Health plans act as a protection in case of any unforeseen medical emergencies. These go long towards ensuring that you can focus on recovery and are not faced with a financial crunch during your illness. These plans help make quality health care affordable and accessible for you. Though most health insurance plans appear alike, there are certain distinctions, such as benefits, eligibility criteria, and limitations. Understanding these differences will help you make the right choice. One must ensure they choose a health plan that is within their financial budget to avoid cancellation of coverage due to non-payment of the premium amount. This article looks at How does Health insurance policy differ from Mediclaim? What to consider before buying a Health insurance policy? Gives overview of Key Features of Health Insurance Policy

A comprehensive Health insurance policy differs from mediclaim. The key feature of mediclaim is the coverage for hospitalization and treatment towards accident and pre-specified illnesses for a specific sum assured limit For filing a mediclaim, hospitalization is required. Health insurance covers the hospitalization expenses and also pre and post hospitalization expenses, compensation for the lost income and more.

Table of Contents

Ways to get best Health Insurance

Understanding your needs

The amount of your sum insured depends on your age and medical history. It also depends on the number of dependents you wish to cover. If you are planning to start a family, the health insurance should have an option for the same too. If the plan is for elderly people above 50, one should keep in mind the senior citizen terms of the policy too. Look particularly for illnesses and medical conditions common in the family, like diabetes or cancer for instance. Also, review the terms and conditions related to exceptions – i.e. illnesses not covered by the policy like pre-existing illnesses and so on.

One of the mistakes made when buying Health Insurance, s deciding the insurance coverage based on today’s costs and, whereas in reality, you are likely to make claims around 25 years from now Hospitalization costs today would be ranging from Rs. 50000 to Rs. 3 Lakhs. Assuming you are 30 today, at an modest average healthcare inflation of 7.5% for the next 20 years, single hospitalization bills will range at around Rs. 13 Lakhs when you are 50 years old.

Search and Compare Online

Information on various health insurance plans is widely available over the internet. There are also health insurance comparison websites which as the name indicates allow users to select health insurers and compare their plans and premiums for common parameters like age and dependents

Buying a policy online is often cheaper as the premium is comparatively lower when you buy a policy online as it is a direct transaction between the buyer and the seller.

You also save on the commission and other operational costs while buying a policy online.

Don’t go for lower premiums by compromising on features The policy which you choose should be worth the money. The policy should be such that it is able to cover maximum expenses during the time of hospitalization.

Understanding what is covered by the health insurance policy

Understanding terms like Rent limit, Copay, No Claim Bonus etc.

For example, If you do not raise any claim during the year, the company would certainly reward you with No Claim Bonus (NCB). The percentage of NCB differs from company to company as per their terms and conditions.Some companies may offer you a lesser amount of premium in the next year, while some may provide you more amount of coverage in the same amount of premium.

For instance: You have a policy of Rs 5 lakh but you do not raise any claim during the policy period of two years. In this case, supposing your insurer provides you NCB of 25 per cent, then your coverage amount may be increased to Rs 6.25 lakh on the same amount of premium you paid previously. This way, companies can provide you an incentive of not raising a claim and sticking to the same company for a long period.

Hospitals charges are different (for the same services) depending on the room type (General, Shared, Private, Deluxe, Super Deluxe etc.) you have chosen. Insurance companies therefore not only deduct the additional room charges over and above your eligibility but also proportionately deduct all other hospital charges that are linked to the room you have chosen

For instance, if the room rent eligibility in your policy is Rs. 4000 per day. In case you opt for a room with daily rent of Rs. 6000, all charges except for products with MRP would be proportionately reduced when the claim is paid.

