Fixed Deposit is one of the simplest and most used Investment product in India. This article covers FD (Fixed Deposits) in Detail.

Table of Contents

All about Fixed Deposits

For someone who does not want any kind of uncertainty with regard to his or her investments, Fixed Deposits is the right choice. But Banks have been reducing rates on Fixed Deposits

- The fixed deposit schemes offered by most banks can be availed for tenures ranging from as short as seven days to as long as 10 years. Few of the banks, such as the State Bank of Patiala, IDBI Bank, the Ratnakar Bank, etc. offer FDs that stretch to 20 years as well.

- The interest on FDs is compounded on a quarterly basis.

- PeriodicPayouts,, monthly or quarterly, are available.

- Most of the banks offer from 0.25% to 0.50% extra to senior citizens.

- Banks offer a higher interest for deposits of Rs. 1 crore and above. These deposits are called Bulk Deposits.

- Banks offer Loan/Overdraft against the amount available in Fixed Deposit. The interest is generally 0.5% to 1% more than that offered to FD.

- TDS (Tax deduction at source) at the rate of 10% is deducted if the interest income is more than Rs 10,000 in financial year per bank

- There might bea penalty for pre-mature withdrawal of Fixed Deposits

Lets Learn about Fixed Deposit Rates

- Best Fixed Deposit Interest Rates

- What is Fixed Deposit

- Fixed Deposit and Interest Rates

- Fixed Deposits ,Tax and TDS

YouTube video on Tax and Fixed Deposit

Our YouTube video Fixed Deposit, TDS on FD and how to show Interest income from FD in ITR, gives an overview of what is Fixed Deposit, how interest from FD is taxed as per income slab, when is TDS deducted on FD,how one can avoid TDS by filling Form 15G/H, how to show interest income from FD in ITR or income tax return

Best Fixed Deposit Rates

Best Fixed Deposit Rates over different periods of time are given below. Increased liquidity on the back of the rise in cash deposits by customers, due to the government’s demonetisation move.and Experts expect RBI to cut key rates. Interest rates of FDs could be headed further downwards. Our article covers Best Fixed Deposit Interest Rates, FD rates and FD interest of the major Banks like SBI, State Bank of India for period of 7 days-10 years giving FD interest rate of 5.25% p.a.-7.00% p.a.

| Period of the FD | Bank and Interest Rate |

| Less than a year |

|

| 1 year |

|

| 2 years |

|

| 3 years |

|

| 5 Years |

|

What is Fixed Deposit?

Fixed Deposits are bank deposits for a fixed or specified period chosen by investor or depositor at a fixed rate of interest. You can deposit money for as short a period as 7 days and upto 10 years. When you open a fixed deposit with the bank then you are lending money to the bank and it pays you interest. As interest rate and time period are fixed this investment product is called as Fixed Deposit. Deposit up to Rs 5 lakhs(earlier was 1 lakh) in any bank is protected under the Deposit Insurance & Credit Guarantee Scheme of India

Each bank or financial institution that is offering fixed deposits fixes its own deposit rates. Interest rates are subject to change from time to time. Interest of FD varies based on the time period, the amount which is deposited. Most of the banks offer higher interest rate(0.5% more) to Senior Citizens.

Our article Overview of Fixed Deposits covers fixed deposit in detail.

Fixed Deposit and Interest Rates

When you open a fixed deposit with the bank then you are lending money to the bank and it pays you interest. Interest on Fixed Deposit can be paid in two ways:

- Interest can be paid on a monthly basis or on a quarterly basis called the Traditional scheme or

- Reinvestment scheme or Cumulative Fixed Deposits where the interest is compounded to the principal amount on a quarterly basis and the interest is reinvested into the fixed deposit. So, after every quarter the principal increases by an amount earned as the interest in the last quarter. The invested amount along with interest is available only at maturity

Interest on FD = Maturity value – Principal.

TDS is deducted on FD if amount increases the threshold limit. Remember Interest earned on FD is considered as Income from Other Sources and is taxed as per your income tax slab.

