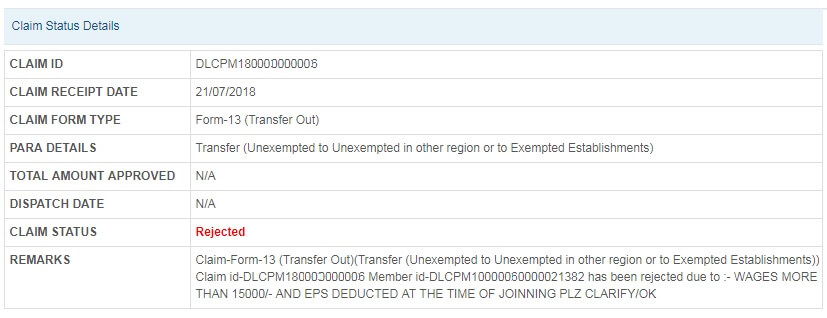

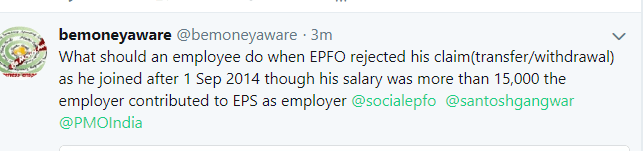

Many of our readers who started working after Sep 2014, have Basic wage above 15,000 and have applied for transfer of their EPF account or claimed their EPF withdrawal have faced rejection from EPFO as shown in the image below. What is the reason for the Rejection? What can be done about it?

Table of Contents

A solution for Salary more than 15,000 and EPF problem which might work?

Our reader, Jobin, has suggested a solution to the problem. His comment, given below, is reproduced here. Appreciate him sharing with all of us. Have raised it on Twitter here, Keeping my fingers crossed.

The Employee needs to follow up for no fault of his. Yes, it sucks but you need to fight out to get your money.

And For your next job make sure that your entire Employer contribution is going towards EPF. Do spread the message in your social media about the problem. You can also tag us at bemoneyaware.

The solution suggested by EPF is “You are advised to approach the employer for rectifying the same by submitting revised return to the EPFO for merging the EPS contribution to EPF”

Hello all,

I am also facing the issue in PF transfer due to the reason that my basic salary is above 15000 when I started the job. After running from pillar to post for around 2 years, finally, I found a solution for this issue. I would like to post the same here for the benefit of all. Request @Bemoneyaware to update in your article.

The solution is that

Step 1) the previous employer (who remitted EPS) has to sent a request to EPFO to merge both EPS and EPF accounts.

Step 2) The EPFO will be able to process the EPS and EPF merger based on this request

Step 3) Finally the member will have only EPF account. Then one will be able to transfer the EPF account to current employer.

Currently completed Step 1 and awaiting Step 2 to be completed.

You might have to follow up

Take the letter from the employer for rectification & submit it to the EPFO office for merging the accounts.

Continuously raise the grievances on the portal for this rectification. this will put some pressure on the EPFO office.

Still facing the issue, then simply raise the RTI application with detailed questions & ask for the reason for the delay. (RTI application fee is just Rs.10). They have to reply to the RTI within 30 days.

Understanding the EPS Contribution

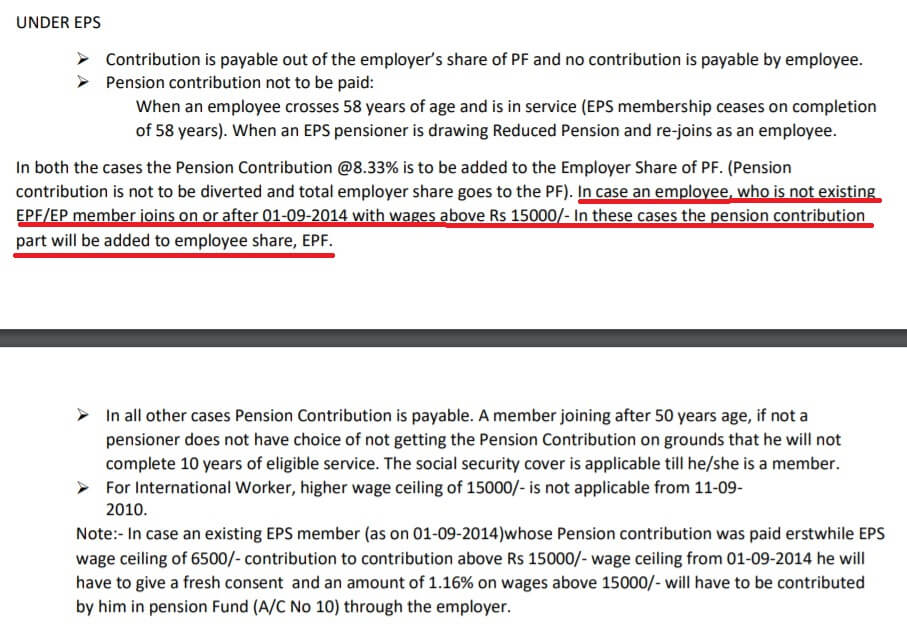

For new members joining the EPF scheme on or after 1 September 2014, the contribution is required to be made only under the PF and insurance scheme – as such employees are not eligible for membership under the pension scheme.

New EPF members enrolled on or after September 1, 2014, and having a salary of more than INR 15,000 month at the time of joining, will not become members of the EPS. Accordingly, the entire contribution of 24% (from the employee and employer) will go to the provident fund account of the employee. The image from the Document on EPF site is shown below

How the EPF, EPS Contribution is calculated

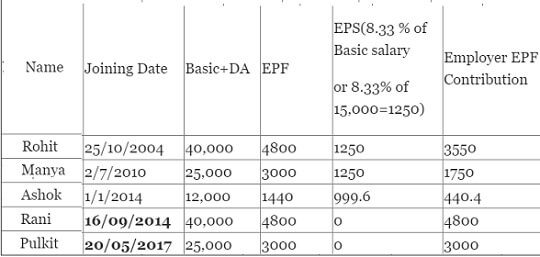

- 12% of Employee’s Basic and Dearness allowance goes to EPF.

- 8.33% of Employer contribution for Salary less than 15,000 and a maximum limit of 1250 goes towards EPS.

- Remaining 3.67% of Employer contribution goes to EPF.

- If Employee Basic and DA are more than 15,000 then entire Employer contribution should go to EPF.

The following table shows the EPF, EPS Contribution for employees who joined before and after 1 Sep 2014 and have a Basic salary more than 15,000

Who is at fault for EPS contribution for Employee with Basic more than 15,000?

Both employer and EPFO.

But also the employee, because

- he faces the problem during Transfer or Withdrawal

- and misses out the interest also as some part of his salary, is diverted to EPS which does not earn interest.

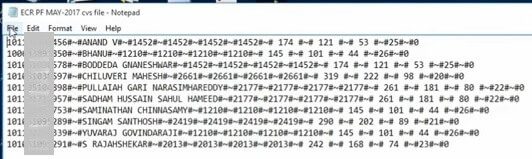

Employer and EPFO both know the joining date of the employee in the company. The Challan which employer submits to EPFO has UAN number, Name of Employee, Basic Wage and EPF calculation as shown in the image below. But it does not have the joining date.

