Table of Contents

Difference between PAN, TAN and TIN

Following table gives the differences between PAN, TAN, and TIN. These are explained later in detail.

| PARAMETER | PAN | TAN | TIN | |

| Full Form | Permanent Account Number | Tax Deduction Account Number | Taxpayer Identification Number | |

| Purpose | PAN acts as a universal identification code for financial transactions | Streamline deduction and collection of tax at source | Track VAT related activities in the country | |

| Who should own it | Every taxpayer/assessee | Every individual/entity who has to deduct or collect tax at source | Any dealer or trader who is liable to pay VAT | |

| How many can one own? | One | One | One | |

| How many digits? | 10 digit alphanumeric code | 10 digit alphanumeric code | 11 digit numeric code (first 2 digits are the state code) | |

| Format of number | The first 5 digits are alphabets representing various information, followed by 4 numbers and an alphabet | A TAN is composed of 4 alphabets, followed by 5 numbers, with an alphabet as the last digit | A TIN is composed of 11 numbers | |

| Issuing Agency | Income Tax Department | Income Tax Department | Commercial Tax Department of respective state | |

| Laws which account for it | Section 139 A of the IT Act of 1961 | Section 203A of Income Tax Act of 1961 | Different states have different Acts under which TIN is applicable | |

| Fines/Penalties | A penalty of Rs 10,000 can be imposed for failure to comply with the rules | A penalty of Rs 10,000 can be imposed for failure to comply with the rules | Penalties vary from state to state | |

| Form to be used for application | Form 49A (Indians), Form 49AA (Foreigners) | Form 49B | Forms vary from state to state | |

| Documents required to apply | Valid ID proof, address proof, photographs (in case of individuals) and proof of age (date of birth) | None. In case of online application the signed acknowledgement needs to be submitted | Proof of registration, PAN, ID proof of owner, etc. (documents required are likely to vary depending on the state in which an entity applies) | |

| Cost of applying | Rs.107 if the communication address is located inside India and Rs.989 if the address is outside India | Rs.55 plus service tax | Varies from state to state | |

What are PAN, TAN and TIN?

PAN or Permanent Account Number

A Permanent Account Number or PAN is a unique 10 digit alphanumeric code which is provided to every taxpayer or assessee in the country and Business, Individuals, Trusts, HUFs, Foreign Citizens and more. It is issued by the Income Tax Department. PAN is mainly used by the Income Tax Department to keep a check on financial transactions that could carry a taxable component. PAN is also an important form of identity. The following image shows the new PAN Card with QR. Our article What is PAN Card? discusses PAN card in detail.

Once obtained, PAN is valid throughout India and for the lifetime of the assessee. The PAN identity does not change even if the change involves address of the assessee or the assessing officer. However, any change in the details that were provided at the time of applying for the PAN, such as address, should be intimated to the department by furnishing the details in the form for Request For New PAN Card Or/ And Changes or Correction in PAN Data.

It is essential for every individual to have a PAN, if the income earned during the year is taxable, which means: Rs 2.5 lakh or more for individuals below the age of 60 years, or more than Rs 3 lakh for senior citizens (above 60 years of age) and Rs5 lakh or more for very senior citizens (above 80 years of age).

Besides that, any individual who is entitled to receive any income, after deduction of tax at source or who is liable to pay excise duty and so on, needs to have a PAN. Apart from that, for various cash transactions too, one has to furnish PAN or Form No. 60 if PAN is not available. In a recent move, the Central Board of Direct Taxes (CBDT) has made it mandatory for all account holders in banks and post offices to provide PAN or Form No. 60.

TAN or Tax Deduction and Collection Account Number

TAN is a unique 10 digit alphanumeric number related to deduction or collection of tax. All entities who deduct or collect tax must have a TAN, quoting it in their TDS or TCS documents. For instance, an employer who needs to deduct tax at source from employees’ income under section 192 of the Act, needs to have a TAN. Under section 203A of the Act, it is mandatory to quote TAN on all tax deducted at source (TDS) returns. If it is not quoted, TDS or tax collected at source (TCS) returns will not be accepted by Tax Information Network-Facilitation Centres (TIN-FCs) and the challans for TDS or TCS payments will not be accepted by banks. Failure to apply for TAN, or not quoting it in the specified documents, attracts a penalty of Rs 10,000.

According to the income tax rules, a property buyer has to deduct TDS at the rate of 1% of the property value if the property value is above Rs 50 lakh. In such cases, the property buyer does not have to acquire a TAN to do so. Instead, one can mention PAN while deducting and filing the TDS return. Our article Payment of TDS on Property and How to pay TDS on Property discusses paying TDS on property in detail.

