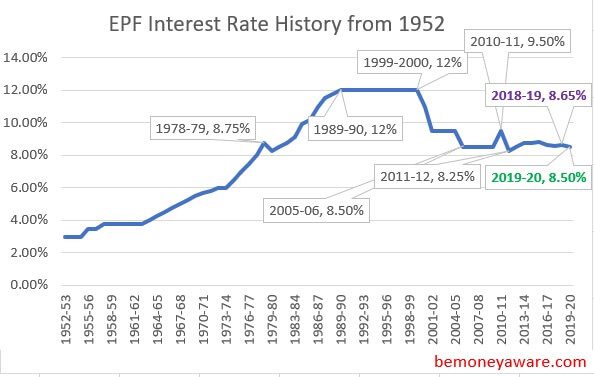

In Mar 2022, EPF Rates for FY 2021-22 were declared as 8.10%, Govt cuts from 8.5%, lowest rate since 1977-78. From FY 2017-18, interest is being credited after Sep instead of Apr. The EPF interest rate of India is decided by the central government with the consultation of Central Board of trustees. In the past several decades, the interest rate has ranged from 8 to 9.5 % as shown in the history of EPF Interest rate. This article talks about the EPF Interest rate, EPF interest rate since 1952 and how EPFO earns money.

On 9 Sep, CBDT recommended splitting payment of the interest rate of 8.5% of EPF for FY 2019-20 in 2 parts, due to “exceptional circumstances arising out of Covid-19”. Credit 8.15% interest immediately and 0.35%, linked to equity investments, before 31 Dec 2020. This has to be sent to the Finance Ministry for ratification. Source Indian Express

0n 4th Mar 2021, EPF Rates for FY 2020-21 were declared as 8.50%. There were concerns about EPFO might find it tough to make an interest rate payout above 8% due to the coronavirus pandemic as there were more withdrawals and lesser contributions by members

Table of Contents

EPF Interest Rate (%) over Years

EPF Interest rates over the last few years are shown below. The complete history is here at EPF Interest Rate from 1952

- 2021-22 8.1%

- 2020-21: 8.5%

- 2019-20: 8.5%

- 2018-19 : 8.65%

- 2017-18 : 8.55%

- 2016-17 8.65%

- 2015-16 8.8%

- 2014-2015 8.75%

- 2013-2014 8.75%

- 2012-13 8.5%

- 2011-12 8.25%

- 2010-11:9.5%

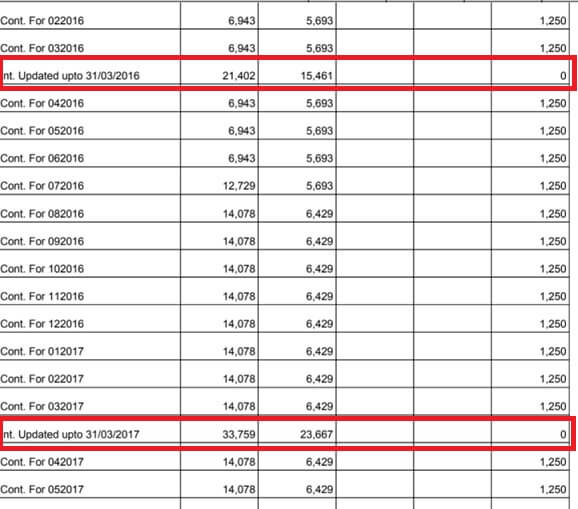

The image below shows UAN passbook with EPF Interest

EPF Interest in passbook

Why EPF interest is credited late?

The EPFO invests 85% of its annual accruals in the debt market and 15% in equities through ETFs.

As per convention, after the Central Board of Trustees recommends the interest rate, it has to be ratified by the Finance Ministry and then it gets credited into the accounts of the fund’s subscribers.

The Finance Ministry has been nudging the EPFO to reduce the rate to a sub-8% level in line with the overall interest rate scenario, which is under strain given the economic slowdown. Small savings rates range from 4.0-7.6%

EPF Interest for FY 2020-21

The EPFO will give 8.5% to its over 5 crore active subscribers for the year.

The Central Board of Trustees of the Employees’ Provident Fund Organisation (EPFO) has recommended splitting payment of the interest rate of 8.5% recommended for financial year 2019-20 into two parts, citing “exceptional circumstances arising out of Covid-19”.