Video of Employer generating EPF Challan

The Video below shows how does employer makes ECR Challan, Uploads it in EPF website for Employer.

What can be done once Employee realizes that there is EPS Contribution?

The Employee needs to follow up for no fault of his. Yes, it sucks but you need to fight out to get your money. For your next job make sure that your entire Employer contribution is going towards EPF

We are looking for the solution, are in talks with many EPF consultants. Some of the solutions by our readers that have met some success are given below. We appreciate the efforts of our readers, Jobin & Yash. If you have found any other workable solution do let us know.

The solution suggested is “You are advised to approach the employer for rectifying the same by submitting revised return to the EPFO for merging the EPS contribution to EPF”

Step 1) the previous employer (who remitted EPS) has to send a request to EPFO to merge both EPS and EPF accounts.

Step 2) The EPFO will be able to process the EPS and EPF merger based on this request

Step 3) Finally the member will have only an EPF account. Then one will be able to transfer the EPF account to the current employer.

You might have to follow

Take the letter from the employer for rectification & submit it to the EPFO office for merging the accounts.

Continuously raise the grievances on the portal for this rectification. this will put some pressure on the EPFO office.

Still facing the issue, then simply raise the RTI application with detailed questions & ask for the reason for the delay. (RTI application fee is just Rs.10). They have to reply the RTI within 30 days.

We have raised this issue with EPFO on social media. We have added it in our Change.org petition. Will keep people updated.

If you have a suggestion please do let us know.

What you can do,

For your next job make sure that your entire Employer contribution is going towards EPF

- Raise EPF grievance for your issue. Our article How to register EPF complaint at EPF Grievance website online

- Raise it on Social Media of EPFO

150 responses to “Basic Salary More than 15000,EPS Contribution,Rejection of Transfer or EPF Claim”

Hi Sir,

I have applied Form 19 for full settlement on May 2023. It got rejected 5 times, saying multiple times.

1) verification of high value claim confirmation not received on letter head by the employer and verification not received by the bank

2) PHOTOCOPY OF BANK PASSBOOK NOT ATTESTED BY THE AUTHORIZED SIGNATORY

3) FORM 15 G / 15H, PAN CARD NOT SUBMITTED BY MEMBER

4) UAN CLAIM ¿ CANCELLED CHEQUE NOT AS PER KYC BANK DETAILS

Point 1: Company gave wrong exit date and amount of mine. I communicated the same to the employer. This is a fault.

Point 2: I have attached a proper cheque with (Name, Acc No and IFSC code). Why the EPFO is asking for the Passbook? Either cheque or passbook is enough rite? EPFO online portal has only max 500 KB attachment limit, can’t attach both the images.

Point 3: Why is EPFO asking for the FORM 15G, when my PF account is more than 10 years. As per rules >5 years, it is not mandatory rite?

Point 4: Cheque is exactly as per Bank KYC details, then why this rejection reason?

Could you please help me in this regard sir?

I am currently working in 4th company and i didnt transfer all my previous 3 Pf to current company. So i have tried to transfer my 3rd company which is previous one to current company through online transfer and it got rejected two times with the below reason.

1. Wages More than 15000 wages, pension amount paid Till date of Exit.

2. Father name differs

I have tried to contact my previous employment multiple times and simply said no mistake from our end and nothing can be done from my end. But i have replied back to the Previous company stating that If whoever joins after 2014 sep and wages more than 15000 needs to submit FORM 3A and to merge the EPS to EPF. Then they gave clarification like below

“As per PF act member who joined before 01/Sep/2014 and their wage could be any thing they are eligible for EPS.

Member who joins after 01/Sep/2014 and their PF Wage(Basic wage) is less than 15000 they are eligible for EPS(Pension).

Member who joins after 01/Sep/2014 and their PF Wage(Basic wage) is more than 15000 they are not eligible for EPS (Pension).

If the member joins before 01/Sep/2014 if they withdraw the pension(FORM 10C) they are service got closed, and if person joined any company from there, their service will be counted and if this person wage is less than 15K again they will eligible or else they will be considered as non EPS.

Note: in your case your first service is started in 01-NOV-2018 and first PF wage is 15000 so your eligible for EPS and as per your declaration we have paid the EPS . if any transfer in came in our company then you will be considered as eps as PF record they can see only one account in their ledger so they considered your service as first service, if you made any previous transfer to our company they can see the details in their record(Which is actually not possible for transfer right now because our company is not your active or present account).

For this we need to submit your form 11 and clarification letter as your eligible for EPS since from your first service and your joining wage is 15000 only.

I have requested to goahead with FORM 11 along with clarification letter and now my question is ” Based on my First Company PF passbook, EPF Wages mentioned as 15000, that means i am eligible for Pension right and after that EPF wages were more than 15000 then all companies paid to Pension till the current company.

Now the previous company submit FORM 11 is right option to choose instead of submit 3A since i am eligible for Pension account. Please confirm. Now my previous stating one point that “if we submitted FORM 11 you will be considered as NON EPS member in our company and you can transfer it to present account and in future your claims will be rejected due to this reason at the time you need to submit FORM 3A to bifurcate the EPS which is your trying to merge now”. What exactly this point meaning and do i face the same issue transfer my first & second company PF transfer to current company, do i need to ask them to send Revised FORM 11 to EPFO same as the immediate previous company following.”

Please confirm and clarify my queries and following up with so many people no one is giving proper information.

1. In passbook, if EPF wages shows 15000 in first company, AM I eligible to EPS ? Even current wages are more than 15000, EPS is deducted so is that fine later to transfer or withdraw?

2. How to transfer my first & second company PF transfer to current company? is the issue observes again with same rejection reason?

3. To correct Father Name, joint declaration form is enough to submit through Current company or Do i need to submit joint declaration form from both companies(Previous & current)

Hello sir, while I changed the company I transfered through online

And it was rejected for below reason:

“EPS CONTRIBUTIONS MERGED PLEASE CLARIFY 2) FATHERs NAME DIFFERS”

When contacted PF office via email they mentioned as stated below:

“Your transfer in received with EPS service from previous office. But current employer merged EPS with PF. Therefore claim was rejected seeking clarification for the same”.

Pls guide me whom to contact and get my problem resolved.

Please acknowledge my request.

I request you to please mention the which PF office

Hello,

This is my experience with RTI filing of PF transfer which was rejected for >15000/- WAGES. CHECK FOR ELIGIBILITY OF MEMBERSHIP UNDER EPS 1995 2) FATHERs NAME DIFFERS.

Initially, I raised a request online for PF Transfer. I was trying to transfer PF from my past employer which was from unexempted employer to an exempted employer. It got rejected.

