Why a Bank Locker

One of the safest way to store valuables like your jewellery, important documents and other precious items is safe deposit vaults or bank lockers. There is a risk of these valuables being stolen from residential or office premises. Hence one opens a locker and puts in valuables.

What is a Bank Locker?

A locker is a small, usually narrow storage compartment. They are commonly found in dedicated cabinets, very often in large numbers, in various public places such as locker rooms, workplaces, schools,gyms. They vary in size, purpose, construction, and security.

Bank lockers are relatively safe for a person to store valuables for a period of time. Bank Lockers are small boxes kept in a room that is guarded heavily and has solid iron doors or concrete walls around it. To open the locker a pair of keys are needed,one key is with the bank and the other is with the customer. Both keys have to be used together to open the locker . Both private and public sector banks provide the facility of lockers today. All these banks go by the guidelines of Reserve Bank of India (RBI). The locker facility is also called as safe custody.

The relationship of the bank and the locker holder is that of a lessor and lessee, or in simple words that of an owner and a tenant. Each customer is charged an annual fee for holding the locker with the bank. The amount depends on various factors such as size of locker, urban or semi urban, public sector or private banks etc.

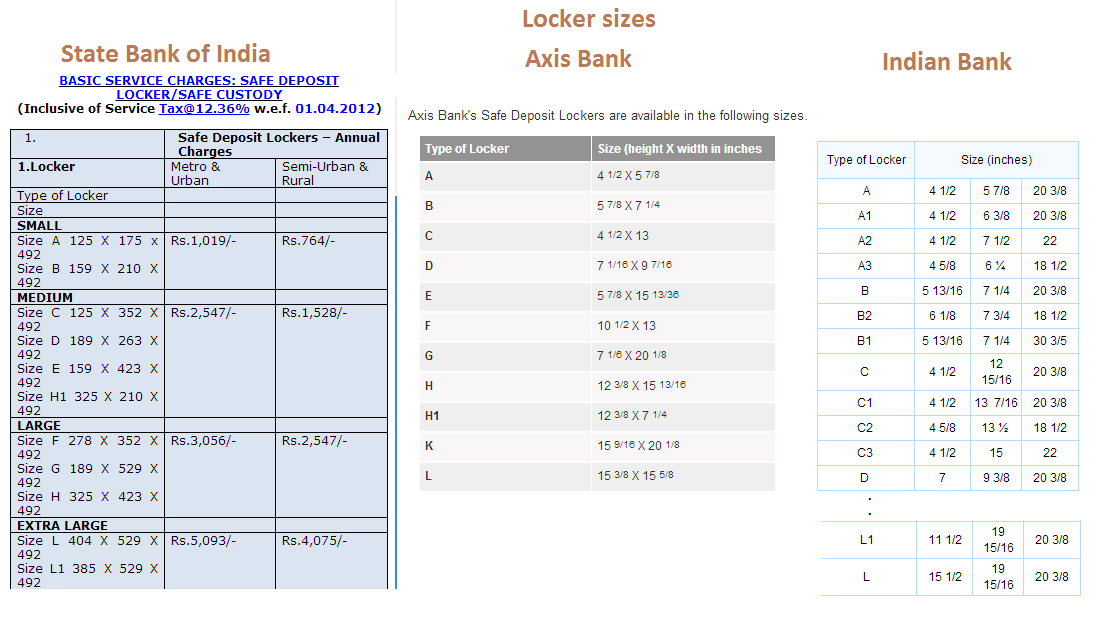

Size of the Locker

Safe Deposit Lockers are available in various sizes .Based on the needs, a customer can choose the size of his locker.

- In layman’s language locker sizes are sometimes classified as Small, Medium and Large. But Technically the lockers sizes are called by alphabets A, B. Many banks over variation so you can have locker sizes A1, A2 etc.

- The lockers sizes start with small-sized ones, often referred to as A-class whose size in inches is generally around 4.5 X 5.875 X 20.75 .

- The size increases in alphabetical order, so the L/K class are usually the largest. L size locker size is around 15.5 X 19.9375 X 20.875.

- As the size increases the rent also increases .

