ITR (Income Tax Return) forms for the financial year 2018-19 or Assessment Year 2019-20 are available for filing. There are not many changes in this year ITR. For Salaried and Pensioners Standard Deduction of Rs 40,000 is available, New Section 80TTB for senior citizens for interest on FD etc and Long Term Capital Gain (LTCG) on equity are introduced. Health and education cess will be 4% (instead of earlier 3%). This article talks about ITR forms for FY 2018-19 or AY 2019-20, changes, Income Tax slabs. These forms require some new details to be filled in by taxpayers mostly in ITR2 such as the number of days of residency in India, holding of unlisted shares and mandatory quoting of PAN of the tenant in case of TDS.

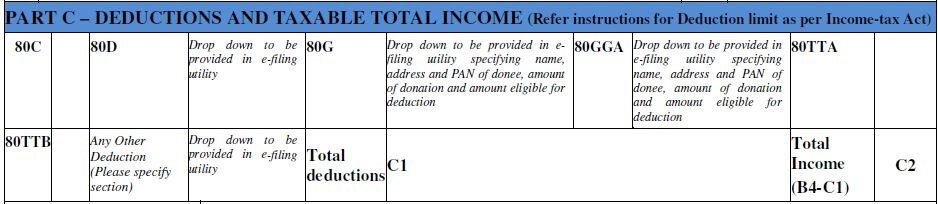

Please file your ITR on time: The last date of filing Income Tax Return (ITR) is 31 July 2019. From FY 2018-19 If taxpayers – individual or corporate – forget to file their income tax returns by the due date, they will not be allowed to claim tax breaks on investments, children’s school fees and medical insurance premiums under the Section 80. So you will no longer be eligible for tax breaks under sections 80C, 80D (mediclaim/ health insurance), 80TTA (savings bank interest), 80G which covers donations, etc if you miss the filing deadline.

Table of Contents

Changes in ITR for FY 2018-19 or AY 2019-20

- Online filing of ITR mandatory: In a departure from the previous year, all individuals (except for super senior citizens i.e above 80 years of age) will be required to file their ITRs electronically. The ITR-1 for FY 2018-19 cannot be filed in paper format by the taxpayers having income below Rs 5 lakh with no refund.