So when visited the PF office personally and asked reason for rejection, I was asked to submit a clarification from my past company on the Past Company letter head stating the reason why Employee EPS share was paid to Employer EPS share along with the attested PF Passbook statement from my past company. I visited my past employer office and My Past employer has given clarification stating that it was done by mistake. So I got the clarification document from my past employer on the company letter head and also go attested the PF Passbook statement. This time I have placed the transfer request manually using Form 13 along with the above mentioned documents. So, when I submitted these documents manually, the PF office has marked an ink stamp on the clarification letter which I got from my past employer stating that they have received the documents. I HAVE TAKEN A PHOTO OF THIS INK STAMPED DOCUMENT AS A PROOF THAT PF OFFICE HAS RECEIVED THIS DOCUMENT(LATER THIS DOCUMENT WAS USEFUL FOR RAISING AN RTI AS A PROOF). I was mentioned that this time the PF transfer would be successful. I was with lot of hope that the transfer would be done but after 1 week, the transfer was rejected with the same above reason.

So I visited the PF office again and when enquired, got the reply that the documents need to be verified by PF commissioner and it would take 2-3 weeks for the process to be done and asked me to raise a claim request after one month. So I waited for another 1 month and raised the request again. This time also PF got rejected mentioning the same above reason. I went to the PF office again and this time they asked me to submit the Past Employer’s Offer letter and first two months of salary slips attested from my past employer again. So again got the Past Employment Offer letter and two salary slips attested and submitted the documents again and waited for 45 days. Then I raised the transfer request again and this time also PF transfer got rejected mentioning the same reason. So I visited the PF office again and they said that the offer letter and salary slips need to be approved by PF Commissioner and asked me to wait for another 45 days. After 45 days I again raised a request and again it got rejected with same reason. Then again after every month for 2 times I raised the transfer request and again it was rejected. By this time I got sure that this request would not work.

So finally I raised an RTI along with the ink stamped document attached to the RTI. I thought my pf transfer would be completed in 2-3 days as mentioned by others here but it took 2-3 days for the RTI to be assigned to the correct PF office. Then for 1 week there was no change in the status of the RTI. Later it got assigned to an associate. Then for another next 1 week there was no change in the status. I thought that there is no use in filing RTI. But after two days I got a reply from the PF commissioner stating that they have merged the EPS and EPF account and I can raise the online transfer request again. So again I raised the request. I thought my PF would be transferred. But after couple of days when I looked at the status, again it was rejected. So again I went to the PF office and said that I have filed and RTI and got reply from PF commissioner stating that the EPF accounts were merged and showed the RTI reply doucment asked the reason for rejection. They said the transfer was rejected due to bulk upload and asked me to raise to the request again. So by now I have lost all hopes of PF transfer. I thought lets file another RTI file another mentioning that my PF transfer still got rejected even though it was mentioned in my first RTI that the PF accounts got merged. So I filed second RTI stating that even though it was mentioned in the first RTI that I can file transfer again, it got rejected and asked them if the PF office has really merged the EPS and EPF account. As usual, it took 2-3 days for the the second RTI to be assigned to the concerned PF Office. But this time this second RTI got assigned to a wrong PF office. And for next 10 days there was no response on the second RTI. I thought the RTI has lost its power. During this time, I did not know what to do. I was thinking the reason for transfer rejection after first RTI was bulk upload, so I thought, this time I will try a bit different. This time I would raise the request again, and instead of getting the online transfer request getting attested through my current employer, this time I have selected the option of getting the transfer request attested through my past employer in the online transfer. So I have raised the online transfer request again. Now coming to the 2nd RTI request, after 14 days, I got a call from the PF office stating that the RTI was assigned to a wrong PF office and they has assigned it to the correct PF office. Now, I thought that it would take another 14 days for the reply. So I felt that lets look at the status of the PF transfer filed again. And when I checked the status of the PF transfer which I asked for attestation through my past employer, this time the PF got transferred. WhoHooooooooo! I was very happy! And after two days when I looked at the status of the 2nd RTI, I got a reply again from the PF office stating that they have rejected due to oversight and they have mentioned that this time the transfer is approved and also provided me an Annexure K.

So, based on my experience I feel that RTI still works. So, as mentioned by others here, it will not be completed in 2-3 days. I may take a bit longer or even less time. But finally it will work. So guys, have trust and keep trying. Its your hard earned money. All the Best!

Thanks for sharing.

Thanks for sharing. Can you please share the clarification letter from your past employer for merging pension account with epf. It would be helpful for me.

Could you please help me in know total of how much time it took for you to get pf transferred?

For me my previous employer is taking months of time providing clarification only they asked for updated form 11 for merging epf and eps . Will i have to do all this. Or my company will take care of if as they asked for updated form 11 to updated from their side?

Hi

Very nicely written ….

for my case … I joined my first company A in March 2015 with basic salary more than 15k monthly then I joined B, C and D companies … All of them were contributing to my EPS.

I could transfer all my funds from

A to B then B to C companies

Now My funds are with C’s PF account and D’s PF account.

When I placed PF transfer request from C to D , it failed due to above said error (Contribution in eps after 2014 with salary more than 15k, please clarify)

Now My questions are

1) All A, B, C and D were contributing wrongly ?

2) Why my previous transfers were accepted/allowed but only recent/last transfer request was rejected ?

3) Now as per solution I need to request employer C for a merger of EPS into EPF … Do I also need to request merger to A and B companies as well ? or only to C company, that will merger all my EPS funds from A and B companies as well)

4) Once EPF is transferred from one company to another company what happens to EPS. Does it also get transferred ? Who owns that EPS, whom to request for the merger of that EPS fund.

Please help ..

Thanks in advance

How to make merger request ?

Or can I claim entire EPS amount and close my EPS account ?

I am Kannan, Joined company xxx in Aug 2012 with a salary of 10k/month and I moved on to the second company in the year 2017 August and the third company in Aug 2018. In all three companies, I had both PF/EPS contributions.

Instead of transferring my first company PF/EPS, I had withdrawn both the amount and due to which my service history is erased. While trying to transfer PF from a second to a third company, it is rejected due to my wages being more than 15000 and I am not eligible for the pension contribution.

I have spoken with my current employer regarding this and stopped pension contribution and they are in the process of submitting revised form 3A to the EPFO to transfer pension contribution to the PF.

But my second company is not responding to this issue, how can I get my service history transferred from second to the third employer.

Was the second company an EPFO trust?

If not, then you can submit the transfer request to your 3rd employer

Go through our article http://bemoneyaware.com/why-transfer-old-epf-account-new-account/ for more details

My joining year of first company was 2011 and had withdrawn the EPF amount completely. When i joined third company during 2016 i had received new UAN number and now am trying to transfer the EPF amount from third to fourth company EPFO rejecting the transfer claim with the same reason of Wages more than 15k not eligible for pension contribution . I think due to the UAN number changes impacting my transfer.

In this case, what action can i take from my end? ( Because am still eligible for pension contribution and joining year was 2011) but i need to prove EPFO officers.

Which year did you join second company?

Were EPS contribution made in the second company?

Please check your EPF passbook of different companies.

For pension check our article http://bemoneyaware.com/eps/ for details

Yes, my second company is a trust. They had transferred the PF amount but not able to transfer the service history.