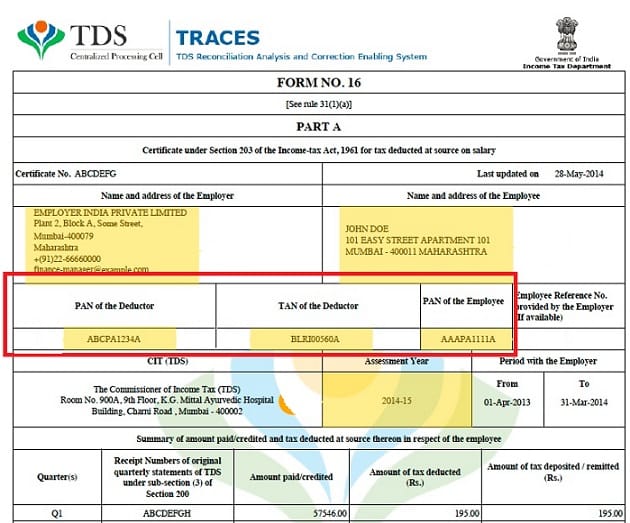

The following image shows the Form 16 of an employee which has PAN, TAN of the employer and PAN of the employee.

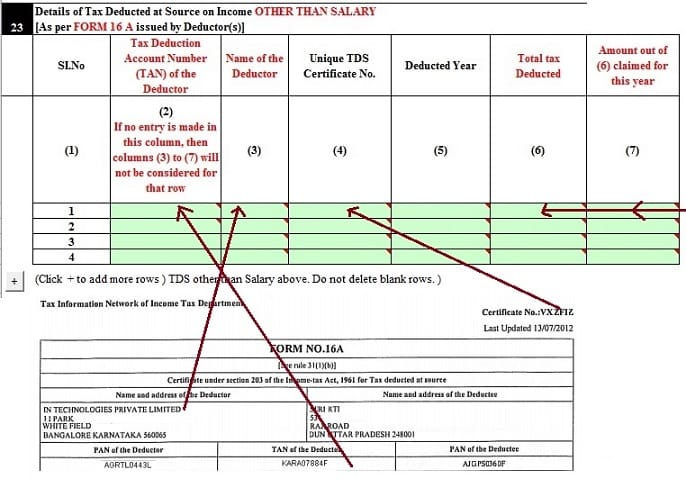

Following image shows PAN and TAN are used while filing ITR for Form 16A. Our article How to fill ITR1 for Income from Salary, House Property, TDS discusses filling ITR1 in detail

TIN or Taxpayer Identification Number

Taxpayer Identification Number or TIN is a unique 11 digit numeric code (first 2 digits are the state code) required for all entities that are registered under VAT. TIN number is used to identify dealers who are registered under VAT and it is also used for interstate sales done between two or more states. TIN is also known as VAT Number or CST Number or Sales Tax Number. TIN is a unique number that’s allotted by the Commercial Tax Department of each State Government.

TIN number or VAT registration is a must for businesses selling goods or products like manufactures, exporters, shopkeepers, dealers, ecommerce sellers selling goods, etc

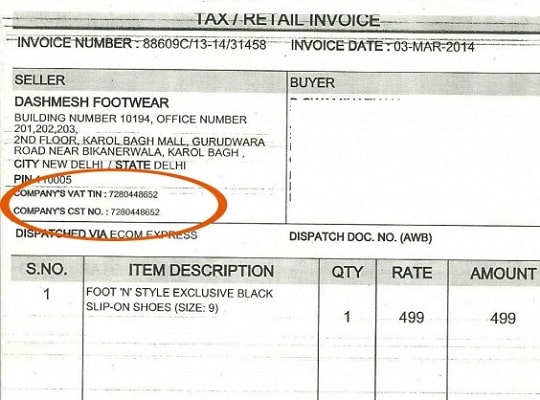

TAN is to be obtained by the person responsible to deduct tax, i.e., the deductor. In all the documents relating to TDS and all the correspondence with the Income-tax Department relating to TDS one has to quote his TAN. The following image shows a bill with TIN

- What is PAN Card?

- Aadhaar : What is Aadhaar, How to enrol,Check Aadhaar status,Download e Aadhaar

- Payment of TDS on Property

- How to pay TDS on Property

- How to fill ITR1 for Income from Salary, House Property, TDS

- Understanding Form 16: Chapter VI-A Deductions

Thanks for sharing this wonderful blog with us. It’s very easy to read I hope you share more blog on Lease Deed. That would be very helpful.

Thanks for Clearing my doubt in TAN and PAN. Its really easy to understand article i hope you post more blog like this. But can you guide me on how to apply TAN Registration Online