notice to my home asking to pay the 1780 Rs money.

Now what I should do? How to tell them that I already payed the extra tax? Do I need to file one more revised return?

Please help.

What does the notice say?

Yes, you have agree to the demand, fill in the revised return with the Self Assessment Tax paid details.

You don’t have to pay the Tax again.

Sir i have deposited self assessment tax. But i forgot to submit education cess with it. Now what should i do??

Sir i have to pay more 450 through challan 280 online. please tell me cess, interest and other details.

I filled itr 1 and also submitted it. I have 5647/-.tax… So i paid it online but i haven show it in itr form …plz guide what to do now..i filled itr1 on 10-july…and paid online tax on 14-July

You would have to revise your ITR.

Please show the details in ITR and resubmit.

In the Filing Status, PART-A General, as shown in the image here

For Return filed under section select Revised 139(5).

For Whether original or revised return select R-Revised.

Enter the E-filing acknowledgement receipt number from the ITR-V. Which you would have got after filing the original return.

You can refer to How to file Revised Income Tax Return ITR for more details.

Sir, I paid tax Rs.490/- and after paid i submitted the ITR. I didn’t give the challan details now again i opened the ITR that the epay tax is showing 32310. How to solve it

So you paid Rs 490 and entered details in ITR.

Why did ITR showing more tax?

Did you forget to calculate earlier?

Did some TDS you claimed is not reflecting?

Please recheck and find out how much you actually need to pay.

ITR just shows me the final amount I need to pay. How do I know the split up of income tax and surcharge and Cess which we provide in netbanking page?

Yes, it is confusing.

You can pay the amount payable as full amount.

No need to break up as cess surcharge.

Income tax department looks at the amount submitted

Excellent Form, All my queries are addressed beautifully…… Keep it Up…. I give you all 5 star

SIR,,I have deposited self assessment tax on line and got the print of receipt quoting A ll the details of tax payment but it is not reflecting in 26AS PL. tell me whether I can submit IT return at this stage or i should wait till it is reflected in 26AS

It takes 2-3 days for data to reflect in Form 26AS.

You can submit your return but we would recommend you to wait till data is reflected

its a defective return & we have issued party a self assessment challan but amount in challan is displayed in interest coloumn. so what section is applicable to it???

You go to bank site. And select incometax statement option.

In that you got option for reprint the challan. Having full details like BSR NO., BANK DETAILS. MAJOR MINOR HEADS ETC ETC.

I HOPE THIS WILL HELP.

I have submitted self assessed tax online,which is debited from my account on 29th July 2017. But i am not able to generate information related to challan no. mainly thru Challan printing option in bank’s website. I got it for another payment made one day later of the smaller amount than the earlier one.Today is the last day of submitting Returns. Please help me.

I have paid online tax but how to file in ITR. Total self Assesment tax paid is till 0 in “Taxes Paid and Verification” tab

Please update the ITR with details of Self Assessment Tax paid as shown in image below.

Go to TAX Details tab and under the last section fill the BSR code,Date of Deposit, Challan No. and TAX PAID under SCh IT – Details of Self Assesement TAX Payments. This will automatically show your amount in the ‘Taxes Paid and Verification Tab’ in D11(ii).

Sir/Mam while calculating tax in last page its showing rs 90 to be pay in epaytax. their i already paid thru challan 280 self assessment tax. on dt 9.8.2018,,but still after 10days its not showing automatically.. i have bsr code n cin number.. kindly guide what to do to final submit itr1

You have to update ITR yourself, as explained in the article.

i paid the self assessment tax online. The bank scheduled it for next day and so i didnt receive the CIN details. How to get it

Which bank was it?

Check our article Reprint Challan 280 for more details.

Hi i have done e-pay tax & Submitted my IT returns without entering details of self assessment tax . Pls help me to solve my problem.

pay self-assessment tax, show it in ITR, revise your return and submit again.

Related articles for you:

Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

How to Revise Income Tax Return (ITR)

You can re-submit your ITR by following below steps:

1.On PART A General Information Page select ’17-Revised 139(5)’ for Return filed option. Automatically Revised will get selected in ‘Whether Original or revised return?’

2. Fill the Original Acknowledgment number and Date of Filing Original Return below that.

3. Go to TAX Details tab and under the last section fill the BSR code,Date of Deposit, Challan No. and TAX PAID under SCh IT – Details of Self Assesement TAX Payments. This will automatically show your amount in the ‘Taxes Paid and Verification Tab’ in D11(ii).

4.Fill all the rest of the details as done previously

5.Preview and Submit

This time it will show 0 tax payable.Hope this helps.

It was of a great help.. My friend encountered a similar issue.. Happy to help her using these detailed steps.. Thanks a lot

i paid self assessment tax under minor head 400 instead of minor head 300. demand has been raised. do i have to pay the tax amount again. or it can be rectified. how rectification can be done online.

also if i repay the tax amount then how can i adjust the earlier paid amount.

Paid self assessed tax thru internet banking.Not able to generate challan no. The amount was debited on 29th July 2017. Pls help me.