What does your EPF passbook say?

Claim Rejected NON EPS MEMBER

What should I do after this now?

Which claim have you made?

Did you try claiming a Pension?

Are you contributing to Pension? Is your basic more than 15,000

My joining date is post Sep 2014 with basic pay more than 15k. My previous employer correctly made entire contribution to EPF only as explained above, but my current employer has made the mistake for contributing to EPS along with EPF. Still my transfer claim from previous to current employer got rejected from same reason.

What’s the solution in this case?

Hi Team

My PF transfer from 2nd employer to 3rd got rejected with comments “Your Claim [ Claim Id – ******** ] has been rejected due to : 1) WAGES MORE THEN 15000/- NOT ELIGIBLE PENSION 2) FATHERs NAME DIFFERS

I started my career with my 1st employer, post sept 2014 with basic salary less than 15k and PF transfer from 1st to 2nd employer had no issues.

With the 2nd employer the basic pay was more than 15k.

When I connected with my 2nd employer(2nd) to submit the clarification letter regarding the EPS amount contributed in the pf account, he is asking me to get the PF statement in month-wise format from 1st company. My 1st company has exempted trust and their std PF statement format is in annual format for ex-employees, hence they refused to share the statement in monthly wise.

Now my 2nd employer is saying that without verifying the monthly-wise PF statement from my 1st company, he can’t proceed further as PF remittance are correctly remitted from him.

What actions I can take next?

When i raised a form 19 to close my pf it was rejected given the reason The member is getting higher wages pl furnishe any previous employment .. what does this mean..

When did you start working? Before or After 1 Sep 2014.

Was your basic wage more than 15,000 per month

Was EPS deducted?

After 1st September 2014 PF Department said if any person starts his new job with a salary more than Rs. 15000 then his pension contribution would be nil

Take the letter from the employer for rectification & submit it to the EPFO office for merging the accounts. Do we have a format for the letter ?

No I don’t have it,

I have asked Labour Law Advisor who are experts in EPF.

This is for having Basic above 15K right?

Hi Sir

I am facing a similar issue as well and need your help to get this done.

My 1st job – Started in 2010 ; left in Feb 2014 – I was getting both pf and eps. I claimed both amounts and went to study MBA and hence did not work for 3 years.

2nd Job – Joined June 2017 ; Resigned April 2021 – I was getting both PF and EPS.

3rd Job – Joined April 2021 – I am only getting PF and no EPS

My transfer claims are getting rejected twice now. What could be done. Please help

What are the reasons for rejection?

Hi,

My claim is rejected with below reason, please could you help how to fix it ?

Your Claim [ Claim Id – KDMAL220150109839 ] has been rejected due to : 1) WAGE IS MORE THAN 15000 BUT PENSION CONTRIBUTION GIVEN, REVIESE ECR 2) FATHERs NAME DIFFERS 3) CLAIM ALREADY SETTLED

OMG, are they asking you to choose one of options?

Which claim have you applied for : Withdrawal or Transfer?

Let’s see the problems one by one

1. Did you join after 1 Sep 2014 with a basic of more than Rs 15,000 then your employer should have not deducted the EPS.

Check your passbook and talk to your employer to revise the return

Read our article Basic Salary More than 15000,EPS Contribution,Rejection of Transfer or EPF Claim for more details.

2. File a EPF complaint to know the FATHER’s NAME as per EPFO records

3. Check your claim history &/passbook

How to file EPF complaint is explained here

My claim was rejected and the reason cited was: “Claim Rejected DATE OF JOINING AFTER 01/09/2014 WAGES ARE MORE THAN 15000/- STILL EPS CONTRIBUTION IS DEDUCTED”

My DOJ EPF and DOJ EPS is 14/03/2013. This is reflecting correctly on the EPFO portal. As per Passbook, Pension contribution was being deducted since April 2013.

I’m not sure why the claim was rejected, as per my interpretation it should not have been. Appreciate any assistance you can provide. I have migrated and I am overseas at the moment and need to get this sorted asap. Please help.

What does your Service History show?

Did you change the job and did not transfer the EPF?

My claim is getting due to the same EPS issue. My basic salary was 15000 when I joined my first organization. As per the company I should be eligible for EPS but still the claim for transfer is getting rejected with the below reason Wages > 15000 but still member of EPS.

I am not getting any proper response after raising grievance multiple times. Any idea on how to resolve this ?

My PF transfer rejected due to below error

1)Higher wages still eps deducted 2) fathers name differs

Kindly suggest what should I do for transfer my money in my current EPF account.

Sad to hear

Please check with your old employer

Did you start working after Sep 2014 and is your Basic more than 15,000

PF Transfer has been rejected with the below reason

1) WAGES MORE THAN 15000/- SUBMIT SALARY SLIPS 1st 2) FATHERs NAME DIFFERS

Please advise on what I need to do. My previous employer is also not responding.

Currently I have 2 UAN and the latest UAN does not show the service history of the previous UAN. I have already claimed the PF amount from the previous UAN. I want to deactivate the old UAN and transfer / update service history from the previous UAN to the current UAN. I have recently did a transfer request but it got rejected. (Remarks : has been rejected due to : 1) FORM 19 AND 10C ALREADY SETTLED ON 05/2016 2) CLAIM ALREADY SETTLED).

I have sent email to employeefeedback@epfindia.gov.in but no response. can you please suggest what to do?

Have you withdrawn the Pension fund also?

The EPFO message says that Form 10C and Form 19 are already settled.

Hi ,

I was having two uan number with two different pf accounts attached to respective uan. let’s say uan A with pf1 account and uan B with pf 2 account. later on pf3 account added to uan B(so 2 pf accounts pf2, pf3 in uan B), later on i have transferred pf1 into pf3 account which got successfully transferred(But pension contribution is showing as zero, rest all transferred successfully with pf and interest both.

Now i am trying to transfer pf2 account into recent pf3 account. but it got rejected due to following message from epfo “1) PRESENTLY YOUR ARE NOT EPS MEMBER(ABOVE 15000/-), IF ANY PREVIOUS SERVICE TRANSFER IT TO THIS PF A/C 2) CLAIM ALREADY SETTLED”.

FYI, i have joined pf2 account company on 23 feb 2016 and there is no eps deduction , only two deductions are there employee and employer amount which is same and also in pf3(recent) account there is no eps deduction too, same as pf2.

Also, FYI in pf1 account yes there was eps deduction along with employer and employee pf deductions and it got transferred successfully into pf3. but now i am not able to tranfer pf2 account into pf3 account which is under same UAN account(eg: uan B)

Please help me to sort out the above error message. i really need money due to some emergency and i came to know that you have to transfer all pf accounts into one to withdraw the complete money. Please suggest the solution ASAP. Waiting for your reply. Thanks in advance.

HI ,

My PF transfer request got rejected for below reASON

New:UAN

DOJ:Feb 2016

Your Claim [ Claim Id – PYBOM210850103109 ] has been rejected due to : 1) ERRONIOUS EPS CONTRIBUTION. NOT A EPS MEMBER AS WAGE EXCEEDS 15000 ON THE DATE OF JOINING 2) CLAIM ALREADY SETTLED

i am already eps member from 2012 from my first company but this account was part of old UAN and i tranfered this amount to current new UAN.