Given below are sizes of locker from State Bank of India and Axis Bank and some sizes from Indian Bank Click on the image to enlarge. Indian Bank offers even more sizes such as A1, A2 till L1, which we have captured in this image

Requirements to have a locker

Both private and public sector banks provide the facility of lockers and are governed by the guidelines of Reserve Bank of India. Some of these guidelines are listed below:

- Though to avail the locker services one need not have a saving account in the bank .But a bank asks new customers to open a savings account. This is because opening a savings account helps complete the know your customer (KYC) norm. Also, a savings account at the branch makes it easy, for the bank,to collect annual charges.

- Banks must allot lockers on a first come, first serve basis. If none are available, the bank branch needs to maintain a waiting list and provide the applicant with a waitlist number. It must also inform the customer when it is available. Please note not all bank branches have lockers. It is a first-come-first-served service that has always been in high demand.

- Bank lockers can be rented on single as well as joint basis. If there are joint holders then all the joint holders have to particularly mention the kind of ownership agreement they are getting into (like either or survivor, former or survivor etc).

- Nomination facility for a locker is available. In case of death of locker holder (or joint holders) a nominee gets access to the locker by producing death certificate and filing up claim form. Our article Bank Account,Term Deposit,Locker:Paperwork Required For Claim discusses nomination for bank lockers , importance etc in detail.

- The bank may ask customer to deposit some amount as security in the beginning for opening a locker, called as Caution Money. This may include the rent for locker for a period of 3 years and also an amount for emergencies when the bank has to break open the locker for example if the customer has lost the key. It is not mandatory to do so but most of the banks do ask. There are several complaints how banks have and are taking advantage of the soaring demand for lockers to force customers to invest in investment products like fixed deposits,insurance schemes which are in violation of the Reserve Bank of India (RBI) rules.

- Bank does Risk categorization of locker hirers, mostly as per deposit account of hirers with Bank. Risk categorise are generally High, medium, low,

- While opening a locker one needs to sign an agreement document, called Memorandum of Letting. It is an agreement between the Bank (called as lessor),who is letting out the locker and Customer (called lessee) hiring the locker regarding operation of the locker. This document is a registered document and attracts stamp duty. The choice of method of paying stamp duty is largely dependent on the state in which the stamp duty is to be paid and the amount of such stamp duty. Various methods of paying stamp duty are e-stamping, franking and Stamp paper.

However, even if you agree to the bank’s conditions, you may still not be able to find a desirable locker. This is because getting a bank locker has become difficult, especially in the metros as Banks don’t have too many lockers. And there is no space to provide new ones. But branches in suburbs have higher number of lockers and so do those in smaller cities . It may be worth your while to scout around for new branches opening in your city because in an effort to lure new customers, they may waive the security deposit. You will also be able to get a locker immediately and won’t have to endure an endless wait as is the case with the existing branches.

Leasing of locker, Surrendering the Locker

- Locker is typically leased for a term usually from 1 to 3 years.

- On expiry of the lease period of the locker, the hirer of locker may either get the lease renewed for further period of one / three years or may surrender / vacate the locker. Vacating of locker by the hirer (Customer) on or before the expiry of lease period is called as Surrendering of Locker.

- Each bank has different refund rules. What happens if you surrender the locker mid-term? Will you have to forego the fee or will the bank refund you on a pro-rata basis?So know the refund rules of your locker.

Rent of Locker

- One needs to pay rent for using the locker (Just like one pays for rented house).

- Locker charges not only vary across banks but also branches, depending on their location-metro city or semi-urban area, busy commercial area etc. There is a wide disparity in rates between public sector banks and private ones. For instance, the rental prices for a medium-sized locker (F class) in a private bank may go up to Rs 20,000 a year, but the same can be had in a public sector bank for one-sixth the price.

- The rate also depends on the type of account you have with the bank. For instance, HDFC Bank is willing to waive 50% of the rent if you are a classic customer, that is, your average quarterly balance is Rs 1 lakh.

- The cheapest lockers are the small-sized ones, often referred to as A-class. The size increases in alphabetical order, so the L/K class are usually the largest and the most expensive lockers.

- To avoid costly surprises, it’s important to check the fine print. For instance, many banks require a minimum account balance to be maintained, which can be an expensive proposition if you select a bank where the limit is set at Rs 25,000-50,000 a quarter.