EPF Interest for FY 2019-20

The EPFO will credit 8.15% to its over six crore subscribers for the year immediately and give the remaining 0.35%, which is linked to its equity investments, before December 31. This, it said, is subject to redemption of its units invested in exchange-traded funds or ETFs and approval by Finance Ministry.

The Central Board of Trustees of the Employees’ Provident Fund Organisation (EPFO) has recommended splitting payment of the interest rate of 8.5% recommended for financial year 2019-20 into two parts, citing “exceptional circumstances arising out of Covid-19”.

EPF Interest for FY 2018-19

EPF interest was credited late for FY 2018-19. The notice came out only on 27 Sep 2019. As Finance Minister approved it on 26 Apr 2019. After the Finance Ministry concurrence, the Income Tax Department and the Labour Ministry would notify the rate of interest for 2018-19. Thereafter the EPFO would give directions to its over 120 field offices to credit the rate of interest into subscribers’ account and settle their claims accordingly.

On 25 May 2018 Retirement fund body EPFO has asked its field offices to credit 8.55% rate of interest for 2017-18, the lowest rate since 2012-13 fiscal. However, it could not be implemented for want of the finance ministry’s approval and was further delayed due to the model code of conduct for Karnataka polls on May 12.

EPFO or Employees’ Provident Fund Organisation on 21 Feb 2018 announced an interest rate of 8.55 for the year FY 2017-18 as compared to 8.65 percent interest rate given to subscribers in 2016-17, and 8.8 percent interest offered in 2015-16. The proposal was sent to Finance ministry. The proposed rate of EPF interest will be ratified by May or June 2018. Hence it will be reflected late in your UAN passbook.

Retirement fund body EPFO On 19 Dec 2016 decided to lower the interest on EPF deposits for the FY 2016-17 to 8.65 percent, from 8.8 provided in 2015-16, for its over four crore subscribers.

Why was the EPF interest rate increased from 8.55% to 8.65% for FY 2018-19

According to the EPFO estimates, there would be a surplus of Rs 151.67 crore after providing 8.65 per cent rate of interest for 2018-19 on EPF. There would have been a deficit of Rs 158 crore on providing 8.7 per cent rate of interest in EPF for last fiscal. That is why the body decided to provide 8.65 per cent rate of interest for 2018-19.

Why was the EPF interest rate lowered to 8.55% for FY 2017-18?

Labour minister Santosh Kumar Gangwar, who heads the body’s central board, said that the interest rate payout was cut because of low returns from debt investments. Although the pension fund manager realized more than Rs 1,000 crore in capital gains by selling off a part of its equity exposure, the earnings were not enough to offer a higher interest rate or even match that of the previous year. EPF rate is higher than the Government Provident Fund and Public Provident Fund, which are earning 7.6% interest this quarter.

Last year, after EPFO paid an interest rate of 8.65%, EPFO had a surplus of Rs695 crore and this year, after EPFO reached a rate of 8.55%, the surplus was Rs586 crore.

When asked why EPFO needs to maintain a surplus worth Rs 600 crore, EPFO financial adviser Manish Gupta said pension funds “across the globe need to maintain a health-stabilizing fund”.

However, employee representatives said that as per earning estimates, an 8.65% interest payout would have still left a surplus of Rs48.42 crore.

Ashok Singh, a senior leader of the Indian National Trade Union Congress and CBT member, said that when EPFO went to the stock market, the argument was that it would enhance returns for PF subscribers. But two-and-a-half years on, they have been constantly reducing the rate.

Currently, EPFO invests 15% of its annual accruals in equities via exchange-traded funds and the remaining 85% in debt instruments, including government bonds, private sector bonds and fixed deposits. Since August 2015, when it entered the stock market, the body has invested a little over Rs44,000 crore. As of January-end, its equity investments have earned around 16% returns.

