Many options to open a bank account are available. State Bank of India is the oldest Indian public sector bank. Through its network of branches in India and overseas, SBI provides a range of financial products. This article talks about Banking with SBI, How to open an account in State Bank of India, How to do Internet Banking such as change ATM Pin, Transfer money using IMPS, NEFT and How to do Mobile Banking with SBI Bank.

As of 31 March 2016, SBI has 49,577 ATMs, offers interest on savings account at 4% p.a and annual debit card maintenance charges are Rs. 100-300 + service tax depending on the type of card. This makes SBI a good choice to open an account with.

Table of Contents

Banking with SBI : Open SBI Bank Account

To utilize any service with SBI you would first require an account with them. You can go to SBI branch with required documents and fill the form. Most of SBI branches now insist that you fill online application form, take print out of the form and then visit the branch. Our article How to open Saving Bank account with SBI the State Bank of India discusses it in deatil

- Go to: https://oaa.onlinesbi.com/oao/onlineaccapp.htm

- Fill the application form.

- Joint Accounts can be also opened online for maximum three persons.

- Download the Filled in Application Form.

- A TCRN (Temporary Customer Reference Number) will be generated, please note down. TCRN will also be sent to the registered mobile number of the applicant(s).

- Print the Application Form.

- Attach the required documents, such as photographs and proof of identity and address, as mentioned in the Account Opening Form.

- You must approach a branch within 30 days of submitting the information online. If the account is not opened within 30 days, the customer information is deleted.

- Visit the branch with documents- 2 recent photographs, Original and copies Address and identity proof like AADHAR Card, Passport, Driving License etc.

- The Account will be opened instantly unlike manual opening as the data is already available in the system.

- You can watch detailed videos from SBI on How to fill Online Application Form for opening SBI New Saving Bank account

How to open Saving Bank account with SBI the State Bank of India

Register for Internet Banking with SBI

Common banking transaction like transferring funds, checking balances, making payments can be effortlessly done without even physically visiting the branch.

To benefit from internet banking with SBI you first need to apply for the same. Make sure to register for internet banking and mobile banking services when you visit the branch for opening your account. This will save your time. Once you apply for Internet Banking you will receive login and transaction credentials on your registered address. When you have received you can use the User ID and password to conduct transactions. On your first successful login, you will be required to change the password.

If you have received your ATM card and you desire to go start your Internet Banking services, you have an easy way out.

- Log on to https://www.onlinesbi.com/

- Click on new user registration

- Enter personal and ATM card details.

- You are done!

A detailed video covering all aspects and how to fill each column is at: https://www.youtube.com/watch?v=36bAHHPNBQE

Internet banking with SBI: Request for ATM card

You can apply for ATM card without visiting the branch. All you need to do is:

- Using Internet Banking details like user ID and password, Login.

- Click on e-services tab and then select ATM card services.

- Click on request ATM card.

- Select either one time password- You get a number as SMS on your registered mobile number or you can select using profile password where you have to enter your profile password.

- Now select your account and enter details.

- As easy as it looks! ATM card will be delivered within 7-8 working days.

A detailed video covering all aspects and how to fill each column is at https://www.youtube.com/watch?v=qprDvMBt42k

Internet banking with SBI: Generate ATM PIN

- Using Internet Banking details like user ID and password, Login.

- Click on e-services tab and then select ATM card services.

- Click on ATM PIN Generation.

- Select either one time password- You get a number as SMS on your registered mobile number or you can select using profile password where you have to enter your profile password.

- Select the appropriate account for ATM Pin generation. You will have to apply differently for each account.

- Enter first two desirable digits, while the last two digits will be sent via an SMS by SBI.

- Confirmation of change will be visible on the screen.

A detailed video covering all aspects and how to fill each column is here https://www.youtube.com/watch?v=0BwQoa5fN8s

Internet banking with SBI: Add beneficiary for IMPS/RTGS/NEFT:

For any fund transfer service, details of the transferee need to be linked with your bank account. For this you need to:

- Using Internet Banking details like user ID and password, Login.

- Click on profile.

- Click on manage beneficiary

- Enter your profile password and submit.

- Click on desired transaction type: IMPS/RTGS/ NEFT.

- Fill details of the beneficiary.

- View your beneficiary details.

- Click on approve through OTP if you desire to add only 1 beneficiary for that day.

- Your beneficiary will be added within next 4 hours.

A detailed video covering all aspects and how to fill each column is here:

https://www.youtube.com/watch?v=OH7hiUdpu_o

Internet banking with SBI: Transfer funds through IMPS

IMPS is an instant money transfer service provided by banks. Money can be transferred 24×7 for 365 days irrespective of any bank holiday. There is a maximum limit of 2 Lakhs for IMPS transactions. IMPS can be done with internet or mobile banking.

- Using Internet Banking details like user ID and password, Login.

- Click on payments and transfers.

- Select IMPS Funds transfer

- Select the applicable option depending on the details you have of the transferee

- If the beneficiary is already added, select the beneficiary and enter the amount.

A detailed video covering all aspects and how to fill each column is here:

https://www.youtube.com/watch?v=baoauwmnV9A

Mobile Banking with SBI

A person cannot carry his desktop or laptop everywhere but can surely carry his phone. Banking transaction can be done in a jiffy on mobile phones and are also highly secured. To avail these services, you will require:

- A smartphone

- Internet connection

- Mobile number should be registered with branch for mobile banking.

Once these pre-requisites are fulfilled, you need to download State Bank Freedom app from Playstore. For any queries on downloading please refer: https://www.youtube.com/watch?v=EZs8VBYi1Ko

Once downloaded,

- Click on obtain user ID

- You will receive user ID and Mpin.

- Enter your user ID and Mpin. Also change your default mpin with a new mpin.

- Once these steps are completed, you will receive a confirmation SMS.

You need to also authenticate your mobile banking with internet banking. For this you need to login with your internet login ID and password on the SBI website.

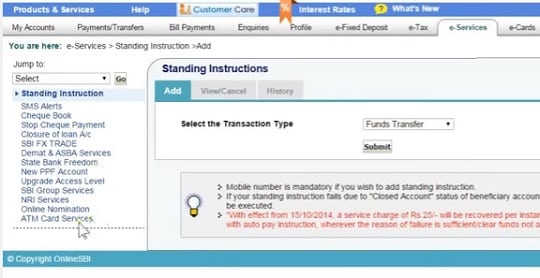

- Click on e-services and then on the left hand side click on State bank freedom.

- Enter the profile password and mobile banking details.

- A confirmation message will be displayed in the screen.

A detailed video covering all aspects and how to fill each column is at : https://www.youtube.com/watch?v=fHxTogt8TEI

Please include information on “High Security Option” in Profile section of SBI Net Banking. This will be useful to many users of SBI Net Banking.

http://www.sbionline.help