- It is also crucial to know how your bank defines a year while calculating locker rentals. Most banks take the date of agreement as the starting point and the subsequent annual rent will have to be paid on that date. However, some banks have a predefined timeline-it may be set according to the calendar year or fiscal year. It is important to know the pattern in order to pay the rent without defaulting.

Using the locker

Custodian is an officer designated by each branch to be in charge of Safe Deposit Lockers. To open the locker a pair of keys are needed,one key is with the bank typically with Custodian and the other is with the customer. Both keys have to be used together to open the locker . Some banks ,like IDBI have now started offering 24×7 locker access at select branches , however this facility comes at a cost.

- Lockers can be operated during the specified timing displayed at the branches. One visits the bank during the locker opening hours with locker key.

- Meets the custodian and does the necessary paper work example signing the register. Waits if someone else is using the locker.

- Along with the custodian visits the deposit vault. Custodian fits in the bank key, customer his key and locker opens. Custodian leaves the deposit room. Customer takes out, puts stuff in privacy. Once he is done, he comes out.

- Please do check for additional charges . Some banks may charge extra if you operate the locker more than a certain number of times, for ex SBI charges for more than 12 times a year.

- The lockers are to be opened by the customer at least once in 6 months. If the locker is not opened for more than a year then there will be a notice issued to the customer for doing the same. If there is no response from the customer then, the bank has the rights to break open the locker in the presence of police in a legal manner. The same may be applicable in areas where the rent is not paid by the customer.

Operate the locker with a cool mind and utmost patience, and before closing the locker have a look around to ensure no valuable as been left out of the locker. Also, don’t allow anyone inside when you are operating the locker. In fact, going to the locker with close family members like son, daughter, husband or wife is usually good, provided the locker is hired in their name too.

Do keep a written record of your contents in the locker. In case of a theft, at least you will know what was stolen. If you are keeping documents in lockers, it is wise to get them laminated.

Breaking Open of Locker

The locker can be broken open in case of

- Loss of key, at hirer’s request.

- If you lose the key,please report immediately . Usually an application is submitted to Branch Manager. Charges for opening the locker or replacing the lost key and for changing the lock will have to be borne by you. While some banks include the cost in the initial security deposit, some charge it later.

- Non-payment of locker rent

- Non- compliance of terms and conditions of lease agreement at the Bank’s discretion like not opening a locker for a period of one year.

Banks can consider opening the locker if it is not operated for a prolonged period, generally more than three years in the case of a customer in the medium-risk category or one year for those in the high-risk category, as per the know your customer(KYC) guidelines. This clause holds true even if the locker owner has been paying his rent regularly and on time, provided the locker agreement clearly mentions this fact. However, the bank has to first ask the customer to give a written explanation for not operating the locker, followed by a notice cancelling the allotment and announcing the opening of the locker

Lockers will be broken open in the presence of the Custodian and one or two outside respectable persons and an inventory of the articles found in the lockers will be prepared duly signed by the persons in whose presence the lockers are broken open.

Responsibility of the bank

The Bank in their agreement typically declare that bank will not be responsible or liable for the contents kept in the locker by the hirer. In case of theft, burglary or similar unforeseen events, action will be initiated as per law. But there are enough cases where the courts have backed customers. By establishing that the relationship between the bank and the depositor is not that of landlord and tenant, these landmark judgements allow you to sue your bank for equivalent compensation in case of burglary or if the locker’s contents are damaged by termites, water seepage and the like, barring natural disasters.

- After a robbery at an Indian Overseas Bank branch in a Chennai suburb in 2012, the police discovered that most bank branches in the city hadn’t installed devices such as security alarms, closed-circuit television (CCTV) cameras or burglar alarms, among others.

- In November 2011, a locker mechanic of a private firm was nabbed with gold worth Rs 20 lakh stolen from the lockers of Andhra Bank in Koritapadu in Guntur city . The bank staff initially rubbished the customer’s claims. But after going through the video evidence, the police found that the lockers were handed over to official mechanics for annual maintenance, and the crime was committed during the period.

