Congratulations on coming up with a keen business idea! Whether you’re adding new life to an older concept, or creating a company that hasn’t existed before- you’ve got a lot on your plate! Unfortunately, money doesn’t just fall out of the sky the moment you think of a lucrative business, and so in comes the need for funding.

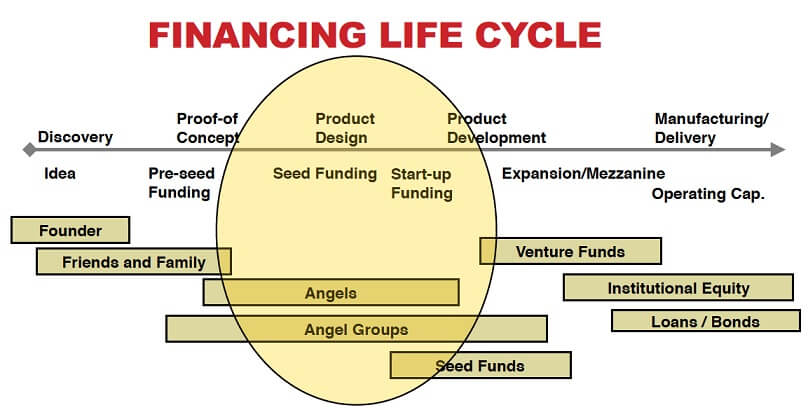

Fortunately, there are tons of options that break down into just a small handful of categories. Decide what will work best for your business, and then get out there and make your business successful. Typical Funding Cycle is shown below

Crowdfunding

Using sites like Kickstarter and GoFundMe has kicked off a lot of businesses in the last ten years. By starting up everything from fidget toy companies to restaurants, these sites allow business owners to take their funding into their own hands.

There are drawbacks, though.

Less than forty percent of KickStarters get the funds they need. This number means that you have over a sixty per cent chance at not succeeding. Although a lot of people are willing to take those odds, you need to think it through before starting one. Crowdfunding for your company can leave a lot of responsibility on your shoulders. Not only are you responsible for advertising yourself and your Kickstarter, but you’ll also have to make sure you back up every claim you lay down for your funders.

The good thing is with sites like this you can make sure your company is still absolutely yours, and won’t have to bend to anyone.

Banks

When lending money gets mentioned, most people think of banks. America/India/World thrives on the tradition of getting loans this way. Unfortunately, it doesn’t work the same for everyone.

Before you apply to a bank for a loan, you need to make sure you have some essential things figured out.

How’s your credit score? How’s your payment history on your car or home? Do you have collateral? Can you prove your business is going to be able to make money? If you get a loan from a bank, you could lose everything if you find yourself unable to pay it back. Twenty per cent of American businesses fail within their first two years of being open. Although an eighty per cent chance at succeeding past that sounds good, you need to consider if you want to stake your house on that bet.

Lending Companies

These are similar to banks in how they work and take applications, except that their main focus is on business loans.Flexibility in business means that you have to be able to prove your ability to make money, while also showing that your idea is innovative and new.If they agree on terms, work with them on those to the extent you’re capable.Don’t change your business entirely, but give them some wiggle room.

These kinds of companies fund new businesses constantly; they know what it takes to make money and get their loan back- and will work to make sure you’re successful.Make sure you read all paperwork clearly and make your own needs clear.