- She won a gift voucher with 10 months validity.

- He paid the hotel bill when he checked out.

- You can settle the invoice by Direct Debit, credit card or debit card.

- Delivery of the free gift promoted with your subscription usually takes six weeks after the receipt of payment.

What is the difference between the words bill, voucher,invoice and receipt was asked by our reader Subin. It made me think on usage of these common terms. Thanks Subin for such interesting questions.

Bill : Bill is defined as a statement of fees or charges which contains the list of items along with their prices that is provided from the seller to the buyer regarding the products bought by the buyer.

Invoice : A commercial document that itemizes a transaction between a buyer and a seller. An invoice will usually include the quantity of purchase, price of goods and/or services, date, parties involved, unique invoice number, and tax information. If goods or services were purchased on credit, the invoice will usually specify the terms of the deal, and provide information on the available methods of payment. Ref Investopedia Definition of Invoice

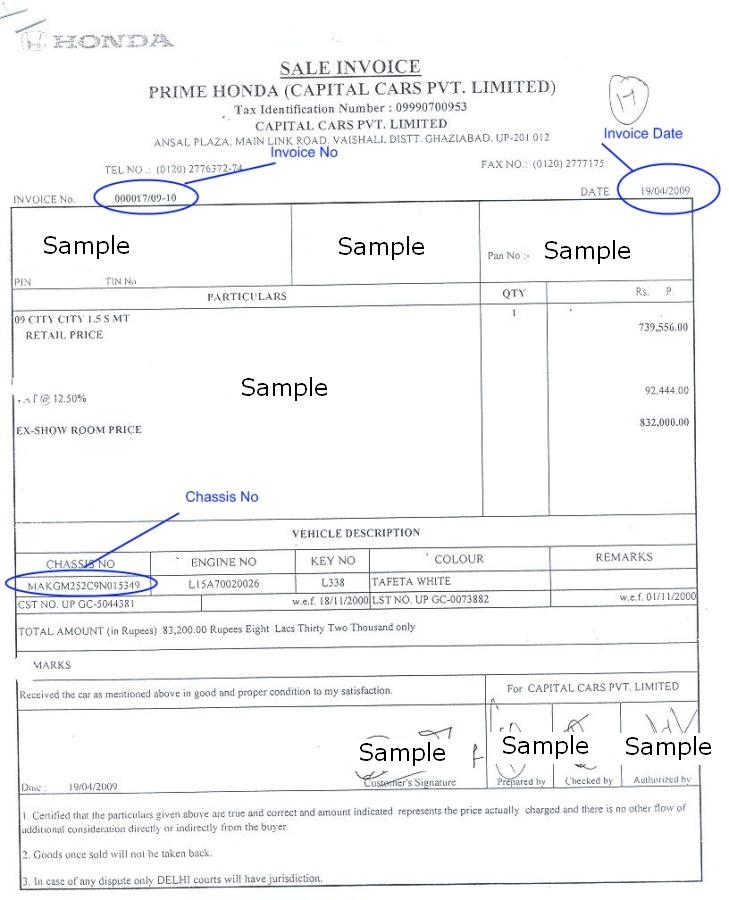

More or less Bill and Invoice carry the same meaning usually in terms of sale. A sales invoice, which is more popularly known as a bill is simply an itemized list of goods or services sold for which payment is due. However Invoice as a word is preferred in terms of business. However not all invoices are bills. A manufacturer may send out a shipping invoice, which details all the parts and accessories included in a particular order. This document should be compared to the actual parts received by the store or customer. Car dealers also receive an invoice from the factory that details the actual price of the basic vehicle and any optional equipment installed. The dealer may offer a discount to the customer which may be below the invoice price. Usually the term invoice indicates money is owed usually meant as We sent them an invoice and we are waiting for payment . Example of Bill and Sales Invoice for Honda Car from HondaCarIndia is given below (Click on image to enlarge)

|

In Rediff What is the difference between BILL and INVOICE? says

- A bill is issued against a sale of goods or service for which payment is settled there itself. An invoice is raised against a credit sale for which payment is settled later.

- Invoice is that document issued by the supplier to the customer with his best offered rates without negotiations. Bill is final document after all settlement on goods sold.

Invoice is temporary and can be changed as taxes can be implemented, discounts can be offered. Whereas Bill is permanent document which can’t be changed and have no duplicate identity i.e. there can’t two bills for same goods but there can be two or more invoices for same goods. So Invoice implies that deal is still under process and Bill implies that Deal is complete and final value of goods has been decided. Payment terms are also mentioned on the invoice stating how and when the buyer is expected to pay, or if the buyer has already paid money in advance. A due date is also mentioned indicating the number of days the buyer has to pay the money.

Unscrupulous companies may generate false invoices to account for missing funds or to inflate sales numbers. These bills or invoices are very important as it is a legal proof and can be challenged in case the things defined in the bills and what the customer gets from the seller, are not same. Similarly, if the payment is not received against the bill, then the seller can lodge a complaint against the buyer. The invoice is legal if corroborative evidence, such as inventory, duplicate bills, etc., proves the goods actually exist or the service was actually performed

Format of Sales Invoice or Bill

There is no prescribed format for issue of Invoice. However, the invoice or bill or challan should contain the following information (Rule 4A of the STR, 1994) from India Service Tax FAQ

- Serial number.

- Name, address and registration no. of the service provider.

- Name and address of the service receiver.

- Description, classification and value of taxable service being rendered.