1.can i be member of EPS? still the rejection is correct or not? Please help me with solsution. Thanks!

Is your current employer deducting EPS or not?

If you have joined before Sep 2014 you can contribute to EPS else not.

Claim Rejected WAGE EXCEEDS 15000 NOT A EPS MEMBER. EMPLOYER TO CLARIFY THE SAME.

this employee joined before sept 2014

pls suggest to cllose the issue

My first employer has opened my EPS account even when wage was more than 15000. After several follow-ups and requests, my EPS contribution has been transferred to the EPF account (employer contribution) but without interest.

Since I was unaware of this issue, so I continued this EPS account in my second employment. The 2nd employer is a trust, not unexempted institution. So what process shall I follow if I want to transfer EPS contribution to the trust

Whether it is unexempted or a trust EPS money goes to EPFO.

You need to inform your employer and follow the process with them again.

They would have you refile the Challan with corrections

Ok, Thanks. I will follow up with them.

My PF claim got rejected for below-

1)PLEASE FORWARD PREVIOUS EPS SERVICE DETAILS FROM KN/WFF/3575066/1015977

2) Wages more than 15 T

Please help is there any solution?

New EPF members enrolled on or after September 1, 2014, and having a salary of more than INR 15,000 a month at the time of joining, will not become members of the EPS. Accordingly, the entire contribution of 24% (from the employee and employer) will go to the provident fund account of the employee.

So is your salary more than 15,000?

Is the contribution being done for EPS?

Please check your passbook.

Then talk to your employer as explained in http://bemoneyaware.com/view-epf-uan-passbook/

Hello sir,

My past employer has contributed entirely to EPF for first 5 months, then to both PF and pension for next 6 months, then to PF alone for the next 3 months. My basic above 15000 for the entire duration of employment in that company. The transfer was rejected saying “PENSION CONTRIBUTION NOT RECEIVED”

What type of letter should I get from the employer to correct this ? Is Form 3A needed ? Kindly help. Earlier, they rejected due to some other reason and I followed up and corrected it. Now, I have got this reason. Your guidance will help to explain to my employer as it is a small company.

Is this your first company or were you contributing to EPF before Sep 2014?

Check with your employer why is he not sticking to one method

Thanks for the reply Sir. This was my 2nd company. 1st company started deducting PF since Dec 2014 only. Is a letter from them sufficient to make this correction ?

My pf transfer claim is getting rejected frequently saying that EPS MERGED WITH EMPLOYER SHARE.CLARIFY

What should I do. Kindly help me to resolve this issue.

Thanks

When did you join the company?

Was it after 1 Sep 2014?

Was your basic salary more than 15,000?

Check your EPF passbook and see if their EPS contribution or not.

Send the picture of the EPF passbook to bemoneyaware@gmail.com

My pf transfer claim is getting rejected frequently saying that EPS MERGED WITH EMPLOYER SHARE.CLARIFY

What should I do. Kindly help me to resolve this issue.

Thanks

Hi Sir,

My Form-10C has been rejected stating “1) JOINED AT 30 YRS SUBMIT PREVIOUS SERVICE DETAILS TO PROCESS F-10C-RO.CHENNAI2@EPFINDIA.GOV.IN 2) PHOTOCOPY OF BANK PASSBOOK NOT ATTESTED BY THE AUTHORIZED SIGNATORY”.

1. I was a contract employee until I joined in this company at the age of 30. So I don’t have any PF accounts or PF contributions for my previous companies. So what and where should I upload to state my situation. Is “ F-10C-RO.CHENNAI2@EPFINDIA.GOV.IN “ an email ID?

2. I had attached a cancelled check leaf at the time of withdrawal. Should I attest it from bank manager?

You can submit the details by raising the complaint at EPFO site http://bemoneyaware.com/epf-grievance-complaint-online/

Yes it would be good to get the cancelled cheque attested

Hi Sir, my pf transfer request cancelled by asking to submit the revised form 3a from privious employer. Epfo said that they will merge eps share getting approval from compitent authority. Any idea how long it may take?

Sad to hear.

As EPFO is Govt related we don’t know.

Hello Team, My PF transfer request has been rejected it states date of joining after 01/09/2014 & wages more than Rs,15000 not an eps member . Please , advise how to get this fixed on priority . It would be a great help if you can help me here

For details on your problem Please go through our article http://bemoneyaware.com/basic-salary-15000-eps-rejection-claim-transfer-epf/

If you think we have helped you,

Please help us by visiting our InstaChannel and liking some images

Join us on our Telegram channel Bemoneyaware to learn more about personal finance

is member eligible to eps Provided that where the pay of the member exceeds fifteen thousand rupees per month the contribution payable by the employer and the Central Government be limited to the amount payable on his pay of fifteen thousand rupees only

Hello all,

I am also facing the issue in PF transfer due to the reason that my basic salary is above 15000 when I started the job. After running from pillar to post for around 2 years, finally I found a solution for this issue. I would like to post the same here for the benefit of all. Request @Bemoneyaware to update in your article.

The solution is that

Step 1) the previous employer (who remitted EPS) has to sent a request to EPFO to merge both EPS and EPF accounts.

Step 2) The EPFO will be able to process the EPS and EPF merger based on this request

Step 3) Finally the member will have only EPF account. Then one will be able to transfer the EPF account to current employer.

Currently I completed Step 1 and awaiting Step 2 to be completed.

Thanks a lot Jobin. The solution is some ray of hope.

Appreciate your sharing.

Keep up updated.

I have updated the article and shared your suggestion on Twitter

Here some tips from my experience with same issue

Take letter from employer for rectification & submit it to EPFO office for merging the accounts.

Continuously raise the grievances on portal for this rectification. this will put some pressure on EPFO office.

Still facing the issue, then simply raise the RTI application with detailed questions & ask for the reason for delay. (RTI application fee is just Rs.10). They have to reply the RTI within 30 days.

Hope this will solve the issue.

Hello, Even my PF transfer has got rejected with the same reason. But the problem is when I stated my 1st job (post Sept,14) my basic pay was less than 15k where as now with 2nd job it’s more than 15k. Now the PF transfer from 2nd job to 3rd got rejected.

Do the 2nd employer needs to send request to epfo to merge the EPS and EPF? while I was eligible for EPS in my 1st job and not in 2nd job??

My 2nd employer is saying that PF contribution were made as like the 1st company and has no fault in them.

Please clarify.

Once you start your contribution in EPS then one cannot stop it.

So your employer would continue to deduct EPS.

It is a max of 1250 per month.

So you just have to live with it.

Hi Jobin,

I’ve the same issue. My ex employer is not responding. Could you please tell me more on How I can get this resolved? Can I withdraw the amount somehow? Or can i request EPFO to merge my EPF and EPS?