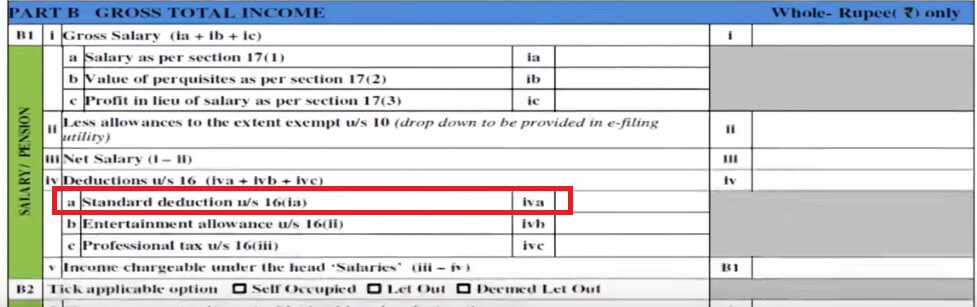

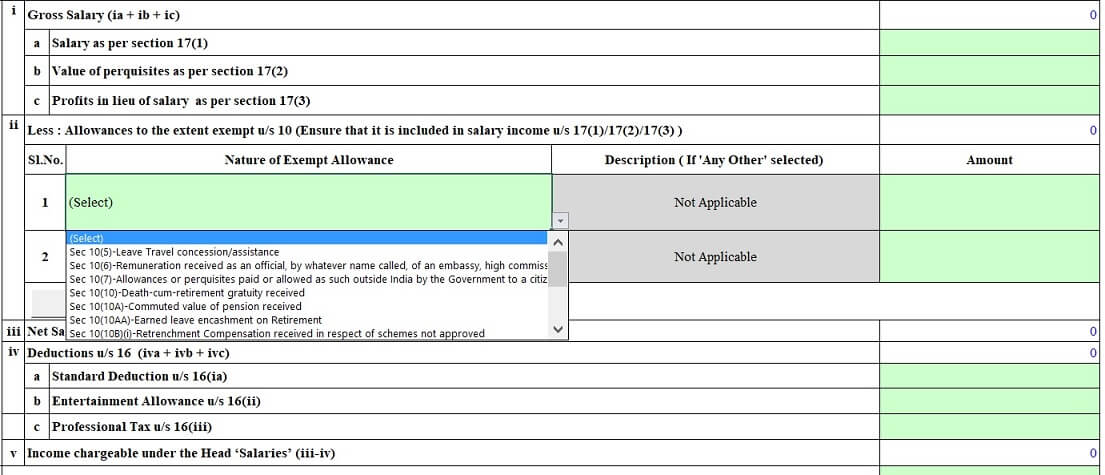

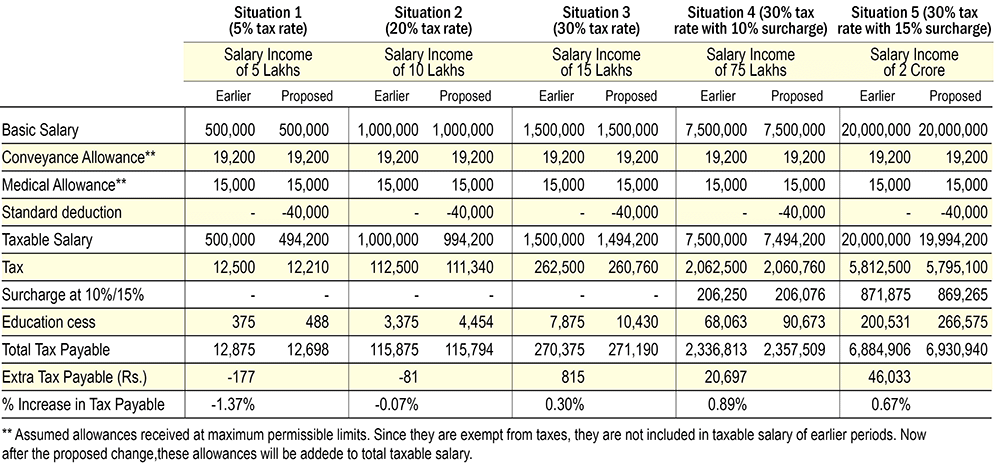

- ITR now come with a standard deduction, For Salaried and Pensioners. While filing ITR, the maximum amount of standard deduction that can be claimed by a salaried individual/pensioner is Rs 40,000 for the financial year 2018-19, as shown in the image below (It was increased to 50,000 Rs for FY 2019-20 announced in the budget 2019 which is applicable from 1 Apr 2019). The standard deduction is essentially a flat amount subtracted from the salary income before calculation of taxable income. Medical reimbursement and transport allowance have been removed, but LTA, HRA are still on.

- For Senior Citizens(those above 60 years), the Interest income earned on Saving Banks Account,Fixed Deposits & Recurring Deposits (Banks / Post office schemes) is exempted up to Rs 50,000 (FY 2017-18 limit was up to Rs 10,000). This deduction can be claimed under new Section 80TTB. Senior Citizens cannot claim deduction under Section 80TTA. In case of senior citizens, the threshold limit of TDS (Tax Deduction at Source) on interest income has been raised from Rs 10,000 to Rs 50,000.

- Long Term Capital Gain (LTCG) on equity is introduced. Long Term Capital Gains(LTCG) at 10% on gains of above Rs 1 lakh from Equity & Equity mutual funds has to be shown in ITR form.

- Entering Salary break up is simpler this year than last year. It is as per Form 16.

- Health and education cess will be 4% (instead of earlier 3%)

- Specifying the type of house property: While providing details of your house property in ITR-1, you are required to specify whether the house is – ‘Self Occupied’, ‘Let-out’ or ‘Deemed Let-out.’ In the previous year’s ITR-1, there was no such option of ‘Deemed Let-out‘ in ITR-1.

- Rent Arrears: While filing ITR, if there are any rent arrears that are received by you in FY 2018-19 then you have to report them property wise as received.ITR-1 & ITR-2 has introduced an additional row ‘Arrears/Unrealized Rent’ received during the year less 30%

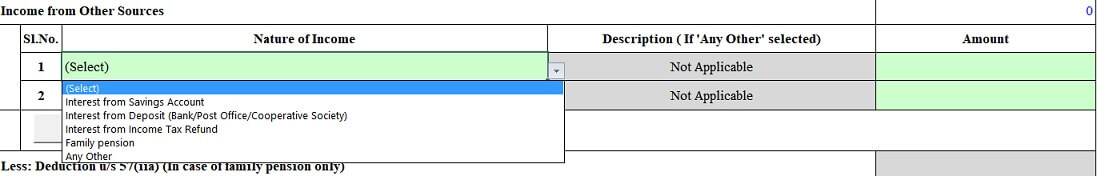

- Full split of interest income Up to last year, a taxpayer was required to show a consolidated amount in respect of interest income taxable under the head ‘Income from other sources’. The new ITR forms now require a complete break-up of the interest income – interest on savings accounts, interest on fixed deposits, Family Pension and even interest on income-tax refund.