So banks in all cases can’t skip their responsibility on flimsy grounds, but it is always wise to tread with care as proving any negligence on the part of the bank is not easy

Alternatives to bank deposit lockers

Are there any alternatives to bank deposit lockers. Yes

Private Lockers

Private companies such as India Safety Vaults (present in Mumbai and Pune) and Navketan Lockers (Hyderabad and Mumbai). Rate card from Navketan Lockers for Locker Type A is given below

| Locker Type | Rate Plan | Rate / Year | Total Rent | Service Tax @ 12.36% | Caution Deposit (Refundable) |

Total Amount Payable |

||||||

| A | One Year | 3,600.00 | 3,600.00 | 445.00 | 2,500.00 | 6,545.00 | ||||||

| Three Years | 2,880.00 | 8,640.00 | 1,068.00 | 2,500.00 | 12,208.00 | |||||||

| Five Years | 2,340.00 | 11,700.00 | 1,447.00 | 2,500.00 | 15,647.00 |

Comparing Bank Lockers and Company Lockers

| Bank Lockers | Company Lockers | |

| Accessibility | Only during office hours; Sundays closed | Open all day and holidays. |

| Number of lockers | Limited number of lockers per bank; can be added | 2,000-4,000 per branch |

| Cost | Annual rental (depends on the size of the locker and from branch to branch), security deposit or fixed deposit. | Security deposit, between three months and three years of advance. No annual rental |

Jewellery Insurance

- There are few standalone jewellery insurance products. such as Axis Bank, Tata AIG’s cover is for people with high net worth.

- However, one can avail of this cover under a home insurance policy. You need not buy a comprehensive plan that covers the house structure but can instead opt for a contents cover under which there is a jewellery and valuables protection section. The contents section covers accidental loss, damage, burglary and theft of jewellery and other precious items, including jewellery kept in some specified bank lockers. Some also cover jewellery worn in person. There is usually a sub-limit for jewellery. For instance, the maximum cover may be 25 per cent of the total sum insured for contents. This means if the contents cover is for Rs 5 lakh, jewellery worth only Rs 1.25 lakh will be covered.

- There are policies with a separate all-risk cover section for jewellery and valuables where one can choose a suitable sum insured. The four public sector general insurers-Oriental Insurance, United India Insurance, The New India Assurance and National Insurance-offer such policies.

Some Do’s and Don’ts for Bank Lockers

- A locker should not be at a lonely place nor should it be at a place with very thick with moving population, like a bus stand, taxi stand, railway station, etc. It should be near your house as you don’t want to cart your valuables across town

- You also need to keep a written record of your contents in the locker. In case of a theft, at least you will know what was stolen.

- If you are keeping documents in lockers, it is wise to get them laminated.

- It also makes sense to operate lockers as in a joint-holding or nomination-based mode. “This ensures that in case of death of the person, the lockers can still be operated or the contents smoothly handed over to the legal heirs

RBI Guidelines Safe Deposit Lockers/Articles in Safe Custody

Related articles:

- Bank Account,Term Deposit,Locker:Paperwork Required For Claim

- On Inheriting,Tax of Property,Mutual Funds,Shares,FD etc

- Joint Bank Account

Should one go for locker? Locker is Private or Public Bank?What has been your experience in getting a bank locker? Using a bank locker? Any suggestions, ideas?

what was the locker rent from the year 2000 to 2014 for locker in an urban city size large (F,G,H).

For SBI bank

Does the back check what we are keeping inside the locker? What if someone hide something illegal there?

No bank does not check it unless the locker has not been opened for a long time.

Thanks for sharing such an informative article

it is an interesting Article, i read this post that was very nice and useful thanks for sharing it.

What are the RBI Regulations with respect to Private Vault/Locker service providers? Where can I find the related notice or circulars issued by RBI?

hello, thanks for sharing useful information

Sir, I want to know something regarding the custody of the bank locker.Actually, there is a bank locker in Allahabad bank in name of my grandmother who is 82 years old and nominee is my father who is mentally not fit.. As the age of my grandmother is 82 so she lost her ability to operate the locker properly . She is just distributing all the expensive things to different strange people’s other than her grandchildren. So it’s really very critical n serious problem. Is there any rule for the grandchildren to take custody of the locker and lock it before they get the full custody ?? Kindly suggest some rules to take action against her …

Thanks for sharing it

What are the rules for joint locker in India. To take out things both persons signature r required or anyone can take out the things.

