We all want to save income tax legitimately on our hard earned money! But how much do you need to invest to save maximum income tax? The article helps to figure out how much of your Section 80C limit has been taken care of and how much you should invest to claim tax deduction under 80C ?

We know income taxes are inevitable. However, the government has allowed certain means using which we can save tax. So, why not use them and save some tax? You can plan to maximize your tax savings and reduce income tax liability by availing the benefit of provisions relating to deductions/exemptions from taxable income under various sections of Income Tax Act. Lets first look at what tax deductions are available to an individual.

| Description | Max Amount (Rs) |

| Income from salary/business or profession /other sources | Income |

| Less: Interest on funds borrowed for acquiring the house property on self-occupied property | Rs. 2,00,000 |

| Gross Total Income | Income – Interest on home loan |

| Less: Deduction available under Sec. 80C | Rs. 1,50,000 |

| Less: Deduction under section 80CCD(1B) (Contribution to NPS scheme) | Rs. 50,000 |

| Less: Deduction under section 80D for medical insurance of self, spouse, and dependent children | Rs. 25,000 |

| Less: Deduction under section 80D for medical insurance of parents (assumed both are senior citizens) | Rs. 30,000 |

| Less: Deduction under section 80TTA for Saving account interest | Rs. 10,000 |

| Less: Deduction under section 80G for Donation | Cannot exceed 10% of Gross Total Income |

| Less: Deduction under section 80E for Education loan | No Limit |

| Less: Deduction under section 80DD disability of self or dependent | 75,000 /1.25 lakh if disability is severe |

| Less: Deduction under section 80DDB for Medical treatment of specified disease or

ailment for self or dependent relative. (Max. – Rs. 40,000/-) |

40,000 |

| Total Income | Income-Sum of all deductions claimed |

| Tax payable | As per income slab on Total Income |

| Less : Rebate u/s 87A | Rs. 5,000 |

| Net Income Tax Liability | Taypayable – Rebate |

For example, A resident individual assessee aged below 60 years having an income of Rs. 7,65,000 from salary/business or profession/other sources including saving bank interest of Rs. 10,000 and living in house / flat acquired with borrowed funds will be required to pay no tax as under if he claims all commonly available tax benefits. Table below shows how much tax savings he achieves by investing different amount under various sections. You can play around with the tax calculator at fino tax to maximise your tax savings

You can then decide is it worth saving 50,000 under NPS to save tax as it has long lock in?

| Description | No Tax saving | Tax saving through

Interest Saving Account |

Tax saving through

80C + Interest Saving Account |

Max Tax saving |

| Income from salary/business or profession/ other sources | 7,65,000 | 7,65,000 | 7,65,000 | 7,65,000 |

| Less: Interest on funds borrowed for acquiring the house property | Rs. 2,00,000 | |||

| Gross Total income | 7,65,000 | 765000 | 7,65,000 | Rs. 5,65,000 |

| Less: Deduction available under Sec. 80C | 0 | 0 | 100000 | Rs. 1,50,000 |

| Less : Deduction u/s 80CCD(1B) (Contribution to NPS scheme) | 0 | 0 | Rs. 50,000 | |

| Less: Deduction u/s 80D for medical insurance of self, spouse, and dependent children | 0 | 0 | Rs. 25,000 | |

| Less: Deduction u/s 80D for medical insurance of parents (assumed both are senior citizens) | 0 | 0 | Rs. 30,000 | |

| Less: Deduction u/s 80TTA for Saving account interest | 0 | 10000 | 10000 | Rs. 10,000 |

| Total Income | 7,65,000 | 755000 | 655000 | Rs. 3,00,000 |

| Tax payable | 78000 | 76000 | 56000 | Rs. 5,000 |

| Less : Rebate u/s 87A | 0 | 0 | 0 | Rs. 5,000 |

| Net Income Tax Liability | 78000 | 76000 | 56000 | Nil |

| Education Cess [ 3% of (Income Tax + Surcharge)] | 2340 | 2280 | 1680 | |

| Total Income tax payable | 80340 | 78280 | 57680 | |

| Tax Savings | 0 | 2060 | 22660 | Rs 80,340 |

Table of Contents

How can you claim maximum tax deduction under 80C section?

