Your Mutual Fund gives a return of 12%. Is it good or bad can only be known if we compare it to some standard or benchmark Benchmark is the standard against which the performance of a mutual fund is measured. Till Mar 2022 It was the fund house that determined the scheme’s benchmark index. In Apr 2022, AMFI has come up with a standard benchmark for mutual funds. Finally, there is uniformity in the benchmarks of the schemes. This article explains, what is BenchMark? List of BenchMark category wise by AMFI

Table of Contents

What is Benchmark?

Your Mutual Fund gives a return of 12%. Is it good or bad can only be known if we compare it to some standard or benchmark

There are various types of mutual funds, those that invest in stocks i.e equity and in bonds, etc i.e debt mutual funds. Even among Equity Mutual Funds are Large-cap, mid-cap, small-cap funds. The difference between small-cap, mid-cap, and large-cap mutual funds in India is in the type of companies they invest in and hence the risk and returns expected from these mutual funds. To know more about the Types of Funds you can read here

The funds are impacted by the rise and fall of the market which is tracked by using an Index such as Sensex or Nifty. How do you know that your Mutual Fund is doing good with respect to say Sensex or Nifty?

It’s like in a class one needed to know the average marks to know how well one has performed.

Benchmark is the standard against which the performance of a mutual fund is measured. Sensex and Nifty are some well-known benchmarks for large-company stocks. S&P BSE 200, CNX Midcap, CNX Smallcap, are some other benchmarks.

If a diversified equity fund, ABC, is benchmarked against the Sensex, then the returns of the ABC will be compared to the performance of the Sensex.

- Assume that the Sensex rises by 14% and your fund’s NAV(Net Asset Value) also grow by 12% in the same year, it means that your fund has outperformed the benchmark.

- But if the NAV of your funds had risen only 8% while the Sensex grew by 14%, it would mean that your fund underperformed its benchmark.

- If on the other hand the Sensex fell 10% and during the same period your fund’s NAV declined by 4%, it means that your fund outperformed the benchmark.

if your fund performs better than the Sensex then it means that it has outperformed the benchmark, and vice-versa.

All the benchmarks followed should be total return indices.