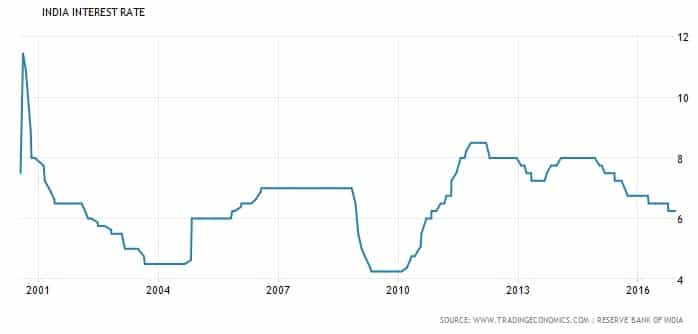

In India, Bank FD rates have fluctuated over the last 20 years. The interest rates in 1991-92 were 12% and decreased 4-5.25% in 2003 before increasing to 8.25% to 9% in 2010-11 and now are above 6%. The image below shows how interest rates have moved over a period of time. How do interest rates affect maturity value? Comparison of Deposit Interest Rates Worldwide, Difference between Interest Rate and Annual Percentage Yield, FD rates in India from 1991-92, Why do Fixed Deposit Rates change? Comparison of Fixed Deposit with Sensex are covered in our article Fixed Deposit and Interest Rates.

Fixed Deposits ,Tax and TDS

When you open a fixed deposit with a bank then you are lending money to the bank and it pays you interest. The applicable interest rate will be given as on the date of receipt of the funds by the bank and is fixed for the specified duration. And interest that is earned on fixed deposits is taxable in the hands of the depositor. Tax or TDS is deducted by the bank, after a threshold.

If the aggregate interest income from fixed deposits that you are likely to earn for all your deposits held in all branches(before 1 June 2015 it was per branch) is greater than Rs 10,000 in a financial year, you become liable for TDS. TDS on fixed deposits is deducted at the following rates for the following category of account holders:

| Type of Account Holders | TDS (%) |

| Resident Individuals, Sole Proprietorship, Trusts, Association of Persons,HUF under section 192 | 10% |

| Domestic Companies | 20.4% |

| NRO Deposits | 30.6% |

A consolidated TDS Certificate in Form 16A, for TDS deducted during a financial year will be issued in the month of April of the following financial year. TDS Certificate shall specify valid Permanent Account Number (PAN) of the deductee, valid Tax Deduction Number (TAN) of the branch, Challan identification Number and receipt No of the quarterly statement. It will also show up in your Form 26AS.

Tax liability is calculated on the first applicant’s name. Deposits held by minors are also subject to TDS. In this case the interest income will be clubbed under the income of the person in whose hands the minor’s income is included.

Investors often book fixed deposits in the name of non-earning family members such as spouse. The rule is that if the money is gifted to a non-earning member and the deposit is booked in his or her name, then the person has to submit a declaration saying his or her income is not taxable. However, when income tax is calculated, it will have to paid by the donor or earning member

If you believe that your total interest income for the year will not fall within overall taxable limits, you should inform the Bank not to deduct TDS on deposits by submitting Form 15G(if age less than 60 years)/ 15H(Senior Citizen)

Our article Fixed Deposits and Tax and FAQ on Tax and Fixed Deposits discuss the Tax, TDS on Fixed Deposits in detail.

- Premature withdrawal or Breaking of Fixed Deposit

- Best Fixed Deposits of Banks

- Senior Citizen,Fixed Deposits and Tax

- Joint Ownership

- Avoid TDS : Form 15G or Form 15H

- Methods of Accounting

- Fixed Deposit Calculator

Thank you for your wonderful comment! Your support and engagement mean the world to me.

Note of Issue Contested Divorce New York

Having ample fixed deposits during times of crisis is a godsend. The last year was pretty rough, but having few months of expenses stashed up in an FD is certainly good. But when it comes to long term saving or investing one cannot take such a conservative approach.

This is worth reading. However, I do have few blogs on finance and Insurance, please visit at http://www.thearticle111.com

Passion is something that makes a person alive. But, are you passionate about something.

If the answer is that you want to be a Banker or a Financer. We want to lead you to a great destination where you can learn the art of Banking and Finance. TKWsIBF promises to give the best knowledge possible to be successful in the Banking and Finance Industry.

Hurry Up! Enroll Now for the Best Banking and Finance Course in Delhi.

Hi,

Thank you for sharing such information.

Hey!

Its such an amazing post. Thanks for sharing.

Nice and detailed article.

Dear Sir,

Thanks for providing such nice and informative articles.

I wanted to know that, I got more than 15000 interest during current year.

That is earned from SBI short term FDs.

TDS is deducted from many of small FDs it is approx. 600 rs.

Do I need to shown this in ITR-1?, as tax is already deducted.

Many thanks in advance.

Best regards

Yes, whatever earnings/deductions you have made/caused to have made, shall need to be reported in the ITR.