Section 80C of the Income Tax Act deals specifically with tax-saving options. The total savings limit under this Section is Rs 1.5 lakh. All your contributions towards small savings and investment schemes like Employee Provident Fund (EPF), Public Provident Fund (PPF), National Savings Certificate (NSC), Equity-Linked Savings Scheme (ELSS), etc. and premium payments for buying life insurance are eligible for deduction under Section 80C. If you use Section 80C intelligently, you can save almost ₹45,000 (before cess) in taxes if you belong to the highest tax slab (of 30%) and utilise the Rs 1.5 lakh limit.

To claim maximum deduction under 80C you should calculate how much of your Section 80C limit has been taken care through EPF, Expenses such as Tution fees of two children.

| Description | Amount |

| Limit under 80C | 1,50,000 |

| EPF Contribution | |

| Tuition fees of two children | |

| Life Insurance premium | |

| Home loan principal | |

| Stamp Duty, registration charges of new house | |

| Need to invest |

Your EPF Contribution and Section 80C

Your contribution towards EPF will be eligible for deduction under Section 80C of Income Tax Act. Your Form 16 shows how to calculate your EPF contribution under 80C as shown in the image below.

Employee’s Provident Fund (EPF) is a retirement benefit scheme that’s available to all salaried employees. This fund is maintained and overseen by the Employees Provident Fund Organisation of India (EPFO) and any company with over 20 employees is required by law to register with the EPFO. It’s a savings platform that helps employees save a fraction of their salary every month that can be used for retirement. You and your employer both contribute 12% of your basic salary (plus dearness allowances, if any) into your EPF

- You and your employer both contribute 12% of your basic salary (plus dearness allowances, if any) into your EPF account.

- The entire 12% of your contribution goes into your EPF account along with 3.67% (out of 12%) from your employer, while the balance 8.33% from your employer’s side is diverted to your EPS (Employee’s Pension

- 3.67% (out of 12%) from your employer contribution goes to EPF, while the balance 8.33% from your employer’s side is diverted to your EPS (Employee’s Pension Scheme).

- It’s important to note that if your basic pay is above Rs.15,000 per month, your employer can only contribute 8.33% of 15,000 (i.e. Rs. 1251) to your EPS and the balance goes into your EPF account.

Your contribution towards EPF will be eligible for deduction under Section 80C of Income Tax Act. The employer’s contribution is also exempt from tax. But you cannot claim the tax deduction on the employer’s contribution under section 80C.

Form 16 with EPF Deductions

Home Loan Principal and 80C

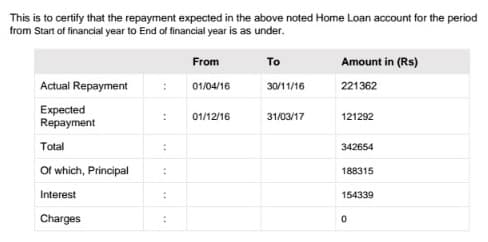

The amount paid as Repayment of Principal Amount of Home Loan by an Individual/HUF is allowed as the tax deduction under Section 80C of the Income Tax Act. However, tax benefit of home loan under this section for repayment of principal part of the home loan is allowed only after the construction is complete and the completion certificate has been awarded. No deduction would be allowed under this section for repayment of principal for those years during which the property was under construction.

This tax deduction under Section 80C is available on payment basis irrespective of the year for which the payment has been made. For example from the provisinal interest certificate one can see that one has paid Rs 188315 as principal for the home loan. This amount can be claimed as the tax deduction under 80C.

Note: You do not get tax benefits for principal repayment if you do not borrow from a scheduled bank or employer. Though You can claim a deduction under Section 24 for interest repayment on loans taken from anyone provided the purpose of the loan is purchase or construction of a property. You can also claim the deduction for money borrowed from individuals for reconstruction and repairs of property. It does not have to be from a bank.

Stamp Duty and Registration Fee

Stamp duty and registration charges and other expenses related directly to the transfer are also allowed as a deduction under Section 80C, subject to a maximum deduction amount of Rs.1,50,000. Claim these expenses in the same year you make the payment on them.

The Amount paid as Stamp Duty & Registration Fee is also allowed as tax deduction under Section 80C even if the Assessee has not taken Loan.

Under the Income Tax Act, Section 2(28a) defines the term interest as interest payable in any manner in respect of any money borrowed or debt incurred (including a deposit, claim or other similar right or obligation). This includes any service fee or other charges in respect of the loan amount. Moreover, there is a tribunal judgment which held that processing fee is linked to services rendered by the bank in relation to loan granted and is thus covered under service fee. Therefore it is eligible for deduction under Section 24 against income from house property .Other charges also come under this category but penal charges do not.