Hi all,

I wonder, Does the Bank custodian/manager/employ have a duplicate key of Customer key. And he/she can Stole the belongings?

Is it possible to Make additional duplicate key for saftey from locksmith?

Replys highly appreciated.

Thanks and regards

Sha

To open the locker two keys are needed,

1 is by bank

2 is by the customer.

I don’t think the bank has a duplicate key of a customer.

Because if customer loses his key they have to break open the locker( and charge customer for it)

Sir somewhere we have to trust them.

Help me on this query – Do we need to declare/reveal to bank about the things(items) we would be keeping in the locker?

No you should not reveal to the bank about what you are keeping in your locker.

Why the question?

I have taken a locker in SBI bangalore in June 2014 and the rent period is till April 2017 and I was out of country during this period tried contacting with SBI customer service but no respond .

Can you please let me know how can I renew my locker from oustide the country and whether my locker is safe or not.

1) If have not accessed the locker any time between this period June 2014-April 2017

2) Want to renew again from outside country

It is best to open locker atleast once a year.

Do you have saving bank account in the same branch?

Are your contact details updated?

Are you getting regular updates from them?

Can you ask anyone to go and talk?

Which branch of SBI in Bangalore? I will try to dig the contact number/email id.

I would like to know the locker rent for the period 2017-18 for locker size A

SAFETRUNK – India’s Biggest and Safest Locker Facility now in Hyderabad, central Location, access locker – 24/7, 365 days a year.

State of art security with active and passive modes round the clock , unrivalled service and convenience.

safetrunk.in for more information –

My mother has a locker in the bank now she is expired can I operate it as my name is only mentioned in the security deposit locker form

SBI asking for 25000 Rs FD for allotment of Locker. when i giked a compliment on SBI website rdgarding the same. one official contacted me on my phone and explained the reason of 25000 FD and give detail charges breakup. which are, as per that official, three years rent i.e. 3000 , year rent in advance(after breaking FD if you will not pay rent on time)i.e.

1000 and 21000 RS for Breaking open of locker. this 21000 charge for breaking open of locker giving some suspicious alerts to me. when i said ok no problem. you can please closed the complaint and requested them to give in writing in the same compliment which you explained me. but they closed the compliment with out writing any charhes or reason. so please give a detail charges breakup for Breaking open of locker. how much it cost to us? if any know or faced the issue regar that. and is it true that 25000 rs FD required for allotment of locker in SBI?

I once visited bank to operate locker, as there was one customer already in locker room, I have to wait for my turn. Now I want to know is there any time limit to operate the Locker? i.e. 10 mints 20 mints or soo. As the customer who was operating their locker took more then 30 minutes and I have to tell the Banks officer to tell them to make quick.

so please is there any R.B.I. guidelines regarding time frame.

A good question.

I tried searching for lockers guidelines regarding time limit couldn’t find.

Will update once I get info.

Sir, would like to know that is there any guidelines laid down by RBI that if there is one customer inside the strongroom operating his/her locker the other customer who also wants to operate is locker will not be allowed. Please let me know if there is a rule laid down bt RBI.

yearly rent is deducted from my sb account .in first quarter i have surrended my locker. let me know can i get refund of locker rent for 3 quarters which is already deducted by bank . thanks.

I am in badly need of the Legal/Lawful updated Notifications from R.B.I.

to save/safeguard the interest of a customer of a bank.

1. Minimum value of Franking the M.O.U. / Agreement with the bank for

addition of a name in ‘A’ Type Locker with Bank of India.

2. What are the requirement/Rule of R.B.I. for asking/insisting/force to

‘Deposit’ with bank from the customer by a Bank (B.O.I.) while taking

a Locker on Rent.

please e-mail me as an evidencial proof.

1. What amount of minimum franking value is mandatory on

agreement/M.O.U. for Bank of India any sized Locker in the case of

addition in name. I need the updated legal Notification from RBI.

