If you’re an existing home loan borrower and are expecting a reduction in the interest rates in line with the recently revision by Reserve Bank of India (RBI) repo rate cut then you may be disappointed. All those people who have taken loans after the 1st of July, 2010, but before 1st of April, 2016 are associated with the lending bank’s base rate. The home loan interest for these borrowers is upwards of 10%. But you can reduce your EMI by switching from Base Rate to MCLR.

Under the base rate rule, the banks were unwilling to change their lending rates or did so with a time lag. A new technique of bank lending known as Marginal Cost of Funds based Lending Rate (MCLR) was put in place for all home loans that was lent after the 1st of April 2016.

If you belong to the pre-April 1 base rate borrowers don’t worry. You have 2 options, either transfer the refinance form to another bank on MCLR or switch to MCLR with the same bank you’ve taken a loan from.

The RBI has clearly stated that all banks should permit base rate borrowers to switch to MCLR. The borrowers can switch to MCLR on mutually agreed terms or all of the existing loans can run normally till maturity. Also, the RBI has stated that the banks can’t treat it as a foreclosure or charge a fee.

MCLR is dynamic and better

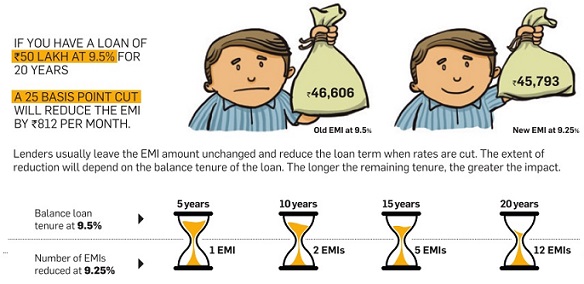

The main reason to shift from base rate to MCLR has to be the laziness seen in banks’ transition on the benefits of RBI rate cuts to the borrowers. But why did the base rate model fail and the MCLR work? The MCLR utilizes marginal cost of funds that include the interest rate at which the bank issues the cost of borrowings, deposits and also the returns on net worth. Our article What it MCLR? Should one switch Loan from Base Rate to MCLR Rate? explains MCLR in detail. Following image shows that if you home loan interest reduces by .25%.

- Either the EMI goes down, in the example below from Rs 46,606(old EMI at 9.5%) to 45,793 (new EMI at 9.25%) a saving of 813 per month on loan of Rs 50 lakh for 20 years. You can check the EMI using our EMI Calculator

- Or the tenure reduces. If you have 15 years of loan left then Balance loan at 9.25% will save you 5 EMIs. Longer the tenure greater the impact.

Related Articles:

- What it MCLR? Should one switch Loan from Base Rate to MCLR Rate?

- Understanding Base Rate of Loans

- Understanding Inflation

- Terms associated with Home Loan

- Factors that affect the Stock Market: RBI Meeting,Inflation Numbers,Quarterly Results