Try raising the complaint at EPF grievance site explained in the article How to register EPF complaint at EPF Grievance website online

Hi,

I got the below reply from epfigms:

“You are advised to approach the employer for rectifying the same by submitting revised return to the EPFO for merging the EPS contribution to EPF”

I’ve been sending emails to my previous employer but they do not seem to be helping.

Please suggest what can be done

Hi, I am in the same boat as you. My transfer needs to be done from Delhi to bangalore and EPFO Delhi has merged epf and eps but i dont see the transfer on portal and can’t seem to connect to EPFO bangalore.

What can i do?

Did you get your transfer completed? Did it require an RTI?

Hi Jobin,

Is your issue resolved?

Hello, I worked at a company for 15 yrs and then in 2017 , i joined another company from 2017 and worked in that till Feb2021.

Currently i have left my Job & After waiting for 2 months ( 60 days unemployed ) i applied for EPF withdrawal through Form 19 in May2021 and today got my response :

Your Claim [ Claim Id -** ] has been rejected due to : 1) PREVIOUS TR RECD NOT ELIGIBLE FOR PENSION MEMBERSHIP BUT ESTT REMITTED PENSION CONTRIBUTION 2) FATHERs NAME DIFFERS

Hence my Q is :

1) I see that my previous employer with whom i worked for 15 yrs deducted my EPS pension but when i got my EPF transferred to new employer in 2017, the Passbook had 0 contribution for EPS. which i understand that after 2014 , if somebody has basic salary above 15000/- they are not eligible for EPS.

So now how do i rectify this issue so that i can withdraw the full amount as i dont know what this point no. 1 means , if my first employer remitted pension contribution then how am i responsible for it and what is my fault in that . I read online that i need to get EPS & EPF merged since i am not currently employed , how do i get this merger ? or if this is the right way to move forward ?

Kindly help if anyone can through some light on this ?

Even i got same rejection reason.. father nme is correct and dont know what is the issue. Claim rejected in the 3rd time, after raising grievance during 1st rejection, they mentioned bifurcation of amt is done and i can reapply.and again i got same rejection reason..dont know what to do

The rule for pension is not applicable if you have been working before 2014 which is in your case.

For example, I have been working before 2014 and my EPS is deducted.

in Transfer of EPF, passbook will show EPS as 0 as explained in the article http://bemoneyaware.com/eps-transfer-epf/

Does earlier Employee history show up in your UAN?

Did your earlier employee have Private trust?

I face similar issue, could you please provide guidance for my specific case. I started working in 2011 and have been contributing to PF since then. My claim got rejected with this messages –

‘PREVIOUSLY EPS MEMBER IN ANOTHER ESTT. NO EPS TILL 04/2020 PL CONTACT EMPLOYER’

Since 2011 i have worked in 4 organisations, first 2 of these organisations made contribution to EPS but for the other 2 i see contribution as 0 for EPS. Further more the organisation i worked with in 2011 i had different UAN than the organisations i worked with later. I had got these 2 UANs merged at some point of time.

On emailing PF i got below reply:

“If you have any closed or live EPS account with d.o.j. prior to 09/14 you may be considered as a EPS member. For that, kindly submit F/11 and furnish that previous a/c number in F/11 to process this claim otherwise if you have closed the EPS account for the period prior to 09/2014 on the date of processing the claim, you are not considered as a EPS member. For that, kindly contact your employer to submit revised F/3A along with employer letter to merge EPS with EPF.”

Could someone please help to guide what should be next step for me?

Thanks!

What did you do to EPF for the jobs before 1 Sep 2014?

Did you withdraw your EPF money or transferred it?

Can you send your EPF passbook to bemoneyaware@gmail.com so that we can check it and answer better

Hi Guys,

My transfer request got rejected with below mentioned comment

“has been rejected due to : 1) WAGES LESS THAN RS.15000/-ELIGIBLE FOR PENSION MEMBERSHIP BUT ESTT NOT REMITTED PENSION CONTRIBUTION 2) CERTIFICATE A/B/C/D/E/F NOT ENCLOSED / SIGNED”

Could you please help me with the further process for successfully transfer.

I am also facing the same issue. My PF transfer claim rejected twice. so, As suggested above, raised the case in PF Grievance. Lets hope for some answer.

Sir,

I apply for pf advance two time always show rejected reasons show (your claim Id-RJRAJ191250036514 has been rejected due to 1. WAGES BELOW 21000 2. CERTIFICATE ENCLOSED IS IMPROPER)

sir i request to you plz help because i need money for my younger brother treatment

UAN NO.100686049097

Hi Sandeep,

I am also facing the same issue. My Transfer claim rejected with the same reason as yours.

Please help me with the solution and suggestion as you have already gone through this.

Please help me. My number 8074730388.

Your Claim [ Claim Id – APHYD191050071926 ] has been rejected due to : 1) PAYMENT NOT MADE BY THE EMPLOYER UPTO 2018-19 AS PER SYSTEM. THE ONLINE IN ADVANCE IS REJECTED. 2) CERTIFICATE A/B/C/D/E/F NOT ENCLOSED / SIGNED

am i eligible for PF advance withdrawn or ot

Ask your employer why the payment was not made?

And raise a complaint with EPF as explained in http://bemoneyaware.com/epf-grievance-complaint-online/, why should you suffer due to your employer

Hi Friends,

i have joined IBM IN 20-JAN-2015, THERE WAS NO EPS CONTRIBUTION INSTEAD I USED TO GET ALL THE 12% OF BASIC SALARY TOWARDS MY EMPLOYER SHARE. NOW WHENEVER I TRY TO WITHDRAWAL THE MONEY I GET BELOW ERROR. DOES ANYONE HERE KNOW THE SOLUTION?

Your Claim [ Claim Id – PYKRP191050030128 ] has been rejected due to : 1) ELIGIBLE FOR PENSION FUND MEMBER SHIP, PLEASE CONTACT YOUR EX EMPLOYER AND RESUBMIT WITH CLARIFICATI 2) CERTIFICATE A/B/C/D/E/F NOT ENCLOSED / SIGNED

Hi,

I am facing the same issue, My claim got rejected and it says Huge wages and EPS Bifurcated, by looking at this article it seems like my pf amount is stuck and does anyone know how to resolve this issue?

Your Claim [ Claim Id – TBTAM191150002501 ] has been rejected due to : 1) WAGES AT THE TIME OF JOINING EXCEEDS 15000/ NOT AN EPS MR,CONFIRM PREVIOUS EMPLOYMENT IF ANY 2) CERTIFICATE ENCLOSED IS IMPROPER

Hi,

My transfer claim rejected due to following reason

Your Claim has been rejected due to: 1) NOT A MEMBER OF EPS 2) CERTIFICATE ENCLOSED IS IMPROPER

What does this mean and how can I get this resolved?

Please help

Hi,

I also got the same problem, got my PF transfer rejected with 1) NOT A PENSION FUND MEMBER BUT PENSION FUND REMITTED.RECFITY THEN SUBMIT CLAIM 2) CERTIFICATE ENCLOSED IS IMPROPER.

If someone knows any solution about this issue, kindly let me know.