EPF Interest Rate Calculation

EPF, EPS

Employee Provident Fund (EPF) is implemented by the Employees Provident Fund Organisation (EPFO) of India. An establishment with 20 or more workers working in any one of the 180+ industries should register with EPFO

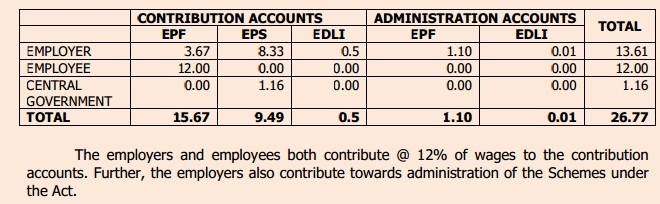

The employer and the employees need to contribute to the EPF from the monthly basic salary plus the dearness allowance. The employee contribution is 12% of the basic salary plus the dearness allowance and the employer contribution is 3.67 % of the employees’ salary to EPF. Rest upto 1250 goes to EPS . The Distribution of Funds is As Per Below. An employee can invest more than 12% of his basic salary in EPF called Voluntary Provident Fund (VPF). Our article Basics of Employee Provident Fund: EPF, EPS, EDLIS talks about EPF, EPF, EDLIS in detail.

The EPF interest rate of India is decided by the central government with the consultation of Central Board of trustees. In the past several decades, the interest rate has ranged from 8-12 % of the balances maintained in the fund. The EPF interest rate notification is available on the official website of EPF India on an annual basis. The same is communicated through major newspapers dailies in all cities. Table given below shows the interest rate over the years from 1952.

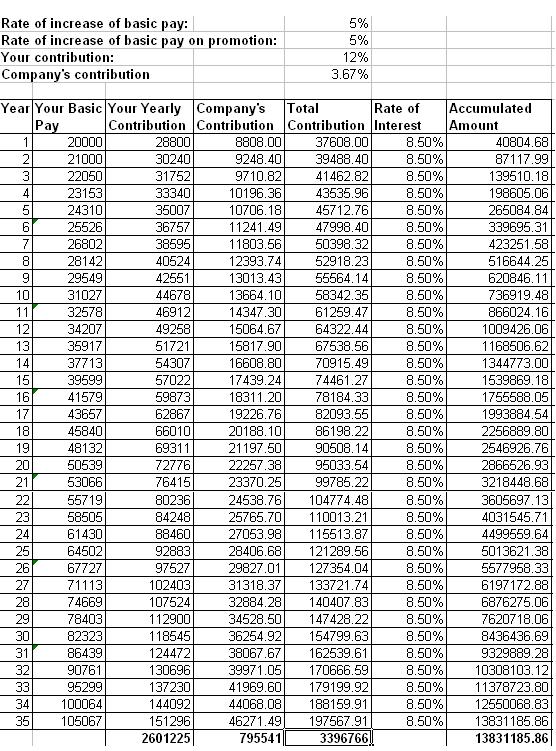

Please remember that EPF accounting year starts from March and ends on February but interest is credited on April every year. EPF interest is yearly compounding but in a year it uses Average Monthly Balance method. Interest is calculated on a monthly basis for the period of investment during the year at the rate of interest specified by the government. This interest is added to the investment in the EPF of the account holder.

If your account remains inactive (no contribution is made) for three years, the money will cease to earn interest but interest would be taxable.

The employee contribution up to Rs 1.5 lakh is deducted from the taxable income under Section 80 (C) of the I-T Act.

The EPFO ‘declares’ the annual interest which is paid out to subscribers each year. The interest earned is tax-free.

This interest is decided based on the surplus of its income over expenses. The fund earns income from the interest on government deposits, gilts, corporate bonds and the other securities it holds in its portfolio. It incurs costs on subscriber payouts and expenses. n 2015-16, EPFO invested 5% of its incremental corpus, or a little more than Rs.6,000 crore, in stocks. Labour ministry officials estimate that in 2016-17, the amount would rise to as much as Rs.10,000 crore. Our article How EPFO Manages Money, EPFO invesment in Stock Market discusses it in detail.

How is EPF interest calculated?

EPF interest is calculated every month but is deposited in the account at the end of the financial year. One gets interest on the opening balance and monthly contribution. At the beginning of each year, there is an opening balance, the amount accumulated till then and then EPF contribution(Employee and Employer) is made monthly. So for next year, the new opening balance would be: old opening balance + contribution throughout the year + interest on the (old opening balance + contribution)

Note EPS contribution does not earn any interest.