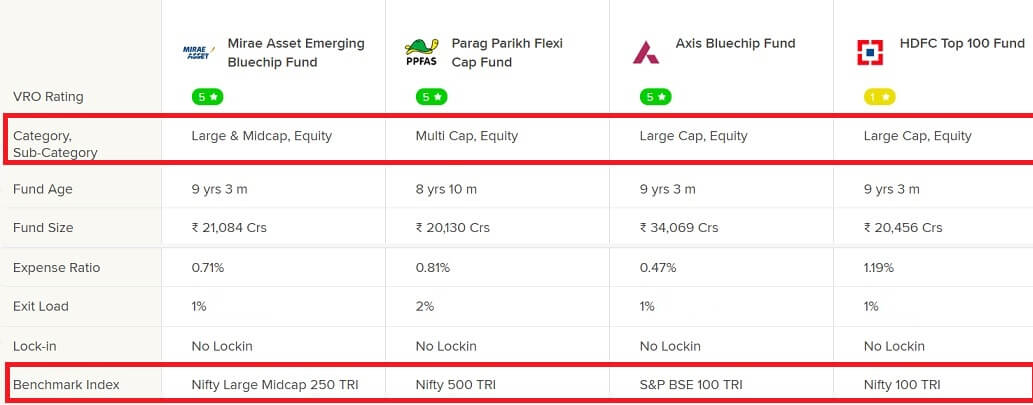

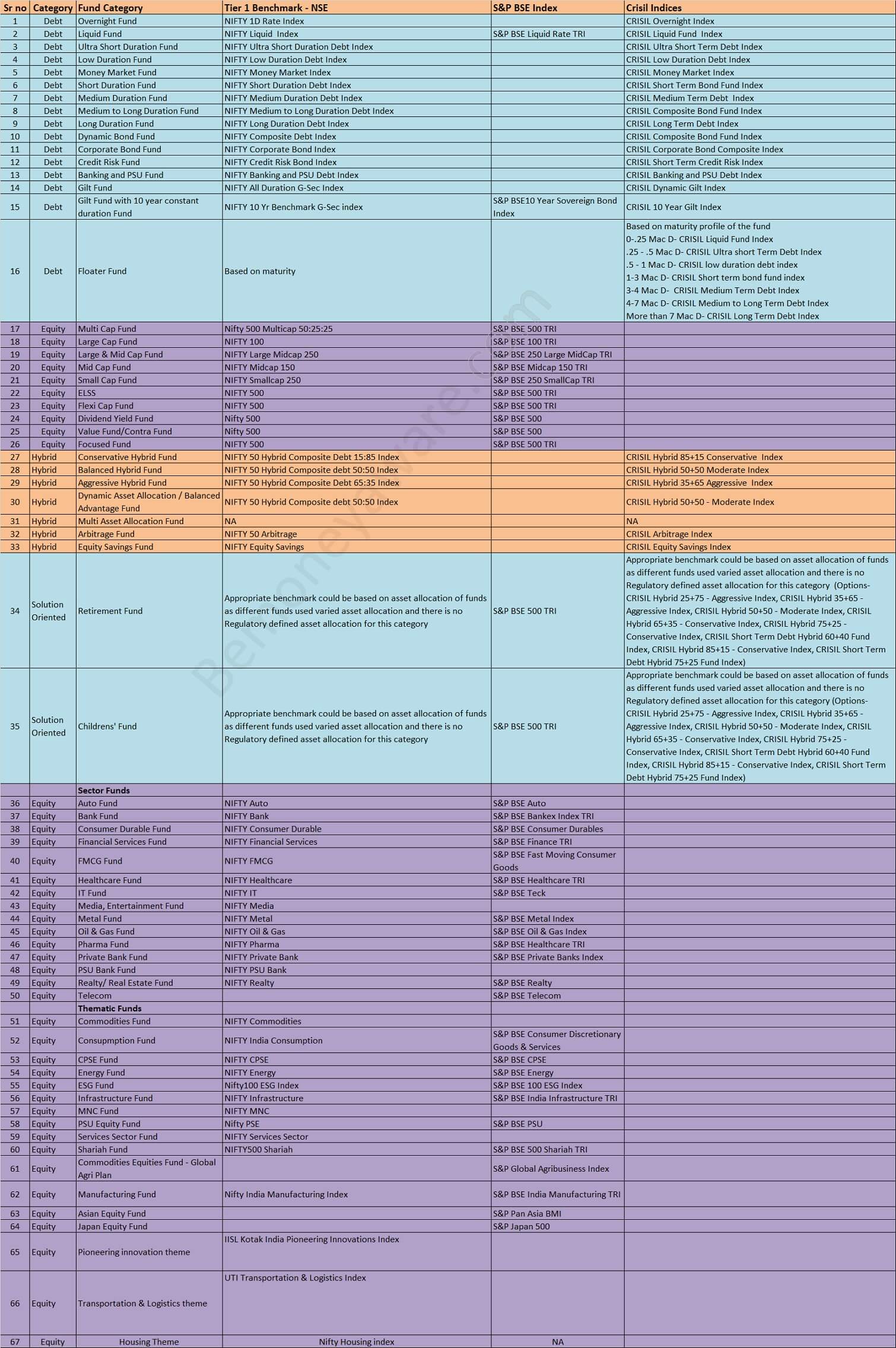

In India, as per the regulatory guidelines implemented by the Securities and Exchange Board of India (SEBI), the declaration of a benchmark index is mandatory. But till Apr 2022, a Mutual Fund scheme could choose its own benchmark as shown in the image below.

Standardized Benchmark for all categories

In India, as per the regulatory guidelines implemented by the Securities and Exchange Board of India (SEBI), the declaration of a benchmark index is mandatory. But till Apr 2022, a Mutual Fund scheme could choose its own benchmark as shown in the image below.

For example, fund managers might brag that their funds generated 14% returns when Sensex returned 11%. But is the Sensex an appropriate index to use? The fund actually invests in small-cap value stocks

In Apr 2022 Mutual Fund body AMFI(Association of Mutual Funds in India) has prescribed a new benchmarking system for mutual funds for each of their schemes in a bid to standardize and bring uniformity to the benchmarks.

Having a common category benchmark is useful for investors to make a relative performance comparison for funds within a category to a single benchmark which is typically representative of the broader investment universe for the category.

SEBI has mandated a two-tiered structure for benchmarking of schemes for certain categories of schemes.

- First-tier benchmark would be reflective of the category of the scheme,

- Second-tier benchmark would be demonstrative of the investment style and strategy of the fund manager within the category.

Funds can also benchmark themselves against a secondary benchmark which is representative of their investment style.

In Apr 2022, AMFI has listed out first-tier benchmarks for 67 types of mutual fund schemes. This includes categories of debt, equity, hybrid, and solution-oriented funds. For instance, a large-cap fund will have Nifty 100 as the tier one benchmark, while a mid-cap fund will have Nifty Midcap 150 as the benchmark.

Common Benchmark Indices within the same category would allow one to compare oranges to oranges and not apples to oranges.

The various benchmark Indices are given below.

Ratios associated with Benchmark Alpha and beta

Alpha and beta are tools that help in comparing the performance of a mutual fund against the benchmark. Alpha and Beta are used to calculate a mutual fund’s performance and stability with respect to the equity market. There are other ratios too for comparing

- Alpha measures the excess or deficit in a fund’s performance against a benchmark index.

- Beta is a measure of fluctuations in the fund against the fluctuations in a benchmark index.

Alpha

Alpha is the excess return on an investment after adjusting for market-related volatility and random fluctuations. Alpha indicates how the fund generated additional returns compared to a benchmark.

Let’s say if fund A benchmarks its returns with Nifty50 returns then alpha equal to 1.0 indicates the fund has beaten the nifty returns by 1%

so the higher the alpha, the better.

Alpha’s baseline is 0 in the case of mutual funds.

- If alpha is negative, then it indicates that the performance of the fund manager was underwhelming.

- If alpha is positive, then it suggests that the fund manager’s performance was overwhelming.

Beta

Beta is used to check how stable a mutual fund was when the markets were volatile.

Beta gives an idea about how volatile fund performance has been compared to similar funds in the market.

- If beta is 1, then it indicates that the mutual fund is showing the same variation as that of the benchmark index.

- If it is more than 1, then it suggests that the value of the fund changes in a much-pronounced manner when compared to the benchmark.

- If beta is less than 1, then it means that the variation in the fund value is lesser when compared to the benchmark index.

One would like to invest in a Mutual fund with a lower beta.

Lower beta implies the fund gives more predictable performance compared to similar funds in the market.

So if you are comparing 2 funds (let’s say Fund A and Fund B) in the same category. I

f Fund A and Fund B have given 9% returns in the last 3 years, but Fund A’s beta value is lower than Fund B.

So you can say that there is a higher chance that Fund A will continue giving similar returns in future also whereas Fund B returns may vary.

Related Articles:

All About Mutual Funds: Basics, Choosing, Paperwork, Direct Investing

Types of mutual funds: Are You Making Right Choice

What do you think of the common benchmark? Will this help you to select a mutual fund?