- The amount of Service Tax payable (Service Tax and Education cess should be shown separately)

In respect of the taxable services relating to the transport of goods by road, provided by the Goods Transport Agency, the service provider should issue a consignment note details of which can be found at India Service Tax FAQ

Receipt

A receipt is a written or printed acknowledgment of the receipt of money or of the delivery of goods for which payment has been made. It is the proof of payment for goods delivered or services rendered, in contrast to a sales invoice, which simply indicates that payment is due for those goods or services. By law, all persons doing taxable business are mandated to issue duly registered receipts or invoices for each sale of merchandise or delivery of service. So customers may rightfully demand a receipt for every purchase that they make and for every service that they receive and pay for.

- A bill is a request for payment, while a receipt is the acknowledgment of payment received.

- A bill is presented when money is owed, while a receipt is given when an amount owing has been paid.

If you customer wants to know what he is paying for he should be able to read the invoice or bill which will have all the information about the transaction including quantity and description of the goods or service, price, additional charges including shipping and taxes, the total price and the payment terms. The receipt should show date of payment, method of payment, amount of payment and a reference to the invoice the payment relates to. It should also show any balance still due.

The difference between a receipt and an invoice only becomes significant when business owners report their taxable sales to tax department . The tax department looks at official receipts first because they are presumed to reflect all money received by the business establishment, thus showing its taxable sales. If business is suspected to be hiding or falsifying its official receipts in an attempt to avoid paying correct taxes, then the tax department will look into the establishment’s sales invoices to check into its transactions. If the sales invoices also appear to be falsified, then they will go directly to the establishment’s customers to find out how much business was actually transacted during the taxable

Voucher

In Accounting terms vouchers mean a document for recording transactions that serves to confirm or witness (vouch) for transaction. Commonly, a voucher is a document that shows goods have bought or services have been rendered, authorizes payment, and indicates the ledger account(s) in which these transactions have to be recorded. Software Tally has 16 different predefined voucher formats such as payment voucher is used for all types of payments, a receipt voucher for all types of money receipts, a sales voucher for recording sales transactions, and so on. But commonly by vouchers we mean following kind :

Gift vouchers which can be exchanged for goods or services up to their face value. When buying a gift voucher check the terms and conditions including the expiry date, what happens to any used part, and whether it can be used in every outlet if the shop is part of a chain. Try to buy vouchers that can be used at more than one outlet or chain and Use vouchers as quickly as possible

Discount voucher :A discount voucher is a type of financial discount incentive that is used by many retail situations to allow consumers to purchase goods and services at reduced prices. Vouchers of this type often come with voucher code, a simple alphanumeric sequence that can be scanned to ensure that the proper discount is applied to the purchase or coupon mentioning the discount.In many instances, a discount voucher must be used at a specific location, and follow all terms and conditions spelled in the voucher itself. For example, a restaurant may issue a discount voucher that provides a discount off the price of a pizza provided atleast a medium size pizza is ordered.

Hotel vouchers : Vouchers are used in the tourism sector primarily as proof of a named customer’s right to take a service at a specific time and place. Service providers collect them to return to the tour operator or travel agent that has sent that customer, to prove they have given the service. So, voucher works as follows :

- Customer receives vouchers from tour operator or travel agent for the services purchased

- Customer goes to vacation site and forwards the voucher to related provider and asks for the service to be provided

- Provider sends collected vouchers to the agent or operator that sends customers from time to time, and asks for payment for those services

- Uncollected vouchers do not deserve payment

It was customary before the information era when communication was limited and expensive. Now when a reservation is made through the internet, customers are often provided a voucher through email or a web site that can be printed. Providers customarily require this voucher be presented prior to providing the service along with identity proof

Related Articles :

- How Gold Ornament is Priced?

- Cheque: Clearing Process, CTS 2010

- It’s not what you earn that makes your financial position!

- Understanding Ex Showroom Price and On Road Price of Vehicle

- Cost of owning a Car

7 responses to “Bill,Invoice, Receipt and Voucher”

[…] Download Image More @ http://www.bemoneyaware.com […]

This article helped me a lot to complete my assignments on difference between voucher and invoice . Thank you.

I agree with you arya. The article is very helpful for online bills, Duplicate Bill, invoice and voucher.

Excellent work. Though very similar, you did good work on the nuance between a bill and an invoice. One question though:

STR mandates Reg.No of the service provider/dealer to be on the bill/invoice. In both the image-examples only the TIN is provided. Can TIN be interchangeably used for Reg No. ?

Thanks Subin. It seems that TIN and Registration number are same (We are looking for difference will update once/if we find it)

From What is TIN number and How to apply for Tin Number?

So, there is no difference in VAT/CST/TIN because these days only one number is needed for all type of sale you made. TIN number is called VAT number when it used for intra state sales. The same TIN number is being consider as CST number when it requires.

Excellent work. Though very similar, you did good work on the nuance between a bill and an invoice. One question though:

STR mandates Reg.No of the service provider/dealer to be on the bill/invoice. In both the image-examples only the TIN is provided. Can TIN be interchangeably used for Reg No. ?

Thanks Subin. It seems that TIN and Registration number are same (We are looking for difference will update once/if we find it)

From What is TIN number and How to apply for Tin Number?

So, there is no difference in VAT/CST/TIN because these days only one number is needed for all type of sale you made. TIN number is called VAT number when it used for intra state sales. The same TIN number is being consider as CST number when it requires.