The following example explains the interest calculation on the EPF of the employee:

- Basic Salary + Dearness Allowance = ₹ 15,000

- Employee’s contribution towards EPF = 12% of ₹ 15,000 = ₹ 1,800

- Employer’s contribution towards EPS = 8.33% of ₹ 15,000 = ₹ 1,250

- Employer’s contribution towards EPF = Employee’s contribution – Employer’s contribution towards EPS = 1800-1250=₹ 550

- Total EPF contribution every month = ₹ 1,800 + ₹ 550 = ₹ 2,350

The interest rate for 2018-2019 is 8.65%. When calculating interest, the interest applicable per month is = 8.65/12 = 0.720%

Assuming the employee joins service on 1st April 2018, contributions start for the financial year 2018 – 2019 from April

| Total EPF Contribution for April = ₹ 2,350 |

| Interest on the EPF contribution for April = Nil (No interest for the first month) |

| EPF account balance at end of Apr = ₹ 2,350 |

| Interest on the EPF contribution till May = ₹ 2350 * 0.72% = ₹ 16.94 |

| EPF Contribution for May = ₹ 2,350 |

| Total EPF balance at the end of May = ₹ 4,700 |

| Interest on the EPF contribution till May = ₹ 4,700 * 0.72% = ₹ 33.87 |

| EPF Contribution for Jun= ₹ 2,350 |

| Total EPF balance at the end of June= 7050=₹ 4,700 + Rs 2350 |

| Interest on the EPF contribution till Jun= ₹ 7050 * 0.72% = ₹ 50.82 |

| .. |

| Interest on the EPF contribution till Mar= 1118.012(516.94+33.87+50.82….) |

The interest will be calculated every month but will be deposited after the end of the financial year (after 31st March 2019 in this case).

The image below shows the calculation for each year. You can also play with EPF calculator here.

EPF Interest Rate from 1952

Interest Rate from 1952 is shown in the table below.

| Financial Year | Interest Rate (%) |

|---|---|

| 2021-22 | 8.1% |

| 2020-21 | 8.5% |

| 2019-20 | 8.5% |

| 2018-19 | 8.65% |

| 2017-18 | 8.55% |

| 2016-17 | 8.65% |

| 2015-16 | 8.8% |

| 2014-2015 | 8.75% |

| 2013-2014 | 8.75% |

| 2012-13 | 8.5% |

| 2011-12 | 8.25% |

| 2010-11 | 9.5% |

| 2009-10 | 8.5% |

| 2008-09 | 8.5% |

| 2007-08 | 8.5% |

| 2006-07 | 8.5% |

| 2005-06 | 8.5% |

| 2004-05 | 9.5% |

| 2003-04 | 9.5% |

| 2002-03 | 9.5% |

| 2001-02 | 9.5% |

| 2000-01 | 11% |

| 1999-2000 | 12% |

| 1998-99 | 12% |

| 1997-98 | 12% |

| 1996-97 | 12% |

| 1995-96 | 12% |

| 1994-95 | 12% |

| 1993-94 | 12% |

| 1992-93 | 12% |

| 1991-92 | 12% |

| 1990-91 | 12% |

| 1989-90 | 12% |

| 1988-89 | 11.8% |

| 1987-88 | 11.5% |

| 1986-87 | 11% |

| 1985-86 | 10.15% |

| 1984-85 | 9.9% |

| 1983-84 | 9.15% |

| 1982-83 | 8.75% |

| 1981-82 | 8.5% |

| 1979-80 | 8.25% |

| 1978-79 | 8.25%+0.5 % bonus*** |

| 1977-78 | 8.00% |

| 1976-77 | 7.50% |

| 1975-76 | 7.00% |

| 1974-75 | 6.50% |

| 1973-74 | 6.00% |

| 1972-73 | 6.00% |

| 1971-72 | 5.80% |

| 1970-71 | 5.70% |

| 1969-70 | 5.50% |

| 1968-69 | 5.25% |

| 1967-68 | 5.00% |

| 1966-67 | 4.75% |

| 1965-66 | 4.50% |

| 1964-65 | 4.25% |

| 1963-64 | 4.00% |

| 1962-63 | 3.75% |

| 1961-62 | 3.75% |

| 1960-61 | 3.75% |

| 1959-60 | 3.75% |

| 1958-59 | 3.75% |

| 1957-58 | 3.75% |

| 1956-57 | 3.50% |

| 1955-56 | 3.50% |

| 1954-55 | 3.00% |

| 1953-54 | 3.00% |

| 1952-53 | 3.00% |

- For FY 1978-79 actual interest rate was 8.25%+0.50% (as a bonus). But this bonus is applicable to the members who did not withdraw any amount from the account during the period of 1976-77 and 1977-78.