ITR-1 for FY 2018-19 or AY 2019-20

- The ITR-1 form is applicable to resident individuals only having a total income up to Rs 50 lakh from salary, one house property and from sources such as interest income etc.

- ITR1 cannot be used by an individual who is either a director of a company or has invested in unlisted equity shares.

- In ITR-1, if you are having a house then you will have to specify whether it is self-occupied, let-out or deemed to let-out.

- This year, you will also be required to provide details of income from other sources. Income from other sources includes interest income from the bank account, fixed deposits, etc.

- The individuals have to provide a break-up of their salary detail as in last year. But details are as per Form 16.

ITR2 for FY 2018-19 or AY 2019-20

ITR-2 is applicable to those individuals and Hindu Undivided Families (HUFs) who do not have income from profits and gains of business or profession.

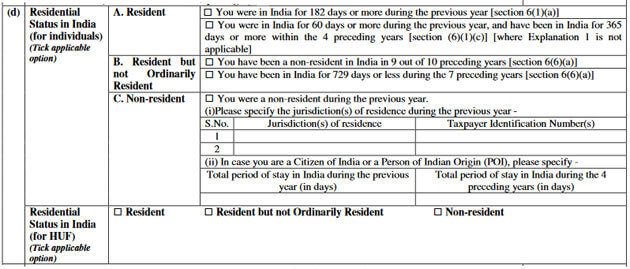

An individual/HUF is now required to provide details of residency status in ITR2, which means, whether in the financial year 2018-19 you were

A resident : You will have to specify that you were in India for 182 days or more during last year [Section 6 (1) (a)] or you were in India for 60 days or more during last year or that you have been in India for 365 days or more within the 4 preceding years [Section 6 (1) (c)].

Resident but not ordinarily resident You have been a non-resident in India in 9 out of 10 preceding years OR you have been in India for 729 days or less during the 7 preceeding years.

Non-resident: You were a non-resident during the previous year. You need to provide details of where you were staying.

Complete details of the buyer to whom you have sold property

If you have sold a property in FY 2018-19, then while filing ITR-2, you will be required to provide complete details of the buyer to whom you have sold the property irrespective whether the capital gains accrued are of short-term or long-term in nature. The details of the buyer will have to be given if TDS is deducted by your buyer while making payment . It is mandatory to deduct TDS if the sale value exceeds Rs 50 lakh.

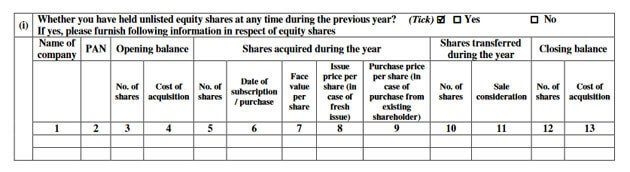

If you have held shares of an unlisted company, then you will have to provide details like name of the company, PAN, number of shares held or acquired by you, shares sold by you etc, in ITR-2.

Long Term Capital Gains on Equity in ITR

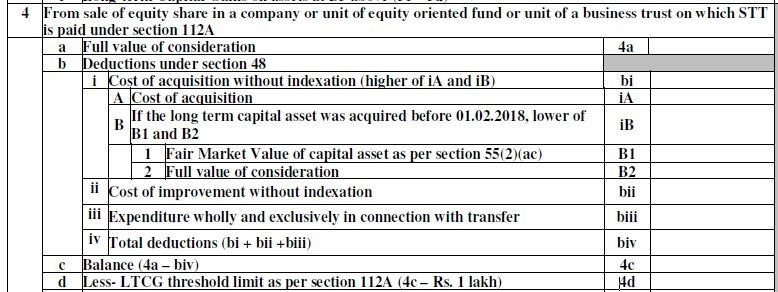

Long Term Capital Gains(LTCG) at 10% on gains of above Rs 1 lakh from Equity & Equity mutual funds has to be shown in ITR form.