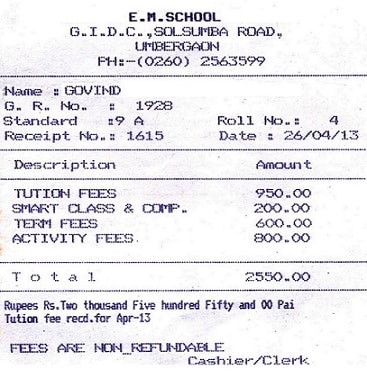

Tuition Fee of Two Children and 80C

In respect of school/ tuition/ education fees, a parent can claim a deduction on the amount paid to any university, college, school or any other educational institution. It can only be claimed in respect of two dependent children and for fees paid to an education institution, college or school.

- The deduction is available to a maximum of 2 children for each individual. Therefore, a maximum of 4 children deduction can be claimed, i.e. 2 by each parent.

- The deduction is available irrespective of the class attended by the child. But, the university must be situated in India. It can be affiliated to any foreign university.

- The deduction is available for only full-time education courses that include Nursery School, Creches & play schools.

- Only tuition fee can be claimed as deduction under section 80C.Development fee and any other fee is not allowed.

- The deduction is available only on actual payment and not on the payable basis: For example, if fees is paid by the parent in April, 2016 for the quarter ending March, 2016 then fee paid will be eligible for deduction in FY 2016-17.

- The person would need to submit receipt issued by the Schools for the payment made during the financial year to their employer & also show in form 12BB before submitting proofs of investments at the end of the Financial year.

- For an Individual other than the salaried employee, you would have to claim the deduction under VI-A schedule by showing the fees paid under section 80C in the income tax return.

Premium for Life Insurance

- As per Section 80C(2) of the Income Tax Act, 1961, any amount paid to an insurer to buy or to keep a life insurance policy in force can be claimed.

- One can claim tax benefits on a life insurance policy bought from any insurer – private or public sector — approved by the IRDAI. An insurance policy taken from an IRDAI registered private insurance company is as good as a policy taken from the Life Insurance Corporation of India (LIC) as far as their tax treatment is concerned.

- Only an Individual or a Hindu Undivided family (HUF) can avail tax benefits on premium paid for a life insurance policy.

- An individual can only claim tax benefit under Section 80C of the Income tax Act, 1961, on life insurance policy(s) bought in the name of self, spouse or children. A policy taken in the name of any other person won’t be eligible for any tax benefits.

- You can buy a life insurance policy for any number of your children irrespective of whether they are minor, major, married, unmarried or adopted.

- For HUF the policy can be taken in the name of any of its members to avail the tax benefits.

- Premium can be claimed as the tax deduction under section 80C only in FY in which paid For example, assume your policy premium due date was 26.3.2017 but you paid the premium late, say after 31.3.2017 but within the grace period allowed by the insurer. The insurer may accept the premium even on say 10.04.2017 as generally 15 days grace period for payment is allowed but the premium so paid cannot be claimed as the deduction in FY 2016-17. However, this amount can be claimed as the deduction in FY 2017-18 i.e. the FY in which the premium is actually paid.

- If the amount of premium paid in a financial year for a policy is in excess of 20% of the actual capital sum assured, then the tax deduction will be allowed only for premiums up to 20% of the sum assured.

- For insurance policies issued on or after April 01 2012, the tax deduction is allowed for only so much of the premium payable as does not exceed 10% of the actual capital sum assured.(15% of actual capital sum assured in case of a person with a severe disability or specified ailment).

- Above benefits shall be reversed if the policy is terminated/cease to be in force within 2 years for traditional products and 5 years for ULIP products after the date of commencement of policy.

thanks a lot for your valuable posts on efilings of income tax returns & Money matters

sharmabd11@yahoo.com

Further I would like to know about giving details of stocks of UNLISTED Companies while filing itr.

Thanks

Unlisted stocks in India or outside India?

nice

I have an investemne of more than 150000 say 170000 then while filing for tax returns under sec 80c how much amount should I mention whether 150000 only or 170000.

Mention 170000 only 150000 would be accepted.

The software updates to take care of the max limit as shown in image