- For FY 2000-01, interest rate was 12% for the period of April-June and 11% from June onward on monthly running balance.

- For FY 2004-05 actual interest rate was 9%+0.50% (Golden Jubilee Interest Rate bonus).

How does EPFO earn to pay Interest

The EPF interest rate of India is decided by the central government with the consultation of the Central Board of trustees. The EPFO, whose corpus comprises contribution by the employee/member as well as his employer, has so far preferred to invest in government bonds rather than equities to avoid any potential risks to the capital. Any suggestion for the retirement fund of salaried employees to be invested in equities is usually met with strong opposition from trade unions and political parties. EPFO fixes the rate based on the interest earned on its investment, a majority of which is in government securities, and it’s expenses.

In Feb 2014, The Department of Economic Affairs has issued a notification under the Securities Contracts (Regulation) Rules Act 1957, permitting the Employees’ Provident Fund Organisation (EPFO) to invest in the stock market. Market regulator SEBI had suggested that the government facilitate the flow of EPFO funds to equity-linked mutual funds to boost the market. The Finance Ministry has been pitching for EPFO funds to be invested in the equity markets to maximise their yields.The Finance Ministry had allowed the EPFO to invest up to 5 per cent of its funds in equity in 2005 and enhanced the limit to 15 per cent in 2008. In Jan 2014 Labour Ministry allowed the EPFO to invest up to 5 per cent of its funds in money market instruments, including units of mutual funds and equity-linked schemes regulated by the Securities and Exchange Board of India.

The total corpus available with EPFO was about Rs 5.46 lakh crore at the end of the financial year 2011-12. The annual incremental inflows consisting of fresh inflows, maturity and interest payments accruing to fund is about Rs 80,000 crore. In the financial year, 2013-14 EPFO managed a corpus of over Rs 5 lakh crore and is estimated to have an income of around Rs 21,000 crore. Ref Times of India Employees Provident Fund Organization raises 2013-14 interest rate to 8.75%

EPFO releases Annual Reports every year. You can see the annual reports from 1952 to 2015-16 at EPF webpage

EPF document explaining How interest rate is calculated

Loading...

Loading...

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Understanding Employee Pension Scheme or EPS

- Voluntary Provident Fund, Difference between EPF and PPF

- Tax on EPF withdrawal

- Transfer EPF account online : OTCP November 10, 2013

- Articles related to Salaried on EPF, Variable Pay, ESOP,NPS, Income Tax, MBA, Changing jobs

Hope you find this helpful. Please share your comment, feedback, questions.

Thank you a bunch for sharing this with all of us you really recognize what you are speaking

approximately! Bookmarked. Kindly also seek advice from my

web site =). We will have a link trade contract among

us

Thanks for sharing a very Informative post bemoneywaye

Thanks Swati

Thanks for sharing a very Informative post bemoneywaye

Thanks Swati

Hi,

Very good information. I was aware of this and using this information I have developed a mobile app and published on mobile store. The app acts like your own passbook.

We have apps on all store.

https://play.google.com/store/apps/details?id=com.ppinngapps.pftracker

Download app and give your feedback.

Regards

Thanks Keshav for information. We checked out the Playstore and wanted to try but couldb’t. Is it because I have Android phone

and it available only Apple?(from your website http://www.pathpartnertech.com/mobileapps/ios/ppinng-mypf)

Hi Kirti,

App is available on all major mobile platform. You should be able to get on Andriod phone. Can you tell me OS version and make of your phone?

Regards

Keshav

Hi,

Very good information. I was aware of this and using this information I have developed a mobile app and published on mobile store. The app acts like your own passbook.

We have apps on all store.

https://play.google.com/store/apps/details?id=com.ppinngapps.pftracker

Download app and give your feedback.

Regards

Thanks Keshav for information. We checked out the Playstore and wanted to try but couldb’t. Is it because I have Android phone

and it available only Apple?(from your website http://www.pathpartnertech.com/mobileapps/ios/ppinng-mypf)

Hi Kirti,

App is available on all major mobile platform. You should be able to get on Andriod phone. Can you tell me OS version and make of your phone?

Regards

Keshav

Very good information on epfo.

Thanks Pankaj

Very good information on epfo.

Thanks Pankaj