The Long Term Capital Gain or LTCG will be taxed at 10% for all listed equity shares and units of equity-oriented MFs where STT is paid on purchase and sale. This means that the LTCG tax would be unchanged for unlisted equity shares where STT is not paid on purchase or sale. So if you have RSU/ESPP/ESOP of MNCs long term capital gains tax is 20% after indexation of cost.

Short term capital gain on equity/equity mutual fund is taxed as per your income slab.

An example of LTCG is given below. Our article Budget 2018:Long Term Capital Gain on Stocks & Equity Mutual Funds explains Long Term Capital Gain in equity in different scenario detail.

Let’s say you bought stock on 10 April 2015 with a purchase price of Rs. 100. Let’s say it was at Rs. 500 as on Jan 31, 2018. You sell it on April 1, 2018 at Rs. 600.

It’s long-term held, since you have owned it for over 1 year. Your capital gains are Rs. 100. Why

The purchase price is the HIGHER of

a) your purchase price, or

b) the price on Jan 31, 2018.

In this case, it’s the higher of 100 and 500, which is 500. So the gain is sale minus purchase = 600 minus 500 which is 100.

Overview of ITR Forms for FY 2018-19 or AY 2019-20

The facility of paper filing (offline) is now only available to those who are more than 80 years old and are filing ITR-1 or ITR-4, rest everyone must mandatorily file online. Earlier those with income up to Rs 5L and not seeking a refund could file in paper form – this is no longer possible.

Usually, most people (salaried, pensioners) use either ITR1 or ITR2 to file their return.

ITR3 is applicable to individuals and HUFs having income from profits and gains of business or profession.

ITR4 is applicable for individuals, HUFs and firms (other than LLP) having total income up to Rs 50 lakhs and having presumptive income from business and profession whose income is computed under section 44AD, 44ADA or 44AE. ITR-4 cannot be used by the individual who is either director of a company or has invested in unlisted shares.

Those filing ITR-3 and ITR-6 (companies) will have to disclose information regarding turnover / gross receipts reported for Goods and Services Tax included now in ITR-3 and ITR- 6 also. Last year, it was applicable only for those assessees filing ITR-4.

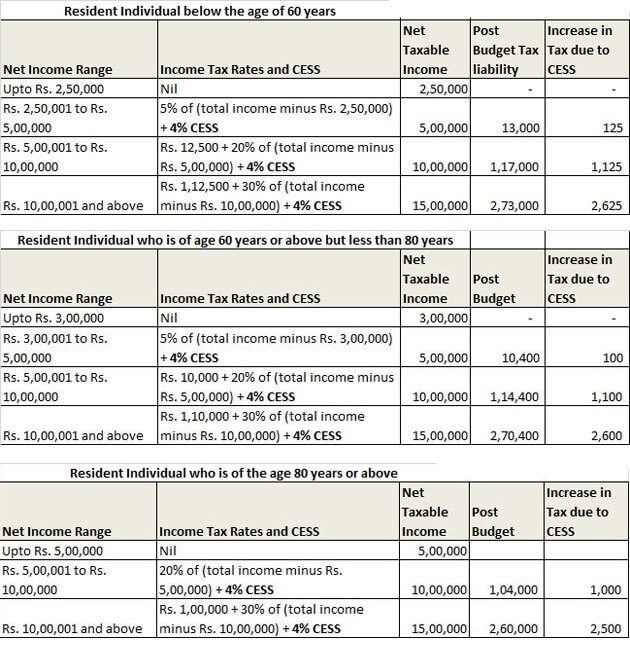

Cess on income tax hiked to 4%: 3% education cess is replaced by a 4% Health and Education Cess to be levied on the tax payable. Tax liability for all tax payers increases now.

- the tax liability for highest tax bracket (assuming Rs 15 lakh income) goes up by Rs 2,625.

- For middle-income taxpayers (between Rs 5 lakh and Rs 10 lakh) the tax liability increases by Rs 1,125 and

- for lowest tax brackets (Rs 2.5 lakhs to Rs 5 lakhs) by Rs 125.

Income Tax Slab for FY 2018-19 or AY 2019-20

Income Tax Slab and the effect of the increase in cess is shown in the table below.