Ex: One with Health Insurance of sum assured of Rs 4 lakhs with daily Rent limit of Rs 4000 takes up a room with daily limit of Rs 8000. Difference in hospital bill is as follows:

No. of Days Hospitalized: 5 Days

| Description | HOSPITAL BILL | HOW MUCH WOULD BE PAID? | PAYABLE AMOUNT EXPLAINED |

|---|---|---|---|

| Room Charges | Rs. 40,000 | Rs. 20,000 | As per eligibility 4000 per day X 5 Days |

| Surgery Costs | Rs. 1,00,000 | Rs.50,000 | Proportionate deduction |

| Doctor Visits | Rs. 5,500 | Rs. 2,750 | Proportionate deduction |

| Medical Tests | Rs. 4,500 | Rs. 2,250 | Proportionate deduction |

| Medicines | Rs. 10,000 | Rs. 10,000 | MRP product, hence no deduction |

| Total | Rs. 1,60,000 | Rs. 85,000 |

Go for comprehensive coverage of illnesses

When you are seeking the right insurance plan, go for a health cover that provides insurance against a large number of illnesses, particularly critical illnesses. It is just as important to review the list of exceptions – these are the diseases that the insurer will not cover. So your formula should be maximum coverage with minimal exceptions.

Network of Hospitals and Cashless

Look at the network hospitals and access to hospitals. The reachability to a hospital is a critical factor in cases of emergency. Any good Insurance company should have a host of network hospitals connected.

Under the cashless model, the medical bills are paid to the hospital directly by the insurance company The hospital pre-approves the medical procedure subject to a ceiling on the sum. Cashless facility is also critical as you would want to run around for arranging the money instead of being close to your loved ones. To use this facility while getting the admission in the network hospital contacting your insurance company’s Third Party Administrator, TPA, who in turn coordinates with the hospital and your insurance company to directly settle your medical bills.

Key Features of Health Insurance Policy

A comprehensive health insurance policy comes with many features such as

Cashless treatment – It is common that every health insurance company has few hospitals under its network. The benefit of theses hospital is that if you get admitted in these hospitals then you do not have to payout from your pocket. The insurer will be there to take care of it. You just need to tell your policy number and the rest of the things will be handled by insurer and hospital.

Pre and Post Hospitalization – It provides coverage on both pre and post hospitalization charges for a period of 30 to 60 days depending on the plan purchased.

Ambulance charges – By having this add- on features you do not have to worry about the transportation charges. It will be handled by the insurer.

No Claim Bonus –You get this benefit for every claim less year. It can be either an increment in the sum assured or a discount in premium.

Medical Check- Up – Free check up is provided by few insurance companies.

Co-Payment – in case of a treatment, some amount is paid by the insured and rest by the insurance company.

Tax Benefits – According to India’s tax system if you are paying a premium amount then you are liable to get tax refund under section 80D of Income Tax Act for a maximum value of Rs.25000 for Indians in the age group of 18 to 50 years and Rs.30000 for senior citizens.

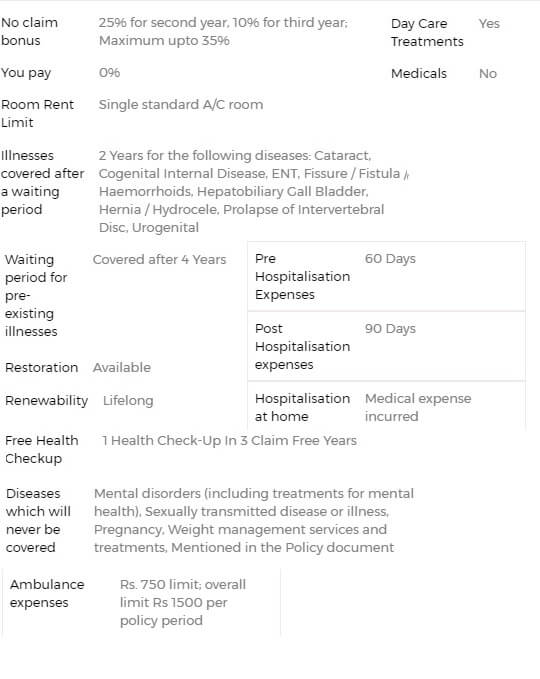

Example of a Health Insurance policy is shown in the image below

Related Articles:

Why one must buy insurance and types of insurance?

Health insurance needs are not a ‘one-size-fits-all’. So look at the coverage and quality of care that the plan provides and then select your Health Insurance Policy. Have you bought Health insurance policy? What did you consider?