Thanks,

I joined organization XXX after post graduation (year 2016) In PF form , I mentioned that , I was not member of EPF and EPS previously. As per rule, as my basic was

more than 15000, i was only memeber of EPF scheme only.

In 2018 , I switched to new company YYY, But this time, I mistakenly mentioned that I am member of EPF and EPS scheme . I am getting 1250 amount in my EPS account.

In 2019 , the YYY company got closed and merged to its parent company ZZZ . In company ZZZ also, I am member of both EPF and EPS scheme.

I tried once PF transfer from XXX to ZZZ , its got success .

I tried once to transfer PF from YYY to ZZZ , its got rejected with EPF Wages is more than Rs15,000.

I have already informed about my mistake to current company ZZZ . They are saying submit a fresh pf document and duly signed letter to PF office mentioning about the mistake . The timeline to resolve this issue ( close eps account) can take 1 year.

Now i am moving to a new company after few weeks , I am planning to mention in new company joining PF doc as ” I am member of EPF scheme only”.

Can someone please let me know, if my process is correct below

1)I will join the new company and i will mention there , I was member of epf scheme only previously. So that , they will not deposit 1250 in my eps account

2) I will wait for the issue resolve from ZZZ company regarding eps account close . once the issue got resolved , I will transfer epf balance to my new company

My PF got rejected for transfer to current employer with the reason below:

1) Wrong EPS deduction seen in system in 2018/12.

2) Certificate A/B/C/D/E/F not enclosed/ Signed.

Pls let me know the reason.

Thanks in advance.

Hi,

My EPF claim got rejected due to the below reason. They said my employer is the reason. I followed up and they told they have given a letter for this to the commissioner a month back. But still it is getting rejected. Do any one knows how long will it takes to merge the accounts?

Your Claim [ Claim Id – PYBOM190XXXXXXXXX ] has been rejected due to : 1) MEMBER HAVING EPS MEMBERSHIP IN PREVIOUS ESTABLISHMENT,PRESENT EPS CONTRIBUTION NOT REMITTED 2) CERTIFICATE A/B/C/D/E/F NOT ENCLOSED / SIGNED

There is no clarity from EPFO on EPS deduction if the salary is more than 15,000.

We again raised the issue on twitter here https://twitter.com/bemoneyaware/status/1174653844367654912

Hi sir,

Good day,

This is sabarish from Tamilnadu,

I submitted my online claim form 19 & 10c on 1st july 2019,it rejected on 20aug 2019,

My salary is less than 15000 but estt not deposit in eps share pls sumbit after ECR revision

Certificate A/B/C/D/E/F is not enclosed or signed

My side submitted all documents approved in portal

What are they means,

This is employee side mistake or else employer

Pls advise me for my next claim will not reject in future,

Regards with,

Sabarish G

BBA,ACMAI.

This is the employer side mistake.

You need to speak to your employer.

Did you check your passbook?

I had raised a grievance for the same issue. They asked me to provide F/11 (previous service particulars). Not sure how and to whom do I provide this F/11.

Hi guys,

Please update here if any one has taken necessary steps for the problem. So that it would be helpful to others.

I just sent a mail to my previous employer & again raised a grievance in EPF (Asking about the solution). Will update here how it goes….

Thanks..this is a grey area and no one knows how it pans out

you have to write a letter to the PF commissioner of your circle (from the employer side) and handover the letter in person to the concerned case worker alongwith 2 copies of your PAN card, For 15G, you can take an acknowledgement in a duplicate letter (photocopy) for your reference.

My transfer claim got rejected with remark “Your Claim has been rejected due to : 1) WAGES MORE THAN RS.15000/-NOT ELIGIBLE FOR PENSION MEMBERSHIP BUT ESTT REMITTED PENSION CONTRIBUTION 2) CERTIFICATE A/B/C/D/E/F NOT ENCLOSED / SIGNED” .I have raised grievance for this problem with EPFO multiple times. But they are not responding properly. I am not sure how I can get my PF transferred to my current Employer PF account. Can you please suggest?

I am also facing the same issue. If anyone knows solution please post it here.

Have you got any reply yet.

sir our employees new joining dt. 02/08/2021

Gross salary Rs. 29699/-PM

Error for Upload for Data but Error Member is not a member of pension scheme. EPS wages should be Zero.

I am working in National Health mission Maharashtra in contractual job.My salary is above 15000 a month but never benefited by EPF. Is it not applicable to contractual job.Please Guide.

no not applicable to contractual job

Any update on this issue? I am facing the same issue

Hello Concerned,

Even i have been facing such an issue. Please can any body guide on further process. I have started my own setup and wont be joining any company in the future.

Please guide and suggest on the above matter.

Regards

Any update

My pf claim status showing EPS MERGED WITH EPF what it means, how can it be solved?

Hi,

My PF claim has been rejected reason“MEMBER JOIN AFTER 09/14 WAGE HIGHER THAN 15000 PLS CONFIRM WHETHER MEMBER IS ALREADY EPS MEMBER/NOT/K”

How would you like me to proceed further to transfer my PF&pension amount. Please help.

my basic salary > 15000

any update?

Hi

My PF claim also rejected as WAGES MORE THAN 15000/- AND JOIN AFTER 09/14 HENCE NOT EPS MEMBER BUT EPS CONT. DEDUCTED PL CLARIFY./OK

can you guide me how to get my pf

Hello Team,

I have issue with my PF transfer. I shall explain you the reasons..

I had joined Accenture on 9th Feb 2016 and worked there for one year and left on 24th Mar’2017. I joined another organisation and had given the UAN number of Accenture and both are linked to one UAN ID.

Before to this i worked in IBM for 4.4 years and i had a UAN which i withdrew it completely. At the time of joining in Accenture they created new UAN number. Now IBM UAN is a dummy UAN since i have withdrawn the complete amount.

My Accenture PF is not transfered to the current organisation and when i initated it was rejected saying “Salary is more than 15000 and eligible for EPS membership but establishment has not extended the same and not remitted EPS contribution.”

Now i am in a position were i cannot transfer nor withdraw. Can you please advise and suggest me what to be done.

Regards

Vineeth

Hi Vineeth,

Have you got any workaround for this problem. I am also facing same problem.

I am also facing the same problem.

Vineeth/Abhijeet : Did you get any solution on this?

Same problem, whom to reach out? previous employer or EPFO

Hi Vineeth/Abhijeet/HImanshu,

I am also facing same issue, did you guys find any solution, please let me know.

Regards,

Ashok

Sir, your employer has to write a letter saying that the merger of EPS+PF of yours alongwith the UAN Number (should be quoted in the letter)…this letter which should be signed with the authorized signatory of your company (check with HR who is authorized signatory).. and take two copies of it (one original+one duplicate photocopy) and submit it in person to the concerned case worker along with Form 15G, 2 copies of clearly visible PAN card.. your claim will be settled in 15 working days

Dear Krishna

I am also stuck with the same problem..wanted to check…will EPFO merge eps and pf ..even if my current organization has a trust ….or epfo will merge eps + pf only if both are with EPFO…please clarify.