Table below shows Income Tax changes for FY 2018-19 due to Standard Deduction, Medical Reimbursement, Cess. (Note: Proposed is now effective)

Video on how to show break up of salary in ITR

This video explains how a salaried person can file his own income tax return ITR1

Related Articles:

Mistakes while Filing ITR and CheckList before submitting ITR

- Budget:2018 Long Term Capital Gain on Stocks & Equity Mutual Funds with Calculator

- Tax: What are Cess and Surcharge?

- E-Filing of Income Tax Return, E-filing : Excel File of Income Tax Return,

- Fill Excel ITR form : Personal Information,Filing Status

- Fill Excel ITR1 Form : Income, TDS, Advance Tax

- Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- Paying Income Tax : Challan 280

- How to fill ITR1 for Income from Salary,House Property,TDS

- Income Tax Notice for Inconsistency in Salary Income and Form 26AS

- Which ITR Form to Fill?

Disclaimer: Please use the article the for informational purpose only.

Happy to read this very useful information. Nice and detailed explanation.

Appreciate your sharing and tweeted

Excellent and very cool post and the subject at the top of magnificence and I am happy to this post..Interesting post! Thanks for writing it.

ITR 2 Form

Thanks For this post.

For more details Visit us on : https://www.trutax.in/itr-2-form

ITR 2 Form e-filing Tax Services and plans for income tax return online with us at Trutax. Our plans involve salary & income, ITR 2 Form house property, Capital gains & others, gst filing, gst efiling, gst registration, gst return

i am filling details in ITR -2 for AY19-20.

i am facing the issue in sheet PartA -General, where they ask for ” Condition for residential status”

since i am a Resident ,i should not select any of the mentioned options however it is not allowed to move further without selecting atleast one.

can you highlight where i am wrong.

Select the Residential Status in India to Resident.

Then Conditions for Residential Status is greyed out.

Hello,

An employee (Resident Indian) working in India in a subsidiary of a US Company is given RSU or Restricted Stock Units of parent company. 25% RSU has vested as per the vesting schedule and he has been issued certain number of stocks. While distributing stocks , 34.32% of stocks are withheld (Sell to cover) to meet tax liability in US and after reducing these stocks, the balance is given to the employee. Indian company also has calculated perquisite based on FMV on total number of stocks including withheld stocks and properly deducted TDS @30.9% and remitted the TDS and issued Form 16 for FY:2018-19 and it is properly reflecting in Form 16 Part A and Part B. So RSUs are taxed twice. About 65.22% value is consumed in tax.

Is double taxation done by company is correct ?

Can DTAA benefits be availed for refund. What is the procedure. Which ITR to file ?

Hello,

In Aug 2018 , there were some RSU ( Restricted stock units) were vested and My US company deducted few RSU as tax withheld and deposited remaining RSU to my fidelity account.

Indian payroll company also included complete RSU as taxable income and added to my income and calculated tax . So double taxation happened .

As I know India is tax treaty with US , Does India US DTAA ( Double taxation avoidance act) not applicable here on RSU ?

Is double taxation done by company is correct ? and How Do I claim/credit this additional tax deducted in US ? Which ITR form is applicable here ?

My status is Indian resident. RSU was awarded by US branch whereas i am located at Indian branch.

Hi,

I have donated some amount (less than 10000) for Gayatri trust. When I am filling the 80G section in my ITR1 form, it is not reflecting. Kindly suggest.

It will not reflect automatically.

You have to fill in the details yourself.

Please go through our article http://bemoneyaware.com/fill-excel-itr1-80g-exempt-income-calculation-tax/ for more details

standard deduction agr form 16 mai na ho to le skte hai kya

You should take the standard deduction if you are salaried.

Form 16 should have a standard deduction. The new format has been suggested by the Income Tax Department.

Please take the standard deduction.

I am having 2 houses :one is self occupied and another is not given for rent.

Now, Should I use ITR-2 or should I use ITR-1 as it has given the option of “deemed let out” this year.

Same the case of LTCG .as it has geiven option of filling in ITR-1

ITR1 can be used only if you have only 1 house property.

As you have 2 house properties then you cannot use ITR1.

Long Term Capital Gain on what? -Selling of land/shares.

Where have you seen Long Term Capital Gain in ITR1?

Long term capital gain is zero and have pension and interest income. Which ITR Form I have to submit.

you have to file ITR-2 to claim tax free income from sale of shares

Can I use ITR-1 for LTCG less than 1Lakh Rupees? Effectively I dont pay any tax anyway.

I have long term capital gain of 21000 from listed shares, this is not taxable ,how can I show this in ITR1 for AY 19-20