2. What is the Rule of RBI for keeping Deposit with Bank compulsorily as

asking bank while giving any size of the Locker to a Customer of the

Bank. (Bank of India). when a customer has already fulfilled the

formalities of M.O.U./ Agreement by franking it.

Please do the needful & e-mail me to save/safeguard the interest of a Customer like me because I have bitter experienced with the misguiding / misleading Rules imposing on us being a Customer of the Bank.

gud information. thanks.

Banks can consider opening the locker if it is not operated for a prolonged period, generally more than three years in the case of a customer in the medium-risk category or one year for those in the high-risk category, as per the know your customer(KYC) guidelines. This clause holds true even if the locker owner has been paying his rent regularly and on time, provided the locker agreement clearly mentions this fact. However, the bank has to first ask the customer to give a written explanation for not operating the locker, followed by a notice cancelling the allotment and announcing the opening of the locker

Lockers will be broken open in the presence of the Custodian and one or two outside respectable persons and an inventory of the articles found in the lockers will be prepared duly signed by the persons in whose presence the lockers are broken open.

But the question arises when customer doesn’t receive the notices and notices returned then what is the next step as a banker. Whether a banker is still allowed to break open the locker ?

I am holding a locker with Indian Bank and today the bank called me to deposit an amount of Rs. 2.00 Lakhs against locker deposit. The officer says it is compulsory or else they will withdraw the facility.. Pl clarify whether the amount and the deposit are compulsory.

No bank can ask and compel you to make a deposit. as per guidlines of RBI maximum amount the bank can ask is the rent of 3 yrs and Rs1000 as deposit. Ask the bank about your quarries through RTI and if every things fail then lodge a complain with banking ombudsman.

Sir,

I am interested for the locker facility. I would like to know the locker opening charges for any of the nationalised bank.

Please do the needful.

Thanking you

Shreyasi Basu

From SBI Locker Charges

One Time Locker Registration Charges:- Rs.500/- +ST

No. of Locker visits per year: 12 visits free: thereafter Rs.100/-+ST per visit

Safe Deposit Lockers Annual Charges

1.Locker

Metro & Urban

Semi-Urban & Rural

Type of Locker

Size

SMALL

Size A 125 X 175 x 492

Size B 159 X 210 X 492 Rs.1,100/- +ST Rs.800/- +ST

MEDIUM

Size C 125 X 352 X 492

Size D 189 X 263 X 492

Size E 159 X 423 X 492

Size H1 325 X 210 X 492 Rs.2,800/- +ST Rs.1,800/- +ST

LARGE

Size F 278 X 352 X 492

Size G 189 X 529 X 492

Size H 325 X 423 X 492 Rs.6,000/- +ST Rs.5,000/- +ST

EXTRA LARGE

Size L 404 X 529 X 492

Size L1 385 X 529 X 492 Rs.8,000/- +ST Rs.7,000/- +ST

This is a fantastic, useful, reliable article with some real care taken in writing it. This is advice one can fall back on. Thank you.

Please let me know that if the locker (at BOI) is in the name of three persons, and one person is not available (doing job out of city), and we want to surrender the locker. What formalities needs to be fulfilled. Kindly explain.

In case of SBI, all people need not be present. You can get signatures. Call the bank in case of BOI they will tell you if all persons need to be present.

sir,plz send corporation bank locker application form

I want to know what all amenities like a ladder, counter to keep small items, writing counter etc and other facilities which are mandatory in a bank locker room and where I can find these details.

sir,

I HAVE LOCKER IN PRATHMA BANK,RAMGANGA VIHAR BRANCH ,MORADABAD.TILL LAST YEAR i.e 2014, RS.600 WAS DEDUCTED FROM MY ACCOUNT AS RENT FOR LOCKER BUT THIS YEAR i.e 2015 RS.1350 WAS DEDUCTED FROM MY ACCOUNT IN FEB.2015.I WANT TO KNOW THAT YOUR BANK HAS INCREASED THE LOCKER RENT OR IT IS BY MISTAKE.PLEASE REPLY ME AND SUGGEST IF I HAD TO DO SOME FORMALITIES FOR THE SAME.

Please ask the bank if they have revised the locker charges.