Even i worked in Accenture and joined Sony few months back but when i do PF transfer i recieve below rejection

PREVIOUS TR RECD MEMBER ELIGIBLE FOR PENSION MEMBERSHIP BUT ESTT NOT REMITTED PENSION CONTRIBUTION 2) CERTIFICATE A/B/C/D/E/F NOT ENCLOSED / SIGNED

Is there any update on this

Sadly no

Hi

Did Your issue resolved?

I am also facing same issue with Accenture. even my join date is near by yours. Now days these it company does not hire a good guys who understated pain of ex employee.

Hi sir/madem,

My PF claim has been rejected stating “WAGES LESS THAN RS.15000/-ELIGIBLE FOR PENSION MEMBERSHIP BUT ESTT NOT REMITTED PENSION CONTRIBUTION/OK

How would you like me to proceed further to withdraw my PF&pension amount. Please help.

As i have joined my company on Nov 2015 and pension started contributing only from July 2018.

Kindly suggest whom should we contact to rectify this and to withdraw PF and EPS amount .

As i look like harrashment.

Is your basic salary less than 15,000 Rs?

Is your company not deducting Pension amount? Can you send the passbook copy to bemoneyaware@gmail.com

Why are you withdrawing your PF/EPS amount?

Are you not planning to join a new company? It is better to transfer.

Please speak with your company ASAP as why did they do it?

Hi,

Now Recently Superme court has announced that above 15000 basis salaried persion is also eligible for PF pension.

Is our related problem. Can we apply again the transfer in PF portal.

Please give clarity

Supreme court has just passed an order how will it be implemented is yet to be seen.

Is there any update on this issue? My pf transfer got rejected with the same reason?

My first organisation had EPS contribution. Now I have joined a new organisation but I was not aware that I should mention about the first organisation’s EPF contribution, now my new organisation is not contributing to EPS . Kindly guide me, and let me know what can be done

When did you start working in the first organization?

Why did you not give old UAN number to a new organization?

How long have you been working in the new organization?

Hi,

Same in my case also. My previous company contributed to EPS as basic less than 15000 wherein current company not contributing to EPS as my basic more than 15000.

I have already transferred to EPF. Kindly let me know if any problem in future and action required from my end

Regards,

Adarsh

did you get any solution to this

Hi team,

In my case I have been employed since 2011 and holding a PF account since then.

1. job1: pf1 – 2011-2015 – I have claimed the full pf account

2. job2: pf2 – 2015 – 2018 – I have requested to transfer to current pf account

3.job3:pf3 2019 jan – present – I have requested the previous pf2 to link with this but the transfer request is rejected saying basic salary is more than 15000. But I am part of PFO since 2011.

Kindly please help whats the best to do now. Any experts ?

any update? i m facing same issue

I am also facing the similar issue. I have withdrawn PF and eps contribution from my first org. 2nd .org started from 2015 and the PF transfer is not happening to my current org PF account. Let me know if I have to submit any document.

Why is the transfer not happening?

Did you submit the papers for transfer to new/old organization

Is it a trust or regional EPFO?

For those of us who had joined before 2014 and the basic pay is more than Rs. 15000 now, can we stop the EPS contribution? In fact, is it possible to completely opt out of both EPF & EPS once your basic pay is more than Rs. 15000?

No you cannot opt out of EPS, Fortunately or unfortunately.

Hi sir/madem,

My PF claim has been rejected reason“wages more than 15000/- and pension contributions not bifurcated which needs clarification from the employer and also confirm the member is already EPS member or not for further necessary action”.

How would you like me to proceed further to withdraw my PF&pension amount. Please help.

my basic salary > 15000

Thank you

Ibrahim

Could you please check with your employer why is he deducting EPS if basic salary is more than 15,000.

I hope you started working after Oct 2014.

Yes, I joined Dec 2016 only. Ok let me check with employer . Thank you for valuable information.

One more doubt

I checked in passbook. Pension contribution had deducted in every month .So now Can employer change this ?

Hi Ibrahim,

Did you got any solution.

Below is mu issue

I joined organization XXX after post graduation (year 2016) In PF form , I mentioned that , I was not member of EPF and EPS previously. As per rule, as my basic was more than 15000, i was only memeber of EPF scheme only. In 2018 , I switched to new company YYY, But this time, I mistakenly mentioned that I am member of EPF and EPS scheme . I am getting 1250 amount in my EPS account. In 2019 , the YYY company got closed and merged to its parent company ZZZ . In company ZZZ also, I am member of both EPF and EPS scheme. I tried once PF transfer from XXX to ZZZ , its got success I tried once to transfer PF from YYY to ZZZ , its got rejected with EPF Wages is more than Rs15,000 I have already informed about my mistake to current company ZZZ . They are saying submit a fresh pf document and duly signed letter to PF office mentioning about the mistake . The timeline to resolve this issue ( close eps account) can take 1 year. Now i am moving to a new company after few weeks , I am planning to mention in new company joining PF doc as ” I am member of EPF scheme only” Can someone please let me know, if my process is correct below 1)I will join the new company and i will mention there , I was member of epf scheme only previously. So that , they will not deposit 1250 in my eps account 2) I will wait for the issue resolve from ZZZ company regarding eps account close 3) once the issue got resolved , I will transfer epf balance to my new company

Hi sir/madem,

My PF claim has been rejected stating “WAGES LESS THAN RS.15000/-ELIGIBLE FOR PENSION MEMBERSHIP BUT ESTT NOT REMITTED PENSION CONTRIBUTION/OK”.

How would you like me to proceed further to withdraw my PF&pension amount. Please help.

Thank you

Majeed

Hello,

Is your basic wage more than 15,000 or less?

Hi I can’t get it.my.pf .till today I also all process apply by now check pan added m mail id changed in. Bt can’t acess site otp or SMS getit my regi no. Pls help m sure suggestion. Pls getit my pf properly in bnk account .

Sir,

In my UAN portal all my KYC details (Aadhar, PAN, Bank account) are uploaded and approved by employer. But in approved section PAN status is Unverified. I left the job (below 5 yrs). My question is

(i) if i appy for claim they have consider my PAN or not

(ii) if i apply claim for epf & eps, how much tds will be deducted

We are looking for the solution, are in talks with many EPF consultants.

I am also facing the same issue. I have requested them for transfer, they rejected with this reason of basic wages > 15000. Again I have raise request for withdrawal, & epfo has rejected that also with same reason.

What to do now???

We are looking for the solution, are in talks with many EPF consultants.

We have raised this issue with EPFO on social media. We have added it in our Change.org petition. Will keep people updated.

What you can do,

For your next job make sure that your entire Employer contribution is going towards

Raise EPF grievance for your issue. Our article How to register EPF complaint at EPF Grievance website online

Raise it on Social Media of EPFO

twitter.com/socialepfo

facebook.com/socialepfo

Any way forward?

It is been six months now. Did they reply back? Any update on this.

I am also facing this issue and raised Grievance for the same and awaiting their reply.

Has your issue been solved?

Did you get any resolution? I am facing the same issue