From there Locker chargescharges are as follows:

26 Locker Rent 1-Small

Urban Rural

Rs.450/- Rs.400/-

2-Medium

Rs.800/- Rs.700/-

3-Large

Rs.1500/- Rs.1300/-

4-Very large

Rs. 2000/- Rs.1800/-

Respected sir,

I beg to state that I have surrendered a Safe Deposit Locker ( Locker no.- 97 ) at Dhanlaxmi Bank, Veraval Branch, PO.- Veraval, Dist.- Junagadh, ( Gujarat ) on 22.09.2015. The Bank had deducted Rs. 3600.00 on 15.01.2015. from my saving account for Safe Deposit Locker rent for the period of one year ( 15.01.2015. to 14.01.2016. ).

Kindly, reply me, am I eligible for refund Safe Deposit Locker rent for the remaining period of one year ( 22.09.2015. to 14.01.2016. )?

Thanking you.

On surrendering lockers too, the norms of the banks vary. While HDFC Bank, for example, does not refund the rent in case you surrender it mid-way, ING Vysya Bank has rules for proportionate refunds on surrender.

If they have deducted the rent for full month I doubt if you would get the rent for remaining period

Respected sir,

I beg to state that I have surrendered a Safe Deposit Locker ( Locker no.- 97 ) at Dhanlaxmi Bank, Veraval Branch, PO.- Veraval, Dist.- Junagadh, ( Gujarat ) on 22.09.2015. The Bank had deducted Rs. 3600.00 on 15.01.2015. from my saving account for Safe Deposit Locker rent for the period of one year ( 15.01.2015. to 14.01.2016. )ie, full one year not the rent for full month.

If, ING VYSYA BANK has provision to refund for Safe Deposit Locker rent for the remaining period after surrendered a Safe Deposit Locker.

Why Dhanlaxmi Bank not refund for Safe Deposit Locker rent for the remaining period after surrender?

Kindly, reply me, rule for refund Safe Deposit Locker rent for the remaining period of one year different in different Banks in INDIA ?

Thanking you.

Respected sir,

If ING Vysya Bank has rules for proportionate refunds on surrender.

Why Dhanlaxmi Bank, Veraval Branch, PO.- Veraval, Dist.- Junagadh, ( Gujarat ) not refund Safe Deposit Locker rent for the remaining period of one year (22.09.2015. to 14.01.2016. )?

Kindly, reply me.

Thanking you.

Sir, each bank has its own rules.

Respected sir,

I had complained this matter to RBI ombudsman, Ahmedabad. Mr. Amishah,RBI ombudsman,Ahmedabad had take necessary action from his end for refund Safe Deposit Locker rent for the remaining period of one year ( 22.09.2015. to 14.01.2016. ).

The Dhanlaxmi Bank, Veraval Branch, PO.- Veraval, Dist.- Junagadh, ( Gujarat ) had deposited Rs.900.00 on 28.10.2015. in my saving account for refund of Safe Deposit Locker rent for the remaining period of one year ( 01.10.2015. to 31.12.2015. ).

Thanking you.

That’s great news. Thanks for getting back to us.

How was the process of complaining to RBI ombudsman

I am surrenduring my locker in*SBI. AM I ELIGIBLE FOR REFUND FOR UNUSED PERIAPPA OF ELEVEN MONTHS. Kindly. clarify.

Dear Baloosastry,

yes,you may be ELIGIBLE FOR REFUND FOR UNUSED PREPAID Safe Deposit Locker rent OF ELEVEN MONTHS.

First,you write the Bank manager, SBI FOR REFUND FOR UNUSED PREPAID Safe Deposit Locker rent OF ELEVEN MONTHS.

Second, you write a complaint to the customer care, SBI FOR REFUND FOR UNUSED PREPAID Safe Deposit Locker rent OF ELEVEN MONTHS.

Third, you write a complaint to the MD, SBI FOR REFUND FOR UNUSED PREPAID Safe Deposit Locker rent OF ELEVEN MONTHS.

Fourth, you write a complaint to the RBI ombudsman, in the area of SBI FOR REFUND FOR UNUSED PREPAID Safe Deposit Locker rent OF ELEVEN MONTHS.

Try again and again will be success.

Thanking you.